Amid the regulatory crackdown on the crypto sector, it helps to look carefully for the best cryptocurrency stock to buy now. Despite its own regulatory challenges, Coinbase Global (NASDAQ: COIN) looks to be the best crypto stock to invest in 2023.

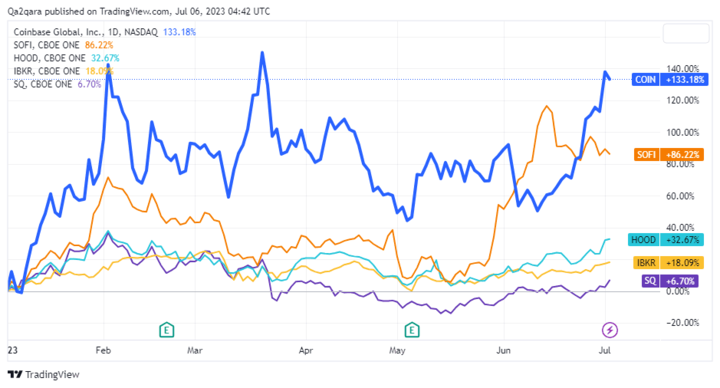

At about $78 currently, COIN stock price has jumped more than 130% since the beginning of the year. As you can see in the chart below, Coinbase stock has risen faster than any other major crypto stock in the cryptocurrency trading business. And Coinbase stock forecast shows it still has substantial upside potential.

As a smart investor, you want to assess the ground before you leap. As a result, you would want to find out why other investors think Coinbase is the best crypto stock to buy now.

Coinbase (NASDAQ: COIN) Stock News

Coinbase Supporting Bitcoin ETF Projects

Cboe and Nasdaq have tapped Coinbase to help them launch spot Bitcoin exchange-traded funds (ETFs). Cboe plans to launch a Bitcoin ETF constructed by Fidelity, while Nasdaq wants to introduce a Bitcoin ETF built by BlackRock. In those arrangements, Coinbase will assist with fraud monitoring as required by the regulator SEC.

Coinbase Defends Against SEC Claims

Coinbase is seeking to dismiss the case that the SEC recently filed against it. The regulator has accused Coinbase of breaking market rules in its widening crackdown on the crypto sector. But Coinbase has hit back, saying that the SEC lacks regulatory authority over it and that the regulator’s case against it is wrong.

Coinbase Considering Introducing a Super App

At a June crypto summit arranged by the Financial Times and others, Coinbase CEO Brian Armstrong discussed plans to turn the platform into a super app. Tencent’s WeChat is a perfect example of a super app. It offers multiple functions, ranging from social to money services. As a super app, Coinbase may be more useful to people by offering a bundle of services.

Coinbase (NASDAQ: COIN) Stock Overview

Source: Coinbase

Coinbase is an American crypto exchange operator. It supports trading in hundreds of cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin. Coinbase also offers crypto transfer and storage services.

The Coinbase platform is used by retail, professional traders, and institutional investors. For example, Coinbase handled Tesla’s purchase of $1.5 billion worth of Bitcoin in 2021.

Founded in 2012, Coinbase initially listed San Francisco as its headquarters before adopting the remote work model. Consequently, the company no longer operates an official corporate headquarters as its staff now works from distributed remote locations.

Coinbase went public in 2021 through the direct listing method. With a market cap of nearly $20 billion, Coinbase is one of the largest crypto exchange operators in the world.

Coinbase co-founder and CEO Brian Armstrong is a crypto billionaire with a net worth of more than $3 billion. Before founding Coinbase with Fred Ehrsam, Armstrong worked as a software engineer for Airbnb (NASDAQ: ABNB).

Coinbase Business Model and Products

How Coinbase Makes Money

Coinbase’s revenue model is simple. It charges a trading fee when users buy or sell cryptocurrencies on its platform. It also charges a fee on crypto transfers outside its platform. Additionally, Coinbase charges a transaction fee on various activities on its platform. Coinbase also offers services that incur subscription fees.

Coinbase’s Main Products and Services

Crypto trading: Coinbase’s primary business is offering crypto trading services. Its crypto exchange service is available in various brand options, including Coinbase (retail traders), Coinbase Pro (professional traders), and Coinbase Prime (institutional traders).

Crypto card: Coinbase partnered with Visa to launch a crypto debit card. The Coinbase card allows users to spend their crypto balances on Coinbase on purchases. With the card, Coinbase users don’t need to sell their crypto assets to convert them into cash to spend

Crypto staking: Coinbase offers a savings account-type product that allows users to generate passive income on their idle crypto assets. The crypto staking service enables users to earn interest when they lock their crypto funds. Staking is a favored method to secure and regulate supply of certain cryptocurrencies.

