I. Introduction

Shopify's stock, trading under the symbol SHOP, has recently witnessed a rollercoaster ride. In 2023, the company's stock performance was intriguingly influenced by various factors. Amid the ebb and flow of market dynamics, Shopify retained its position as a leading e-commerce solution provider.

In recent months, there has been a slight dip in the stock value, suggesting a momentary advantage for bearish sentiment. Shopify stock has surged by approximately 45% in 2023, indicating a bullish trend. While past performance does not always indicate future results, understanding the recent trends can provide insights into the stock's resilience and adaptability.

Volatility of SHOP Stock Price

SHOP stock has been volatile in 2023. It started the year on a strong note, with several record highs. However, it experienced minor corrections and dips during the first half, in line with broader market sentiments.

If we compare the data with the S&P 500, we would see a significant price fluctuation in SHOP stock, while the S&P 500 remained calm with a maximum peak of 27.57%.

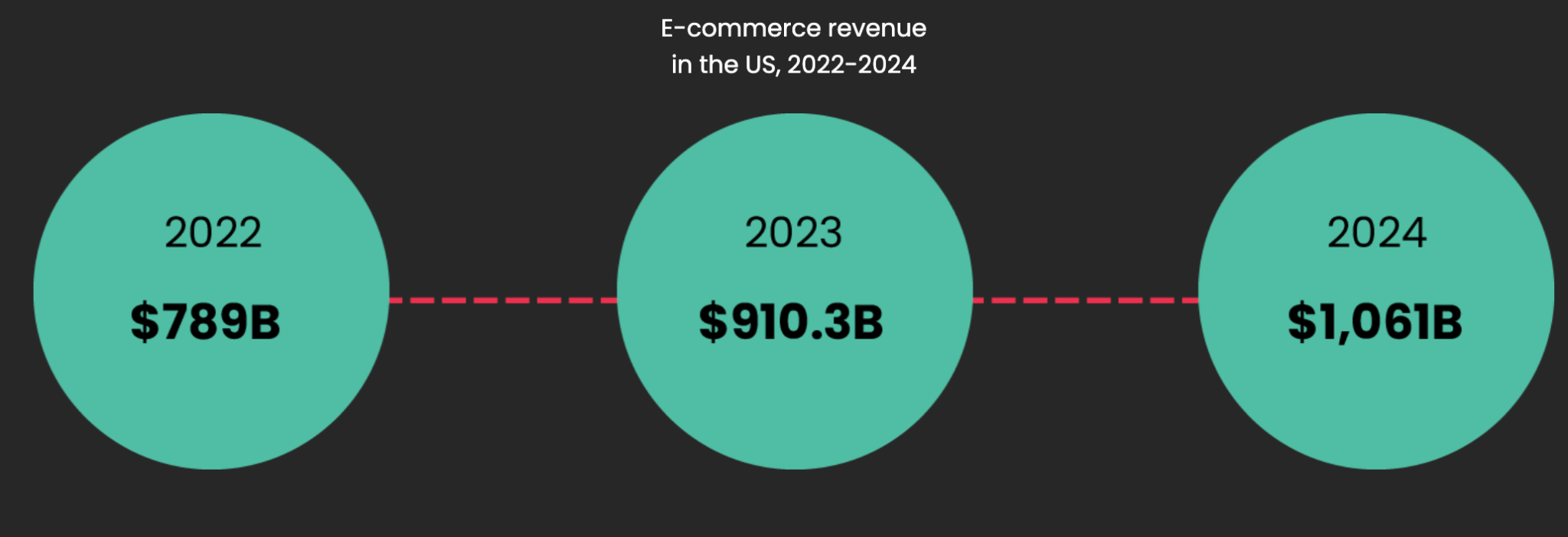

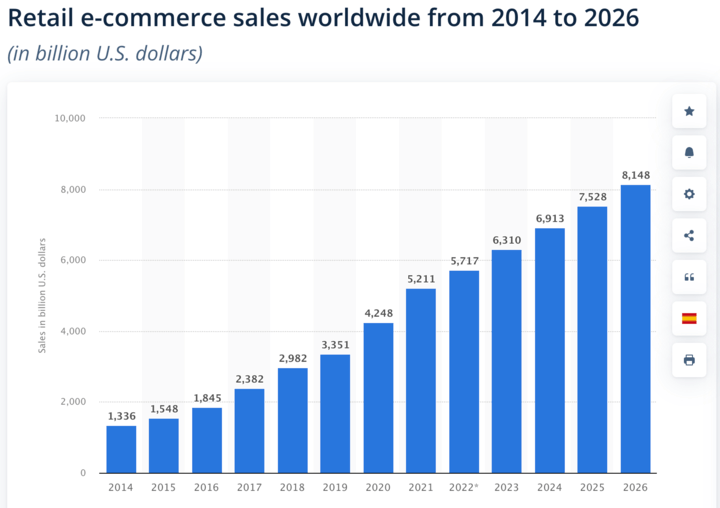

E-commerce Boom

One of the primary drivers of SHOP's performance in 2024 has been the ongoing surge in e-commerce. As more businesses embrace online selling, Shopify has been well-positioned to benefit from this trend. Investors have recognized the company's role as a crucial e-commerce enabler, supporting its stock price.

