Uber Technologies has been on fire since the year started beating analysts' expectations, improving investors' confidence, and proving that it might be able to sustain its profitability in the face of tough competition.

Uber stock has had a bullish run so far and it looks to continue that way for the rest of 2023 making it more attractive to potential investors. So, its current rally has everyone asking: should I buy Uber stock? Before you decide, let's review the company's near-term challenges and financial strength.

Uber Company Profile

It was founded by two friends Travis Kalanick and Garrett Camp who wanted people to be able to request a ride from their phones. It was officially launched in 2009 with Ryan Graves as its CEO but Kalanick later took over in December 2010.

By 2011, it had expanded from just San Francisco to other cities like New York, Boston, Seattle, Chicago, Washington DC, and Paris. By 2015, it became the most valuable startup in the world with a valuation of $51 billion. However, in 2017, the company faced a series of challenges and its IPO became the biggest first-day dollar loss in IPO history in the US. Before its IPO it was valued at $120 billion but afterward, it was valued at $69 billion. Now Uber market cap is at $77.82 billion with Dara Khosrowshahi as the CEO of the company.

Source: Brittania

Business Model and Services

Business Model

Uber is still mostly a ride-sharing consumer-centric business that connects drivers with riders. It is estimated to have over 100 million monthly users and offers various ride options from bikes and scooters to vehicles.

The Uber business model focuses on building partnerships and letting those partners work under their brand providing services rather than developing a product of their own. So, Uber doesn't own any of the cars and only makes sure that service standards are met. Uber also takes a 20-25% fee on all fares by drivers using their services.

Services

Uber has expanded its services from just ride-sharing. Customers can now place orders for food delivery, groceries, and other items. There is also a freight segment for delivering products globally.

Source: Ridester.com

Uber's Financials and Growth

Review of Uber's Financial Statements

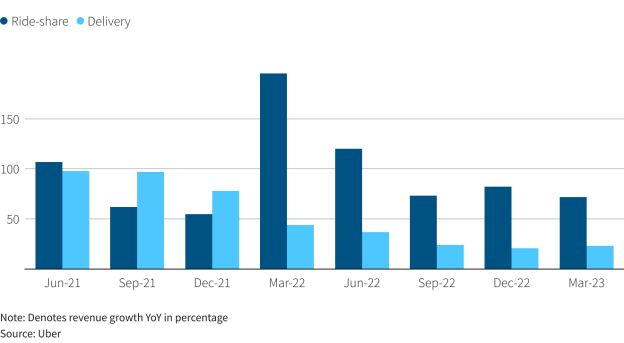

From 2017 up until 2022 on an annual basis, Uber has not had a profitable year. In addition, its earnings growth for the past 5 years is -4.9% compared to the industry's average of 13.5%. Surprisingly, Uber revenue growth rate has been impressive with its revenue growing from 3.8 billion in 2016 to almost $32 billion in 2022. In 2021, it had a net loss of $496 million but this number significantly increased in 2022 to $9.14 billion which was also higher than its $6.7 billion net loss for 2020.

It has stable top-line growth and is focused on improving profitability. Its total assets are estimated at around $32 billion and the company holds $4.17 billion in cash as well as $3.49 billion in receivables. Its assets can easily cover its liabilities of $23.78 billion and with Uber market cap being $77.8 billion, the company can raise enough capital to balance its account if the need arose. Also, the company's adjusted EBITDA margin went up from -4.4% in 2021 to 5.4% in 2022 and rose to 8.6% in the first quarter of 2023. Uber is expected to keep improving with a target of $800-850 million for its Q2 2023 adjusted EBITDA.

Key Financial Ratios and Metrics

Like most tech companies, Uber is still recovering from the effects of the pandemic but it seems to be doing better than its rivals, Lyft and Doordash, both ride-hailing companies as well. Both Doordash and Lyft are reporting relatively lower revenue to Uber bringing in $7.16 billion and $4.1 billion respectively compared to Uber's $33 billion in revenue. However, all three companies, Uber, DoorDash, and Lyft all have negative profit margins of -10%, -19%, and -37% respectively.

