With the growing popularity of electric vehicles, Lucid Group Inc. has emerged as a strong contender in the automotive industry. As the maker of the highly rated Lucid Air, the company has garnered significant attention from investors and traders alike. But is Lucid Stock (LCID) a good investment opportunity? In this comprehensive analysis, we'll take a closer look at the company's financials, market position, and growth potential to see whether the stock is worth investing in.

Lucid Group is a technology, and automotive company focused on designing, developing, manufacturing, and selling electric vehicles (EV), EV powertrains, and battery systems. The company is focused on creating sustainable transportation solutions through advanced technology and engineering expertise.

Lucid has been in the news lately due to the release of its flagship vehicle, the Lucid Air, and its successful merger with Churchill Capital Corp. IV. As a result, many investors and traders are interested in investing in Lucid Stock (LCID) and want to know if it's a good investment opportunity.

Company Overview

Lucid Group is a technology and automotive company founded in 2007 by Bernard Tse, Sam Weng, and Shih-Chung Chou. The company's headquarters is located in Newark, California, United States. Peter Rawlinson is the current CEO of Lucid Motors.

Lucid Group's financials have been progressively improving though with some setbacks like negative net income. As of April 14, 2023, the company's market capitalization was $14.1 billion, with approximately 1.8 billion shares outstanding. In terms of net income, Lucid Group reported earnings of $-1.51 per share on February 22, 2023, for the 2022 fiscal year. While Lucid Group has yet to make much profit, it's crystal clear that the company’s project is moving in the right direction and the fundamentals are solid.

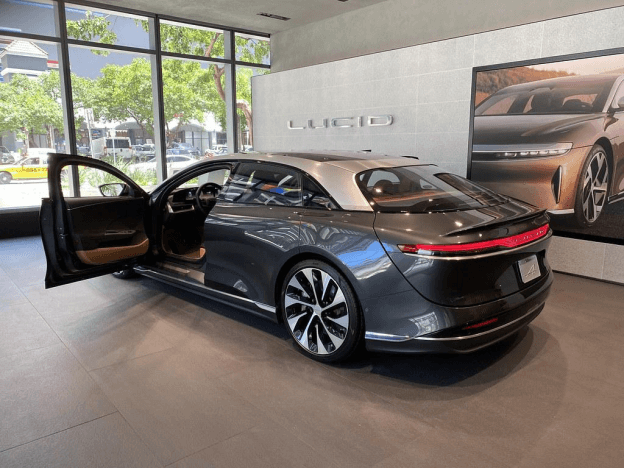

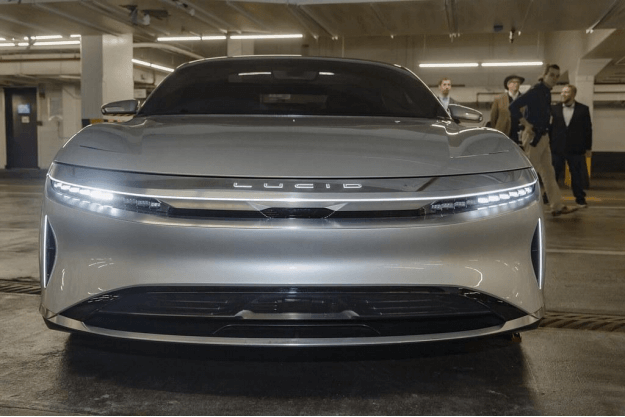

Regarding industry and products/services, Lucid Group primarily focuses on the design, development, and manufacturing of luxury electric vehicles. The company's latest vehicle, the Lucid Air, is an electric sedan that is redefining the luxury car segment and the electric vehicle space. It is currently one of the most powerful EVs in the world, with the world’s longest driving range, upscale styling, and superb interiors.

Lucid Group's leadership team comprises experienced executives and industry experts who bring a wealth of knowledge and expertise to the company. Peter Rawlinson, the company's CEO and CTO, is a former chief engineer at Tesla who oversaw the development of the Model S. Rawlinson's leadership and technical expertise have been instrumental in developing the Lucid Air and the company's overall success.

Other key members of Lucid Group's leadership team include Sherry House, the Chief Financial Officer with over 25 years of experience in finance and accounting, and Derek Jenkins, the Vice President of Design, who previously worked at Mazda and VW. The company's board of directors is also composed of experienced industry experts and business leaders, including Andrew Liveris, the Non-Executive Independent Chairman of the Board, who previously served as the CEO of Dow Chemical.

Under Peter Rawlinson's leadership, Lucid Group has successfully secured funding from various investors, including Saudi Arabia's Public Investment Fund, which invested $1.3 billion in 2018. This funding has allowed the company to build its manufacturing facility in Casa Grande, Arizona, where they recently produced the Lucid Air.

