Uber Technologies (NYSE:UBER) has been a prominent player in the tech-driven transportation and delivery services sector. In recent times, its stock performance has been impressive, influenced by various factors including financial metrics, market sentiment, and strategic initiatives. Here, the analysis aims to delve into Uber's stock performance, analyze influencing factors, and provide insights on its future trajectory.

I. Recent Uber Stock Performance

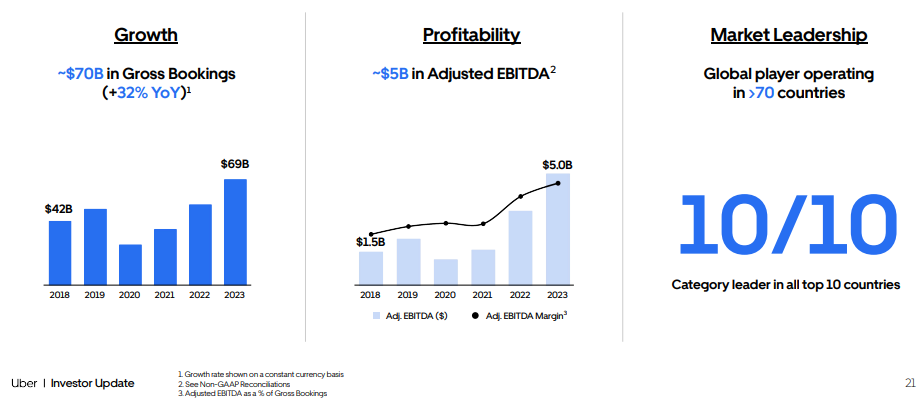

Uber's stock performance has shown resilience and growth over recent quarters, reflecting its strategic initiatives and market positioning. Notably, its stock price has demonstrated significant momentum, with a strong upward trend evident in its performance metrics. For instance, its 52-week range showcases a notable increase from $29.22 to $82.14, highlighting solid momentum in the Uber market cap and high price return.

Source: stockcharts.com

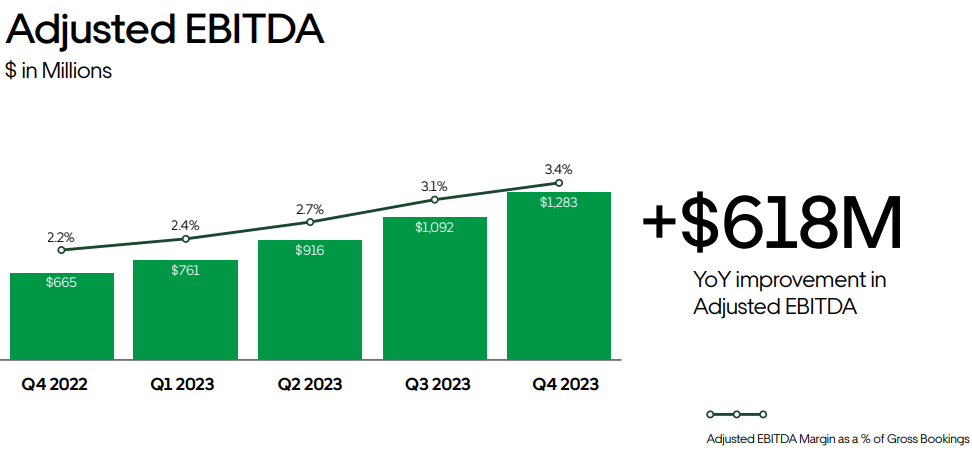

Several key influencing factors have contributed to Uber's robust stock performance. Firstly, the company's financial performance, as evidenced by its quarterly and yearly results, has been impressive. In Q4, Uber reported strong figures, including $1.3 billion in adjusted EBITDA and $652 million in GAAP operating income, signaling sustainable, profitable growth. Additionally, its focus on cost management and operational efficiency has bolstered investor confidence in its ability to deliver consistent returns.

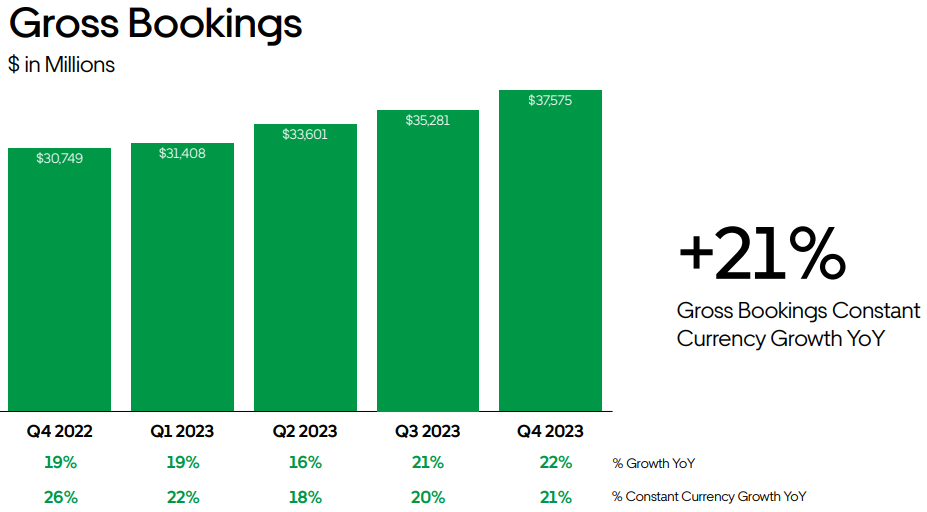

Moreover, Uber's diversified business segments, including mobility, delivery, and freight, have contributed to its overall resilience and growth. The mobility segment witnessed robust gross bookings growth of 28% YoY in Q4, driven by strong demand and expanding use cases. Similarly, the delivery segment experienced accelerated gross bookings growth, reflecting increased membership penetration and operational improvements.

Furthermore, Uber's strategic initiatives, such as the Uber One membership program and investments in new growth vectors, have been well-received by investors. These initiatives aim to enhance user engagement, expand market reach, and drive long-term growth with healthy economics.

