Which is the best e-commerce stock to buy in 2023? Many investors think Shopify (NYSE: SHOP) is it. Currently trading at around $67 per share, SHOP stock is up more than 80% since January.

As you can see in the chart below, Shopify has outperformed other top e-commerce stocks like Amazon (NASDAQ: AMZN), MercadoLibre Inc (NASDAQ: MELI), and BigCommerce (NASDAQ: BIGC).

Is Shopify stock a good long-term investment? Read on to find out why Cathie Wood and other top investors are excited about Shopify stock.

Shopify (NYSE: SHOP) Stock News

- Not to be left behind in the AI race, Shopify has developed an artificial intelligence assistant called the Sidekick. Shopify has built Sidekick as an AI-powered tool for merchants. For example, Shopify merchants can use Sidekick to manage their online stores, such as applying discounts across products. In addition, Sidekick can generate quick statistics about their sales performance on command.

- Shopify has partnered with Roku Inc (NASDAQ: ROKU) to enable shoppers to buy products from its merchants directly from their televisions. When a Roku viewer sees a product ad from a Shopify merchant, they can simply press OK on the Roku remote to purchase that product.

- To simplify its structure and focus on its core business of powering online stores, Shopify has divested its logistics unit. It has sold its logistics business to Flexport, which operates a global logistics platform. In connection with this transaction, Shopify received an additional 13% equity interest in Flexport.

- In an effort to cut costs and improve profitability, Shopify has decided to reduce its workforce. The company plans to reduce its headcount by 20%. What's happening here is that Shopify has discovered that it has an excess workforce, and now it wants to slim down a bit. There will be severance costs in the short term, but there should be significant cost savings in the future.

Shopify (NYSE: SHOP) Stock Overview

Shopify is an e-commerce platform provider. It offers tools that allow merchants to set up and run online stores. Shopify is available in more than 175 countries and hosts nearly 2 million merchants on its platform. Shopify is a top investor in the buy-now-pay-later provider Affirm Holdings Inc (NASDAQ: AFRM).

Founded in 2006, Shopify is headquartered in Ottawa, Canada. Shopify went public in 2015. With a market cap of about $90 billion, Shopify is one of the top e-commerce technology companies in the world.

Shopify co-founder and CEO Tobias Lutke is a billionaire with a net worth of more than $6 billion, according to Bloomberg. Much of Lutke's fortune is tied to his 7% stake in Shopify. Shopify's other founders are Daniel Weinand and Scott Lake.

Shopify's Top Shareholders

While Shopify is popular with retail investors, it is also a favorite e-commerce stock of many elite institutional investors. Here are some of Shopify's top professional shareholders:

|

Shopify Shareholder |

Stake |

|

Baillie Gifford |

5.9% |

|

Morgan Stanley |

5.6% |

|

Capital Research Global Investors |

5.1% |

|

Vanguard Group |

3.3% |

|

T. Rowe Price Associates |

2.4% |

Shopify stock is also a major holding in Cathie Wood's ARK funds. In addition, the top e-commerce stock is a favorite of many hedge funds, including Capstone Triton.

Key Events in Shopify's History

|

2010 |

Shopify was named Ottawa's fastest-growing company. |

|

2012 |

Shopify acquired mobile app developer Select Start Studios. |

|

2013 |

Shopify acquired the design studio, Jet Cooper. |

|

2014 |

Shopify launched the premium Shopify Plus plan. |

|

2015 |

Shopify went public. |

|

2018 |

Shopify surpassed $1 billion in annual revenue. |

|

2022 |

Shopify partners with JD.com to give its merchants access to the Chinese market. |

Shopify's Business Model and Services

Shopify acts like a digital landlord for merchants. It operates a platform for merchants to set up online stores. Merchants pay a monthly fee, similar to rent, to host their stores on the Shopify platform. In addition, merchants can access additional tools and features for a fee to help drive sales and manage their online stores.

