Covid-19 took a toll on many companies, and this unique retail, advertising, and social media company - Pinterest (NYSE: PINS) - was no exception. In the previous year, 2021, the company was profitable with revenue up nearly 50% year-over-year, which was a comeback from a losing streak after the company went public in 2019.

You'd think 2023 would be a better year, but Pinterest: PINS started the year with a loss of $0.31 in earnings per share. Doesn't look like a great stock, does it? But when you look at Pinterest's balance sheet at the end of the first quarter of 2023, you might change your mind, because the company recorded an estimated $1.65 billion in cash, along with other compelling metrics that will be clearly disclosed and analyzed in this article. And with Julia Brau Donnelly joining Pinterest as Chief Financial Officer, this "social media phenom" is poised to take off. See below why you should invest in PINS stock with VSTAR.

Pinterest Inc.'s Overview: Leveraging Advertising for Growth and Profitability

Image Source: Unsplash

Pinterest was established in 2009 through the collaborative efforts of founders Ben Silbermann, Paul Sciarra, and Evan Sharp, but the innovative platform wasn't unveiled to the public until 2010. Pinterest delved into e-commerce, introducing a shopping feature in 2016.

The company's presence was solidified in 2014 when it went public on the NYSE, making its mark on the market. It ventured into augmented reality in 2018 with the AR try-on feature. Pinterest Inc. made further progress in 2020 with the introduction of engaging video ad formats, marking its foray into dynamic content. A significant shift occurred in 2022 when Ben Silbermann handed over the CEO role to Bill Ready, ushering in a new chapter.

Pinterest, Inc. operates as a visual discovery engine, allowing users to explore a wealth of ideas, from recipes to home and style inspiration. With approximately 463 million users by the end of the first quarter of 2023, Pinterest's massive user base plays a critical role in the company's advertising revenue generation.

While user growth is important, the real story is in understanding revenue per user. In the first quarter of 2023, Pinterest's revenue per user was $1.32, down slightly from the previous year. This metric represents the financial importance of each user to the company's overall revenue.

Geographically, the U.S. market is the most profitable, with an average revenue per user of $5.11, followed by Europe at $0.74 and the rest of the world at just $0.10. The variation in revenue per user across regions highlights the importance of growing the user base in both domestic and international markets.

Pinterest's CEO, Bill Ready, who assumed his role in June 2022, plays a crucial role in the company's direction. With a tenure of 1.08 years, his leadership and focus on increasing advertising opportunities are instrumental in driving sustainable profitability.

Leadership Team and Top Shareholders

Image Source: Istock

In addition to Bill Ready, Pinterest's executive team includes Benjamin Silbermann, co-founder and executive chairman, and Evan Sharp, another co-founder. Wanjiku Walcott serves as chief legal and business affairs officer and company secretary, and Naveen Gavini is the photo-sharing platform's chief product officer. Julia Donnelly currently holds the position of CFO.

In terms of ownership, the top 25 shareholders collectively own 62.26% of the company. Notable among them is The Vanguard Group, Inc. which owns 8.11% of Pinterest's shares. Benjamin Silbermann, one of the co-founders, owns a significant 5.66% stake in the company, and his total value in Pinterest shares is $1.1 billion.

As Pinterest continues to evolve and innovate, the collective efforts of its leadership team and significant contributions from top shareholders play a critical role in driving the company's vision and executing on strategic initiatives.

Pinterest Inc.'s Business Model and Products

How Pinterest Makes Money

Pinterest generates revenue through advertising, primarily through its "Promoted Pins" feature. These promoted pins look like user-created pins, but they are paid advertisements from companies that have been named. The company uses user data to target ads based on users' interests, searches, and demographics. Because users frequently pin items of interest, this advertising process is tailored to their preferences, making it an effective revenue stream for Pinterest.

In addition, Pinterest has integrated a "Buy It" button that allows users to purchase pinned products directly from the platform without visiting separate merchant websites. Participating merchants can partner with Pinterest, potentially expanding e-commerce opportunities. However, it is not clear whether Pinterest will charge commissions to these partners..

Main Products and Services

Image Source: Unsplash

Pinterest works differently and offers users a unique experience unlike traditional social media platforms like Facebook or Twitter. Instead of sharing photos directly with friends, Pinterest users curate personal pinboards of images uploaded by friends, strangers and businesses. Users can also upload their own photos and pin them to their portfolios.

