Upstart Holdings has had its fair share of ups and downs lately, dealing with the brunt of the rising interest rates and the fear of investors about a possible recession. By the middle of 2022, it has fallen from its all-time high in 2021 and has suffered with maintaining profitability. But from the way things are shaping out, the company is already on its way to recovery.

With its renewed focus on profitability, the startup has ramped up its efforts at cutting costs, and the latest investments it got from long-term partners, have renewed investor sentiment in the company and UPST stock has benefited from it massively. But its current rally comes with a high degree of risks as analysts are not sure it can sustain the rise short-term. So if you've been considering the question "should I invest in Upstart stock" here are some details to consider first.

Upstart Holdings Inc's Overview

What is Upstart

As an AI Lending platform, Upstart Holdings partners with banks and various credit unions to provide loans for customers. It was founded a little over a decade ago in April 2012 by Dave Girouard, Anna Counselman, and Paul Gu, with an Income Share Agreement product that allowed individuals to raise funds by sharing a certain percentage of their future income. By 2014, Upstart moved away from this product and fully went into the loan marketplace, offering the standard 3-year loan which has now been expanded to include a 5-year loan.

Upstart Company became one of the first AI lending platforms and also introduced an unconventional way to determine a person's creditworthiness. This means that in addition to the typical requirements like income, credit report, and FICO score, Upstart looks at your educational background and work history to determine if you can repay your loan.

Source: Value the Market

How does Upstart make money?

Upstart leverages the power of AI to provide a superior loan product, while addressing the issues present in the traditional lending system with its income and default prediction model. It operates a two-sided marketplace business model, meaning that Upstart does not underwrite the loan itself, but rather the bank or credit union with which it connects lenders.

It aggregates customer demands for loans and then connects them with bank partners that can provide the loans customers are looking for. The startup considers over 1,500 parameters into account to access the risk of lending loans.

Plus, Upstart Holdings majorly partners with small banks that cannot employ an army of statisticians. As such, its major source of revenue comes from fees paid by banks which can be referral fees or loan servicing fees as customers repay their loans.

Products and Services

With Upstart, borrowers pay less interest because of the accuracy of their model. Once you qualify for a loan, you can apply for all sorts of loans ranging from personal loans for things like weddings to loans for small businesses and car refinance loans. The loans Upstart provides range from $1,000 to $50,000 with interest rates between 7% to 36%. The use of AI to automate the process allows Upstart to issue more loans to people with little to no discrimination.

Source: Seeking Alpha

Upstart also partners with up to 13 coding boot camps that borrowers can apply to and the funds for this are provided by accredited investors and private individuals.

Upstart Inc Financials

UPST Earnings

Although its Q1 2023 revenue was $103 million, a 67% decrease from last year but from 2017 to 2022, its total revenue has increased by almost 1400% which is quite impressive for a startup.

The company has been quite profitable since the time it was publicly listed but it has struggled recently.

It has $425 million in cash, down from $1 billion in 2022 and there is an operating cash flow loss of $76 million. It has a total debt of $1 billion but holds a shareholder equity of $627.2 million resulting in a debt-to-equity ratio of 159.6%. However, its total liabilities and assets are relatively balanced standing at $1.2 billion and $1.8 billion respectively.

Key Metrics of UPST Financials

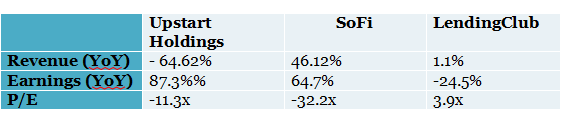

Upstart Holdings is doing well for itself as a startup with a potential for long-term growth but compared to its competitors, it is quite overvalued.

UPST Stock Performance

A. UPST Stock Trading Information

Primary Exchange: NASDAQ: UPST

Country & Currency: USA (USD)

Upstart IPO: UPST started trading on Nasdaq in December 2020 and opened at $26 above its IPO price of $20 per share.

Trading Hours: Investors can trade in the UPST Premarket hours (4:00 - 9:30 am ET) and After Hours Market (4:00 - 8:00 pm ET)

Upstart Holdings Stock Splits: N/A

Upstart stock Dividend: N/A

Latest Upstart Developments or Upstart News Investors/Traders Should Note

Upstart $2 billion funding

UPST stock has been on a bullish run after the lending marketplace secured an additional $2 billion in funding. The company succeeded in securing long-term commitments from its partners to provide these funds for loaning activities.

