Introduction

Carnival Corp is the world's largest cruise company, operating 10 brands and over 100 ships that serve more than 13 million guests annually. The company has been severely impacted by the COVID-19 pandemic, which forced it to suspend most of its operations and incur heavy losses since 2020. However, the company has also taken several measures to improve its liquidity, reduce its costs, and prepare for the recovery of the cruise industry.

Source: Canival

Carnival Corp's Overview

Carnival Corp was founded in 1972 by Ted Arison, who started with one ship called the Mardi Gras. The company is headquartered in Miami, Florida, and has a dual-listed structure with Carnival plc in London. The company operates 10 cruise brands that cater to different segments of the market, such as Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises, Cunard, AIDA Cruises, Costa Cruises, P&O Cruises Australia, and Carnival China.

The company's current CEO is Arnold W. Donald, who joined the company in 2013 and has over 30 years of experience in various industries. The company's top shareholders include Vanguard Group Inc., BlackRock Inc., State Street Corp., Fidelity Management & Research Co., and Dodge & Cox.

Some of the key milestones in the company's history include:

- Acquiring Holland America Line in 1989 and Seabourn Cruise Line in 1992

- Merging with P&O Princess Cruises plc in 2003 to form the world's largest cruise company

- Launching the world's first LNG-powered cruise ship, AIDAnova, in 2018

- Celebrating its 50th anniversary in 2022 with a series of special events and activities

Carnival Corp's Business Model and Products/Services

Source: Cruise fever

How Carnival makes money

Carnival makes money by providing cruise vacations to its guests, who pay for their fares, on-board spending, shore excursions, and other services. It also generates revenue from other sources such as air transportation services, travel insurance, hotel bookings, and tour operations.

The company's revenue is affected by various factors such as passenger capacity, occupancy rates, ticket prices, onboard spending per guest, fuel costs, currency exchange rates, and seasonality.

Main Products and Services

Carnival offers a variety of products and services to its guests, such as:

- Cruise vacations: The company offers cruises ranging from two to over 100 days to more than 700 destinations around the world.

- Onboard activities: The company provides various onboard activities to enhance the guest experience.

- Shore excursions: The company offers shore excursions that allow guests to explore the local culture, history, nature, and adventure of the destinations they visit.

- Other services: The company also offers other services such as air transportation services, travel insurance, hotel bookings, tour operations, Internet access, photography, shopping, medical services, and weddings.

Source: carnival

Carnival Corp's Financials, Growth, and Valuation Metrics

Review of Carnival Corp's financial statements

Market Capitalization: As of July 11, 2023, Carnival Corp had a market capitalization of $25.6 billion.

Net Income: For the fiscal year ended May 31, 2023, Carnival Corp reported a net loss of $3.4 billion, a 62% decline year-over-year. In fiscal year 2022, the company reported a net loss of $6.093 billion, a 35.87% decline from 2021

Revenue Growth: For the twelve months ended May 31, 2023, Carnival Corp's revenue was $17.487 billion, a 198.62% increase year-over-year. In fiscal year 2022, Carnival Corp's annual revenue was $12.168 billion, a 537.74% increase from 2021.

Profit Margins: For the twelve months ended May 31, 2023, Carnival Corp's net profit margin was -19.83%.

Return on Equity: For the twelve months ending in the second quarter of 2023, Carnival Corporation had a negative return on equity (ROE) of -50.48% due to the net loss of $3 billion.

Balance Sheet Strength and Implications: As of May 31, 2023, Carnival Corp had cash and cash equivalents of $4.49 billion and total debt of $35.08 billion. The company's debt-to-equity ratio was 507.87 and its current ratio was 0.71 as of February 28, 2023. The company has taken several measures to improve its liquidity and reduce its costs, such as raising $23.6 billion of new capital through debt and equity offerings since March 2020.

Key financial ratios and metrics

To assess Carnival Corp's valuation, we can compare its valuation multiples (P/E, P/S, P/B, EV/EBITDA) to its peers and the industry. However, since Carnival Corp reported a net loss in fiscal year 2020, its P/E ratio is not meaningful. Therefore, we will use the forward P/E ratio based on the estimated earnings for fiscal year 2022.

