I. Recent Super Micro Computer Stock Performance

Recent SMCI stock price performance and changes

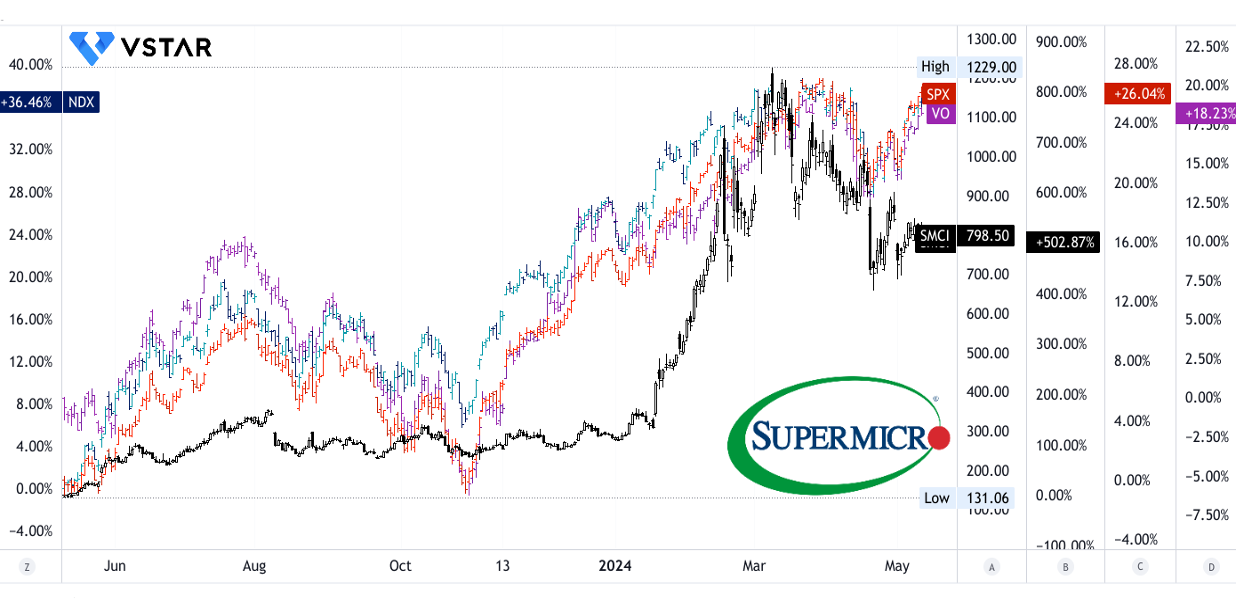

Super Micro stock (NASDAQ: SMCI) has experienced significant volatility in its stock performance, evident from its 52-week range of $131.06 to $1,229. Against the S&P 500 (SPX) and Nasdaq-100 (NDX), SMCI exhibits both remarkable short-term gains and substantial long-term outperformance. In the past year, its price return soared by +500%, surpassing the SPX's +26% and NDX's +36%. This trend extends over a three-year and five-year horizon, with SMCI recording a staggering 3-year price return of nearly 2,200% compared to the S&P 500's nearly 25%.

Similarly, when compared to the Vanguard Mid-Cap Index Fund ETF, SMCI's performance stands out. SMCI consistently outperforms over the short term. For instance, its 1-year price return of SMCI drastically surpasses the Vanguard Mid-Cap ETF's 1-year return of 18%.

Main influencing factors

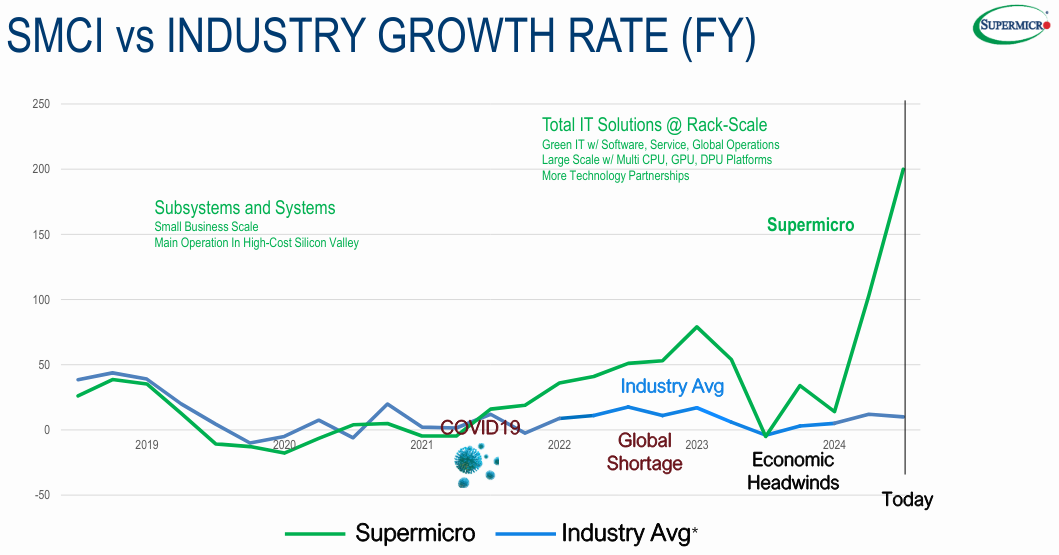

Super Micro Computer Inc. has witnessed remarkable stock performance recently, largely propelled by its third-quarter fiscal year 2024 results. Several key factors have influenced this surge.

Firstly, Supermicro's financial results for Q3 FY2024 showcased impressive growth. Net sales surged to $3.85 billion, marking a 200% increase year-over-year, while non-GAAP diluted net income per common share soared to $6.65, reflecting a staggering 308% rise compared to the same period last year. This substantial growth was primarily driven by the burgeoning demand for AI rack-scale plug-and-play solutions, indicating Supermicro's strong positioning in the AI infrastructure market.