Source: SeekingAlpha

Insider selling is causing concern

Upstart's CFO Sanjay Datta sold over 26,00p shares at almost $24 per share resulting in a sale of almost $625,500. However, Datta still owns over 419,000 shares, worth more than $10 million. Another insider Natalia Mirgorodskaya sold shares worth $42,000.

This insider selling has left investors feeling uncomfortable because it could indicate a possible decline in Upstart's stock price.

B. Overview of UPST Stock Performance

Upstart investors have been on a roller coaster ride after going public in 2020 at around $30 per share. At its peak in 2021, the stock was trading at around $400 per share and the Upstart stock forecast at the time, was largely positive as investors expected the trend to continue. Now trading at $37.03 per share, it seems that wasn't the case as shareholders are currently trying to break even.

However, the startup itself has grown significantly over the years and the stock itself has tripled since it bottomed at $11.93 in early May and up until now, the price movement has been relatively flat. The stock initially tumbled last year as the rising federal interest rates and slowing economic growth made bankers fearful about providing loan facilities.

The company's Q1 2023 earnings report didn't have much impact on investors' sentiment but it did show the potential for more growth in the second quarter as Upstart secured $2 billion in long-term funding. Later on, it was revealed that there was an agreement for Castlelake to take up to $4 billion of consumer installment loans, indicating that the startup is on its way to recovery.

The parabolic run has shifted analysts' Upstart Holdings stock price target to around $40 to $41. But if the stock corrects sharply, Upstart stock price prediction sees it holding at around $20 for the rest of the year.

C. Key drivers of UPST Stock price

AI Momentum

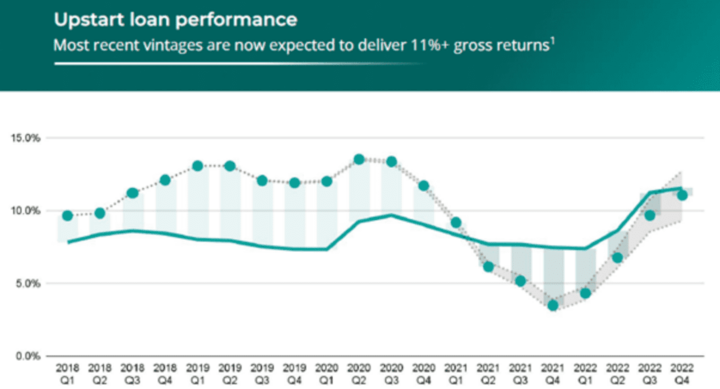

The improvement in AI has helped Upstart to develop a more accurate credit model to separate good and bad risk. With the data gathered over the years, its AI is trained using over $100 billion in sales performance data and it continues to learn and adjust based on real-time loan performance.

Source: Fintel

The improved financial health of customers

According to CEO David Girouard, the financial health of American consumers has improved compared to what it was in 2022. This is shown by the personal saving rate increasing by 5.1% since 2022.

New Guidance for Q2 2023

Upside adjusted its guidance for Q2 2023 but it is still relatively higher than analysts' prediction. It expects to bring in $135 million in revenue compared to analyst estimates of $126.25 million. Net income loss and adjusted net income loss are also predicted to be around $40 million and $7 million respectively.

D. Analysis of Prospects for UPST Stock

Despite the current macroeconomic headwinds, it is hard to fault the technology and potential of Upstart Holdings as a company and its underlying asset.

Upstart is on the road to recovery and investors are warming up to it as indicated by its current rally but it is still down by 94% from its all-time high in 2021. Investor sentiment is becoming more positive but it remains generally bearish for the short term.

Source: Invezz

Upstart Stock Forecast

The stock is still very volatile with considerable risk, resulting in a median UPST stock price target of $13 for 12 months. This indicates a possible 64.89% decrease from its current price. This is reflected in Upstart stock buy or sell rating show as it received 17 buy ratings, 32 sell ratings, and 21 hold ratings.

Risks and Opportunities

Here are some risks and opportunities facing Upstart Holdings in the near term:

Potential Risks

Strong Competition: The company has to deal with other consumer finance companies like SoFi, LendingClub, AXP, and Prosper.

Struggle to find bank partners: Upstart has a promising business model but it still relies on 3rd party investors to provide loans. The recent interest rate hikes and recession worries have caused these investors to pull back from funding loans.

Loss in its workforce: Upstart slashed 20% of its workforce or about 365 jobs to reduce its annual operational costs.

