I. Recent Rivian Stock Performance

Recent RIVN stock price performance and changes

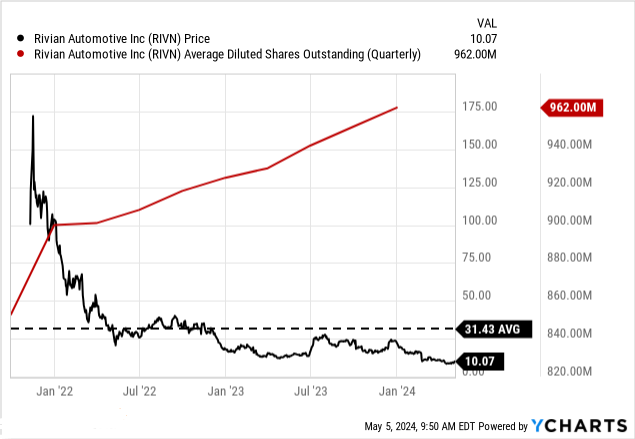

The recent performance of Rivian Automotive's (NASDAQ:RIVN) stock has been tumultuous, marked by significant fluctuations across various timeframes. Over the past week, RIVN has seen a solid price return of 11.4%, overperforming the S&P 500's 0.55%. However, this slight uptick comes amidst a broader negative trend, with RIVN experiencing substantial declines over the past year (-57%). The 52 Week range of the stock is $8.26-$28.06. A vital fundamental issue with the stock price is rapidly boosting average diluted shares outstanding.

Source: YCharts.com

Main influencing factors

Several factors contribute to Rivian's volatile performance. Firstly, market sentiment plays a pivotal role. Rivian, being a newcomer to the electric vehicles (EVs) industry, faces heightened scrutiny and speculation. Initial enthusiasm following its IPO has waned as investors reassess the company's valuation and growth prospects against competitors like Tesla and traditional automakers. Market sentiment can swiftly sway RIVN stock price, evident in its recent volatility.

Moreover, operational challenges and supply chain disruptions have plagued Rivian. Like many companies, Rivian has encountered issues sourcing critical components, hindering its production capacity. Delays in vehicle deliveries and production targets have dampened marketconfidence, fueling concerns about Rivian's ability to execute its ambitious plans.

Furthermore, macroeconomic factors impact RIVN's stock performance. Global economic conditions, inflationary pressures, and shifts in consumer preferences towards EVs all influence marketperceptions of Rivian's potential. Geopolitical events, regulatory changes, and the broader market environment can amplify RIVN's volatility.

Source: spglobal.com

Expert Insights on Rivian Stock Forecast for 2024, 2025, 2030 and Beyond

There is optimism for Rivian Automotive stock. While forecasting a rapid increase, reaching $40 by 2024, $59 by 2025, and $135 by 2030, the RIVN forecast highlights potential challenges in the EV market's competitive space.

Source: Analyst's compilation

II. Rivian Stock Forecast 2024

The average Rivian price target by the end of 2024 is projected at $40.00, based on the momentum of change-in-polarity over the short-term, projected over Fibonacci retracement/extension levels.The current price of Rivian Automotive stands at $10.07, notably below both the trendline and baseline, which are $13.86 and $14.26, respectively. This indicates a downward trend in the stock price. The modified exponential moving averages suggest that the stock is experiencing a consistent downward movement, deviating from the expected values. Such a trend suggests a potential bearish sentiment in the market regarding Rivian Automotive.

Moreover, the primary support level is identified at $5.00, suggesting a significant potential downside risk. The pivot of the current horizontal price channel is at $15.92, indicating a pivotal point where the stock might change its direction. Core resistance is observed at $32.22, which could pose a challenge for the stock to surpass. Additionally, the resistance level stands at $21.08.

Source: tradingview.com

The Relative Strength Index (RSI) value is 37.94, indicating that the stock is not oversold or overbought at the moment. However, it is closer to the regular bullish level of 28.58 than the regular bearish level of 62.17, suggesting a potential bullish sentiment in the market. The presence of bullish divergence and the upward trend of the RSI line further support this interpretation.

The MACD indicators paint a bearish picture for Rivian Automotive, with the MACD line at -2.33, below the signal line of -1.81, and a negative MACD histogram of -0.520. This indicates a stable strength of the bearish trend, suggesting a potential continuation of the downward movement in the RIVN stock price. The MACD analysis aligns with the overall downward trend observed in Rivian Automotive stock.

