Lucid Motors is one of the most promising electric vehicle (EV) companies. The company is known for its luxury EVs that combine innovative technology, high performance, and elegant design. Lucid stock (NASDAQ: LCID) debuted on the public market in July 2021 through a merger with a special purpose acquisition company (SPAC) called Churchill Capital Corp IV. Since then, Lucid stock has been one of the most volatile and popular stocks among investors and traders.

But what is the future outlook for Lucid stock? Is it a good time to buy or sell Lucid stock now?

What factors will influence LCID stock price in 2023 and beyond? How to invest in electric vehicle stocks? How can you trade Lucid stock effectively and profitably?

In this article, we will answer these questions and more. We will review Lucid's financial performance, industry trends and events, market response, and investor sentiment in 2022. We will also look at the critical metrics for Lucid stock analysis, such as revenue growth, vehicle deliveries, battery technology advancements, and international expansion. We will also analyze Lucid's risks and challenges in the competitive EV industry. Finally, we will provide a 2023 forecast for Lucid stock based on technical analysis and discuss whether Lucid is an excellent stock to buy or sell.

2022 Review of Lucid Stock

Lucid Stock had a roller-coaster ride in 2022. The stock started the year at $8.17 and reached a high of $21.78 in February, driven by the hype and excitement around the company's merger with Churchill Capital Corp IV and its upcoming production and delivery of its flagship EV, the Lucid Air. However, the stock then plummeted to a low of $6.09 in October amid supply chain disruptions, production delays, regulatory hurdles, and increasing competition in the EV industry.

Financial Performance

As of May 11, 2023, Lucid stock was trading at $7.06, with a market capitalization of $13.13 billion. The company reported its first revenue of $232 million in the third quarter of 2022 after delivering 13,000 vehicles in the same period. The company also reported a net loss of $509 million and a negative free cash flow of $1.1 billion in the third quarter. The company had $3.91 billion in cash and short-term investments and $3.53 billion in total liabilities as of December 31, 2022.

Industry Trends and Events

Lucid faced several challenges and opportunities in the EV industry in 2022. On the one hand, the company benefited from the strong demand for EVs, especially in the luxury segment, and the favorable policy and regulatory environment in the US and abroad. The company also announced several milestones and achievements, such as winning the Motor Trend Car of the Year award for Lucid Air, expanding its retail network and service centers across the US, launching its Gravity SUV concept, and securing a strategic partnership with Saudi Arabia's sovereign wealth fund.

On the other hand, the company also faced fierce competition from established automakers such as Tesla, Ford, GM, and Volkswagen and new entrants such as Rivian, Polestar, and Canoo. The company also struggled with supply chain issues, such as the global chip shortage, battery constraints, and labor shortages, which affected its production capacity and delivery schedule. The company also faced regulatory risks, such as potential tariffs, trade disputes, and environmental regulations that could impact its operations and profitability.

Market Response and Investor Sentiment

The market response and investor sentiment towards Lucid stock news were mixed in 2022. Some analysts and investors were bullish on Lucid's long-term growth potential, citing its innovative technology, strong brand recognition, manufacturing capabilities, and service and support network. They also praised Lucid's leadership team, led by CEO Peter Rawlinson, formerly Tesla's chief engineer. They also believed Lucid had a competitive edge in the EV market with its high-performance and high-efficiency vehicles that could challenge Tesla's dominance.

However, some analysts and investors were bearish on Lucid's near-term prospects, citing its high valuation, negative profitability, cash burn rate, and execution risks. They also questioned Lucid's ability to scale up its production and delivery targets, meet customer expectations and quality standards, and overcome operational and financial challenges. They also pointed out that Lucid faced intense competition from legacy automakers and new entrants that could erode its market share and margins.

Lucid Stock Key Metrics to Watch

Lucid stock investors should pay attention to several key metrics that indicate the company's financial performance, market position, technological innovation, and growth potential. Here are some of the most important metrics to watch for Lucid stock predictions:

Financial Performance

Sales Revenue: Lucid reported a 159% increase compared to a year ago, putting the 1Q revenue at $149.4 million.

Revenue Growth: Lucid projects a revenue growth rate of 88% for 2023, reaching $1.14 billion.

Gross Margin: Lucid aims to achieve a gross margin of 20% by 2024, higher than Tesla's current gross margin of 18.8%.