Furthermore, Supermicro's strategic initiatives and investments have played a pivotal role in driving its growth trajectory. The company's focus on developing innovative Direct Liquid Cooling (DLC) solutions to address the escalating demand for efficient cooling in AI systems has positioned it as a leader in the industry. The successful development and production readiness of DLC liquid cooling technology has bolstered Supermicro's competitive edge, enabling it to cater to the evolving needs of high-end customers, including CSPs and NCPs.

Source: Q3 2024 Presentation

Moreover, Supermicro's proactive approach to addressing supply chain challenges through significant investments in production, operation, and management software underscores its commitment to sustaining rapid growth. The successful completion of a convertible note and secondary equity offering, raising an additional $3.28 billion, highlights investor confidence in the company's future prospects and growth trajectory.

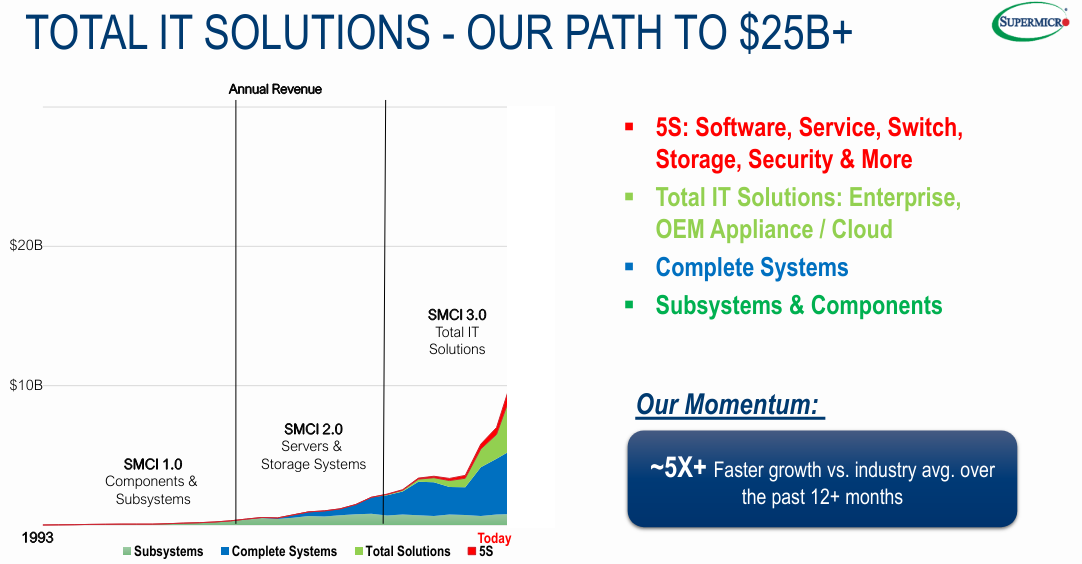

Additionally, Supermicro's diversified revenue streams across different verticals, including enterprise/channel, OEM appliance, large data center, and emerging 5G/Telco/Edge/IoT markets, have contributed to its robust financial performance. The company's ability to adapt and innovate in response to evolving market dynamics has strengthened its market position and fueled its growth momentum.