Source: tradingview.com

The 2024 Rivian forecast presents a spectrum of predictions, reflecting the uncertainty and volatility inherent in stock market analysis.

Tipranks.com suggests a conservative forecast, with an average Rivian target price of $16.91, representing a 90.00% increase from the current price of $8.90. This Rivian stock projection implies moderate growth potential. Stockanalysis.com offers a more bullish Rivian stock outlook, with an average target of $17.91, indicating a 101.01% increase from the current price. This projection aligns with a positive sentiment among analysts, suggesting substantial potential gains.

In contrast, coinpriceforecast.com presents a more cautious perspective, forecasting a year-end price of $13.59, indicating a 53% increase from the current value. While this projection falls between the other two estimates, it underscores the uncertainty surrounding Rivian future performance.

A. Other RIVN Stock Forecast 2024 Insights: Is Rivian a good stock to buy?

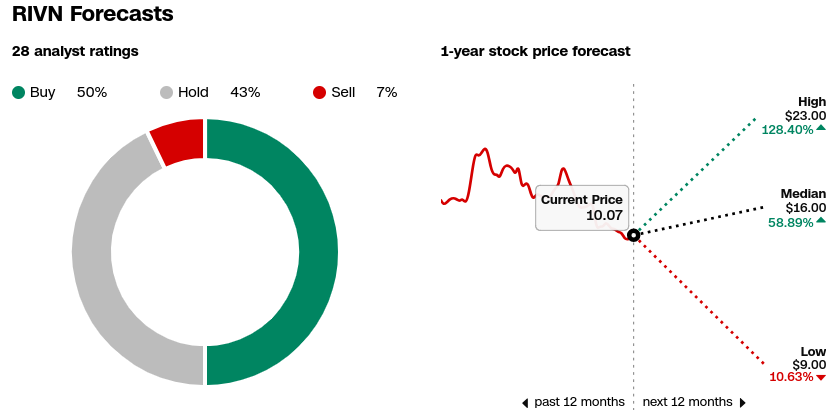

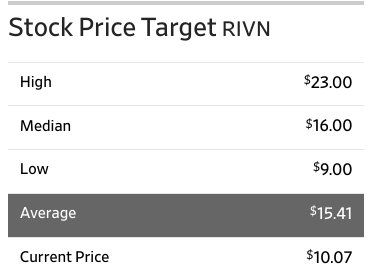

CNN.com holds the forecasts from 28 analysts, the consensus reflects a mixed sentiment. Among these analysts, 50% recommend buying RIVN stock, 39% suggest holding, and 11% advise selling. This distribution underscores the uncertainty surrounding Rivian's future trajectory.

Turning to price targets, the disparity among Rivian projections further complicates the forecast. The high-end estimate stands at $23.00, indicating an optimistic outlook with potential for significant growth. Conversely, the low-end forecast of $9.00 implies a more conservative stance, reflecting apprehensions or uncertainties about Rivian's performance. The median forecast, at $16.00, serves as a midpoint, capturing a balanced perspective derived from the collective insights of analysts.

Considering Rivian's current stock price of $8.90, it's evident that the forecasts imply varying degrees of potential appreciation or depreciation.

Source: edition.cnn.com

B. Key Factors to Watch for Rivian Stock Price Prediction 2024

Rivian Automotive (Nasdaq: RIVN) presents a complex investment landscape in 2024, marked by both bullish and bearish factors.

Rivian Stock Projections 2024 - Bullish Factors

- Strong Revenue Growth and Market Position: Rivian's revenue estimates for 2024 demonstrate robust growth, especially in the first and fourth quarters. With an expanding market for EVs (EVs) and positive consumer sentiment, Rivian's focus on building brand loyalty and customer satisfaction, as evidenced by its top ranking in owner satisfaction surveys, bodes well for future revenue streams.

- Product Innovation and Expansion: The upcoming launch of the R2 mid-sized SUV represents an opportunity to tap into a significant market segment. Rivian's emphasis on vertically-integrated propulsion platforms and user experience aligns with consumer demand for advanced EV technology and intuitive design.

- Operational Efficiency and Cost Reduction: Despite challenges in ramping production, Rivian has made significant strides in driving cost efficiency and optimizing its production processes. Gross profit per vehicle has improved, indicating progress towards achieving profitability. Planned initiatives such as material cost reductions and production facility enhancements further bolster prospects for improved margins.