Source: Uber-Q4-23-Earnings-Supplemental-Data

Expert Insights on UBER Stock Forecast for 2024, 2025, 2030 and Beyond

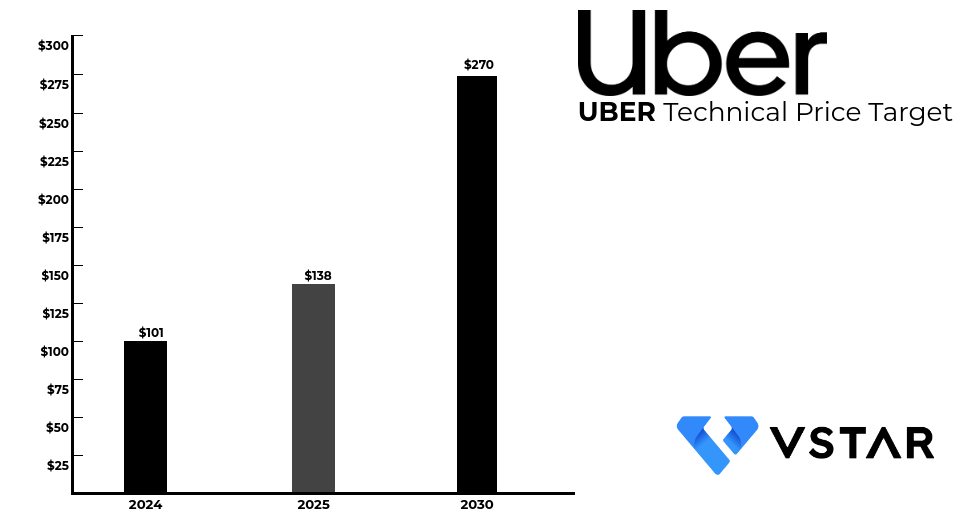

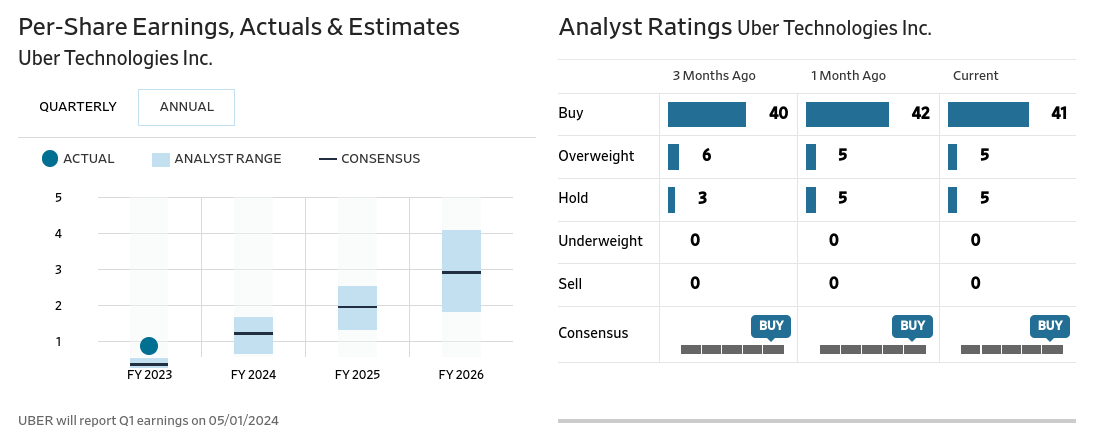

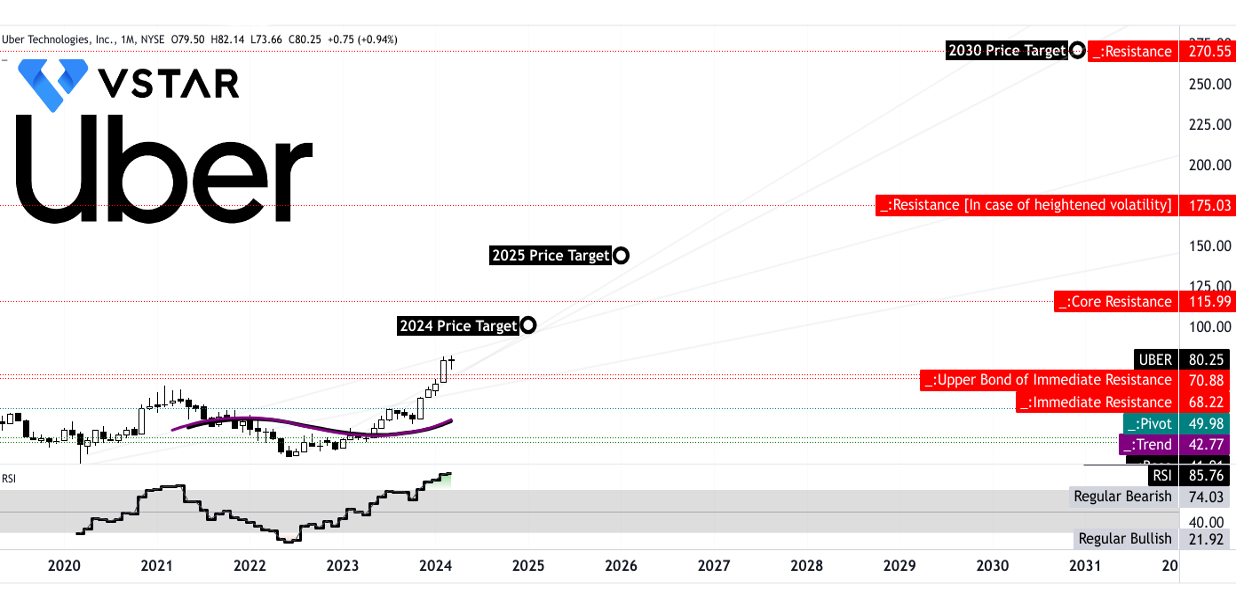

Technical forecasts for Uber's stock performance offer a glimpse into its future trajectory. Target prices for 2024, 2025, and 2030 indicate bullish sentiments, with projected targets of $101, $138, and $270, respectively. These Uber stock predictions underscore analysts' confidence in Uber's ability to sustain growth momentum and capitalize on emerging demand in the transportation and delivery sector.