The platform allows registered users to upload, store, sort and manage images and other media content, including videos. This interactive feature creates a personalized experience for users, while their friends can explore their boards to see what interests them.

Pinterest's primary products and services include Promoted Pins - paid advertisements that look like regular pins - and the "Buy It" button, which allows users to purchase products directly from the platform.

Pinterest sees itself as a tool that allows users to plan for the future by curating images or sets of images. Its bulletin board-like platform has attracted approximately 445 million monthly active users, known as "pinners", who browse and share images and content in the form of "pins".

A Compelling Investment: Pinterest Inc. (PINS): Unveiling Growth Potential

Image Source: Istock

Investors, the opportunity before you is undeniably compelling: Pinterest Inc, a formidable company poised for greatness.This social media powerhouse is making waves, and 2023 is proving to be a pivotal year in its history.

Fueling Growth: Revenue Surge and Market Capitalization

Pinterest's financial statements tell a story of remarkable growth. In just two years, its revenue jumped from $2.80 billion to a staggering $2.83 billion in 2023. A staggering market capitalization of $19.6 billion, reflecting investors' unwavering confidence in this game-changing company, further underscores this achievement.

Strategic Focus: Reinventing Social Media

Unlike traditional social media giants, Pinterest differentiates itself by presenting a new realm of possibility: planning for the future. With a solid gross margin of 75.25%, Pinterest is nimbly transforming advertising with its "promoted pins" feature that resonates with a discerning audience.

Leap of Faith: The Road to Profitability

Think of this investment as a leap of faith in a visionary company. While EPS stands at -0.44, understand that this journey of innovation and expansion comes with short-term risks. Pinterest's net profit margin may currently be -10.58%, but rest assured, this is the result of strategic investments that will soon blossom into prosperous rewards.

Financial Prudence: Strong Debt-to-Equity and Expense Control

Pinterest's prudence shines through in its financial management. With a debt-to-equity ratio of 0%, the company boasts a stable foundation free from the shackles of long-term debt. The company's meticulous expense control is also evident, with gross profit of $2.13 billion against total expenses of $2.44 billion. Such discipline provides a solid foundation that positions Pinterest for long-term sustainability.

PINS Stock Performance Analysis: A Journey of Promise

PINS Stock Trading Information

Image Source: Istock

Intriguing since its inception, Pinterest Inc (PINS) has charted an impressive course in the stock market, captivating investors worldwide with its growth potential.

IPO Time; Primary Exchange & Ticker; Country & Currency

Pinterest began its journey to the public market on April 18, 2019. The New York Stock Exchange (NYSE) serves as its primary exchange, where the company trades under the ticker symbol "PINS." Operating in the United States, Pinterest's stock trades in U.S. dollars, capitalizing on the momentum of one of the world's largest economies.

Trading Hours: Pre-Market; After-Market

With an insatiable appetite for growth, Pinterest stock trades during regular market hours from 9:30 a.m. to 4:00 p.m. ET. While the trading window opens during regular hours, the company's allure transcends traditional boundaries, fostering opportunities in the pre-market trading session from 4:00 AM to 9:30 AM ET and the after-market period from 4:00 PM to 8:00 PM ET.

Stock Splits: None But Promising

Pinterest's stock hasn't split to date, maintaining its pristine value and signaling belief in the company's potential.

Dividends: None

Pinterest stands out for its relentless focus on growth and expansion, and has chosen to forgo dividends for the time being.

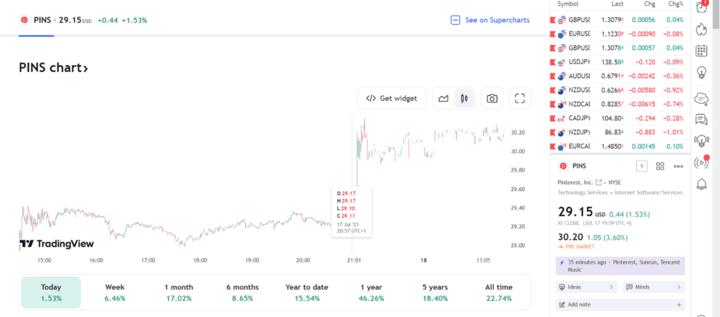

PINS Stock Price Performance since its IPO: A Journey of Stability

Since its IPO, Pinterest Inc. (PINS) has maintained a steady path in the stock market, demonstrating resilience and stability amidst market fluctuations.

