No one has a crystal ball to see which stock will be the next big hit. Most people just follow their guts when it comes to trading stocks. However, being speculative and making guesses is not enough to make you a successful trader. In the world of investing, understanding stock valuation is highly essential for any investor looking to make informed decisions when trading stocks.

Stock valuation involves determining the intrinsic value of a company's stock by analyzing its financial and economic data. This analysis is mostly executed with knowledge and experience on trending topics like stock market trends or the best stock to buy at the moment. The importance of stock valuation cannot be overstated. It allows you to identify potential investment opportunities by finding stocks that are undervalued relative to their true worth.

Are you ready to enter the thrilling world of stock trading? Whether you're a seasoned investor or still in the learning phase, this article will teach you all you need to know to become a pro in today's fast-paced market.

Methods of Stock Valuation

One of the challenges often faced by stock traders is the choice of trading and stock valuation to use. There are two main methods of stock valuation: fundamental analysis and technical analysis. Both of these methods have their own unique peculiarities and differences. As a stock trader who wants to up his trading game, understanding the when, why, and how to use these two trading methods is extremely crucial. Whatever strategy you choose, knowing how to implement it makes all the difference.

Fundamental Analysis

Fundamental analysis is a method used in determining a company's intrinsic value by analyzing its business and financial statistics. Fundamental analysis is primarily concerned with financial records such as the income statement, the company’s balance sheet, and the cash flow statement. This method of stock valuation also assesses the company's management, market standing, and emerging patterns. The elements of fundamental analysis include:

1. Key financial ratios

The price-to-earnings (P/E) ratio, the price-to-sales (P/S) ratio, and the price-to-book (P/B) ratio are all vital financial ratios used in fundamental research. Using these ratios, you can gauge whether a given stock trades at a premium or discount to its industry rivals. Also, these ratios portray the company's value and management, leaving investors with an unambiguous choice.

Let's say a trader is considering investing in Rivian stock. The trader might use the following financial ratios to evaluate the stock:

P/E ratio: The P/E ratio is calculated by dividing the stock price by the company's earnings per share (EPS). For example, if Rivian has a stock price of $250 and an EPS of $25, its P/E ratio would be 10. After calculations, a high P/E ratio could indicate that the stock is overvalued relative to its earnings potential, while a low P/E ratio could indicate that the stock is undervalued. The same rule applies to price-to-book and price-to-sales ratios.

Based on these ratios, the trader might determine that Rivian stock is undervalued relative to its industry peers and decide to invest in the stock.

2. Discounted Cash Flow (DCF) analysis

Discounted cash flow analysis allows you to calculate the present value of a company's future cash flows. Investors with a long-term horizon favour this technique of valuation. This helps you understand how much the company makes and whether it's worth the investment risk.

For example, if a trader is considering investing in a lemonade stand that they expect will generate $100 in profits each year for the next three years, The trader believes they can earn a 10% annual return on their investment.

Using the DCF method, the present value of the future cash flows would be calculated as follows:

Year 1: $90.91 (calculated as $100 divided by 1.1)

Year 2: $82.64 (calculated as $100 divided by 1.1 squared, or 1.21)

Year 3: $75.13 (calculated as $100 divided by 1.1 cubed, or 1.331)

The present value of the future cash flows is then added up: $90.91 + $82.64 + $75.13 = $248.68.

With this analysis, the trader may consider investing in the lemonade stand if the current market value of the business is below $248.68.

Technical Analysis

Technical analysis examines a stock's price and volume data to identify patterns and trends. Instead of looking at a company's fundamentals, this technique analyzes stocks’ past price movements and trading activity. Technical stock trading involves analyzing price charts to predict the stock's direction.

Technical analysis is a very potent method of trading. However, when used with fundamental analysis and in-depth market research, it becomes a more comprehensive investment strategy.

The two most important elements in technical analysis are charts and technical indicators.

