自周一以来,特斯拉股价下跌 7.8%,跌破 200 美元,触及 5 月底以来的最低点。尽管市场整体上涨,而且之前一直苦苦挣扎的科技板块也出现反弹,但这种下跌还是出现了。

松下减产可能影响特斯拉

特斯拉电池供应商松下宣布削减第二季度日本汽车电池产量。此外,他们还将年度利润预测下调了 15%,将此调整归因于全球电动汽车 (EV) 销量下降的影响。

值得注意的是,松下为全球多家汽车制造商使用的电动汽车 (EV) 生产电池,但他们在美国内华达州超级工厂与特斯拉合作。

这次减产影响了日本和国际客户,不包括北美业务。第二季度,松下减少了向特斯拉供应 1865 电动汽车电池。这些旧电池仍在特斯拉 Model S 和 Model X 车辆中使用,这些车辆不符合《通货膨胀减少法案》(IRA) 规定的电动汽车税收抵免资格。

松下首席财务官 Hirokazu Umeda 表示,由于高端特斯拉车型超过了 IRA 的 80,000 美元价格上限,需求有所下降。

特斯拉财务报表审查

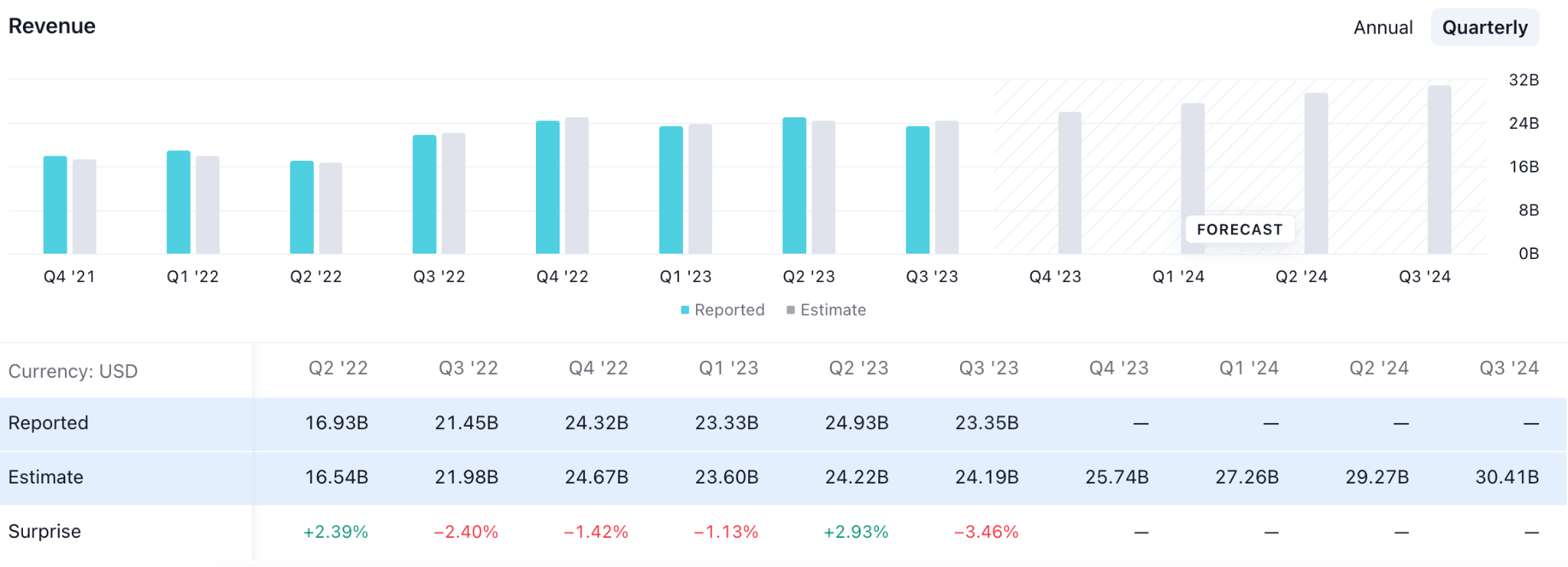

在最新的收益报告中,特斯拉每股收益下降 9.48% 至 0.66 美元。然而,收入受到的影响较小,比预期的 241.8 亿美元下降了 3.45%。

在最新的收入曲线中,尽管芯片问题和生产持续存在,但最近 4 个季度报告仍保持在 240 亿美元的水平。

来源:Tradingview

当前的流动性比率显示出积极的情绪,其中流动资产比流动负债高1.18倍。 因此,这表明公司有足够的流动资金来运营日常业务。

但最近两个季度净利润率下降至7.93%,低于前8个季度。 不过,最近两个季度的毛利率并未达到17.89%,与前8个季度相比并没有低多少。

最后,由于公司有更大的空间通过债务融资产生投资,因此长期股本债务看起来很稳定。

特斯拉股票(TSLA)技术分析

在特斯拉股票 (TSLA) 日线图中,当前价格交易于 2023 年波动的 50% 斐波那契回撤水平,这表明存在折扣区域。 此外,212.09 水平下方出现更低的低点,而当前价格已接近下降通道支撑位。

主图中,动态20日指数移动平均线仍高于当前价格,而190.41是直接支撑位。

在这种情况下,D1 蜡烛线高于 217.58 水平时的看涨反转可能是一个多头机会,目标是 269.42 水平。

另一方面,跌破 190.00 水平可能是一个强烈的看跌机会,这可能会导致价格跌向 151.99 支撑位。