Source: Analyst's compilation

II. Uber Stock Forecast 2024

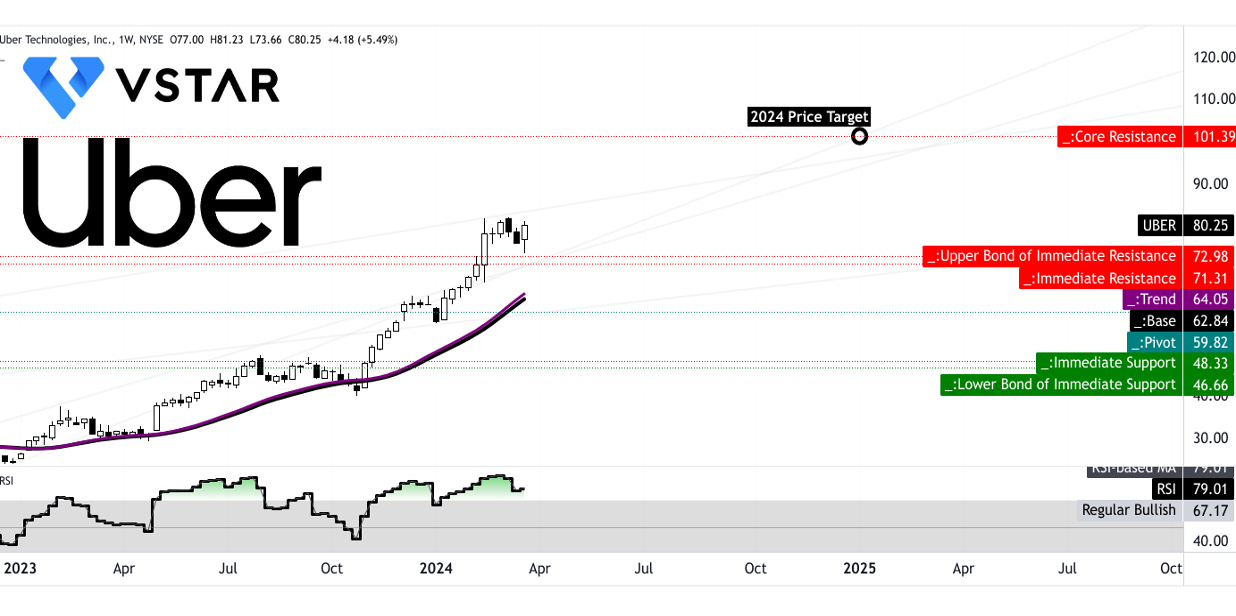

The stock price of Uber may hit $101 by the end of 2024, based on Fibonacci retracement and the current momentum of the change in polarity of its ongoing uptrend. Looking at the relative strengths index (RSI), at 79, the current price is at an overbought level. Therefore, there may be a small price correction where the price may hit $72 downward before resuming the uptrend. Also, the trend line (purple line) is serving as a dynamic support for the uptrend. This trend line can be considered a navigator for the current uptrend. On the down side, $60 (pivot) and $48 (lower bond of the current support range) will serve as vital support levels in the short term. However, hitting these levels is less likely without macro-adversity like a mild recession or presidential election volatility.

Source: tradingview.com

Uber stock forecast in 2024 presents divergent perspectives from coinpriceforecast.com and 30rates.com. Coinpriceforecast.com predicts Uber stock price to reach $110 by the end of the year, with a mid-year projection of $99.92 and a year-end target of $116.26, indicating a 54% increase. Conversely, 30rates.com offers a month-by-month Uber forecast, with December showing an opening price of $110.72, a low-high range of $110.08-$129.22, a closing price of $119.65, and a total increase of 47.7%.