Net Income: Lucid annual net income for 2022 was $-1.304 billion, a 72.52% decline from the previous year. The net income for the Q1 ending March 31, 2023, was $-0.780 billion, an 858.99% increase over thr years.

Earnings per Share (EPS): Lucid reported a negative EPS of -$0.39in Q1 2023, and analysts' consensus EPS for June 2023 is $-0.43. The company expects to have a positive EPS by 2025.

Price-to-Sales (P/S) Ratio: Lucid has a P/S ratio of 41 as of May 11, 2023, higher than Tesla's P/S ratio of 6.94 as of the same date. Comparing the forward P/E ratios of Lucid and Tesla, investors have a more favorable outlook for Lucid's future earnings than Tesla's. However, it is essential to consider other financial metrics and factors when evaluating a company's prospects, as P/E ratios alone do not provide a comprehensive picture of a company's financial health or prospects.

Price-to-Earnings (P/E) Ratio: Lucid does not have a P/E ratio yet, as it is not profitable. However, based on its projected EPS and current stock price, Lucid has a forward P/E ratio of -96, lower than Tesla's forward P/E ratio of 28.82 as of May 11, 2023. This means that Lucid Group is expected to have a lower earning per share than Tesla in the future.

Vehicle Deliveries

Lucid delivered 13,000 vehicles in Q3 2022. The company also expects to deliver between 10,000 and 14,000 vehicles in 2023. Lucid's vehicle deliveries indicate customer demand, production capacity, and market share.

Battery Technology Advancements

Lucid is known for its battery technology that enables its vehicles to achieve industry-leading range, efficiency, and fast charging capabilities. The company claims that its Lucid Air can travel up to 520 miles on a single charge and recharge 300 miles in just 20 minutes. The company also plans to launch its Gravity SUV in 2023, featuring a battery technology similar to the Lucid Air.

International Expansion

Lucid is expanding its presence in international markets, especially in Europe and the Middle East. The company has opened several retail locations and service centers across Europe and announced plans to build a new manufacturing facility in Saudi Arabia by 2024.

Risks and Challenges

Lucid faces various risks that could affect its business, such as supply chain disruptions, regulatory and policy-based risks, and increasing competition. The company has been delayed by the global chip shortage and other supply chain issues that have postponed its production and delivery targets. The company also operates in a highly regulated industry that could face potential tariffs, trade disputes, policy changes, and environmental regulations in different markets. Moreover, the company competes with established automakers and new entrants in the EV industry, which is becoming more crowded and competitive. The company must offer its customers superior products, services, and experiences to stand out.

2023 Expectations of Lucid Stock

Lucid's Financial Performance Forecast

Revenue and earnings growth projections

Lucid Group Inc (NASDAQ: LCID) is expected to report its first full-year revenue in 2023 as it ramps up production and deliveries of its luxury electric vehicles. Analysts, on average, expect the company to generate revenue of $2.6 billion in 2023, up from $0.2 billion in 2022. The company is also projected to narrow its net loss from -$1.41 per share in 2022 to -$1.00 per share in 2023.

Profit margins and cash flow expectations

Lucid Group Inc is expected to improve its gross margin from -8.9% in 2022 to 14.7% in 2023, benefiting from economies of scale and higher average selling prices. The company is also expected to increase its operating cash flow from -$1.1 billion in 2022 to -$0.5 billion in 2023 as it reduces operational expenses and capital expenditures. The company expects to become cash flow positive by 2025.

Lucid Market Share Projection

Sales and market share growth projections

Lucid Group Inc (NASDAQ: LCID) aims to capture a significant share of the global electric vehicle market, expected to grow at a compound annual growth rate (CAGR) of 26.8% from 2021 to 2028. The company plans to launch several new products and services in the next few years, including its flagship Lucid Air sedan, which won the 2022 Motor Trend Car of the Year award. The company expects to deliver about 10,000 to 14,000 vehicles in 2023, up from less than 1,000 in 2021. The company also intends to introduce its electric SUV, Project Gravity, in 2024, followed by more affordable models in 2025. The company projects to sell about 251,000 vehicles in 2026, with a global market share of about 2.5%. In addition, the company plans to offer various services to its customers, such as charging solutions, software updates, vehicle maintenance and repair, and battery recycling.