Historical Highs and Lows

There have been notable highs and lows in Pinterest's stock price history. The 52-week range reflects the stock's journey from a low of $16.78 to a high of $29.27, reflecting the company's ability to weather market conditions and maintain investor interest.

Current Stock Price

As of the last trading day, Pinterest stock was trading at $29.15, offering investors an enticing entry point into this transformative company.

Stock Price Volatility Analysis

Pinterest is demonstrating its resilience by remaining relatively stable in the face of market dynamics. Over the past 3 months, the stock's volatility has mirrored that of the broader U.S. market, moving within a modest range of +/- 7% on a weekly basis. This stability is a testament to the company's focused growth strategy and ability to navigate changing market conditions.

Key Drivers of PINS Stock Price

A variety of factors affect Pinterest's stock price. The company's key drivers include revenue growth and advertising performance. The company's ability to retain and grow its user base, as well as its success in monetizing its platform through promoted pins, plays a critical role in the stock's performance.

In addition, investors are closely monitoring Pinterest's strategic partnerships, product innovation and expansion efforts, as these efforts have the potential to create new revenue streams and drive future growth.

PINS Stock Forecast

When we start forecasting the price of Pinterest Inc (PINS) stock, a tapestry of insights emerges, weaving together analyst recommendations, price targets, and key support and resistance levels.

PINS Stock Price Trend Analysis

Pinterest stock has been on an upward trajectory, reflecting the company's growth potential and investor confidence. The 20-day and 50-day exponential moving averages at $27.10 and $25.91, respectively, provide a buy signal, underscoring the stock's momentum.

According to the TradingView charts, Pinterest stock has demonstrated important resistance and support levels. The resistance level is at $29.68, while the support level is anchored at $20.58. These levels serve as important markers to guide investors through potential price movements.

Analyst Recommendations and Price Targets

The consensus analyst recommendation for Pinterest is a "Moderate Buy," with 21 analysts providing their outlook over the past 3 months. Of these, 9 analysts rate the stock a "Buy," indicating confidence in its growth prospects, while 12 analysts recommend a "Hold."

Image Source: Istock

Price targets from major analysts reflect their expectations for Pinterest's future performance

The average price target is $28.05, which implies a downside of -3.77% from the current share price of $29.15. The highest price target is $34.00, indicating the potential for significant growth if the company continues its growth trajectory. On the other hand, the lowest price target is $21.00, which represents a cautious perspective.

Challenges and Opportunities

Image Stock: Istock

Competitive Risks: Challenging Titans with Unique Advantages

Pinterest Inc. (PINS) stands tall among its competitors, including heavyweights like Facebook and Instagram. The competitive landscape poses risks as social media giants vie for users' attention and advertising revenue. However, Pinterest's unique advantages set it apart:

Emphasizing Visual Discovery

Pinterest's focus on visual content discovery sets it apart from platforms like Instagram and Facebook, which primarily facilitate content sharing. This niche advantage appeals to users looking for inspiration and ideas, making it a preferred platform for planning future projects and exploring interests.

Appealing User Demographics

Pinterest's predominantly female user base with an above-average income sets it apart from other platforms. This demographic profile piques the interest of advertisers, creating fertile ground for targeted advertising and revenue growth.

Other Risks: Embracing the Unknown

While Pinterest's advantages provide resilience, it's vital to recognize potential risks:

Market Saturation: The social media landscape is constantly evolving, and Pinterest must maintain its appeal to retain users and attract new ones. Market saturation could hinder user growth, requiring innovative strategies to stay ahead.

Advertising Competition: Facebook and Instagram have impressive advertising capabilities. Pinterest will need to continually improve its advertising tools and offerings to attract marketers and secure advertising revenue.

Growth Drivers: Navigating a World of Potential

Image Stock: Istock

Pinterest's growth potential is supported by various factors:

Expanding Use Cases: Pinterest's platform versatility encourages users to explore diverse interests, from recipes to home improvement ideas. The company's growth opportunities extend to tapping into new user segments and expanding its total addressable market (TAM).

E-Commerce Integration: Pinterest's "buy it" button propels the company into the e-commerce space, opening up new opportunities for revenue generation. By bridging the gap between inspiration and purchase, Pinterest is leveraging its resources to facilitate consumer transactions.

Future Outlook and Expansion: A Visionary Journey

Pinterest's future outlook revolves around a visionary expansion:

International Markets: By expanding its international reach, Pinterest can unlock significant growth potential in untapped markets and transform from a U.S.-centric platform to a global social media leader.

