I. Recent Plug Power Stock Performance

Recent PLUG stock price performance and changes

Plug Power's recent stock performance reflects significant volatility and downward trends. Over the past year, PLUG stock has experienced a substantial decline, with a 52-week range spanning from $2.26 to $13.44. Momentum and sector relative grades both indicate poor performance, with PLUG consistently underperforming its sector across various timeframes.

In the last three months, PLUG's price performance reflects a decline of nearly 27%. Similarly, over six and nine months, the stock's performance represents decreases of over 54% and 63%, respectively. The one-year price performance also received an F grade, with a staggering decline of almost 67%.

This poor performance contrasts sharply with historical averages, where PLUG typically outperformed its sector and exhibited positive momentum. However, recent trends show a stark reversal, with PLUG significantly lagging behind both sector averages and its own historical performance.

Main influencing factors

Several factors have influenced Plug Power's recent stock performance. Firstly, operational achievements, such as the launch of their Georgia plant and the initiation of a joint venture with Olin in Louisiana, signal significant advancements in green hydrogen production. These endeavors position Plug Power as a leader in the renewable energy sector and contribute to market sentiment regarding the company's future prospects.

Financially, efforts to improve cash management and address concerns regarding the company's financial health have been instrumental. Operational successes, including collaborations with major corporations like Walmart, Home Depot, and Amazon, underscore Plug Power's growing market footprint and potential for revenue generation.

Innovation remains a key driver, with the introduction of new platforms and products showcasing Plug Power's commitment to staying ahead in the green energy sphere. However, challenges such as delays in scaling up new product platforms and fluctuations in hydrogen fuel markets have impacted sales projections and, consequently, stock performance.

Strategic decisions aimed at bolstering financial stability, such as significant restructuring initiatives and pricing adjustments, demonstrate Plug Power's proactive approach to navigating market complexities. These efforts, coupled with a focus on improving margins and reducing cash outflows, are expected to pave the way for sustained growth and profitability, positioning Plug Power for long-term success in the renewable energy sector.

Expert Insights on PLUG Stock Forecast for 2024, 2025, 2030 and Beyond: Is Plug Stock a Buy?

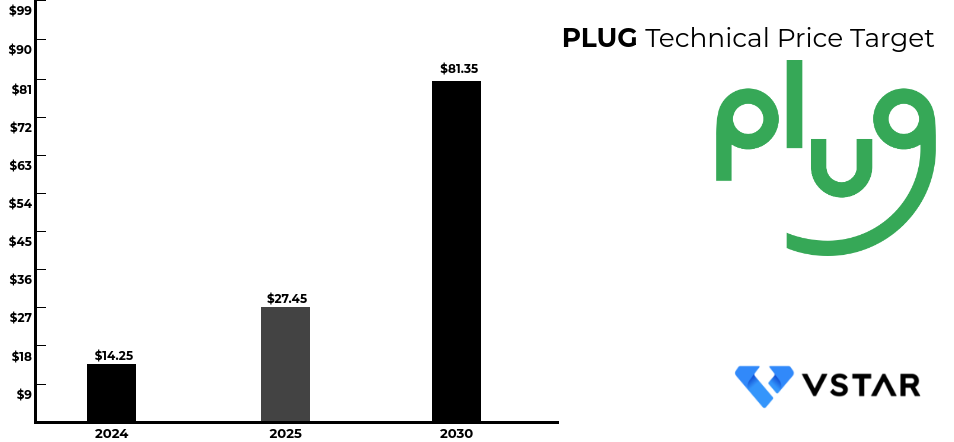

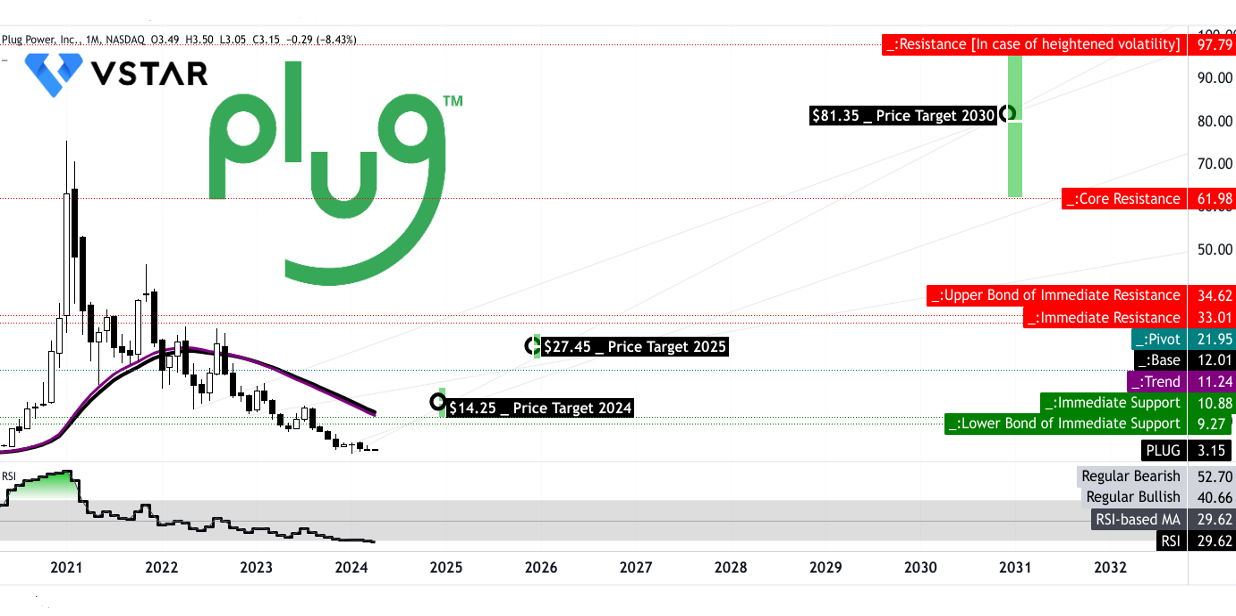

Expert forecasts for Plug Power (PLUG) stock indicate gradual growth, with a target of $14.25 for 2024, reflecting cautious optimism amid operational advancements. Projections extend to $27.45 by 2025, reflecting increasing market confidence in Plug Power's long-term potential. By 2030, Plug Power predictions reach $81.35, suggesting sustained growth in renewable energy sectors.

