- Accenture's Q1 showcased a 12% growth in bookings, reflecting client trust and a strong market position.

- Strategic acquisitions of $788 million expanded capabilities in diverse sectors like cloud, cybersecurity, and healthcare.

- The company invested $3 billion in AI, leading in GenAI with over $450 million in sales, positioning for scalable AI solutions.

- Despite challenges, Accenture sustained revenue growth, financial discipline, and diversified market resilience.

In the dynamic landscape of global business consultancy, Accenture (NYSE: ACN) emerges as a beacon of innovation and resilience. Through a detailed analysis of its Q1 fiscal 2024 performance, this article illuminates Accenture's strategic prowess. Witness a company that not only weathered challenges but thrived, showcasing a 12% surge in bookings, fortifying client trust and market dominance. Delving deeper, discover how Accenture's calculated acquisitions, amounting to $788 million, strategically expanded its foothold in critical sectors, propelling its capabilities to unprecedented heights. Moreover, the company's staggering investment of $3 billion in Artificial Intelligence, particularly GenAI, marks its visionary stance in pioneering transformative technologies.

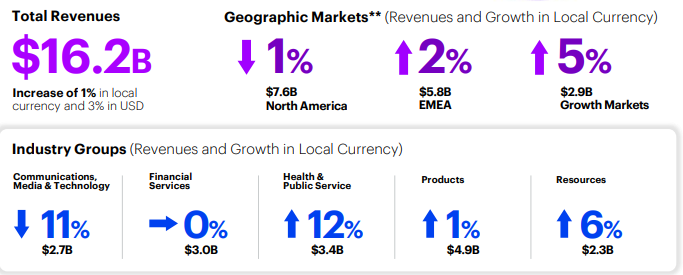

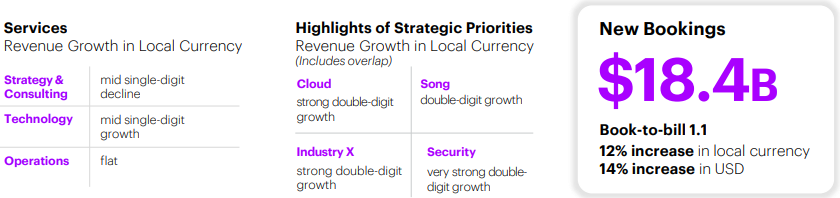

Source: First Quarter Fiscal 2024 Infographic

1. Bookings Growth and Client Trust

Accenture's Q1 bookings of $18.4 billion demonstrated a remarkable 12% growth in local currency. This substantial increase in bookings signifies the robust demand for Accenture's services and solutions among its client base. Notably, more than 30 clients generated quarterly bookings exceeding $100 million, with a significant portion originating from North America. This data reflects the immense trust clients have placed in Accenture to spearhead their major programs and ongoing reinventions.

Expanding on Bookings Growth:

Accenture's ability to secure $18.4 billion in bookings indicates the company's strong market positioning and the recognition of its expertise across various industries. This significant increase in bookings reflects the trust clients have in Accenture's capabilities to deliver value-driven solutions, consultancy services, and technological innovations.

The consistent growth in bookings also highlights the effectiveness of Accenture's client engagement strategies, where the company has growthfully cultivated long-term relationships with a diverse range of clients. This growth trend suggests Accenture's adeptness in identifying and addressing client needs, fostering trust, and delivering solutions that align with clients' business objectives.

Source: First Quarter Fiscal 2024 Infographic

Deepening Trust and Client Relationships:

The fact that more than 30 clients generated over $100 million in bookings indicates not just the scale of business but also the depth of client relationships. This level of trust suggests that Accenture is regarded as a pivotal partner by large enterprises, positioning itself at the center of critical initiatives and transformations.

Accenture's growth in securing substantial bookings in North America, accounting for more than half of the $18.4 billion, further reinforces the company's strong foothold in this key market. This reflects not only the trust but also the reliance of North American clients on Accenture for significant projects and essential programs.

The continued growth in bookings reflects positively on Accenture's ability to consistently meet or exceed client expectations. It also highlights the company's adaptability and responsiveness to evolving market demands, positioning it as a preferred partner for organizations looking to drive innovation, transformation, and growth.