Image source: manaferra.com

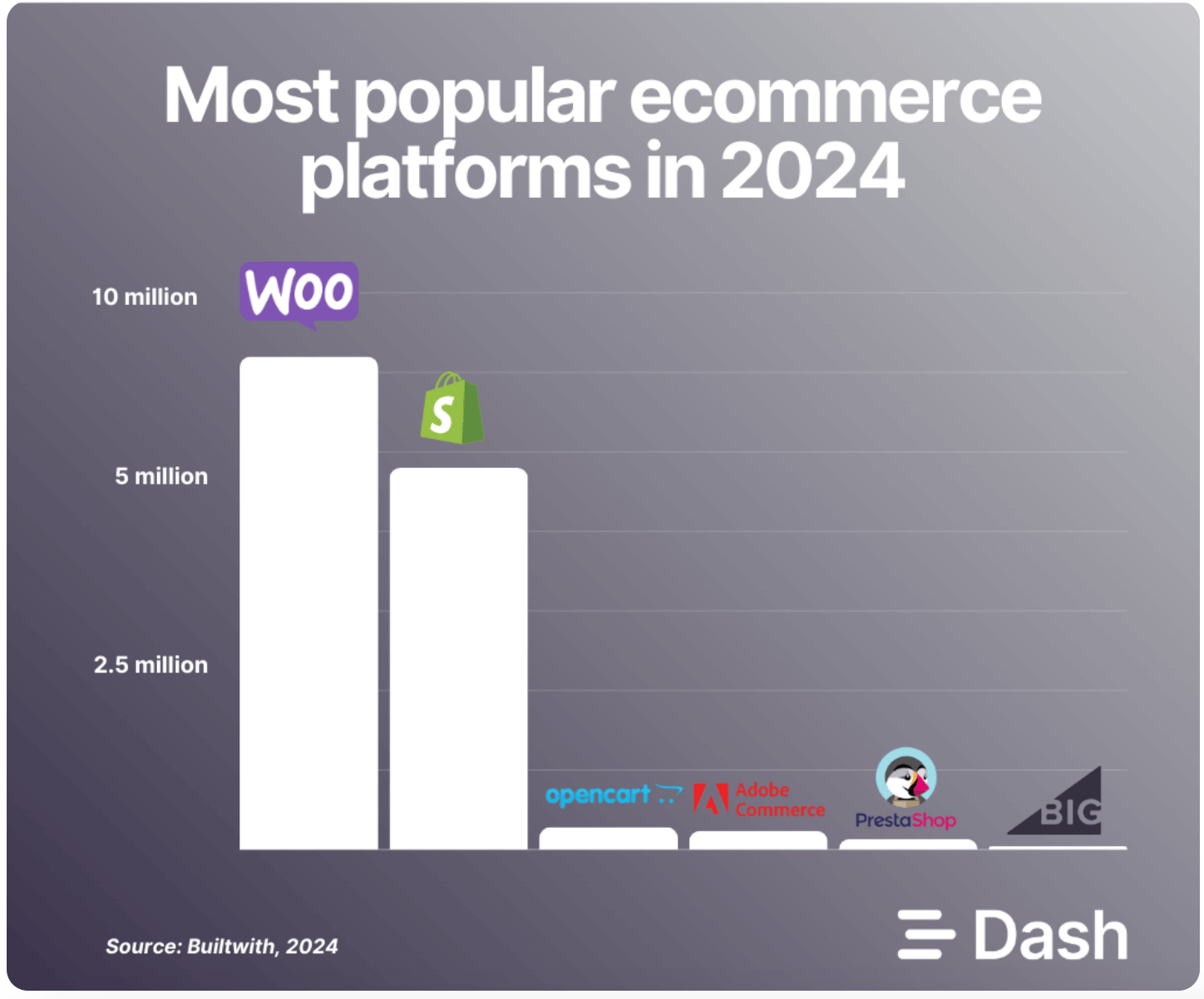

Competitive Dynamics

Shopify operates in a competitive landscape, and the moves of its competitors and other e-commerce giants can impact its stock price. The company's ability to innovate and maintain a leading position in the industry is essential for investors.

