Before the UK CPI release, GBPUSD lost its bullish momentum on Tuesday following the US Retail sales. As the broader market sentiment is bearish in the higher timeframe, investors should see how the CPI release comes before projecting the GBPUSD price.

The UK CPI is Ahead

At present, market participants are pricing in a 25% chance that the Bank of England will raise interest rates at its upcoming meeting on November 2, after the conclusion of the FOMC meeting.

Key economic indicators will have a major impact on expectations for the coming days. The Consumer Price Index (CPI) report for September which is scheduled for release on Wednesday. The annual CPI rate would decline from 6.7% to 6.5%, an absolute rate of least acceleration since February 2022, if there were a monthly increase of 0.3%.

Such an increase would indicate that the annualized growth rate of the UK Consumer Price Index (CPI) in Q3 was below 1%, as opposed to the 8% annualized growth rate observed in Q2. It is worth noting that the core inflation rate in the United Kingdom has slowed below the headline rate, reaching 6.2% in August. The lowest rate for the year was 5.8% in January.

US Dollar Index (USDX) Lost Momentum After The US Data

The US Dollar Index (DXY) moved below the 20-day Simple Moving Average (SMA) after September’s Retail Sales and Industrial Production figures from the US.

Nonetheless, the US Dollar failed to show a significant upward pressure even though the Retail Sales reports surpassed expectations. However, the USD's decline could be constrained by the elevated yields on US Treasuries and the Federal Reserve's growing propensity to adopt a more aggressive posture.

Despite the proactive measures the Federal Reserve took, economic activity in the United States remains resilient. Furthermore, the inflation data for September suggests a moderate acceleration in the Consumer Price Index (CPI).

In the press conference that followed the September decision, Jerome Powell emphasized that the Federal Reserve remains ready to resume interest rate increases if the data support such a course of action. Consequently, investors are making arrangements in anticipation of a possible ultimate increase in interest rates in 2023.