Crypto custody: Coinbase provides crypto storage services. It offers the Coinbase wallet service to consumers and the Coinbase custody service to institutional clients. Think of Coinbase’s storage platform as a bank for cryptocurrencies.

Coinbase’s Financial Performance and Balance Sheet Strength

Your search for the best crypto stock to buy now would be incomplete without assessing the fundamentals of the target stock. If there is one great force that constantly moves stock prices, it is earnings reports.

For that reason, let’s explore Coinbase’s financial statements to get a feel of where the company stands financially.

Coinbase’s Revenue

The company generated revenue of $773 million in the first quarter, which rose 23% from the previous quarter and surpassed the consensus estimate of $655 million.

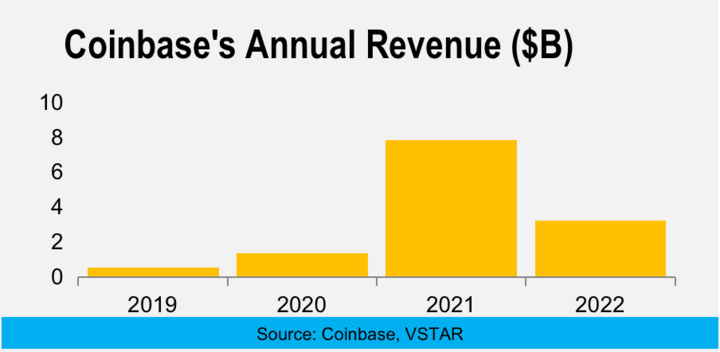

The company delivered revenue of $3.2 billion in 2022. As you can see in the chart above, Coinbase had its best revenue year since IPO in 2021, when it reported revenue of $7.8 billion. That year, the company benefited from people investing their stimulus checks in crypto.

Although pandemic-driven benefits have fizzled, there is still plenty of room for Coinbase to grow its revenue.

Coinbase’s Net Income

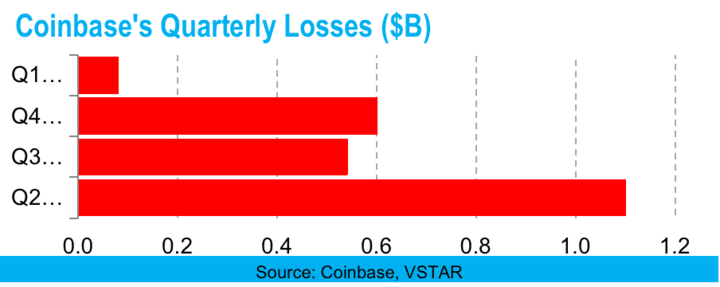

The company has had a mix of profit and loss seasons. It made a loss of $79 million in Q1. Despite the persistent red ink, the loss was substantially lower than the $557 million in the previous quarter and $430 million loss in the year-ago quarter. The company’s quarterly losses have narrowed sharply in recent periods as you can see in the chart below.

On an annual basis, Coinbase made a profit of $3.6 billion in 2021 but slipped to a $2.6 billion loss in 2022 as it faced various headwinds. With the company taking steps to improve its efficiency with job cuts and other measures, it could return to profits soon or later.

Coinbase’s Profit Margins

Although Coinbase’s profit margins are still in the negative territory, they’re improving. The company’s operating margin improved to -16% in Q1, compared to -88% in the previous quarter. The net margin also improved to -10% from -88% in the previous quarter.

Coinbase’s Cash Position and Balance Sheet Condition

If cash is the lifeblood of a business, Coinbase has plenty of life. The company produced $463 million in cash flow from operations in Q1. It finished the quarter with $5.3 billion in cash balance.

Coinbase’s balance sheet is in great shape, showing more than $139 billion in assets against a long-term debt of only $3.4 billion. The current ratio stands at a strong 1.04, and the debt-to-equity ratio is an impressive 0.63.

Coinbase (NASDAQ: COIN) Stock Analysis

Coinbase (COIN) Stock Valuation

Coinbase stock currently trades at a price-to-sales (PS) ratio of 6.48. That is a more favorable valuation than that of many other crypto stocks. For example, SoFi Technologies (NASDAQ: SOFI) stock trades at a PS ratio of 4.67 and Interactive Brokers (NASDAQ: IBKR) trades at a PS ratio of 10.

Moreover, Coinbase stock’s price-to-book (PB) ratio of 3.20 isn’t too far from Block (NYSE: SQ) stock’s PB ratio 2.29. And it is better than Interactive Brokers stock’s PB ratio 11.60.