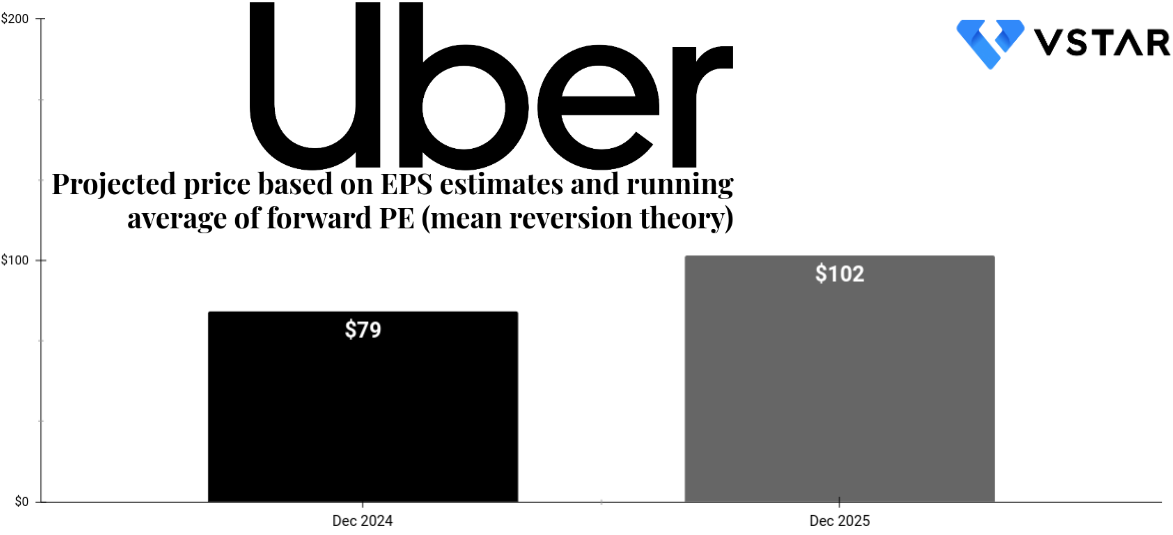

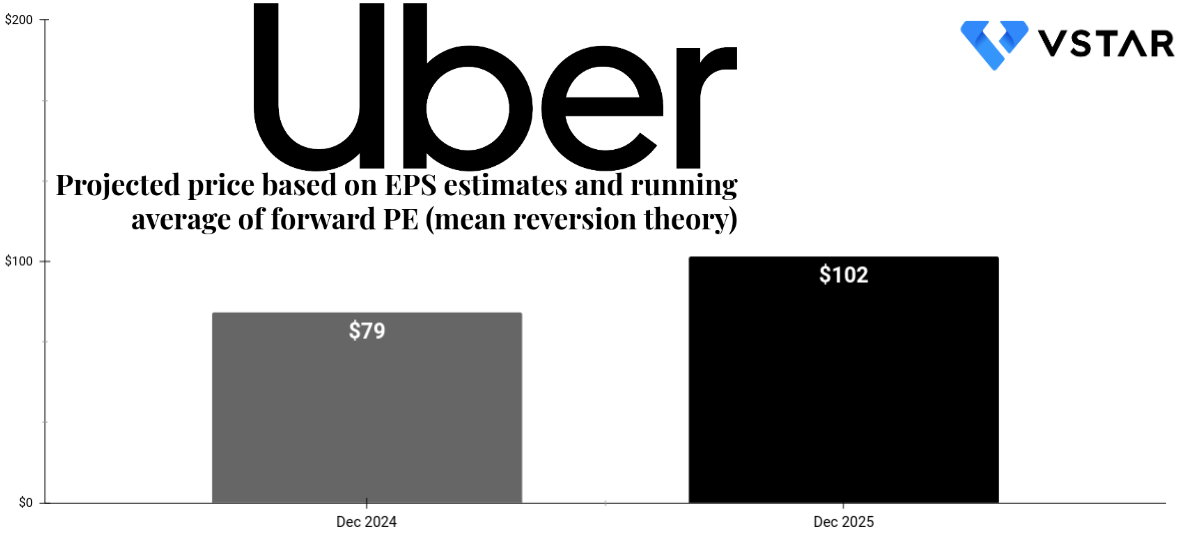

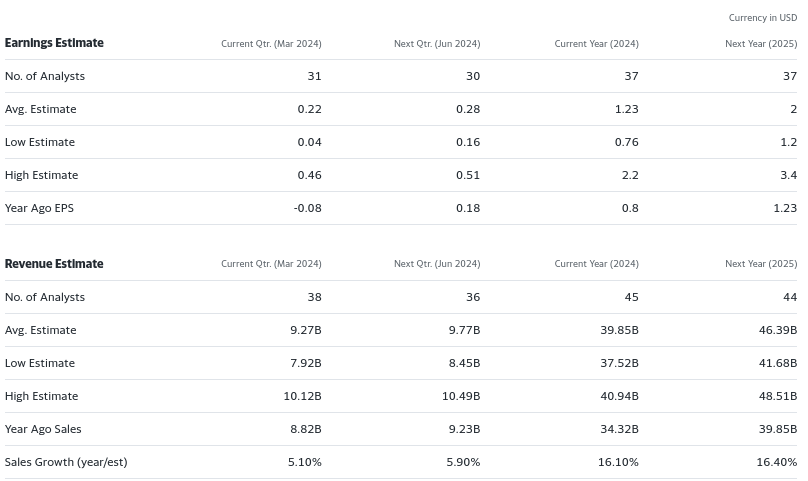

Considering the forward PE of 64.41, the stock price may hit $79 by the end of 2024. This estimate is based on a consensus EPS estimate of $1.22. This provides a conservative outlook for UBER's growth prospects.

Source: Analyst's compilation

A. Other UBER Stock Forecast 2024 Insights: Is Uber stock a Buy?

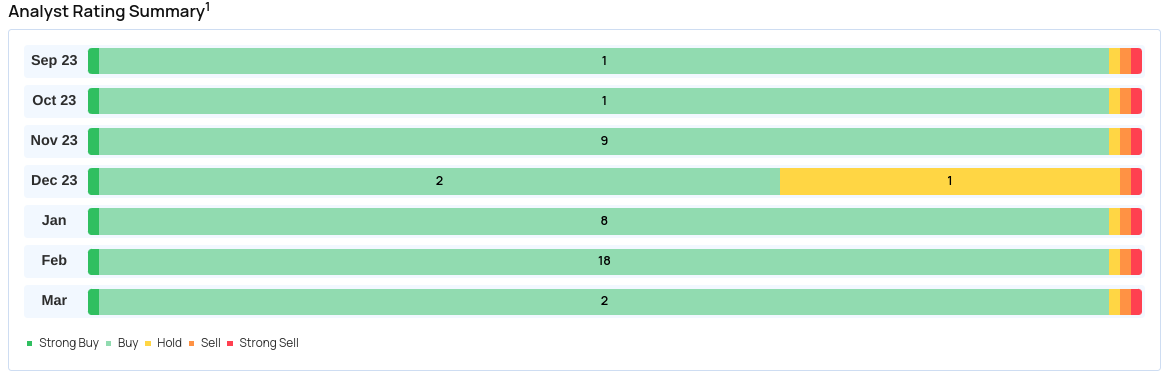

In 2024, Uber Technologies (UBER) garnered a range of price targets and ratings from prominent financial institutions and analysts, providing investors with a spectrum of perspectives on the company's future performance.

Source: benzinga.com

Piper Sandler, represented by Thomas Champion, maintains an optimistic outlook with a maintained "Overweight" rating and a Uber stock price target increase from $78 to $92. Similarly, Argus Research, through Bill Selesky, maintains a "Buy" rating and increases the Uber price target from $69 to $95, indicating substantial potential for growth.

JMP Securities, led by Andrew Boone, maintains a "Market Outperform" rating with a modest price target adjustment from $76 to $86. Citigroup, with Ronald Josey's analysis, maintains a "Buy" rating with a Uber stock target price adjustment from $83 to $91, reflecting confidence in Uber's trajectory.

UBS, represented by Lloyd Walmsley, maintains a "Buy" rating with a price target range of $94 to $96, suggesting a bullish sentiment towards Uber's prospects. RBC Capital, led by Brad Erickson, reiterates an "Outperform" rating and adjusts the Uber price target to $85, indicating continued confidence in the company's performance.

JP Morgan, analyzed by Doug Anmuth, maintains an "Overweight" rating with a Uber price target increase from $84 to $95, highlighting sustained positive sentiment within the financial community towards Uber's future growth potential.

