I. Introduction

Recent Sea Limited Stock Performance

Sea Ltd. (NYSE: SE) saw an upgrade from Neutral to Buy, showing optimism and moving up from $44.00 to a $50.00 price target. Economists predict that Sea will successfully address the competitive e-commerce landscape in advance of the release of the Q4 2023 report in late February or early March. Sea Ltd.'s better outlook is attributed to strong gaming bookings, steady EBITDA margins, and expanding fintech profitability.

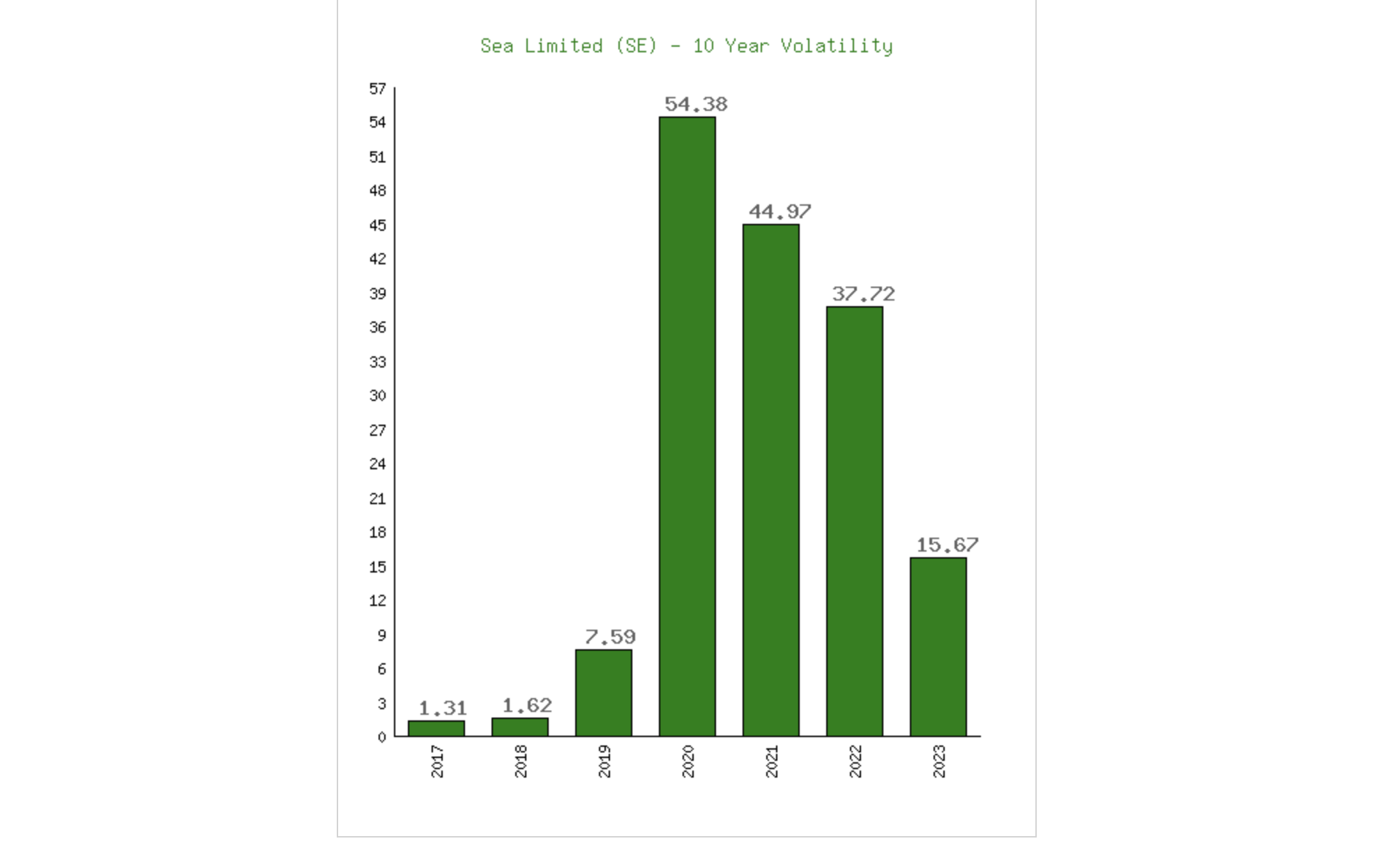

Sea Ltd.'s key metrics include a 46.56% gross profit margin over the last twelve months and a 5.55% rise in sales. Even though Sea stock price has dropped 42.13% over the past six months, projections suggest that this year might be profitable, suggesting a potential reversal. With more cash on hand than debt and liquid assets above short-term liabilities, Sea Ltd. has good liquidity that investors should take into account. The volatility of the stock offers opportunities for individuals who don't mind taking on more risk.

Expert Insights on SE Stock Forecast for 2024, 2025, 2030, and Beyond

Current SE stock projection indicates that by February 11, 2024, shares of Sea Limited should have increased by 2.53% to $43.08 per share. SE stock has seen 4.48% price volatility over the last 30 days, with 17 out of 30 (or 57%) green days. Given that SE stock is now trading 2.47% below the projection, now is a good time to purchase Sea Limited shares.

Assuming that its average annual growth rate is steady, the Sea Limited stock forecast for 2025 is $70.03. This would result in a 66.67% rise in the price of SE stock.

If Sea Limited's current 10-year average growth rate continues, the stock is expected to rise 2,043.28% from current Sea share price to $900.61 by 2030.

II. SE Stock Forecast 2024

At the starting of the year 2024, the Sea Limited stock price was trading around $34.50 price area. Currently, the price of Sea Limited is $41.5, which is almost a 16.87% increase since the beginning of this year.

