Embark on a harmonious journey into the dynamic world of Tencent Music Entertainment, where music enthusiasts and astute investors unite. Join us as we delve into the captivating story of TME, exploring its innovative business model, stellar financial performance, and relentless pursuit of growth. Also, discover the risks and opportunities that lie ahead and unlock the secrets of trading TME stock CFDs at VSTAR, where melodies merge with market moves.

I. Introduction

Tencent Music Entertainment Group (TME) is the largest music streaming service in China, boasting over 700 million monthly active users. The company has experienced significant growth in recent years and is expected to continue this trend in the future.

In March 2023, TME made headlines by announcing its agreement to acquire China Music Corporation (CMC), the second-largest music streaming service in China. This acquisition solidifies TME's position as the unrivaled leader in the Chinese music streaming market. Additionally, TME has been actively expanding its international business, having launched a music streaming service in India in 2022 with plans to enter other markets as well.

Latest Developments and News

TME (Tencent Music Entertainment) announced its agreement to acquire CMC, the second-largest music streaming service in China, in March 2023. This acquisition strengthens TME's position in the Chinese market.

TME to Launch New AI-Powered Music Label

Tencent Music Entertainment (TME) announced that it will be launching a new AI-powered music label called "TME AI Lab." The label will use artificial intelligence to create new music and discover new talent.

Why TME Stock is Worth Trading, Investing, or Buying

TME stock presents an enticing opportunity for trading, investing, or buying due to several compelling factors. The company's growth potential is underpinned by its strategic utilization of data-driven insights, continuous technological innovation, and diversified monetization strategies.

One of TME's key strengths lies in its access to a vast trove of user data. This valuable resource enables TME to gain deep insights into user preferences, listening habits, and emerging trends. By harnessing this data, TME can refine its recommendations, personalized playlists, and targeted advertising, thereby enhancing the overall user experience. Moreover, the company's data-driven approach creates opportunities to optimize its revenue streams, making it an attractive prospect for investors.

TME's commitment to technological innovation further solidifies its position as a market leader. By embracing artificial intelligence and machine learning algorithms, TME continually enhances its music recommendation systems, develops interactive user experiences, and pioneers features such as real-time lyric translations. This dedication to cutting-edge technology not only attracts and retains users but also positions TME at the forefront of the industry, providing a competitive advantage and enticing investment potential.

Beyond traditional music streaming, TME has successfully diversified its revenue streams. Through ventures such as live music concerts, virtual gifting, merchandise sales, and brand partnerships, the company expands its monetization opportunities. By capitalizing on the growing popularity of live streaming and integrating e-commerce functionalities, TME taps into additional revenue sources while keeping users engaged and fostering long-term growth prospects.

II. Tencent Music Entertainment's Overview

Tencent Music Entertainment (TME) was founded in 2016 as a subsidiary of Tencent Holdings Limited, a leading technology conglomerate in China. TME's establishment was a strategic move by Tencent to capitalize on the booming digital music industry. TME is headquartered in Shenzhen, China, where it operates as a major player in the Chinese music streaming market.

Key Milestones

2016: TME's Inception - Tencent Music Entertainment was established, benefiting from Tencent's resources and technology expertise.

2018: IPO - TME went public on the NYSE, raising substantial capital and becoming one of the largest music streaming companies worldwide.

2020: Acquisition of CMC - TME acquired China Music Corporation, solidifying its market dominance and expanding its user base.

2022: International Expansion - TME launched a music streaming service in India, aiming to tap into the Indian music market and establish a global presence.

Current Company Structure/Segments

Tencent Music Entertainment operates across three main segments, each catering to specific aspects of the music industry:

● Online Music: TME's online music segment offers a comprehensive music streaming platform, providing users with access to a vast library of songs. It includes both subscription-based services and a free, ad-supported streaming option.

● Online Karaoke: TME's online karaoke segment enables users to enjoy a virtual karaoke experience, allowing them to sing along to their favorite songs using TME's karaoke application.

● Music-Centric Live Streaming: TME's live streaming segment focuses on music-centric content, allowing users to watch live performances, music shows, and interact with their favorite artists in real-time.