2. Strategic Acquisitions and Market Expansion

Accenture's strategic approach to acquisitions, totaling $788 million across diverse global markets, showcases its focus on expanding its capabilities in key strategic areas. These acquisitions spanned geographic markets and focused on strengthening the company's foothold in critical sectors such as capital projects, digital marketing, cloud, cybersecurity, and healthcare.

Analysis of Strategic Acquisitions:

Accenture's acquisition strategy aims to complement its existing strengths by strategically investing in areas that align with emerging market opportunities and client demands. The $788 million investment across 12 acquisitions reflects the company's intention to diversify its portfolio and enhance its service offerings to better serve clients in specific industries and regions.

The acquisitions in North America, such as Anser Advisory and Comtech, highlight Accenture's focus on capital projects—a market with an $88 billion addressable opportunity. These acquisitions position Accenture to capitalize on the growing demand for consulting and program management services in infrastructure projects, indicating a strategic move to expand its footprint in this lucrative sector.

Expanding cloud capabilities through acquisitions like Ocelot Consulting and Incapsulate indicates Accenture's focus on strengthening its cloud services portfolio. In a rapidly evolving digital landscape, enhancing cloud capabilities becomes instrumental in catering to clients' increasing demands for scalable, secure, and efficient cloud solutions.

The acquisitions in EMEA and Growth Markets further exemplify Accenture's proactive approach to penetrating and consolidating its presence in these regions. For instance, investments in cybersecurity capabilities in Spain with the acquisition of Innotec and digital healthcare in the UK through Nautilus Consulting and The Storytellers demonstrate the company's pursuit of specialized expertise in key sectors to meet regional demands.

Strategic Importance of Acquisitions for Growth:

Accenture's acquisitions signify a strategic move to fortify its market position and expand its offerings in high-growth sectors. These acquisitions enable the company to not only broaden its service portfolio but also gain access to specialized skills, technologies, and talent pools that strengthen its competitive advantage.

The acquisitions serve as a proactive response to market dynamics, aligning with Accenture's focus on staying ahead of industry trends and client needs. By strategically investing in key areas, the company positions itself as an agile and adaptive organization capable of addressing evolving market demands.

Overall, Accenture's strategic acquisitions across diverse markets and industry sectors signal the company's focus on growth, innovation, and client-centric service expansion, positioning it strongly for rapid growth potential by bolstering its capabilities and market presence.

3. Investments in AI and Data Capabilities

Accenture's substantial investment of $3 billion over three years in AI (Artificial Intelligence) highlights its strategic focus on harnessing emerging technologies to drive innovation, transformation, and value for its clients. The company's strong emphasis on Generative AI (GenAI) has resulted in remarkable sales exceeding $450 million in the previous quarter, demonstrating an early leadership position in this transformative technology.

Analysis of AI Investment Strategy:

Accenture's significant investment in AI reflects its focus on being at the forefront of technological advancements and leveraging AI capabilities to deliver value-driven solutions to clients. This investment is aimed at developing AI-driven solutions that can revolutionize client operations, drive efficiencies, and unlock new opportunities across industries.

The focus on GenAI as a cornerstone of Accenture's AI strategy is strategic, given its potential to reinvent client businesses over the next decade. The company's growthful sales of over $450 million in GenAI projects in a single quarter indicate strong client demand and confidence in Accenture's AI expertise and offerings.

Accenture's plans to double its highly skilled data and AI practitioners from 40,000 to 80,000, with an additional 5,000 practitioners as of Q1, signify the company's focus on scaling its capabilities. This growth in specialized talent pool aligns with the increasing demand for AI-driven solutions and positions Accenture to cater to evolving client needs effectively.

Implications of AI Investments for Growth:

Accenture's strategic investments in AI reflect its readiness to capitalize on the transformative potential of AI technologies. GenAI's substantial sales and the ongoing focus on scaling AI expertise signify a strong market demand and the company's capability to deliver innovative solutions that generate tangible value for clients.

The company's deepening expertise in AI, coupled with the planned expansion of skilled practitioners, enhances its competitive advantage in the AI-driven market landscape. Accenture's focus on developing specialized AI solutions and services aligns with the evolving needs of businesses seeking digital transformation and positions the company for rapid growth potential in emerging AI-driven markets.