Expert Insights on SMCI Stock Forecast for 2024, 2025, 2030 and Beyond

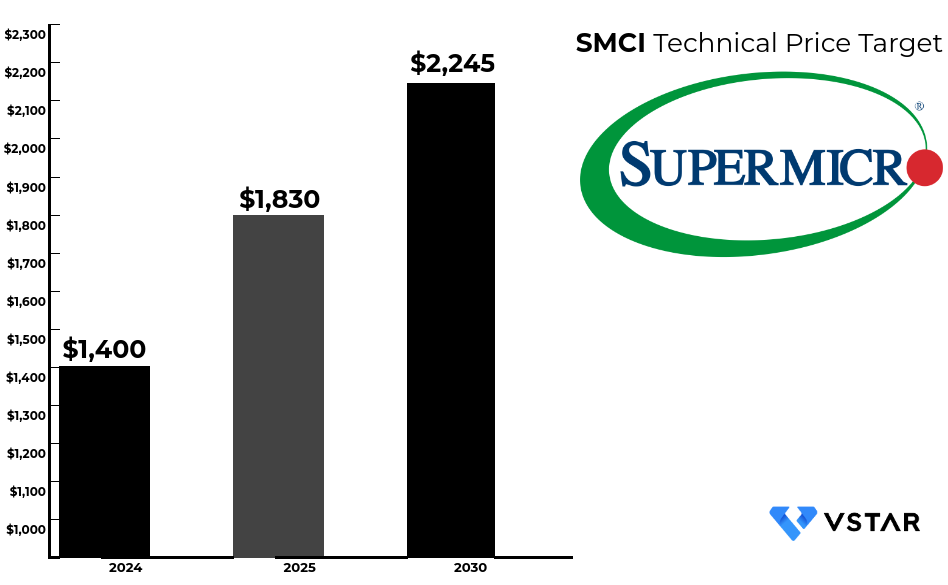

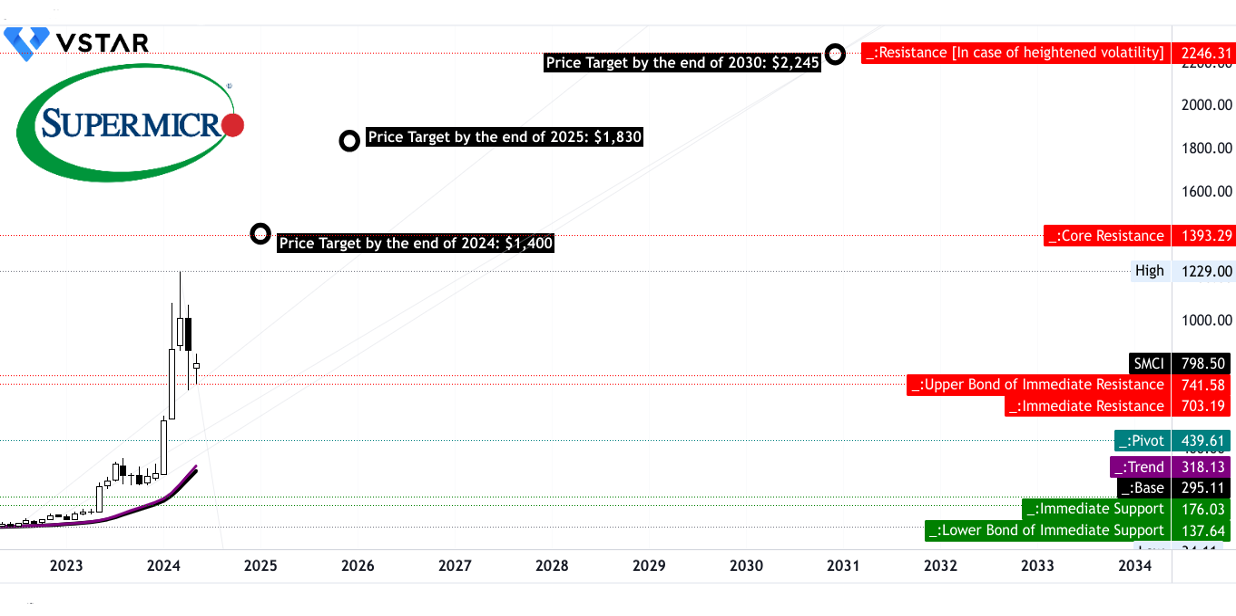

Super Micro Computer is a technology company with recent stock performance showing promise. Forecasted targets for SMCI stock suggest bullish growth, with targets of $1400 for 2024, $1830 for 2025, and $2245 for 2030. These projections imply a steady trajectory, reflecting positive sentiment and potential for sustained profitability, likely influenced by technical factors.