Overall, these insights from various analysts and institutions suggest a generally positive Uber stock outlook in 2024, with most maintaining or increasing their price targets and ratings.

B. Key Factors to Watch for Uber Stock Prediction 2024

Bullish Factors for Uber Stock Forecast 2024

Strong Uber Financials' Performance: Uber's recent financials showcase promising growth. In 2023, the company achieved sustainable profitability, reporting $1.3 billion in adjusted EBITDA and $652 million in GAAP operating income. This performance demonstrates Uber's ability to generate positive earnings and attract investors.

Source: Uber-Q4-23-Earnings-Supplemental-Data

Diversification and Innovation: Uber has diversified its business beyond ride-hailing into segments like food delivery and freight. The company's delivery gross bookings grew by 17% YoY, and its freight gross bookings remained stable. Diversification mitigates risks and enhances revenue streams, indicating resilience and adaptability.

Strategic Partnerships: Uber has formed strategic partnerships to drive growth and innovation. Its 10 autonomous partnerships across mobility, delivery, and freight highlight efforts to leverage cutting-edge technology. Such collaborations enhance Uber's competitive edge and potential for future market dominance.

Membership Growth: The growth of Uber One membership, reaching 19 million members across 25 countries, signifies strong customer loyalty and engagement. Membership programs contribute to recurring revenue and foster customer retention, which are favorable indicators for long-term sustainability.

Market Expansion: Uber continues to expand its market presence globally, tapping into new geographic regions and market segments. The company's expansion into areas like grocery and retail, as evidenced by $7 billion in gross bookings, underscores its commitment to diversification and innovation.

Bearish Factors for Uber Stock Forecast 2024

Regulatory Challenges: Uber faces regulatory challenges in various jurisdictions, including issues related to worker classification, safety regulations, and licensing requirements. Regulatory uncertainty can disrupt operations, increase compliance costs, and undermine investor confidence.

Competition: Intense competition in the ride-hailing and food delivery sectors poses a threat to Uber's market share and profitability. Competitors offering similar services at lower prices or with better incentives could erode Uber's customer base and reduce its margins.

Supply Chain Disruptions: Uber's operations rely heavily on a network of drivers, restaurants, and delivery partners. Disruptions in the supply chain, such as driver shortages, restaurant closures, or logistical challenges, could adversely affect Uber's service quality and financial performance.

Economic Instability: Economic downturns or uncertainties, such as inflationary pressures, rising fuel costs, or geopolitical tensions, may impact consumer spending and travel patterns. Reduced consumer discretionary spending could lead to lower demand for Uber's services, affecting its revenue and profitability.

Technological Risks: Uber's reliance on technology exposes it to risks such as cybersecurity threats, data breaches, or technological failures. Any disruptions or vulnerabilities in Uber's technology infrastructure could result in service outages, reputational damage, and financial losses.

III. Uber Stock Prediction 2025

The stock price of UBER may hit $138 by the end of 2025. This is the main resistance level in the weekly time frame. It is derived from Fibonacci retirement and the forward projection of current average price momentum. The 2024 price target, which is $101, may serve as a core resistance for the stock's upward momentum. However, the price may breach this level after interacting with it and delivering a small correction to test $87 as support. Another level worth noting is $120, which may eventually serve as resistance with a possible correction to test $101.

Source: tradingview.com

For the RSI, there is no bearish divergence emerging. Based on that, even being overbought, the stock's uptrend is not weak in strength.

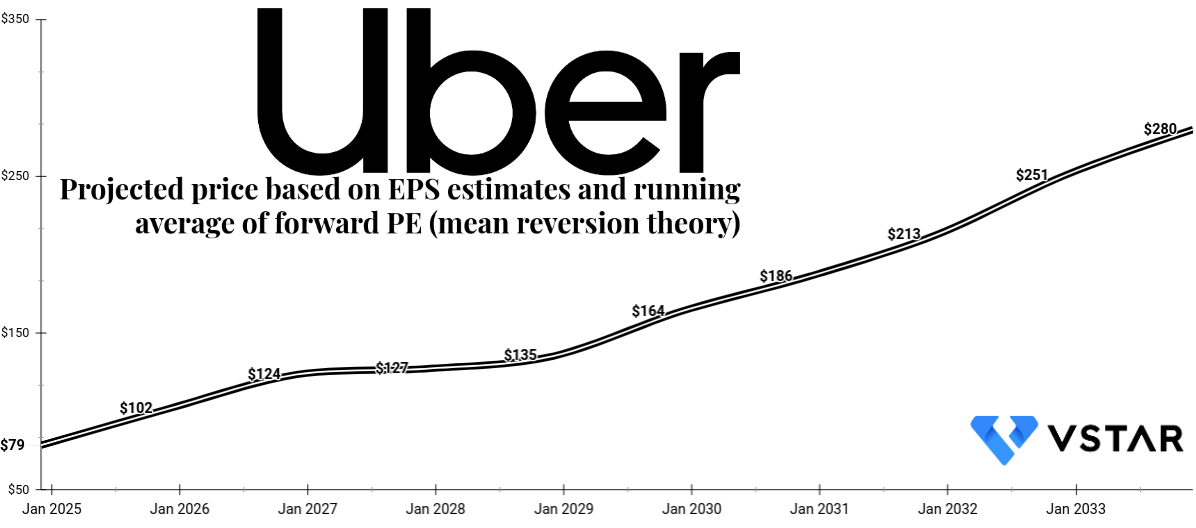

Considering the 2024 forward PE of 64.41 and long-term average of forward PEs of 31.33, the Uber share price may reach $102 by the end of 2025. This is based on mean reversion theory. Through an interpolation to match the 2024 forward PE and the long-term average, a forward PE of 50.71 is projected for 2025. This forward PE is then multiplied by the consensus EPS estimate of $2.01. Over the long term, the price may revert back to its long term average forward PE, and over the course, the price may reach $102 in the midterm.

