- PepsiCo anticipates a 10% organic revenue growth rate for fiscal year 2023, showcasing its market share-capturing ability.

- It also plans to return approximately $7.7 billion to shareholders, emphasizing its focus on delivering value.

- Low unemployment rates in markets where PepsiCo operates enhance the company's long-term growth prospects.

- Through its pep+ initiative, PepsiCo demonstrates its inclination towards environmental sustainability, responsible sourcing, and healthier food options.

In the fast-paced realm of the food and beverage industry, PepsiCo (NASDAQ: PEP) has mastered the art of longevity. As consumer preferences shift, markets evolve, and global dynamics fluctuate, this global powerhouse remains an unwavering force. What's the secret to their enduring success? The article explores the fundamental strengths that define PepsiCo's path to prosperity. From robust financial performance and strategic innovation to unwavering commitments to sustainability and competitive dynamism, the article unravels the intricate threads that have woven the tapestry of PepsiCo's long-term value creation.

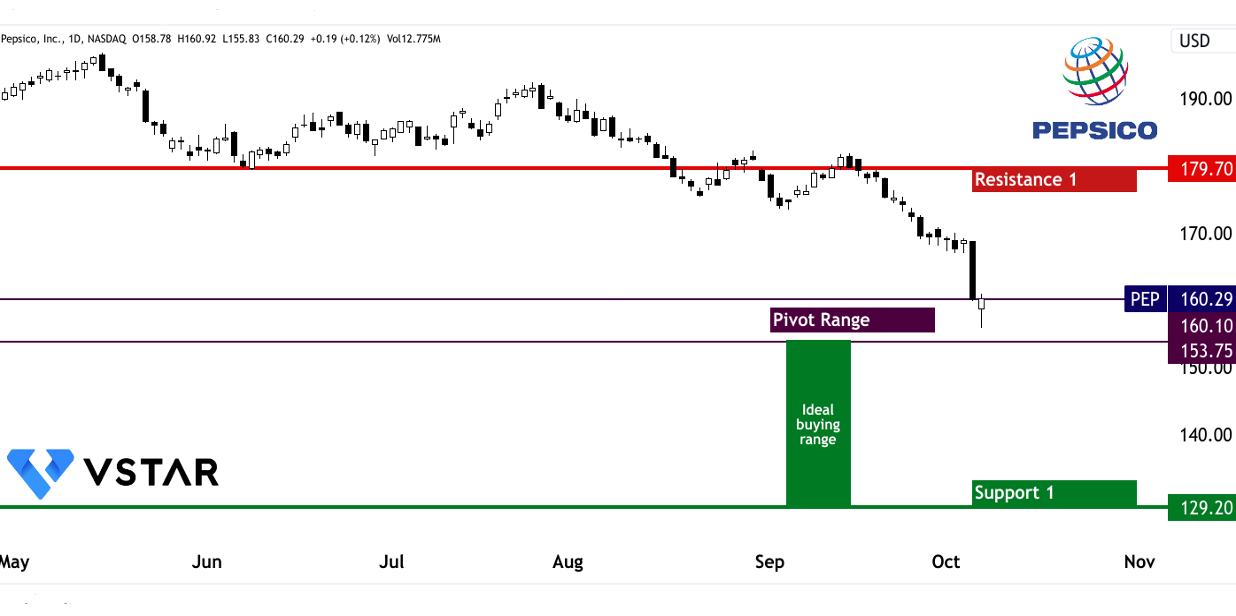

The technical perspective on the weekly moves of PepsiCo stock can be comprehended as follows:

Source: tradingview.com

Due to the volatility ahead of Q3 earnings, the above critical technical levels can be considered while initializing the long positions (near support level) and partial exits (near resistance level). The continuous weekly technical developments can be observed on vstar.com.

Robust Performance and Macro Exposure

PepsiCo's Q3 guidance for fiscal 2023 is indicative of its strong financial position and growth potential. The company expects to achieve a 10 percent organic revenue growth rate, up from the previous estimate of 8 percent. This increase signifies PepsiCo's ability to capture market share and expand its product offerings.