COIN Stock Trading Information

Coinbase stock is listed on the Nasdaq exchange where it trades under the “COIN” ticker symbol. Coinbase is among the most heavily traded crypto stocks. On an average, more than 16 million Coinbase shares exchange hands daily.

You can start trading COIN stock as early as 6.30 a.m. to as late as 8 p.m. ET if you take advantage of the premarket and postmarket trading session. Otherwise, regular trading in Coinbase shares begins at 9.30 a.m. and ends at 4 p.m.

Coinbase stock split history: The crypto exchange operator hasn’t split its stock since the IPO.

Coinbase dividend yield: The company doesn’t pay dividends yet, and the management hasn’t discussed dividend plans.

Coinbase (NASDAQ: COIN) Stock Performance

The crypto exchange operator priced its stock at $250 for the IPO. The stock closed its first day of trading at $328, representing a 30% jump over the IPO price. As you can see in the chart above, COIN stock rose to the all-time high of $430 immediately after its public debut.

But the stock struggled to keep its lofty position. Coinbase stock price dropped more than 80% in 2022, as you can see in the chart above. The stock looks to be on a strong recovery path in 2023, soaring more than 130% since the year began.

The COIN stock has traded between a low of $31 and a high of $116 over the past year. At about $78 currently, the stock has jumped 160% over its 52-week low and is closing in on its 52-week high.

Why Is Coinbase Stock Going Up?

A confluence of factors is driving Coinbase stock this year. These are some of the reasons COIN stock is soaring:

Improving financials: Coinbase reported Q1 earnings that not only improved from the previous quarter, but also surpassed Wall Street expectations.

Bitcoin ETF projects: Investors have cheered Coinbase’s involvement with spot Bitcoin ETF projects by Fidelity and BlackRock.

Insider buying: Coinbase insiders are showing confidence in COIN stock outlook. The insiders have purchased $50 million worth of Coinbase shares in recent months, according to TipRanks data.

Hedge funds are buying: Apart from insiders, hedge funds are also bullish on Coinbase stock. According to TipRanks, hedge funds have purchased nearly 4 million Coinbase shares in recent months.

Coinbase (NASDAQ: COIN) Stock Forecast

Anyone looking for the best crypto stocks to buy now would want to know high Coinbase stock can go from here.

Nearly two dozen analysts have weighed on the Coinbase stock outlook with a range of COIN stock price targets. The stock has already soared past analysts’ average price forecast of $57. The stock’s peak price prediction of $200 implies 150% upside potential.

Coinbase (NASDAQ: COIN) Stock Technical Analysis

As you can see in the chart above, COIN stock is running along the upper Bollinger Bands and its RSI reading has crossed 70.

This shows that while the stock may have potential to push higher from here, there is a strong incentive for traders to take profit at this point. Consequently, the stock could pull back for some time before resuming the uptrend.

Coinbase’s Challenges and Opportunities

Every business presents challenges and opportunities, and Coinbase has its fair share of both. Let’s explore Coinbase’s risks and opportunities:

Coinbase’s Risks and Challenges

Tight regulations: The regulatory climate has remained largely adverse to the crypto sector, which is worrying for Coinbase. For example, the company is battling a SEC lawsuit that is accusing it of breaching market rules.

Hacking of crypto platforms: Cryptocurrency trading and custody providers are constantly a target of hackers seeking to steal funds or sensitive data. A breach of Coinbase’s system can result in a massive financial loss and reputational damage.

Increased competition: Coinbase faces intense competition from many actors in the crypto space. These are some of Coinbase’s main competitors:

|

Competitor |

Threat |

|

Coinbase vs. Binance |

Binance is one of the biggest names in the crypto exchange business. It competes with Coinbase for crypto trading fee revenue and it tries to win by offering competitive prices. |

|

Coinbase vs. Crypto.com |

Similar to Coinbase, Crypto.com offers crypto trading and crypto staking services. Additionally, it offers a crypto card. It challenges Coinbase for trading and transaction fee revenue. |

|

Coinbase vs. Gemini |

Gemini operates a crypto trading platform and offers crypto custody and staking services. Moreover, it supports NFT trading and issues crypto cards. It challenges Coinbase on multiple fronts. |

Coinbase’s Competitive Advantages

Despite the raging competition, Coinbase (NASDAQ: COIN) has a chance to defend its turf and grow. These are some of the company’s strengths in the battle:

Solid financial position: With more than $5 billion in cash and a minimal debt load, Coinbase is in a much better financial condition than many of its rivals. Consequently, the company has greater financial flexibility to counter competitive threats.

Strong brand recognition: Coinbase is among the most well-known and trusted brands in crypto space. It can leverage its strong brand and reputation to win business where competitors may struggle. Amid the increasing theft and hacking risks, crypto investors want to work with a trusted brand more than ever.