Key Financials

When evaluating the company as a potential investment opportunity, it is important to examine key financial metrics that indicate the company's overall health and potential for profitability.

Lucid currently has a negative gross margin, operating margin, and net profit margin. These figures suggest that the company's cost management could be improved, as its costs of goods sold and operational expenses are currently higher than its revenue generated from sales. Additionally, Lucid's negative P/E ratio and high P/S and P/B ratios indicate that the stock may be overvalued and not generating positive earnings per share.

Despite the company's negative profitability metrics, Lucid has experienced significant revenue growth in recent years, with a year-over-year growth rate of 415.51%. However, the company's negative earnings per share and lack of positive EPS growth suggest that it has not been able to effectively translate this revenue growth into profitability.

Examining Lucid's overall health, the company's debt-to-equity ratio is higher than the industry average, indicating a heavier reliance on debt financing.

It is also important to note that Lucid does not currently pay dividends, and there is no information on a potential future payout. Overall, while Lucid has shown promising revenue growth. The company's poor profitability figures and high valuation ratios, however, might make potential investors think twice before making an investment.

Production Capacity

Lucid Group has a state-of-the-art production facility in Casa Grande, Arizona. The facility spans over 590 acres and comprises four buildings: general assembly, body, paint, and battery modules.

Lucid Group's latest report shows that the company produced 3,493 vehicles in Q4, representing a 53% increase from the previous quarter. In 2022, the company had 7,180 vehicles, exceeding its annual production guidance of 6,000 to 7,000 cars.

The company has also provided its 2023 production guidance of 10,000 to 14,000 vehicles, indicating a significant increase in production capacity. Lucid's production capacity utilization is expected to improve as the company scales up its production and invests in its facilities and technology.

Growth Prospects

Growth Potential and Strategy

Potential growth opportunities in the EV industry are significant, given the ongoing shift towards electric mobility and the increasing demand for sustainable transportation. Lucid's growth and expansion strategy involves producing and delivering high-quality, luxury electric vehicles. Lucid aims to capture a considerable share of this growing market by leveraging its technology, design, and customer experience strengths.

Recent Developments

Lucid's current market share in the EV industry is relatively small, given its recent entry into the market. However, Lucid's market share in the luxury EV segment has been steadily growing, and the company is expected to continue gaining market share in the coming years. Lucid has a high projection for its market share, as the company is targeting a global market share of 10% in the luxury EV segment by 2030.

Recent developments in Lucid's business operations include several meaningful partnerships, collaborations, and acquisitions. In 2022, Lucid announced a partnership with LG Energy Solution to secure a long-term supply of lithium-ion battery cells for its vehicles. The company also acquired the EV charging network provider EVgo, which will help expand its charging infrastructure.

Future Services and Technology

Lucid is focused on developing and implementing cutting-edge technology in its vehicles. The company is investing in battery technology advancements, such as solid-state batteries, to improve the range and performance of its cars.

Other future technologies and services in development by Lucid include vehicle-to-grid (V2G) technology, which allows its vehicles to power the grid during periods of high demand. Lucid is also developing a subscription-based service model, offering customers a flexible and cost-effective way to access its vehicles.

Future Projections

Lucid's revenue and earnings projections are expected to grow in the coming years, driven by increased production and delivery of its electric vehicles.

Planned investments and capital expenditures are significant for Lucid, as it aims to expand its production capacity and global footprint. In 2022, Lucid announced plans to invest $2.6 billion in production facilities and infrastructure, which will help to increase its production capacity and expand its presence in key markets.

Future financial targets and goals for Lucid include the following:

● Achieving profitability in the near term.

● Increasing its global market share in the luxury EV segment.

● Investing in research and development to improve its technology and product offerings.

Risks and Challenges

Like any other business, Lucid faces various risks and challenges that could impact its growth and financial performance. Some of the risks and challenges facing Lucid include the following:

Regulatory Risks

As a player in the EV industry, Lucid is subject to various government regulations and policies that could impact its operations. Any changes in rules or policies related to environmental protection, tax incentives, subsidies, or tariffs could harm Lucid's business.

Competitive Risks

The EV industry is highly competitive, with major players like Tesla, Ford, General Motors, and Rivian all vying for market share. Lucid's success will depend on its ability to compete effectively against these established players and new entrants in the market.

Economic Risks

Supply chain disruptions, currency risks, trade policies, consumer sentiment, and global economic conditions are all factors that could affect Lucid's operations and financial performance.

Industry-Specific Risks

As a company operating in the EV industry, Lucid is exposed to specific risks related to the industry. These risks include technological advancements by competitors, the availability and cost of raw materials, changes in consumer preferences and behaviors, and potential safety concerns related to EVs.