Source: Analyst's compilation

In 2025, forecasts from coinpriceforecast.com and 30rates.com diverge on Uber's stock price trajectory. Coinpriceforecast.com predicts Uber's price to reach $125 by the middle of the year, with a year-end projection of $146.01, marking a 93% increase from the previous year. Conversely, 30rates.com forecasts Uber's price to open at $172.67 in December, with a low-high range of $166.04-$194.92 and a closing price of $180.48, reflecting a 123% increase over the year. These Uber stock projections suggest significant growth potential for Uber in 2025, driven by factors such as market trends, company performance, and industry developments.

A. Other UBER Stock Forecast 2025 Insights: Is Uber a good stock to buy?

Considering the Wall Street Journal's (WSJ) EPS estimate of $1.99, the price may reach $101 by the end of 2025. The WSJ estimates indicate progressive bottom line performance in the upcoming years, with over 80% of analysts currently holding a bullish stance.

Source: WSJ.com

Similarly, YahooFinance analysts project an EPS of $2 for 2025, which provides a $101 price target. However, considering the high EPS estimate of $3.4, the price may reach as high as $172, optimistically.

Source: YahooFinance

B. Key Factors to Watch for Uber Stock Prediction 2025

Bullish Factors for Uber Stock Price Prediction 2025

Robust Revenue Growth: Uber's consensus revenue estimates for December 2025 indicate an expected growth of approximately 15.90% year-over-year, with estimates ranging from $39.45 billion to $53.74 billion. This growth trajectory reflects the company's success in expanding its delivery business beyond food to include grocery and retail, as well as its burgeoning Uber Direct service. For instance, the delivery and mobility segments have experienced significant growth, with an annualized gross bookings rate of $7 billion in grocery and retail alone.

Membership Program Success: Uber's membership program, Uber One, has demonstrated impressive penetration, covering 45% of gross bookings and driving higher consumer engagement and retention rates. The membership strategy has proven effective in incentivizing repeat usage across various services, thereby contributing to increased revenue streams.

Market Leadership and Expansion: Uber maintains its position as a market leader in several key markets, including seven of the top 10 gross bookings markets. The company's successful expansion into previously challenging markets like Spain and Germany underscores its ability to capture new territories and drive growth through geographical diversification.

Diversification of Services: Uber's strategy of diversifying its service offerings beyond ride-sharing to include delivery, grocery, and retail has yielded positive results. The expansion into adjacent sectors has unlocked new revenue streams, expanded the consumer base, and increased engagement levels. Notably, Uber's Uber Eats platform has evolved into a comprehensive delivery service, offering a wide range of products beyond just food.

Technological Advancements: Uber's continued investment in technology, including AI-driven predictive models and a shared tech stack across its various business lines, enhances operational efficiency and enables rapid innovation. For instance, the company's focus on autonomous vehicles (AVs) as part of its mobility strategy positions it at the forefront of the future of transportation.

Bearish Factors for Uber Stock Forecast 2025

Profitability Challenges: While Uber has demonstrated strong revenue growth, its profitability remains a concern. Despite achieving $4 billion in adjusted EBITDA in 2023, the company continues to face pressure to improve margins, particularly in highly competitive markets such as ride-sharing and food delivery. The ongoing need to invest in driver incentives, technological development, and market expansion may continue to weigh on profitability in the short term.

Regulatory Risks: Uber operates in a heavily regulated industry, subject to scrutiny and evolving regulatory frameworks worldwide. Regulatory challenges, such as changes in labor laws impacting driver classification and safety regulations for autonomous vehicles, pose significant risks to Uber's operations and could lead to increased compliance costs and legal uncertainties.

Competition and Market Saturation: The ride-sharing and delivery markets are highly competitive, with numerous players vying for market share. Competitors may introduce aggressive pricing strategies or innovative services to attract customers, potentially eroding Uber's market position and profitability. Additionally, market saturation in key regions could limit Uber's ability to sustain its historical growth rates.

Dependency on Gig Workforce: Uber's business model relies heavily on gig workers (drivers and couriers) to provide services. Regulatory changes or legal challenges related to worker classification could disrupt Uber's operations and increase labor costs. Moreover, maintaining a satisfied and engaged gig workforce is essential for ensuring service quality and customer satisfaction.

Economic Uncertainty: Uber's performance is closely linked to macroeconomic factors such as consumer spending, employment levels, and overall economic stability. Economic downturns or recessions could lead to reduced demand for discretionary services like ride-sharing and delivery, negatively impacting Uber's revenue and profitability.

IV. Uber Stock Forecast 2030 and Beyond

The stock price may hit $270 by the end of 2030. Now, projecting on such a long-term horizon involves a regular check on the stock movement. Following the current price momentum and current technical direction, the price is attainable over this period. On the other hand, looking at the RSI at 86, a correction is possible. However, the indicator is not forming any negative divergence with the price. If the RSI remains above 50 over this period, the price target may be attained by the stock earlier than expected.

On the monthly time frame, the trend line (purple line) is reflecting upward momentum. Interestingly, the price has breached the upper bond of its recent price consolidation over the past four years. This is a strong bullish signal of an upcoming markup phase in the stock's long-term price cycle. In this direction, a rapid markup phase followed by a distribution phase may materialize the projected price level during the decade.

Source: tradingview.com

Under the mean reversion theory, projecting over the long-term average of forward PEs, the price may hit $186 by 2030 and $280 by 2033. This projection is based on conservative consensus EPS estimates. As theory suggests, over the long term, the stock price moves along with its long-term average. These levels can be considered as price projections with high confidence.

Source: Analyst's compilation

According to coinpriceforecast.com's long-term projections, Uber's stock is anticipated to experience significant growth beyond 2030. The forecast indicates a gradual increase, with Uber's price reaching $150 in 2026, $200 in 2028, $250 in 2029, and $300 by 2034. The forecast reflects a steady upward trajectory, with each year showing substantial gains. By 2035, Uber's price is expected to soar to $318.76, representing a remarkable 332% increase from the baseline. Such optimistic projections suggest confidence in Uber's business model, potential market expansion, and technological advancements.

A. Other UBER Stock Forecast 2030 and Beyond Insights: Uber Stock Buy or Sell?

Uber's core business of contracted mobility remains pivotal to its success. With a disruptive platform connecting passengers with drivers, Uber has capitalized on the growing demand for convenient transportation solutions. Analysts' long-term outlooks for the ride-hailing industry vary, with projections ranging from 9% (as per Mordor Intelligence) to 19% (as per Coherent Market Insight) annual growth through 2030. Despite differing estimates, sustained growth in contracted mobility underscores Uber's significant market potential.

