作為一家公司,Tilray Inc 處於令人羨慕的地位。它是當前頗具爭議的大麻市場的先行者,現在擁有一系列有價值的品牌和願意的消費者基礎。通過以8500萬美元現金收購百威英博的8個飲料品牌,Tilray將成為美國第五大精釀啤酒公司,為公司提供了更大的增長空間。那麼,現在是購買 Tilray 股票的好時機嗎?

Tilray 每個季度仍然在燒錢,其股價在過去三年中下跌了 70%。Tilray 在現在競爭激烈的市場中繼續面臨挑戰,而且似乎不會很快好轉。然而,Tilray 可能是贏家,但仍需要更多時間來成長。

Tilray的背景

該公司由 Brendan Kennedy 於2013年創立,是一家大麻和消費品公司,其主要總部位於美國,但在加拿大、新西蘭、澳大利亞和拉丁美洲開展業務。

2018年,它成為第一家在美國主要證券交易所納斯達克公開交易的大麻公司,IPO價格為17美元,並獲得了貝萊德公司、瑞士國家銀行、ETF Managers Group、Vanguard Group等機構投資者的大部分投資、和薩斯奎哈納國際集團有限公司。同年,Tilray 實現了另一個里程碑,成為第一家將產品運送到美國的加拿大大麻公司,並最終與諾華子公司 Sandoz 簽署了一項協議,在全球範圍內分銷醫用大麻。儘管該行業有更多的大麻公司,但它仍然是最重要的參與者之一,並且在首席執行官歐文·大衛·西蒙(Irwin David Simon) 的領導下,正在增加其在葡萄牙和德國的業務。

資料來源:MarketWatch

商業模式和服務

Tilray 專注於 4 個核心業務領域:大麻業務、分銷、健康業務和酒精飲料。它直接向客戶銷售產品,還擁有零售商、批發商、醫院、藥房、醫生、政府和研究人員等其他客戶。

為了擴大和改善多元化,Tilray 專注於積極收購。它收購了 Aphria 和 Hexo 等一些主要競爭對手,以及 The Batch、Good Supply 和 Sweet Water 等其他感興趣的公司。通過收購這些業務以及大麻在美國可能合法化,Tilray 計劃到 2024 年實現 40 億美元的年收入。

產品與服務

Tilray 通過銷售和分銷醫用和成人大麻建立了自己的地位。然而,多年來,其產品範圍已大大擴展。該公司現在向客戶購買和轉售藥品,其中包括作為其健康品牌一部分的健康產品。但 Tilray 仍在通過涉足酒精業務來進一步實現其投資組合多元化。

資料來源:Business Wire

財務和增長指標

現在,讓我們來看看Tilray Brands的財務狀況。憑藉著18.5億美元的市值,Tiray Inc仍然是一家相對有價值的公司。然而,它的財務狀況並不像我們期望的那麼強大。在最近五月份的盈利電話會議之後,Tilray實現了1.8419億美元的收入,但淨利潤卻達到了-1.3871億美元。其凈利率為-75.31%,但這已經是一個顯著改善了,考慮到二月份時曾達到-804.32%。其營業收入也有所改善,從-8,718萬美元增加至-2,450萬美元。

此外,Tilray 今年的總資產增長率下降了 19.30%,目前為 44 億美元。然而,它仍然平衡了負債和股東權益,分別為10.7億美元和33.3億美元。儘管有一些改進,但 Tilray 可能還需要一段時間才能實現盈利。

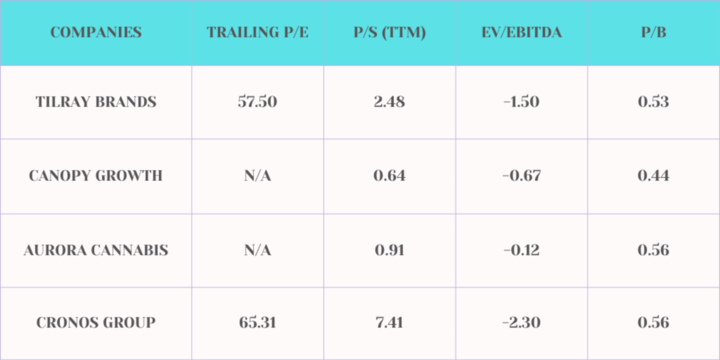

Tilray 被低估了嗎?