Source: tradingview.com

II. SMCI Stock Forecast 2024

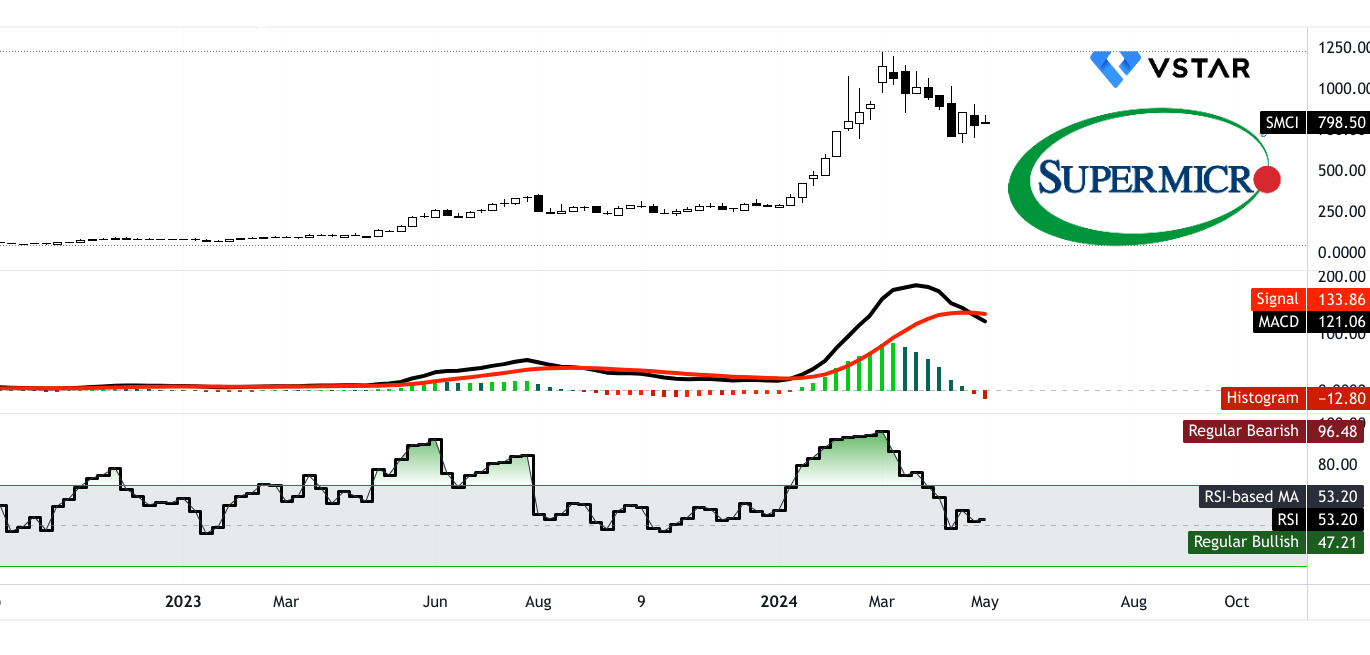

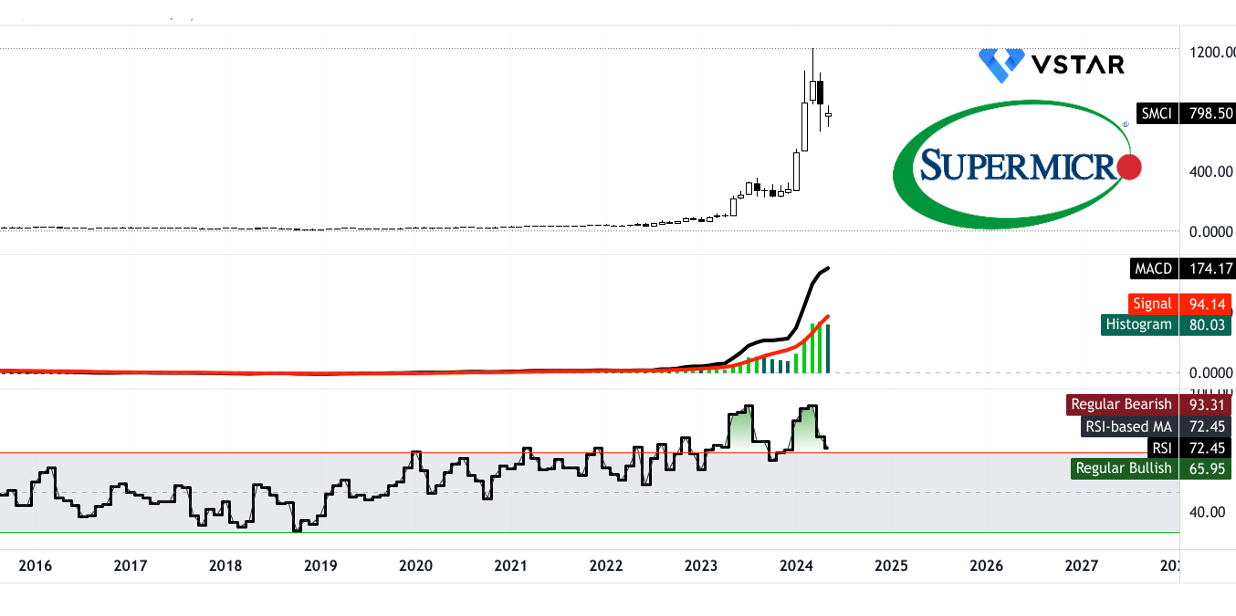

The technical SMCI forecast by the end of 2024 stands at an ambitious $1,400. This SMCI prediction isn't merely speculative but is grounded in the momentum of change-in-polarity observed over the mid- to short-term, projected over Fibonacci extension levels. The current price of $798.50 reflects a downward trend. During the trend, the modified exponential moving average trendline at $743 and the baseline at $716.74 provide crucial support. While the current direction of the stock price appears downward, this seems a transient phase amidst the broader narrative of growth and potential.

Source: tradingview.com

Primary support at $775.90 and the pivot of the current horizontal price channel at $926.83 suggest a robust test for upward trend. Resistance is at $1,077.76 for the upward momentum, whereas the core support is at $450.16 alleviates concerns about substantial downside risk. Moreover, the Relative Strength Index (RSI) at 53.2 signifies equilibrium, while the Moving Average Convergence/Divergence (MACD) trend, though bearish, showcases increasing strength, indicative of an impending reversal.

Source: tradingview.com

Super Micro Computer has garnered varied forecasts for its stock price in 2024. TipRanks suggests an optimistic average SMCI price target of $1,132.10, with a high forecast of $1,500.00 and a low forecast of $800.00, indicating a potential 41.78% change from the current price. Conversely, StockAnalysis presents a more conservative outlook, with a $1,005 average SMCI stock price target 2024, ranging from $250 to $1,500, projecting a 25.90% increase. CoinPriceForecast echoes optimism of SMCI price prediction, predicting a $1,291 year-end price, a notable 62% rise from the current valuation of $798.50.

A. Other SMCI Stock Forecast 2024 Insights: Is SMCI a Buy?

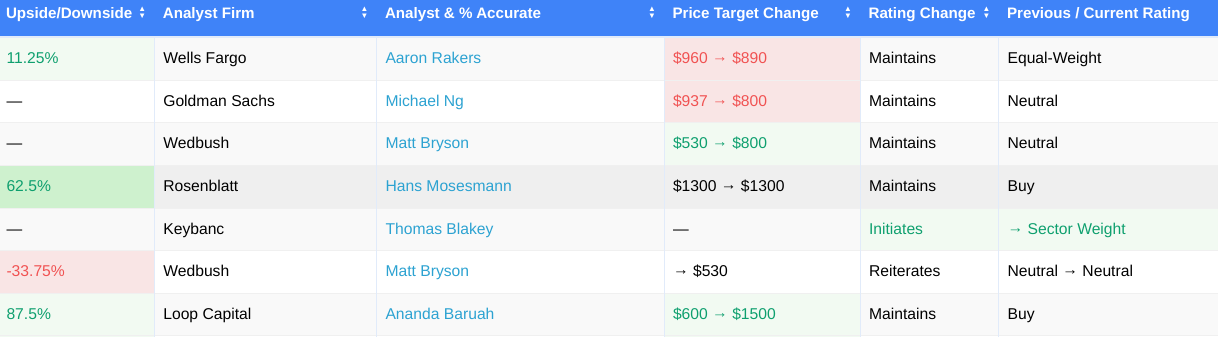

Super Micro Computer is subject to varied forecasts and ratings from prominent institutions and analysts, impacting investor sentiment and decision-making. As of May 1, 2024, a spectrum of forecasts reveals contrasting outlooks. Wells Fargo's Aaron Rakers maintains an equal-weight rating with a target of $890, projecting an 11.25% upside. In contrast, Goldman Sachs, led by Michael Ng, maintains a neutral stance with a SMCI target price of $800, indicating minimal movement.

Similarly, Wedbush's Matt Bryson also maintains a neutral outlook for SMCI forecast 2024 but adjusts the target from $530 to $800. Rosenblatt's Hans Mosesmann maintains a bullish buy rating, suggesting a significant upside of 62.50% with a target of $1300. Loop Capital's Ananda Baruah maintains a bullish stance for SMCI stock price forecast, with a buy rating and an ambitious target of $1500, projecting an 87.50% increase. However, Keybanc's Thomas Blakey recently initiated coverage with a sector weight rating, implying a neutral stance.