The anticipated core constant currency EPS growth of 12 percent is a testament to the company's financial strength and efficient operations.

PepsiCo's focus on returning approximately $7.7 billion to shareholders through dividends and share repurchases reflects its dedication to delivering value to investors.

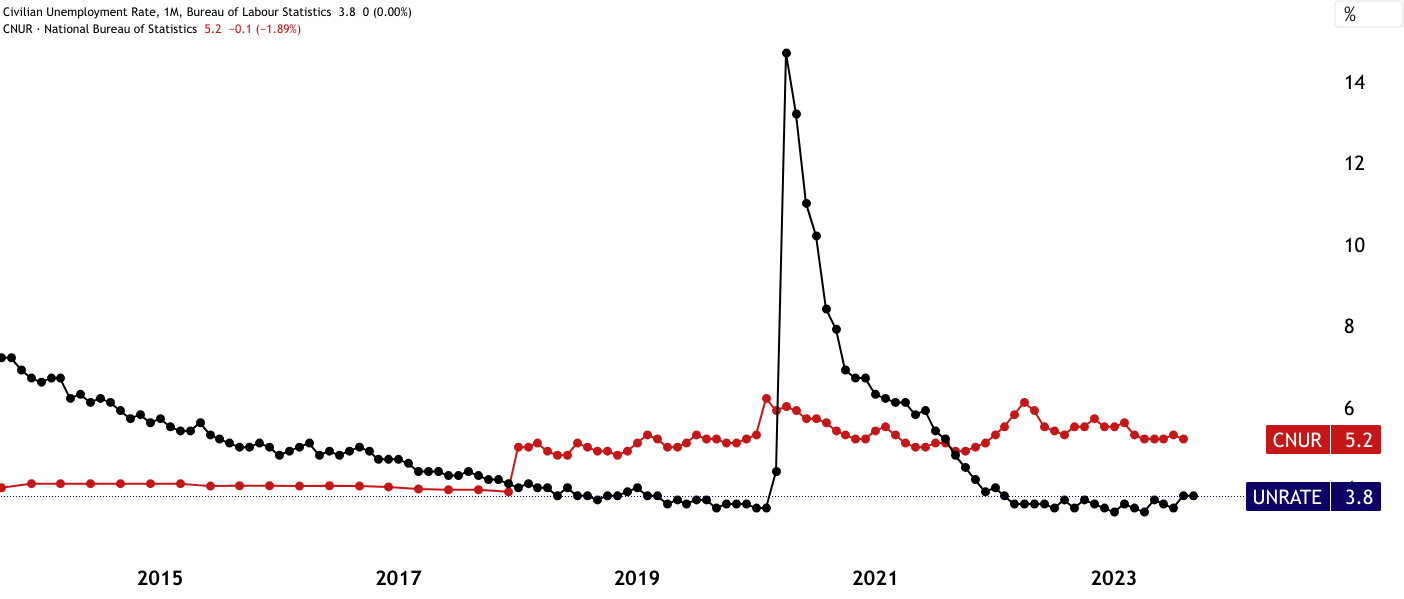

The global economy plays a critical role in PepsiCo's long-term prospects, and low unemployment rates in most markets where the company operates are a positive indicator. Low unemployment levels mean that consumers have stable sources of income, making them more likely to continue purchasing PepsiCo's products.

In developed markets, where PepsiCo has a strong presence, low unemployment rates contribute to consumer confidence and spending. In developing markets like Mexico and parts of Asia, where the company is expanding its footprint, low unemployment rates signify growing middle-class populations with increasing purchasing power. As these economies continue to develop, PepsiCo may capture a larger share of consumer spending. Low unemployment rates not only boost consumer behavior but also signal economic stability, making it easier for PepsiCo to plan for long-term growth and investments.

