Meta is Building the Next Computing Platform: From AI Advertising Engines to the Smart Glasses Revolution

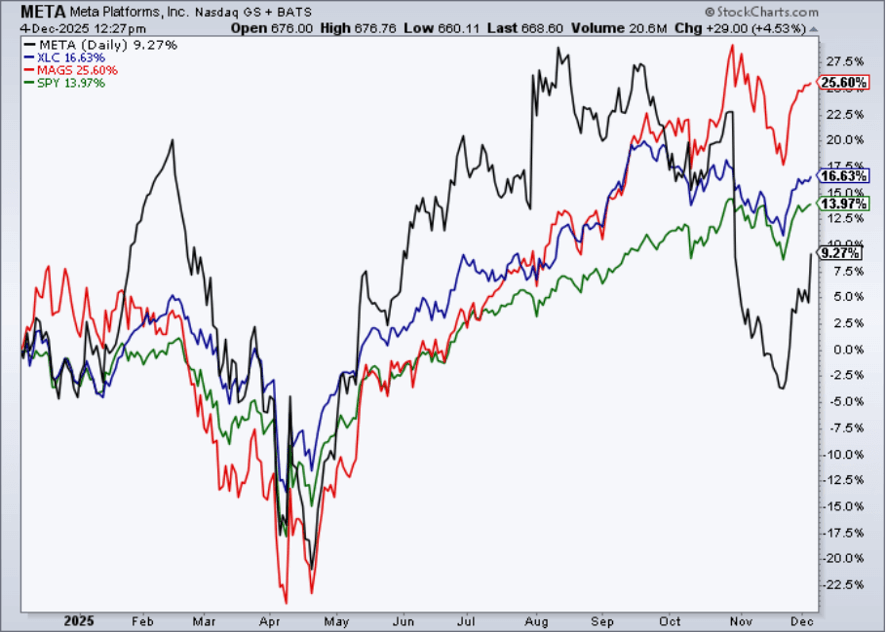

Meta Platforms (META) shares have recently pulled back approximately 11% from their October highs, a move the market largely interprets as a signal of pressure from expanding AI CapEx. However, a deeper analysis reveals this is not a deterioration of fundamentals, but rather a misinterpreted phase of adjustment. Meta's AI-driven advertising business is compounding growth at the industry's fastest rate, while the success of its Ray-Ban Meta smart hardware is positioning the company for a new platform cycle potentially larger than the smartphone. In other words, current stock volatility looks more like an opportunity for long-term investors than a risk warning.

- AI-Driven Advertising: Structural Upgrades from Model Optimization to Foundation Models

Meta's ad growth has entered the second phase of its AI drive: transitioning from "Automated Optimization (Advantage+)" to "Generative/Foundation Models (GEM)."

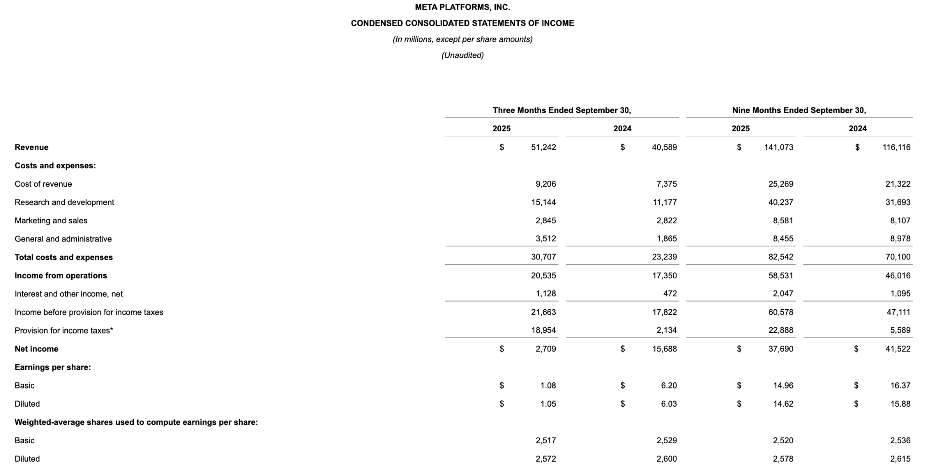

In the third quarter, the company’s advertising revenue saw robust growth, driving total revenue up significantly by 26% year-over-year to $51.2 billion, beating market expectations. The core driver of this result is the Advantage+ automated delivery system, which has reached an annualized revenue run rate of over $60 billion, making it one of the industry's largest and most growth-certain AI delivery engines.

