Alibaba Group Holding Ltd (NYSE: BABA) stock price has dropped about 15% from where it was trading a year ago. At about $90 currently, BABA stock is 70% off its all-time high of $317 reached.

Should you buy the dip in Alibaba stock? What is Alibaba stock prediction? Read on to find out whether Alibaba stock is about to rebound or sink lower.

Alibaba Group (NYSE: BABA) Stock News

China to Reduce Ant Group Fine

Chinese regulators are considering a softer blow on Alibaba’s affiliate Ant Group. The authorities initially planned to slap Ant with a $1 billion fine, but they’re considering lowering the fine to about $700 million.

Alibaba has a large economic interest in Ant with its 33% stake in the business, so a lower fine is welcome for Alibaba investors. Ant is the Chinese fintech provider that operates the widely popular payment app called Alipay. The fine is expected to mark the end of a long-running clampdown on Ant and could pave the way for the long-delayed Ant Group IPO.

Alibaba Cloud IPO

Alibaba is preparing to spin off its cloud computing business into an independent public company. It is aiming for the Alibaba Cloud IPO within a year. Alibaba shareholders will get a stake in the cloud unit after the spinoff.

There is an opportunity for Alibaba to raise additional cash and lower its expenses by separating its cloud unit and taking it public through an IPO.

Big Short's Michael Burry Doubles Stake in Alibaba Stock

It seems sophisticated traders believe Alibaba stock is going to bounce back and that the present dip is a buying opportunity. American hedge fund manager Michael Burry has bought additional shares in Alibaba to double his stake in the company.

Burry, who made huge profit from predicting the 2008 global financial meltdown and was featured in the Big Short film, has a $10 million stake in Alibaba stock.

Alibaba Group (NYSE: BABA) Stock Overview

Source: Alibaba

Alibaba is a Chinese multinational ecommerce and technology company. Many have nicknamed it the “Amazon of China” because of the similarity of their businesses.

Founded in 1999, Alibaba is headquartered in Hangzhou, China. Alibaba’s famous co-founder Jack Ma was an English teacher in China. Ma recently landed a role as a visiting professor at the University of Tokyo.

Alibaba CEO Daniel Zhang has been at the helm of the company since 2015. Zhang initially led Alibaba’s ecommerce operations and is credited for creating the popular Singles’ Day shopping holiday.

Key Milestones in Alibaba’s History

|

Year |

Milestone |

|

2003 |

Alibaba launched Taobao online marketplace |

|

2004 |

Alibaba launched Alipay mobile payment platform. |

|

2005 |

Taobao in mainland China market share hits 60% Yahoo invests in Alibaba |

|

2012 |

Taobao begins to accept international credit and debit cards. |

|

2014 |

Alibaba IPO |

|

2017 |

Alibaba inks Olympic sponsorship deal lasting until 2028 |

Alibaba Business Model and Products

How Alibaba Makes Money

The company operates ecommerce platforms and provides cloud computing and logistics services. Alibaba also runs digital media and payments operations. The company’s flagship operation is rooted in the China retail industry.

In the China ecommerce industry, Alibaba operates online marketplaces where merchants can set up digital shops. The company charges merchants a fee to sell on its platforms. The company also makes money from transaction fees when merchants and shoppers use its payment services to settle trades.

Alibaba’s Main Products and Services

Taobao marketplace: The online shopping platform facilitates retail trades. Individuals and businesses can open online stores to sell goods on the platform.

Tmall: This online marketplace connects businesses with shoppers. Although it works similar to Taobao, Tmall is dedicated to selling brand-name products.

Cainiao: This is a logistics platform. It handles shipping of orders for Alibaba’s marketplace customers. Cainiao provides domestic and international delivery services.

Alibaba cloud: This is a cloud computing platform. It provides cloud storage and other cloud services to businesses. Many digital products such as video apps are hosted on the Alibaba cloud.

Youku: This is a YouTube-like online video platform. It offers licensed and original shows as well as user-generated content.

Alibaba Financial Performance

Financial reports have a huge impact on the Alibaba stock price. Therefore, it helps to know how Alibaba’s business is performing. You should also look at Alibaba’s balance sheet to see whether the company stands on solid financial grounds.