As per the current growth, SE stock price may reach the $60.00 price level at the end of 2024, signaling a 44% growth from the current trading price.

The Sea Limited daily chart suggests an impulsive bullish recovery as the price exceeded the $41.00 resistance level. After an extended period of volatility, bulls finally take over the market and may recover further upward as the huge bearish gap in the market is yet to fill up. However, the 46.69 resistance level is still protected. Above this line, the 50% Fibonacci Retracement level could be a crucial level to anticipate.

Moreover, the RSI indicator has created a bullish divergence, indicating that the price may recover higher toward the $55.00 price area to fill the gap. Also, the exponential moving average currently resides below the price and holds the price as strong support. It may help the price to sustain the bullish momentum toward the $55.00 price level in the coming days.

For this reason, a daily candle above the 46.60 level could take the price to the 67.00 level before reaching the 88.83 level within 2024.

Let's see what other indicators say about this stock:

- Relative Strength Index (RSI): The 14-day RSI hovers above the 50.00 line, with a higher possibility of reaching the 70.00 overbought level. In that case, a bullish range breakout could provide a long opportunity.

- Average Directional Index (ADX): The ADX reached the 20.00 line and formed a bullish rebound. It signifies a strong trend formation, which could initiate impulsive pressure in the main price.

- Aroon: Aroon Up is at 90% level, suggesting a strong buying pressure in the main price chart. However, Aroon Down tapped to the 10% with no sign of consolidation. The ongoing buying pressure is valid as long as the Aroon Up is above the 50% line.

A. Other Sea Limited Stock Forecast 2024 Insights

According to statistics from Gov Capital.com, the price of Sea Limited (SE) stock as of February 5, 2024, is $41.490, showing a downward trend over the previous year. This pattern implies that the stock had difficulties during this time and could not have been very popular in similar market groups.

Analysts at TipRanks.com provide a more positive outlook going forward, predicting significant gains for Sea Limited. A 29.05% rise from the current price of $41.90 is represented by the average price target of $54.07. The lowest price target is anticipated to be $32.00, while the highest target is $80.00. This prediction, based on observations from 17 Wall Street analysts over the previous three months, shows that experts are optimistic and believe Sea Limited's stock value will rise significantly.

B. Key Factors to Watch for Sea Stock Forecast 2024

With good financials, growth indicators, and optimistic analyst opinion, Sea Limited stock forecast for 2024 seems promising. Considering the evolving industry, it is a good idea to keep an eye out for any new chances in SE stock.

SE Financials

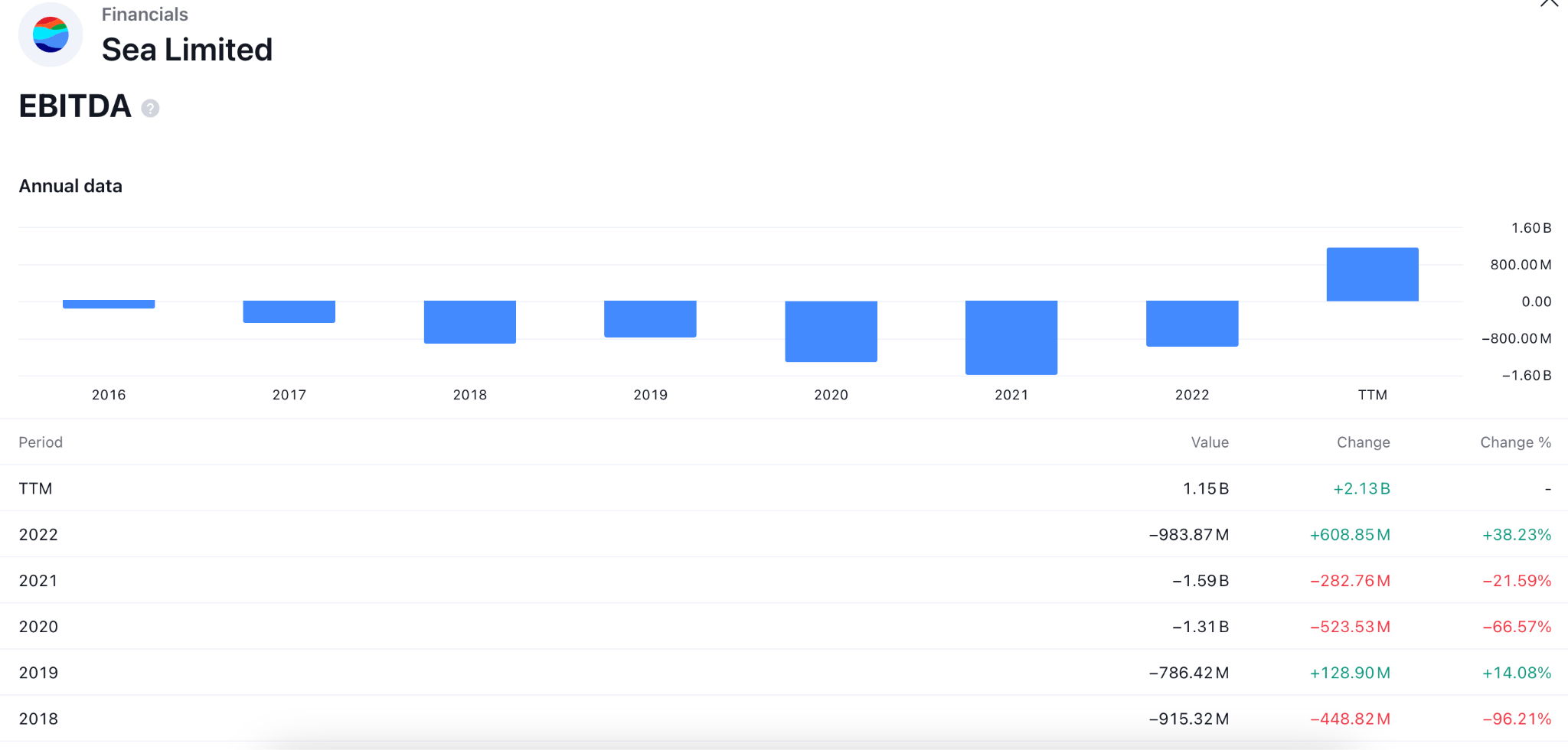

Sea Limited's profit margins show strong operational success, such as a 46.56% gross margin. However, the net margin was negative for the last 2 years.