According to Yahoo Finance, as of July 11, 2023, Carnival Corp had a forward P/E ratio of 16.7, a P/S ratio of 4.6, a P/B ratio of 1.5, and an EV/EBITDA ratio of 18.7.

The table below shows the comparison of Carnival Corp's valuation multiples with its peers and the industry:

|

Company |

Forward P/E |

P/S |

P/B |

EV/EBITDA |

|

Carnival Corp |

16.7 |

4.6 |

1.5 |

18.7 |

|

Royal Caribbean Group |

15.2 |

5.2 |

2.3 |

19.8 |

|

Norwegian Cruise Line Holdings Ltd |

13.3 |

3.8 |

-0.2 |

17 |

Based on the table, we can see that Carnival Corp has a higher forward P/E ratio than its peers, indicating that it is more expensive relative to its expected earnings growth. However, Carnival Corp has a lower P/S ratio than Royal Caribbean Group, indicating that it is cheaper relative to its sales.

Carnival Corp also has a lower P/B ratio than Royal Caribbean Group, indicating that it is cheaper relative to its book value. The company has a similar EV/EBITDA ratio as Royal Caribbean Group, indicating that it is valued similarly relative to its earnings before interest, taxes, depreciation, and amortization.

It is vital to note that the valuation multiples are based on the current stock price and the estimated earnings for the fiscal year 2022, which are subject to uncertainty and volatility due to the COVID-19 pandemic and its impact on the cruise industry. Therefore, the valuation multiples may not reflect the true value of Carnival Corp's business and its future growth potential.

CCL Stock Performance Analysis

CCL Stock trading information

Carnival Corp's common stock is traded on the New York Stock Exchange (NYSE) under the ticker symbol CCL. The company also has American depositary shares (ADSs) that are traded on the London Stock Exchange (LSE) under the symbol CUK. The company's primary exchange is the NYSE and its primary currency is the US dollar (USD).

The company's trading hours are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays, excluding US market holidays. The company also has pre-market trading from 4:00 a.m. to 9:30 a.m. ET and after-market trading from 4:00 p.m. to 8:00 p.m. ET on weekdays. The company has not conducted any stock splits since its IPO in 1987.

The company has suspended its dividend payments since March 2020 due to the COVID-19 pandemic. The last dividend payment was $0.50 per share in February 2020, which represented a dividend yield of 6.1% at that time.

CCL Stock Price Performance Since its IPO

Carnival Corp made its initial public offering (IPO) on July 14, 1987 at $3.875 per share (adjusted for dividends and splits). Since then, the company's stock has experienced significant fluctuations. On July 26, 2018, Carnival Corp reached its historical high, with the stock price soaring to $71.94 per share. This represented an impressive gain of 1,756% from its IPO price.

However, the company faced challenges in the wake of the COVID-19 pandemic, causing its stock price to plummet to a historical low of $7.80 per share on April 2, 2020. This marked a loss of 80% from its IPO price. As of July 17, 2023, Carnival Corp's stock price stands at $26.54 per share, reflecting a gain of 585% from its IPO price but a loss of 63% from its historical high.

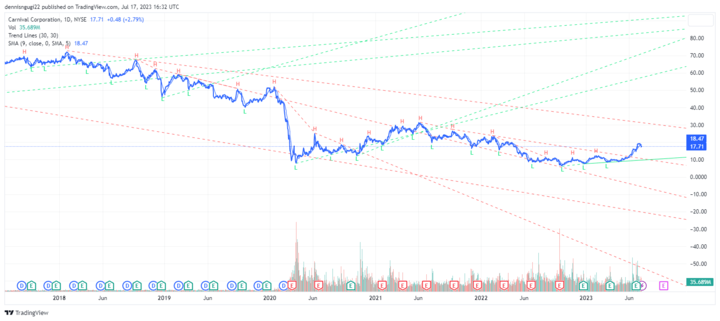

The company's stock price has been highly volatile since the COVID-19 pandemic, as shown in the chart below:

Source: tradingview

CCL Stock Forecast

CCL Stock Price Trend Analysis

To analyze the trend of Carnival stock price, we can use technical indicators such as moving averages, trend lines, and chart patterns.

Moving averages are lines that show the average price of a stock over a certain period. They can help identify the direction and strength of a trend, as well as potential support and resistance levels.