Extended to 2032, targets rise to $97.80, reflecting continued optimism and potential for Plug Power's innovative solutions to address global energy challenges. These forecasts consider factors such as operational performance, market dynamics, and broader industry trends in shaping Plug Power's future trajectory.

Source: Analyst's compilation

II. PLUG Stock Forecast 2024

The Plug Power stock price may hit $14.25 by the end of 2024. The price is following a severe downtrend over the short term. However, the projections are based on recent price swings projected forward through Fibonacci retracement and extension levels. The current pierce trend also has a significant ongoing accumulation phase in the market price cycle. The price is currently hovering near the support zone ($4.05-$4.50). Any proper close above this support zone will initiate bullish momentum.

Looking at the relative strengths index (RSI), at 36, it signals that bullish momentum is already emerging. The price inflection point can be observed in bullish drives in the indicators relative to the recent price lows.

Source: tradingview.com

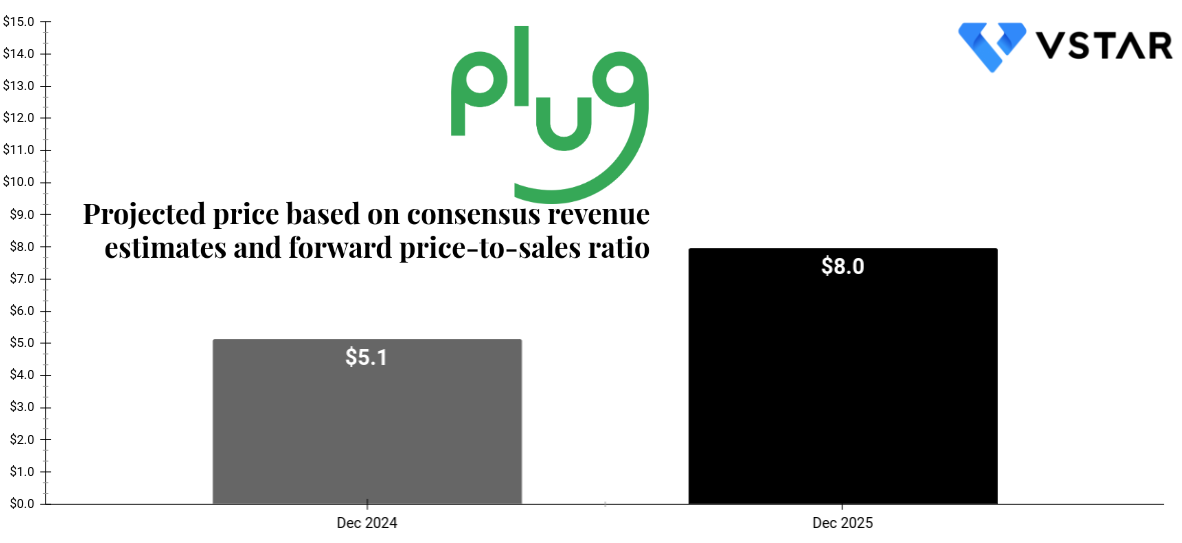

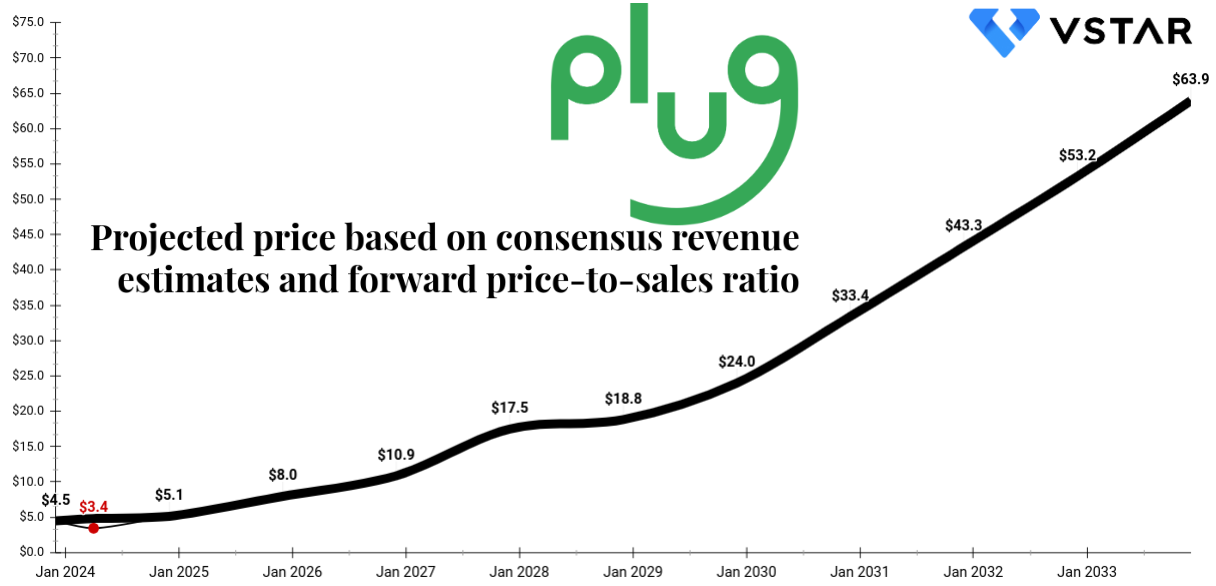

Fundamentally projecting the price over conscience's revenue estimate and current forward price-to-sales ratio leads to $5.1 by the end of 2024. This is the conservative measure, still singling out upside relative to the current price level.

