At the end of 2022, UAL stock was down -13% year to date as the company gradually recovered from the pandemic-induced slump and the company's financial reports fell short of expectations.

But as the airline industry prepares for a massive boom in passenger travel, United is poised to quadruple its earnings this year, and its recent Q1 2023 earnings have improved investor confidence in the stock. However, with recession fears still looming, the pressing question is: Should I buy UAL stock? Before you make a decision, here are some details to consider.

United Airlines Holdings Background

United Airlines History

UAL dates back to 1929, when William Boeing, Federick Rentschler and their associates formed United Aircraft Transport Corporation, which was responsible for both aircraft manufacturing and air travel. In 1931, United Airlines was born in Chicago as a holding company that provided management for four different operating divisions. It later became an independent company in 1934 with a network of routes from New York City to San Francisco and Seattle, as well as some north-south routes in the West.

In 1961, it merged with Capital Airlines to become the largest airline in the Western world and held that title for several decades. United expanded again in 1990 after acquiring Pan American's routes between London and the United States, and eventually bought Pan American's Latin American and Caribbean route systems after the company went bankrupt.

After a few more mergers and surviving bankruptcy, it remains one of the largest airlines in the world, with Ted Philip as chairman and Scott Kirby as CEO.

Who owns United Airlines?

Source: Yahoo Finance

Business Model and Products

Business Model

United operates a mass-market business model focused on providing air travel options to customers around the world. The company's primary value proposition is to create accessibility for travelers by providing a wide range of options. It also provides customized services for customers with special needs, such as those with disabilities, and continues to innovate. For example, it was the first airline to introduce stewardesses and the first U.S. airline to install WiFi on its international fleet.

Another way it attracts customers is by offering a variety of ways to reduce the cost of air travel through getaway deals, discounts for U.S. veterans, and promotional certificates. In addition, the company uses its mobile app, website, online travel agencies, and traditional agencies to reach customers.

Products/Services

United's primary product or service is providing air travel to passengers. This accounts for approximately 84% of United Airlines' revenues. It also provides cargo and mail services to freight forwarders, logistics companies, and commercial businesses. It also has a flight school and provides maintenance and ground handling services to other companies.

Financials and Growth

1. Review of United Airlines Financial Statements

United's revenue for 2022 was largely driven by the expansion of its international capacity, with international revenue nearly 30% higher than domestic revenue. The company's balance sheet shows that it has more debt, as it has $30.7 billion in debt as well as $38.6 billion in adjusted debt. The high level of debt makes the balance sheet a bit strained, but it has $17.2 billion in cash and marketable securities to offset this, bringing net debt down to $13.5 billion.

It still has $23.6 billion in debt due within 12 months and another $40.1 billion in long-term debt. In addition to its $17.2 billion in cash, it has $2.27 billion in receivables that are also due in the next 12 months. Thus, its liabilities, both short-term and long-term, are more significant than its cash and receivables by $44.3 billion.

However, the company is looking forward to a profitable 2023 as air travel demand returns to pre-pandemic levels. Its total liabilities leave a lot of room for improvement, but its EBIT is positive this year at $3.9 billion. It is difficult to project too far out due to macroeconomic risks, but earnings are expected to grow 19% in 2024 and another 19% in 2025.

2. Key Financial Ratios and Metrics

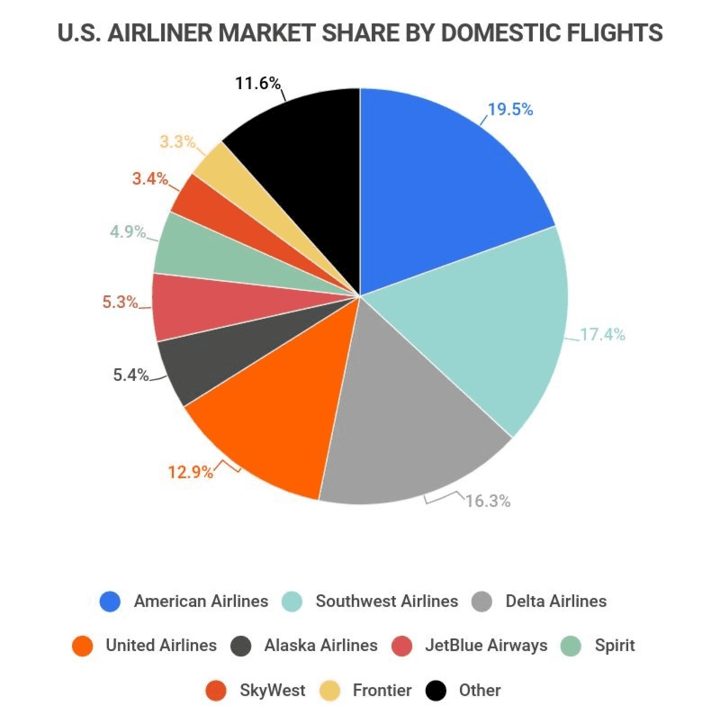

Since UAL, Delta Airlines, and Southwest Airlines are targeting the same niche, they are always competing against each other for a competitive advantage. However, because United Airlines is the largest of the three, its financials remain more stable than its peers. While UAL's year-over-year revenue growth rate increased by 51.06%, Delta and Southwest are slowly catching up with year-over-year growth rates of 36.49% and 21.56%, respectively. Based on their current balance sheets, the net profit margin of all three companies is negative, possibly due to increased operating costs and the fact that demand for air travel is still recovering. However, UAL remains slightly better at -1.7% while Delta Airlines and Southwest Airlines remain at -2.85% and -2.79% respectively.