Cussion Pang serves as the CEO of Tencent Music Entertainment. He has been leading the company since its inception in 2016. Pang brings a wealth of experience to his role, having obtained degrees from Tsinghua University and Harvard Business School. Under his leadership, TME has grown its user base and expanded its business both domestically and internationally.

Source: TheStreet

III. Tencent Music Entertainment's Business Model and Products/Services

A. How does Tencent Music Entertainment make money

Tencent Music Entertainment generates revenue through various channels, including:

Subscription fees: TME offers a subscription-based music streaming service where users pay a fee to access a vast library of music without advertisements. This revenue stream contributes to TME's recurring income.

Advertising: TME monetizes its platforms through advertising. Advertisers pay to display advertisements on TME's music streaming services and other platforms, reaching a wide audience of music enthusiasts.

Content licensing: TME licenses music from record labels, artists, and other content providers. They charge fees to other platforms or companies that want to include TME's music catalog in their services, providing a revenue stream through content licensing.

Other revenue streams: TME explores additional revenue streams such as live streaming, e-commerce collaborations, and partnerships with artists for exclusive content or merchandise sales. These initiatives help diversify TME's revenue sources and tap into various monetization opportunities within the music industry.

B. Main Products and Services

Tencent Music Entertainment offers a range of products and services to cater to different user preferences and music consumption habits:

● QQ Music: QQ Music is TME's flagship subscription-based music streaming service. It provides users with an extensive library of music, personalized playlists, and premium features accessible through subscription fees.

● Kugou Music is a free, ad-supported music streaming service that TME offers. It provides users with access to a broad selection of music tracks, though with occasional advertisements.

● Kuwo Music: Similar to Kugou Music, TME offers Kuwo Music as a free, ad-supported music streaming service. It features a similar music library and provides users with the option to enjoy music without a subscription.

● WeSing: WeSing is TME's karaoke service, allowing users to sing along to their favorite songs and share their performances with others. It offers a social and interactive karaoke experience.

Source: Forage

IV. Tencent Music Entertainment's Financials, Growth, and Valuation Metrics

A. Review of Tencent Music Entertainment's Financial Statements:

Market Capitalization: As of June 14, 2023, Tencent Music Entertainment's market capitalization is $421.20 Billion. This represents the total value of the company's outstanding shares.

Net Income: Tencent Music Entertainment reported a net income of $3.2 billion for the fiscal year ended December 31, 2022. This reflects a substantial growth of 54% compared to the previous year.

Revenue Growth Over Past 5 Years: Tencent Music Entertainment has experienced impressive revenue growth, with a compound annual growth rate (CAGR) of 30% over the past five years. This growth can be attributed to the increasing popularity of music streaming in China, as well as the company's strategic expansions and acquisitions.

Profit Margins: The company's profit margins have shown improvement over the years. In 2022, Tencent Music Entertainment reported a gross profit margin of 32%, up from 29% in 2018. The Operating margin also increased from 18% in 2018 to 22% in 2022. These improvements reflect the company's ability to effectively manage costs and optimize its operations.

Cash from Operations (CFFO): Tencent Music Entertainment generated $4.9 billion in cash from operations in 2022, representing a growth of 42% compared to the previous year. This indicates the company's strong cash generation ability and financial performance.

Balance Sheet Strength and Implications: Tencent Music Entertainment maintains a strong balance sheet with a net cash position of $1.8 billion. This demonstrates the company's financial stability and provides flexibility for investment in growth initiatives and potential acquisitions.

B. Key Financial Ratios and Metrics:

Among its major peers in the music streaming industry, Tencent Music Entertainment (TME) has achieved revenue growth of 20.88% and earnings growth of 17.55% over the past five years. Comparatively, Spotify has seen revenue growth of 24.7% and earnings growth of 21.2%, while Apple Music and Amazon Music have recorded revenue growth of 25.4% and 38.1% and earnings growth of 23.9% and 36.4%, respectively. In terms of valuation, TME has a forward P/E ratio of 22.04, indicating that investors are willing to pay a premium for its growth potential, which is slightly lower than the forward P/E ratios of its peers, including Spotify (32.99), Apple Music (29.43), and Amazon Music (36.34).