While Advantage+ provides the underlying efficiency for ad inventory optimization, the true shaper of future ad growth is Meta's breakthrough at the recommendation model level, including the Andromeda ranking system and the all-new Generative Ads Model (GEM).

II.GEM: The World's Largest Advertising Foundation Model Driving "Exponential Efficiency"

Meta has consistently focused on leveraging AI to boost commercial returns for advertisers. GEM is the technical core of this strategy and currently the industry's largest RecSys (Recommendation System) foundation model, with a training scale approaching that of Large Language Models (LLMs), trained across thousands of GPUs.

The deployment of GEM has delivered immediate and significant commercial improvements:

- Instagram ad conversion rates increased by 5% (Q2)

- Facebook Feed ad conversion rates increased by 3% (Q2)

Following architectural upgrades in the third quarter, Meta noted:

- Performance doubled with the same data and compute input

This implies that future scaling of GEM will yield higher marginal returns, creating long-term compounding of advertising efficiency.

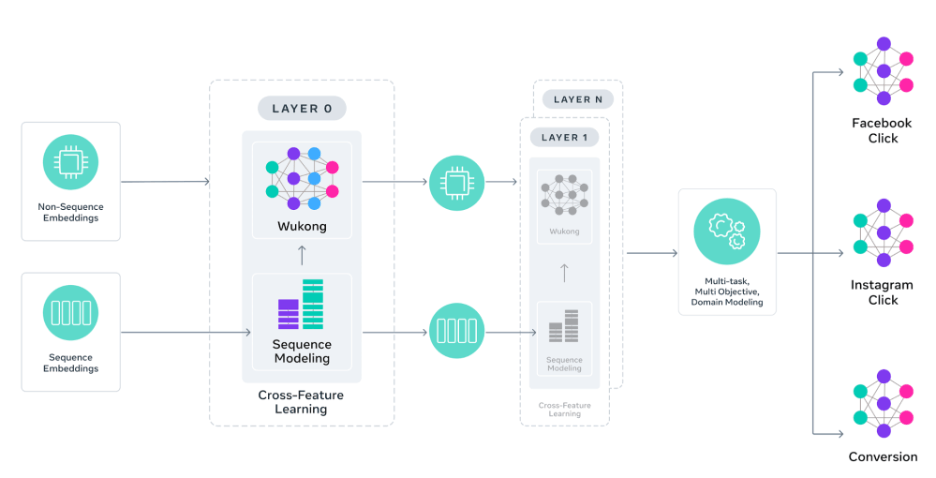

- GEM's Core Innovations: The Ad Recommendation System Enters the Foundation Model Era

Through three key innovations, GEM pushes ad recommendation architecture to the technical height of "LLM levels":

① Scalable Architecture → 4x Efficiency in Ad Performance

GEM adopts a hybrid attention mechanism, pyramid-level long-sequence modeling, and an enhanced Wukong feature interaction structure, allowing the model to achieve 4x the performance efficiency with the same compute power.

② Knowledge Transfer System → 2x Migration Efficiency

Meta has built a system combining direct and hierarchical transfer, enabling GEM to provide capabilities to hundreds of vertical models (VMs), achieving a knowledge distillation efficiency that is 2x that of traditional methods.

③ System-Level GPU Infrastructure Refactoring → 23x Training Efficiency

Meta has achieved multiple breakthroughs in its training system:

- GPU usage scale increased 16x

- Effective training FLOPs increased 23x

- Model FLOPs Utilization (MFU) +1.43x

- Training task startup time accelerated 5x

- PyTorch compilation time reduced by 7x

This makes GEM the most cost-efficient and scalable advertising foundation model to date.

- Andromeda: Complementary Effects with Ranking Engines and GEM

Andromeda is a high-performance ranking engine built by Meta in collaboration with NVIDIA, capable of filtering the best combinations from tens of millions of ad candidates within milliseconds. If we liken the ad system to an industrial assembly line:

- GEM is responsible for "Understanding" — Modeling user intent, behavioral sequences, and ad semantics.

- Andromeda is responsible for "Selection" — Finding the optimal ad combination in real-time scenarios.

Together, they drive a structural increase in advertiser ROI, giving Meta's ad business an extremely strong competitive moat.

- Reels: Continued Strengthening of the Short-Video Commercial Engine

Reels is one of the fastest-growing products in Meta's content ecosystem. Currently:

- User video watch time is up 30%+ year-over-year

- Reels annualized revenue run rate exceeds $50 billion

As GEM accurately models user video behavior and Andromeda improves real-time recommendation efficiency, Reels is poised to continue increasing its revenue share, becoming a key pillar of structural advertising growth.

