I. Introduction

A. Recent Tesla Stock Performance

Tesla's stock performance has been both dynamic and influential in the market. The stock price witnessed fluctuations over various time frames. For instance, in the past year, Tesla exhibited a price return of over 100%, outperforming the S&P 500 Total Return of 26%. However, in the short term, the stock faced challenges.

Source: Nasdaq.com

Several factors influenced these fluctuations. Notably, Tesla's production disruptions during the last quarter due to factory upgrades led to a sequential decline in production volumes. Despite these setbacks, Tesla's growth trajectory remains strong, with significant developments across its production facilities in the US, China, and Europe.

Influencing Factors

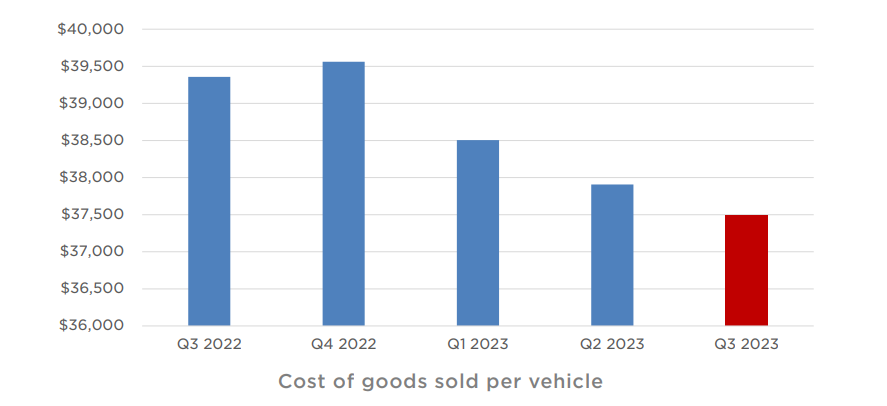

Production and Supply Chain Upgrades: Tesla's decision to upgrade production lines caused short-term setbacks but aimed at long-term efficiency gains. The gradual ramp-up of Model Y production in Texas and the progress in manufacturing the 4680 cells are indicative of Tesla's commitment to technological advancements and cost efficiency.

International Market Expansion: Despite the factory downtime in Q3, the Shanghai factory in China has been operating near full capacity, serving as a crucial export hub. Similar efforts are underway in Europe, where the Model Y remains a best-selling vehicle. These expansions signify Tesla's global growth strategy and market adaptability.

AI Development and Software Enhancements: Tesla's focus on AI development, exemplified by commissioning one of the world's largest supercomputers, underscores the company's commitment to advancing self-driving capabilities. Moreover, improvements in vehicle software, like enhanced rental experiences and in-app service features, enhance customer satisfaction and loyalty.

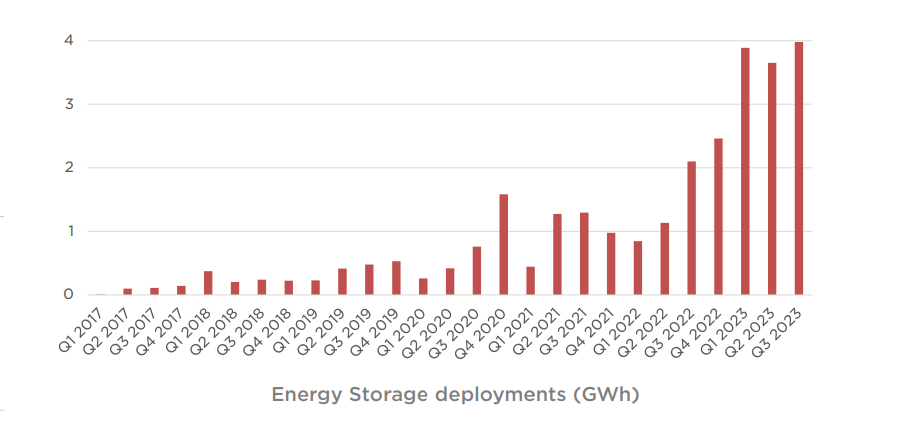

Energy and Storage Initiatives: Despite challenges in solar deployments, Tesla witnessed a notable surge in energy storage deployments. The company's growth in this sector, driven by the Lathrop Megafactory's expansion, highlights Tesla's resilience and adaptability in navigating market challenges.

