The cryptocurrency market in 2024 is being shaped by a confluence of factors, ranging from technological advancements and regulatory developments to the emergence of new financial instruments like Exchange-Traded Funds (ETFs). The article delves into specific aspects offering insights into Bitcoin's potential price direction. It explores market stability, the convergence of stablecoins and Central Bank Digital Currencies (CBDCs), industrial applications, the impact of ETFs, U.S. Treasury yield curve dynamics, and the implications of implied volatility on Bitcoin price.

Source: nytimes.com

Impact of ETFs on Bitcoin Price

The approval of Bitcoin ETF is a significant development. While skepticism exists regarding a substantial influx of fresh capital into the cryptocurrency market, the focus shifts to the potential rotation of funds from existing crypto products into newly created ETFs. The predicted outflows from products like Grayscale Bitcoin Trust (GBTC) towards more cost-effective spot Bitcoin ETF could alter market dynamics, potentially influencing Bitcoin's price through changes in market liquidity and investor sentiment.

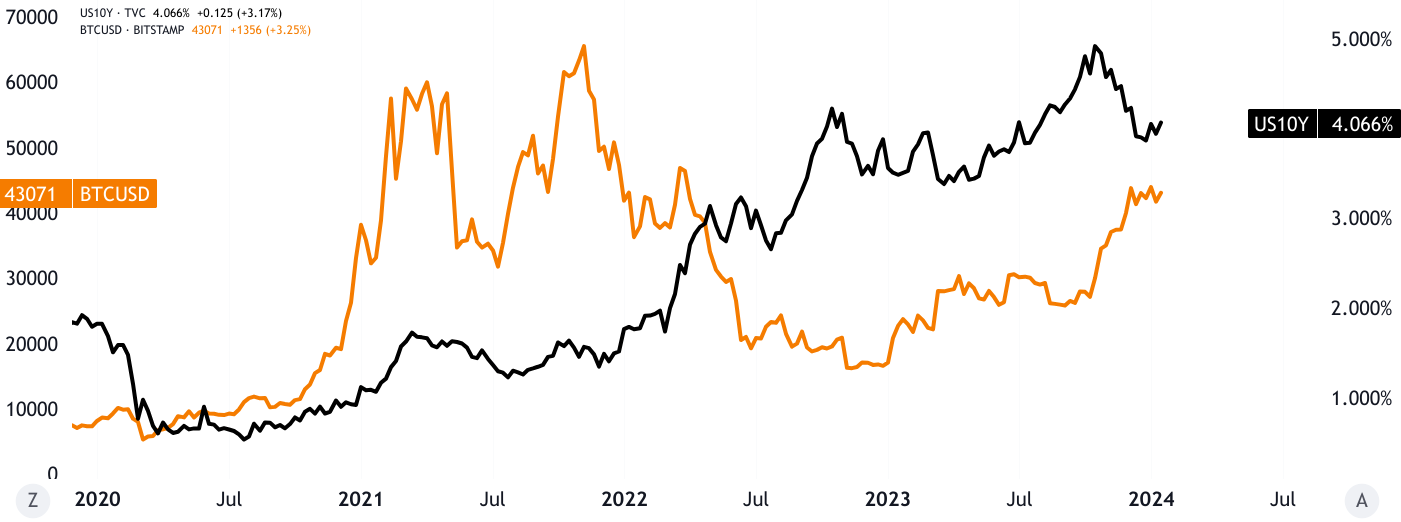

U.S. Treasury Yield Curve and Bitcoin as a Safe Haven

The normalization of the U.S. Treasury yield curve is presented as a potential precursor to an impending recession. Historical data suggests that economic recessions impact investor confidence, potentially leading to decreased demand for riskier assets, including Bitcoin. However, the analysis introduces a counterpoint – a potential monetary easing by the Federal Reserve. This could create a favorable environment for Bitcoin as a safe-haven asset, similar to its 2020-2021 performance during and after the recession induced by the COVID-19 pandemic.