The ride-hailing industry exhibits characteristics akin to those of social media platforms, where network effects contribute to the dominance of a single player. Uber's extensive user base and driver network have solidified its position, with Bloomberg estimating its market share at 75% in the U.S. While network effects create barriers to entry for competitors, they also necessitate responsible governance to prevent monopolistic practices and ensure fair competition.

Source: Uber Investor update

B. Key Factors to Watch for Uber Stock Prediction 2030 and Beyond

Bullish Factors for Uber Stock Forecast 2030 and Beyond

Consensus EPS and Revenue Growth: Uber's consensus EPS estimates project steady growth, with an increase from $1.22 in December 2024 to $8.93 by December 2033. Similarly, revenue estimates indicate consistent growth, reaching $116.87 billion by December 2033. This sustained growth trajectory reflects Uber's potential to expand its earnings and revenue streams over the long term.

Electric Vehicle (EV) Transition: Uber's commitment to achieving 400 million EV miles driven on its platform in the U.S. by the end of 2023 demonstrates its proactive approach towards sustainability. Collaborations with automakers, rental companies, and charging companies highlight Uber's efforts to accelerate the adoption of EVs, aligning with President Biden's goal of having 50% of all new vehicle sales be electric by 2030. With Gen Z projected to form a significant portion of Uber's user base by 2030, the company stands to benefit from its environmentally friendly initiatives.

Source: whitehouse.gov

Diversification and Expansion Strategy: Uber's strategy to diversify its service offerings beyond ride-hailing into sectors like food delivery, grocery, and retail presents significant growth opportunities. The success of Uber One membership, with a penetration rate of 45% of gross bookings, indicates the potential for recurring revenue streams and increased consumer engagement. Moreover, Uber's focus on enhancing the consumer experience through technological advancements and operational improvements positions it favorably to capture market share in various segments.

Bearish Factors for Uber Stock Price Prediction 2030 and Beyond

Regulatory Challenges: Regulatory uncertainty poses a significant risk to Uber's operations and financial performance. Ongoing legal battles and potential regulatory changes regarding driver classification and labor rights could disrupt Uber's business model and increase operating costs. Navigating regulatory challenges while maintaining driver flexibility will be critical for Uber to sustain its growth trajectory.

Competition and Market Saturation: Intense competition within the ride-hailing and delivery market, coupled with market saturation in core segments, threatens Uber's market share and profitability. Escalating customer acquisition costs and aggressive competition from new players could lead to margin pressures and hinder sustainable growth. Uber's ability to differentiate its offerings and sustain competitive advantages amid intense competition will be crucial for long-term success.

Economic Vulnerabilities: External factors such as economic downturns and geopolitical tensions pose risks to Uber's financial performance. Disruptions to consumer spending patterns and travel behaviors during uncertain times, as evidenced by the COVID-19 pandemic, can adversely impact Uber's revenue streams and profitability. Maintaining financial resilience and adaptability to changing market conditions will be essential for mitigating economic vulnerabilities.

V. Uber Stock Price History Performance

Uber Stock Price Key Milestones

In 2019, Uber entered the public market with considerable anticipation, yet its market cap closed at $51.05 billion by year-end. The stock faced early challenges, reflecting concerns over the company's profitability amid fierce competition and regulatory scrutiny. However, the market cap demonstrated investor confidence in Uber's disruptive potential within the transportation sector.

The subsequent year, 2020, marked a significant turnaround for Uber, with its market cap soaring to $89.95 billion by year-end, representing a remarkable 76.19% increase. This surge was fueled by strategic expansions into new markets, diversification into food delivery through Uber Eats, and the pandemic-induced shift towards contactless services. The surge in demand for food delivery services amid lockdowns provided a lifeline for Uber's business, buoying investor optimism and propelling its market cap to new heights.

However, in 2021, Uber faced headwinds as the market cap dipped to $81.34 billion, reflecting a 9.56% decrease. Factors contributing to this decline included lingering concerns over the company's path to profitability, regulatory challenges in key markets, and uncertainty surrounding the post-pandemic recovery. Despite continued growth in its delivery segment, profitability concerns weighed on investor sentiment, limiting the stock's upside potential.

The rollercoaster ride continued into 2022, with Uber experiencing a substantial market cap decline to $49.32 billion, marking a significant 39.37% decrease. The stock faced renewed scrutiny over its business model, labor practices, and regulatory hurdles, contributing to investor skepticism and a downward pressure on its valuation. Additionally, rising inflationary pressures and interest rate hikes further dampened investor enthusiasm for high-growth stocks like Uber, leading to a downturn in its market cap.

However, Uber managed to stage a remarkable comeback in 2023, with its market cap surging to $126.70 billion, representing an impressive 156.89% increase. The resurgence was driven by robust growth in its core ride-hailing and delivery segments, successful cost-cutting initiatives, and improved profitability metrics. Moreover, strategic acquisitions and partnerships bolstered Uber's competitive position and fueled investor optimism, driving the stock to new heights.

As of 2024, Uber's market cap stands at $166.63 billion, reflecting a 31.52% increase from the previous year. The company's resilient performance amid ongoing challenges underscores its adaptability and ability to navigate turbulent market conditions. Despite facing regulatory, competitive, and macroeconomic headwinds, Uber has demonstrated resilience and innovation, cementing its position as a leading player in the global transportation and delivery industry.

Source: tradingview.com

Uber's stock performance against the S&P 500 Index: Is Uber a Buy?