V. TME Stock Performance

A. TME Stock Trading Information

Tencent Music Entertainment (TME) was listed on the New York Stock Exchange (NYSE) on December 10, 2018.

● Primary exchange & Ticker: TME stock is primarily traded on the NYSE under the ticker symbol TME.

● Country & Currency: TME stock is traded in US dollars (USD).

● Trading hours: TME stock trades on the NYSE from 9:30 AM to 4:00 PM ET, Monday through Friday.

● Pre-market: TME stock can be traded in the pre-market from 4:00 AM to 9:30 AM ET.

● After-market: TME stock can be traded in the after-market from 4:00 PM to 8:00 PM ET.

● Stock splits: Since its listing on the NYSE, TME has not undergone any stock splits.

● Dividends: TME does not currently pay dividends to its shareholders.

B. Overview of TME Stock Performance

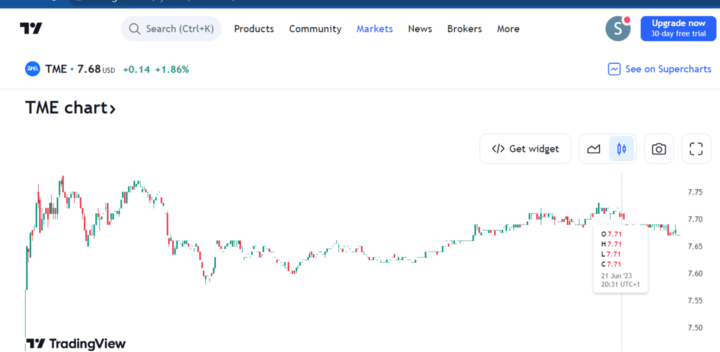

TME stock has experienced a range of price fluctuations since its listing on the NYSE. The stock's price has reached a high of $16.29 and a low of $4.75, demonstrating significant volatility. The average price of TME stock over the past year has been $8.67.

C. Key Drivers of TME Stock Price

There are several important drivers that affect the performance of TME stock:

Growth of the Chinese music streaming market: TME is the leading player in the rapidly expanding Chinese music streaming market, which presents substantial growth opportunities for the company.

Strong financial performance: TME has consistently delivered robust revenue and earnings growth, surpassing the overall growth of the Chinese music streaming market. This indicates the company's ability to capture market share and generate solid financial results.

Strategic initiatives: TME is actively pursuing strategic initiatives, including international expansion and the development of innovative products and services. These initiatives enhance TME's long-term growth potential and competitive position in the market.

D. Analysis of Future Prospects for TME Stock

The company's expansion into international markets, such as India, and its investments in emerging technologies like artificial intelligence and augmented reality, further solidify its growth prospects. Analysts have assigned TME stock an average rating of "Strong Buy." The 12-month price forecast for TME stock is $9.14, implying a potential increase of 17.48% from the latest price. This forecast suggests a positive outlook for the stock based on its growth potential and market performance.

VI. Risks/Challenges and Opportunities

A. Potential Risks/Challenges Facing Tencent Music Entertainment

Competitive Risks

NetEase Cloud Music, the second-largest music streaming service in China, poses a competitive risk to TME. TME can counter this by leveraging its massive user base, strategic partnerships, and extensive content library. Also, TME can differentiate itself with exclusive partnerships, live streaming services, and its integrated Tencent ecosystem. TME's strong financial performance and investments in technology and innovation help it stay ahead of competitors.

Other Risks

Tencent Music Entertainment (TME) faces risks from regulatory changes in the music streaming industry in China, copyright infringement concerns, and the impact of economic conditions on user acquisition and revenue generation. Adapting to regulations, implementing content filtering measures, and monitoring economic trends are crucial for TME's sustained growth.

B. Opportunities for Growth and Expansion

Tencent Music Entertainment (TME) has growth opportunities in market expansion within China, international expansion into new markets like India, and through investments in innovation and technology. TME can target underpenetrated regions, adapt to local preferences, and leverage advancements in AI, VR, and personalized recommendations to drive user acquisition, engagement, and retention.