Source: Analyst's compilation

Expert forecasts for Plug Power (PLUG) stock in 2024 vary across different platforms. Tipranks.com projects a range of $2.50 to $18.00, with an average target of $5.35.

Similarly, cnn.com's forecast spans from $2.50 to $18.00, with an average target of $4.20. Stockanalysis.com presents a narrower range, with targets ranging from $2.50 to $27.00, averaging at $6.33, indicating a potential increase of 84.55%. Coinpriceforecast.com offers a mid-year target of $3.90 and year-end target of $4.16, reflecting a 21% increase from the current stock price. These forecasts depict varying levels of optimism and caution regarding Plug Power's performance in 2024.

Source: CNN.com

A. Other Plug Power Stock Forecast 2024 Insights: Is PLUG a good stock to buy?

In 2024, Plug Power stock forecast is shaped by a variety of insights from key institutions and analysts, reflecting divergent opinions and expectations.

HSBC's analyst, Samantha Hoh, paints a bullish picture with a PLUG price target of $8.50, indicating a substantial 148.54% potential upside from the current price of $3.42. This optimism is rooted in HSBC's confidence in Plug Power's future performance, maintaining a Buy rating.

Conversely, Piper Sandler's analyst, Kashy Harrison, adopts a more cautious stance, maintaining an Underweight rating with a Plug Power price target of $2.90, suggesting a 15.2% decrease from the current price. This perspective reflects concerns or reservations about Plug Power's prospects.

Evercore ISI Group's analyst, James West, maintains an Outperform rating and forecasts a 75.44% increase, setting a PLUG stock price target of $6.00. This indicates confidence in Plug Power's ability to outperform market expectations.

Craig-Hallum's Eric Stine also expresses optimism, maintaining a Buy rating with a PLUG target price of $5.00, suggesting a 46.2% potential upside. This viewpoint likely reflects positive sentiment towards Plug Power's growth prospects and technological advancements.

Canaccord Genuity's analyst, George Gianarikas, takes a more balanced approach, maintaining a Hold rating with a PLUG price target of $4.00, implying a 16.96% potential upside. This suggests a more conservative stance compared to other analysts, acknowledging both potential opportunities and risks associated with Plug Power stock.

Source: Benzinga.com

B. Key Factors to Watch for Plug Power Stock Prediction 2024

PLUG Stock Forecast 2024 - Bullish Factors

Expansion of Green Hydrogen Production: Plug Power Inc's recent achievements, including the launch of its Georgia plant and joint venture with Olin in Louisiana, signify its leadership in green hydrogen production. These initiatives position Plug Power as a key player in the emerging green energy sector, fostering optimism among investors about its growth potential.

Strategic Partnerships and Investments: Plug Power's partnerships with major retailers like Walmart, Home Depot, and Amazon, as well as its collaboration with GALP for a 100-megawatt electrolyzer project, underscore its commitment to innovation and market expansion. Such collaborations enhance Plug Power's market footprint and revenue streams, instilling confidence in its future prospects.

Plug Power Stock Forecast 2024 - Bearish Factors

Challenges in Scaling Up Operations: Plug Power has encountered challenges in scaling up its hydrogen production facilities and new product platforms, leading to delays in sales and revenue recognition. Issues such as industry-wide fuel shortages and delays in facility operations have impacted Plug Power's financial performance and profitability, contributing to uncertainties among investors.

Market and Regulatory Headwinds: Plug Power faces uncertainties stemming from market dynamics and regulatory changes, such as recent guidance on tax credits and manufacturing incentives. Factors like interest rate hikes and economic volatility further complicate Plug Power's access to debt capital and may affect its ability to execute growth initiatives effectively.

Lower-than-Expected Sales and Margins: Plug Power's lower-than-anticipated sales volumes and margins in Q4 2023 highlight operational challenges and market uncertainties. Delays in product deployments and lower sales due to fuel issues have resulted in lower gross margins and profitability, prompting Plug Power to implement measures to improve margins and cash flow in 2024.

III. PLUG Stock Forecast 2025

The PLUG stock price may hit $27.45 by the end of 2025. The projection is based on short-term price swings and the current momentum of the change in polarity projected over Fibonacci retracement and extension levels. On the upside, the price may experience severe resistance across the current horizontal price channel.

Here, $4.05 and $10.75 are the lower and upper bond of the channel, and $7.40 is the pivot of the channel.

Looking at the RSI at the current lower lows and higher lows, the RSI fabricated solid bullish diversions. A proper close above the trend line (purple line), a modified exponential moving average, may serve as a critical navigator to mark the ensession of a new market price cycle.

Source: tradingview.com

Using the conservative measure of the current forward price-to-sales ratio and consensus topline estimates for 2025, the price may hit $8 by the end of 2025. Although it is lagging behind technical targets, the price projection reflects a bullish Plug Power outlook.

Source: Analyst's compilation

PLUG stock forecast 2025 diverges among sources. Coincodex.com predicts $6.46 by March, marking an 87.86% surge from the previous year. Conversely, coinpriceforecast.com projects a slower rise, forecasting $5.36 by year-end, indicating a 56% increase. In 2024, PLUG witnessed a notable upturn, jumping from $3.90 mid-year to $4.16 by year-end, reflecting a 21% growth. These forecasts hint at PLUG's volatility and potential, considering its significant fluctuations.