Source: 2023 Q3 Quarterly Update Deck

Services and Profit Diversification: Tesla's Services and Other businesses continue to expand successfully. Supercharging, insurance, and body shop & part sales contribute significantly to profit growth. The focus on expanding Supercharging capacity indicates Tesla's preparedness for increased fleet sizes and potential collaborations with other OEMs.

B. Expert Insights on TSLA Stock Forecast for 2023 - 2024, 2025, 2030 and Beyond

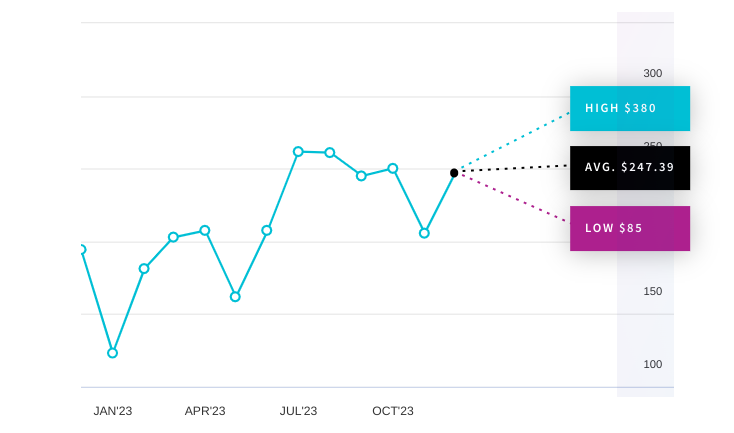

The projected stock prices for Tesla (TSLA) demonstrate an upward trajectory over the coming years, reflecting anticipated growth and market sentiment. By the end of 2023, analysts estimate a price of $254, with expectations of gradual but steady progress owing to ongoing production upgrades and advancements in AI technology. Moving into 2024, projections suggest a further increase to approximately $445-$493, indicating improved production capabilities, market expansion efforts in key regions like Europe and Asia, and continued focus on technological innovations.

As the horizon extends to 2025, the estimated price climbs to around $625-$650, signifying a matured market presence, potential breakthroughs in autonomous driving technology, and continued strides in sustainable energy solutions. Looking even further ahead, by 2030, forecasts become more speculative ($1,725), with potential price trajectories varying widely due to anticipated transformative shifts in transportation, energy sectors, and technological advancements. However, despite uncertainties, a range of projections indicates a potentially steeper upward trajectory beyond 2030 ($2,105 by 2032).

II. Tesla Stock Forecast 2023 - 2024

The stock price of Tesla may hit the target of $445-$493 by the end of 2024.

Source: tradingview.com

The target range is derived from the Fibonacci retracement and the current momentum. Based on the current momentum, $231 is the pivot that serves as solid support over the short term. Similarly, the 66-day exponential moving average (EMA) and 260-day EMA serve as navigators for the projected uptrend. These EMAs have already delivered a bullish crossover in mid-2023. Supporting the solid bullish potential of the stock.

Source: Analyst's compilation

Similarly, looking at the fundamental valuation and mean reversion theory, the stock holds 84% upside. Based on 5-year average Tesla forward PE of 117 and the analysts' earnings estimate of $3.98, the price should be $466 by the end of 2024, as forward PE may revert back to its long-term mean.

Various tesla forecast sources provide different projections for Tesla's stock price. Coinpriceforecast.com anticipates a 1% rise from the current value to $254 by the end of 2023, marking a 106% year-to-year increase. They suggest further growth in 2024, with a mid-year projection of $274 and an anticipated year-end price of $283, reflecting a 12% increase from the current value.

In the same context, TradersUnion.com offers a more optimistic tesla stock outlook, estimating a mid-2023 price of $315.9 and an end-of-year price of $355.53. Moving into 2024, they project a mid-year price of $395.16, rising to $444.74 by year-end. Meanwhile, gov.capital forecasts a December 2024 price range between $386.3709 and $522.7371, showing a wide variance in potential outcomes.

A. Other TSLA Stock Forecast 2023 - 2024 Insights: Is tesla stock a buy?

In the imminent EV battleground, external forces pose the greatest challenge to Tesla's trajectory. Legacy automakers such as Ford (F) and General Motors (GM) plan extensive EV releases in 2024. Simultaneously, aggressive production scaling by upstarts like Rivian (RIVN) and Lucid (LCID) compounds the competitive landscape. Analysts, particularly Wedbush's Dan Ives, emphasize the pivotal role competition plays in Tesla's market dominance. Ives projects Tesla's revenue growth to accelerate from 24% in 2023 to over 30% in 2024, underscoring the critical juncture the company faces amid escalating competition.

