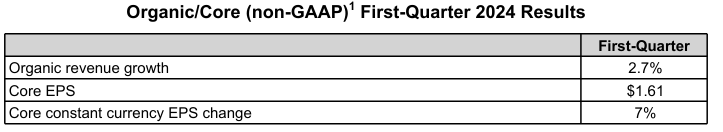

- PepsiCo's organic revenue grew by 2.7% in Q1 2024, with the international segment showing strong growth, especially in developing markets.

- Core constant currency EPS rose by 7% in Q1 2024, with a guidance of 8% for the full year.

- Challenges include a slowdown in organic revenue growth and decline in core operating profit margin.

- Technical analysis suggests positive momentum with a price target projection of $213.70 by year-end.

Delve into PepsiCo's (NASDAQ:PEP) financial health and market performance. Explore its organic revenue growth, international success, and challenges. From fundamental strengths to technical analysis, uncover what drives its stock price.

PepsiCo Fundamental Strengths

Organic Revenue Growth

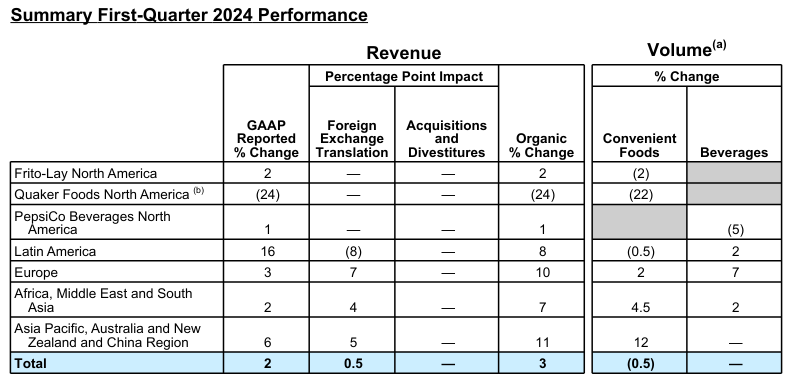

PepsiCo's organic revenue growth, a key performance metric, reflects the company's ability to generate revenue from its core business operations, excluding the impact of acquisitions, divestitures, and foreign exchange fluctuations. In the first quarter of 2024, PepsiCo delivered a 2.7 percent increase in organic revenue, compared to a robust 14.3 percent growth in the same period of the previous year. The performance of PepsiCo's global convenient foods and beverage segments contributed to organic revenue growth, with a 2.5 percent increase in global convenient foods organic revenue and a 3 percent increase in global beverage organic revenue. PepsiCo remains committed to delivering at least 4 percent organic revenue growth for the full year of 2024.

Source: Q1 2024 Earnings

Strong International Business Performance

PepsiCo's international segment demonstrated impressive growth, as evidenced by a 9 percent increase in organic revenue during the first quarter of 2024. This growth trend is consistent with the company's performance over the past twelve quarters, where it achieved at least high-single-digit organic revenue growth. Specifically, developing and emerging markets like Mexico, Brazil, Turkey, Egypt, Pakistan, and China delivered double-digit organic revenue growth, showcasing PepsiCo's strong foothold and growth potential in these regions. Furthermore, the international division's core operating margin increased by 180 basis points, highlighting its improved profitability.

Core Constant Currency EPS Growth

PepsiCo's core constant currency earnings per share (EPS) growth is a key financial metric that measures the company's profitability and efficiency in generating earnings from its core business operations, excluding the impact of currency fluctuations. In the first quarter of 2024, PepsiCo achieved a 7 percent increase in core constant currency EPS, compared to an 18 percent growth in the same period of the previous year. Looking ahead, PepsiCo reaffirmed its guidance of at least 8 percent core constant currency EPS growth for the full year of 2024. This guidance reflects PepsiCo's confidence in its ability to drive bottom-line growth.

PepsiCo Fundamental Weakness

Slowdown in Organic Revenue Growth:

PepsiCo experienced a significant slowdown in organic revenue growth compared to the previous year. In the first quarter of 2024, organic revenue grew by only 2.7 percent, compared to a robust 14.3 percent growth in the same period of 2023. This deceleration indicates a potential challenge in sustaining rapid revenue expansion, which could hinder the company's growth trajectory. The decline in organic revenue growth was primarily attributed to the underperformance of the Quaker Foods North America business due to product recalls, which detracted approximately one percentage point from the overall organic revenue growth rate.

Source: Q1 2024 Earnings

Decline in Core Operating Profit Margin:

Despite efforts to drive productivity initiatives, PepsiCo witnessed a decline in core operating profit margin in certain segments. For example, Quaker Foods North America reported a significant decline of 35 percent in core operating profit, primarily due to the impact of product recalls and inflationary pressures. Similarly, Frito-Lay North America experienced a 2 percent decline in core operating profit, contrasting with a strong 24 percent growth in the previous year's first quarter. These declines in core operating profit margins suggest challenges in cost management and operational efficiency, which could hinder the company's ability to improve profitability and sustain growth.

PEP Stock Forecast 2024

The current PepsiCo stock price stands at $175.58, surpassing the trendline of $168.82 and the baseline of $168.88. Both the trendline and baseline, derived from modified exponential moving averages, indicate an upward direction in the Pepsi stock price. This suggests a positive momentum in the mid- to short-term. The average price target for PepsiCo by the end of 2024 is projected to reach $213.70. This projection is based on the momentum of change-in-polarity over the mid- to short-term, evaluated alongside Fibonacci retracement/extension levels. While an optimistic price target is not provided, the analysis of the price momentum of the current swing over the mid- to short-term, combined with Fibonacci retracement/extension levels, could provide additional insights into potential upside scenarios.

PepsiCo stock forecast - Support and Resistance Levels

PepsiCo's primary support is noted at $173.26, with the pivot of the current horizontal price channel at $169.03. In case of heightened volatility, resistance levels are projected at $194.36 (upper level) and $182.40 (core level). Conversely, support levels are observed at $164.80. The absence of core support and support levels in case of heightened volatility indicates a potential vulnerability to significant downside movement.

Source: tradingview.com

PEP Stock Forecast - RSI And MACD Analysis

The RSI value stands at 60.27, indicating a positive trend. The current RSI level surpasses both the regular bullish level of 38.89 and the regular bearish level of 54.52. Despite a bearish divergence, as indicated, the RSI line trend remains upward, signaling potential strength in the stock's performance. Moreover, the MACD indicator portrays a bullish trend with the MACD line at 0.1401 and the signal line at -1.24. The MACD histogram stands at 1.380, illustrating an increasing strength of the bullish trend. This aligns with the overall positive outlook for PEP stock price.

Source: tradingview.com

Conclusion

PepsiCo's fundamental strengths like organic revenue growth and international performance align with positive price momentum. Despite challenges, PEP stock forecast technical analysis indicates a bullish trend, suggesting potential upside.