Source: Zippia

Considering its market cap of $15.57 billion and Delta's and Southwest's market caps of $23.35 billion and $17.77 billion, United is trading well below its intrinsic value, making it a compelling investment opportunity.

How is UAL Stock Doing?

A. UAL Stock Trading Information

Primary Exchange & Ticker: NASDAQ: UAL

First Listed: Feb 10, 2006

Country & Currency: USA (USD)

Trading Hours: Pre-market (4:00 - 9:30 am) and After hours market (4:00 - 8:00 pm)

United Airlines Stock Splits: United stock has split 2 times in its history - in 1994 and 1995. There have been no splits since then.

United Airlines Stock Dividends: United Airlines does not pay a regular dividend.

United Airlines News Investors and Traders should note

Purchase of 200 new Boeing Widebody Planes

United Airlines announced the largest order of widebody aircraft by a U.S. airline. The airline has ordered 100 Boeing 787 Dreamliners and plans to purchase 100 more. The new airplanes will be delivered between 2024 and 2032 to expand the airline's capacity.

Plans to hire more employees

United has already hired 7,000 new employees in the first four months of the year to support increased air travel, and plans to hire 15,000 more employees through 2026.

Official Partner of US Ski and Snowboard

United Airlines will be the sole provider of transportation for the U.S. Ski and Snowboard Team athletes around the world to train and compete in international events through 2027.

B. Overview of UAL Stock Performance

Between 2008 and 2019, United Airlines stock price rose 243%, but the company was hit hard after the presence of Covid 19 imposed severe restrictions on air travel. Due to the sharp decline in air travel, the stock fell from 89.70 at the beginning of 2020 to 19.90 in May of that year. UAL stock's growth rate from 2019 to date is -31%, but that's expected to improve as air travel picks up this year, though it's still below pre-pandemic levels.

Now trading at $48.01 at the time of writing, United Airlines Holdings is poised for a comeback, with its stock value already up 25.61% this year alone. Its strong Q4 2022 earnings report, despite recession fears, has renewed investor confidence and this has only been bolstered by an equally impressive Q1 2023 report, as the company continues to see a strong 2023. The Wall Street price target for United Airlines stock is $61.83, indicating that the stock could rise 33.6% by the end of the year.

C. Key Drivers of UAL Stock Price

Q1 2023 Earnings Call

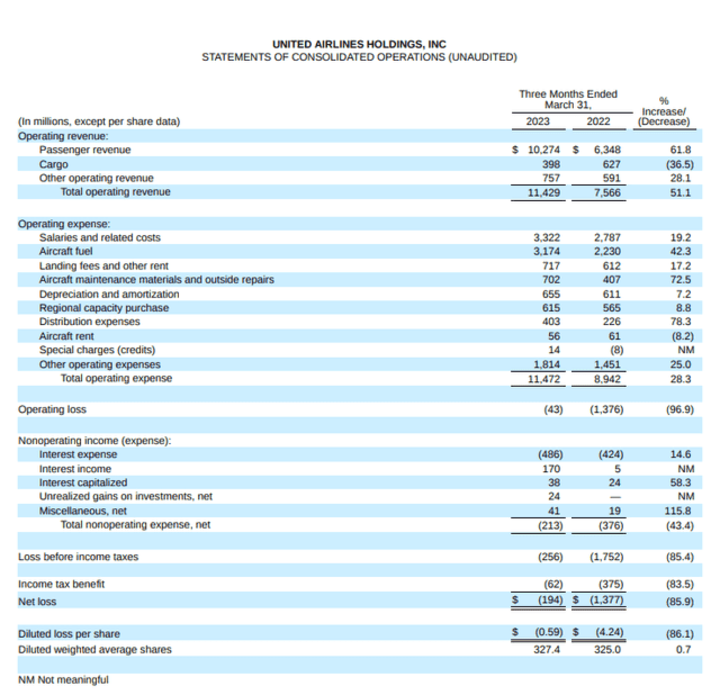

Overall, UAL outperformed analyst expectations despite having to deal with higher labor and fuel costs. The company's year-over-year revenue growth rate is 51.1%, and its capacity increased by 23.4% compared to the first quarter of 2022. The company did report a net loss of $194 million and a diluted loss per share of $0.59, but this was not surprising as it was in line with analyst consensus.

Air Travel Recovery

United Airlines is experiencing a steady recovery in domestic and international air travel demand. Growing consumer demand, despite the risk of recession, allows them to manage operating costs by charging higher ticket prices.