A. Other Plug Power Stock Prediction 2025 Insights: Is Plug Power a buy?

Source: WSJ.com

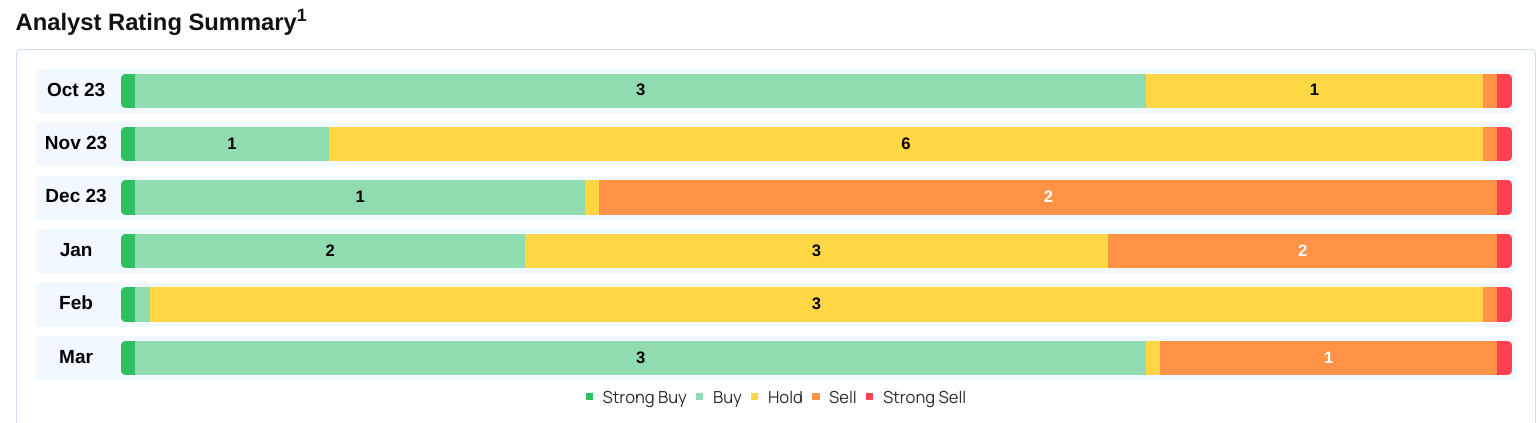

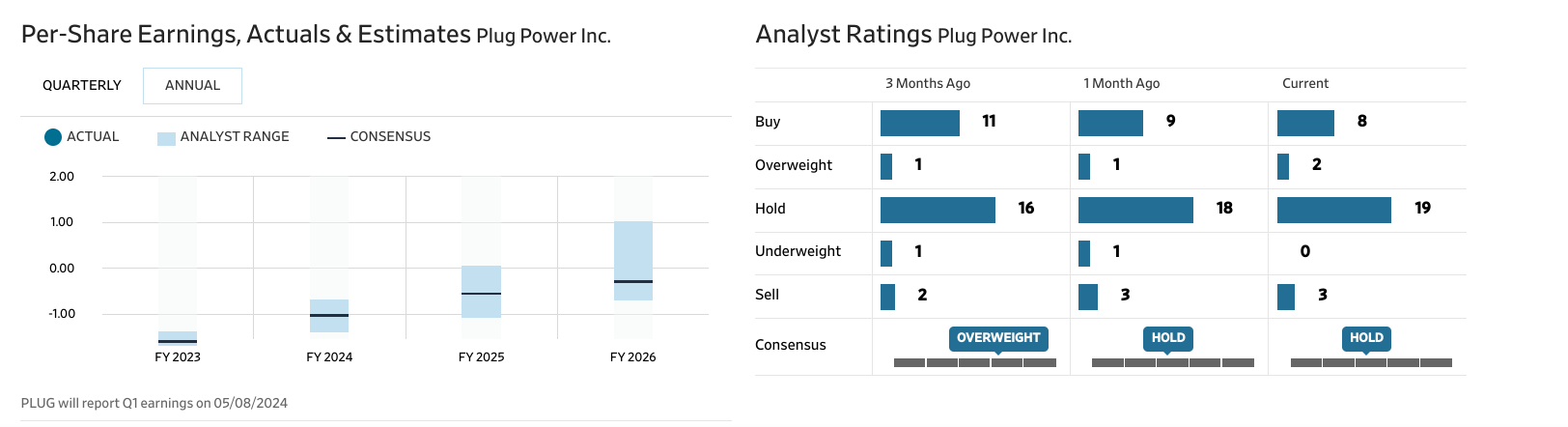

Plug Power has seen fluctuating analyst ratings over the past three months, indicating a mixed sentiment among investors. While the number of "Buy" ratings has decreased slightly from 11 to 8, "Hold" ratings have remained relatively stable, suggesting a cautious stance. Notably, there are no "Underweight" or "Sell" ratings currently, which might signal a moderate level of confidence in the company's future prospects. However, it's essential to monitor these ratings as they can influence investor behavior and stock performance.

Regarding PLUG earnings estimates for FY 2025, there's a notable increase in pessimism over the past month, with the estimate worsening from -$0.53 to -$0.51. This downward trend contrasts with the more optimistic estimate of -$0.37 three months ago. Such changes in estimates could reflect shifting market dynamics, changes in the company's fundamentals, or adjustments in analyst expectations based on new information.

Overall, the varying analyst ratings and estimate trends underscore the uncertainty surrounding Plug Power's future performance.

B. Key Factors to Watch for Plug Power Stock Price Prediction 2025

For Plug Power stock forecast 2025, several key factors will influence its performance, encompassing both bullish and bearish aspects.