Strategic Partnerships: Collaborations with industry giants like Apple strengthen Pinterest's position as a search engine for visual inspiration, leading users to discover new products, apps, and experiences.

Why Traders Should Consider PINS Stock

Source: Istock

Pinterest Inc. (PINS) is a compelling investment proposition that holds an exquisite tapestry of new, captivating reasons for traders to embrace its transformative stock:

- Global Reach and User Engagement: With a growing user base of approximately 463 million, up 7% year over year, Pinterest's international footprint creates an expansive market reach. Traders can capitalize on the platform's ever-increasing user engagement, with the expectation of increased revenue generation as more users actively participate.

- Revitalized Revenue Potential: Pinterest's focus on advertising, with revenue per user of $1.32 in Q1 2023, represents a powerful revenue stream that continues to evolve. Traders can ride the wave of advertising growth, particularly in the U.S. market, where average revenue per user is a substantial $5.11, unlocking potential profitability.

- Strategic Partnerships: Pinterest's recent partnerships with Google Cloud and TSMC demonstrate its commitment to innovation and exploring new market opportunities. Traders can see this as an exciting catalyst, paving the way for further growth and potential expansion into emerging industries like the metaverse.

- Improving Financial Metrics: Pinterest's financial performance has been on a consistent upward trajectory, with its market capitalization rising 23% to $76.47 billion by 2023. Traders can find confidence in the company's strong net income of $985.65 million and healthy cash flow from operations, which indicates robust financial health.

Trading Strategies for PINS Stock: Embracing the Visionary Journey

As traders embark on this visionary journey with Pinterest Inc (PINS), they can employ a variety of strategies to capitalize on its limitless potential:

- Ride the Wave of Growth: Traders can position themselves for long-term growth by recognizing Pinterest's unique advantages and global appeal. By establishing a strategic long position, they can benefit from the platform's expanding use cases and its ability to capture an engaged user demographic.

- Short-Term CFD Trading Opportunities: Pinterest stock price volatility, with stable weekly fluctuations of around +/- 7%, presents an opportunity for short-term CFD traders to capitalize on price swings. Utilizing technical analysis and chart patterns, traders can use CFDs to seize timely entry and exit points, leveraging short-term momentum. CFDs allow traders to speculate on these price movements without owning the actual shares, providing the potential for gains whether the price rises or falls.

- Diversified Portfolio Approach: Including Pinterest stock in a diversified investment portfolio allows traders to capitalize on its potential while managing risk. By mixing growth-oriented assets with stable investments, traders can optimize their risk-reward profile.

Trade PINS Stock CFD with VSTAR: A Gateway to Triumph

VSTAR continues to be an unbeatable platform for CFD trading, aligning itself with Pinterest Inc.(PINS) as it embarks on a path of transformative growth. Traders can leverage VSTAR's robust trading tools, diverse asset selection and secure environment to capitalize on the limitless potential of PINS stock.

VSTAR's comprehensive CFD trading offering covers a wide range of products, from stocks and indices to currency pairs, commodities and cryptocurrencies. This range of options allows traders to explore and profit from a variety of market movements.

VSTAR boasts best-in-class market depth and order execution, ensuring timely moves with confidence. The user-friendly trading application offers flexible leverage options that amplify trading power and simplifies the process, all with remarkably low transaction costs and transparent fees.

The platform's robust technical infrastructure ensures stability and security, creating a secure environment for investment. In addition to providing a seamless platform, VSTAR's regulatory compliance ensures a transparent and fair trading environment that enhances the security of transactions.

Conclusion

Pinterest Inc. (PINS) beckons traders with an awe-inspiring world of discovery and financial potential. With its unique market positioning, global reach and strategic partnerships, Pinterest represents an exceptional investment opportunity. As you embark on this visionary journey, seize the opportunity to capitalize on its growing user base, reinvigorated revenue potential, and impressive financial metrics.

Choose your trading strategies wisely, whether it's riding the wave of long-term growth, capitalizing on short-term opportunities, or building a diversified portfolio. Embrace the transformative essence of Pinterest Inc.(PINS) and navigate the dynamic world of visual inspiration with the confidence of VSTAR's robust trading platform.

Ignite your trading journey and let it lead you to triumph and growth. Harness the Pinterest momentum and unleash your trading success today!