How Shopify Makes Money

- The company has several revenue streams. These are Shopify's primary revenue streams:

- Subscription fees: Merchants who run online stores on the Shopify platform pay a monthly subscription fee. Shopify offers a variety of subscription plans, with costs ranging from $30 to $2,000 per month.

- Transaction fees: Merchants can use the payment service provided by Shopify or a third-party option. Those who choose to use a third-party payment service will be charged a transaction fee, which is calculated as a percentage of the sale.

- Referral Payments: Shopify has certain partnership agreements that include referral payments. For example, the company may be paid when its customers use services offered by its partners, such as Affirm, which offers short-term shopping loans.

- Advertising services: Shopify offers online marketing services to merchants and app developers on its platform. For example, developers can pay to promote their apps in the Shopify app store. Similarly, merchants can pay to promote their stores.

Shopify's Main Products and Services

|

Online stores |

The company operates a cloud-based platform where merchants can build and run online stores. |

|

POS system |

For merchants who want to sell offline in addition to online, Shopify provides POS devices and related software. |

|

Shopify App Store |

The company operates an app marketplace similar to Apple's App Store, where customers can access third-party apps. |

|

Shopify Payment |

The company provides a payment processing service for its merchants, allowing them to accept credit cards and other payment methods. |

|

Shopify Capital |

The company offers small business loans that merchants on its platform can use to replenish their stores when they're short on cash. |

Shopify reports its revenue under two main categories as Merchant Solutions and Subscription Solutions. The vast majority of its revenue, more than 75% of the total, comes from its Merchant Solutions business.

Shopify's Financial Performance and Balance Sheet Condition

Earnings reports have a huge impact on stock prices, and the state of the balance sheet can mean the difference between a thriving company and a failing one.

Therefore, evaluating Shopify's financials can help you decide whether it's the top e-commerce stock to buy now. Let's examine Shopify's financial performance and balance sheet strength.

Shopify's Revenue

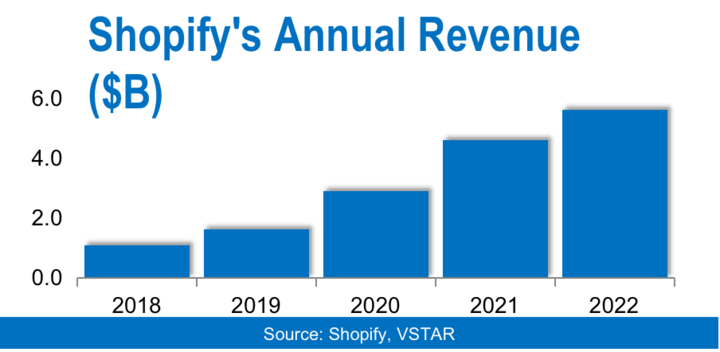

In 2022, the company's revenue increased 21% to $5.6 billion. In 2021, revenue increased 57% to $4.6 billion. This followed an 86% increase in revenue to $2.9 billion in 2020. In 2023, Shopify's revenue is projected to increase by 20% to $6.7 billion. The chart below illustrates Shopify's annual revenue trend.

The company has reported consistent annual revenue growth since its IPO. In 2015, the year of the IPO, Shopify's revenue was just $205 million. In just two years, the revenue more than tripled to $673 million in 2017. A year later, the revenue nearly doubled to $1.1 billion in 2018.

Shopify's Net Income

The company has been in and out of the black. In 2022, it lost $3.5 billion, compared to a profit of $2.9 billion in 2021 and a profit of $320 million in 2020.

For much of its history, Shopify has prioritized growth over profitability. Going forward, the company may focus more on profitability even as it continues to pursue growth. Recent actions, such as the sale of its logistics division and job cuts, suggest that the company is taking steps to control costs to improve profitability.