Trend lines are straight lines that connect the highs or lows of a stock price over time. They can help identify the direction and slope of a trend, as well as potential breakout or breakdown points.

Chart patterns are shapes that form on a stock chart that indicate the continuation or reversal of a trend. They can help identify potential entry and exit points for trading.

Based on the chart below, we can see that CCL stock price has been in a downtrend since January 2018, as indicated by the red downward-sloping trend line. However, the stock has been up 133% this year which is above its 50-day and 200-day moving averages since February 2020, indicating a bullish sentiment. This means that Carnival Corp's stock price has been recovering since the pandemic.

Source: tradingview

Key Resistance & Support Levels of CCL Stock

- Resistance levels are prices where sellers tend to outnumber buyers, creating downward pressure on the stock price. Support levels are prices where buyers tend to outnumber sellers, creating upward pressure on the stock price.

- Based on the chart below, we can identify some key resistance and support levels for Carnival stock in the past year as follows:

- Resistance level 1: $11 per share, which coincides with the neckline of the inverse head and shoulders pattern and the 200-day moving average.

- Resistance level 2: $12.6 per share, which coincides with the previous high in August 2022.

- Resistance level 3: $19.5 per share, which coincides with the previous high in July 2023 and the 50% Fibonacci retracement level of the downtrend from January 2023 to April 2023.

- Support level 1: $8.4 per share, which coincides with the previous low in May 2021 and the 23.6% Fibonacci retracement level of the uptrend from April 2022 to June 2022.

- Support level 2: $7.4 per share, which coincides with the previous low in January 2023 and the red trend line.

- Support level 3: $14.8 per share, which coincides with the previous low in June 2023 and the psychological round number.

Source: tradingview

Carnival Stock Forecast

- Analyst recommendations are opinions or ratings given by financial analysts or experts on a stock's potential performance. They can range from strong buy, buy, hold, sell, to strong sell. Price targets are estimates of a stock's future price based on various assumptions and models.

- According to Yahoo Finance, as of July 11, 2023, some 19 analysts covering CCL stock had the following consensus recommendations:

- Buy: 7 analysts (37%)

- Hold: 10 analysts (53%)

- Sell: 2 analysts (10%)

- The table below shows the price targets from some of the major analysts and the implied upside/downside based on the current stock price of $26.54 per share:

|

Analyst |

Price Target |

Implied Upside/Downside |

|

Morgan Stanley |

$14 |

-47% |

|

Credit Suisse |

$18 |

-32% |

|

Barclays |

$24 |

-10% |

|

JPMorgan |

$31 |

+17% |

|

Goldman Sachs |

$32 |

+21% |

|

UBS |

$36 |

+36% |

|

Citigroup |

$40 |

+51% |

Based on the table, we can see that the average price target is $27.86 per share, which represents a slight upside of 5% from the current stock price. The highest price target is $40 per share, which represents a significant upside of 51% from the current stock price. The lowest price target is $14 per share, which represents a substantial downside of 47% from the current stock price.

Challenges and Opportunities

Competitive Risks

Main Competitors

Carnival Corp faces intense competition from other cruise operators in the global market. Some of its main competitors include:

- Royal Caribbean Group: The second-largest cruise company in the world, operating four brands and over 60 ships that serve more than 6 million guests annually. Its brands include Royal Caribbean International, Celebrity Cruises, Silversea Cruises, and Azamara.

- Norwegian Cruise Line Holdings Ltd: The third-largest cruise company in the world, operating three brands and over 30 ships that serve more than 3 million guests annually. Its brands include Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises.

- MSC Cruises: The fourth-largest cruise company in the world, operating one brand and over 20 ships that serve more than 2 million guests annually. It is a privately owned company based in Switzerland.

- Disney Cruise Line: A subsidiary of The Walt Disney Company that operates four ships that serve more than 1 million guests annually. It is known for its family-friendly cruises that feature Disney characters and themes.

Source: Cruzely

Carnival Corp Competitive Advantages

Carnival Corp has several competitive advantages that help it maintain its leading position in the global cruise market. Some of these advantages are:

- Brand Diversity and Loyalty: Carnival Corp operates nine different cruise brands that cater to various segments of the market, ranging from budget to luxury, and from family to adventure. Each brand has its own loyal customer base and distinctive identity, which allows Carnival Corp to appeal to a wide range of travelers and capture more market share.