PLUG Stock Prediction 2025 - Bullish Factors

Expansion of Hydrogen Production and Infrastructure: Plug Power's strategic initiatives, including the launch of the Georgia plant and joint venture with Olin, demonstrate its commitment to expanding its hydrogen production capabilities. These efforts position Plug Power as a leading player in the green hydrogen sector, poised to capitalize on the growing demand for clean energy solutions.

Strong Financial Growth: Consensus revenue estimates for 2025 suggest a significant increase, indicating robust growth prospects for Plug Power. The projected YoY revenue growth of 55.05% reflects optimism among analysts regarding Plug Power's revenue-generating potential, driven by increased demand for its products and services in the renewable energy market.

Plug Power Price Prediction 2025 - Bearish Factors

Operational Challenges and Delays: Despite Plug Power's ambitious growth plans, challenges related to scaling up operations and product development may pose risks to its performance. Delays in product deployments, as highlighted in the discussion by Paul Middleton, could impact revenue recognition and profitability, leading to potential investor concerns about Plug Power's ability to execute its strategic initiatives effectively.

Margin Pressures: Despite anticipated revenue growth, Plug Power may face margin pressures due to factors such as increased competition and higher costs associated with scaling up operations. Lower-than-expected margins could impact Plug Power's profitability and financial health, leading to downward pressure on its stock price.

IV. PLUG Stock Forecast 2030 and Beyond

The PLUG forecast may hit $81.35 by the end of 2030. These levels reflect fibonacci retracement and extension levels. Magnified over midterm momentum of change in polarity (monthly time frame). These projections signify the potential progress of the stock price over the upcoming accumulations, markup, and distribution phases of the market price cycle. On the upside, notable resistance levels are $21.95 (pivot), $34.6 (upper bond of the horizontal price channel), and $62 (core resistance).

Looking at the RSI, which is currently below 30, signifies a vital oversold state of stock after 5 years. This level is also way below the regular bullish level of 41.

Source: tradingview.com

Fundamental projections using the current forward price-to-sales ratio and consensus revenue estimate for 2030 provide a PLUG price target of $33.4. The variability between fundamental and technical price projections can be observed in the stock's current market price on March 31 of $3.4 and theoretical price of $4.65. This variability becomes more intense over the long term.

Source: Analyst's Compilation

The PLUG stock forecast for 2030 exhibits substantial growth projections, with varying estimates from coincodex.com and coinpriceforecast.com. According to coincodex.com, PLUG's value is anticipated to soar from $6.46 in 2025 to an impressive $151.23 by 2030, reflecting a remarkable 4,296.11% increase. Similarly, coinpriceforecast.com predicts a steady ascent, with PLUG expected to reach $12.82 by year-end 2030, marking a substantial 273% rise from the beginning of the year.

These forecasts illustrate differing levels of optimism regarding PLUG's future performance. Coincodex.com's projections indicate an exponential growth trajectory, with each year surpassing the previous one by significant margins. Meanwhile, coinpriceforecast.com presents a more conservative outlook, suggesting a more gradual but still substantial appreciation in value over the forecast period.