Source: LinkedIn

Opportunities

Demand for automotive loans: Upstart has launched a product called Auto Retail which offers customers the chance to purchase dealer inventory in-store or online. So far, up to 778 dealerships have signed up for Auto Retail.

Promising technology: While the fintech company still has to deal with the problem of 3rd party financiers, its model is still holding up well despite the challenges in lending currently.

Room for growth: Apart from personal and automotive lending, Upstart has plans to release mortgage and small business loans. Plus, it is still a relatively young company with good long-term potential if it can manage its current macroeconomic troubles.

Future Outlook and Expansion

Upstart's high dependence on its bank and credit union partners exposed it a lot to the volatility in the debt markets but the company's prospects for the future still look great.

For one, they plan to enter into mortgage lending before the end of the year and later get into small business lending which could provide a $3.8 trillion opportunity for the company. As technology improves, its AI model will also become more valuable, especially when you consider how much data would be used to train it.

UPST Stock Trading Strategies

A. Technical Analysis Strategies

As a trader, there is little you can do without good technical analysis strategies because it is one of the best ways to get near-accurate predictions about market movement. Upstart stock has tripled recently, showing just how volatile it currently is and you would need tools like Bollinger Band and average true range. This will help you keep track of the rising volatility and determine how risky trading UPST stock will be. Pair this with two to three moving averages (200, 50, and 20 day moving averages) and the Relative Strength Index to get optimal signals to buy or sell Upstart stock.

B. Fundamental Analysis Strategies

Fundamental analysis is majorly used to assess if the stock is trading higher or lower than its fair value. To analyze UPST you would need financial reports like earnings as well as micro elements like sales performance. Also look at key details like the company's revenue, profit, and losses over a period of months and years. Fundamental analysis is important for all trading styles but especially helps in long-term upstart stock investment.

Source: Medium

C. News-Based Trading Strategies

News-based trading strategies seek out trading opportunities and accurate UPST stock forecast when relevant economic data and information make the headlines. Economic news is enough to trigger massive changes in price and hike volatility which could create lucrative opportunities.

Checking for relevant Upstart stock news to get a broader picture of how the industry is reacting to it. You can do this by looking at economic calendars and even social media.

D. Risk Management Strategies

Trading is a good opportunity to make a profit. But the negative effects of a losing trade are often overlooked. If you have strategies for spotting trading opportunities along with optimal entry and exit points, then you must implement a strategy that can mitigate the effect of losses.

Implementing risk management techniques for UPST involves the use of stop-loss orders, maintaining a positive risk/reward ratio, and trading with a diversified portfolio.

How to Trade UPST Stock CFD at VSTAR?

By trading stock CFD, you can:

● Make a profit without owning UPST stock

● Trade in both bear and bull markets

● Increase your profit potential with high leverage and keep more of your capital

Trading UPST stock CFD with VSTAR gives you:

● A higher chance of growing your portfolio because you retain most of your profits

● Security as VSTAR is a globally regulated platform

● 24/7 support with its customer service

● More opportunities with fast execution of trading orders and deep liquidity.

Conclusion

Upstart's increasing volatility cannot be ignored and trading the stock needs to be done with a degree of caution and risk management. The company will probably not be profitable this year but analysts are hopeful that it would recover in 2024, considering that its partners were still willing to commit $2 billion to its long-term development.

It will be hard for Upstart to get back to the level of profitability it enjoyed at its peak because of the changing economic conditions, but it could pay off big time in the long run when its current issues are settled.

FAQs

1. Who owns the most Upstart stock?

Upstart's founders and early employees own significant amounts of the company's stock. CEO Dave Girouard is probably the largest individual shareholder.

2. What do analysts say about Upstart stock?

Analysts have mixed views on UPST stock. Some see significant growth potential, while others are concerned about rising interest rates and recession risk.

3. What is the price target for Upstart stock?

Upstart stock price targets range widely from about $25 on the low end to $350 on the high end. The average analyst price target is currently around $100.

4. What is a fair price for Upstart stock?

Estimates of a "fair value" stock price for Upstart vary widely based on assumptions about growth rates, profit margins, interest rates, and other factors. Most analysts place fair value between $60 and $150.

5. What is Upstart stock forecast for 2025?

UPST stock price forecasts for 2025 also vary widely. More bullish forecasts see over $500 while bearish views are under $50. The average 2025 prediction is around $150-$200.