Ives, a perennial Tesla supporter, foresees a bullish trajectory for the company. Despite Wall Street's concerns about EV demand erosion amidst surging competition, Ives maintains an optimistic tesla outlook. He applauds Elon Musk's strategic price reductions, especially in China, driving estimated volumes to a robust 1.8 million in 2023. Ives reaffirms his long-standing outperform rating on Tesla, elevating the 12-month price target from $310 to $350 and envisioning a market capitalization of $1.11 trillion.

Ives underscores Tesla's adept handling of challenges in China, foreseeing record-breaking fourth-quarter volumes amidst stabilized gross margins. He highlights Tesla's sustained commitment to innovation, doubling down with the Cybertruck and hinting at an anticipated sub-$30k vehicle announcement in the upcoming months.

Despite Ives' bullish stance, CNN Business presents a contrasting view, suggesting a median 12-month price forecast of $258.80 for Tesla, projecting a modest 2.49% increase from the current price of $252.52. This disparity in analyst estimations underscores the uncertainty surrounding future of Tesla amid the intensified EV landscape.

The exponential rise of Tesla stock by 106.6% YTD showcases its dominance compared to rival automakers' modest gains. Ives' optimistic projection aligns with China's news on Tesla's advancements in energy-storage batteries, indicating a continued push for innovation amidst fierce competition. Tesla stands at a crucial crossroads, navigating an increasingly competitive landscape while striving to maintain its pioneering role in the global EV transformation.

Source: Nasdaq.com

B. Key Factors to Watch for Tesla Stock Predictions 2023 - 2024

Bullish Factors for Tesla Stock Prediction 2023 - 2024:

Production and Expansion: Tesla's ongoing production ramp-up and expansion plans in various locations, including Gigafactory Texas, Shanghai, and Berlin-Brandenburg, bode well for future growth. The gradual increase in Model Y production and advancements in battery technology, like the 4680 cells and high-density powertrain architecture, indicate potential efficiency improvements and cost savings.

Source: 2023 Q3 Quarterly Update Deck

AI Development and Software Enhancements: Tesla's focus on AI development, as seen with the commissioning of a substantial supercomputer, signifies the company's commitment to advancing its Full Self-Driving (FSD) capability. The vast amount of data generated by Tesla's vehicle fleet aids in developing and improving autonomous driving features.

Energy and Services Segments: Despite challenges in solar deployment due to external factors like high interest rates and policy changes, Tesla's energy storage deployments have surged. Additionally, the growth in Tesla's Services and Other business, driven by services like Supercharging, insurance, and parts sales, contributes to profit growth year-over-year.

Bearish Factors for Tesla Stock Predictions 2023 - 2024:

Recall and Regulatory Scrutiny: Tesla's recent recall of approximately 2 million vehicles due to concerns over Advanced Driver Assistance Systems (ADAS) has raised safety concerns and invited regulatory scrutiny. The National Highway Traffic Safety Administration (NHTSA) flagged issues with Tesla's Autopilot, potentially leading to aggressive regulatory oversight and legal challenges.

Potential Market Share Erosion: Tesla's dominance in the electric vehicle market faces challenges from competitors. Any erosion of Tesla's market share in the face of increased competition could impact the company's growth trajectory and stock value.

Legal Liabilities: The possibility of facing substantial lawsuits related to defects in the Autopilot system that might have contributed to accidents poses a risk to Tesla's financials. Legal liabilities resulting from such lawsuits could impact the company's bottom line.

III. Tesla Stock Prediction 2025

The stock price of Tesla may hit the target of $625-$650 by the end of 2025.

Source: tradingview.com

The target range is derived from the Fibonacci retracement and the current trend channel. Based on the prevailing price trends, $241 is the pivot that serves as solid support over the mid-term. Similarly, the 52-week exponential moving average (EMA) and 104-week EMA serve as navigators for the projected uptrend. These EMAs are in a bullish pattern (crossover) in mid-2023. On the downside, $166 serves as mid-term support.

Again, to correlate through the fundamental valuation and mean reversion theory, the stock holds 151% upside. Based on Tesla's 5-year average forward PE of 117 and the analysts' earnings estimate of $5.42, the price should be $634 by the end of 2025, as forward PE may revert back to its long-term mean.