Source: Simplywall.st

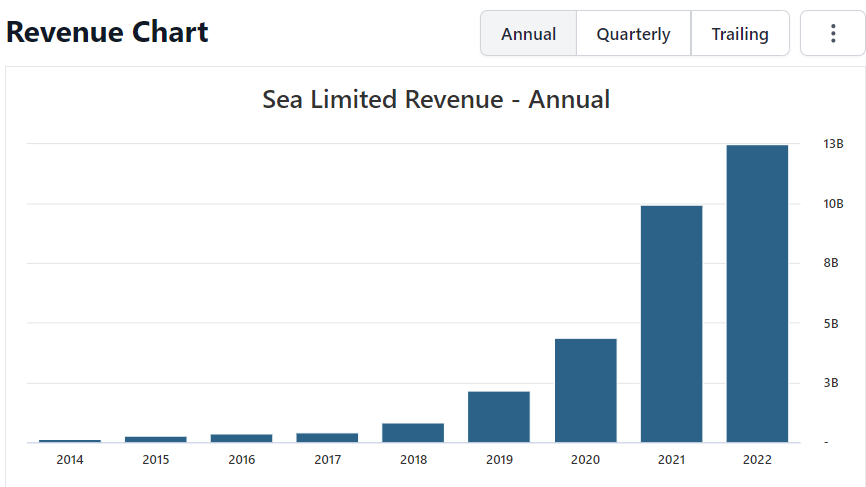

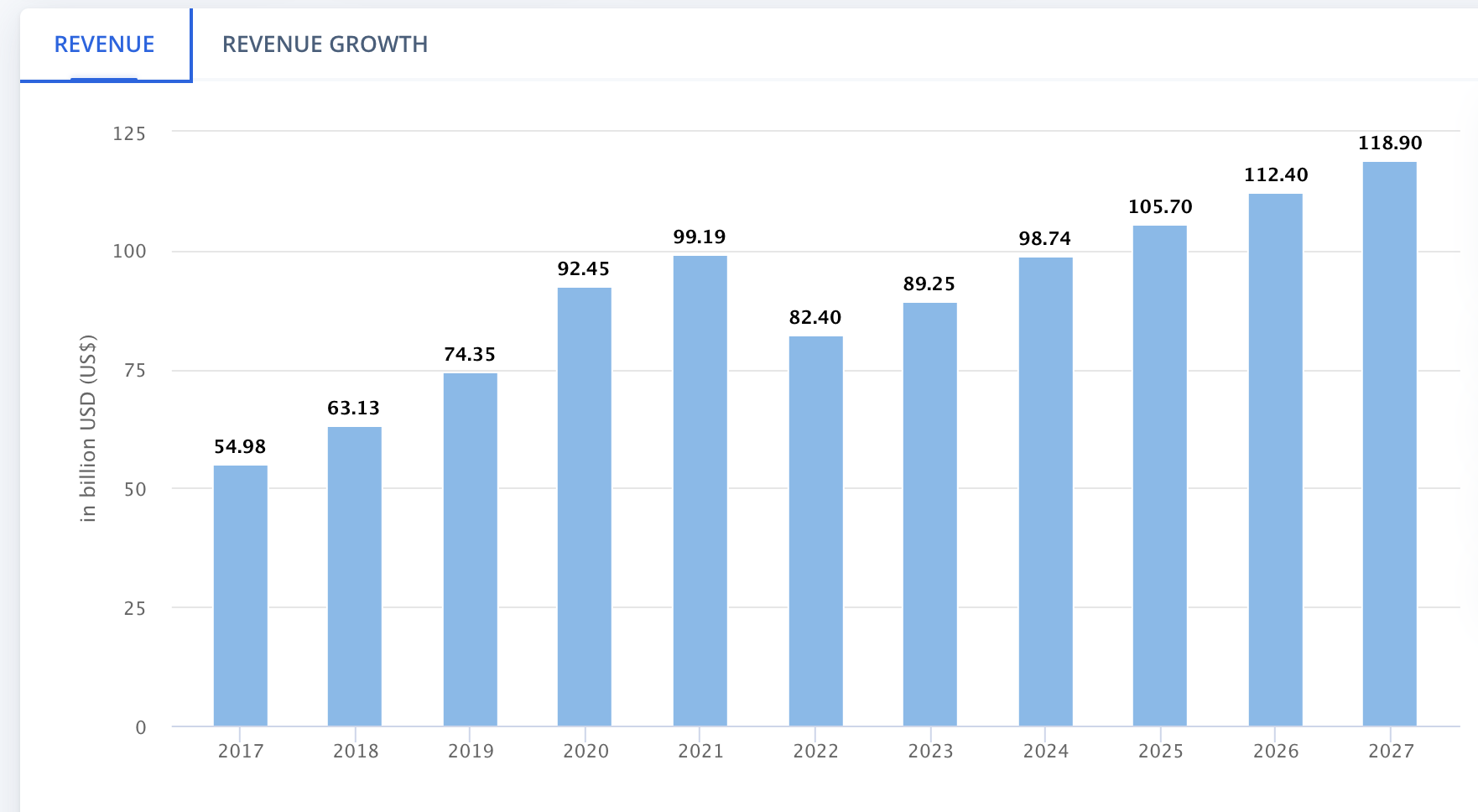

Revenue growth

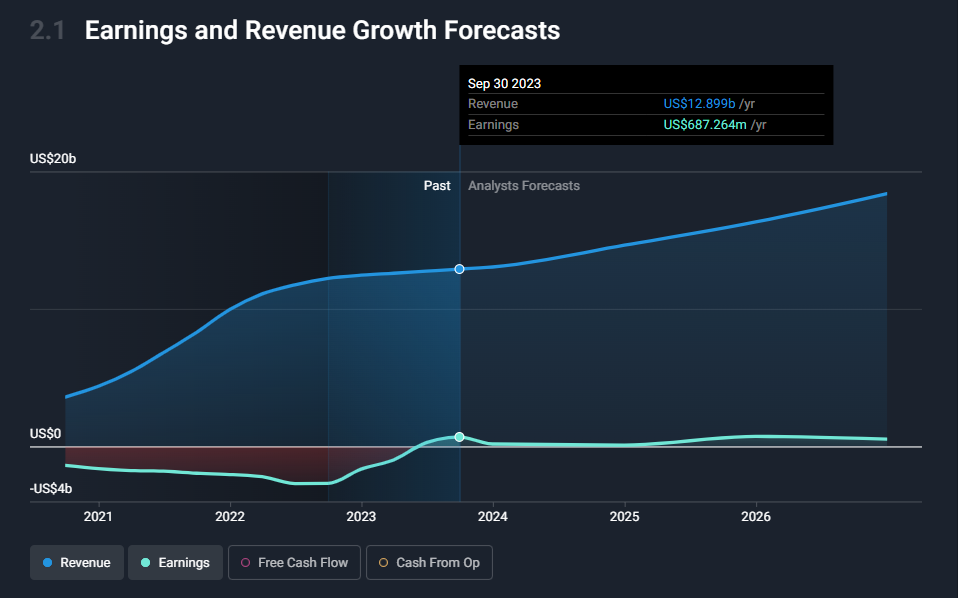

Sea's potential for growth is demonstrated by a projected 11.06% revenue increase over the following five years. The company's sales for the last 12 months were $12.90 billion, and its net income was $687.26 million, or $1.21 per share.

Source: Stockanalysis

Recent developments

After a drop in bookings and quarterly active users (QAUs) after the peak in Q3 2021, Sea hopes to revive its gaming division, Garena, in 2024. Garena's business stabilized in Q3 2023, with QAUs of $544 million and bookings of $448 million, despite a difficult period. The segment's adjusted EBITDA of $234 million indicated its continued profitability.

Experts believe that Garena will rebound in 2024, particularly if it decides to rejoin the Indian market. For traders considering Sea's trajectory and possible return into the market, tracking the rise in QAUs and bookings over the year becomes essential. Keep yourself updated about upcoming changes and prospects for expansion.

Market fluctuations

Sea Limited's price has changed by -36.60% over the last 52 weeks, showing significant market volatility. The 50-day moving average indicates a possible stability of around $38.16. A consensus "Buy" recommendation and an average price target of $64.86 indicate a possible upside of 54.82%, indicating that analysts have enthusiastic perspectives.

Compared to the S&P 500, this stock failed to provide a decent return in recent days. However, the solid bottom is visible; a push from the fundamental perspective could be a long opportunity.

Competitions

Taking into account the success of its competition is essential when evaluating Sea Limited's stock projection for 2024. To determine Sea Limited's position and possible growth trajectory in 2024, monitor the performance of these rivals.