Image source: Builtwith, 2024

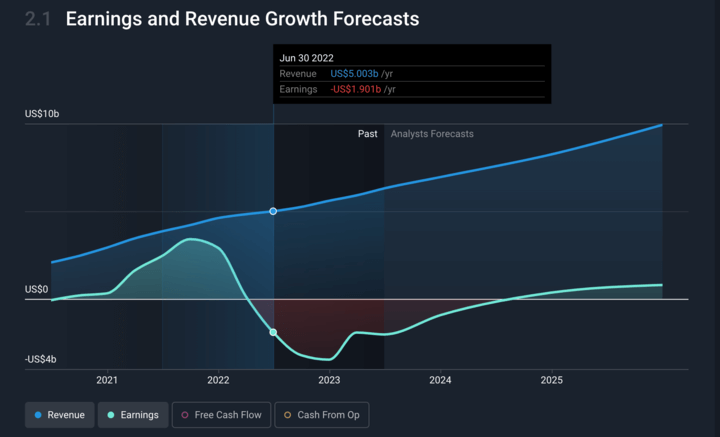

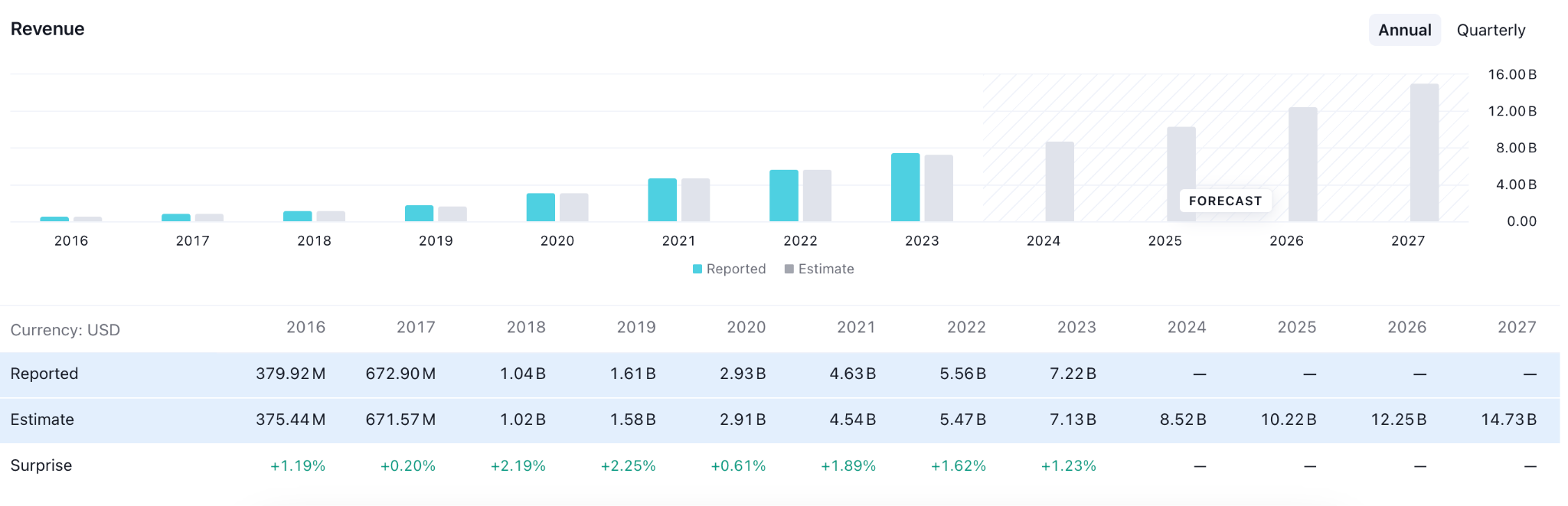

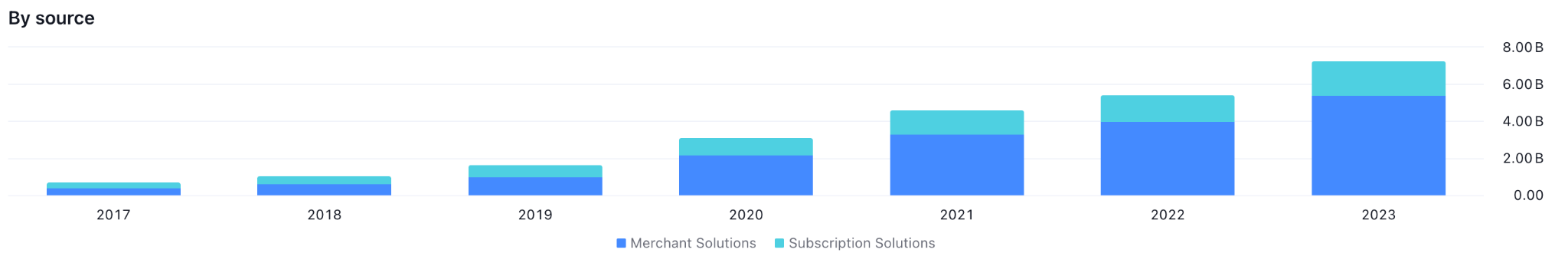

Revenue growth

The revenue growth shows three consecutive upbeat results, which could be a remarkable achievement for the Shopify stock. Moreover, the forecasted revenue for upcoming years are higher, supported by the possible surge in the ecommerce industry.

Source: TradingView

Expert predictions for Shopify stock (SHOP) offer valuable insights for both short-term and long-term investors. In 2024, experts believe that the stock could close the year at a $100.00 level before reaching $130.00 by the end of 2025.

Later on, the stock could rise to $131.26 in 2025, $219.08 in 2026, $365.47 in 2027, $609.69 in 2028, $1,017.10 in 2029 and $1,696.76 in 2030.

Looking ahead to 2025 and 2030, predictions are equally optimistic. Shopify's strategic growth initiatives, global expansion, and ever-evolving product offerings are expected to drive long-term success.

II. Shopify Stock Forecast 2024

A. SHOP Stock Forecast for 2024

At the beginning of 2024, Shopify stock price was valued at $76.31. Fast forward to today, and it's trading at $78.71, reflecting a 3.17% increase since the start of the year. The projected Shopify stock price for the end of 2024 is $100.00, signaling a year-over-year growth of 30.90%.

From the current trading price to year-end, that's a 10% climb. Looking at the first half of 2024, we anticipate Shopify's price to reach $72.41, with an additional gain in the second half, closing the year at $100.00. This represents a 26.72% increase from the current price.

The daily chart of SHOP stock suggests a bullish continuation as the current price hovers above the 20-day EMA line. Moreover, the 100-day Simple Moving Average is below the previous line, suggesting a bullish continuation signal.

Based on this structure, SHOP stock could continue to move higher and find a peak at the 161.8% Fibonacci Extension level from the previous swing.

Among Shopify stock forecasts for 2024, the forecast from coinpriceforecast is remarkable, which suggests that the stock could end the year by remaining at the $87.14 price level.

In another forecast, tradersunion suggests that the closing price for Shopify stock could reach the $110.6 level before the year-end of 2024.

Let's see the 2024 Shopify stock forecast from several technical indicators on the daily chart:

- Moving Average: The current 50 EMA hovers above the 100-day SMA, while both lines are below the current price. As long as these lines are below the current price, we may expect the upward momentum to continue.

- Relative Strength Index (RSI): The 14-day RSI tapped hovers above the 50.00 level for a considerable time. It signals that the bullish pressure is still valid, where the ultimate target for the RSI line is 70.00.

- Average Directional Index (ADX): The ADX rebounded from the 20.00 satisfactory level in October, which suggests an active bearish trend toward the sellers' side.

B. Other 2024 Shopify Stock Forecast Insights from Big Institutions

According to Tiprank, Shopify Stock could reach an 82.84 level by the end of 2024. As the year started from the $66.90 level, the particular close could represent a 20% yearly gain.

According to Longforecast, the optimistic buying pressure could remain for the Shopify stock, reaching the 101.63 level by the end of 2024.

C. Analyst Price Targets and Ratings

According to coincodex, Shopify stock could close in 2024 at a $217.26 level, which is a strongly optimistic view.

Analysts from JPMorgan have upgraded SHOP stock from "market perform" to "outperform" status, a bullish posture in contrast to the consensus "hold" rating based on 35 analyst opinions.

According to 30rates, the particular stock could end the year by closing at the $101.63 level, which will eliminate most of its yearly gains.

D. Key Factors to Watch for SHOP Stock Forecast 2024

As we explore Shopify's stock forecast for 2023, it's essential to consider the key factors that can influence its performance. These factors provide insights into the bullish and bearish aspects of Shopify's future prospects.

Financial growth

Firstly, its robust financials continue to impress investors. With a projected annual revenue of $8.52 billion for 2024, an increase of 15.3%, Shopify's financial health remains strong.

Source: Simplywall.st

Impressive development

Moreover, Shopify's recent developments have further fueled optimism. The company's acquisition of innovative startups like "Shop" has diversified its service offerings, enhancing its value proposition to businesses and consumers. These strategic moves reinforce Shopify's role as a key player in the evolving e-commerce landscape.

In the below image, the surge in the research and development cost for the stock suggests a pending outcome in the coming year.

Image source: macrotrend

Ecommerce growth

Additionally, the e-commerce sector's overall growth provides a favorable backdrop for Shopify. As online shopping becomes increasingly entrenched in consumer behavior, Shopify is well-positioned to capitalize on this trend, making it a preferred choice for investors seeking exposure to the e-commerce boom.

Source: statista

Regulatory pressure

Regulatory changes pose a risk to the e-commerce industry and, by extension, to Shopify. Alterations in data privacy regulations, tax policies, or trade regulations can affect the company's operations and profitability.