Rivian Stock Price Forecast 2024 - Bearish Factors

- Economic and Geopolitical Uncertainties: Rivian acknowledges the impact of existing economic uncertainties, including historically high interest rates affecting demand. Geopolitical factors also pose risks to supply chains and market dynamics, potentially affecting Rivian's production and delivery targets.

- Operational Challenges and Cost Pressures: The complexity of ramping production and integrating new technologies presents ongoing challenges. While Rivian has demonstrated resilience in navigating these hurdles, unexpected setbacks could strain resources and hinder profitability goals. Additionally, the planned shutdown in 2024 for introducing cost-saving measures may temporarily disrupt output and incur additional expenses.

III. Rivian Stock Forecast 2025

The average RIVN price target by the end of 2025 is estimated at $59. This projection is based on the momentum of change-in-polarity over the mid-term, extrapolated over Fibonacci retracement/extension levels. This indicates a substantial potential for growth compared to the current price. Rivian Automotive's current stock price stands at $10.07, notably below the trendline and baseline of $13.86 and $14.26 respectively. This suggests a downward deviation from the expected trajectory. The direction of the stock price is categorized as sideways, indicating a lack of clear upward or downward momentum.

Rivian stock has various support and resistance levels:

- Primary Support: $5.00

- Pivot of Current Horizontal Price Channel: $15.92

- Resistance (In Case of Heightened Volatility): $46.80

- Core Resistance: $32.22

- Resistance: $21.08

- Support: $10.75

The existence of multiple resistance levels indicates a degree of adversities during upside movement, in these areas where increased selling pressure may be expected.

Source: tradingview.com

The forecast for Rivian Automotive's stock performance in 2025 presents a stark disparity between predictions from different sources, namely coinpriceforecast.com and coincodex.com.

Coinpriceforecast.com anticipates a significant uptrend for Rivian stock, forecasting a mid-year price of $17.67 and a year-end price of $20.39 in 2025. This represents a substantial increase from its projected 2024 year-end price of $13.59, with a predicted growth percentage of 129%. Such an optimistic outlook may be based on factors like anticipated growth in EV demand, Rivian's innovative products, and potential market expansion.

Conversely, coincodex.com offers a more conservative forecast, predicting a price of $7.37 for RIVN stock prediction 2025, reflecting a decline of 17.15% from the previous year. This pessimistic projection could be influenced by factors such as concerns over market saturation, increased competition in the EV sector, or operational challenges facing Rivian.

A. Other RIVN Stock Forecast 2025 Insights: Is Rivian Stock a Buy?

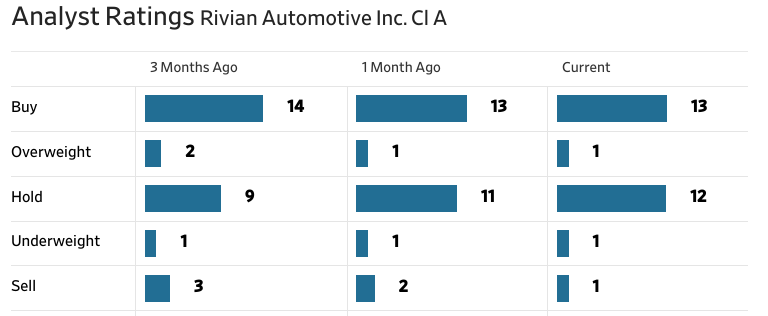

According to WSJ, the Rivian analyst ratings for have undergone fluctuations over the past few months. While the majority of ratings lean towards "Buy" or "Overweight," there's a notable presence of "Hold" ratings as well, indicating a mixed sentiment among analysts. The range of price targets further reflects this sentiment, with a high of $23.00, a median of $16.00, and a low of $9.00, averaging at $15.45. These figures imply a considerable variance in expectations regarding RIVN's future performance.

Source: WSJ.com

Source: WSJ.com

Analysts from Barclays, Needham, and Morgan Stanley maintain their coverage on RIVN, albeit with different outlooks. While some analysts uphold their bullish stance, suggesting significant upside potential, others maintain a more cautious approach, emphasizing downside risks.

For instance, Barclays' Dan Levy adjusted the Rivian price target from $12 to $10, maintaining an "Equal-Weight" rating, while Needham's Chris Pierce lowered the Rivian stock price target from $18 to $13, maintaining a "Buy" rating. Such variations highlight the complexities involved in forecasting stock performance and the diverse perspectives within the financial community.