Plans for global expansion: partnerships and collaborations

Lucid Group Inc (NASDAQ: LCID) is also pursuing global expansion opportunities, especially in Europe and the Middle East. The company has already established a presence in several countries, such as Germany, France, Italy, Norway, Saudi Arabia, and the United Arab Emirates. The company also plans to build a second factory in Saudi Arabia by 2024, with an annual production capacity of up to 50,000 vehicles. The company has a strategic partnership with Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), which owns about 60% of Lucid's shares. The company collaborates with other partners, such as LG Chem for battery supply, Electrify America for charging network access, and Amazon for Alexa integration.

Technical Analysis

Technical analysis is a method of evaluating the performance of a stock by analyzing its price movements and trading volume. Technical analysts use various tools and indicators to identify market patterns and trends and determine the optimal entry and exit points for trading. Some of the common technical analysis tools are:

● Charts: Graphs of price and volume over time in various formats. They show price patterns and trends.

● Moving averages: Indicators that show the average price over a number of periods. They show trend direction, strength, and crossovers.

● Oscillators: Indicators that show the momentum and speed of price movements. They show overbought or oversold conditions. Examples are RSI, stochastic, and MACD.

● Volume: The number of shares traded in a period. It shows interest and activity in stock and confirms or denies price signals.

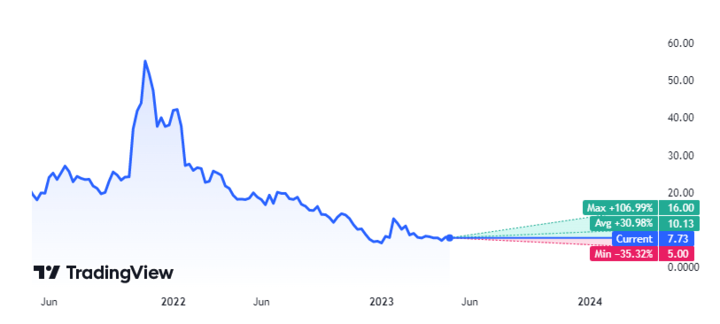

According to the monthly chart of lcid stock above, It has been in a downtrend since February 2023, reaching a high of $12.95. The stock has been trading below its 50-day and 200-day moving averages, which are declining and act as resistance levels. The stock has also been making lower highs and lows, indicating a bearish sentiment. The RSI is below 50, indicating a lack of momentum, while the MACD is below zero and its signal line, indicating a bearish trend. The volume has also decreased, indicating a lack of interest and activity in the stock.

Based on this technical analysis, Lucid stock price prediction 2023 has no solid bullish case. However, short-term trade opportunities may exist if the stock breaks above its resistance levels or shows signs of reversal. Alternatively, there may be some opportunities for short-selling if the stock breaks below its support levels or shows signs of further decline.

Lucid Stock Forecast 2024

Lucid stock is currently trading around $3. Production challenges, price cuts, and a challenging macro environment for growth stocks have weighed heavily on the stock. If Lucid can execute on ramping up production of the Air sedan to meet its target of over 10,000 vehicles in 2024, demonstrate consumer demand for its high-end EV offerings, and continue to have sufficient capital, the stock could regain some lost ground. Recent analyst ratings include a Sell rating from Goldman Sachs with a $2 price target, a Buy rating from Bank of America with a $5 price target, a Hold rating from RBC Capital with a $3 price target, and a Sell rating from UBS with a $1 price target. The analyst community remains divided on Lucid's manufacturing capabilities, growth trajectory, and long-term addressable market, with price targets ranging from $1 to $5.

Is Lucid an excellent stock to buy?

Lucid Group Inc (LCID) has a strong growth potential, a loyal customer base, and a strategic partnership with Saudi Arabia's sovereign wealth fund. However, the company faces fierce competition, high valuation, and operational risks. Whether Lucid is a good stock to buy depends on your risk appetite, time horizon, and investment goals. Lucid has several competitive advantages in the EV industry that could make it a good stock to buy for long-term investors. Here are some of them:

● Innovative Technology: Lucid has developed its proprietary technology for its vehicles, such as its battery system, electric motors, power electronics, and software.

● Strong Brand: Lucid, the electric vehicle manufacturer, possesses a strong brand characterized by technological innovation, luxury, and sustainability. The company's reputation stems from its advanced features, commitment to high-end design, and emphasis on environmental consciousness. Lucid's brand strength is further bolstered by effective marketing strategies, exceptional customer service, and a focus on creating a premium ownership experience. Through these factors, Lucid has established itself as a prominent player in the automotive industry and a symbol of the future of sustainable transportation.