讓我們將其與一些最強大的競爭對手進行比較:

根據其關鍵指標和財務狀況,Tilray 的估值合理,但具有巨大的利潤潛力。

Tilray 股票表現

1. 交易信息

主要交易所和股票代碼:NASDAQ: TLRY

交易時間:投資者可以在盤前(東部時間上午 4:00 - 上午 9:30)和盤後市場(東部時間下午 4:00 - 晚上 8:00)交易 TLRY 股票。

股票分割:無

股息:無

2. 股票表現

至少可以說,Tilray 的股票表現就像過山車一樣。 Tilray 於 2018 年 6 月在納斯達克證券交易所以每股 17 美元的價格首次公開募股後,引起了廣泛關注,11 月漲幅超過 120% 至每股 214 美元。到 2019 年 8 月,興趣逐漸減弱,交易價格為 29 美元。從那時起,Tilray 的股價一直呈螺旋式下降。

Tlry 股價目前交易價格為2.63 美元,自IPO 以來,投資者儘管在2021 年向大麻行業投入了大量資金,但開始遠離大麻行業,股價已下跌88.59%。戈登·約翰遜(Gordon Johnson) 等一些分析師表示,Reddit 股價上漲推動了Tilray 的增長。不能持有的雜草庫存。

該公司盈利能力不足以及管理層的一些決策也引發擔憂。例如,在有消息傳出該公司定價了價值 1.5 億美元的可轉換優先票據後,TLRY 股價 5 月份又暴跌 21.2%。

儘管如此,還是有一些積極的一面。在財務報告改善以及與 Anheuser-Busch 達成交易的消息傳出後,該股上個月上漲了 58% 以上。然而,尚不清楚這是否會在今年剩餘時間內維持增長。

3. Tilray 2023年股價預測

Tilray 股票分析表明,儘管多次嘗試推高,但該股仍處於下跌趨勢。

其關鍵支撐位和阻力位仍為 2.46 美元至 2.78 美元,但如果大麻行業如預期改善,今年可能會走高。不過,分析人士並沒有抱太大希望。 TD Cowen、Alliance Global Partners 和 Piper Sandler 等專家降低了對 Tilray 股票的預期,並維持中立立場。現在是一個大問題:我應該購買 Tilray 股票嗎?目前,這是不可取的。根據 18 名分析師對 Tilray 股票的評級,13 名分析師認為持有,5 名分析師認為買入,這意味著您應該在此期間暫緩持有。

Tilray 股價目標

如果該公司今年確實有所改善,分析師設定的最高估計為 4.25 美元,最低估計為 1.90 美元,平均價格為 2.68 美元。 Tilray 2023 年的股票預測不太樂觀。

風險與機遇

風險

- 不存在的增長: Tilray 正在進行有價值的收購,但其盈利卻出現虧損。其運營淨利潤和營業收入分別為-1.3871億美元和-2450萬美元。由於這些挑戰,TLRY 股票預測也不樂觀。這對於那些可能不想投資一家不賺錢的公司的成長型投資者來說很重要。

- 收購糟糕的公司:並非所有收購都是好的。例如,Hexo 已經在虧損,並且不再像收購之前那樣重要。

- 激烈的競爭: Tilray 面臨來自 Canopy Growth 、 CV Sciences 、 Canndescent 和 Aurora Cannabis 等其他公司的競爭。加拿大競爭局還建議審查大麻加工,以鼓勵該行業的更多競爭。

機會

- 大麻市場正在改善:由於大麻市場開始從長期低迷中復蘇,Tilray 的收入和增長可能會回升。它控制著加拿大13%的市場,現在政府正在重點放寬監管,它的銷量將會回升。這是 Tilray 2025 年股票預測相對積極的原因之一,因為投資者預計市場將出現重大改善。

- 改善酒精業務的銷售:在過去的幾年中,大麻製造商對多元化的關注已獲得回報,特別是在酒精飲料市場。其最新的收購是未來幾年酒類年銷售額達到 3 億美元計劃的一部分。

- 市場領導者: Tilray 仍然在加拿大大麻市場佔據領導地位,這使其比其他競爭對手更具優勢。

Tilray 的增長動力

德國休閒大麻合法化

德國內閣最近通過了一項法案,使娛樂性大麻的使用合法化。這是歐洲最自由和最具爭議的大麻法,可能會影響各國的更多法規,這對 Tilray 來說是個好消息。收購 Aphria 後,它成為德國大麻市場的主要參與者,佔據 20% 的市場份額。

來源:TimeOut

最近的精釀啤酒廠優惠

Tilray 收購精釀啤酒品牌後,股票前景變得更加樂觀。分析師認為這是一項戰略舉措,有助於推動多元化,同時提高盈利潛力。現在,Tilray 已成為美國第五大精釀啤酒公司,預計未來將實現大幅增長。

