Tesla, Inc. (NASDAQ: TSLA) is a company that consistently captivates investors and the general public alike, with its innovative electric vehicles (EVs), advancements in AI and software, and ambition to revolutionize the energy and transportation sectors.

Financial Performance

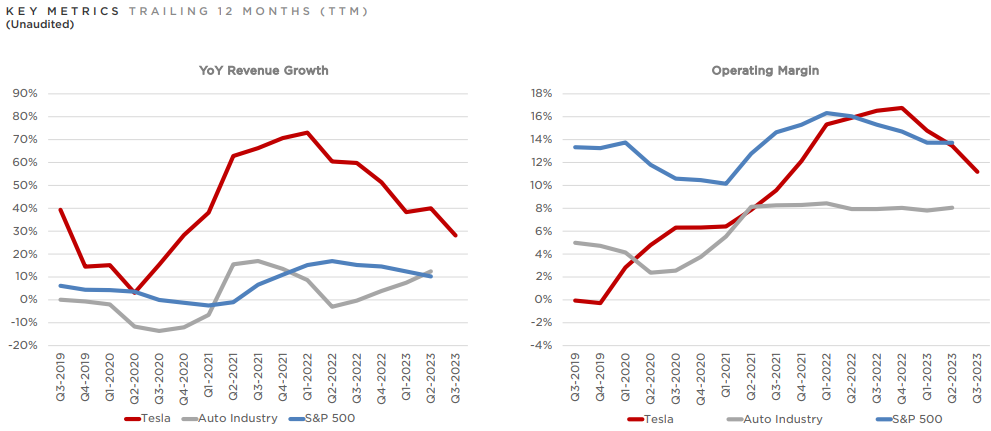

Revenue Growth: Tesla's Q3 2023 revenue of $23.4 billion represents a 9% YoY growth. This growth can be attributed to higher vehicle deliveries, including new factories' contributions, and diversification into other segments of the business. However, the positive momentum is partially offset by a reduced average selling price (ASP) YoY, excluding FX impact, and a $0.4 billion negative FX impact. It's crucial for Tesla to maintain or enhance revenue growth to sustain its valuation.

Operating Income: Tesla's Q3 operating income decreased to $1.8 billion, yielding a 7.6% operating margin. Several factors have impacted this metric negatively, including reduced ASP due to pricing and product mix, an increase in operating expenses related to projects like Cybertruck and AI development, costs tied to production ramp, and negative FX impacts. Tesla should work on cost optimization and maintaining profit margins as it expands.

Cash Position: Tesla reported $26.1 billion in cash, cash equivalents, and investments at the end of Q3 2023. This marks a $3.0 billion sequential increase, driven by financing activities and free cash flow generation of $0.8 billion. A robust cash position is crucial for Tesla's expansion plans and R&D investments, and it's vital to track this metric for liquidity and capital allocation insights.

Source: Q3 Quarterly Update Deck

Production and Expansion

Gigafactory Texas: Tesla's plan to initiate pilot production of the Cybertruck and deliver it this year is a significant milestone. Gradual growth in Model Y production in Texas is planned, as the supply chain is optimized cost-effectively. Furthermore, the production of the higher density 4680 cell is on track, and capacity expansion for cathode production and lithium refining in the U.S. is ongoing. This expansion is integral to meeting global demand and reducing costs.

Gigafactory Shanghai: The Shanghai factory has been operating at near full capacity for several quarters, a sign of successful international expansion. Tesla's expectation of maintaining production run rates is essential for capturing Asian and global markets. Shanghai serves as a key export hub, solidifying its strategic importance.

Gigafactory Berlin-Brandenburg: Model Y's continued success as the best-selling vehicle in Europe underscores the importance of this factory. Like in Texas, a gradual production ramp-up is planned. Europe represents a massive EV market, and Tesla's ability to cater to it is crucial.

AI and Software Development

AI Development: Tesla's heavy focus on AI development, especially in the context of safe real-world application, is key to enhancing its EVs' autonomous capabilities. The investment in a massive supercomputer to accelerate AI development is significant. Tesla should continue to leverage its extensive vehicle fleet to gather anonymized data for improving Full Self-Driving (FSD) features.

Vehicle and Other Software

Customer Experience: Enhancements to Tesla's app for renters using its vehicles through Hertz are commendable. These features, such as keyless entry and preconditioning, offer customers a seamless experience. The redesign of the in-app service experience, allowing for scheduling, tracking service, and making payments, should lead to greater customer satisfaction and loyalty.

Battery, Powertrain & Manufacturing

Cost Optimization: Despite macroeconomic challenges and factory shutdowns in Q3, Tesla has maintained an average vehicle cost of approximately $37,500. The pursuit of further cost reduction is integral to remaining competitive in the EV market. The adoption of an 800-volt architecture for the Cybertruck is a promising development that can lead to cost savings and performance improvements.

Energy Storage

Deployment Growth: Tesla reported a remarkable 90% YoY increase in energy storage deployments in Q3. This achievement is linked to the ramp-up at the Megafactory in Lathrop, CA. Tesla's continued focus on energy storage is aligned with global trends toward renewable energy sources.

Solar

Challenges in Solar: Solar deployments witnessed a decline on both sequential and YoY bases. External factors, such as high interest rates and changes in net metering regulations in California, have created challenges for the solar business. Tesla must adapt to overcome these headwinds and remain competitive in the solar market.