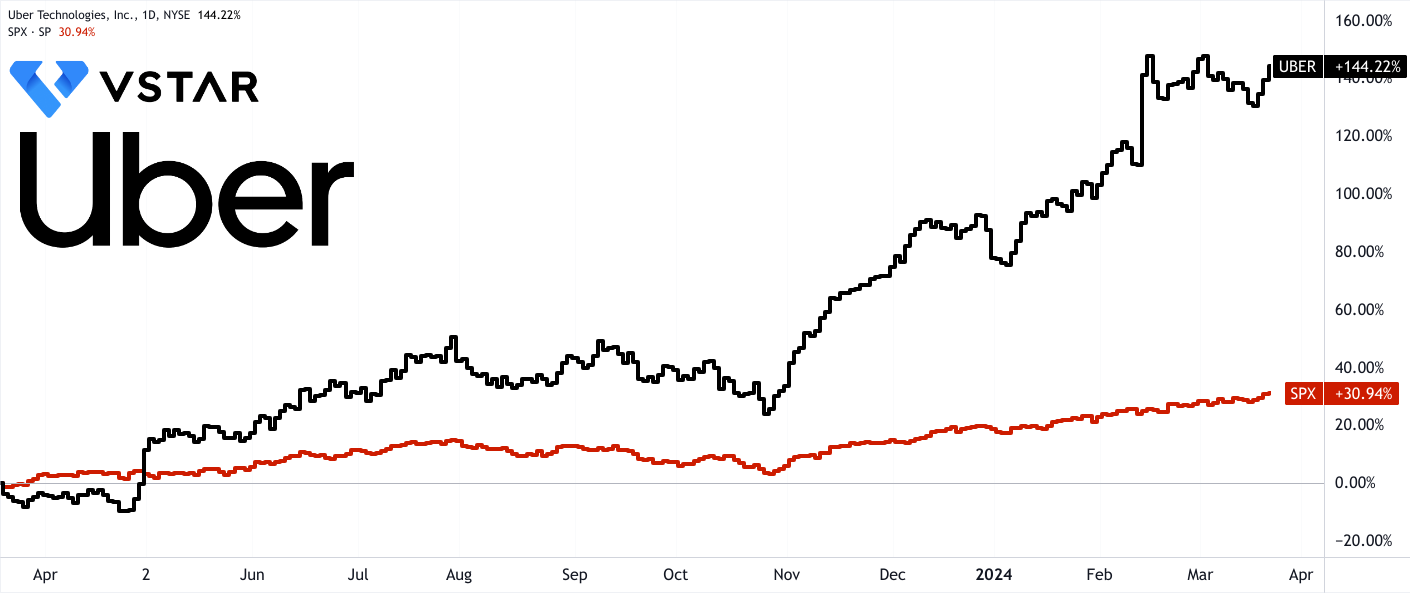

Comparing Uber's stock performance against the S&P 500 index across different time frames provides valuable insights into its relative performance and market trends. Over the past week, Uber's stock price has seen a modest increase of 2.56%, outperforming the S&P 500, which recorded a return of 1.48%. This short-term performance indicates favorable market sentiment towards Uber, possibly driven by positive news or developments within the company or industry.

Expanding the timeframe to one month, Uber continues to deliver a competitive return of 4.8%, compared to 5.4% for the index. Despite lagging slightly behind, Uber's performance remains respectable, suggesting sustained investor interest and confidence.

Zooming out to a six-month period, Uber's stock demonstrates substantial growth, with a remarkable return of 72.40%. This significant surge far surpasses the S&P 500's return of 19.07% over the same period. Such impressive performance likely reflects strong business fundamentals, successful strategic initiatives, or positive market sentiment towards the company's long-term prospects.

Year-to-date (YTD), Uber has delivered a robust return of 30.34%, indicating consistent positive momentum in the stock price throughout the year. This performance is notably higher than the S&P 500's YTD return of 9.89%, reaffirming Uber's attractiveness to investors seeking above-average returns.

Looking back over the past year, Uber's stock has delivered exceptional growth, recording a remarkable return of near 150%, significantly outpacing the S&P 500's return of over 30%. This stellar performance underscores Uber's ability to generate substantial value for its shareholders amid evolving market conditions and competitive pressures.

Source: tradingview.com

Examining the three-year performance, Uber has achieved a solid total return of 40.6%, indicating consistent growth and resilience over the medium term. Here, matching the S&P 500's total return of 40.4% over the same period, Uber's performance remains commendable, reflecting its status as a leading player in the ride-sharing industry.

VI. Conclusion

In conclusion, Uber stock forecast for 2024, 2025, and beyond offers a mixed but generally optimistic outlook, influenced by various factors such as financial performance, market trends, the regulatory landscape, and technological advancements.

Is Uber Buy or Sell?

For 2024, technical forecasts suggest a Uber target price of $101, with analysts projecting prices around $79 to $110 by year-end.

Looking ahead to 2025, forecasts predict further growth, with prices expected to reach $102 to $180 by year-end. The technical target stands at $138. Factors driving this growth include robust revenue projections, successful diversification strategies, and technological advancements. While regulatory challenges and competition pose risks, Uber's market leadership, membership program success, and expansion efforts position it favorably for long-term success.

Beyond 2030, Uber stock price may reach $270 technically. The Uber price prediction of $186–$280 is driven by sustained revenue and EPS growth, electric vehicle initiatives, and market expansion. While regulatory challenges and economic uncertainties persist as risks, Uber's resilience, innovation, and strategic partnerships underscore its potential to thrive in the evolving transportation landscape.

Investment recommendations remain positive technically, with analysts maintaining or increasing price targets and ratings, indicating confidence in Uber's fundamental growth potential.

How to buy Uber stock?

For traders considering exposure to Uber stock through CFDs, VSTAR offers benefits such as leverage up to 1:200, low trading costs with a $0 commission, access to global stock markets, and lightning-fast execution. These features enable traders to maximize opportunities and capitalize on Uber's stock performance within a dynamic trading environment.

FAQs

1. What is the highest stock price of UBER?

The all-time highest closing stock price for Uber Technologies was $81.39 on February 15, 2024. The 52-week high is currently $82.14.

2. Is UBER stock expected to rise?

Uber stock is expected to rise, with estimates suggesting that it could reach $110 by the end of 2024.

3. What is the stock price forecast for UBER in 2025?

The Uber stock price forecast in 2025 is approximately $150.

4. What will UBER stock be worth in 5 years?

Uber stock is predicted to be worth around $114.39 in 5 years.

5. What will Uber stock be worth in 10 years?

In 10 years, Uber stock is estimated to reach $264.89.