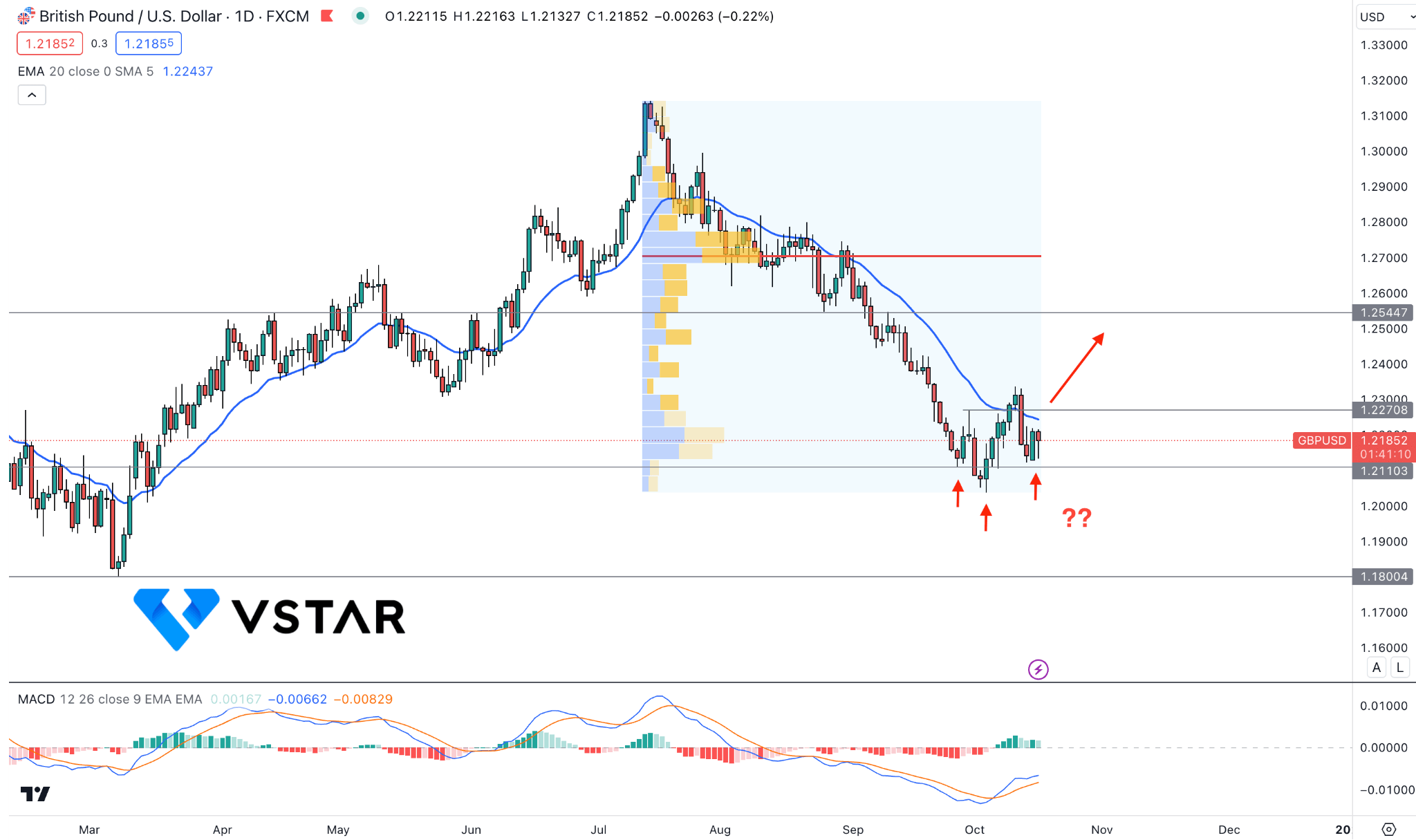

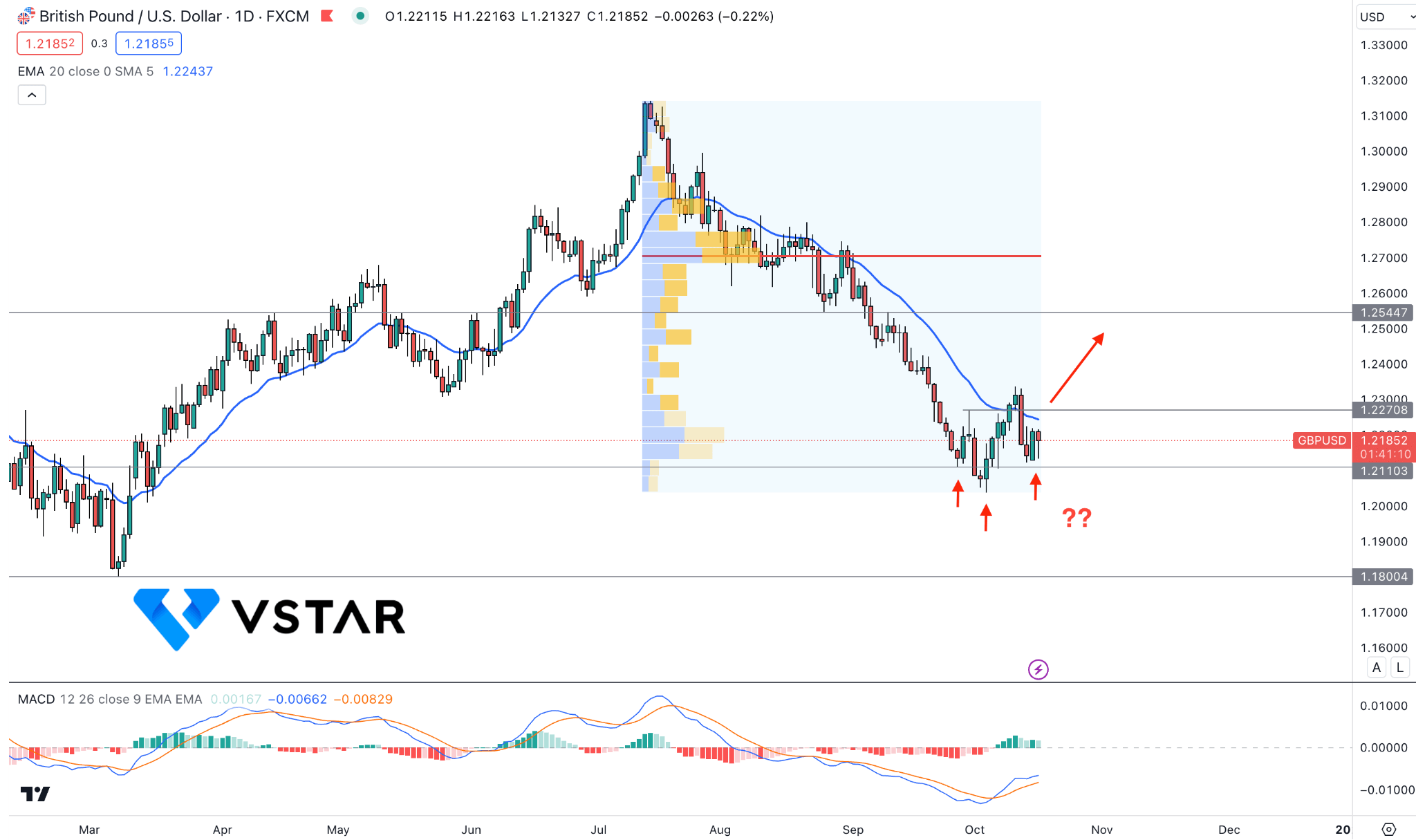

GBPUSD Technical Analysis

In the daily GBPUSD chart, a potential inverse Head and Shoulders pattern formation is seen where a bullish daily candle above the 1.2339 high could validate the bullish reversal.

On the other hand, the broader market direction is still bearish, where a weaker UK report could resume existing trends at any time. The dynamic 20-day EMA is working as a resistance, while the MACD Histogram starts losing momentum from the positive side.

Based on this outlook, a bearish trend continuation opportunity needs a daily candle below the 1.2110 level, which could extend the loss toward the 1.1800 psychological level.