With a market valuation of $23.73 billion and a comparatively high P/E ratio of 37.49x, Sea Limited is a more impressive investment than Dillard's, Macy's, Ollie's Bargain Outlet Holdings, Nordstrom, and Kohl's Corporation.

At $41.93 right now, Sea Limited is trading between $34.35 and $88.84 during a 52-week range. The price change in a single day was 0.21%. Sea Limited is positioned as a major player in the business by its market capitalization despite the fact that certain competitors, such as Dillard's and Macy's, have higher pricing and P/E ratios.

SE Stock Forecast 2024 - Bullish Factors

Multiple bullish indications are present for Sea Limited. The company's noteworthy 11.06% revenue growth prediction for the next five years shows a strong growth trajectory. With an average price objective of $64.86, or a possible upside of 54.82%, analysts forecast a favorable sentiment for the stock.

An optimistic outlook is supported by the quick ratio of 1.69 and the debt-to-asset ratio of 0.26, which reflect the company's robust financial health and liquidity.

SE Stock Forecast 2024 - Bearish Factors

Even with a bright future, being aware of potential pitfalls is important. The stock has dropped -36.60% over the past 52 weeks, indicative of market volatility. The higher beta value would be a major factor as most of the US indices are at record highs, and downside pressure could be challenging for SE bulls.

Traders should monitor variables that affect this volatility, such as macroeconomic circumstances or difficulties distinctive to the business. Furthermore, there might be challenges from any negative news that damages the company's brand or from laws and regulations.

III. SE Stock Forecast 2025

The Sea Limited stock forecast, which projects a 66.67% rise from its present value to $69.78 in 2025, is an alluring proposition.

The weekly chart shows a bullish breakout above the 20-week EMA line, while the broader context is corrective.