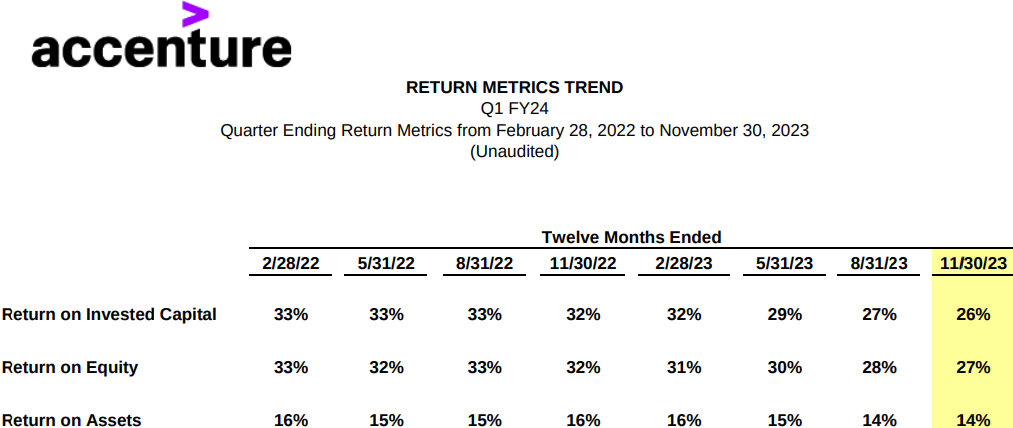

4. Financial Discipline and Growth Amidst Challenges

Accenture showcased resilience and financial discipline amidst challenges, evident in its Q1 performance. Despite certain industry-specific challenges impacting consulting work and slower decision-making, the company achieved a 1% growth in revenues and a 6% growth in adjusted EPS. These figures indicate the company's ability to adapt to evolving market dynamics while maintaining growth trajectories.

Analysis of Revenue and EPS Growth:

Accenture's ability to achieve revenue growth amid challenges reflects its diversified portfolio and agility in responding to market shifts. Despite headwinds affecting consulting work due to lower discretionary spending and slower decision-making, the company managed to sustain its revenue growth. This resilience showcases the effectiveness of its strategies in navigating industry-specific challenges.

The 6% growth in adjusted EPS indicates the company's growth in managing costs, optimizing operations, and delivering value to shareholders. Despite facing cost optimization actions, which impacted operating margins by 90 basis points and EPS by $0.17, Accenture maintained positive EPS growth. This showcases the company's ability to strike a balance between investing in the business and delivering returns to shareholders.

Source: Q1 Fiscal 2024 Supporting Materials

Cost Optimization and Margin Expansion:

Accenture's business optimization actions, initiated in March to reduce structural costs, aimed to create greater resilience. The 20 basis points expansion in adjusted operating margin, despite recording $140 million in costs associated with these actions, reflects the company's strategic focus on cost optimization while ensuring sustained growth.

The company's prudent financial management is evident in its ability to invest in business expansion and people while delivering modest margin expansion. This disciplined approach to managing expenses, optimizing operations, and balancing investments with returns positions Accenture for sustainable growth amidst market challenges.

Implications of Financial Discipline for Growth:

Accenture's ability to achieve revenue growth, maintain EPS growth, and expand operating margins despite challenges signifies its robust operational resilience. This resilience positions the company favorably in the market, demonstrating its capability to weather industry-specific challenges while continuing to deliver value to shareholders.

The strategic focus on cost optimization actions reflects Accenture's focus on creating a leaner and more agile operational structure. This discipline in managing costs, coupled with sustained investments in business expansion and people, forms a solid foundation for sustained growth, providing the company with the flexibility to navigate future market uncertainties.

5. Geographic Market Diversification and Resilience

Accenture's diversified presence across various geographic markets, despite challenges in specific regions like the UK, showcases its resilience and adaptability. While facing a 1% revenue decline in North America, the company witnessed growth in other regions such as EMEA and Growth Markets. This diversified market presence reflects Accenture's ability to capitalize on growth opportunities across different global markets.

Analysis of Geographic Market Performance:

The revenue decline of 1% in North America, attributed to declines in specific sectors like communications and media, was offset by growth in public service, indicating a balanced performance in the region. The company's ability to mitigate challenges in specific sectors while capitalizing on growth opportunities in others speaks volumes about its adaptability and market intelligence.

The 2% revenue growth in EMEA, primarily led by growth in public service and banking and capital markets, demonstrates Accenture's resilience in navigating challenges within the European market. Despite declines in the UK, growth in markets like Italy, Austria, and France indicates the company's ability to capture opportunities in diverse regions.