B. Key Factors to Watch for Rivian Stock Price Prediction 2025

Rivian Stock Prediction 2025 - Bullish Factors

As per S&P Global, Rivian's stock price in 2025 is poised for bullish growth due to significant industry developments favoring EVs (EVs). For instance, BMW promises diversified electric models across key segments, while Volkswagen, Audi, and Jaguar's commitments to transition entirely to EVs bolster Rivian's market potential. Ford and GM's substantial investments in EV technology underscore industry-wide confidence, with GM targeting a 40% EV product portfolio. Stellantis' EUR 30 billion EV investment by 2025 further solidifies Rivian's position in the expanding market.

Source: spglobal.com

- Revenue Growth Trajectory: Rivian's projected revenue for 2025 indicates a substantial increase of 57.51% year-over-year, reaching $7.65 billion. This growth is supported by the company's strong delivery performance in 2023, doubling production and exceeding initial guidance.

- Strong Brand Presence and Customer Satisfaction: Rivian's emphasis on building a brand that resonates with customers has yielded positive results, as evidenced by high owner satisfaction ratings and brand loyalty. The expansion of Rivian Spaces and service centers, along with initiatives to provide more opportunities for consumers to experience Rivian vehicles firsthand, enhances brand awareness and customer engagement.

Rivian Stock Predictions 2025 - Bearish Factors

- Negative Rivian Earnings Per Share (EPS) Estimates: Despite revenue growth projections, Rivian's EPS estimates remain negative, indicating ongoing losses. While YoY growth in EPS is expected to improve by 37.57% in 2025, the company's continued profitability challenges may dampen marketsentiment and stock performance.

- Supply Chain Disruptions and Production Challenges: The incorporation of new design changes and technology into Rivian's production processes may lead to short-term disruptions and impact production output. Delays in supply chain management and the introduction of new materials could potentially hinder delivery targets and affect financial performance.

- Dependence on EV Market Growth: Rivian's success hinges on the broader electrification trend in the automotive industry. While optimistic about the long-term transition to EVs, any slowdown or disruption in this trend could dampen market confidence and impact Rivian's growth trajectory.