Alibaba’s fiscal year begins in April and ends in March. The company reports its earnings in Chinese yuan but provides dollar equivalents of its earnings numbers.

Read on to learn about Alibaba’s financial performance and balance sheet condition.

Revenue

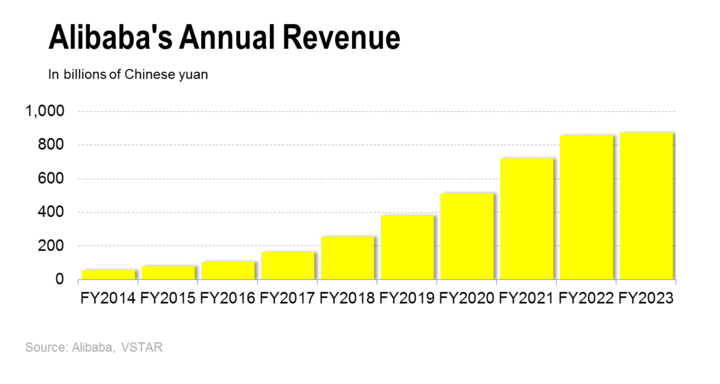

Alibaba’s revenue increased 2% year-over-year to 208.2 billion yuan ($30.3 billion) in the March 2023 quarter. For the fiscal 2023 ended March, the company delivered revenue of $868.7 billion yuan ($126.5 billion), which increased from 853.1 billion yuan in the previous year.

The company has recorded a compound annual revenue growth rate of 20% over the past 5 years and 30% since the IPO in 2014. See the chart below for Alibaba’s annual revenue trend since the IPO.

Net Income

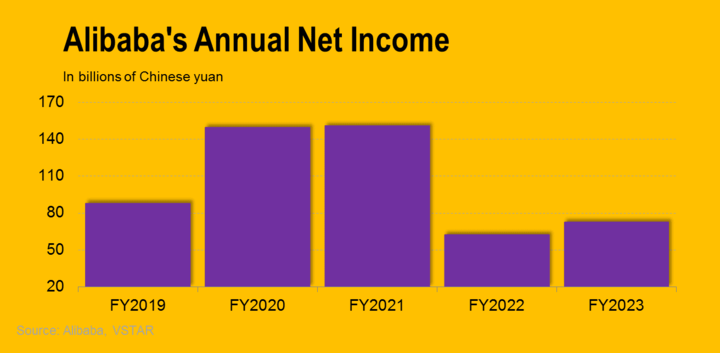

Alibaba delivered a net income of 23.5 billion yuan ($3.4 billion) in the March 2023 quarter. For fiscal 2023, the company reported a profit of 72.5 billion yuan ($10.6 billion). Although Alibaba has been consistently profitable on an annual basis, its profit has fluctuated as you can see in the chart below.

Profit Margins

Alibaba’s operating margin is a closely watched metric. The company’s operating profit margin came to 7.3% in the March quarter. The operating margin halved from 14% in the previous quarter as the company encountered high operating costs.

For fiscal 2023, the company achieved an operating margin of 11.6%, marking a significant improvement from 8.2% in the previous year. Although Alibaba’s margins fluctuate, the company has maintained its operating profit margin above 10% for most of the past 5 years.

Cash Position and Balance Sheet Condition

Alibaba generated $4.6 billion in cash flow from operations and $3.5 billion in free cash flow in the March 2023 quarter. The company ended the quarter with $28 billion in cash.

Alibaba’s balance sheet shows $255 billion in assets against $22 billion in long-term debt. With a current ratio of 1.8 and debt-to-equity ratio of 0.16, Alibaba looks to be on solid financial grounds.

Alibaba Group (NYSE: BABA) Stock Analysis

Baba Stock Trading Information

Alibaba Group (NYSE: BABA) stock is dual-listed in the U.S. and Hong Kong. The company listed its shares in Hong Kong in 2019, several years after its U.S. IPO.

Alibaba stock went public in the U.S. in 2014 at the IPO price of $68. The stock is listed on the NYSE under the “BABA” ticker symbol. The company currently has a market cap of about $230 billion. Its market cap once stood above $850 billion.

Trading in BABA stock starts at 9:30 a.m. and ends at 4 p.m. ET on weekdays for the regular session. Investors seeking extra trading hours can take advantage of extended trading sessions. Premarket trading in BABA stock begins at 6.30 a.m. and the post-market session runs until 8 p.m.