Shopify's Profit Margins

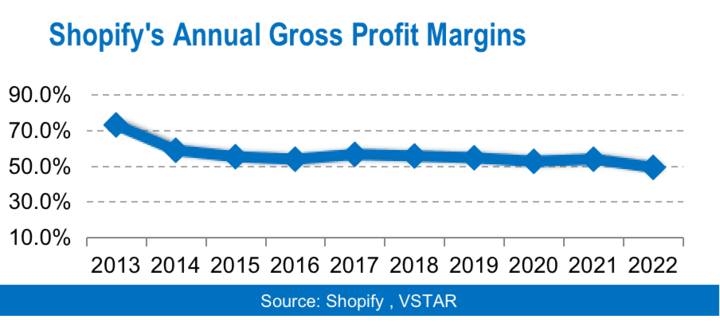

The company's gross margin was 49% in 2022, compared to 54% in 2021 and 53% in 2020. Although Shopify's gross profit margin fluctuates with different cost environments, the company has maintained a gross profit margin above 50% for most of the years since its IPO.

Shopify's Cash Position and Balance Sheet Condition

As of March 2023, the company had $4 billion in net cash. Shopify's balance sheet shows $11 billion worth of assets against only $1.4 billion in long-term debt. The company has an impressive debt-to-equity ratio of 0.17 and a current ratio of 6.71.

Shopify (NYSE: SHOP) Stock Analysis

Shopify (SHOP) Stock Valuation

Shopify stock currently trades at a forward price-to-sales (forward PS) ratio of 12.35, compared to a forward PS of 2.34 for Amazon, 2.44 for eBay, and 4.10 for MercadoLibre. Based on the forward P/S ratio, Shopify looks overvalued.

The stock trades at a price-to-book (PB) ratio of 10.39, compared to a PB ratio of 8.87 for Amazon, 4.68 for eBay, and 29 for MercadoLibre. Based on the P/B ratio, Shopify stock looks fairly valued.

Shopify (SHOP) Stock Trading Information

Shopify stock is dual-listed in the U.S. and Canada. In Canada, the stock trades on the Toronto Stock Exchange under the ticker symbol "SHOP". In the U.S., Shopify stock trades on the NYSE under the ticker symbol "SHOP". Shopify is one of the most active top e-commerce stocks. On average, 13 million shares of Shopify stock trade daily.

You can trade Shopify's U.S.-listed stock as early as 4 a.m. and as late as 8 p.m. ET by taking advantage of extended trading hours for the pre-market and post-market sessions. Otherwise, the regular trading session begins at 9:30 a.m. and ends at 4 p.m. ET.

Shopify (SHOP) Stock Split History

Shopify has split its stock once since going public. In June 2022, the company implemented a 10-for-1 stock split. As a result, an investor who originally owned 1,000 shares of the company received 10,000 shares after the split.

Companies typically split their stock to make it more affordable for retail investors. At the time Shopify's stock split went into effect, the stock price was $350. As a result of the 10-for-1 split, the stock price dropped to about $35. Because of the lower stock price, the stock price can skyrocket after the split. In fact, Shopify's stock price has nearly doubled since the split.

Shopify (SHOP) Stock Dividend Yield

The company doesn't pay a dividend yet. Most of the top e-commerce stocks, including Amazon and Alibaba, don't pay dividends either.

Instead of distributing cash to shareholders, these companies choose to reinvest the money they make back into the business. Shopify invests heavily in areas such as research and development and marketing efforts. The company has no plans to start paying dividends in the foreseeable future.

Shopify (SHOP) Stock Performance

Shopify went public at an IPO price of $17 per share, above the expected range of $14 to $16, which had already been raised from a range of $12 to $14. The split-adjusted IPO price is $1.70.

SHOP stock soared on its debut, gaining more than 50% on its first day of trading. As you can see in the chart below, the stock continued to climb in the years that followed, reaching a split-adjusted all-time high of $176.43.