IV. Rivian Stock Forecast 2030 and Beyond

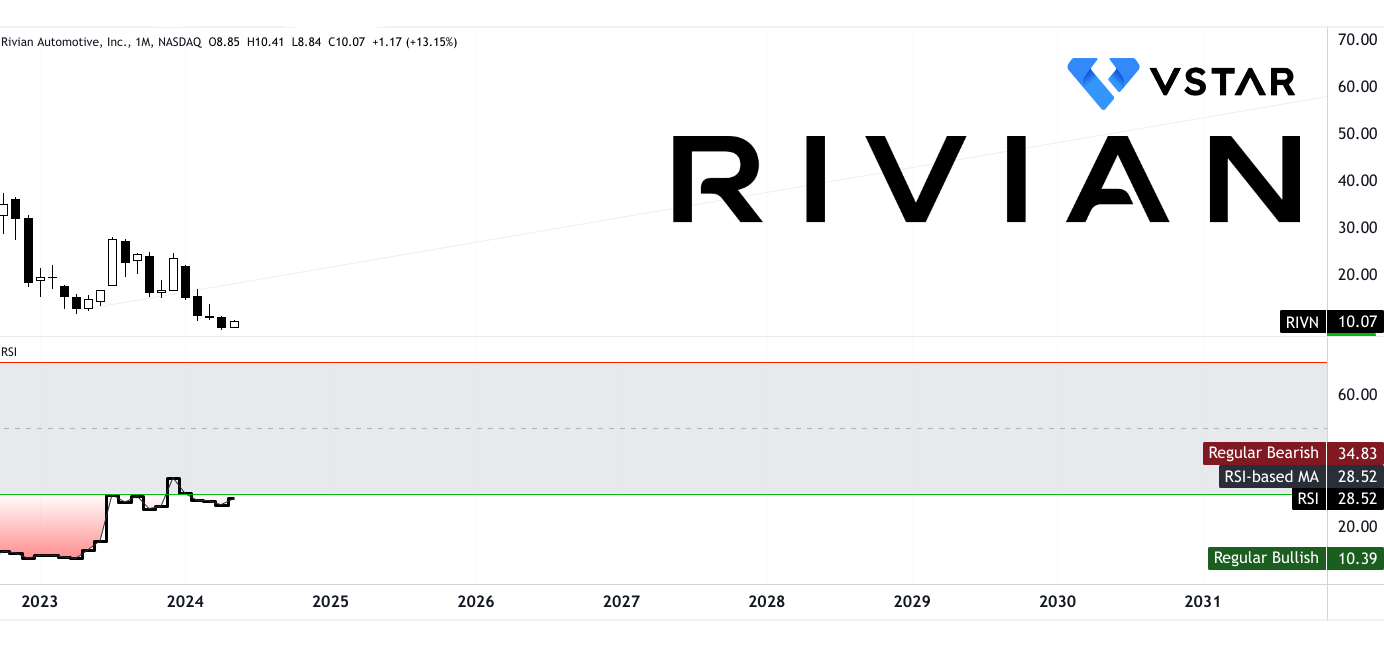

The projected RIVN price target by the end of 2030 is $135.00. This projection is based on the momentum of change-in-polarity over the long-term, extrapolated over Fibonacci retracement/extension levels. While this long-term target appears optimistic, it's crucial to note that such projections rely heavily on assumptions regarding future market conditions and the company's performance. The current price of Rivian Automotive stands at $10.07, considerably lower than both the trendline and baseline values. The trendline is at $24.27, and the baseline is at $25.86. This indicates a significant deviation from the average trend, suggesting a downward movement in the stock price.

The primary support level for RIVN is noted at $5.00, suggesting a significant downside potential from the current price. The pivot of the current horizontal price channel is at $18.27, indicating a potential turning point in the price movement. Resistance levels are identified at $57.96, $39.22, and $88.28, suggesting potential barriers to upward price movement.

Source: tradingview.com

The RSI value for RIVN is currently at 28.52, indicating oversold conditions. This value falls between the regular bullish level of 10.39 and the regular bearish level of 34.83. Additionally, the presence of bullish divergence suggests a potential reversal in the price trend, although no bearish divergence is observed. The RSI line trend is identified as sideways, indicating a lack of clear directional bias.

Source: tradingview.com

Coinpriceforecast.com presents a more optimistic outlook on Rivian price prediction, projecting steady growth for Rivian stock from 2024 to 2035. According to this forecast, Rivian stock price is expected to experience substantial gains, reaching $32.38 by 2035. This forecast suggests confidence in Rivian's ability to capture a significant share of the EV market, capitalize on technological advancements, and maintain strong financial performance over the next decade.

In contrast, coincodex.com's predictions paint a more pessimistic picture, forecasting a decline in Rivian's stock price from 2025 onwards. According to this forecast, Rivian stock price is expected to decrease to $3.06 by 2030. This Rivian Automotive stock prediction implies concerns regarding Rivian's ability to sustain growth, potential market challenges, or unforeseen disruptions impacting the company's performance.

A. Other RIVN Stock Forecast 2030 and Beyond Insights: Will Rivian go up?

As per Morningstar, the forecast for Rivian Automotive and the broader EV industry paints a picture of exponential growth and transformation. Morningstar projects a quadrupling of global EV sales by 2030, with EVs comprising 40% of total auto sales, translating to around 40 million vehicles globally. Falling battery costs and improving infrastructure are expected to drive this growth, with China leading in EV sales, followed by Europe and the US catching up by 2030.

Source: morningstar.com

SP Global also emphasizes the accelerating transition to EVs, projecting that by 2030, over one in four new passenger cars sold globally will be electric. Major automakers are rapidly transitioning to EV production, with ambitious targets for electrification. Ford, Cadillac, Bentley, Jeep, Chrysler, Toyota, BMW, and Stellantis are all committing to significant EV initiatives, from full electric lineups to substantial shares of EV sales by 2030.

Source: spglobal.com

These forecasts highlight the industry's momentum towards electrification and the potential for Rivian to capitalize on this trend.

B. Key Factors to Watch for Rivian Stock Price Prediction 2030 and Beyond

Rivian Stock Price Prediction 2030 and Beyond - Bullish Factors

- Expanding Revenue Growth: Rivian's revenue estimates demonstrate significant growth projections, with expectations to reach $38.12 billion by 2030. This trajectory is supported by the company's focus on scaling production and expanding its product lineup targeting a market segment with limited EV options beyond Tesla.

- Technological Innovation: Rivian's emphasis on vertically integrated propulsion platforms, electronics, and software highlights its commitment to delivering an exceptional user experience.

- Go-to-Market Strategy: Rivian's aggressive go-to-market strategy, including expanding its retail footprint and providing opportunities for customers to experience its vehicles firsthand, indicates a proactive approach to building brand awareness and increasing demand.