Source: Analyst's compilation

Various price predictions for Tesla in 2025 present a range of forecasts, reflecting differing methodologies and perspectives. Coinpriceforecast.com estimates a considerable increase, suggesting Tesla will start the year at $283, reach $347 by mid-year, and close at $382, indicating a 51% increase from the current price. Walletinvestor predicts a starting price of $244.521, while Long Forecast projects a higher opening price of $418 for 2025.

Tradersunion.com anticipates Tesla to be valued at $494.31 in the middle of 2025, rising to $556.33 by year-end. Meanwhile, gov.capital's forecast suggests Tesla could reach $676.886 by December 31st, with a potential range between $575.3531 and $778.4189.

A. Other Tesla Price Prediction 2025 Insights: Is Tesla a good stock to buy?

Craig Irwin, an analyst at Roth Capital, takes a pessimistic stance, setting a significantly lower target of $85 for Tesla stock. He contends that Tesla's current valuation is excessively inflated. Irwin underscores the looming challenges for Tesla, emphasizing intensified competition, potential disruptions from factory closures, and anticipated delays in product launches. He highlights Ford and the Chinese EV manufacturer BYD as immediate threats to Tesla's market share, propelling his conservative forecast.

In stark contrast, Adam Jonas from Morgan Stanley holds an optimistic outlook, elevating Tesla prediction to $400. Jonas is buoyed by Tesla's innovative endeavor, the Dojo supercomputer. He envisages vast potential in Dojo, anticipating its role in enhancing Tesla's Full Self-Driving (FSD) capabilities. Jonas forecasts that Dojo's implementation could yield substantial cost savings of over $6 billion for Tesla, envisioning a paradigm shift akin to Amazon's lucrative venture into cloud computing through Amazon Web Services.

Tom Narayan of RBC Capital maintains a bullish sentiment, reiterating a "Buy" rating and setting a tesla stock target price of $300, reflecting an upside potential of around 18.79%. Meanwhile, Emmanuel Rosner from Deutsche Bank remains optimistic, maintaining a "Strong Buy" stance but slightly adjusting the Tesla price target from $275 to $260, indicating a modest 2.95% upside. On the other hand, Mark Delaney at Goldman Sachs maintains a more reserved perspective, upholding a "Hold" rating with a Tesla price target of $235, implying a downside potential of 6.95%.

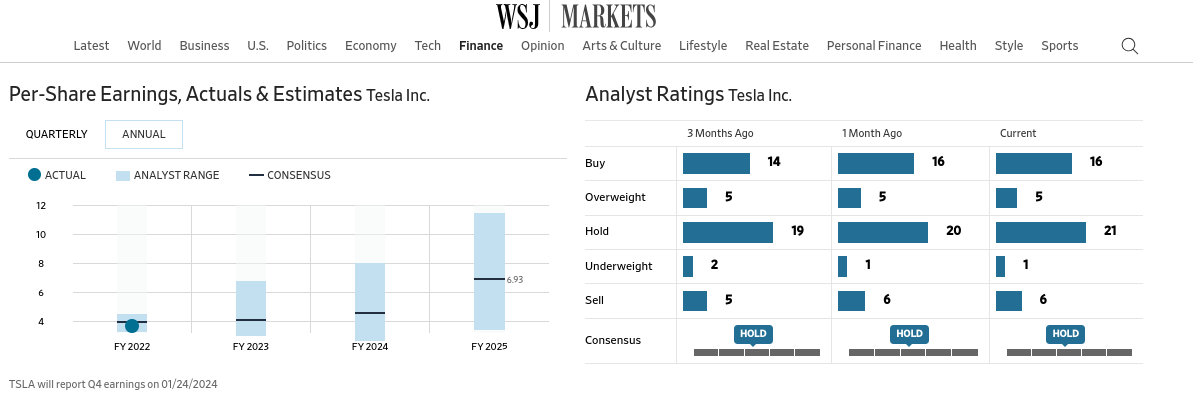

Source: WSJ

![]()

Source: Analyst's compilation

The Wall Street estimated $6.93 EPS by 2025 for Tesla. Taking the trailing PE of 81 from YahooFinance provides a price level of $565. This signifies 124% upside from the current level.