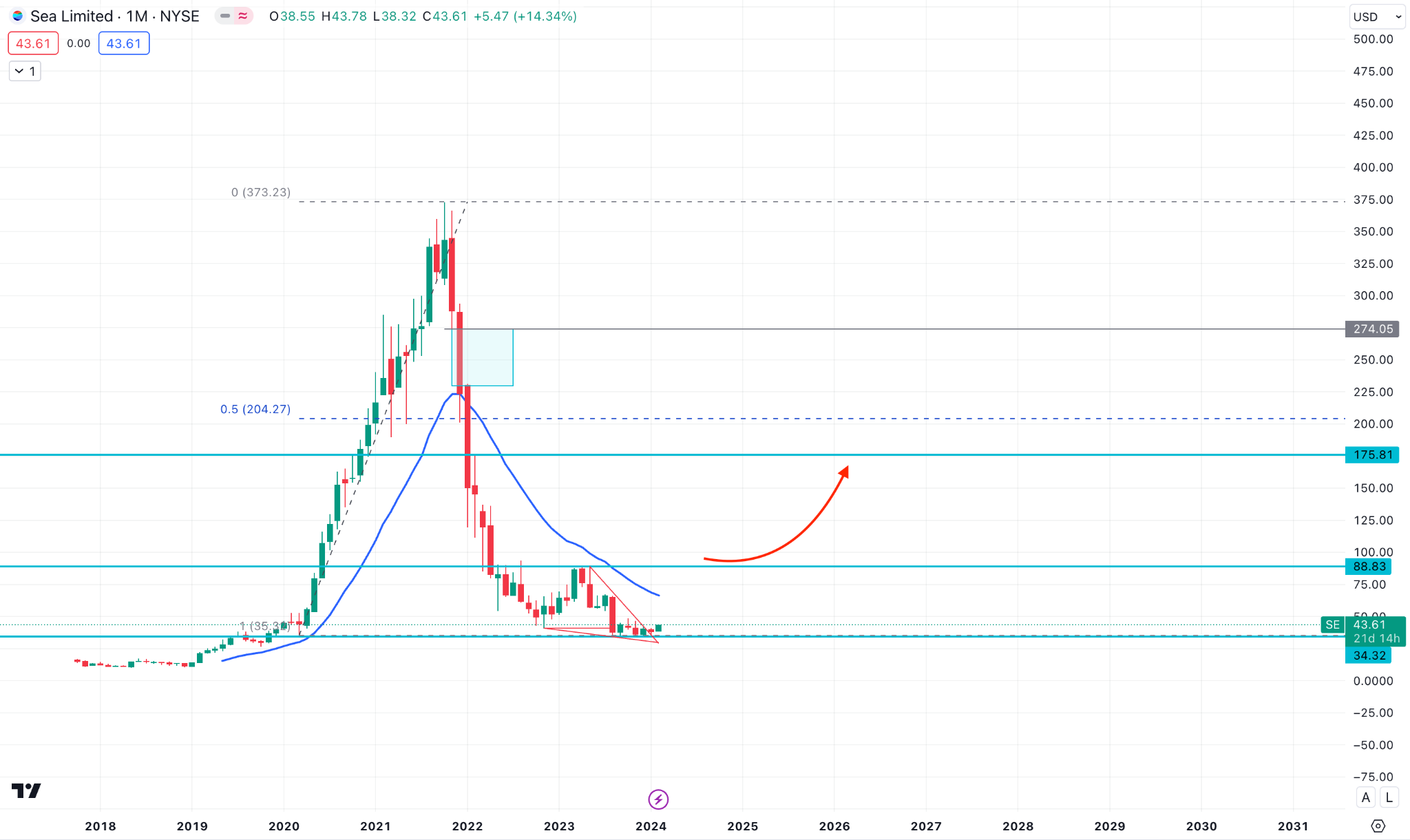

The current bottom at 34.32 is not confirmed, so sufficient buying pressure is visible from this line. The price action in 2024 would be a crucial factor for this stock as more consolidation and a breakout above the 88.83 high could open room for reaching the 175.81 swing high.

In the existing swing from March 23, 2020 to October 18, 2021, the 50% Fibonacci Retracement level is at 204.27 level, which is way above the current price. As long as the price trades above this level, we may consider it as a discounted area. Any long trading opportunity from the discounted zone has a higher winning possibility, depending on the price action context.

Overall, the extreme buying pressure might take the price toward the 204.27 level, but investors should monitor how the price reacts to the 80.00 to 88.83 area in 2024.

On the other hand, a bearish continuation is possible in 2025, where a stable market below the 34.32 low would be a crucial level to watch. Below this static line, the next long-term support is at the 15.48 level.

A. Other Sea Limited Stock Forecast 2025 Insights

Based on the predicted statistics from pandaforecast.com, Sea Limited (SE) is expected to make a remarkable move in 2025. Its possible range, with 5.47% volatility, is $33.74 to $35.70, with a starting price of $34.62. As the months pass, a positive tendency becomes apparent. April's target is $38.48, after a March target of $36.58. May stays at $39.00, rising somewhat to $39.89 in June. July and August remain stable at $39.89 and $39.03, while September experiences a little increase to $40.02, continuing the upward trend.

The minor declines in October and November, at $38.18 and $38.23, may make them appealing entry targets for investors. December ends the year at $38.18, indicating the dynamic nature of Sea Limited's stock and its potential for wise investment decisions. Investors should closely analyze monthly fluctuations to identify growth potential and smart entry points in this compelling story of the stock's trajectory until 2025.

Yahoo Finance predicts that Sea Limited's 2025 stock projection provides insightful information on its income statement and historical performance. Sea Limited showed steady growth, with sales rising from $9.96 billion in 2020 to $12.9 billion by December 30, 2022. The gross profit increased to $6 billion, indicating a growing trend. Operating income showed improvement, rising from a prior deficit to $919.7 million. Compared to the previous year's deficit, net income for common stockholders increased to $687.3 million.

Improved profitability was reflected in the earnings per share, which increased to $1.23 from a negative $2.96. Investors may make more educated decisions using historical stock data, highlighting volatility. For growth-oriented tech investors, Sea Limited's favorable financial trends and past performance point to a bright future for 2025.