Rivian Stock Forecast 2030 and Beyond - Bearish Factors

- Persistent Losses: Despite revenue growth projections, Rivian's earnings per share (EPS) estimates indicate continued losses in the near term, with negative EPS expected until 2029. Prolonged losses could dampen marketconfidence and hinder stock price appreciation, especially if the company struggles to achieve profitability targets.

- Capital Expenditure: Rivian's substantial capital expenditures, driven by investments in production facilities and next-generation technologies, may strain its financial resources and impact cash flow. While necessary for long-term growth, elevated capital expenditures could weigh on profitability and marketconfidence if not managed effectively.

V. Rivian Stock Price History Performance

A. RIVN Stock Price Key Milestones

Rivian stock price has seen notable fluctuations in recent years. In 2021, Rivian market cap reached a peak of $93.35 billion, reflecting high marketoptimism following its IPO and strong market reception for its EVs. However, by 2022, the market cap plummeted to $16.28 billion, marking an 82.56% decrease, likely due to concerns about production delays and increasing competition in the EV sector.

In 2023, there was a partial recovery, with the market cap rising to $22.46 billion, indicating renewed market confidence, potentially driven by progress in production and delivery targets. However, by the end of 2024, the RIVN market cap fell again to $10.02 billion, representing a 55.39% decrease, possibly due to ongoing challenges in scaling production and meeting demand, along with broader market volatility impacting high-growth stocks.

Key Rivian share price levels reflect these shifts, with peaks in 2021 followed by significant declines and intermittent recoveries, influenced by factors such as production performance, competition, and market sentiment toward EV manufacturers.

Source: companiesmarketcap.com

B. Rivian Stock Price Return and Total Return Against S&P 500

Rivian Automotive's stock performance has been volatile. In the short term, it outperformed the S&P 500 with a 1-week price return of 11.39% compared to the S&P 500's 0.55%. However, over one month, it underperformed both the S&P 500 with a return of -4.46%. Over longer periods, Rivian's performance is negative, significantly trailing the broader market indices. Year-to-date, its price return stands at -57.08%, contrasting starkly with the S&P 500's 7.50% return. Similarly, its one-year return of -21.39% lags behind the S&P 500's 25.35%. This suggests Rivian's struggle to maintain momentum.

Source: seekingalpha.com

VI. Conclusion

A. Rivian Outlook: Is Rivian a good investment?

Rivian's stock performance has been turbulent, influenced by various factors such as market sentiment, operational challenges, and macroeconomic conditions. Despite recent volatility, analysts forecast potential growth, with projections estimating $40 by 2024, $59 by 2025, and $135 by 2030. However, uncertainties persist, including competition, supply chain disruptions, and geopolitical events. Investors eyeing Rivian may consider its long-term potential amidst short-term challenges, balancing risks and rewards. Investment in Rivian stock via CFDs could offer opportunities for speculative trading, but prudent risk management is advisable given the stock's volatility.

B. Trade Rivian Stock CFD with VSTAR

Trading Rivian Stock CFDs with VSTAR offers advantages such as tight spreads, zero commissions, deposit bonuses, demo accounts, copy trading, market monitoring tools, and educational resources. These benefits enhance the trading experience, providing flexibility, transparency, and support for traders of all levels. VSTAR's platform empowers traders to capitalize on Rivian's volatility, potentially maximizing returns while managing risk effectively. Whether seeking short-term gains or long-term investment exposure, Rivian CFD trading with VSTAR presents a comprehensive solution tailored to individual trading preferences and objectives.

FAQs

1. Is Rivian stock expected to go up?

The sentiment surrounding Rivian stock is mixed, with some analysts being bullish and suggesting that the stock could go higher. Piper Sandler upgraded Rivian stock to a "buy" rating and set a price target of $21 per share.

2. What will Rivian be worth in 2025?

Predictions for Rivian stock price in 2025 vary, but some forecasts suggest an average analyst price target of around $16.61.

3. What will Rivian be worth in 2030?

Some estimates suggest that Rivian stock could reach an average price of $139.43 by 2030, with a high forecast of $269.09.

4. Who are the largest shareholders of Rivian?

The largest shareholders include Amazon.com, Inc., with 158.36 million shares, and institutional investors like Price (T.Rowe) Associates Inc, Vanguard Group Inc, and Blackrock Inc. among others.