Source:benzinga.com

B. Key Factors to Watch for SMCI Stock Prediction 2024

Super Micro Computer Stock Forecast 2024 - Bullish Factors

Robust Financial Performance:

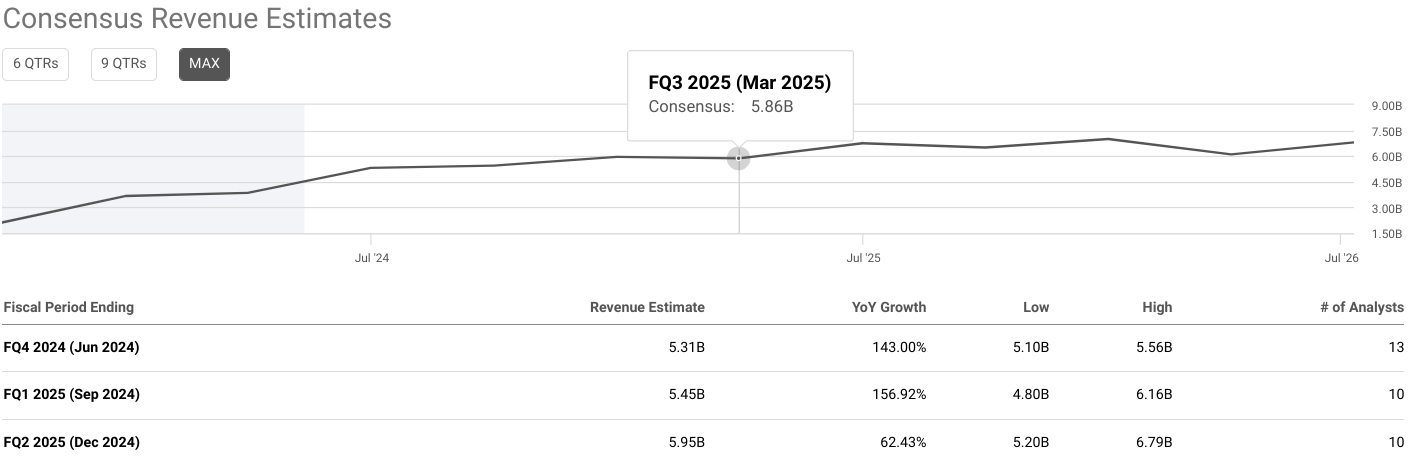

SMCI reported a quarterly revenue of $3.85 billion, marking a 200% year-on-year increase, indicating strong growth momentum. Consensus EPS estimates for fiscal periods ending in 2024 forecast substantial growth, ranging from 51.41% to 130.73% YoY. Revenue estimates also reflect impressive growth rates of up to 156.92% YoY.

Source:seekingalpha.com

Investments in Production Capacity and Efficiency:

Initiatives such as the Silicon Valley Green Computing Park and the APAC Science and Tech Center demonstrate a commitment to scaling operations to meet growing demand. Expansion plans, including the Supermicro Malaysia Campus, indicate efforts to optimize production and streamline operations for enhanced efficiency.

Focus on Cutting-edge Technologies:

SMCI's emphasis on AI and liquid cooling solutions enhances its competitive edge. Introduction of next-generation products and partnerships with industry leaders like NVIDIA showcase the company's innovative prowess and potential for market lead.

Source: Q3 2024 Presentation

SMCI Stock Forecast - Bearish Factors

Supply Chain Challenges:

The company acknowledges facing difficulties due to the requirement of new components, especially those related to Direct Liquid Cooling (DLC). These challenges have the potential to impede production and limit the company's ability to meet increasing demand, ultimately affecting revenue generation.

Increasing Operating Expenses:

The company's investment in production, operation, management software, and customer service is commendable, but it raises concerns about margin sustainability. With operating expenses increasing by 14% quarter-over-quarter and 72% year-over-year, there's a risk of margin compression if revenue growth doesn't match or exceed expense growth.

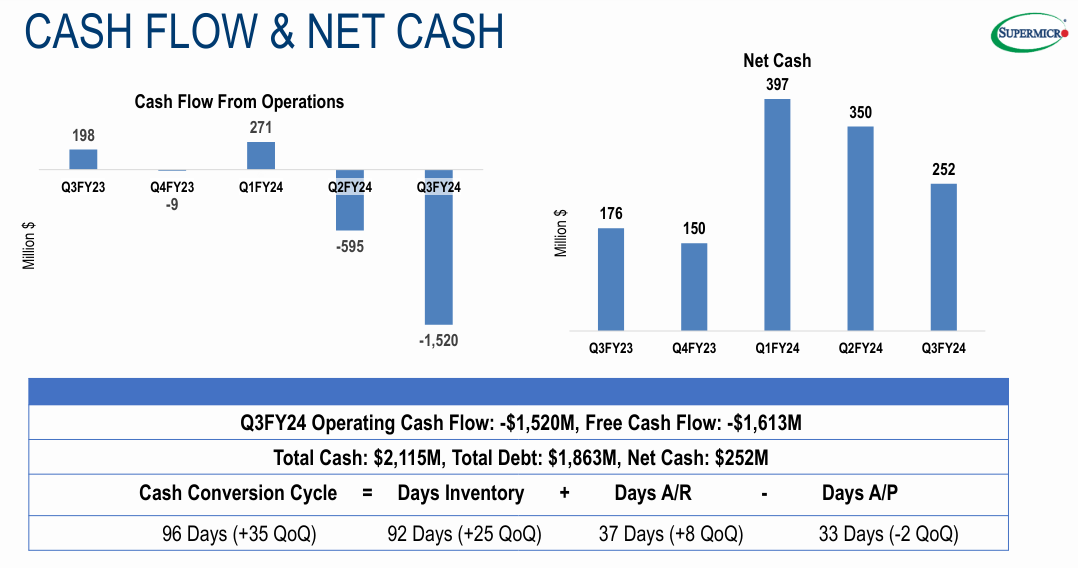

Capital Structure Concerns:

SMCI's recent fundraising activities, including a convertible note and secondary equity offering, raise questions about its capital structure. The company's net cash position has declined, and its reliance on debt financing could pose challenges if economic conditions or interest rates change unfavorably.