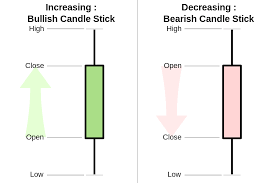

1. Charts

Charts are graphical representations of historical prices, time intervals, and the volume of stocks. Bar charts, line charts, and candlestick charts are a few examples of the types of charts that you need to understand to be able to visualize and predict price trends and patterns. If a trader cannot view and differentiate charts, it is safe to say stock trading is not feasible. Why? Charts depict past and present price and volume movement of the stock. Investors must be able to read charts in order to determine their future direction and invest appropriately.

BAR CHART

LINE CHART

2. Technical indicators

Technical indicators allow you to understand the demand and supply trends of the market. Although numerous technical indicators can be used to gain insight into price flow and trend mechanisms, they cannot all be used simultaneously.

Moving averages, bollinger bands, the relative strength index (RSI), stochastic oscillators, and the moving average convergence divergence (MACD) are just a few technical indicators used by technical experts to spot patterns in stock price data. Investors can use these signs to help them make better-informed choices.

Let's say someone is considering investing in BYD. They look at BYD’s stock price chart and notice that it has been trending upward for the past six months. However, they want to use technical indicators to confirm this trend and make a smarter decision.

The trader might look at the following indicators:

Moving averages: The person might use a 50-day and 200-day moving average to identify the stock's long-term trend. If the 50-day moving average is above the 200-day moving average, it could indicate a bullish trend.

Relative strength index (RSI): They could also use the RSI to determine whether the stock is overbought or oversold. If the RSI is above 70, it could indicate that the stock is overbought and due for a correction. If it is below 30, it could indicate that the stock is oversold and due for a rebound.

Bollinger Bands: Bollinger Bands can also be used to identify the upper and lower price levels of a stock based on its volatility. If the price is touching or breaking through the upper band, it could indicate an overbought condition. Conversely, if the price is touching or breaking through the lower band, it could indicate an oversold condition.

Technical indicators can help to solidify a trader’s position on whether a company is in a bullish trend and is not currently overbought or oversold. They may decide to invest in the stock with this information in mind.

Key Factors to Consider in Stock Valuation

When valuing stocks, you should consider several key factors. Among these factors are

● Company Performance

● Industry Analysis

● Macroeconomic Factors.

Company Performance

1. Revenue and earnings growth

Revenue and earnings growth are two metrics used to assess a company's performance. Pro traders look at a company's revenue and earnings growth over time to see if it is increasing or decreasing. This can provide information about the company's market share, competitive position, and potential growth.

2. Profit margins

Profit margins are a measure of a company's profitability. Most companies only have big names but incur more losses than profits. Investors should assess a company's profit margins to know if it is generating a healthy return on its sales. To calculate a company's profit margin, you can subtract its cost of goods sold (COGS) from its total revenue, then divide the result by the total revenue. To express this margin as a percentage, multiply the final figure by 100.

3. Return on Equity (ROE)

Return on equity can also indicate how well a company performs. Return on equity (ROE) measures a company's ability to generate profits from shareholder equity. Since ROE is calculated by deducting all liabilities from the company's assets, it can be used to determine how effectively the company can use its equity to increase profits.

For instance, in the fiscal year 2021, Apple's net income was $74.5 billion, and its shareholder equity was $69.8 billion. Using these numbers, we can calculate Apple's ROE as follows:

ROE = Net Income / Shareholder Equity

ROE = $74.5 billion / $69.8 billion

ROE = 1.07

This means that Apple generated $1.07 in net income for every dollar of shareholder equity. A high ROE like this suggests that Apple effectively uses its equity to generate profits for its shareholders. However, it's important to consider other factors, such as industry norms, financial stability, and future growth potential, when analyzing a company's ROE.

Failure to run a background check on companies before investing in their stock is a potential way to lose an investment. Names are not enough to decide which stock to invest in. You also need to look at the company’s performance over a certain period to avoid being deceived.

Industry Analysis

Industry analysis is another critical factor to consider when conducting a stock valuation. These are some of the key components of industry analysis that investors should assess.

● Competitive Landscape

● Industry Growth Prospects

● Regulatory Environment

1. Competitive landscape

Top of that list is the competitive landscape of the industry that you want to invest in. Evaluating the competitive landscape of an industry helps determine the market share of different companies and the barriers to entry for new competitors. This allows you to see different investment options that can serve as alternatives to the stock you have in mind.