Competitions

Competitive pressures in the e-commerce sector represent another bearish factor. The presence of tech giants and other e-commerce platform providers intensifies competition, and Shopify must continuously innovate and adapt to maintain its market share.

Bullish factors

This bullish projection is driven by the company's consistent revenue growth and expansion into new markets, strengthening its position as a leading e-commerce solution provider.

Bearish Factors

Despite the predominantly bullish outlook, potential bearish factors warrant consideration. Market volatility remains an ever-present concern, and external factors, such as global economic shifts or geopolitical events, can temporarily impact Shopify's stock performance.

III. Shopify Stock Forecast 2025

A. SHOP Stock Forecast for 2025

Over the next five years, Shopify is set for substantial growth. Starting 2025 at $120.00, the stock is expected to reach $100.00 within the year's first half and end 2025 at $145.00.

In the weekly chart of SHOP stock, a clear bullish pressure is seen where the latest price trades above the 71.57 event level. Moreover, the ongoing buying pressure is still below the 50% Fibonacci Retracement level from the 2021-2022 swing, suggesting more room to move higher.

Therefore, a stable price above the 71.57 to 60.00 zone could be a potential buy zone in this stock, targeting the 145.50 resistance level.

On the other hand, a consolidation and a stable bearish market below the 60.00 line could indicate a selling pressure, which could lower the price towards the 30.00 level.

According to coinpriceforecast, 2025 would be a positive year for Shopify stock as the price could reach the $123.80 level before the yearly close and reach the $113.01 level at the mid of that year.

Coincodex suggests that the stock could reach the 131.00 level in 2025.

Traderunion has also forecasted a positive year for Shopify stock as the price could reach the $137.84 level before the year-end of 2025.

Let's see the 2025 Shopify stock forecast from several technical indicators on the on the weekly chart of SHOP stock:

- Moving Average: The recent price trades are stable above the 50-day Simple Moving Average level, suggesting ongoing buying pressure in the market.

- Relative Strength Index (RSI): The weekly RSI hovers above the 50.00 level in 2024, suggesting. In that case, an upward pressure is potent in the RSI line as long as it hovers above the neutral line.

- Average Directional Index (ADX): The ADX reached the 20.00 line in Q4 of 2023 but failed to show a strong rebound. However, the trend trading signal is potent as long as the ADX line hovers above the 20.00 satisfactory line.

B. Other 2025 Shopify Stock Forecast Insights from Big Institutions

As projected by various big institutions, SHOP stock forecast 2025 is a valuable insight for investors. These institutions conduct in-depth analyses, considering various factors that influence stock prices.

A recent report from Pandaforecast suggests that the Shopify stock could close at the 103.95 level during the year-end of 2025. However, the stock could rise up to the 95.66 level within the year.

Another report from SeekingAlpha suggests that the stock could reach the $1,550 level, representing 24x 2025 gross profits.

C. Analyst Price Targets and Ratings

Analyst price targets and ratings can provide valuable insights into what experts in the financial industry anticipate for a particular stock, such as Shopify, in the year 2025. Here's an overview of analyst price targets and ratings for Shopify stock forecast 2025:

Goldman Sachs maintains a "Buy" rating on Shopify stock and has set a 2025 Shopify price target of $950. They are optimistic about the company's potential for substantial growth in the e-commerce sector over the next few years.

Morgan Stanley also rates Shopify stock as "Overweight" and sets a 2025 price target of $1,000. They see Shopify as a leader in the e-commerce industry and expect strong financial performance.

With a "Buy" rating, Bank of America Merrill Lynch sets a 2025 price target of $1,050 for Shopify stock. They view the company's expanding ecosystem and acquisitions as key growth catalysts.

UBS also maintains a "Buy" rating for Shopify stock and sets a 2025 price target of $980. They anticipate robust international growth and the company's ability to cater to diverse markets.

Average Analyst Price Target: When averaging the price targets from these institutions, the 2025 price target for Shopify is approximately $960. This suggests an overall bullish sentiment among analysts, with the stock expected to experience significant growth in the coming years.

Analyst Ratings

- The majority of analysts recommend buying or holding Shopify stock, with "Buy," "Overweight," and "Outperform" ratings being common.

- Analysts often cite factors like Shopify's dominant position in the e-commerce industry, its continuous innovation, and its ability to serve a wide range of businesses as reasons for their positive ratings.

- It's important to note that while these ratings and price targets provide valuable guidance, they are based on the analysts' assessments of the company's current performance and future potential. As with any investment decision, it's crucial to conduct your research, consider your investment goals, and evaluate market conditions before making investment choices.

These analyst ratings and price targets offer insight into the positive outlook for Shopify stock in 2025. However, it's essential to monitor market dynamics and company performance changes to make informed investment decisions.

D. Key Factors to Watch for SHOP Stock Forecast 2025

In this section, we will see key fundamental factors that an investor should know before buying Shopify stock for the next 2-3 years.

Shopify Earnings Could Soar in 2025

Shopify's revenue could increase to roughly $10.22 billion by 2025. This would represent a remarkable annual growth rate of nearly 31%, although it should be noted that the annual growth rate over the past three years averaged around 60%.

Let's see the Earnings per share forecast for Shopify stock (SHOP):

Source: TradingView

The company's core Software-as-a-Service (SaaS) subscriptions grew from 2020 to 2023 with sales of merchant services such as payment processing, shipping, and financing. In addition, Shopify is establishing a comprehensive distribution network in the United States merchants' products to customers, which could work as a strong bullish factor.

Shopify is positioning itself as a merchant-centric alternative to Amazon, which is presently the subject of increased antitrust scrutiny.

Shopify's Omnichannel Capability

Shopify is a market-leading e-commerce platform, and it is investing significantly in its omnichannel capabilities. This comprises POS systems, fulfillment solutions, and in-store experiences. Shopify aims to simplify merchants' selling across all channels, including online, offline, and social media.

Shopify's mission is to make commerce more accessible to all. This includes reducing the cost of establishing and operating a business and providing merchants with the tools and resources they need to succeed. Shopify's expansion into new markets and consumer segments is also a priority.

Shopify invests continuously in its platform and infrastructure to make it more dependable, scalable, and secure. Shopify invests in new technologies, including artificial intelligence and machine learning, to assist merchants in enhancing their businesses.