Market leader: Coinbase controls more than 50% of the U.S. crypto exchange market. The strong head start puts the company in a great position to offer extra services that can generate it more revenue and make its clients more loyal.

Strategic partnerships: Coinbase has forged strategic partnerships with some of the biggest players in the financial sector and beyond. For example, the company secured a deal to bring crypto payment options for Google cloud customers.

Coinbase’s Growth Opportunities

As one of the top brands in the crypto sector, Coinbase has numerous growth opportunities. These are some of the ways the company could drive its revenue growth and improve its profitability:

International expansion: Although Coinbase has launched in some 100 countries, there is still plenty of room to grow for the company internationally. The company recently launched in Bermuda and has its sights on several other key offshore markets.

Expanded product offering: Coinbase supports an extensive list of cryptocurrencies, but it isn’t exhaustive yet. There are still many altcoins that the company could add to its menu. Moreover, international expansion could allow Coinbase to expand its revenue streams by offering products that it may not provide in the U.S.

Education and reward program: Coinbase has a program that teaches people about cryptocurrencies. Those who take the lessons can earn crypto rewards. This has proved to be a highly effective marketing strategy that can lead to huge success as the company expands overseas.

Leveraging AI technology: Coinbase has recently slashed jobs in an effort to cut costs and improve its profit margins. The company can apply AI technologies to not only improve its operational efficiency and help margins, but also enhance the customer experience.

Although the regulatory crackdown on the crypto sector presents a challenge for Coinbase, it also could be a blessing in disguise to the company. Many crypto providers may shut down because of the crackdown. As a result, Coinbase could have fewer competitors in the future if it survives the crackdown.

Coinbase (NASDAQ: COIN) Stock Investing Strategies

When it comes to making money with Coinbase stock, there are a few ways you could do it. These are the two popular Coinbase investing strategies:

1. Buying and Holding Coinbase Shares

This is the trading investing method. It involves purchasing Coinbase shares and holding them for an extended period, usually several years. Your hope is that the stock price would appreciate during your holding period to allow you to make a profit. But this investing strategy has its benefits and drawbacks.

Pros:

● You can vote at Coinbase’s shareholder meetings.

● Your share count may increase in the event of a Coinbase stock split.

● You may earn dividends in the future.

Cons:

● The upfront capital requirement can be huge.

● You only gain when the COIN stock price is going up.

● You need to await a long time to see returns.

2. Trading Coinbase Stock CFD

This strategy involves predicting what direction Coinbase stock price will move, usually over short periods such as hours, days, or weeks. CFD trading gives you light exposure to COIN stock, but with potential for huge gains. Since Coinbase CFD contracts are usually priced lower than the stock’s market price, you can get started with little upfront capital.

If you expect Coinbase stock price to go up, you would purchase contracts that pay you the price increase. On the other hand, you would purchase contracts that pay you the price decrease if you expect the stock to fall.

Let’s say you purchased 500 contracts. If you predicted a rise in Coinbase stock and it goes up by $5 in a day or so, you would make a profit of $2,500 on that trade. If you correctly predicted the stock would decline and it goes down by $3, you would make a profit of $1,500.

Because it allows you to bet on a stock’s up and down movements, CFD trading offers the best way to make money with COIN stock in any market condition. But like everything else, it has its benefits and downside.

Pros:

● You require minimal upfront capital to get started.

● It allows you to capture profits over short periods such as hours and days instead of years.

● You can make money whether Coinbase stock is in a bull or bear market.

Cons:

● You don’t get shareholder voting rights at Coinbase meetings.

● You don’t qualify for potential dividends.

Trading Coinbase (NASDAQ: COIN) Stock CFD with VSTAR

If you have identified Coinbase as the best crypto stock to buy now and want to trade Coinbase CFD, the next thing you want to do is get the best CFD broker.

Consider using VSTAR for Coinbase CFD trading. A fully licensed and regulated CFD broker, VSTAR offers tight spreads and no-commission trading on standard accounts to maximize your profit.

Designed for beginner and pro traders, VSTAR has low upfront capital requirement, supports high-speed trading, and offers prompt customer support. These are some of the reasons VSTAR has excellent ratings on Trustpilot.

Open your VSTAR account today and start trading Coinbase stock CFD. The account is free and you also get up to $100,000 in a demo account for your trading practice.

Final Thoughts

While it can be difficult to identify the best crypto stock to buy now amid the regulatory headwinds in the sector, Coinbase (NASDAQ: COIN) is a strong one to consider. With CFD trading, you can make money whether Coinbase stock is going up or down.