A. Other Plug Power Stock Forecast 2030 and Beyond Insights: PLUG Stock Buy or Sell?

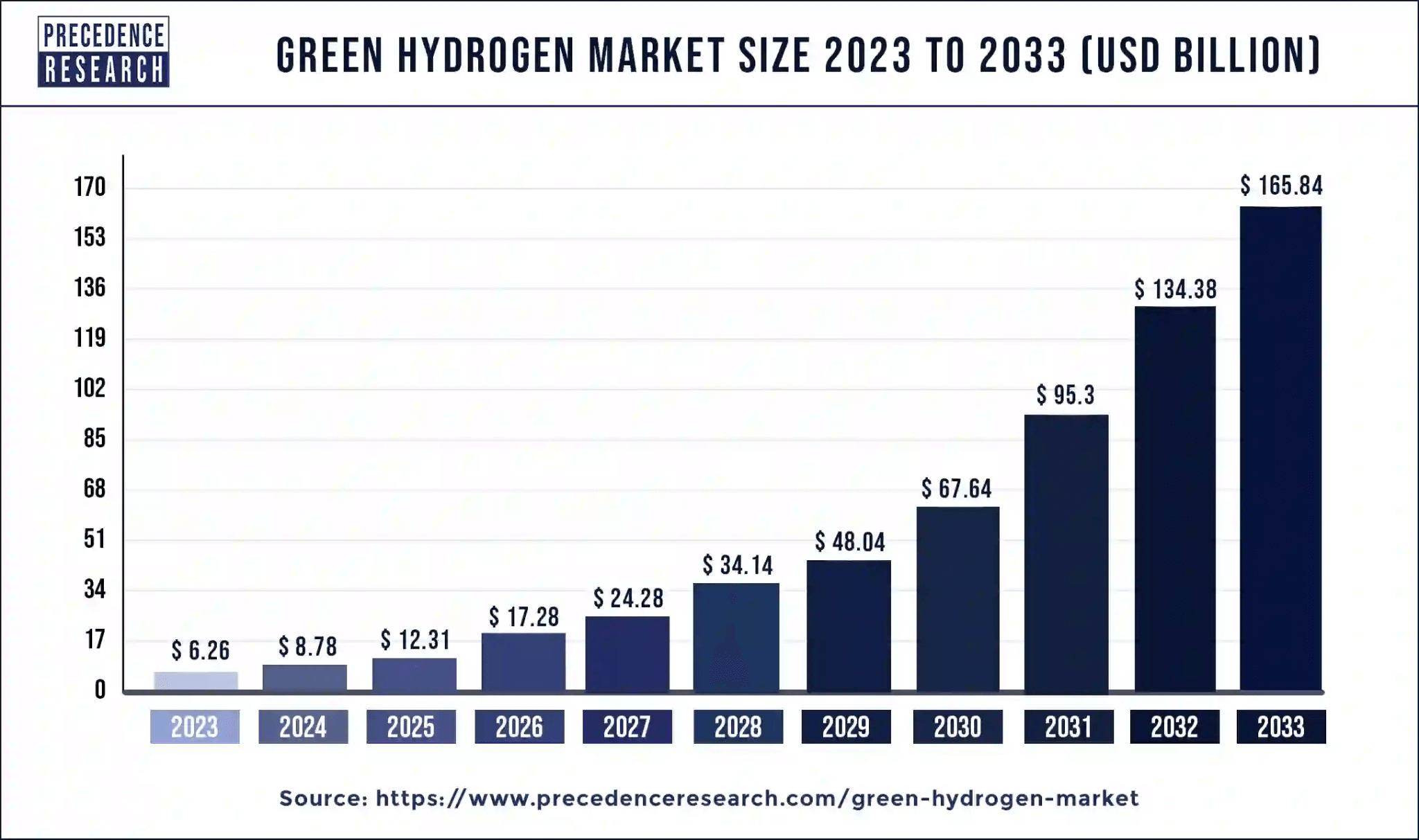

Plug Power operates in the green hydrogen sector, a market projected to grow substantially in the coming decade. The global green hydrogen market is expected to surge from USD 6.26 billion in 2023 to over USD 165.84 billion by 2033, exhibiting a remarkable CAGR of 38.77% during 2024-2033.

Source: precedenceresearch.com

Key regional dynamics highlight the dominance of Asia Pacific, contributing over 47.05% of revenue in 2023 and expected to maintain its lead with a CAGR of 41.1% from 2024 to 2033. China, in particular, holds a significant share, producing one-third of global green hydrogen. Europe also plays a substantial role, with initiatives like the European Green Deal driving market growth.

Factors fueling this growth include the environmental benefits of green hydrogen, which emits significantly less CO2 than grey hydrogen. The versatility of green hydrogen extends its applications to transportation, industrial operations, and residential energy, thereby enhancing the decarbonization potential of renewable energy sources.

Despite its promise, challenges persist, including high initial investments and maintenance costs. However, favorable regulations and increasing environmental concerns are expected to bolster market expansion. Additionally, advancements in wind energy, which has seen a 50% cost reduction since the last few decades, are facilitating green hydrogen production.

The mobility industry emerges as a key end-user, driven by the superior energy efficiency of hydrogen compared to fossil fuels. With the commercialization of fuel cell-based engines, green hydrogen-powered vehicles offer a viable long-term solution, further propelling market growth. Overall, the global green hydrogen market is poised for significant development, that will aggressively push the topline growth of Plug Power decisively over the long-term.

B. Key Factors to Watch for Plug Power Stock Price Prediction 2030 and Beyond

PLUG Stock Forecast 2030 and Beyond - Bullish Factors

Revenue Growth Trajectory: Consensus revenue estimates project a robust growth trajectory for Plug Power, with revenue expected to increase from $1.58 billion in 2025 to $6.62 billion by 2030. This significant YoY growth indicates strong market demand for Plug Power's products and services in the renewable energy sector.

Improving Nasdaq:PLUG Financials: Despite short-term challenges, Plug Power's financial forecast shows a gradual improvement in its earnings per share (EPS) over the forecast period. From an estimated EPS of -0.52 in 2025, analysts anticipate Plug Power to achieve a positive EPS of 0.78 by 2030, indicating a turnaround in profitability and investor confidence.

Strategic Expansion and Market Leadership: Plug Power's strategic initiatives, such as the launch of the Georgia plant and joint ventures like the one with Olin, position the company as a leader in green hydrogen production. These initiatives, coupled with investments in innovative platforms and products, underscore Plug Power's commitment to spearheading sustainable energy solutions, attracting investor interest and confidence in its long-term growth prospects.

Plug Power Stock Forecast 2030 and Beyond - Bearish Factors

Operational Challenges and Execution Risks: Plug Power faces operational challenges, including delays in scaling up operations and product deployments. Challenges in the hydrogen fuel market, as witnessed in 2023, could persist, affecting Plug Power's revenue recognition and profitability. Moreover, delays in new product platforms and inventory valuation charges may impact margins and financial performance, raising concerns among investors about Plug Power's ability to execute its growth strategy effectively.

Regulatory and Economic Uncertainties: Regulatory changes, such as recent guidance on tax credits and manufacturing incentives, may affect Plug Power's financial performance and growth trajectory. Additionally, economic factors like interest rate hikes and capital market fluctuations could impact Plug Power's access to capital and financing options, posing risks to its expansion plans and stock performance.

