- EIA weekly Oil data reveals increased refinery inputs and gasoline production.

- Declining distillate fuel production contrasts with rising crude oil imports.

- Inventories below five-year averages hint at potential supply tightness.

- Fluctuating spot prices and declining retail prices reflect mixed market sentiments for CFDs on Crude Oil.

Amidst the fluctuating landscape of the global Crude Oil market, the intricately woven tapestry of supply, demand, and market sentiments dictates the trajectory of CFDs on Crude Oil. Examining recent EIA weekly data offers a lens into this dynamic pricing, where subtle shifts in refinery outputs, inventory fluctuations, and price volatilities define the intricate dance of market forces.

Refinery Inputs and Production

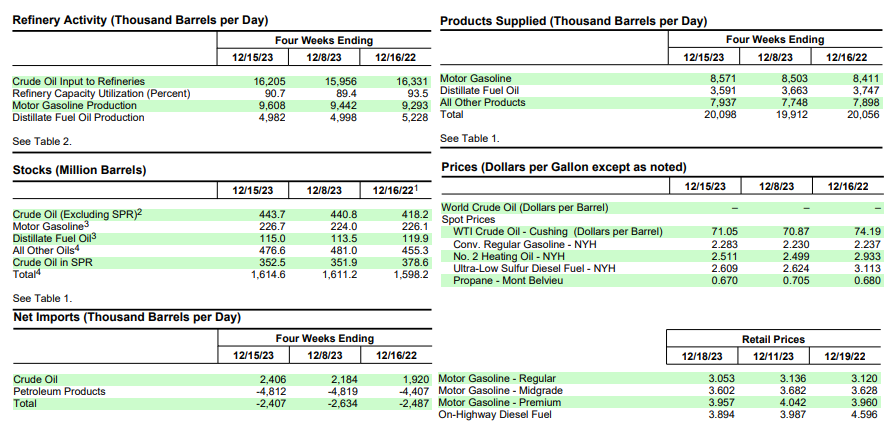

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending December 15, 2023, marking an increase of 403 thousand barrels per day from the previous week. This rise in refinery inputs signifies heightened demand for crude oil processing into various petroleum products. Refineries operated at 92.4% of their operable capacity, indicating an almost full utilization rate, likely due to increased demand for refined products in the market.

Gasoline production during the same period increased to an average of 10.0 million barrels per day. This surge in gasoline production aligns with increased refinery inputs and suggests a response to meet elevated demand for gasoline, potentially driven by consumer needs such as travel and transportation.

However, distillate fuel production declined last week, averaging 4.9 million barrels per day. This decrease might indicate a shift in demand dynamics or operational adjustments in refineries, impacting the supply of diesel, heating oil, and other distillate fuels.

Source: EIA.gov

Imports and Inventories

U.S. crude oil imports averaged 6.8 million barrels per day during the last week, marking an increase of 233 thousand barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.7 million barrels per day, indicating a 7.6% increase compared to the same period last year. This surge in imports potentially indicates efforts to bolster supply to meet escalating demand or mitigate any shortfall in domestic production.

Commercial crude oil inventories, excluding those in the Strategic Petroleum Reserve, rose by 2.9 million barrels from the previous week, reaching a total of 443.7 million barrels. While this increase might suggest a growing inventory, it's essential to note that this level is approximately 1% below the five-year average for this time of the year. This could imply a slightly tighter market compared to the historical average.

Both gasoline and distillate inventories increased last week, but they remain below their respective five-year averages for this time of year. Gasoline inventories rose by 2.7 million barrels, standing at about 2% below the five-year average. Meanwhile, distillate fuel inventories increased by 1.5 million barrels and are roughly 10% below the five-year average. These lower-than-average inventory levels might indicate potential supply constraints or higher-than-expected demand for these refined products.

Product Supplies

Total products supplied over the last four-week period averaged 20.1 million barrels a day, marking a minor increase of 0.2% from the same period last year. Among the products supplied, motor gasoline showed a more significant increase, averaging 8.6 million barrels a day, up by 1.9% from the same period last year. This points to sustained or slightly growing demand for gasoline.

However, the supply of distillate fuel products averaged 3.6 million barrels a day over the past four weeks, representing a decrease of 4.2% from the same period last year. This decline in demand for distillate fuels, including diesel and heating oil, might suggest changes in consumption patterns or a shift toward alternative energy sources for heating and transportation needs.

Price Fluctuations

The West Texas Intermediate (WTI) crude oil price increased to $71.05 per barrel on December 15, 2023. This marks a rise of $0.18 from the previous week's price but remains $3.14 less than the price recorded one year ago. Despite the increase in price from the previous week, the year-over-year decline might reflect market dynamics such as global supply and demand balances, geopolitical tensions, or changes in production and consumption patterns.

The spot price for conventional gasoline at New York Harbor rose to $2.283 per gallon, reflecting an increase of $0.053 compared to the previous week and $0.046 more than last year's price. Similarly, the New York Harbor spot price for No. 2 heating oil rose to $2.511 per gallon, marking an increase of $0.012 from the previous week but remained $0.422 below the year-ago price. These mixed trends in spot prices for gasoline and heating oil indicate varying market conditions and consumer demand compared to the previous year.

The national average retail price for regular gasoline declined to $3.053 per gallon on December 18, 2023. This decline represents a decrease of $0.083 compared to the previous week's price and $0.067 below the price recorded last year. Moreover, the national average retail diesel fuel price fell to $3.894 per gallon, marking a significant decrease of $0.093 from the previous week and $0.702 less than the price recorded one year ago. These declining retail prices suggest either reduced demand or increased supply, impacting consumer behavior and market dynamics.

Possible Implications on Price of CFDs on Crude Oil

Bullish Indicators:

- Increased Refinery Inputs and Gasoline Production: The rise in refinery inputs and gasoline production signals a surge in demand for refined products, possibly indicating a bullish market sentiment.

- Higher Crude Oil Imports: The increased imports may suggest efforts to meet escalating demand or compensate for potential domestic supply constraints, potentially exerting upward pressure on prices.

- Decline in National Average Retail Prices: Despite mixed spot price fluctuations, the decline in retail prices could indicate decreased demand or increased supply, potentially influencing market sentiment in favor of bullish movements.

Bearish Indicators:

- Decrease in Distillate Fuel Production and Product Supplied: The decline in distillate fuel production and demand for these products might indicate changing consumption patterns or a shift toward alternative energy sources, potentially indicating a bearish market sentiment.

- Inventories Below Five-Year Averages: The inventory levels below the five-year averages for gasoline and distillate fuels could signify potential supply tightness, which might lead to price volatility but could also influence bearish sentiments.

- Lower Spot Prices for Gasoline and Heating Oil Compared to Last Year: The decline or stagnation in spot prices compared to the previous year suggests weaker market sentiment, possibly indicating an oversupply scenario or weakened demand dynamics.

CFDs on Crude Oil: Technical Take

After completing the final bearish impulsive wave, the price of CFDs on WTI crude oil has stabilized and is heading towards a bullish trajectory. The 13-day EMA (green line) and 21-day EMA (red line) may also form a bullish crossover.On the positive side, the price may reach $78.10, as marked by the blue arrow. However, on the downside, the price may hit the pivot at $71.60, which is equally likely in the process of price stabilization and current price momentum, marked by an orange arrow.

Source: tradingview.com

In conclusion, while the oil market presents a mixed picture with increased gasoline production and refinery inputs versus declining distillate fuel production, the uncertainties shadowing inventory levels and fluctuating prices complicate predicting the CFD price direction. The delicate balance between supply tightness and demand dynamics implies potential volatility.