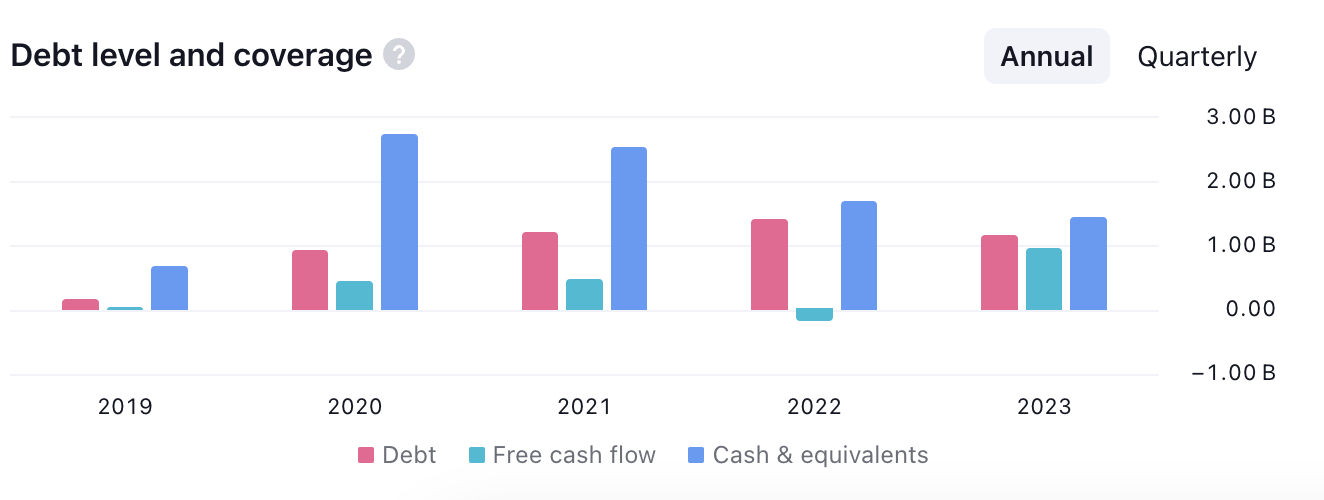

Shopify gearing

Gearing measures the relation between equity and debt finance, where higher debt finance might incur a risk of default. As per our research, Shopify has more room to generate investment from debt finance as the current level is still lower.

Source: Tradingview

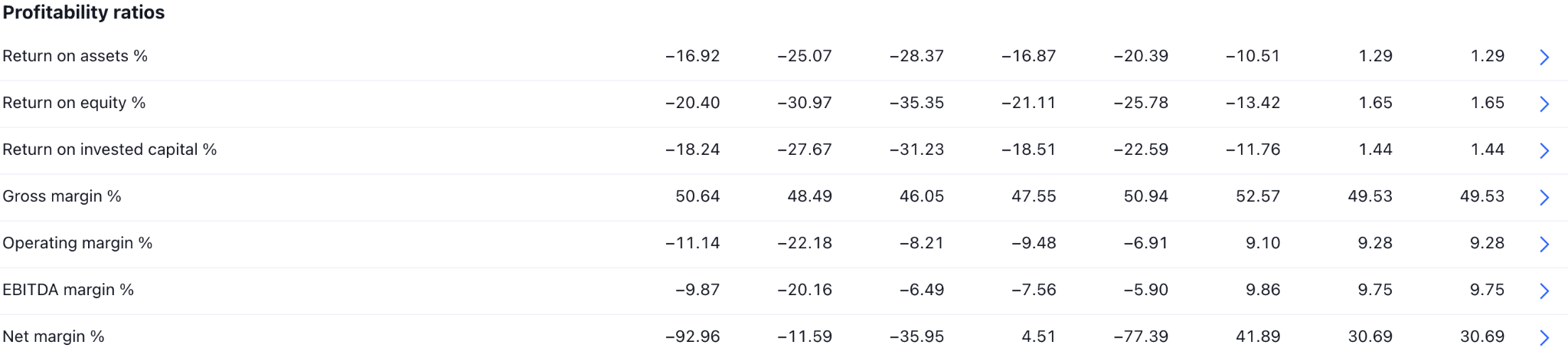

Profitability ratio

The company's profitability ratio shows a positive result on GP margin only, which is due to the business expansion with additional costs on research and development. However, the negative result does not mean the company is doing poorly. This is because the ecommerce industry is an emerging sector where an increase in profitability could come with the benefit of current R&D.

Source: Tradingview

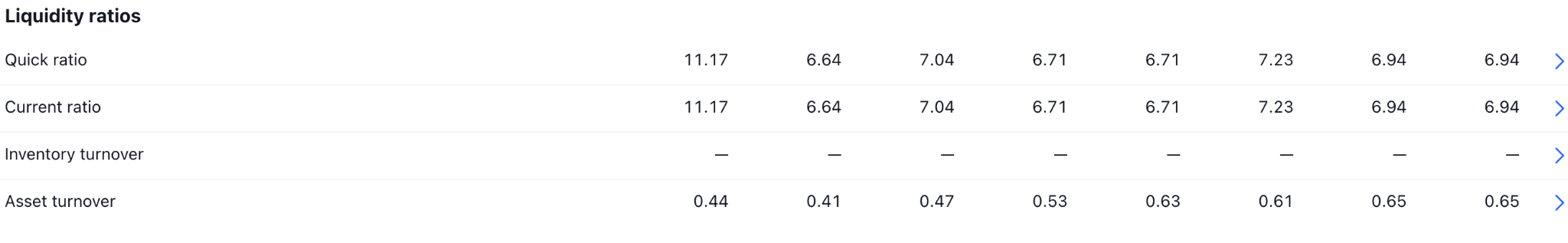

Liquidity ratio

The quick ratio of the latest quarter shows a stronger picture, as it remains above the positive territory every time. It is a sign that the company has had enough liquidity in recent quarters to perform the day-to-day business operations with less possibility of fund shortages.

Source: Tradingview

Shopify stock price prediction 2025 - Bullish Factors

Shopify's potential growth may be influenced by robust revenue and earnings growth, expanding market share, or innovative product offerings. For instance, if the company continues to report substantial revenue increases and introduces new features or services that attract more businesses, this could drive the stock higher.