Alibaba has not had a stock split since the IPO and the company doesn’t pay dividends yet.

Instead of dividends, Alibaba returns cash to investors through stock buybacks. The company has a $40 billion stock repurchase plan running until 2025. Alibaba had $19.4 billion remaining in the current buyback program at the end of March 2023.

Alibaba Group (NYSE: BABA) Stock Performance

Alibaba IPO stock price was set at the high-end of the expected $66 - $68 pricing range, a sign of strong demand for the Chinese ecommerce stock. Indeed, BABA stock recorded a strong debut, surging almost 40% on its first day of trading to close above $93.

As you can see in the chart above, Alibaba stock kept rising after the debut, breaching the $200 mark in 2018 and hitting an all-time high of $317.14 in October 2020.

The stock’s spike to the peak came at the height of the Covid-19 pandemic and lockdowns that drove many people to shop online. But Alibaba stock has been on a steady downtrend since that peak as you can see in the chart above.

In the past year, BABA stock has declined 15%, though that is better than the nearly 40% drop in JD.com (NASDAQ: JD) stock price in the same period. But Amazon and the broader S&P 500 have fared better year-to-date as the chart above shows.

Why Is Alibaba Stock Falling?

Regulatory issues: Alibaba stock’s decline can largely be attributed to regulatory challenges the company has faced in China. The regulatory issues disrupted the company’s business and also weighed on investor sentiment.

Geopolitical issues: The conflict in Ukraine has been disruptive to the business operations of companies with global exposure. As a result, BABA stock price has been impacted by real or perceived threats from geopolitical headwinds.

Alibaba Group (NYSE: BABA) Stock Prediction

Alibaba’s steep decline has many investors wondering whether BABA stock is undervalued and has become too cheap to ignore. If you’re considering buying the dip in Alibaba stock, read on to find out the BABA stock forecast.

More than a dozen Wall Street analysts have weighed on BABA stock outlook with varying price predictions. The average Alibaba stock price forecast is $144, which implies nearly 65% upside potential. The peak BABA stock price target of $180 suggests over 100% upside. Even the base BABA stock price target of $115 implies nearly 30% upside.

Why Is Alibaba Stock Expected to Rise?

After two tough years, analysts believe the worst is now behind Alibaba. Consequently, the general view on Wall Street is that BABA stock is undervalued at current prices. Alibaba stock currently trades at a forward PE ratio of 10x, compared to 13x for JD stock and 18x for PDD Holdings (NASDAQ: PDD) stock.

These are a few factors that can explain the bullish sentiment around Alibaba stock:

Easing regulatory environment: After a long period of tight regulatory measures, pressure is easing on Chinese tech companies.That is a reprieve for Alibaba, which has struggled with a number of regulator issues.

Economic stimulus: China has lined up various economic stimulusmeasures that could benefit Alibaba. With a focus on boosting consumer demand and supporting the private sector, China has cut a key interest rate and increased government spending is expected.

Alibaba restructuring: In a major reorganization move, Alibaba recently decided to split into six companies. The restructuring that will see some businesses spun off is expected to make Alibaba more efficient and the market has welcomed the move.

Alibaba’s Challenges and Opportunities

Alibaba’s financial results and stock price are impacted by how the company navigates its challenges and makes use of the opportunities. Let’s explore Alibaba’s challenges and opportunities.

Alibaba’s Weaknesses and Challenges

Reliance on China: Although Alibaba is a global company, it generates most of its revenue in China. As a result, an economic slowdown in China can weigh heavily on the company’s financial performance.

Regulations: Alibaba operates in tightly regulated industries such as cloud, media, and financial services. Increased regulatory restrictions can slow the company’s revenue growth and increase operating costs.

Counterfeits: Alibaba’s online marketplaces host millions of merchants. There are sellers that attempt to sell fake products on Alibaba platforms. Counterfeit products can hurt consumer confidence in Alibaba’s service or expose the company to lawsuits.

