The U.S. dollar experienced bullish pressure on Wednesday, supported by its reputation as a safe-haven asset and the upbeat U.S. data. Earlier, the appreciation of the currency was restrained by dovish statements made by two officials of the Federal Reserve.

Safe Havens Demand of USDX

Traders are increasingly alarmed by the escalation of violence in the Middle East, specifically in Gaza, where the Israeli military struck more than 200 targets overnight in retaliation for Hamas attacks over the weekend.

In anticipation of a protracted conflict that has already claimed more than 1,500 lives, Israel may launch its first ground offensive in Gaza since 2014, according to rumors. The aforementioned context is anticipated to maintain backing for the U.S. dollar, although it is a counterpart of the safe haven Gold (XAUUSD).

The USD/ISR pair fell 0.2% to 3.9375 on the Israeli shekel, stabilizing just above its lowest level in nearly eight years. Stability was restored due to the central bank's pledge to sell $30 billion in foreign exchange.

Higher U.S. Yields Indicate An Interest Rate Hike

Indications from Federal Reserve officials that the recent selloff of bonds may eliminate the need for additional increases in interest rates moderate the dollar's ascent.

"There may be less necessity to increase the Fed funds rate if long-term interest rates continue to be elevated due to higher term premiums," said Dallas Fed President Lorie Logan.

In light of the recent surge in yields, Fed Vice Chair Philip Jefferson reiterated this sentiment, stating that the central bank must "proceed with caution."

FOMC Minutes & PPI Review

The US Dollar Index (USDX) became slightly bearish after the hot Producer Price Index (PPI) release. The monthly figure comes at 0.3%, higher than the previous report of 0.2% increase.

After that, the FOMC meeting minutes led to a limited reaction on the financial market. As per the current document, members have judged the risk for achieving the ultimate goal. Most of the members see the continued pressure on inflation.

At the September meeting, the Fed agreed to keep the interest rate at 5.25% to 5.5%, as expected. Moreover, the central bank has shown an interest in an additional rate hike in 2023.

Overall, inflationary pressure is considered when a rate cut is needed to fight the current situation. It is time to see how the CPI report comes on Thursday, where an ease in inflation could be a bullish sign for the US Dollar Index (USDX).