Although Uber is in a relatively better position than its competition, it is still trading under its fair value of $68 which indicates that it is undervalued. The fact that it has been losing money annually is a key factor for this but as the company shows that it can maintain profitability, this is likely to improve.

How is Uber Stock Doing?

Trading Information

Primary Exchange & Ticker: NYSE: UBER

Country & Currency: USA (USD)

Trading Hours: Pre-market hours (7:00 - 9:30 am) and after-market hours (4:00 - 8:00 pm)

Stock Splits: N/A

Dividends: N/A

Latest Developments

Goldman Sachs Pick

Uber's position in the tech industry began to look better this year when Goldman Sachs, one of the top Wall Street banks picked Uber as one of the tech stocks with the most compelling risk-to-reward ratio this year. They stated that the company was in a good position to weather volatile market conditions if one should occur in 2023 and their Uber stock price prediction sees the stock hitting $47 by the end of the year.

Inclusion of Waymo robotaxi

Waymo recently announced a partnership with Uber to use its autonomous vehicles to offer ride-hailing services and deliveries through Uber Eats. This was a surprising partnership because the two companies were once competitors in the robotaxi space and also settled a lawsuit for $245 million as Waymo accused Uber of poaching one of its leading engineers.

Uber's Advertising Business

The company's management acknowledged that its advertising business was a major factor in boosting its earnings in delivery and Uber expects to generate $1 billion in ad revenue by 2024.

Overview of Uber Stock Performance

2023 has been a big year for Uber stock, up by more than 50% and succeeded in reaching 52-week highs. Its performance is more incredible when you look at its rise over 12 months as it is up by 70%. Its recent first-quarter earnings report has also made bullish investors more confident about the stability of the company.

This is its seventh consecutive profitable quarter as its revenue rose by 29% from Q1 2022 to $8.8 billion and completely exceeded analysts' expectations by a little over $90 million. On a GAAP basis, the company also performed well as it narrowed its net loss from $5.9 billion to $157 million beating analysts' forecast by $0.01. Its impressive first-quarter earnings caused its stock to increase by another 16% just two days after it was released.

However, at $38.45 it is still trailing behind its IPO price of $45 and is still subject to near-time challenges. It may not get to its all-time low of $14 but current uber stock forecast sees its stock growth cooling down a bit before it begins its rally again and the company is also expected to face tougher currency headwinds before the end of the year. But regardless, Wall Street investors are relatively positive and Uber stock analysis indicates that it is a moderate to strong buy. So, analysts’ Uber stock price target for 2023 sees it finally surpassing its IPO price to reach $48 with a possible high of $75. But if it drops, it is expected to land anywhere between $30-$32.

Key Drivers of Uber Stock Price

Q1 2023 Earnings Report

Uber financials for Q1 2023 left investors cheering and showed that the company really had a strong start for the year and would hopefully continue its epic run. Its revenue of $8.82 billion topped analysts' expectations by a little over $100 million and its adjusted profits came to $761 million compared to Wall Street's estimate of $678.6 million. It did report a net loss of $157 million which was lower than the $5.9 billion loss it incurred last year.

Increasing Customers

For the first quarter, Uber's monthly active platform users increased to 130 million or 13% year-over-year. People are also taking more trips as it rose to 2.1 billion and gross bookings also climbed by 19% to $31.4 billion.

Analysis of Future Prospects for UBER Stock

Uber is demonstrating that its financial foothold is becoming better and it is already recovering from the blow dealt to its business by the pandemic. Plus, they are already implementing AI on both the consumer and driver side of their business to predict accurate arrival times for deliveries and rides as well as enable more drivers to join the platform by making the onboarding process more cost-effective and reliable. You also have to remember their move to autonomous driving.