Source: Q3 2024 Presentation

III. SMCI Stock Forecast 2025

The Super Micro Computer stock prediction by the end of 2025 stands at $1,830. This ambitious target is supported by momentum shifts over the mid- to short-term, coupled with Fibonacci extension levels. The stock's modified exponential moving averages provide that trendline at $743 and a baseline at $717. This suggests a sideways trend in the stock's direction. However, despite this, a bullish long-term forecast emerges. One can discern pivotal points such as the primary support at $775.90 and the pivot of the current horizontal price channel at $927. Core resistance levels lie at $1,404 and $1,078.

Source: tradingview.com

Super Micro Computer stock forecasts for 2025 vary. Coincodex.com projects a price of $1,163.57, suggesting a 45.62% increase, assuming past growth trends continue. Conversely, coinpriceforecast.com predicts a higher value of $2,056, reflecting a more optimistic outlook, citing a long-term forecast. Discrepancies arise from differing methodologies, including historical data analysis and long-term trend projections.

A. Other SMCI Stock Price Target 2025 Insights: SMCI buy or sell?

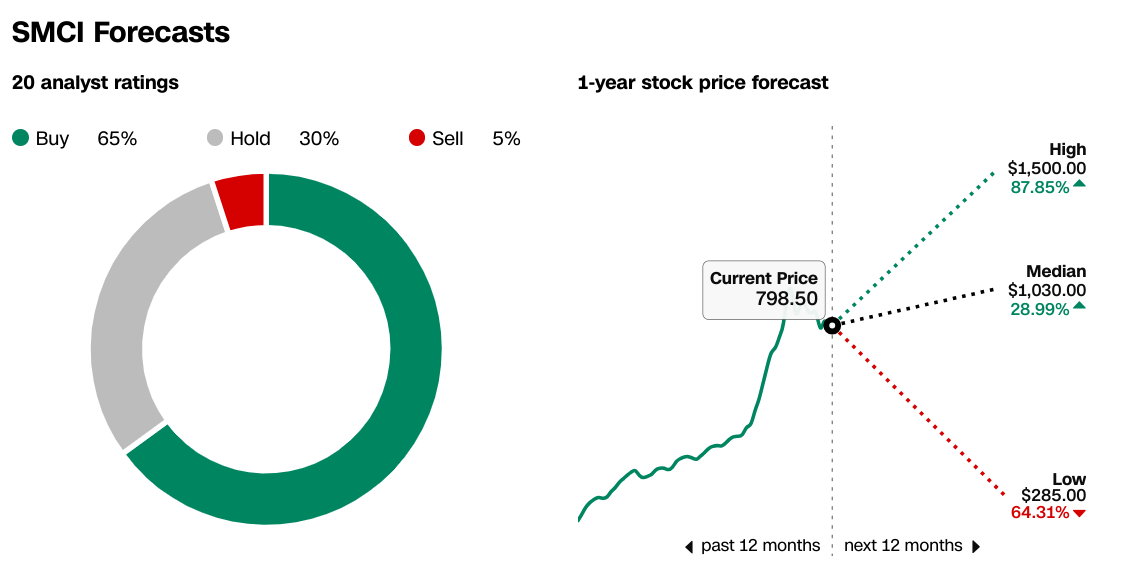

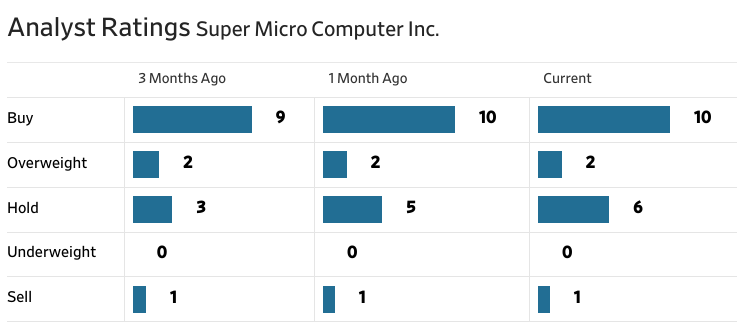

Super Micro Computer presents a mixed outlook for 2025, with varying predictions from different sources. CNN reports analyst forecasts indicating a bullish sentiment, with a high target of $1,500, a median of $1,030, and a low of $285. The majority of analysts suggest a buy rating, accounting for 65%, followed by 30% hold, and a minority of 5% advocating for sell.

Source:CNN.com

Similarly, the Wall Street Journal's data showcases a generally positive outlook, with an average price target of $1,045. The number of buy and overweight ratings has increased over the past months, indicating growing confidence in the stock. However, it's important to note the presence of hold and sell ratings, albeit in the minority.