- Global Presence and Expansion: Carnival Corp has a strong global presence, with ships sailing to more than 700 destinations across all seven continents. The company also continues to expand its fleet and its geographic reach, especially in emerging markets such as Asia, where the demand for cruises is growing rapidly. By offering more choices and experiences to its guests, Carnival Corp can attract new customers and increase repeat bookings.

- Operational Efficiency and Innovation: Carnival Corp strives to improve its operational efficiency and reduce its environmental impact by investing in new technologies and practices.These innovations help Carnival Corp lower its fuel consumption and emissions, as well as enhance its safety and reliability.

- Customer Satisfaction and Engagement: Carnival Corp focuses on delivering high-quality service and memorable experiences to its guests, which results in high customer satisfaction and retention rates. These interactions help Carnival Corp build strong relationships with its customers and increase their loyalty and advocacy.

Other Risks

Besides competitive risks, Carnival Corp also faces other risks that could adversely affect its business and stock performance, such as:

- COVID-19 pandemic risk: The COVID-19 pandemic has been the biggest challenge for Carnival Corp and the cruise industry as a whole. The pandemic has forced Carnival Corp to suspend most of its operations and incur heavy losses since March 2020. The pandemic has also created significant uncertainty and volatility in the demand and supply of cruises, as well as the health and safety of guests and crew. The pandemic has also affected the company's ability to access capital markets, comply with debt covenants, and maintain its credit ratings. The company's recovery from the pandemic will depend on various factors such as the availability and effectiveness of vaccines, the lifting of travel restrictions and advisories, the implementation and acceptance of health and safety protocols, and the restoration of consumer confidence and demand.

- Regulatory risk: The cruise industry is subject to various regulations and laws in the countries and regions where it operates. These regulations and laws cover areas such as environmental protection, health and safety, labor, taxation, consumer protection, antitrust, and anti-corruption.

- Operational risk: The company's operations involve various risks such as mechanical failures, accidents, fires, collisions, piracy, terrorism, weather events, natural disasters, outbreaks of diseases, cyberattacks, and other unforeseen events.

- Reputational risk: The company's reputation is one of its most valuable assets, as it affects its ability to attract and retain guests, employees, partners, investors, and regulators.

Despite the risks and challenges that Carnival Corp faces, the company also has some opportunities that could enhance its business and stock performance in the future, such as:

Recovery of the cruise industry: The cruise industry is currently recovering from the COVID-19 pandemic in the long term, as vaccines become more widely available and distributed, as travel restrictions and advisories are lifted, as health and safety protocols are implemented and accepted, and as consumer confidence and demand is restored. The cruise industry has a loyal customer base that is eager to resume cruising once it is safe and feasible. The cruise industry also has a largely untapped market potential that could drive future growth, as only 3.7% of the global population has ever taken a cruise.

Growth opportunities

Carnival Corp has several growth opportunities and drivers that could increase its revenue and profitability in the future, such as:

- Expanding its presence in emerging markets such as China, India, and Southeast Asia, where the demand for cruises is growing rapidly due to the rising middle class, increasing disposable income, and changing travel preferences.

- Launching new ships that feature innovative designs, amenities, and technologies that enhance the guest experience, differentiate the company from its competitors, and attract new segments of customers.

- Developing new products and services that cater to the evolving needs and preferences of its guests, such as personalized offerings, experiential travel, sustainability initiatives, and digital solutions.

- Leveraging its loyalty program to increase customer retention, repeat bookings, and onboard spending.

- Partnering with other travel providers such as airlines, hotels, tour operators, and destination authorities to offer more value-added packages, options, and experiences to its guests.

Source: Business Journal

Future outlook and expansion

Carnival Corp has a positive outlook and expansion plan for the future. The company saw a continued acceleration of demand, with total bookings made during the quarter reaching a new all-time high for all future sailings. Total customer deposits reached an all-time high of $7.2 billion (as of May 31, 2023), surpassing the previous record of $6.0 billion (as of May 31, 2019) by over $1 billion, a 26% increase compared to the prior quarter. The company expects continued growth in adjusted free cash flow to be the driver for paying down debt over time.