B. Key Factors to Watch for Sea Ltd Stock Forecast 2025

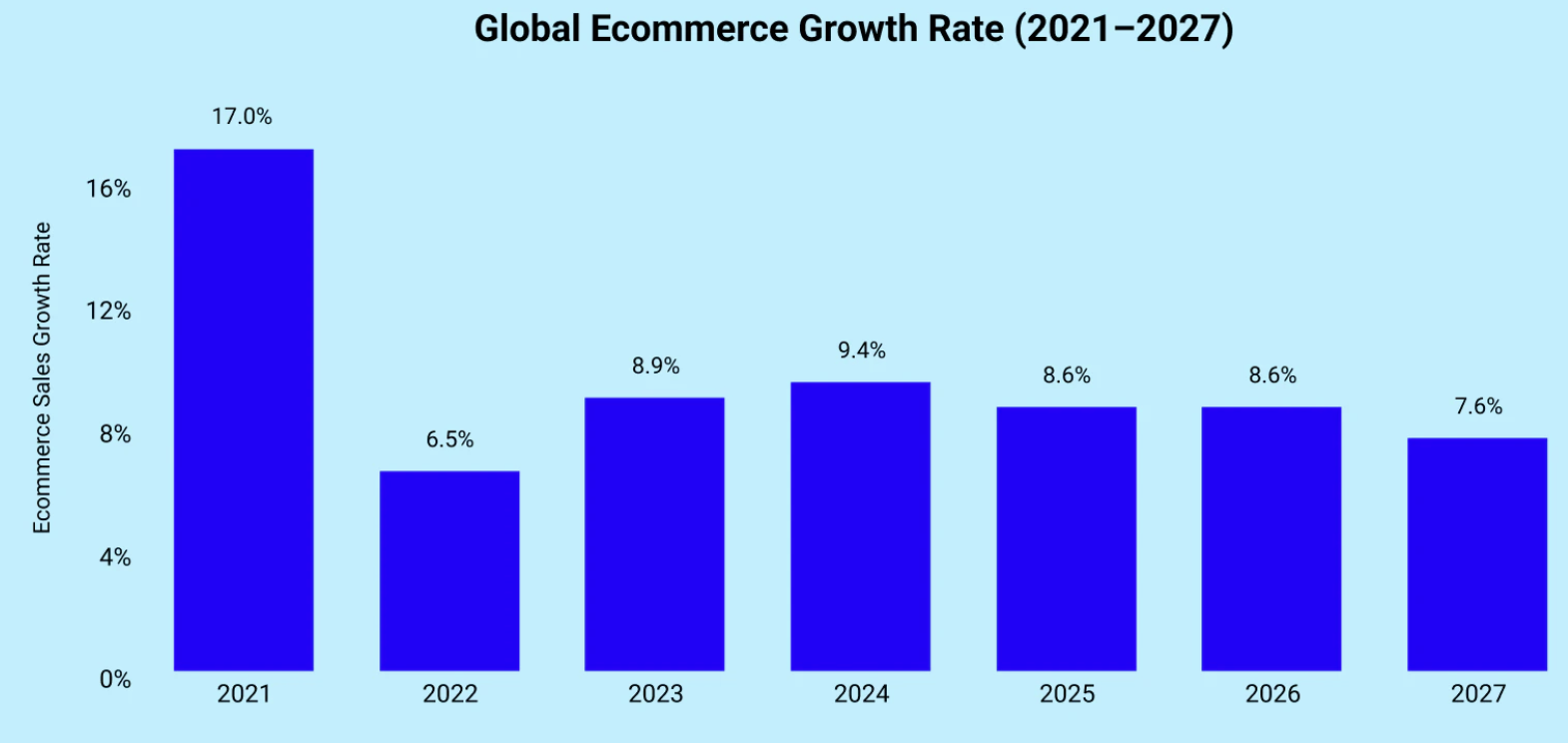

Growth in E-commerce

Sea Ltd's e-commerce business is expected to grow, especially in Southeast Asia. Shopee, Sea's e-commerce platform, is expected to witness major revenue growth due to its expanding online consumer base and rapid digital usage.