Source: Seeking Alpha

D. Analysis of Future Prospects for UAL Stock

United Airlines posted a significant year-over-year increase mainly because air travel is picking up, and the company expects this to continue into the second quarter of 2023 and probably through the end of the year as capacity increases. The data from the UAL stock buy or sell signals along with analyst estimates also indicate that the stock is a buy for 2023.

UAL Stock Forecast

The company's main business is passenger air travel, and if demand returns to pre-pandemic levels later this year or in 2024, the stock could continue to rise. Taking this into consideration, the United Airlines stock analysis for 2024 sees its stock value rising to an average of $63.90.

Risks and Opportunities

Risks

Strong Competition: UAL is a well-known airline but it still faces strong competition from other companies because they are targeting the same niche audience. United Airlines' competitors are Delta Airlines, American Airlines, Spirit Airlines, and Turkish Airlines.

Control Risks: United Airlines has been having issues with its Pratt & Whitney engines which could become a problem for the company because they operate a large fleet of planes.

Macro Risks: Although the company hopes to quadruple its profits this year alone, its management announced that macroeconomic risks have increased because of bank collapses. This affected the company's bookings for two weeks, but its earnings outlook could be threatened if the economy eventually falls into recession.

Opportunities

Increase in air travel: These days more people are traveling for experiences or leisure, and the increasing need for in-the-moment happiness is one of the key drivers of air travel demand to date.

Low valuation: UAL's low valuation gives the stock plenty of room to grow as it currently trades at bargain levels.

Strong 2023 Outlook: United is expected to post unusually strong numbers in 2023, with total revenue and earnings expected to grow 10% and 200%, respectively, this year compared to 2022. United Airlines stock's forecast for 2023 is also positive, as investors' confidence was renewed after the company's Q1 2023 earnings.

Source: Airport Technology

Future Outlook and Expansion

United Airlines is ready to take advantage of the massive increase in air travel by adding new flights and services. It plans to add 40% more flights between the US, New Zealand, and Australia by the next northern winter. This includes new routes from Los Angeles to Brisbane and Auckland, and more flights from San Francisco to Brisbane and Sydney.

By December later this year, UAL also has plans to add 3x weekly flights between San Francisco and Christchurch and is being aggressive with its international expansion in the South Pacific.

How to Invest in UAL Stock

Here are some ways to invest in United Airlines stock:

Long-term hold: Although UAL is looking forward to a great 2023, it is still largely dependent on economic conditions in the short term. But as one of the largest airlines in the world with stable demand, its long-term fundamentals are solid.

Options: If you have some investing experience and flexible strategies to take advantage of price changes, then investing in UAL options is the way to go. But before you invest, be sure to use the UAL options chain. This will give you behind-the-scenes information on what both buyers and sellers are doing.

CFDs: Like Options, investing in UAL CFDs means that you are taking advantage of short-term price movements as long as you can accurately predict where the asset is going.

Source: DNA India

Why trade UAL Stock CFD with VSTAR

Super low trading Cost: VSTAR offers ultra-low trading costs, allowing you to keep more of your profits.

Fully Regulated: VSTAR is a multi-regulated and reliable broker. It operates under the European Regulatory Framework of MiFiD and all your deposits are kept in a separate account from the company's account.

Lightning Fast Execution: Your trades are executed as soon as you want them and there is 24/7 live support during market hours to guide you through any issues.

How to trade UAL Stock CFD with VSTAR

VSTAR makes it easy to catch profitable financial opportunities in a few steps:

● Open the vstar.com website or download the app on Apple Store and Google Play

● Click Register and fill in your details

● Deposit your funds into the account

● Start trading!

Conclusion

United Airlines has ambitious plans to grow its business in the next five years, and it is well positioned to do so. They have enough cash to fund their operations, and if the demand for air travel continues to rise, they can greatly increase their profitability.

UAL stock is predicted to remain profitable throughout the year, but before you do, make sure you consider the risks of the investment and see if it suits your investment style.

FAQs

1. Is United Airlines a Buy, Sell or Hold?

Hold - The majority of analysts currently have a neutral/hold rating on UAL stock. UBS, Citi and Cowen all have a Hold rating on UAL stock. Macro concerns limit near-term upside.

2. Is UAL a good stock to buy?

Mixed - UAL trades at a lower P/E ratio than its peers, indicating potential value. However, high debt levels and operational challenges have analysts cautious about buying now.

3. Is UAL Stock undervalued?

Slightly undervalued - The average analyst price target of $51 suggests upside and that the stock is cheap relative to historical P/E ratios. But uncertainty remains.

4. Is United Airlines a dividend stock?

United Airlines does not pay a regular dividend.

5. How many times has United Airlines stock split?

2 splits historically - In 1994 and 1995, relatively early in United Airlines' history as a public company.

6. How high will UAL stock go?

The average analyst target is around $51. Predictions of upside to $60-70 long term if conditions improve.

7. What is the forecast for UAL stock?

Cautiously optimistic long-term - Analysts see earnings growth pushing UAL back toward $60+ in 12-24 months if travel demand holds up. But significant near-term risks remain.