SHOP stock forecast 2025 - Bearish Factors

Conversely, Shopify stock could face challenges due to increased competition, economic downturns, or negative shifts in consumer behavior. A bearish scenario might involve slowing revenue growth, shrinking margins, or regulatory changes that impact the e-commerce industry.

Understanding these bullish and bearish elements is essential for investors, enabling them to make informed decisions in their Shopify stock investment journey. Monitor these factors as they evolve to adjust your investment strategy accordingly.

IV. Shopify Stock Forecast 2030 and Beyond

A. Shopify Stock Price Prediction 2030

Looking further ahead, between 2030 and 2034, the stock price is estimated to rise from $400.00 to $1000.00 area, marking a significant increase. Beginning 2030 at $335.83, it is expected to reach $373.06 in the first half of the year and close the year at $419.58, an impressive growth from its current value.

In the Shopify stock forecast for 2030, strong selling pressure might come as the near-term support areas are untouched. However, the ongoing buying pressure is visible as the recent price exceeds the dynamic 20-month EMA.

Therefore, any bearish pressure and an immediate bullish momentum from the 20-month EMA, or the static 45.42 level, could be a long-term bullish signal for Shopify stock.

On the other hand, significant selling pressure, with a stable market below the 45.00 psychological line, could lower the price toward the 30.00 line

According to coincodex, Shopify stock could reach beyond the $1,692.67 level in 2030, while Traders Unios suggests the $419.58 level before the year-end of 2030.

Let's see the 2030 Shopify stock forecast from several technical indicators on the SHOP monthly chart:

- Moving Average: The Pump and dump is over, which is a signal of a pending consolidation in the coming year. Based on this MA position, investors should wait for a range breakout before finding a stable trend.

- Relative Strength Index (RSI): The monthly RSI shows a downside pressure and rebounded above the 50.00 line. However, the current reading remains sideways, which needs more clues before forming a bullish signal.

- Average Directional Index (ADX): The monthly ADX moved below the 20.00 level for the first time in 2023. However, the recent reading suggests a valid rebound above this line, suggesting a trend trading opportunity.

B. Other 2030 Shopify Stock Forecast Insights from Big Institutions

There are several forecasts for Shopify stock for 2030, which could be a great source to anticipate the future stock price.

According to sharepricetarget, SHOP could reach up to $204 a share, which could be the upper limit. Another forecast from the source said the price could test the $178.00 level before the end of 2030.

As per the forecast from Coincodex, the price could reach the $ 1,372.57 level in 2030, representing a 1300% growth from the current price.

C. Analyst Price Targets and Ratings

According to a Simply Wall Street prediction, Shopify's stock price will reach $2,970 per share by 2030.

Another report from Motley Fool Canada suggests that Shopify stock could maintain an expandable growth in the coming year. Therefore, the stock could provide a 400% gain from the current price by 2030. As a result, an investment in Shopify stock of $20,000 could reach up to $100,000 by the end of 2030.

D. Key Factors to Watch for SHOP Stock Forecast 2030

Analysts are generally bullish on Shopify stock, with many predicting that the company will continue to grow rapidly in the coming years. Some analysts have even set price targets of over $2,000 per share for Shopify stock by 2030.

However, it is important to note that stock market forecasting is a notoriously difficult task. Many factors can affect the price of a stock, including economic conditions, competition, and investor sentiment. As a result, it is impossible to say with certainty what Shopify stock price will be in 2030.

Here are some of the specific factors that could contribute to Shopify's growth in the coming years:

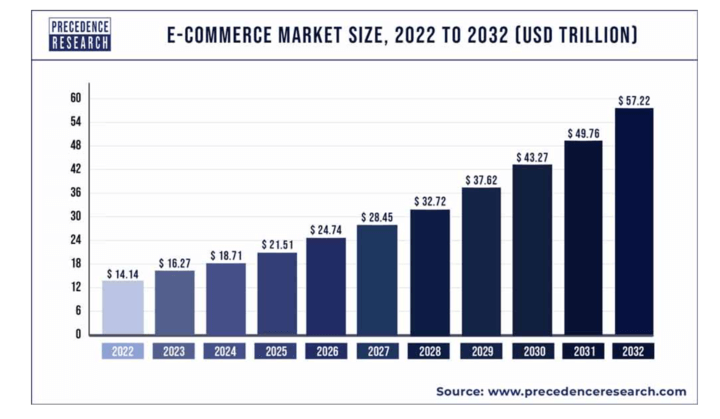

The continued growth of e-commerce

E-commerce is growing rapidly worldwide, and Shopify is well-positioned to capitalize on this trend. According to a forecast, the E-commerce Market could reach $21,168.6 billion by 2030, at a CAGR of 16.9% from 2023 to 2030. As Shopify is a market leader in this industry, the continued growth could be a strong bullish factor for SHOP.