Operational Risks

Lucid faces various operational risks, including production delays, quality control issues, supply chain disruptions, and cyber threats. Any of these risks could impact Lucid's operations and financial performance.

Financial Risks

Lucid's financial performance is subject to various risks, including interest rate, liquidity, and credit risks. Any changes in interest rates or credit markets could impact Lucid's ability to raise capital or service its debt.

Lucid's success will depend on its ability to effectively manage these risks and challenges while continuing to innovate and grow in the highly competitive EV industry.

Bottom Line

As we have seen, Lucid Motors (LCID) has demonstrated impressive growth potential in the emerging electric vehicle (EV) industry, with a strong focus on innovative technology and sustainable mobility. The company has shown a commitment to developing advanced battery technology and autonomous driving capabilities, which could give it a competitive edge in the EV market.

Even with negative profit margins, Lucid's recent financial performance has been strong and not as bad as it looks, with significant revenue growth and production capacity expansion. While there are risks and challenges. Lucid's growth potential and focus on innovative technology make it a compelling investment opportunity for those interested in the EV industry.

Exploring Investment Options: How to Invest in Lucid Stock (LCID)

If you are considering investing in Lucid Motors stock, there are several ways to do so.

Three Ways to Invest in Lucid Stock (LCID)

A. Holding its Share

One of the most straightforward ways to invest in LCID is by purchasing its shares. This involves buying company shares through a stockbroker, which gives you company ownership. By holding LCID shares, you can benefit from any increase in the company's stock price, and you may also receive dividends if the company chooses to distribute them. For instance, you could buy 500 shares of LCID at $25 per share, investing a total of $12,500. If the stock price increases over time, you could potentially sell the shares at a higher price, earning a profit. Alternatively, you could hold onto the shares and collect any dividends paid out by the company.

B. Options

Options are financial contracts that give you the right to buy or sell LCID shares at a specified price on or before a specific date. Trading options allows you to speculate on the underlying asset's price movement without owning the shares themselves. Options trading can be more complex than buying shares directly, but it also allows for more flexibility in your investment strategy. For example, you could buy a call option on LCID with a strike price of $30 that expires in six months. This means that you have the option to buy 100 shares of LCID at $30 each within the next six months. If the stock price rises above $30, you could exercise the option and buy the shares at a discount. However, if the stock price falls below $30, you could let the option expire and lose the premium you paid for the option.

C. Contracts for Difference (CFD)

CFDs are financial instruments that allow you to trade on the price movements of LCID shares without actually owning them. When trading CFDs, you agree with a broker to exchange the difference in price between the opening and closing positions of a trade. CFD trading can be done with leverage, which means you can trade with less capital and potentially earn higher profits. For instance, you could enter into a CFD contract with a broker to buy 1000 shares of LCID at the current market price of $25 per share. If the stock price rises to $30 per share, you could sell the CFD contract and make a profit of $5 per share. However, if the stock price falls to $20 per share, you would need to sell the CFD contract and lose $5 per share.

Each of the three investment options has its advantages and disadvantages. Holding shares of LCID is a direct way to invest in the company and benefit from any price appreciation, but it also exposes you to the risk of losses. Options trading offers more flexibility in your investment strategy but can also be more complex and involve a learning curve. CFD trading allows you to trade on price movements without owning the shares themselves and offers the potential for higher profits, but it also carries higher risks due to leverage.

Top Reasons to Trade Lucid Stock (LCID) CFD with VSTAR

If you want to trade Lucid Stock (LCID), trading Contracts for Difference (CFD) with VSTAR may be a good option. Here are a few reasons why:

Regulated and Safe: VSTAR is a regulated and reputable broker, ensuring your investments are safe and secure. VSTAR must follow strict rules and regulations as a regulated broker to protect investors' interests.

Institutional Trading Experience: VSTAR offers an institutional-level trading experience with zero commissions and tight spreads, allowing traders to maximize their profits. With deep liquidity and reliable, fast order execution, VSTAR ensures that traders have the tools they need to succeed in the competitive world of trading.

Supported Payment Methods: They also support a range of payment methods, including VISA and Mastercard, international bank wire transfers, and popular e-wallets such as Tether, Skrill, Neteller, SticPay, and Perfect Money. This allows traders to easily and securely fund their accounts using the payment method of their choice.

Conclusion

Our comprehensive analysis concludes that Lucid Stock (LCID) is a good investment opportunity for traders and investors: the emerging EV industry and Lucid's innovative technology position the company for significant growth potential. The company's strong financial performance, recent expansion efforts, and production capacity utilization further indicate its potential for success.

The best way to get more profits while trading Lucid stock is through CFDs with a reliable broker like VSTAR. While risks and challenges are associated with any investment, the overall outlook for Lucid Stock appears promising. We encourage you to conduct research and consult a financial advisor before making investment decisions.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.