B. Key Factors to Watch for Tesla Stock Price Prediction 2025

Bullish Factors for TSLA stock forecast 2025:

Revenue Growth and Consistency: Forecasts suggest a substantial increase in revenue, reaching an estimated $145.58 billion by the end of fiscal year 2025, marking a robust year-on-year growth rate of 23.17%. This trajectory indicates sustained financial health and an expanding market presence for Tesla. The consistent revenue growth reflects the company's ability to capitalize on increasing demand for electric vehicles (EVs) and related services such as AI and energy storage.

Forward Price/Sales Ratio: The forward price-to-sales (P/S) ratio stands at 5.51, signaling an optimistic market valuation in anticipation of Tesla's future performance. This metric indicates investors' confidence in the company's ability to generate higher sales relative to its market valuation. A lower P/S ratio might indicate undervaluation, whereas a higher ratio often suggests market enthusiasm for growth prospects.

Analyst Tesla Predictions: The range of revenue estimates provided by analysts reflects a positive sentiment regarding Tesla's topline. With projected revenue ranging between $125 billion to $171.45 billion, these estimations indicate a consensus among analysts about the company's potential growth trajectory. Such unanimity among analysts can bolster investor confidence and potentially influence market sentiment in Tesla's favor.

Bearish Factors Affecting Tesla Stock Forecast 2025:

Increased Competition and Market Saturation: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share. If Tesla fails to maintain its edge in innovation, it could face challenges in sustaining its market dominance. Additionally, as more companies enter the EV space, the market might become saturated, potentially impacting Tesla's growth rate.

Source: 2023 Q3 Quarterly Update Deck

Regulatory and Supply Chain Risks: Regulatory changes in environmental policies or alterations in government incentives for electric vehicles could impact Tesla's profitability and market position. Moreover, global supply chain disruptions or material shortages might hamper Tesla's manufacturing capabilities, leading to production delays and affecting revenue projections.

Market Volatility and Investor Sentiment: While the aforementioned bullish indicators are promising, fluctuations in market sentiment, broader economic uncertainties, or unexpected events could cause volatility in Tesla's stock price. A sudden shift in investor sentiment driven by geopolitical events, macroeconomic shifts, or adverse publicity could adversely affect Tesla's stock performance.

IV. Tesla Stock Forecast 2030 and Beyond

What will tesla stock be worth in 2030? The stock price of Tesla may reach the target of $1,725 optimistically, $1,475 modestly, or $1,225 pessimistically by the end of 2030. However, optimistically, the tesla stock price forecast may hit $2,105 by 2032.

Source: tradingview.com

The target levels are derived from the Fibonacci retracement and the current trend channel. Based on the prevailing price trends, $253 is the pivot that serves as solid support over the long term. Similarly, the 24-month exponential moving average (EMA) and 108-month EMA serve as core navigators for the markup phase. These EMAs are in a bullish pattern (crossover) over the long term. On the downside, $135 serves as mid-term support.

Source: Analyst's compilation

Moreover, as per the fundamental valuation and mean reversion theory, the stock holds 387% (by 2030) and 760% (by 2032) upside. Based on Tesla's 5-year average forward PE of 117 and the analysts' earnings estimate of $10.52 (2030) and $18.57 (2032), the price should be $1,231 by the end of 2030 and $2,173 by the end of 2030, as forward PE may revert back to its long-term mean.

The various predictions for Tesla's stock price in 2030 from different sources exhibit significant disparities, presenting a challenge in determining the most reliable forecast. Coinpriceforecast.com suggests a moderate increase, estimating a rise from $709 to $889 (+25%) by the year-end. However, the predicted growth within the year fluctuates, starting at $709, reaching $724 within the first half, and concluding at $739, reflecting a +193% increase from the present value.

Tradersunion.com offers a more optimistic outlook, forecasting Tesla to potentially reach $1362.19 by 2030 and an even higher value of $3335.36 by 2034. In contrast, coincodex.com projects an aggressive surge, proposing a leap to $3,615.25 by 2030, predicting a staggering 1,331.55% growth from the current price if Tesla maintains its 10-year average growth rate.

Contrarily, gov.capital's forecast for December 27, 2028, presents a wide range of possibilities, between $1461.79 (least possible) and $1977.72 (best possible), indicating substantial uncertainty in predicting Tesla's trajectory.