Source: TheStreet

However, it still has to deal with competitive rivals like Lyft and DoorDash who are consistently improving their services. So, is Uber a buy? For 2023, uber stock outlook remains positive and with an enterprise value of $69 billion, its stock is relatively cheap. There will be pullbacks and occasional dips to allow the stock to rest but it is expected to keep rising making it a good buy for this year.

Risks and Opportunities

Risks

1. Competition:Uber's expansion in the USA and abroad not only increases its operational risks but the competition it faces. Uber competitors in the ride-hailing industry are Lyft and Doordash and they are slowly eating away at their market share. As for its grocery delivery business, it faces off against other strong companies like Target, Instacart, Amazon, Walmart, and Gopuff.

2. Price Surges:Uber has been criticized for its surge pricing meaning that its prices can change depending on demand and supply. This means that the prices vary regularly depending on the cars available and the number of passengers that need them.

3. Driver problems:Uber drivers are currently complaining about the rates they earn for their work because they now earn less in fares and tips than taxi drivers. These drivers have organized two strikes and encouraged passengers to boycott the company.

Source: Business Model Analyst

Opportunities

1. Professional Service:Uber guarantees the professionalism of its drivers and ensures that both the driver and passenger are treated with respect. Both drivers and passengers are allowed to rate the other's performance allowing you to root out unprofessional drivers and unruly passengers.

2. Embracing Digitalization: Uber has made it much easier for customers to get anything they need from its app.

3. Driverless technology: The use of autonomous driving features will help the company become more popular with the public.

Future Outlook and Expansion

Uber has been able to scale its business rapidly and is now operating in over 10,500 cities worldwide but there is still more room for growth. The company can continue to expand its footprint in the food delivery industry through Uber Eats as the industry is expected to be valued at $384 billion by 2027. Uber already holds 26% of that market but will have to be meticulous in its plans for expansion since the industry is very competitive.

Plus, the company is not yet a household name in Europe meaning that there are still a lot of untapped markets in the continent. By 2025, Uber wants to get almost every driver on the platform to increase its attractiveness. If they can do this, they can lower costs for passengers, and expand their operation to more countries.

How to Invest in Uber Stock

There are different ways you can invest in Uber stock:

1. Hold the share:Uber can still extend its operations to more countries and like most tech companies right now, Uber is trading at a bargain and is positioned as a viable long-term buy.

2. Options: Uber options are relatively safe to invest in especially now that investor sentiment about is positive. Since you are investing with short-term volatility, make sure you have relevant risk-management tools to protect your profits.

Source: CNBC

3. CFDs: Uber stock has been going up and down since is Q1 2023 earnings came out and news of its collaboration with Waymo, which provides a good opportunity to invest. The best part is you can invest even when the stock price is falling and still make profit.

Why Trade Uber Stock CFD with VSTAR

The VSTAR trading platform offers several advantages for traders who want to invest in Uber stock CFD and have an edge over the market:

Trade with leverage: You can protect your capital and expand your position in the market with leverage of up to 1:200.

Competitive Spreads: VSTAR offers spreads from 0.0 pips on major assets.

Licensed and Regulated: VSTAR operates under international regulatory boards and adheres strictly to industry standards.

How to Trade UBER Stock CFD with VSTAR - Quick Guide

VSTAR makes it easy to start trading in 4 quick steps All you have to do is:

● Open the VSTAR website or the app

● Click on Register or Create Account to get registered.

● Type in your email and password and login

● Provide your personal information and complete your trading profile

You are ready to start trading!

Conclusion

Uber's increasing profitability, scalability, first-mover advantage, and strong position in various markets increase its growth potential significantly. There is no easy way to tell how it would perform in the future but the company is likely to continue to grow at a steady pace throughout 2023. However, it would have to make working for the company more attractive to drivers and remain ahead of the stiff competition if it wants to remain a profitable company.