Source: oberlo.com

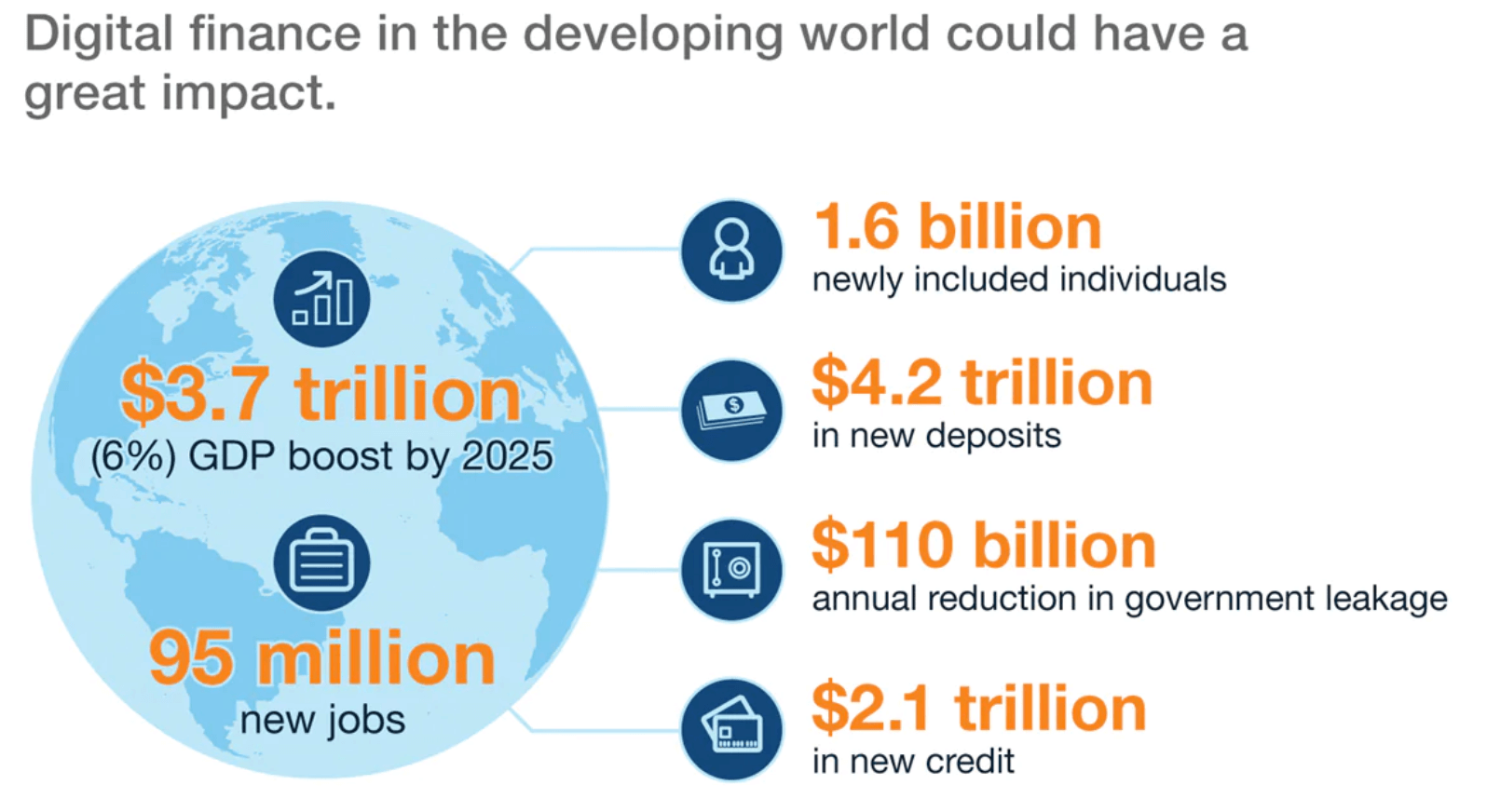

Opportunities in Digital Finance

SeaMoney, the company's division dedicated to digital finance, has promising futures. SeaMoney's market share and income sources should increase as digital payment and financial services continue to take off in the area.

Source: mckinsey.com

Strength of the Gaming Segment

Garena, Sea's gaming business, has strong development potential. Garena is well-positioned to benefit from the growing demand for gaming entertainment around the world because of its investments in esports and well-known titles like Free Fire.

Source: statista.com

Regulatory Risks

Sea's operations may face difficulties as a result of heightened attention to regulation in several markets. Changes in regulations or limitations on digital finance and e-commerce operations may affect the company's growth direction.

Increased Competition

Sea faces competition from both long-standing competitors and recent arrivals in its highly competitive marketplaces. Increasing competition can pressure margins and prevent Sea from gaining market share.

Let's see the list of competitors for this company:

- Shopee: An e-commerce platform similar to Amazon and Alibaba.

- Alibaba Group (BABA): The dominant e-commerce player in China is also expanding into Southeast Asia.

- Amazon (AMZN): The global e-commerce giant makes inroads into Southeast Asia.

- Lazada: An e-commerce platform owned by Alibaba, primarily focused on Southeast Asia.

- Tencent Holdings (TCEHY): A Chinese tech giant with a strong mobile gaming presence responsible for popular titles like Honor of Kings and PUBG Mobile.

- NetEase (NTES): Another Chinese tech giant focusing on mobile gaming, known for titles like Knives Out and Onmyoji Arena.

Market Volatility

Sea Ltd's stock performance may be impacted by both market volatility and economic concerns. Variations in the state of the world economy, currency rates, and customer attitude may have an effect on Sea's forecast for sales and profitability.

Source: netcials.com

Sea Limited Stock Forecast 2025 - Bullish Factors

Bullish sentiment is fueled by Sea Ltd's growing digital ecosystem, solid revenue growth forecasts of 15% per year, and significant market penetration in Southeast Asia. Its cutting-edge e-commerce and gaming systems also provide it with a competitive advantage.

Sea Limited Stock Forecast 2025 - Bearish Factors

Worries about rising competition in the e-commerce industry, possible regulatory obstacles in emerging nations, and currency exchange rate concerns may weaken investor confidence. Furthermore, relying heavily on one area for revenue risks a company from geopolitical unrest.

IV. SE Stock Forecast 2030 and Beyond

If Sea Limited's stock continues to rise at its 10-year average pace, it is predicted to rocket to $897.39 in 2030 - a staggering 2,043.28% increase from its present value.

SE's monthly chart shows a squeeze breakout where recent price action shows a corrective momentum within a triangle pattern. A bullish triangle breakout in 2024 with consolidation could signal a long-term bull run, but it needs to see how the price reacts in the 20-month EMA line.

Overall, investors should wait for a valid breakout from the 20-month EMA line with a monthly candle above the 100.00 psychological level, which could be an immediate long signal toward the 274.05 inefficiency zone. Above the 175.81 level, we could aim for the 373.23 level, which is the current all-time high.

A. Other Sea Limited Stock Forecast 2030 and Beyond Insights

Topgraphs.com's stock insights for Sea Limited point to an optimistic future, with experts projecting that Sea will dominate the worldwide market by 2030. Sea Limited's strategic posture, which is diversified across digital finance, gaming, and e-commerce, offers durability. This projection shows long-term growth with a strong price target of $550, which encourages investors to take advantage of the chance now for excellent profits eventually.