A. Other TSLA Stock Forecast 2030 and Beyond Insights: Will tesla stock go up?

Analyst Seth Goldstein highlights Tesla's strategic positioning in capturing growth within the solar energy and battery storage markets. The company's diversification into offering additional auto-related services like insurance and autonomous driving software signifies an attempt to enhance revenue streams beyond vehicle sales. These initiatives suggest potential for incremental revenue and market penetration beyond traditional automotive sales.

ARK Invest's Cathie Wood has an optimistic long-term perspective on Tesla's potential trajectory. Her bullish outlook is rooted in her belief that Tesla's innovative initiatives, notably the Dojo supercomputer, will significantly contribute to the company's growth and valuation.

Wood's bullish forecast for Tesla, setting a target of $1,400 or higher by 2027, underscores her confidence in Tesla's ability to capitalize on technological advancements and innovative ventures. Specifically, she highlights Dojo - a powerful computing system designed to enhance Tesla's Full Self-Driving (FSD) capabilities.

Source: 2023 Q3 Quarterly Update Deck

B. Key Factors to Watch for Tesla Stock Price Prediction 2030 and Beyond

Bullish Factors Influencing Tesla Stock Prediction 2030 and Beyond:

Global EV Market Growth and Market Leader Status: Forecasts indicate a substantial surge in global electric vehicle sales, expected to reach 40% of total auto sales by 2030. Tesla's current leadership in the global EV market places it in a favorable position to capitalize on this growth. The anticipated rise in electric vehicle sales globally, as projected by Fortune Business Insights, bodes well for Tesla's future revenue, potentially increasing from $500 billion to nearly $1,580 billion by 2030.

Expansion Plans and Diversification: Tesla's ambitious goal to increase vehicle production to 20 million by 2030 (compared to 1.31 million in 2022) reflects an aggressive expansion strategy. Additionally, the company's focus on diversifying beyond electric passenger cars and trucks into energy segments like battery technology and potential ventures in autonomous driving and cloud computing (Dojo) indicates a commitment to exploring diverse revenue streams for sustained growth.

Bearish Factors Impacting Tesla Price Prediction in 2030 and Beyond:

Intensifying Competition: Increasing competition within the electric vehicle market poses a significant challenge for Tesla. Other automakers are aggressively entering the EV space, offering consumers more choices. Tesla's response to defend its market share by potentially reducing prices might impact profit margins and impede sales growth.

Execution and Deadline Challenges: Tesla's historical track record of missing self-imposed deadlines could impede its competitive edge if rival EV makers accelerate innovation and execution. Delays in product launches, like the prolonged delay in the Cybertruck launch, offer opportunities for competitors like Ford, Rivian, and GMC to seize market share and audience attention, potentially eroding Tesla's dominance.

V. Tesla Stock Price History Performance

TSLA Stock Absolute Price Performance

2010 - 2019: Early Growth and Market Establishment

2010 - 2012: Tesla's market capitalization remained relatively low, reflecting the company's early-stage position in the market. It grew from $2.52 billion in 2010 to $3.86 billion in 2012. During this period, Tesla focused on establishing its presence in the electric vehicle (EV) industry, introducing models like the Roadster and laying the groundwork for future expansion.

2013 - 2015: The market capitalization surged significantly from $18.51 billion in 2013 to $31.54 billion in 2015. The launch of the Model S and the company's strategic advancements in battery technology, along with a growing consumer interest in sustainable transportation, contributed to this growth.

2016 - 2019: Tesla's market cap continued its upward trend, reaching $75.71 billion in 2019. Key factors included the introduction of the Model X, Model 3, and ongoing innovation in battery technology. Despite production challenges, the company established itself as a major player in the EV market.

Source: tradingview.com

2020 - 2023: Market Volatility and Significant Growth

2020: Tesla's market cap surged to $668.90 billion, driven by continued vehicle production, increased sales, and investor enthusiasm for electric vehicles. The announcement of future gigafactories and battery advancements also contributed to this substantial growth.

2021: The market cap crossed the trillion-dollar mark, hitting $1.061 trillion, indicating investor confidence in Tesla's potential and its future role in the EV and renewable energy sectors. The company's focus on expanding production capacities and its inclusion in major stock indices boosted investor sentiment.

2022: There was a significant market correction, with Tesla's market cap dropping to $388.97 billion, attributed partly to broader market volatility, concerns about supply chain disruptions, and regulatory challenges. Despite this decline, Tesla remained a dominant force in the EV market.