The company is introducing its SEA Change Program, a set of key performance targets designed to achieve important strategic goals over three years ending in 2026. Carnival Corporation & plc's Chief Executive Officer Josh Weinstein commented, "We reached a meaningful inflection point for revenue this quarter, with net yields surpassing 2019's strong levels, and we achieved positive operating income, cash from operations, and adjusted free cash flow.

Why Traders Should Consider CCL Stock

Reasons Why Traders Should Consider CCL Stock

Traders should consider CCL stock for several reasons, such as:

- CCL stock is undervalued relative to its peers and the industry based on some valuation multiples such as P/S and P/B, indicating that it has a higher potential for appreciation than its competitors and the industry as a whole.

- CCL stock is also trading at a significant discount to its pre-pandemic levels, indicating that it has a lot of room for recovery once the cruise industry resumes its normal operations and demand.

- CCL stock is also supported by the strong fundamentals of Carnival Corp, which is the world's largest cruise company with a diversified portfolio of brands, a loyal customer base, and a largely untapped market potential.

- CCL stock is also driven by the positive outlook and expansion plan of Carnival Corp, which aims to resume its operations in a phased manner, launch new and innovative ships, develop new products and services, and leverage its partnerships and loyalty program.

- CCL stock is also attractive to traders looking for high volatility and liquidity, as the stock price fluctuates significantly due to the COVID-19 pandemic and its impact on the cruise industry. The stock also has a high trading volume and a low bid-ask spread, making it easy to buy and sell.

Trading Strategies for CCL Stock

Traders can use various trading strategies for Carnival stock, depending on their risk appetite, time horizon, and market conditions. Some of the possible trading strategies are:

- CFD Trading: CFD stands for contract for difference, which is a type of derivative that allows traders to speculate on the price movements of an underlying asset without owning it. CFD trading has several advantages, such as Leverage, Short Selling, and Hedging.

Traders can use leverage to amplify profits or losses by trading with more capital than they have. Short selling involves selling borrowed CCL stock and buying it back at a lower price to profit from the difference. Hedging reduces risk by taking an opposite position in a correlated asset alongside CCL stock.

- Swing Trading: This is a medium-term strategy that involves holding a position for several days or weeks, depending on the market trends and technical indicators. One possible swing trading strategy for CCL stock is to use the Bollinger Bands indicator, which measures the volatility and trend of a stock price.

- Day Trading: This is a short-term strategy that involves buying and selling a stock within the same trading day, without holding any position overnight. One possible day trading strategy for CCL stock is to use the Commodity Channel Index (CCI) indicator, which measures the deviation of a stock price from its average.

Trade CCL Stock CFD with VSTAR

If you are interested in trading CCL stock, you should consider trading CCL stock CFD at VSTAR, which is one of the best online trading platforms in the world. VSTAR offers several advantages for traders, such as:

- Low fees and commissions: VSTAR charges low fees and commissions for trading CCL stock CFD, which can help you save money and increase your profits.

- High security and reliability: VSTAR uses advanced encryption and security protocols to protect your personal and financial information and transactions.

- User-friendly interface and tools: VSTAR has a user-friendly interface and tools that make trading CCL stock CFD easy and convenient.

- Customer support and service: VSTAR has a dedicated customer support and service team that is available 24/7 to assist you with any issues or questions you may have regarding trading CCL stock CFD.

If you want to learn more about trading CCL stock CFD at VSTAR, you can visit VSTAR's website or contact VSTAR's customer support team for more details.

Conclusion

In this article, we have explored Carnival Corp (NYSE: CCL) stock, which is the stock of the world's largest cruise company. We have learned about the company's history, business model, products and services, financial performance, valuation, stock performance, and future prospects. We have also discussed the risks and challenges that the company and the stock face, as well as the opportunities and growth drivers that they have. We have also shared some reasons why traders should consider CCL stock and some trading strategies that they can use.

As a bonus, we would like to mention that Carnival Corp is making progress after the COVID-19 pandemic, as it has resumed its operations in some markets and regions, such as the US, Europe, and Asia. The company has also implemented health and safety protocols and obtained regulatory approvals to ensure the well-being of its guests and crew. Therefore, we believe that Carnival Corp (NYSE: CCL) stock is a good investment opportunity for traders who are looking for value and growth in the travel sector.