III.Smart Glasses: The Key Gateway to the Next-Generation Computing Platform

Despite the strength of the advertising business, what may truly reshape Meta's long-term valuation framework is the explosive growth of Ray-Ban Meta smart glasses.

As of the first half of 2025:

- Sales are up +200% year-over-year

- Cumulative shipments exceed 3.5 million units

- Market share in the AR/VR wearable device market exceeds 70%

Unlike past AR products, Meta has achieved "truly wearable for daily use" smart glasses for the first time:

- Stylish design

- Reasonable pricing

- AI and multi-modal features available anytime

- Full-time interaction capabilities including voice, video, and environmental understanding

The importance of smart glasses lies not in the "hardware," but in their potential to become the primary gateway of the AI era.

If smart glasses become the mainstream human-machine interface, Meta's position will be akin to the iPhone for Apple in 2007: Not just selling devices, but controlling the gateway, the platform, and the ecosystem.

In this direction, Meta is clearly leading the entire industry.

IV.Robust Financial Structure: Ample Ammunition for AI and Hardware Expansion

Meta possesses strong financial strength to support dual-track expansion:

- Cash and cash equivalents of $44.4 billion

- Quarterly free cash flow exceeding $10 billion

- Almost zero long-term debt

- GAAP gross margin of 82%

- Core operating profit +18% year-over-year

Excluding the impact of one-time tax items, the company's Q3 EPS would reach $7.25, indicating extremely high earnings quality.

Market concerns regarding CapEx are mostly focused on GPU and data center expansion, but Meta's current investment is essentially:

Trading short-term volatility for a higher long-term growth ceiling, rather than passively filling a cost black hole.

Against the backdrop of continuous ad efficiency improvements and the new gateway provided by the smart glasses platform, these investments will become key drivers of future earnings expansion.

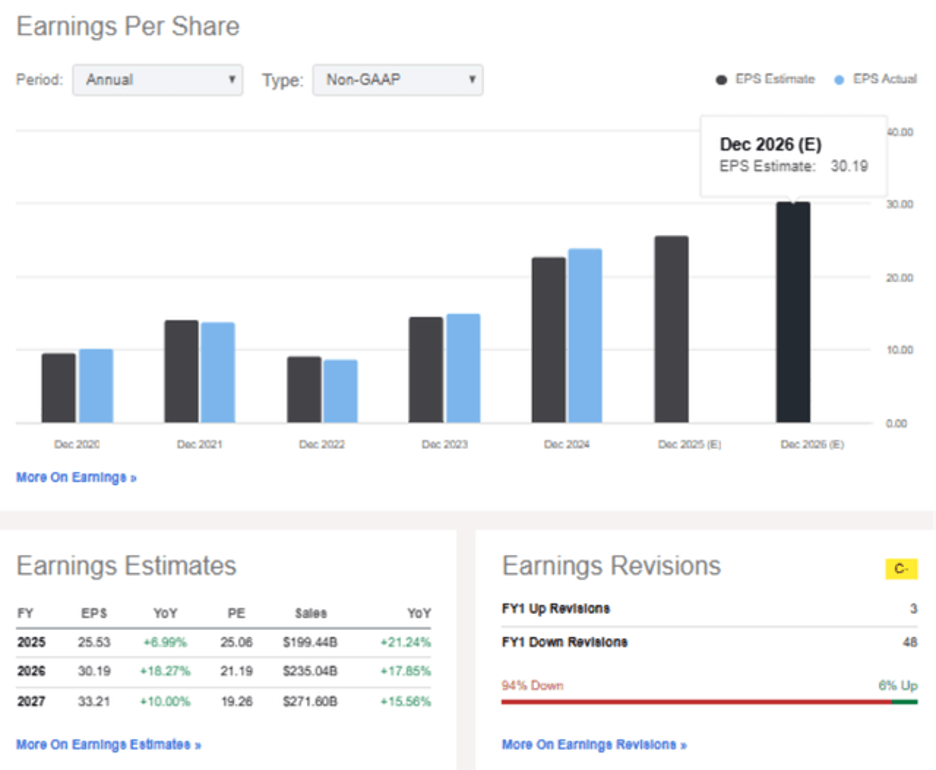

V.Valuation: The Market Has Not Yet Priced in Meta's Platform Optionality

Meta's current forward P/E is approximately 27.5x, significantly lower than its long-term growth potential and platform logic would suggest.

Assuming:

- Future EPS annual growth rate of approximately 12%

- Applying the premium deserved by a platform-type enterprise

Then Meta's reasonable valuation range should be: $720–$750.

The current stock price still possesses obvious room for upward repair.