2023: The market cap rebounded strongly to $809.03 billion, reflecting renewed investor confidence driven by the company's ability to navigate challenges, advancements in technology, strategic global expansions, and sustained demand for EVs.

Tesla Stock Relative Price Performance

Short-Term Outperformance (1W, 1M, 6M)

1 Week (1W): Despite a slight decline in the past week, Tesla stock has outperformed the S&P 500, which saw a slightly positive return of 0.75%. This may suggest that even during a short-term downturn, Tesla fared relatively better compared to the broader market.

1 Month (1M): Tesla's positive return of 7.83% in the past month surpassed the S&P 500's 4.35% return, indicating stronger performance driven by factors specific to Tesla's business, such as product launches or strategic announcements.

6 Months (6M): Although Tesla experienced a -4.56% return over six months, it still outperformed the S&P 500's 8.51% return during this timeframe. Despite facing challenges, Tesla's performance was relatively stronger compared to the broader market.

Source: Nasdaq.com

Mid to Long-Term Outperformance (YTD, 1Y, 3Y, 5Y, 10Y)

Year-to-Date (YTD) and One Year (1Y): Tesla's remarkable YTD and 1-year returns of 105.02% and 101.47%, respectively, significantly exceeded the S&P 500's 23.83% and 24.39% returns. This signifies Tesla's exceptional growth and investor appeal compared to the broader market's performance.

Source: Nasdaq.com

Three Years (3Y): Despite a moderate 18.32% return over three years, Tesla still outpaced the S&P 500's 28.95% return, albeit with a narrower margin. This suggests Tesla's resilience and ability to maintain relative strength over a longer period.

Five Years (5Y) and Ten Years (10Y): Tesla's monumental returns of 1,084.63% (5 years) and 2,544.58% (10 years) far exceeded the S&P 500's 96.75% (5 years) and 161.48% (10 years). This showcases Tesla's extraordinary growth trajectory and substantial outperformance over an extended period, demonstrating its position as a market leader.

VI. Conclusion

In conclusion, Tesla's stock performance has been a rollercoaster, marked by dynamic fluctuations influenced by various internal and external factors. The company's resilience, innovation, and strategic advancements have driven its market dominance in the electric vehicle (EV) space. Looking ahead to price forecasts, a consensus among analysts suggests an upward trajectory, albeit with variations in estimates.

Should I buy tesla stock or should I sell tesla stock? For 2023-2024, the projected prices for Tesla (TSLA) range between $254 to $493 by the end of 2024, showcasing potential growth influenced by ongoing production upgrades, global expansion efforts, and technological innovations. Despite optimistic tesla stock projections, challenges from increased competition, regulatory scrutiny, and potential market share erosion remain pertinent.

Is tesla stock a good buy? Moving into 2025, forecasts predict a price range of $625 to $650, emphasizing a matured market presence, advancements in autonomous driving technology, and sustainable energy solutions. However, differing opinions exist, with some analysts expressing caution due to intensified competition and potential market saturation.

Looking further ahead to 2030, optimistic projections place Tesla stock at $1,725, driven by global EV market growth, expansion plans, and diversified revenue streams. Yet, there are cautious predictions, highlighting concerns regarding competition, execution challenges, and market volatility.

Trade in Tesla

Should I invest in Tesla? Investment recommendations need careful consideration, weighing Tesla's innovative strides, global market potential, and competitive challenges. How to buy Tesla stock? Traders might consider utilizing platforms like VSTAR for trading Tesla Stock CFDs, edging on the Leverage Up to 1:200, $0 commission with transparent trading cost, lighting fast platform, and insights from various sources and expert opinions to inform their investment strategies.

FAQs

1. Is Tesla a Buy, Hold, or Sell?

Most analysts currently have a Buy or Hold rating on Tesla stock.

2. Is Tesla stock expected to rise?

Yes, analysts expect Tesla stock to continue rising over the next 12 months.

3. What is the 12-month forecast for Tesla stock?

The average 12-month price target for Tesla stock from analysts is around $300 per share.

4. What is the Tesla stock prediction 2025?

If growth continues, analysts expect TSLA stock price over $500.

5. What is the 5-year prediction for Tesla stock?

In 5 years, if Tesla continues its current trajectory, analysts predict Tesla stock price potentially over $1,000.

6. What is the long-term forecast for Tesla stock?

The long-term outlook is very positive - if Tesla maintains its leadership in EVs and autonomy, Tesla stock price could continue rising for the foreseeable future.