Over the past year, Shopify stock has traded between a low of $23 and a high of $71. At around $67 now, the stock has surged 200% from its 52-week low and is approaching its 52-week high. Despite the surge, SHOP stock still trades at a generous 60% discount to its all-time high.

Shopify (SHOP) Stock Forecast

Evaluating Shopify stock price targets can help you gauge whether this is the best e-commerce stock to invest in right now.

Approximately three dozen analysts have weighed in on the outlook for Shopify stock, with a range of SHOP stock price forecasts that range from $30 to $80. In terms of stock ratings, 13 analysts have a Buy rating on SHOP stock, while 20 analysts have a Hold rating on the stock. Only 2 analysts have a sell rating on Shopify stock.

If you look at where SHOP stock is right now, you can see that the stock is sprinting faster than analysts expected. Shopify has already beaten the average SHOP stock forecast of $56 by more than 20% and is only 15% shy of the highest price target of $80.

Why is Shopify (SHOP) Stock Going Up?

Shopify stock has been soaring, making it the top e-commerce stock to buy in 2023, due to a number of factors. These are some of the reasons why SHOP stock is going up and why it may continue to rise:

- Improving financial results: Shopify reported earnings for the first quarter of 2023 that were both better than the same period in 2022 and better than analysts' expectations. The company also issued a positive outlook for the second quarter.

- Promising operational adjustments: Investors have cheered Shopify's decision to sell its logistics unit and cut some jobs to improve its operational efficiency. These moves have raised hopes that the company could generate more consistent annual profits.

- Buying the dip: Shopify is attracting investors looking for the top e-commerce stocks to buy the dip. With SHOP stock still 60% below its all-time high, many investors are excited about the opportunity to buy the dip in this popular e-commerce stock.

Shopify (SHOP) Stock Technical Analysis

The above chart shows various technical indicators for Shopify stock (SHOP). The upper segment of the chart shows the Bollinger Bands, the middle segment shows the MACD indicator and the lower segment shows the RSI reading.

If you look at the Bollinger Bands, you can see that Shopify stock is just coming out of a consolidation phase in July 2023. This type of consolidation is usually followed by a breakout, which can be to the upside or to the downside. In this case, SHOP stock looks primed for a bullish breakout.

A look at the MACD chart suggests that this could be a short breakout, or there could be some hesitation before a larger breakout. First, although the MACD line has crossed above the signal line in a bullish indication, note that the close is above the middle zero line. Second, the RSI reading of 63 is close to the overbought level.

Shopify's Challenges and Opportunities

Because every business has challenges and opportunities, it takes a strong company to thrive. As you might expect, Shopify has its fair share of challenges and opportunities, and it helps to examine them to see if SHOP stock is a good investment.

Shopify's Risks and Challenges

- Regulations: Shopify is a leading e-commerce platform provider with a global footprint. Stringent or changing regulations, such as those related to market competition, data privacy, and taxation, may slow Shopify's growth or increase its compliance costs.

- Cybersecurity threats: Given the nature of its business, Shopify handles sensitive data, including financial information. If Shopify suffers a major cybersecurity breach, it could lose sensitive information, face large fines, and suffer reputational damage.

- Competition: As the market leader, Shopify is the target of competition in the e-commerce platform industry. These are some of Shopify's major competitors and the threats they pose:

|

Competitor |

Threat |

|

BigCommerce |

Shopify and BigCommerce compete for the business of hosting online stores for merchants. Their revenue models are largely similar, with both focusing more on subscription sales. |

|

Adobe |

Adobe Commerce, formerly known as Magento, provides tools for building and managing online stores. As such, it competes with Shopify for online merchants. |

|

WooCommerce |

WooCommerce not only offers competing tools for creating and running online stores but also competes with Shopify in offering marketing and payment services. |

Shopify's Competitive Advantages

- Solid financial position: With $4 billion in cash, $11 billion in assets, and only $1.4 billion in long-term debt, Shopify is more financially stable than most of its competitors. As a result, it has greater flexibility to fund programs like product research and marketing to drive growth.