Market Stability and Ethereum's Role

The upcoming summer may usher in a more sustainable period for the cryptocurrency market. The focus on Ethereum's scalability through Layer 2 solutions (L2s) is crucial. These solutions address Ethereum's historical challenges related to capacity and high transaction fees. As the market moves closer to resembling traditional financial ecosystems, the scalability enhancements could result in increased confidence among investors, potentially influencing the demand for Bitcoin positively.

Convergence of Stablecoins and CBDCs

A key prediction centers around the convergence of central banks towards regulated stablecoins and CBDCs. The rationale for this shift is portrayed as a pragmatic choice rather than an ideological embrace of decentralization. The analysis suggests that CBDCs, while limited in programmability, might not fully satisfy the demand for blockchain-based programmable money required for decentralized finance (DeFi) and digital asset transactions. This points towards sustained interest in alternative digital assets, including Bitcoin, which could serve as a programmable and decentralized alternative.

Progress in Industrial Applications

The slow progress in industrial applications can be acknowledged, with a steady re-acceleration despite recent setbacks like crypto exchange scandals. The potential re-embrace of blockchain technology by corporations hinges on solutions improving and memories of past challenges fading. This aspect indirectly signals the possibility of Bitcoin benefiting from increased institutional adoption as solutions become more robust, contributing positively to its perceived value.

Implications on the Price of Bitcoin

The cautiously optimistic sentiment regarding market stability, regulatory support, and technological advancements implies an increased demand for Bitcoin. The acknowledgment of Ethereum's scalability improvements and the potential convergence of CBDCs and stablecoins may position Bitcoin as an attractive investment option in the evolving cryptocurrency landscape.

Additionally, The introduction of Bitcoin ETF is likely to reshape market dynamics. The potential shift of funds from existing products like GBTC to ETFs could impact Bitcoin's liquidity and pricing. Investors' preference for cost-effective alternatives may create a competitive environment that influences Bitcoin's price positively.

Depending on investors' perception of Bitcoin during economic uncertainty, its price may be influenced by broader market conditions. The potential monetary easing by the Federal Reserve, however, could mitigate adverse effects and contribute to Bitcoin's resilience.