Source: precedenceresearch

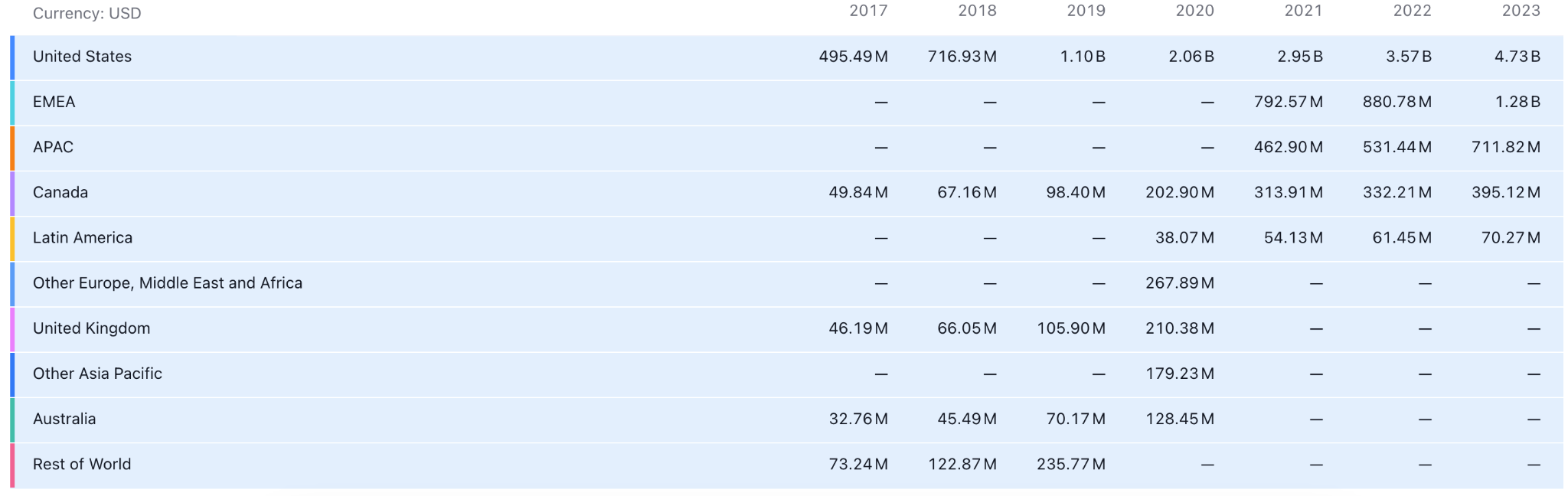

Shopify's expanding international presence

Shopify is expanding its international presence, giving it access to new markets and customers. The company has taken several steps to expand its portfolio, where remarkable actions are- building global partnerships and finding potential business partners.

Source: TradingView

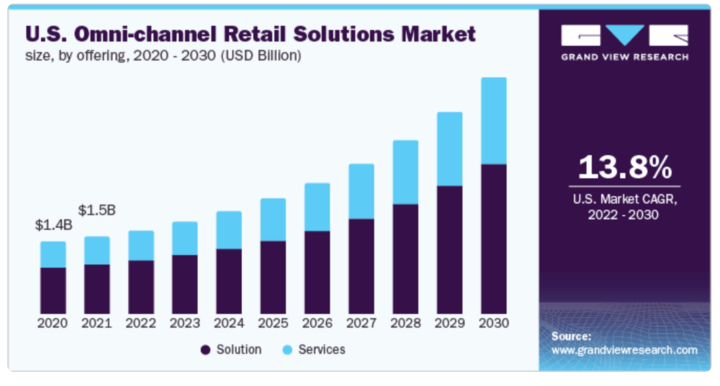

Shopify's increasing focus on omnichannel commerce

Shopify invests in omnichannel commerce solutions, which will help its merchants sell their products and services through multiple channels. The global market for Retail Omni-Channel Commerce Platforms could reach $27.7 Billion by 2030, which could be a strong bullish factor for SHOP.

Source: grandviewresearch

Shopify's growing ecosystem of apps and services

Shopify has a large and growing ecosystem of apps and services that merchants can use to enhance their stores and businesses.

Source: Tradingview

Shopify stock forecast 2030 - Bullish Factors

The Omnichannel e-commerce solution would be a great bullish factor for Shopify stock as the company's presence in this field will be at the top. Therefore, a surge in the industry could affect the stock price with a positive sentiment, leading to a new all-time high formation.

Shopify stock forecast 2030 - Bearish Factors

In the technological revolution, innovation is the key element as new technology could reduce the time and effort of a company. Moreover, there are rivals like Amazon.com and Alibaba to provide a huge investment in research and development in the e-commerce industry, which could be a threat to Shopify.