- Leading market share: Shopify controls the largest share of the e-commerce software platform market in the U.S., according to Statista. The company is so far ahead of the competition in terms of market share that it could take years for its competitors to catch up.

- Strong brand recognition: Shopify has built a widely recognized and respected brand among merchants, app developers, and shoppers. As a result, the company is able to leverage its brand trust to attract key partners through which it can earn additional revenue through referrals.

- Diversified business: Shopify has a more diversified business than most of its competitors. As a result, it is better positioned to weather adverse economic climates that could put many of its competitors out of business.

Shopify's Opportunities

Although Shopify faces various challenges, it has many opportunities to grow its business and make it more profitable. Let's explore Shopify's opportunities to see what's possible for this e-commerce company.

- International expansion: While Shopify has already reached 175 countries, there are still many untapped international markets for the company. Additionally, there is still plenty of room for Shopify to expand in its existing international markets.

- Strategic partnerships: Partnerships have proven to be beneficial for Shopify. For example, the agreement with Affirm is driving sales for Shopify merchants. The partnership with Roku also has great potential. Shopify is also exploring a delivery partnership with Amazon for its Buy with Prime plan.

- Small business lending: Shopify offers loans to small businesses through its Shopify Capital unit. Since launching the lending service in 2018, the company has provided approximately $5 billion in loans to merchants. With the small business lending market estimated to be worth $1.4 trillion, Shopify Capital has tremendous growth opportunities.

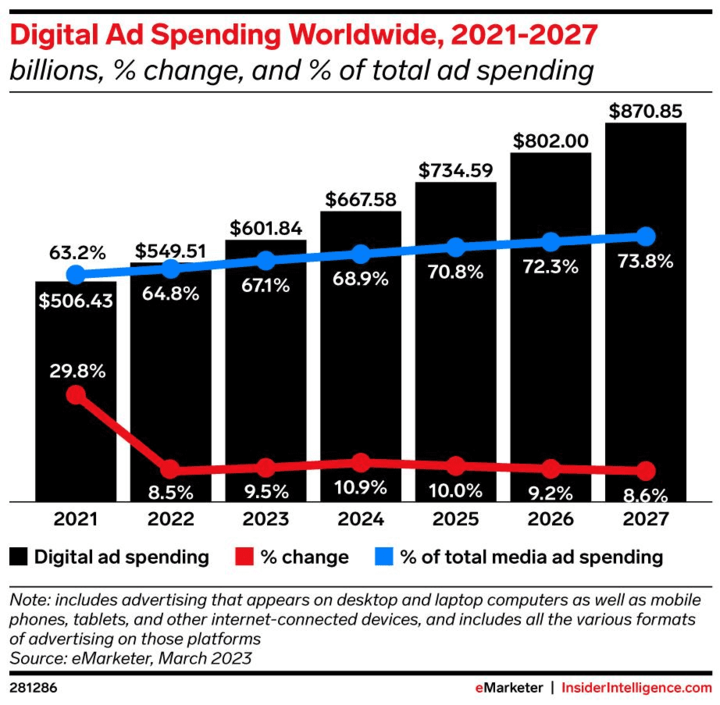

- Advertising: Amazon and Alibaba are making billions of dollars by promoting merchants and brands on their platforms. Shopify also has a huge opportunity in this space, especially as its merchant and buyer base grows. The global digital advertising market is projected to grow from $522 billion in 2021 to $870 billion in 2027.

Source: eMarketer

- AI technology: Artificial intelligence technology has significant potential for Shopify. The company can integrate AI into its solutions to make them more powerful and outstanding. In addition, Shopify can use AI to enhance its operational efficiency, which can lead to more consistent profits.