Services and Other Business

Core Drivers of Growth: Tesla's Services and Other business segments, including Supercharging, insurance, and body shop & part sales, have been core drivers of profit growth. The profitability of pay-per-use Supercharging, even with capital expenditure scaling, is noteworthy. Tesla's commitment to expanding Supercharging capacity and management to accommodate other OEMs is strategic.

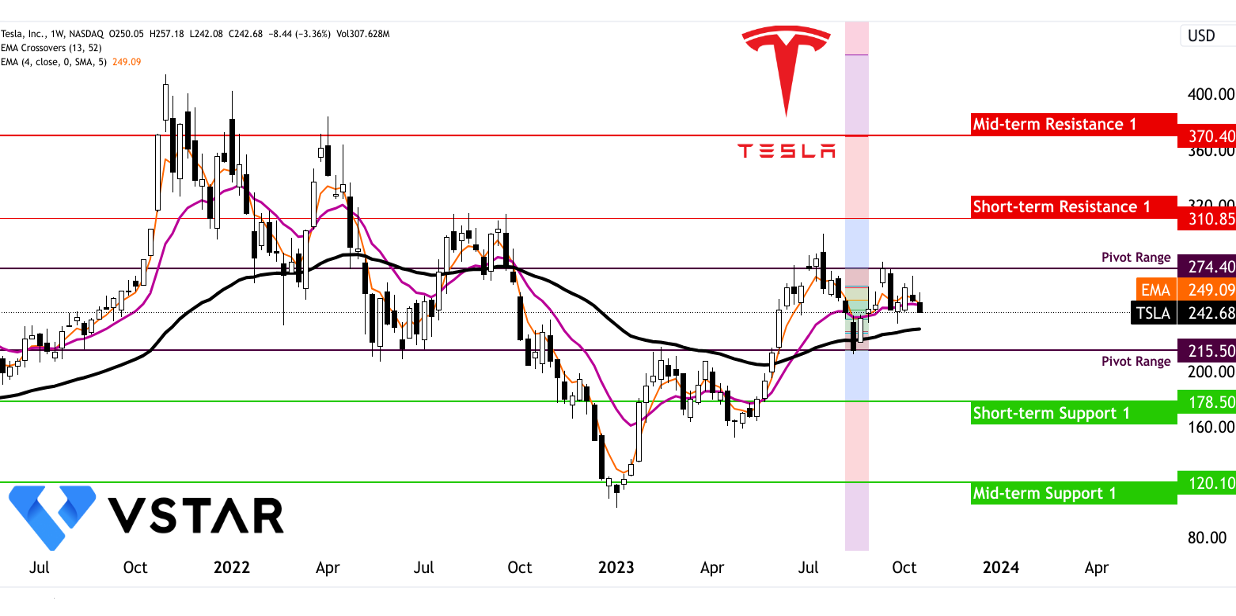

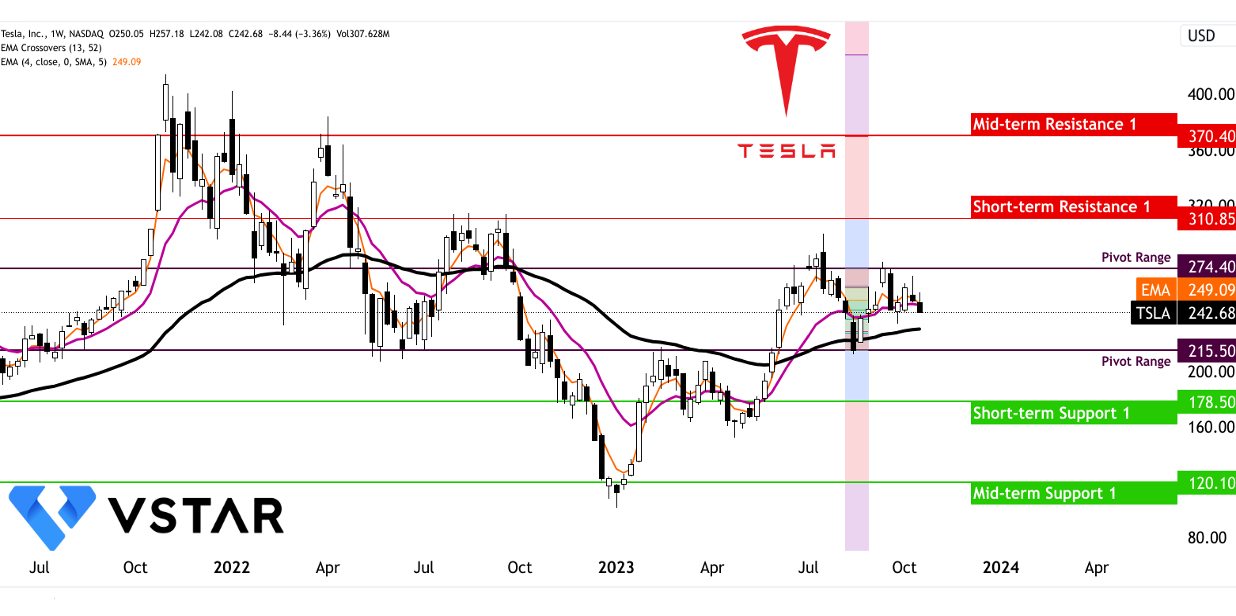

The technical perspective on the weekly price moves of Tesla stock can be comprehended as follows:

Source: tradingview.com