Source: WSJ.com

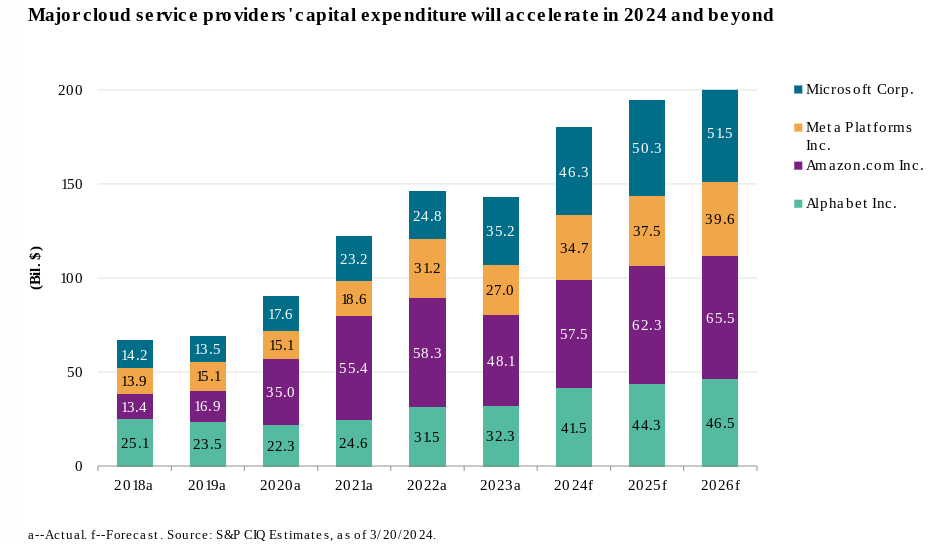

As per S&P Global, total capital spending by major CSPs, including Alphabet, Amazon, Meta, and Microsoft, is expected to increase by 26% in 2024. Growth in AI-specific spending is anticipated to surpass the overall capital spending increase, indicating a higher rate of investment in AI technologies. Super Micro Computer stands to benefit from the increasing investments in AI infrastructure, particularly in cloud service providers (CSPs). These entities have been leading the AI investment cycle, with substantial capital allocated towards AI training, an area critical for the development and commercialization of AI technologies.

Source: spglobal.com

A survey by KPMG suggests that 43% of companies with revenues exceeding $1 billion plan to invest at least $100 million in Gen AI over the following year. IDC forecasts that spending on Gen AI solutions will double to $40 billion in 2024 and then increase by another 75% to nearly $70 billion in 2025. Forecasts suggest sustained growth in AI infrastructure spending, with estimates indicating a doubling of investment in Gen AI solutions by 2025. Super Micro Computer's strategic position within this evolving landscape indicates potential for growth, as enterprises increasingly transition from AI trials to full-scale deployment, necessitating investments in AI infrastructure and related services. As the demand for AI technologies continues to surge, SMCI stands poised to capitalize on the burgeoning market opportunities.

B. Key Factors to Watch for SMCI Stock Prediction 2025

SMCI Stock Forecast 2025 - Bullish Factors

Strategic Investments:

Super Micro Computer is making significant investments in production, operation, management software, and cloud features to cater to the growing demand for AI solutions. The company raised $3.28 billion through a convertible note and secondary equity offering to support its expansion plans, indicating confidence in future growth.

Strategic Partnerships:

Collaborations with industry leaders like NVIDIA underscore Super Micro Computer's commitment to innovation. Deployments of NVIDIA HGX AI supercomputers and the development of next-generation AI systems based on upcoming GPU technologies reflect the company's readiness to capitalize on evolving market trends.

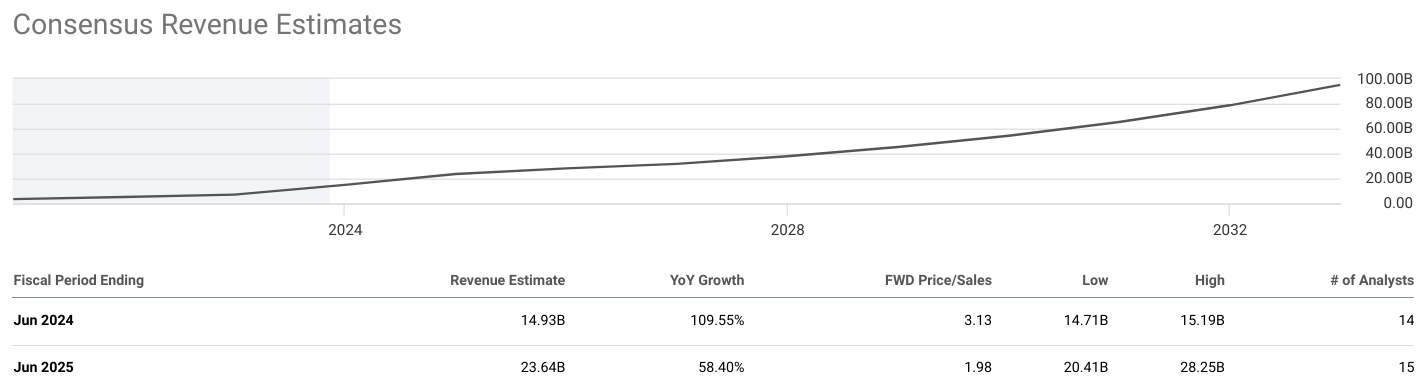

Topline Growth:

Super Micro Computer's revenue is projected to grow substantially, with consensus estimates suggesting a 58.40% year-over-year increase to $23.64 billion by June 2025. This growth trajectory reflects the increasing demand for AI-driven solutions in the market.

Source:Seekingalpha.com

SMCI Stock Forecast 2025 - Bearish Factors

Increased Competition:

The AI market is highly competitive, with established players and emerging startups vying for market share. Super Micro Computer faces the risk of intensified competition, which could exert downward pressure on margins and profitability if it fails to differentiate its offerings effectively.

Dependence on Key Customers:

A significant portion of Super Micro Computer's revenue comes from a few large customers, as evidenced by one existing CSP/large data center customer representing 21% of Q3 revenues. Dependence on a limited customer base poses risks, including the potential loss of key contracts or reduced orders, which could adversely affect financial performance.

IV. SMCI Stock Forecast 2030 and Beyond

For SMCI price prediction 2030, Super Micro Computer exhibits intriguing potential for growth by 2030. The forecasted SMCI stock price target 2030 of $2,245 suggests a significant appreciation from its current level of $798.50. The modified exponential moving average indicates the trend line at $318.13, significantly below the actual market price. This suggests a potential volatility for upward movement. The SMCI price target for 2030 is derived from a momentum-based analysis, considering changes in polarity over the mid- to long-term and projected over Fibonacci extension levels.

Source: tradingview.com

The primary support at $741.58 and core resistance at $1,393.29 provide crucial boundaries for assessing the stock's movement. These levels indicate potential areas of consolidation or breakout. The RSI value of 72.45 suggests bullish momentum, while the MACD indicators depict a stabilized bullish trend. However, the downward RSI trend and presence of bearish divergence warrant cautious observation.

