- Bitcoin price shows volatility, ranging from $67,376.20 to $69,999.85 in 24 hours, indicating solid trading sessions.

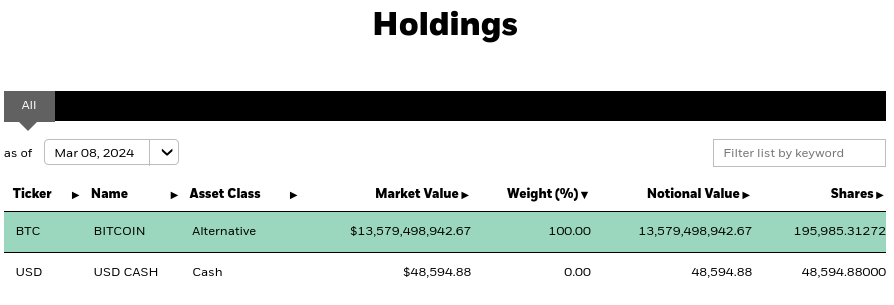

- BlackRock's iShares Bitcoin ETF (IBIT) accumulates 195,985 bitcoins, surpassing MicroStrategy's holdings.

- Bill Ackman suggests Bitcoin's rise could impact energy prices, inflation, and the economy.

- BlackRock plans to acquire spot bitcoin ETPs for its Global Allocation Fund, reflecting institutional acceptance and adoption of cryptocurrencies.

Bitcoin has hit above $70K, this week both fascination and volatility dominated Bitcoin price movements. Beyond the surface-level price movements lie deeper insights into institutional involvement and regulatory landscapes. BlackRock's accumulation of Bitcoin through its iShares Bitcoin ETF (IBIT) signals a paradigm shift in traditional finance, as institutional giants recognize the potential of cryptocurrencies as legitimate investment assets. Meanwhile, figures like billionaire hedge fund manager Bill Ackman add intriguing narratives to the mix, speculating on Bitcoin's impact on energy prices and economic dynamics. This article delves into this week's Bitcoin's price dynamics, institutional investments, and regulatory implications.

Source: stockcharts.com

Bitcoin Price Movement

Bitcoin's price movement over the past 24 hours has been volatile, with a low of $67,376.20 and a high of $69,999.85. This range indicates considerable fluctuations within a short timeframe, suggesting active trading and potentially conflicting market sentiments. The opening price of $69,466.30 experienced a change of $770.72 during this period. Such rapid price movements can be influenced by various factors, including trading volumes, investor sentiment, macroeconomic trends, and news events. The 52-week low and high for Bitcoin are $21,888 and $70,136.33, respectively, with the current price approaching its all-time high. This indicates a strong upward trend over the past year, with Bitcoin experiencing substantial growth in value. Additionally, the year-to-date returns for Bitcoin stand at 62.52%, indicating impressive performance relative to traditional investment assets.

Bitcoin Market Stats

Bitcoin's market capitalization is $1.35 trillion, reflecting its dominant position within the cryptocurrency market. This considerable market cap suggests Bitcoin's status as the leading cryptocurrency by value and market share. With a maximum supply of 21 million coins and a total supply currently matching this figure, Bitcoin's scarcity contributes to its perceived value and investment appeal. The 30-day volatility, calculated at 0.56713100, indicates fluctuations in Bitcoin's price over the past month. While volatility presents opportunities for traders to profit from price movements, it also poses risks, as sudden price swings can lead to substantial gains or losses. The 24-hour transaction count of 363,011 highlights the high level of activity within the Bitcoin network, with numerous transactions being processed within a relatively short timeframe. The average transaction fee over the past 24 hours is $6.89, suggesting moderate transaction costs for users conducting Bitcoin transactions.

BlackRock's Bitcoin ETF Accumulation

BlackRock's iShares Bitcoin ETF (IBIT) has accumulated a substantial amount of Bitcoin, with holdings totaling 195,985 bitcoins. This accumulation surpasses MicroStrategy's holdings, indicating BlackRock's considerable investment in Bitcoin through its ETF product. The rapid inflow of bitcoins into IBIT suggests growing institutional interest in Bitcoin as an investment asset. This institutional demand is likely driven by factors such as Bitcoin's potential as a store of value, its role as a hedge against inflation, and its performance relative to traditional asset classes. The success of IBIT and other spot ETFs in attracting institutional capital has contributed to Bitcoin's price surge of over 60% this year. Institutional adoption is a key driver of Bitcoin's mainstream acceptance and could further propel its price upward as more institutions allocate funds to the cryptocurrency.