Source: tradingview.com

Furthermore, PepsiCo's strong performance in Europe signifies its ability to excel in diverse markets. The company's success in the region is driven by several factors:

- A robust snack portfolio: PepsiCo's strong market positions in snacks have contributed to its European success.

- Improved pricing strategies: The company's ability to negotiate win-win solutions with customers has resulted in better pricing and profitability.

- Significant productivity gains: PepsiCo's focus on simplification and digitalization has driven efficiency improvements.

- Shifting consumer behavior: The company has adeptly navigated changes in consumer preferences.

This strong European performance is indicative of PepsiCo's adaptability and its ability to thrive in various market conditions.

Consistent Growth and Market Outperformance

PepsiCo has delivered impressive results with seven consecutive quarters of double-digit organic revenue growth. This sustained growth signifies the company's adaptability to evolving consumer preferences and its ability to maintain a strong market presence. The company's diverse portfolio of well-known brands, including Lay's, Doritos, Cheetos, and Gatorade, has contributed significantly to its continued market share gains.

Notably, PepsiCo has successfully navigated consumer behavior shifts, especially during challenging times like the COVID-19 pandemic. Despite economic uncertainty, consumers have continued to favor PepsiCo's products in both developed and developing markets.

Furthermore, PepsiCo's strong marketing efforts and brand equity have played a significant role in retaining consumers within its product categories. Consumers perceive value in PepsiCo's products, making them more resilient to price increases. This value perception is a result of sustained investment in brand building and product quality over the years. In the long term, this positive consumer behavior will continue to benefit PepsiCo, as it can rely on a loyal customer base that values its products, leading to sustained revenue growth and profitability.

Investments in the Supply Chain

One of PepsiCo's fundamental strengths lies in its robust supply chain management. The company's agile supply chain and robust local sourcing networks have enhanced its ability to thrive in dynamic operating and macroeconomic environments.

Also, the company has made significant improvements in this area, resulting in more efficient material flows from suppliers. These improvements are not temporary; they represent a long-term commitment to operational excellence. PepsiCo's ability to manage its supply chain effectively ensures consistent product availability, reduces costs, and enhances customer satisfaction.

Further, efficient supply chain management is particularly crucial in the food and beverage industry, where timely delivery of products is essential to meet consumer demand. By consistently optimizing its supply chain, PepsiCo can maintain its competitive edge and respond effectively to changing market dynamics.

For instance, PepsiCo's direct-store delivery system in the U.S. is a powerful asset that contributes significantly to the company's long-term success. This system ensures efficient distribution, timely restocking of store shelves, and effective execution of marketing initiatives.

Lastly, efficient DSD allows PepsiCo to capture market share and respond swiftly to changes in consumer preferences. It ensures that PepsiCo's products are readily available to consumers, driving sales and brand loyalty. The company's continued investment in its DSD capabilities positions it to maintain a strong presence in the competitive beverage market.

Sustainability Initiatives (pep+)

PepsiCo's focus on sustainability through its pep+ (PepsiCo Positive) initiative is evident in its actions and results. The company has more than doubled its regenerative farming footprint in 2022 through groundbreaking partnerships, the adoption of new technologies, and collaboration with trusted farmer-facing organizations.

Additionally, improving operational water-use efficiency by 22 percent in 2022 (compared to a 2015 baseline) in high-risk locations signifies the company's commitment to responsible water management.

PepsiCo's success in reducing added sugars and sodium levels across its portfolio, along with achieving its saturated fat reduction goal four years ahead of schedule in 2021, aligns with the growing demand for healthier and more sustainable food and beverage options.

Lastly, initiatives such as the use of reusable packaging with SodaStream and Gatorade reusable bottles demonstrate a commitment to eco-friendly practices.