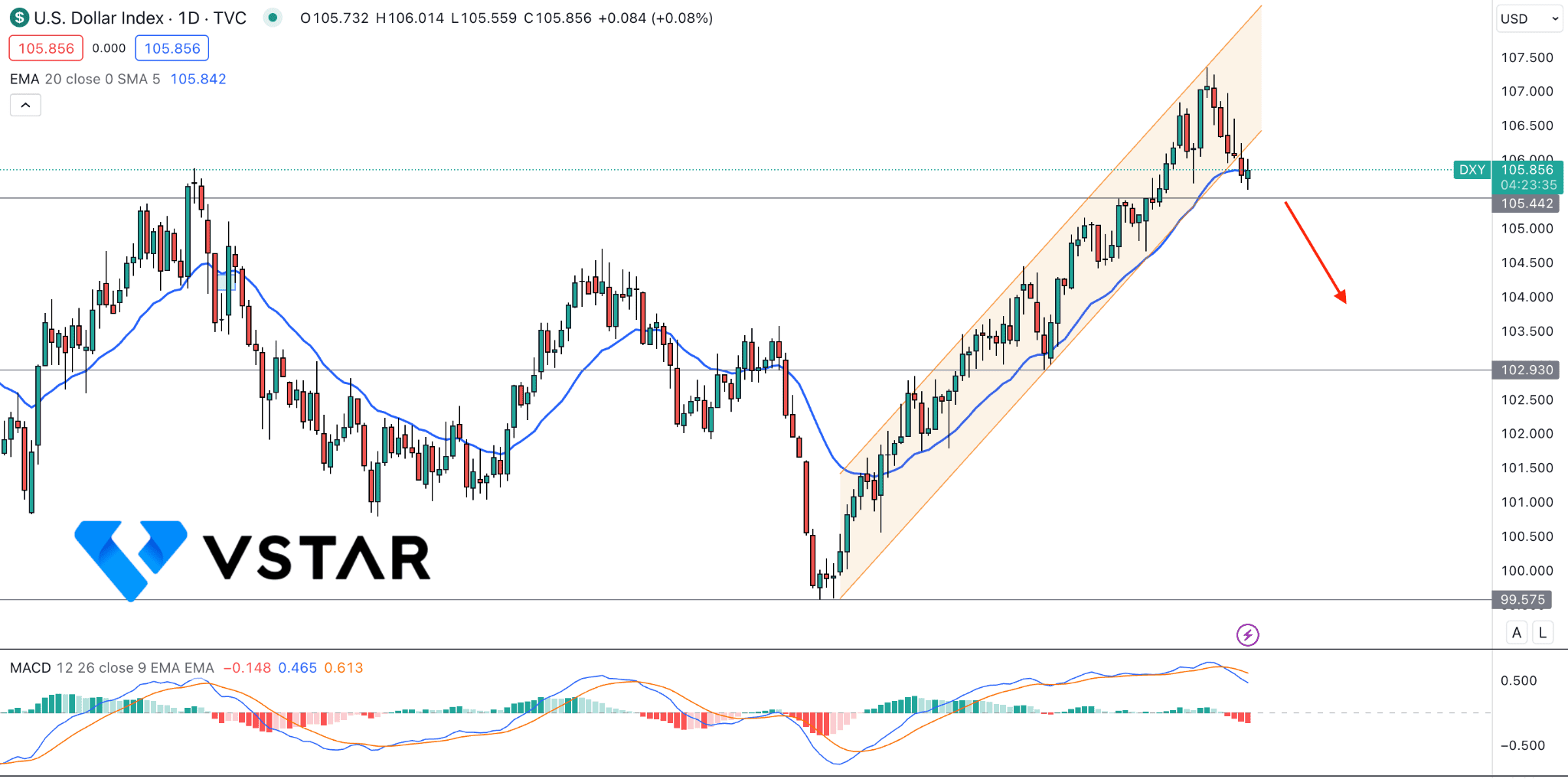

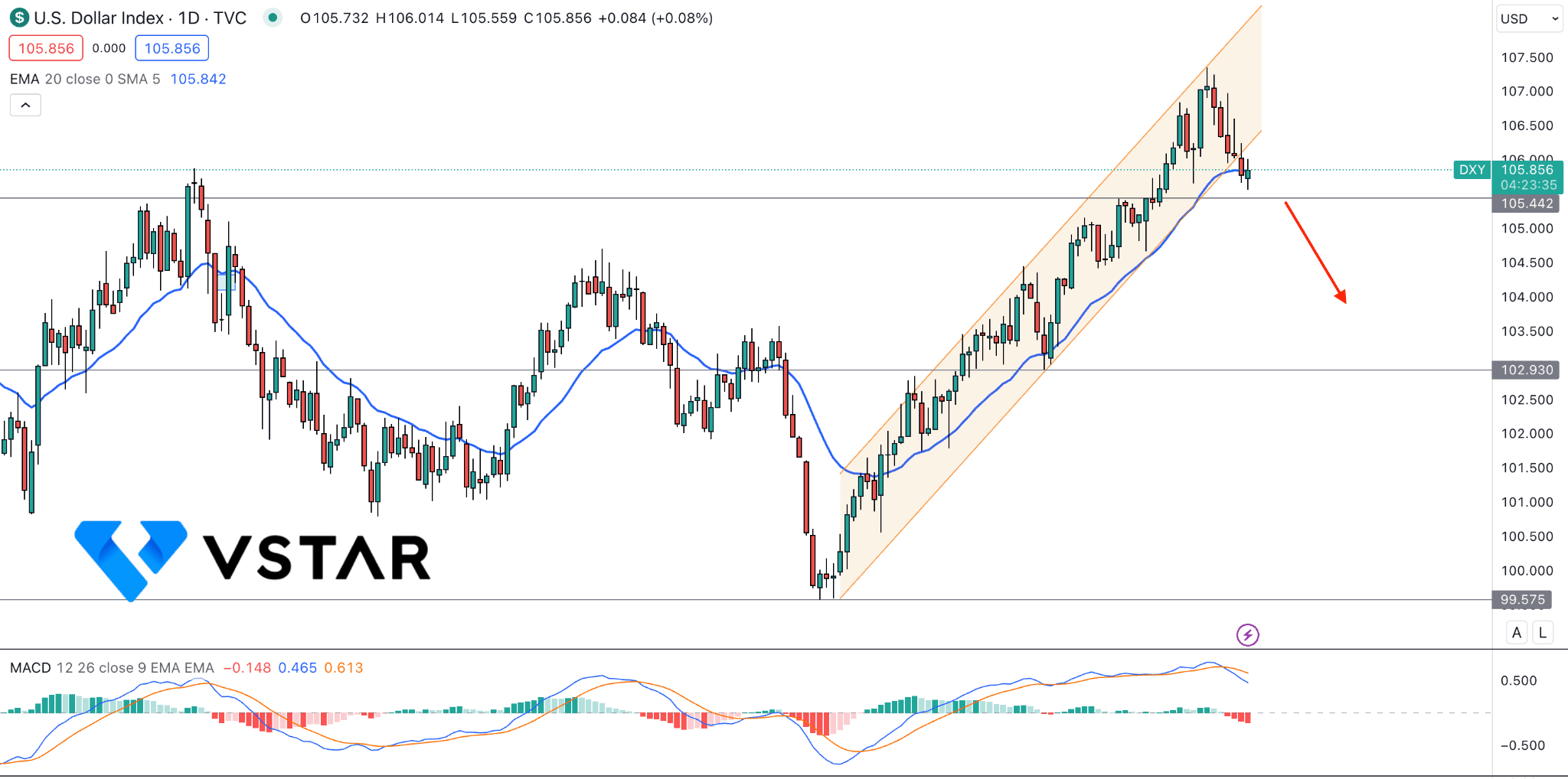

US Dollar Index (USDX) Technical Analysis

In the short-term USDX outlook, bearish momentum is potent as bulls failed to hold the momentum above the 20-day Simple Moving Average level.

In the daily chart, the 14-day Relative Strength Index (RSI) is above the 50.00 neutral line, while a bearish crossover has formed in the MACD Signal line. Also, the MACD Histogram is in the negative zone, which could be a strong signal of a possible bearish pressure.

In the current price action, the near-term support level is at the 105.44 area, which could be the primary barrier to the possible downside pressure. On the bearish side, an ascending channel breakout is in play, where a daily candle below the 105.40 level could lower the price toward the 102.92 level.

On the other hand, an immediate bullish recovery with a daily close above the 20-day EMA could be a long signal, advancing the price above the 107.34 swing high.