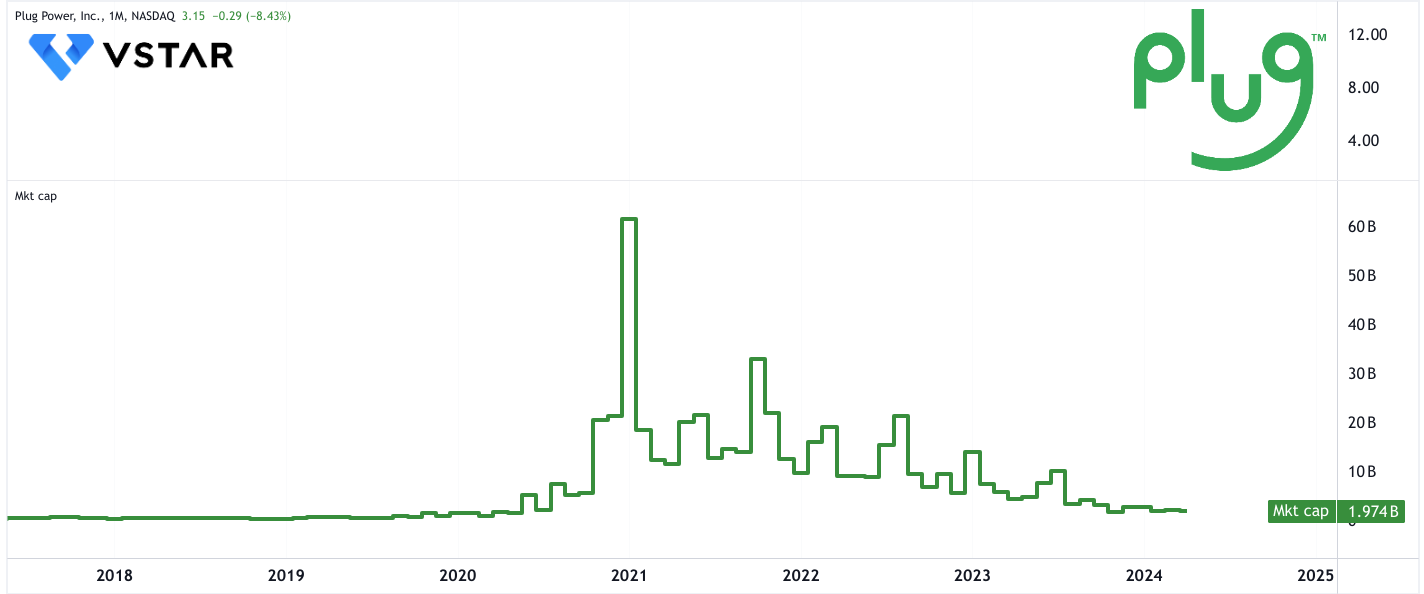

V. PLUG Stock Price History Performance

A. Plug Power Stock Price Key Milestones

2024:

Market Cap: $2.35 billion _ Change: -13.61%

Despite a decrease in market capitalization from the previous year, the decline is less severe compared to the preceding years, indicating a potential stabilization in investor sentiment.

2023:

End of Year Market Cap: $2.72 billion _ Change: -62.21%

The significant decrease in market capitalization reflects investor concerns over operational challenges faced by Plug Power during the year, such as delays in scaling up operations and uncertainties in the hydrogen fuel market. Operational hurdles, including delays in product deployments and lower-than-anticipated sales volumes, contribute to the decline in market capitalization, highlighting the importance of execution risk management in Plug Power's growth strategy.

2022:

End of Year Market Cap: $7.21 billion _ Change: -55.68%

Despite robust growth in the previous year, Plug Power experienced a substantial decrease in market capitalization, reflecting a correction in investor sentiment and concerns over the company's ability to sustain its growth trajectory.

Source: tradingview.com

2021:

End of Year Market Cap: $16.27 billion _ Change: 15.45%

Plug Power experiences growth in market capitalization, driven by heightened investor optimism surrounding the company's strategic initiatives and market leadership in the green energy sector.

2020:

End of Year Market Cap: $14.09 billion _ Change: 1370.04%

Plug Power undergoes a remarkable surge in market capitalization, propelled by increased investor interest in renewable energy stocks and optimism surrounding the company's growth prospects.

2019:

End of Year Market Cap: $0.95 billion _ Change: 252.77%

Plug Power experiences substantial growth in market capitalization, driven by increasing recognition of hydrogen fuel cell technology as a viable alternative in the clean energy landscape.

2018:

End of Year Market Cap: $0.27 billion _ Change: -49.6%

The decrease in market capitalization reflects challenges faced by Plug Power in achieving profitability and scaling its operations amid competitive pressures and regulatory uncertainties.

2017:

End of Year Market Cap: $0.53 billion _ Change: 148.78%

Plug Power experiences significant growth in market capitalization, driven by increased adoption of hydrogen fuel cell technology and growing investor interest in renewable energy stocks.

2016: End of Year Market Cap: $0.21 billion _ Change: -42.96%

The decrease in market capitalization reflects challenges faced by Plug Power in achieving profitability and overcoming operational hurdles, including manufacturing delays and supply chain constraints.

2015:

End of Year Market Cap: $0.37 billion _Change: -26.9%

Plug Power experiences negative growth in market capitalization amid ongoing efforts to commercialize its fuel cell technology and expand its customer base.

2014:

End of Year Market Cap: $0.51 billion _ Change: 215.8%

Plug Power undergoes significant growth in market capitalization, driven by increasing adoption of hydrogen fuel cell technology across various industries.

2013: End of Year Market Cap: $0.16 billion _ Change: 760.88%

Plug Power experiences a significant surge in market capitalization, driven by growing investor enthusiasm for renewable energy stocks and increasing adoption of hydrogen fuel cell technology.

2012:

End of Year Market Cap: $19.11 million _ Change: -58.78%

The decrease in market capitalization reflects challenges faced by Plug Power in achieving profitability and scaling its operations amid competitive pressures and regulatory uncertainties.

2011:

End of Year Market Cap: $46.38 million _ Change: -5.21%

Plug Power experiences relatively stable market capitalization amid ongoing efforts to commercialize its fuel cell technology and expand its customer base.

2010: End of Year Market Cap: $48.93 million _ Change: -46.82%

The decrease in market capitalization reflects challenges faced by Plug Power in achieving profitability and overcoming operational hurdles, including manufacturing delays and supply chain constraints.

2009: End of Year Market Cap: $92.01 million _ Change: 2.07%

Plug Power experiences relatively stable market capitalization amid ongoing efforts to commercialize its fuel cell technology and expand its customer base.