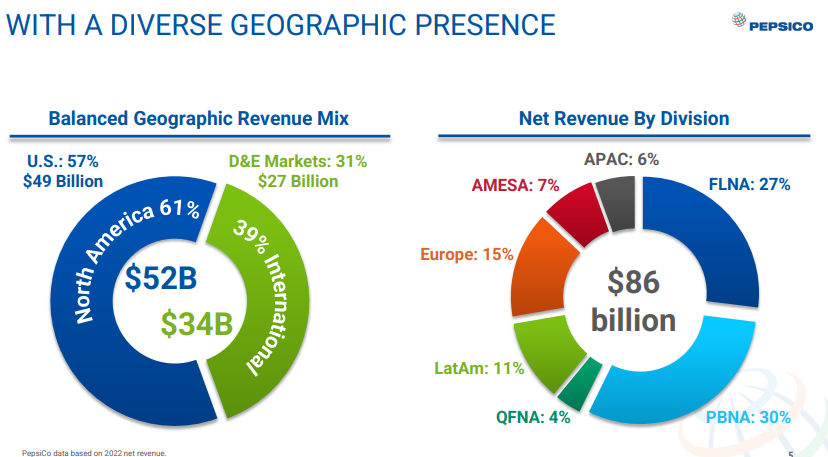

International Growth and Rational Competition

PepsiCo's international business has been a significant driver of growth, achieving nine consecutive quarters of double-digit organic revenue growth. The company's ability to gain market share in both developed and emerging markets, including China, India, Brazil, Mexico, Saudi Arabia, Turkey, and many others, highlights its global appeal and adaptability to local consumer preferences. A notable example is PepsiCo's collaboration with Celsius, a brand capturing new consumers in the energy drink category.

Further, the company is considering the expansion of Celsius and other brands into more developed markets, where the energy drink category is more established. This strategic move diversifies PepsiCo's product offerings and opens up new growth avenues. By seizing expansion opportunities, PepsiCo ensures that it remains a dynamic player in the global food and beverage industry, positioning itself for sustained success in the long term.

Interestingly, competitive dynamics can greatly influence a company's growth, and PepsiCo has benefited from rational competition in both its snack and beverage businesses. Rational competition implies that competitors are not engaging in destructive pricing wars or market share battles that erode profitability for all players. A stable competitive environment allows PepsiCo to focus on its strategies and initiatives rather than constantly reacting to aggressive competitive moves. This strategic freedom is essential for the company to invest in innovation, marketing, and productivity-enhancing measures that drive long-term growth.

Source: CAGNY Presentation

Strategic Pricing and Product Diversification

PepsiCo's strategic product diversification is a key element of its strategy. The company's expansion into the sports nutrition category and the launch of innovative products such as STARRY demonstrate its focus on meeting evolving consumer demands. Further, PepsiCo's dedication to health and wellness is evident in its efforts to reduce added sugars, sodium, and saturated fat in its products. The focus on zero-sugar offerings, nutritious convenience foods, and sustainable packaging aligns with consumer trends favoring healthier and eco-friendly choices. In particular, PepsiCo's focus on zero-sugar propositions in more affluent European markets has been successful.

PepsiCo's diverse portfolio of brands is another core strength that will serve it well in the long term. The company's portfolio includes a wide range of products, from carbonated soft drinks to snacks and healthier options. A strong portfolio also means that PepsiCo can navigate market fluctuations and economic challenges more effectively, as it has multiple revenue streams to rely on.

Logically, balancing pricing and commodity inflation is a critical factor for PepsiCo's financial health. The company has successfully managed its pricing strategy, ensuring that it aligns with commodity cost increases. This alignment ensures that PepsiCo maintains its margins and profitability even when faced with rising input costs.

Finally, PepsiCo's pricing strategy is not driven by short-term considerations but is designed to be sustainable over the long haul. This pricing strategy, when combined with efficient cost management and productivity gains, positions PepsiCo for sustained margin improvement.