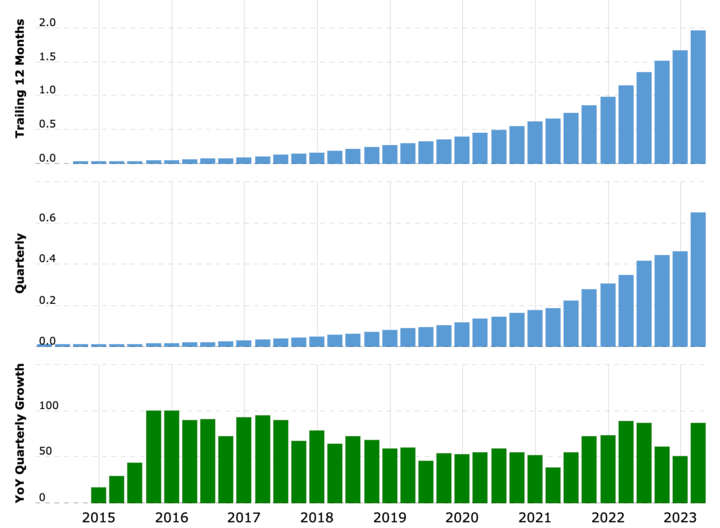

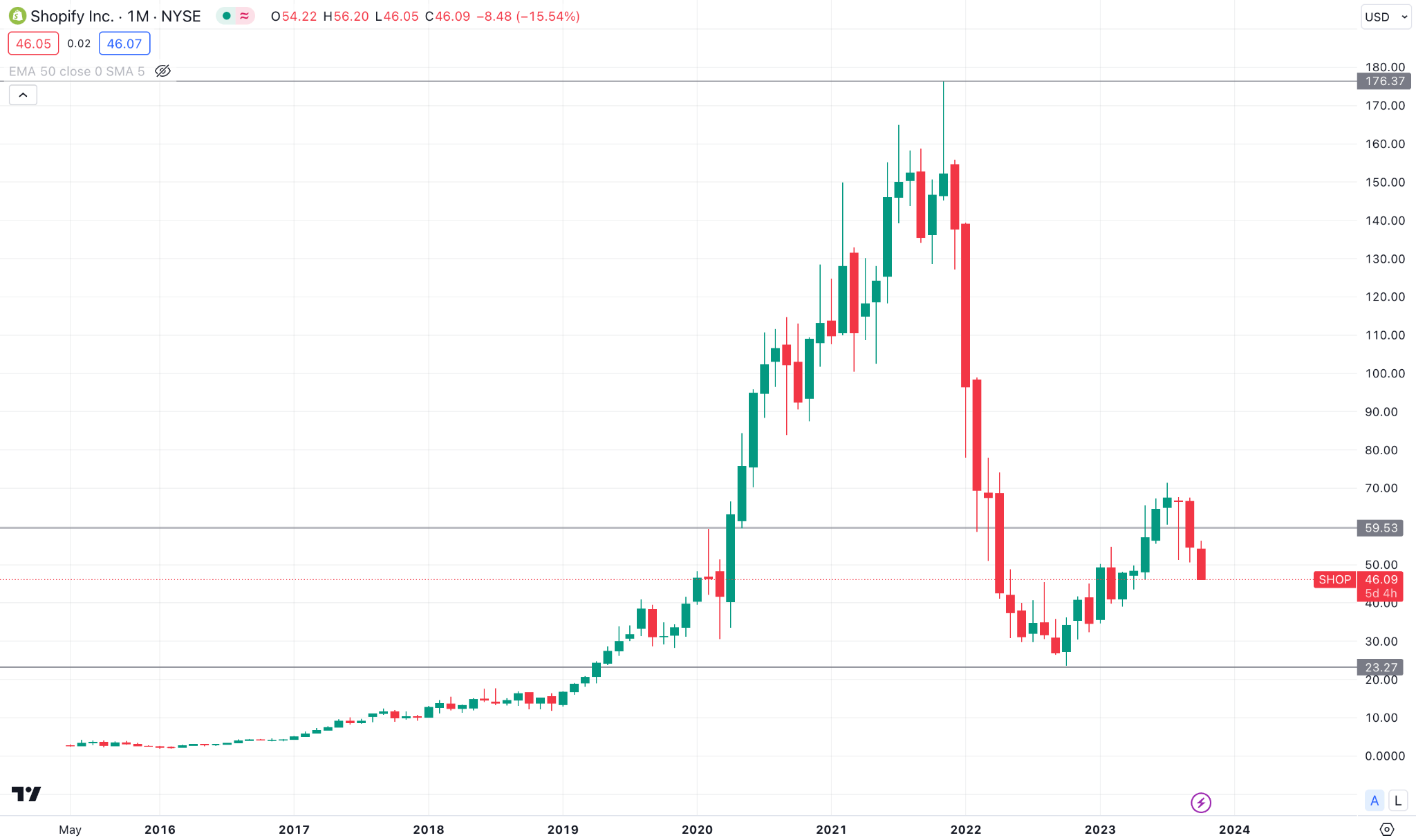

V. Shopify Stock Price History Performance

Over the past decade, Shopify's stock price has been on a meteoric rise. Its initial public offering (IPO) in 2015 marked the beginning of its impressive journey. Since then, the stock has shown a consistent upward trajectory, reflecting the company's ability to capitalize on the booming e-commerce market.

2006 - Founding and IPO: Shopify was founded in 2006, and its initial public offering (IPO) was on May 21, 2015, with a price of $17 per share. Later on, the stock started trading on the New York Stock Exchange under the ticker symbol "SHOP".

2015 - Business Expansion: After the IPO, Shopify stock (SHOP) began to rise with an expansion in the e-commerce platform. It made it easier for businesses to set up online stores. As a result, the stock price reached around $30 by the end of the year.

2016 - Growth Expansion: Shopify continued to experience strong growth as it attracted more merchants to its platform. The stock price doubled and reached approximately $60 by the end of 2016.

2017 - Explosive Growth: Due to the robust user acquisition and increased revenues, Shopify stock price surged during 2017, reaching around $100 per share by mid-year.

2018 - Challenges and Recovery: In 2018, Shopify faced challenges when Citron Research released a critical report on the company, causing a temporary dip in the stock price. However, the stock quickly rebounded as the company continued to grow and innovate.

2019 - International Business Expansion: Shopify expanded its international presence by implementing new features, leading to steady stock price growth. As a result, the stock managed to trade at around $315 per share before the year-end.

2020 - E-commerce Surge & Pandemic: The COVID-19 pandemic led to a surge in the e-commerce industry, benefitting Shopify as more businesses went online. As a result, the stock price doubled in 2020, reaching approximately $1,100 per share.

2021 - Shopify Plus: Shopify introduced new services like Shopify Plus and expanded its fulfillment network, contributing to further stock price growth. As a result, the stock reached the $1500 peak during the year.

2022 - A Correction: Shopify sells its Shopify Logistics business to Flexport for $2.2 billion. The deal allows Shopify to focus on its core commerce platform and services. Also, Shopify's CFO disclosed the long-term business plan at the Goldman Sachs Communacopia & Technology Conference.

2023 - A Surge: Shopify E-commerce Summit aimed to help DTC businesses with the latest trends, practical tips, and solutions for growth. Moreover, the Shopify Unite is a virtual event focused on bringing the developer community together with the Shopify team for deep dives on the latest platform releases, offering opportunities for interaction. In the price chart, investors have experienced a significant price surge, from 34.19 to 78.41 level, with a 129.34% gain.

In the current monthly chart, the 100.00 psychological resistance level could work as a key trend identifier. A crucial bullish momentum above this line could be a potential long opportunity, which might create a new all-time high in the coming years.

VI. Conclusion

For investors, Shopify presents a compelling opportunity. With a track record of consistent revenue growth, strategic acquisitions, and an established presence in the e-commerce industry, it remains a robust choice for long-term investment. Shopify stock forecast for 2024, 2025, and 2030 offers an exciting outlook for investors. Its position as a key player in the e-commerce industry, along with positive price projections, makes it a compelling choice for those seeking to capitalize on the digital commerce revolution. Please note that various factors can influence stock prices, and these predictions are based on available data and trends at the time.

To engage with Shopify stock and harness its potential, consider trading Shopify Stock Contracts for Difference (CFD) with VSTAR. CFDs allow you to speculate on the price movements of Shopify stock without owning the underlying asset. This flexible and leveraged trading option can amplify your potential returns. Ensure you conduct thorough research and risk management when trading CFDs.

FAQs

1. Is Shopify a good stock to buy?

Shopify is generally considered a good long-term investment, though the stock price has been volatile recently. It has growth potential as e-commerce expands.

2. Is Shopify stock expected to rise?

Most analysts expect Shopify stock to rise from its current price over the next 12 months. The average 12-month price target is around $75.

3. Is Shopify a Buy, Sell or Hold?

Most analysts rate SHOP stock as a "buy" or "hold". At current levels, it could be a good buy for long-term investors.

4. What is the prediction for SHOP stock?

The consensus among analysts is that Shopify stock will gradually recover over the next 12-18 months, after falling significantly from its pandemic highs. Many expect the stock to trade in the $70-80 range by the end of 2023.

5. What will Shopify stock be worth in 2025?

By 2025, many analysts estimate Shopify stock will reach $100-150 per share, based on continued revenue and earnings growth.

6. What is the 5-year forecast for Shopify stock?

Over the next 5 years, Shopify is expected to grow revenue by more than 20% annually. If growth remains strong, the stock could potentially double from current levels by 2028.