美國加強監管

在聯邦層面,大麻仍然是非法的,但這種趨勢可能很快就會改變。 23 個州和華盛頓特區現已將娛樂性大麻合法化,從而使 Tilray 在美國市場加速增長。

Tilray 的未來展望

那麼, Tilray 是一隻值得買入的好股票嗎?儘管作為一家大麻製造商,Tilray 目前正在努力實現盈利,但它仍在製定計劃,到2024 財年達到預計的40 億美元年銷售額。儘管聯邦大麻合法化還遙遙無期,但這家大麻公司已經給自己設定了一個目標:當通過投資 MedMen 發生這種情況時,可以獲得相當大的曝光量。此外,它還通過與 Pharmaidea 合作,進一步拓展歐洲市場。其醫用大麻部門 Tilray Medical 和 FL Group 已獲得意大利衛生部的許可,可以分銷新的醫用大麻化合物。

來源: CannaReporter

但有一些事情值得懷疑。

由於拜登政府尚未表現出任何渴望,美國大麻合法化可能不會很快發生。如果總統席位落入共和黨人手中,由於該黨在毒品問題上的強硬立場,這可能會更加困難。

此外,尚不清楚未來五年歐盟或其他國際市場的大麻市場是否會出現顯著增長,因為法案往往需要很長時間才能通過成為法律。加上 Tilray 迄今為止進行的收購,該公司可能會在一段時間內保持虧損狀態,而不斷增長的運營成本可能會使其更加難以恢復。

為什麼交易者應該考慮 TLRY 股票

Tilray 股票可能對長期投資者沒有吸引力,但在最近的市場走勢之後,交易員可以從中獲利。

在與 Anheuser-Busch 達成交易後,Tilray 股價在過去一個月上漲了 60.25%,該交易可能會在今年剩餘時間內推動 Tilray 股價上漲。 Tilray 股票在報告收入增長 26.51% 後,也從最近的收益報告中獲得了一些動力。此外,Tilray 的波動性更大,過去 3 個月每週波動 +/- 16%。這為交易者提供了充分的機會來獲取短期收益並從股票中獲利。

但為了充分利用 TLRY 股票交易,交易者依賴以下策略:

- 燭台模式交易策略:交易者依靠價格圖表進行交易,而燭台是最喜歡使用的圖表之一。燭台交易策略使用由一根或多根燭台形成的燭台模式來告知接下來將發生什麼。例如,當錘子燭台圖案像此圖表中那樣出現在圖表上時,表明存在潛在的下降趨勢。

- 布林線策略:考慮到 Tilray 股票的波動性,交易者使用布林線來監控突破並確定股票是否超買或超賣。它使用簡單,但必須與其他指標一起使用,因為它只關注價格和波動性而忽略其他標準。

使用布林線時的基本規則是,當價格穿過上軌線或保持在中線和上線之內時,交易者可以開買倉。然而,如果價格觸及下軌,則趨勢正在失去力量,並且可能會發生逆轉。

- 移動平均線策略:移動平均線或 MA 是最流行的技術指標之一,交易者可以使用簡單、指數或加權 MA 進行交易。

在 TLRY 價格圖表上使用 MA 的最簡單方法是指示趨勢變化。例如,當價格高於移動平均線時,表明潛在的上升趨勢,而低於移動平均線則表明可能發生下降趨勢。

- 差價合約交易:差價合約交易是交易者從 Tilray 等快速流動資產中賺錢的另一種流行方式。通過差價合約,交易者無需持有 TLRY 股票即可推測價格變動。然而,它如此受歡迎的原因是,即使投資額很小,交易者也可以利用槓桿來最大化他們的頭寸。如果您的賬戶中有 1000 美元,您可以使用 1:100 的槓桿進行最多 100,000 美元的交易。此外,與傳統股票交易相比,差價合約的成本更低,並且在交易規模和執行方面具有更大的靈活性。然而,要充分受益於差價合約交易,您需要與合適的經紀商進行交易,讓您能夠使用可最大化每筆交易的功能和工具。

在VSTAR 交易 TLRY 股票差價合約

交易 TLRY 股票差價合約是一種利用波動性股票獲利的方式,而 VSTAR 為您提供了一種簡單便捷的方式來增加您的利潤潛力。它配備了每日市場報告、經濟日曆、交易信號和其他交易工具,以進行 Tilray 股票技術分析並在競爭市場中做出決策。

如需有關不同市場的更多信息和知識,VSTAR 提供廣泛的教育資源,例如文章和播客,提供改變市場遊戲規則的分析。

結論

Tilray 股票是一項不錯的長期投資嗎? Tilray 變得更加多元化,但投資它仍然風險很大。該公司在實現盈利之前仍需應對許多挑戰,我們將不得不等待,看看該公司在下一個 Tilray 股票收益日是否仍在改善。如果其不同業務都能盈利,那麼其長期前景將會改善。

*免責聲明:本文內容僅供學習,不代表VSTAR官方立場,也不能作為投資建議。