Why Traders Should Consider SHOP Stock

Shopify (SHOP) stock is trading at a steep discount to its all-time high, suggesting that the stock has a long runway ahead of it. SHOP stock's technicals suggest that the stock is poised for a major breakout.

Shopify is the leader in the e-commerce platform industry. Its leading market share provides a strong competitive advantage. In addition, the company has solid financials and a promising outlook given its many growth opportunities.

Shopify (SHOP) Stock Investing Strategies

Source: Pixabay

Depending on how much money you have to invest and how quickly you want to see returns, there are several ways to make money with Shopify stock. Let's take a look at the two most common SHOP stock investment strategies:

1. Buy and hold Shopify stock

This is the traditional way to invest. It involves buying as many shares of Shopify stock as you can afford and then holding them in your portfolio for at least a few years.

With this investment strategy, you hope that Shopify's stock price will rise during your holding period, allowing you to make a profit. As a result, you would suffer a loss if the stock falls in price. Buy-and-hold investing has its advantages and disadvantages.

Pros:

- You will have shareholder voting rights and the ability to influence decisions made by Shopify's board of directors and management.

- The number of shares you own may increase if Shopify splits its stock in the future.

- You will be eligible to receive dividends if Shopify decides to begin paying dividends.

Cons:

- You need a lot of up-front capital to get started, and you may have no control over your initial capital requirements.

- It takes a long time to see returns, and the market can turn around at the last minute and wipe out years of accumulated gains.

- You can only profit if the SHOP stock price goes up.

2. Trade Shopify Stock CFD

This investment strategy provides light exposure to Shopify stock. Instead of buying and holding Shopify stock in your portfolio, you simply predict which way SHOP stock will move next.

With CFD trading, you buy contracts that pay you if Shopify stock goes up or down, depending on your prediction.

Let's say you buy 500 CFD contracts and predict that Shopify stock will go up over the course of an hour, a day, or a week. If the stock actually goes up by $6, you would make a profit of $3,000. The profit is calculated by multiplying the change in the stock price by the number of contracts purchased.

If you predicted the stock would go down and it actually went down by $3, your profit would be $1,500.

As you might expect, this investment strategy has its pros and cons.

Pros:

- You can profit whether Shopify stock goes up or down.

- You can profit over short time frames, such as an hour, day, or week, rather than waiting years for returns.

- You require minimal upfront capital as CFD contracts typically cost less than the underlying stock.

Cons

- You're not entitled to dividends. But this won't be a problem when you trade Shopify stock CFD as the company doesn't pay dividends anyway.

- You don't get voting rights. Again, this isn't something to worry about as Shopify rarely makes controversial proposals that you might want to veto.

Trade Shopify (SHOP) Stock CFD with VSTAR

If you've decided that Shopify is the best e-commerce stock to buy now and you're ready to start trading Shopify stock CFD, the next thing you'll want to do is choose the best CFD broker. Consider using VSTAR to trade Shopify CFD.

VSTAR is designed for both professional and beginner traders. It has a low initial capital requirement of just $50. Traders on a tight budget can take advantage of the generous leverage VSTAR offers to increase their position and maximize their profits.

With tight spreads and no commission on standard accounts, VSTAR offers a low-cost trading platform. In addition, the platform is fully licensed and regulated, so you can have peace of mind when trading CFDs with VSTAR.

Traders have given VSTAR an excellent rating on Trustpilot. Open your VSTAR account today and start trading Shopify stock CFD. For new traders, VSTAR offers a demo account complete with up to $100,000 in free virtual cash to practice trading.

Final Thoughts

Shopify (SHOP) is an excellent e-commerce stock to consider for either long-term investment or short-term trading. As a leader in the e-commerce platform business with a solid balance sheet and tremendous growth potential, Shopify appears well-positioned to thrive for many years to come.

You can buy and hold Shopify stock for long-term gains and trade Shopify stock CFDs for short-term profits.