Competition: As a market leader in China ecommerce industry and the cloud market, Alibaba is a major target of competition. These are some of the main Alibaba competitors and the threats they pose:

|

Alibaba competitor |

Threat |

|

Alibaba vs. JD vs. PDD |

Alibaba and JD are fierce competitors in China’s ecommerce industry. Pinduoduo (PDD) is also a threat to Alibaba’s online retail business. |

|

Alibaba vs. Tencent vs. Amazon vs. Google |

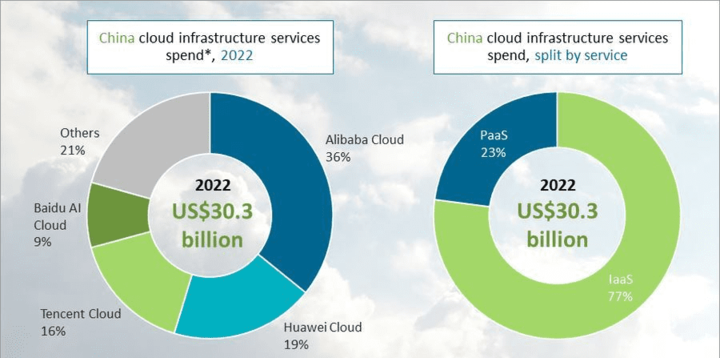

Alibaba and Tencent are in the battle for control of China’s cloud market. Internationally, Alibaba faces off with Amazon, Microsoft, and Google for cloud revenue. |

|

Alibaba vs. Baidu |

Alibaba and Baidu compete for control of the artificial intelligence technology market. The companies have launched several rival AI products, including generative AI tools. |

Alibaba’s Competitive Advantages

1. Solid Financial Position

With nearly $30 billion in cash and light debt, Alibaba is in a great financial position. It can afford to fund major product research efforts to help it stay ahead of many of its competitors. Moreover, the company can afford to pay its bills even in a tough economic environment.

2. Leading Market Share

Source: Canalys.com

Alibaba dominates the ecommerce and cloud computing markets in China. The company also holds strong positions in important businesses such as digital media and logistics. Moreover, Alibaba is a leading figure in China’s budding AI-powered products market.

3. Massive Scale and Strong Brand Position

Alibaba has built a massive operating scale in ecommerce, cloud, media, and other businesses. As a result, the company enjoys many economies of scale over its many competitors. Moreover, Alibaba is among the most recognized brands and household names in online retail in China and abroad.

4. Diversified Business

As a technology conglomerate, Alibaba runs a well-diversified business spanning retail, cloud computing, media, fintech, and logistics. As a result, the company has spread out its risks better than many of its rivals.

Alibaba’s Opportunities

1. International Expansion

Although Alibaba already operates in several countries, its business remains concentrated in China. But the company has many growth opportunities overseas in areas like digital payments, cloud, and ecommerce.

2. Advertising

Marketers are increasingly shifting their budgets from traditional media to digital platforms. Alibaba has about a billion consumers on its online shopping platforms. That is a huge audience that marketers would want to reach and presents a massive advertising opportunity for Alibaba.

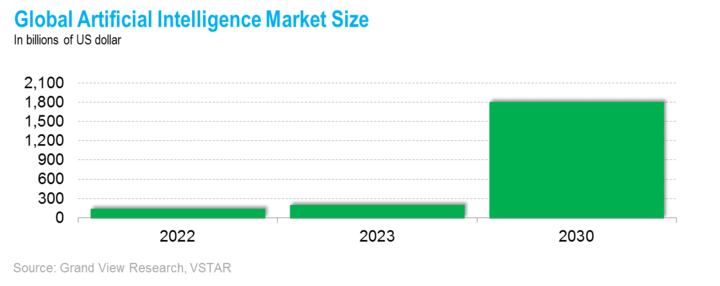

3. Artificial Intelligence

Alibaba has developed its ChatGPT-type generative AI tool called Tongyi Qianwen. At its March 2023 earnings call, Alibaba executives revealed that thousands of enterprise customers applied to try its generative AI tool.

The global market for AI solutions is expanding rapidly at an annual compound rate of 37% and is forecast to hit $1.8 trillion by 2030. The market was valued at $136 billion in 2022 and is estimated to be worth $196.6 billion in 2023.