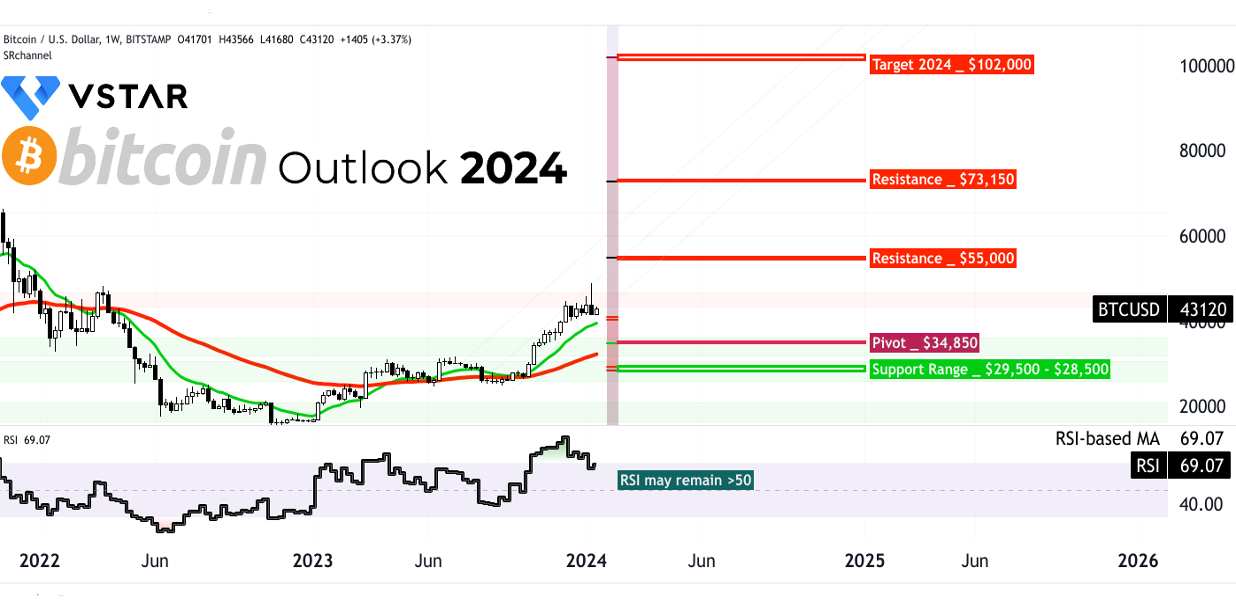

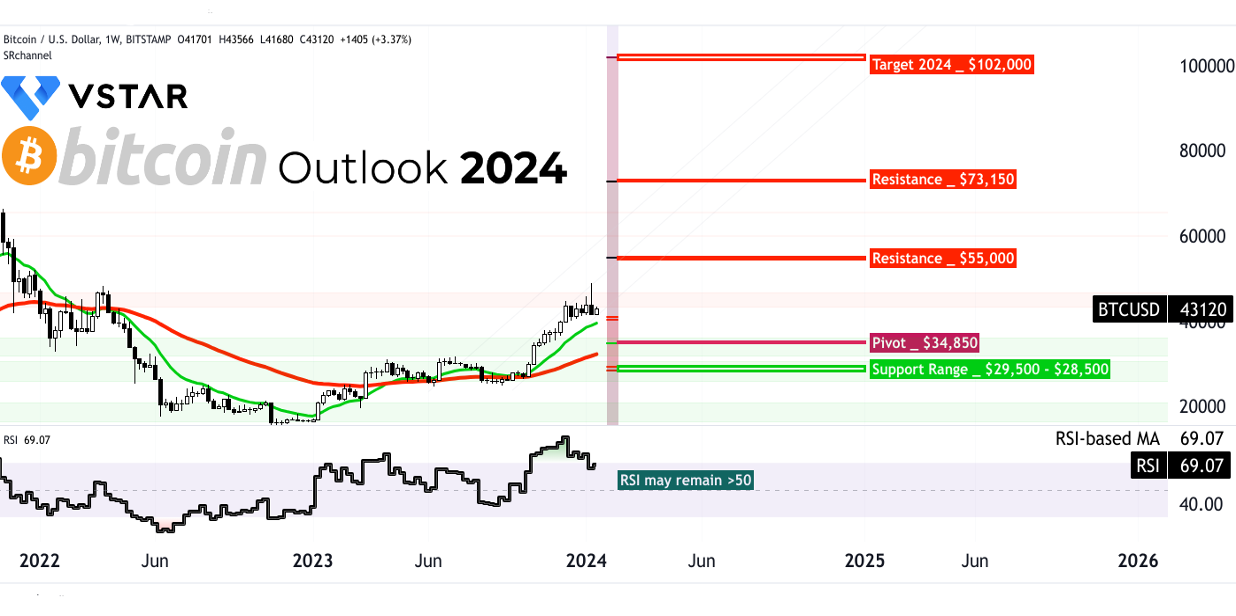

Bitcoin (BTCUSD) Technical Take

After integrating the new regulatory development (Bitcoin ETF approval) into the previous coverage, Bitcoin prices may reach $102,000 by the end of 2024. The projection is based on the application of Fibonacci retracement and current momentum. However, on the upside, to hit the target, Bitcoin may face resistances near $55,000 by the end of Q1 2024 and $73,150 by the end of H1 2024. Interactions with the resistance levels may lead to corrections, but the prices may rebound quickly.

Source: tradingview.com

Looking at the RSI (relative strength index), the indicator may remain above the 50 level during the year, suggesting a consistent markup for the prices in 2024.

Considering the volatile nature of Bitcoin, the prices may test the support at the pivot level of $34,850. However, $29,500 to $28,500 may serve as a short-term support range for the prices, but reaching these levels is less likely after the fundamental developments in the crypto ecosystem, especially the SEC approval of ETFs.

Finally, 13-week (greenline) and 52-week (redline) exponential moving averages (EMAs) may serve as critical navigators for the trend during the year. Here, 13-week EMA serves as dynamic support. Similarly, in the case of heightened volatility, the 52-week EMA provides support for the prices on the down side.

In conclusion, taking all these factors into account, the overall indication is towards a potential positive price direction for Bitcoin in 2024.