2. Industry growth prospects

Furthermore, you can also check the sector’s growth prospects. You want to be sure if the sector has a significant growth metric. You also want to know if it will decline over the next few years or if it will fail to adapt to changing technological pressure. A good stock should be able to stand the test of time.

3. Regulatory environment

Regulatory factors can have a significant impact on an industry. Though this also looks trivial, it can affect a stock's value. Any company that is not regulated is not safe to invest in, as it gives them the autonomy to act as they wish. Ensure the company is registered with major regulatory bodies and has followed due process in the jurisdiction in which they trade. Investors should evaluate the regulatory environment of an industry to determine the potential risks and opportunities associated with investing in companies operating within that industry.

Macroeconomic Factors

Macroeconomic factors can also have a significant impact on stock valuation. Factors like interest rates, inflation, and GDP growth can impact a company and, in the long run, the company’s stocks.

1. Interest rates: First and foremost, interest rates are a factor that can impact the cost of borrowing and the cost of capital for companies. This will surely tell on the company’s financials and eventually on the stock. Investors should evaluate the impact of interest rates on a company's operations and profitability.

2. Inflation: Inflation can impact the purchasing power and the profitability of companies. And with prices inflated, the company will either adapt quickly by developing mitigating measures or suffer losses that can have a negative impact on the company’s stock value.

3. GDP growth: GDP growth is a measure of the overall economic growth of a country. As trivial as this might look, every company domiciled in a particular country thrives off its country’s GDP. Therefore a meticulous evaluation of the GDP growth of a company’s growth by intending investors will either give a green or red signal.

Extensive research on every aspect of a company and its stock is necessary for getting results in stock trading.

Methods Of Trading Stocks

There are several ways to trade stocks. However, most investors trade using either traditional trading or contract for difference (CFD) trading. Each method has its advantages and disadvantages. Therefore, you should consider your investment goals and risk tolerance before choosing a trading strategy.

Traditional Trading

Traditional trading involves buying and selling stocks through a stockbroker or an online trading platform. You can buy and sell stocks through a stockbroker or an online trading platform for long-term investment or sell them in response to market trends.

Long-term investing involves holding stocks for an extended period, typically several years. Investors who opt for long-term investing focus on the fundamentals of the company and aim to benefit from its growth over time.

On the flip side, day trading involves buying and selling stocks within a single trading day. Day traders aim to profit from short-term market trends and fluctuations in stock prices. Day trading requires significant time and effort, and it can be risky.

Contract for Difference (CFD) Trading

CFD trading is an example of derivative trading that allows you to speculate on the rise or fall of a particular stock's price without owning the asset but continuing to receive revenue based on the price changes in the asset.

CFD trading involves entering into a contract with a broker to exchange the difference in price between the opening and closing positions of a particular stock. This type of trading technique allows you to benefit from price movements without owning the underlying asset.

CFD trading can offer several advantages, such as leverage, low transaction costs, and flexibility. However, it can also be risky, as leverage can magnify losses, and you may be exposed to counterparty risk. You can also lose your initial position if you enter the CFD trade at the wrong time and your spread size gets reduced.

Traditional Trading or CFD Trading?

While both traditional and CFD trading gives you several opportunities to profit from the stock market, they differ in several ways. These are some differences between traditional trading and CFD trading. However, CFD trading has several advantages over traditional trading. These include:

● Ownership: Traditional trading involves owning the underlying asset, while CFD trading does not.

● Leverage: CFD trading offers leverage, while traditional trading does not.

● Costs: CFD trading typically has lower transaction costs than traditional trading.

● Flexibility: CFD trading offers more flexibility regarding trading hours and the ability to go both long and short on positions.

How to Successfully Trade Stocks and CFDs

Successful trading requires a combination of knowledge, discipline, and practice. Here are some tips that can help you trade stocks and CFDs more effectively:

A. Choose a Tested and Trusted Broker

Choosing the right broker is as vital to successful trading as your trading strategy. Online brokers offer different trading platforms, fees, and services, so investors should carefully research and compare their options before choosing a broker.