Goldman Sachs offers an optimistic view and projects that Sea Limited's shares would trade at $450 by 2030. The firm's confidence in Sea's ability to maintain strong growth momentum and seize market opportunities is reflected in this ambitious aim. Also, in line with this bullish outlook, J.P. Morgan anticipates that SE stock will trade at $500 by 2030.

Morgan Stanley rates the shares of Sea Limited as a buy, with a $480 price target by 2030. This positive forecast demonstrates the company's faith in Sea's potential for long-term growth and its standing as a major participant in the digital economy.

B. Key Factors to Watch for Sea Ltd Stock Forecast 2030 and Beyond

Sea Limited's financials recovered despite a substantial -36.81% fall over the previous 52 weeks, which shows volatility. An impressive 11.10% return on equity (ROE) indicates strong financial efficiency. Furthermore, Sea Limited has a net cash position of $4.99 billion, or $8.84 per share, which provides protection against future difficulties.

There are some crucial elements that you should be aware of in order to make informed decisions, as they will significantly influence how SE's stock performance develops in the future.

Maintaining e-commerce leadership

Shopee, Sea's e-commerce platform, currently dominates Southeast Asia. They'll likely focus on solidifying this position by expanding into new markets like Africa and Latin America, enhancing logistics and fulfillment networks, and diversifying product offerings.

Achieving profitability in e-commerce

While Shopee shows impressive growth, profitability still needs to be achieved. As per our anticipation, an increased focus on efficiency and cost optimization would be a bullish factor for SE. Also, leveraging data analytics and exploring new revenue streams like advertising or fulfillment services could signal stable profitability.

Growing SeaMoney, the digital payments platform

SeaMoney boasts strong user growth but limited monetization. Strategies could include offering additional financial services like microloans or insurance. Also, other decisions like partnerships with banks and other financial companies, allowing cryptocurrencies and other digital markets, could bring bulls to the market.

Sea Ltd Stock Forecast 2030 and Beyond - Bullish Factors

After prioritizing rapid expansion, Sea might shift towards balancing growth with profitability. Although Southeast Asia remains the core market, expansion is expected in other high-growth regions.

Investors should monitor how the company implements technology. Sea will likely invest in AI, big data, and other technologies to enhance its platforms and services.

Sea's interconnected businesses offer synergy. Expect further integration and collaboration between Shopee, SeaMoney, and Garena.

Sea Ltd Stock Forecast 2030 and Beyond - Bearish Factors

The higher beta with the market would be a challenging factor. Already top US indices are at top and a sufficient downside correction might happen, leading to a pressure on traders.

A failure to provide an impressive earnings growth with a business expansion could be a strong bearish factor. Also investors should monitor how competitors are doing to identify any inherent threat.

V. SE Stock Price History Performance

Source: TradingView

- 2019: Sea Ltd. goes public on the NYSE with an IPO that raised $2.1 billion. The stock showed a stable buying momentum, with an impressive 300% yearly gain.

- 2020: Sea Money secures a digital banking license in Singapore, further expanding its fintech services. Shopee, Sea's e-commerce platform, has seen explosive growth during the pandemic, becoming the leading e-commerce platform in Southeast Asia. As a result, another 400% gain was seen during that year.

- 2021: Garena, Sea's gaming division, achieves record revenues driven by Free Fire's global success. Sea expands its logistics network with the acquisition of Kerry Logistics. The stock gained an additional 88% gain and formed a top before moving sideways.

- 2022: Sea Money launches mobile wallet services in Malaysia and Thailand. The stock lost momentum and moved 77% down from the yearly opening price.

- 2023: In 2023, one of the key events for Sea Limited (SE) was its continued expansion and diversification across its various business segments.

VI. Conclusion

Sea Ltd. stands out with a market value of 21.62 billion USD and a P/E ratio of 32.87. The excellent valuation of the company as of Q3 2023 (based on the previous twelve months) with a PEG ratio of 0.26, notwithstanding recent volatility, points to a potential low-price point in relation to near-term earnings growth.

Sea Limited's (SE) stock projection indicates a positive outlook for the future. According to analysts, prices are expected to grow steadily in 2024, reaching $50 per share. More increase is anticipated by 2025, possibly surpassing $60. The prognosis is still positive for 2030; projections suggest that prices may rise over $100. Trading SE stock CFD with VSTAR offers a simplified way for investors looking for possibilities to profit from these projections.

VSTAR offers access to a wide range of global markets, including currencies (FX), stocks, indices, gold, and oil, providing traders with ample opportunities to diversify their portfolios. The institutional-level trading experience with the lowest trading fees, including zero commissions and super-tight spreads, could allow traders to maximize their profits.

VSTAR's trading platform caters to both professional traders and beginners with its easy-to-use interface. It offers a minimum deposit requirement of only $50 and negative balance protection to safeguard traders' funds. Additionally, traders can explore real-time trading opportunities on popular markets and access risk-free demo accounts for practice.

For more information, traders can visit the official website at www.vstar.com to explore the platform's features and services in detail.

FAQs

1. What is SE Ltd target price?

The 12-month average analyst target price for SE stock is $55 per share.

2. What is the prediction for SE stock?

The forecast for SE stock is generally positive for the next 1-2 years. Analysts expect continued strong revenue and earnings growth as the company continues to expand into the e-commerce and financial technology markets in Southeast Asia.

3. What is the SE stock forecast for 2025?

If SE can maintain annual growth rates in the 25-35% range, the stock price could reach $100+ per share by 2025. Key drivers will be the growing adoption of SeaMoney digital financial services, the expansion of Shopee eCommerce platform, and the growth of Garena digital entertainment business across Southeast Asia.