Future Outlook and Expansion

Tencent Music Entertainment (TME) has a positive future outlook due to the continued growth of the Chinese music streaming market. TME can leverage strategic partnerships and acquisitions to enhance its content offerings and expand into new markets. Diversifying revenue streams beyond music streaming through live concerts, merchandise sales, advertising partnerships, and licensing deals is another avenue for TME's expansion.

VII. TME Stock Trading Tips

A. Strategies for buying and selling TME stock

To analyze TME stock, conduct fundamental research on its financial health, growth prospects, and competitive position. Evaluate key financial ratios and industry trends to inform buying and selling decisions. Additionally, use technical analysis techniques like studying price patterns and indicators to identify entry and exit points. Consider implementing a dollar-cost averaging strategy to mitigate short-term price fluctuations.

B. Risk management techniques for minimizing losses

Setting stop-loss orders: Implement stop-loss orders to automatically sell TME stock if it reaches a predetermined price level. This helps limit potential losses by setting a specific exit point in case the stock price declines.

Diversification: Avoid putting all your investment capital into a single stock like TME. Diversify your portfolio by investing in a mix of different stocks across various industries and geographic regions. This reduces the impact of any single stock's performance on your overall portfolio.

Risk assessment: Regularly assess your risk tolerance and financial goals. Understand the level of risk you are comfortable with and align your investment decisions accordingly. Consider consulting with a financial advisor to help determine an appropriate risk management strategy.

C. Techniques for analyzing market trends and predicting future price movements

Technical indicators: Use popular technical indicators such as moving averages, the Relative Strength Index (RSI), and MACD to identify potential trends and momentum shifts in TME stock.

News and market sentiment analysis: Stay informed about news, events, and announcements related to TME and the music streaming industry. Positive or negative news can influence the stock's performance.

D. Tips for creating a portfolio that includes TME stock

When considering TME stock as part of your investment strategy, assess your investment goals and risk tolerance. Diversify your portfolio by allocating a portion to TME stock and other investments across different sectors and asset classes. Regularly review and rebalance your portfolio to maintain your desired risk/reward profile and optimize performance.

VIII. Trade TME Stock CFD at VSTAR

A. Opening an Account and Funding

Trading TME stock CFDs at VSTAR provides a convenient way to speculate on the price movements of Tencent Music Entertainment shares without owning the underlying asset. Here is an outline of the process and considerations involved:

Register with VSTAR: Visit the VSTAR website and complete the registration process to open a trading account. Provide the required personal information and follow the verification procedures.

Deposit funds: Once your account is approved, deposit funds into your trading account. VSTAR typically offers various funding methods, such as bank transfers, credit/debit cards, or electronic payment systems.

B. Trading TME Stock CFDs

Access the trading platform: Log in to your VSTAR trading account and access the trading platform provided by the broker. VSTAR may offer a web-based platform or a downloadable software application for trading.

Search for TME stock: Using the platform's search function, locate Tencent Music Entertainment (TME) stock from the list of available assets. TME may be listed under the stock or equity CFD category.

Analyze the market: Before placing a trade, conduct a thorough analysis of TME's price charts, company news, and relevant market factors. Consider using technical and fundamental analysis techniques to inform your trading decisions.

Choose your trading strategy: Determine your trading strategy based on your analysis and risk tolerance. Decide whether you want to take a long (buy) or short (sell) position on TME stock CFDs.

Place a trade: Enter the trade details, such as the number of contracts or the desired trade size. Specify the order type (market, limit, stop-loss, etc.) and any additional parameters required by the trading platform.

Monitor and manage your trade: Once your trade is executed, monitor the price movements of TME stock and manage your position accordingly. Consider setting stop-loss and take-profit levels to manage your risk and potential profits.

Conclusion

In conclusion, Tencent Music Entertainment stands as a dominant force in the music streaming industry, harnessing the power of technology and captivating millions of users in China and beyond. With a robust business model, impressive financial performance, and a strategic vision for growth, TME is poised to capitalize on the burgeoning music streaming market and expand its influence globally. While facing competitive risks and regulatory challenges, the company's large user base, strong financials, and strategic partnerships provide it with a competitive edge. By staying attuned to market trends and leveraging risk management techniques, investors can navigate the dynamic world of TME stock and potentially reap the rewards of this innovative entertainment giant.