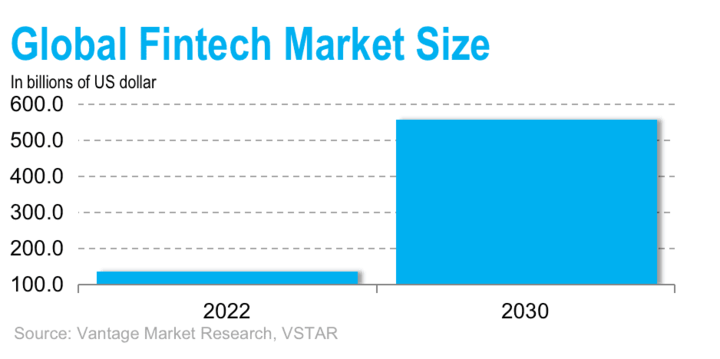

4. Financial Technology

Alibaba is the leading provider of mobile money services in China through its Alipay brand. While Alipay primarily provides transaction and light banking services currently, Alibaba’s fintech market opportunity is still huge in areas like saving and investing in China and abroad.

The global fintech market size is on course to surpass $556.6 billion by 2030, from $133.8 billion in 2022.

5. Olympics Sponsorship

Alibaba joined as a major Olympics sponsor in 2017. Its brand first featured in the global sports event as a major sponsor in the 2018 games. Olympic games draw billions of viewers and involve the participation of hundreds of big brands.

The Olympics sponsorship position gives Alibaba significant exposure that it can leverage to increase its sales and draw important partnerships to take its business forward.

Alibaba Group (NYSE: BABA) Stock Trading Tips

There are several ways you can make money with Alibaba stock depending on your investment goal, investing timeline, and risk tolerance. Read on to see the popular Alibaba stock investing methods and the strategies you can apply to reduce your risks and maximize your profit.

1. Buying and Holding Alibaba Shares

If you’ve a long-term investing timeline, like saving for retirement, mortgage deposit, or children’s college fund, this is the best investing method to pursue with Alibaba stock.

Alibaba Shares Investing Strategies

● Apply dollar-cost averaging technique to grow your position steadily.

● Invest in other stocks in addition to Alibaba to diversify your portfolio.

Advantages of Holding Alibaba Shares

● You benefit directly from the stock buyback program

● You may receive dividends in the future

● You get voting rights

Disadvantages of Holding In Alibaba Shares

● Requires a large initial capital

● You only make money when the stock price moves up

● You wait long to see returns

2. Trading Alibaba Stock CFD

If you’re investing for income to fund your living expenses or short-term goals, trading Alibaba stock CFD can work well for you. CFD trading involves predicting the direction of stock price movements. As a result, it allows you to capture profit from stock price fluctuations over short timelines such as an hour, day, week, or month.

Alibaba Cfd Trading Strategies

● Apply the 1% rule to protect against your account getting wiped out by a losing trade.

● Use stop and limit order features to minimize losses from losing trades and conserve gains from winning trades.

Advantages of Trading Alibaba Stock CFD

● Requires little starting capital

● You can make money both when the stock is going up when it is falling.

● You can capture profit by the hour, day, or other short timelines.

Disadvantages of Trading Alibaba Stock CFD

● You don’t get voting rights in the company.

● You can’t participate in Alibaba stock buybacks.

● You are not eligible for potential dividends.

Trading Alibaba Stock CFD with VSTAR

If you’re ready to start trading Alibaba stock CFD for short-term profit opportunities, consider using VSTAR.

Designed for frequent and high-speed traders, VSTAR is a fully licensed and regulated CFD trading platform.

VSTAR is a traders’ favorite because of its low fees, tight spreads, and minimal starting capital requirement of $50. Moreover, the platform offers generous leverage and risk management tools such as stop and limit order features.

VSTAR offers a $100,000 demo account for new traders to try out their strategies before investing real money.

Consider creating your VSTAR account today to start trading Alibaba stock CFD. The account is free to open and all you need is an email account or phone number. For account funding, VSTAR supports credit cards, bank transfer, and digital wallet deposits.

Final Thoughts

After a long period of consolidating, Alibaba Group (NYSE: BABA) stock looks primed for a strong takeoff. The recent restructuring, the easing of restrictions in China, and reviving hopes of Ant Group IPO can provide tailwinds for the BABA stock.

While there is a strong case to buy and hold Alibaba shares, you can also capture profit on the go by trading Alibaba stock CFD with VSTAR.