The 5% revenue growth in Growth Markets, primarily driven by sectors like chemicals and natural resources, public service, and banking and capital markets, highlights Accenture's growth in tapping into emerging market opportunities. The growth in Japan, specifically, showcases the company's ability to leverage opportunities in high-potential markets.

Implications of Geographic Diversification for Growth:

Accenture's diversified geographic presence mitigates risks associated with regional market fluctuations, allowing the company to capitalize on growth opportunities in various markets. The ability to sustain growth in regions like EMEA and Growth Markets, despite challenges in certain sectors or regions, demonstrates the company's resilience and adaptability.

The strategic reorganization of geographic segments, such as merging the Middle East and Africa into EMEA and reclassifying prior years' data, reflects Accenture's focus on transparency and clarity in reporting. This reorganization enables stakeholders to better understand the company's geographic performance and growth prospects in different regions.

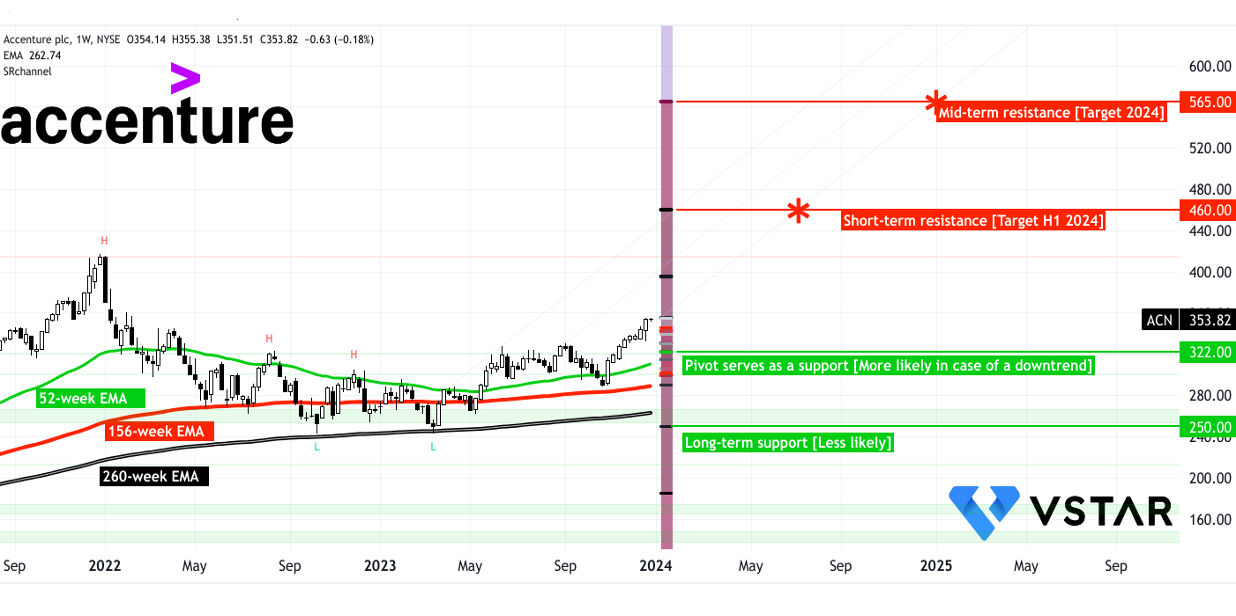

6. ACN Stock Technical Take

The ACN stock price is on an upward trend. It is evident from the bullish alienation in the 52-week, 156-week, and 260-week EMAs. Furthermore, based on current momentum and bullish trends, the price may reach $460 by H1 2024 and $565 by the end of 2024. These levels are derived from Fibonacci retracement.

On the downside, the accenture stock price may retest the pivot at $322, which is more likely in a recessionary state of the economy. In the presence of high volatility, $250 can be considered long-term support.

Source: tradingview.com

In conclusion, Accenture's fundamental strengths, including robust bookings growth, strategic acquisitions, significant investments in AI and data capabilities, financial discipline amidst challenges, diversified geographic market presence, and client-centric innovation, lay a strong foundation for rapid growth potential. These strengths demonstrate the company's resilience, adaptability, and strategic foresight in navigating market dynamics, delivering value to clients, and creating sustainable growth opportunities for shareholders.