2008: End of Year Market Cap: $90.15 million _ Change: -74.03%

The decrease in market capitalization reflects challenges faced by Plug Power in achieving profitability and scaling its operations amid competitive pressures and regulatory uncertainties.

2007: End of Year Market Cap: $0.34 billion _ Change: 2.82%

Plug Power undergoes moderate growth in market capitalization amid increasing adoption of hydrogen fuel cell technology and growing investor interest in renewable energy stocks.

2006: End of Year Market Cap: $0.33 billion _ Change: -23.32%

Plug Power's market capitalization experiences a decline due to challenges in achieving profitability and scaling its operations amidst intensifying competition in the clean energy sector.

2005: End of Year Market Cap: $0.44 billion _ Change: -1.61%

Plug Power's market capitalization remains relatively stable, reflecting cautious investor sentiment amid ongoing regulatory uncertainties and competitive pressures in the fuel cell industry.

2004: End of Year Market Cap: $0.44 billion _ Change: -15.26%

Plug Power experiences a decrease in market capitalization as challenges in achieving profitability and scaling its operations persist amidst regulatory uncertainties and competitive pressures.

2003: End of Year Market Cap: $0.52 billion _ Change: 130.66%

Plug Power's market capitalization undergoes significant growth, driven by increasing investor optimism surrounding the potential of fuel cell technology to revolutionize the clean energy sector.

2002: End of Year Market Cap: $0.22 billion _ Change: -47.94%

Plug Power's market capitalization experiences a decline amidst challenges in achieving profitability and scaling its operations amidst competitive pressures and regulatory uncertainties.

B. PLUG Stock Price Return and Total Return

1W (One-Week) Performance:

Plug Power's stock price saw a 1-week return of 3.30%, outperforming the S&P 500, which had a return of 0.49%. This indicates short-term bullish momentum for Plug Power, potentially driven by positive Plug Power news or market sentiment specific to the company.

1M (One-Month) Performance:

Over the past month, Plug Power's stock price declined by -11.57%, contrasting with a positive 2.08% return for the S&P 500. This suggests a period of underperformance for Plug Power, possibly influenced by company-specific factors or broader market trends affecting the clean energy sector.

6M (Six-Month) Performance:

Plug Power's stock witnessed a significant decline of -54.74% over the past 6 months, reflecting substantial weakness in its price performance. In comparison, the S&P 500 posted a much stronger 22.29% return during the same period. This indicates a prolonged period of underperformance by Plug Power relative to the broader market.

YTD (Year-to-Date) Performance:

Year-to-date, Plug Power's stock price has decreased by -23.56%, while the S&P 500 has returned 9.94%. This signifies a negative performance for Plug Power compared to the broader market during the current year, suggesting challenges or setbacks faced by the company.

1Y (One-Year) Performance:

Over the past year, Plug Power's stock price plummeted by -70.65%, significantly underperforming the S&P 500, which returned 27.61%. This substantial underperformance highlights significant challenges or weaknesses faced by Plug Power, leading to a sharp decline in its stock price.

Comparison with S&P 500:

Plug Power consistently underperformed the S&P 500 across all timeframes analyzed (1W, 1M, 6M, YTD, 1Y) in terms of price return and total return. The S&P 500 demonstrated stronger returns compared to Plug Power, indicating better overall performance and potentially lower risk compared to investing in Plug Power stock.

Source: tradingview.com

VI. Conclusion

Plug Power (PLUG) presents varying forecasts for 2024, 2025, and 2030. Technical analysis suggests a potential PLUG price target of $14.25 by 2024, with bullish momentum anticipated based on Fibonacci retracement levels and accumulation phases. However, fundamental projections offer a conservative estimate of $5.10 by 2024.

For Plug Power forecast 2025, technical analysis forecasts a price of $27.45, emphasizing resistance levels and bullish momentum. Conversely, fundamental analysis suggests a more conservative estimate of $8.00. Looking ahead to 2030, technical analysis predicts a price of $81.35, highlighting significant resistance levels and oversold conditions, while fundamental analysis provides a target of $33.40.

Investors and traders should apply the Dollar-Cost Averaging method to establish long-position in the stock to take advantage of bullish momentum systematically.

Additionally, trading Plug Power stock CFDs with VSTAR could offer opportunities. For traders considering exposure to Plug Power stock through CFDs, VSTAR offers benefits such as leverage up to 1:200, low trading costs with a $0 commission, access to global stock markets, and lightning-fast execution. These features enable traders to maximize opportunities and capitalize on Plug Power's stock performance within a dynamic trading environment.

FAQs

1. Is Plug Power a good stock to buy?

Analysts have given Plug Power a consensus rating of "Hold," with an average rating of 2.12, based on 7 buy ratings, 15 hold ratings and 4 sell ratings.

2. Is PLUG stock expected to rise?

The average analyst price target for the next 12 months is $8.2715, which implies a +221.85% upside from the current price.

3. How high will PLUG stock go?

The highest analyst price target for PLUG stock is $10.81, indicating significant upside from current levels.

4. Is Plug Power undervalued?

Valuation metrics suggest that Plug Power may be overvalued, its Value Score is F.

5. What is the PLUG stock price prediction for 2024?

Analysts predict that Plug Power stock could reach an average price of $6.05 by 2024, representing a potential upside of 135.6%.

6. What will Plug Power be worth in 2025?

PLUG stock is expected to reach an average price of $13.61 in 2025, with a high estimate of $19.95 and a low estimate of $7.2622.

7. Does Plug Power have a future?

Plug Power has set ambitious targets for 2030, aiming for $20 billion in revenues at a 35% gross margin, which could translate to about $3 billion in net earnings.