Source: tradingview.com

The forecasts for Super Micro Computer stock from coincodex.com and coinpriceforecast.com diverge, but both predict substantial growth. Coincodex anticipates a steady rise, reaching $7,618.17 by 2030, implying an 853.39% increase from 2025. Conversely, coinpriceforecast.com projects a more gradual ascent, with the stock hitting $5,000 by 2032. While both sources indicate bullish trajectories, investors should consider factors such as technological advancements, market trends, and company performance to make informed decisions. Additionally, risks inherent in stock investments, including volatility and unforeseen events, should be taken into account when evaluating these forecasts.

A. Other SMCI Stock Forecast 2030 and Beyond Insights: SMCI stock buy or sell?

Super Micro Computer may hit solid growth amidst the booming AI infrastructure market, projected to reach USD 421.44 billion by 2033 as per Precedence Research. With a CAGR of 27.53%, demand for robust AI infrastructure is set to surge.

Source: precedenceresearch.com

Similarly, Super Micro Computer holds promise in the burgeoning AI market, with S&P Global projecting substantial growth. Anticipated expansion from $200 billion in 2023 to nearly $650 billion by 2028 signifies a high 20% CAGR, constituting 15% of global IT spending. This trajectory hints at robust future prospects, driven by increased IT spending relative to global GDP.

B. Key Factors to Watch for SMCI Stock Prediction 2030 and Beyond

SMCI Stock Forecast 2030 and Beyond - Bullish Factors

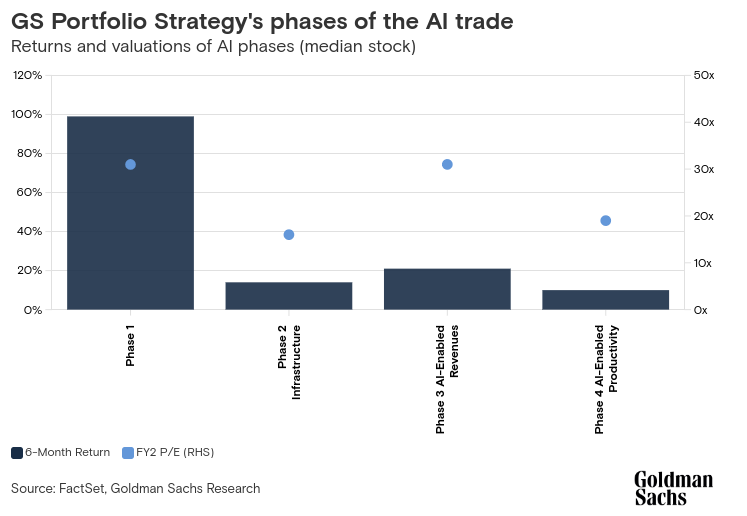

Position in AI Infrastructure Phase 2:

As outlined by Goldman Sachs, SMCI stands to benefit from the buildout of AI-related infrastructure. Semiconductor designers and manufacturers, cloud providers, and network equipment makers are all key players in this phase, and SMCI's role in providing essential computer and network equipment puts it in a favorable position.

Source: goldmansachs.com

Consensus Revenue Growth:

Consensus revenue estimates indicate substantial growth projections, with revenue expected to surge from $14.93 billion in 2024 to $54.34 billion by 2030. This growth trajectory reflects significant market potential and suggests optimism surrounding SMCI's future performance.

Positive Revenue Revision Trends:

The consistent upward revision of revenue estimates indicates growing confidence in SMCI's financial outlook. This trend, especially over the past six months, suggests that analysts anticipate robust performance in the coming years.

SMCI Stock Price Prediction 2030 and Beyond - Bearish Factors

Demand Fails:

Inadequate ROI and performance inaccuracies in AI technology adoption may delay demand for SMCI's products, particularly from CSPs and technology vendors, impacting its revenue streams.

Cannibalization:

The cannibalization of IT budgets, with a shift towards AI investment for efficiency gains, may divert funds away from other IT projects, potentially reducing demand for SMCI's offerings if AI initiatives fail to meet ROI expectations.

V. Conclusion

A. SMCI Stock Outlook

Looking ahead to 2025 and beyond, Supermicro stock forecast suggests continuing its upward trajectory, with targets reaching $1,830 by 2025 and $2,245 by 2030. Factors contributing to this bullish outlook include sustained revenue growth, strategic investments, and a favorable position in the expanding AI infrastructure market.

Here, Super Micro Computer Stock is a buy. It has exhibited remarkable volatility in its stock performance, with significant short-term gains and long-term outperformance against benchmarks such as the S&P 500 and Nasdaq-100. This is driven by robust demand for AI rack-scale plug-and-play solutions and strategic investments in innovative technologies like Direct Liquid Cooling (DLC).

B. Trade Super Micro Computer Stock CFD with VSTAR

Trading SMCI stock CFDs with VSTAR offers benefits such as copy trading features, enabling investors to replicate successful strategies of experienced traders. Moreover, Trading SMCI Stock CFD with VSTAR holds the edge through low trading costs, institutional-level experience, and a user-friendly app for both pro traders and beginners, enhancing the trading experience.

FAQs

1. Is SMCI a good stock to buy?

According to Zacks, SMCI has a Strong Buy rating, indicating that it is expected to outperform the market in the coming months. The Motley Fool also highlights the high demand for Super Micro Computer's server products and high expectations for the company's growth, suggesting that the stock could be a good buy.

2. What is the future price of SMCI stock?

The average 12-month SMCI price target set by analysts is $954.38, with a high estimate of $1,500.00 and a low estimate of $250.00.

3. What is the prediction for SMCI in 2024?

The SMCI stock forecast by the end of 2024 stands at an ambitious $1,400.

4. What will SMCI be worth in 2025?

The projected SMCI stock price target 2025 stands at $1,830.