Brand Strength and Margin Improvement

PepsiCo's portfolio of iconic brands, including Pepsi, Lay's, Gatorade, and Tropicana, continues to resonate with consumers globally. These brands have a strong presence and enjoy a significant share of their respective markets. PepsiCo's adaptability to evolving consumer preferences and its consumer-centric approach have been key to its sustained success. For instance, initiatives such as offering diverse packaging options, introducing new flavors, and expanding product lines demonstrate PepsiCo's focus on delivering products that resonate with consumers.

Fundamentally, PepsiCo's investments in technology and digitalization are key to its future growth. The adoption of artificial intelligence for predictive analytics enhances forecasting and planning processes. Digitalization efforts improve consumer communication, marketing activities, and safety measures at worksites, contributing to improving core operating margins. Measures such as removing inefficiencies, optimizing advertising and marketing spend, modernizing the supply chain, and accelerating automation contribute to margin improvement.

Key specific risks for PepsiCo include:

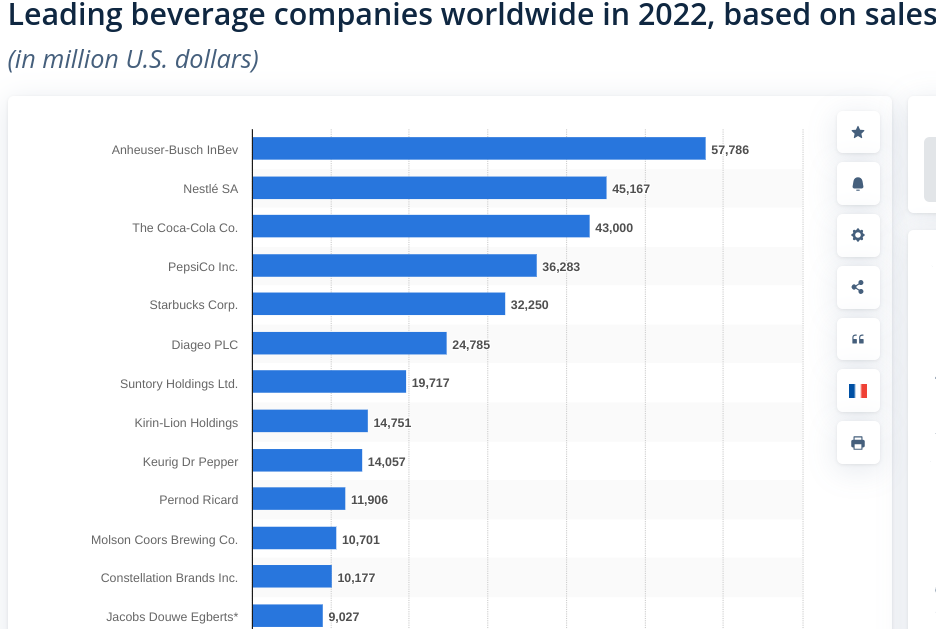

- PepsiCo faces intense competition from rivals like Coca-Cola and other beverage and snack companies. Market share battles and pricing wars could erode profitability.

- Rapid shifts in consumer preferences toward healthier and sustainable products pose a risk. PepsiCo must continuously innovate to meet these demands.

- Disruptions due to natural disasters, pandemics, or geopolitical issues could impact the availability of raw materials and distribution, affecting production and sales.

- Stricter environmental regulations may increase operational costs and require significant changes in packaging and sourcing practices.

- Increasing focus on health and wellness could lead to reduced consumption of sugary and unhealthy products, impacting PepsiCo's traditional offerings.

- PepsiCo's global presence exposes it to currency exchange rate fluctuations, affecting revenues and profits in different markets.

- Economic recessions or downturns may reduce consumer spending, affecting PepsiCo's sales and profitability.

Source: statista

In conclusion, PepsiCo's fundamental strengths are geared towards creating long-term value for shareholders. The company's strong financial performance, sustainability initiatives, and adaptability position it to thrive in a competitive and dynamic market environment. The combination of brand strength, consumer-centric innovation, and a commitment to environmental and social responsibility underpins PepsiCo's long-term value proposition.