Source: blackrock.com

Bill Ackman's Interest in Bitcoin

Billionaire hedge fund manager Bill Ackman has expressed interest in Bitcoin, highlighting its potential impact on energy prices, inflation, and the economy. Ackman's speculative scenario suggests a feedback loop where rising Bitcoin prices lead to increased mining activity, higher energy consumption, inflationary pressures, and a decline in the value of fiat currencies. This narrative suggests Bitcoin's role as a disruptive force within the financial system and its potential to reshape traditional economic dynamics. Ackman's acknowledgment of Bitcoin's potential as a hedge against inflation and currency devaluation reflects a shifting mindset among traditional investors, who are increasingly recognizing the value proposition offered by cryptocurrencies. However, Ackman's comments also highlight the risks associated with Bitcoin's price volatility and its potential implications for broader economic stability.

BlackRock's Plans for Bitcoin ETPs

BlackRock, one of the world's largest asset managers, has announced plans to acquire spot bitcoin exchange-traded products (ETPs) for its Global Allocation Fund. This decision suggests BlackRock's recognition of Bitcoin as a legitimate investment asset and its willingness to integrate cryptocurrencies into traditional investment portfolios. The incorporation of Bitcoin ETPs into BlackRock's funds reflects broader institutional acceptance and adoption of cryptocurrencies as part of diversified investment strategies. The success of Bitcoin ETPs, such as IBIT, in attracting institutional capital suggests the growing demand for exposure to Bitcoin among mainstream investors. BlackRock's move to acquire Bitcoin ETPs for its funds signals confidence in Bitcoin's long-term value proposition and its potential to deliver attractive returns for investors.

Implications on Price of Bitcoin (BTC)

Institutional Investment:

The considerable accumulation of bitcoins by institutions like BlackRock through ETFs indicates a growing institutional appetite for Bitcoin as an investable asset. Institutional investors are increasingly recognizing Bitcoin's potential as a store of value, a hedge against inflation, and a portfolio diversifier. The influx of institutional capital into Bitcoin could drive up demand and consequently the price of Bitcoin in the long run.

Market Volatility:

Despite institutional interest, Bitcoin remains highly volatile, as evidenced by its price fluctuations over short timeframes. While volatility presents opportunities for traders to profit from price movements, it also poses risks for investors, as sudden price swings can lead to considerable losses. High volatility may deter some institutional investors from allocating large sums to Bitcoin, as they seek more stable assets with predictable returns.

Regulatory Impact:

Regulatory developments play a crucial role in shaping Bitcoin's price trajectory. Positive regulatory developments, such as the approval of Bitcoin ETFs and clearer regulatory guidelines, could boost investor confidence and drive up demand for Bitcoin. Conversely, adverse regulatory measures, such as bans on Bitcoin trading or stricter regulations, could create uncertainty and dampen investor sentiment, leading to price declines.

Market Sentiment:

Public statements and sentiments from influential figures like Bill Ackman can influence investor perception and sentiment towards Bitcoin. Positive endorsements and increased mainstream acceptance of Bitcoin could attract more investors and drive up demand, pushing prices higher. Conversely, negative sentiments or concerns about Bitcoin's environmental impact, regulatory risks, or technological limitations could lead to sell-offs and price corrections.

Supply Dynamics:

Bitcoin's fixed supply of 21 million coins and its diminishing rate of new coin issuance through mining halvings are fundamental factors influencing its price dynamics. Institutional accumulation of Bitcoin, coupled with increasing demand from retail and institutional investors, could exert upward pressure on prices, especially as the supply approaches its maximum limit. However, factors such as lost coins, locked-up supply, and long-term hodling behavior among Bitcoin holders also play a role in determining the effective supply available for trading.

Technical Take: Bitcoin (BTCUSD)

The BTC price may hit $75,260 by the end of this week. This projection is based on the current momentum of higher highs and Fibonacci retracement. The price is way above the trend line (purple), which supports the possibility of a correction to retest the $64,150 level during this week.

However, looking at the Relative Strength Index (RSI), a bearish divergence has emerged. But this divergence is weak in nature, making the downside possibility less likely with a minor price dip. As a positive note, the price may move up aggressively to $86,175 if it takes support at $64,150 in the coming week.

Source: tradingview.com

In conclusion, Bitcoin's recent surge past $70K epitomizes its volatile motion. Beneath surface price shifts lies institutional recognition, exemplified by BlackRock's massive Bitcoin ETF accumulation, now surpassing MicroStrategy's holdings. Bill Ackman's speculation on Bitcoin's ripple effects adds depth, reflecting its disruptive potential. Meanwhile, regulatory nuances and market sentiments sway its trajectory. Despite volatility, institutional influx suggests a bullish outlook, amplifying demand and propelling prices. Regulatory clarity and positive sentiment further buoy Bitcoin's prospects. With its fixed supply and increasing institutional interest, Bitcoin's price trajectory points upwards, potentially reaching $75,260 this week, with corrective dips presenting buying opportunities for bullish continuation towards $86,175.