Looking for a top-tier trading broker that offers lightning-fast execution and competitive fees? Look no further than VSTAR!

VSTAR’s institutional-level trading allows personal clients to enjoy institutional benefits such as lower trading costs and better liquidity when compared to personal trading. This allows clients to have access to more securities. They are also guaranteed the best price and trade execution. VSTAR is regulated by the Cyprus Securities and Exchange Commission (CYCEC). This means that VSTAR is held to strict regulatory standards, ensuring that they operate fairly and transparently, with traders being the utmost priority.

With their institutional-level trading experience and CYCEC regulation, VSTAR is the reliable choice for traders of all levels, offering the lowest trading fees and a super-tight spread to give you more profit.

B. Place Trades Appropriately

Everyone can place trades, but not everyone can make good ones. Any trader must understand how to place a trade. To place trades, you must understand the different orders available. Orders allow you to maximize your profits based on the current market conditions.

1. Market orders: First of all, market orders are executed at the prevailing market price. They are suitable for traders who want to buy or sell quickly and at the best available price.

2. Limit orders: Limit orders allow traders to set a specific price at which they want to buy or sell a stock. They are useful for traders who want to enter or exit a position at a specific price.

3. Stop orders: Stop orders allow traders to set a specific price for buying or selling a stock if the price moves in a certain direction. They are useful for traders who want to limit their losses or lock in profits.

C. Manage Risks Effectively

Managing risk is essential to successful trading. Though stock trading always comes with a P&L, the power of every trader and investor is risk management. How do you manage risks?

1. Setting stop-loss orders: Stop-loss orders allow traders to limit their losses by automatically selling a stock when it falls to a certain price. They are useful for traders who want to limit their losses.

2. Diversifying your portfolio: Diversification involves investing in different stocks and asset classes to spread risk. Diversification can reduce exposure to market volatility.

3. Avoiding emotional trading: Emotional trading can lead to poor decision-making and can cause traders to buy or sell based on fear or greed. Adhere to your trading strategy and avoid making impulsive decisions based on emotions.

Tips for Stock Valuation

Stock valuation is a critical component of profitable trading. Without correct stock valuation, it becomes difficult to make successful trades. Stock valuation assists you in avoiding common mistakes and errors that you would dismiss on a normal day. Here are some tips and common errors you should avoid in order to improve your stock valuation skills:

1. Avoid Over-reliance on one metric: First of all, you should avoid relying on a single metric to evaluate a stock's value. Instead, you should consider multiple metrics, including financial ratios and qualitative factors, to understand a company's performance comprehensively.

2. Do not be too focused on short-term results: You also should not be too focused on short-term results when evaluating a stock's value. Note the company's long-term growth prospects, competitive position, and industry trends.

3. Be alert to qualitative factors: Furthermore, do not ignore qualitative factors such as management quality, brand strength, and industry trends when evaluating a stock's value. These factors can have a significant impact on a company's long-term performance.

4. Conduct thorough research: The importance of research cannot be overemphasized. Read the company's financial statements, including its balance sheet, income statement, and cash flow statement, to get a better understanding of its financial health. You should also stay informed about industry trends, competitive threats, and regulatory changes impacting a company's performance. Following news sources and industry publications can also help you stay up-to-date.

5. Seeking expert opinions: A smart trader knows when to ask for external help. You should seek out expert opinions from financial analysts and industry experts to get a better understanding of a company's growth prospects and competitive position. However, investors should be cautious and evaluate expert opinions critically.

Takeaway

Whether you want to trade stocks long-term or short-term, it is a must to have an in-depth knowledge of both fundamental and technical analysis, as they are crucial to having a successful trade. It is also imperative that you choose the best broker and trading option while managing risks to make consistent profits.

You must not only continuously value your stocks, but you must also have a solid trading education because the stock market is volatile. Stock market volatility can cause investors to lose money. You will, however, know when to buy or sell a stock if you have a solid trading education.

Trading stocks can yield huge profits. However, it requires cautious planning, tested strategies, extensive research, and the management of risk. You can increase your chances of being successful in the stock market by paying attention to the company’s general outlook and using the right technical analysis.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of VSTAR, nor can it be used as investment advice.