● Manufacturing Capabilities: Lucid has built its state-of-the-art factory in Arizona, which has an annual production capacity of 34,000 vehicles and can be expanded to 400,000 vehicles in the future. Lucid also plans to build another factory in Saudi Arabia by 2024.

● Service and Support: One of the critical components of Lucid service and support is the Lucid Customer Care team. This dedicated team of experts can assist customers with any inquiries or concerns regarding their Lucid electric vehicles. Whether it's technical support, troubleshooting, or general assistance, the Lucid Customer Care team strives to provide prompt and knowledgeable responses to ensure customer satisfaction. Lucid Motors has established a network of authorized service centers. These service centers are strategically located to provide convenient access to professional maintenance and repair services for Lucid vehicle owners. Staffed by highly trained technicians, these service centers are equipped with state-of-the-art diagnostic tools and genuine Lucid parts to ensure the highest quality and reliability in servicing customers' vehicles. To further streamline the ownership experience, Lucid offers scheduled maintenance plans. These plans help customers maintain their vehicles in optimal condition, including regular inspections, software updates, and preventive maintenance.

What are the ways to trade Lucid stock?

There are three main ways to trade Lucid stock:

1. Holding its shares

This means buying and owning Lucid stock for a long-term investment. You can buy Lucid shares through a broker or an online trading platform. You will benefit from any increase in the share price and any dividends the company may pay. You will also have voting rights and other benefits as a shareholder. However, you will also risk losing money if the share price falls or the company performs poorly.

2. Options

This means buying or selling contracts that give you the right, but not the obligation, to buy or sell Lucid stock at a specified price and date in the future. You can use options to speculate on Lucid stock price's direction or hedge your existing position. Options involving leverage, time decay, and volatility are more complex and risky than holding shares. You can trade options on Lucid stock through an options broker or an online trading platform.

3. CFDs

This means trading contracts for difference (CFDs) on Lucid stock. CFDs are derivatives that allow you to speculate on the price movement of Lucid stock without owning the underlying asset. You can trade CFDs on Lucid stock through a CFD broker like VSTAR or an online trading platform. CFDs have some advantages and disadvantages compared to traditional stock trading:

● Ownership: With CFDs, you do not own Lucid stock but only trade on its price movement. This means you do not have to pay commissions, fees, taxes, or stamp duty associated with owning shares. However, you also do not have any voting rights or other benefits as a shareholder.

● Leverage: With CFDs, you can trade with leverage, opening a larger position than your initial deposit. This can magnify your profits or losses depending on the price movement of Lucid stock. Leverage also involves paying interest charges on your open positions, which can reduce your net returns.

● Short-selling: With CFDs, you can go short or sell Lucid stock if you expect its price to fall. This can allow you to profit from bearish market conditions or hedge your existing long position. However, short-selling also involves unlimited risk, as the price of Lucid stock can rise indefinitely.

Why Trade Lucid Stock CFD with VSTAR?

VSTAR is a leading online platform offering CFD trading on thousands of financial instruments, including Lucid stock. VSTAR has some features and benefits that make it an ideal choice for trading Lucid stock CFD:

● Competitive spreads and low commissions: VSTAR offers tight spreads and low commissions on Lucid stock CFD, which can help you reduce your trading costs and maximize your profits.

● Advanced trading tools and indicators: VSTAR provides access to various trading tools and indicators to help you analyze Lucid stock CFD's market trends and signals. You can use technical, fundamental, sentiment, and more analysis to make informed trading decisions.

● Risk management features: VSTAR allows you to set stop-loss and take-profit orders on your Lucid stock CFD positions, which can help you limit your losses and lock in your profits. You can also use trailing stops, guaranteed stops, and negative balance protection to enhance your risk management.

● Educational resources and customer support: VSTAR offers a range of educational resources and customer support services that can help you improve your trading skills and knowledge of Lucid stock CFD. You can access webinars, tutorials, articles, videos, and more to learn about CFD trading and Lucid stock forecast. You can also contact VSTAR's customer support team via phone, email, or live chat for any queries or issues.

Conclusion

Lucid Motors is a promising electric vehicle company that has attracted a lot of attention from investors and traders. Three main ways to trade Lucid stock are holding shares, options, or CFDs. Each method has advantages and disadvantages that you should consider before choosing one. If you want to trade Lucid stock CFD with competitive spreads, low commissions, advanced trading tools, risk management features, educational resources, and customer support, you should try VSTAR today.