Trong những năm qua, mọi người trên toàn thế giới đã bắt đầu quan tâm đến tài sản kỹ thuật số, điều này dẫn đến sự tăng trưởng vượt bậc trong ngành công nghiệp tiền điện tử. Giao dịch tiền điện tử là một trong những cách mà các nhà đầu tư tạo ra doanh thu từ ngành này: khoảng 112 tỷ USD được giao dịch bằng tiền điện tử hàng ngày. Có lẽ bạn đang tự hỏi liệu giao dịch tiền điện tử có mang lại lợi nhuận không? Có, đó là một sự đầu tư mạo hiểm có lợi nhuận nếu được thực hiện một cách chính xác và có chiến lược. Có tiềm năng mang lại lợi nhuận cao khi giao dịch tiền điện tử, đặc biệt là trong giao dịch CFD tiền điện tử.

Đối với hầu hết các nhà giao dịch mới bắt đầu, giao dịch tiền điện tử có vẻ phức tạp. Tuy nhiên, không nhất thiết phải như vậy khi bạn có thể áp dụng các kỹ thuật và chiến lược giao dịch đã mang lại hiệu quả cho hàng triệu nhà giao dịch có lãi trong những năm qua. Để tăng cơ hội thành công trong giao dịch tiền điện tử, bạn cần biết các nguyên tắc giao dịch, thực hành quản lý rủi ro và hiểu phân tích thị trường. Bài viết này là một hướng dẫn toàn diện phác thảo tất cả những gì bạn cần để chuyển từ một nhà giao dịch mới bắt đầu thành một nhà giao dịch có lợi nhuận ổn định trên thị trường tiền điện tử. Hãy bắt đầu nào.

Unsplash

Phát triển chiến lược giao dịch

Là một nhà giao dịch mới bắt đầu, bạn không bao giờ nên nhảy vào thị trường mà không biết cách xác định các cơ hội giao dịch và cách bạn giao dịch chúng. Vì lý do này, bạn cần một chiến lược giao dịch. Chiến lược giao dịch là gì? Đó là một phương pháp có hệ thống (thường dựa trên các quy tắc hoặc tiêu chí được xác định trước) được sử dụng để mua và bán tài sản/công cụ tiền điện tử trên thị trường.

Trước khi phát triển chiến lược của mình, bạn phải đặt ra các mục tiêu rõ ràng và thực tế cho giao dịch của mình. Nó sẽ giúp bạn đi đúng hướng khi bạn bắt đầu thực hiện chiến lược giao dịch của mình.

Để phát triển một chiến lược giao dịch hợp lý, bạn sẽ cần trả lời các câu hỏi sau:

A. Khung thời gian giao dịch ưa thích của bạn là gì?

Các nhà giao dịch khác nhau có phong cách giao dịch khác nhau. Bạn có thể là scalper, day trader, swing trader hay position trader. Tất cả các phong cách này tập trung vào các khung thời gian phù hợp với khung thời gian giao dịch ưa thích của bạn và khả năng sẵn sàng theo dõi thị trường của bạn.

Đây là những khung thời gian phù hợp với từng phong cách giao dịch trên:

1. Khung thời gian tốt nhất cho scalper- từ 1 phút đến 15 phút

2. Khung thời gian tốt nhất cho day trader - từ 15 phút đến 4 giờ

3. Khung thời gian tốt nhất cho swing trader - từ hàng ngày đến hàng tuần

4. Khung thời gian tốt nhất cho position trader - từ hàng tuần đến hàng tháng

B. Mức độ chấp nhận rủi ro hoặc khả năng chịu đựng rủi ro của bạn như thế nào?

Giao dịch tiềm ẩn rủi ro và bạn có thể thua giao dịch vào một thời điểm nào đó. Do đó, việc đánh giá mức độ chấp nhận hoặc khả năng chịu đựng rủi ro của bạn là chìa khóa để phát triển chiến lược giao dịch của bạn. Bạn sẵn sàng thua lỗ bao nhiêu khi theo đuổi lợi nhuận tiềm năng trong một giao dịch?

Để xác định mức độ chấp nhận rủi ro của bạn, bạn cần xem xét những thứ như

● Mục tiêu

● Kinh nghiệm/kỹ năng giao dịch

● Số lượng giao dịch bạn thực hiện trong một khoảng thời gian nhất định

● Tỷ lệ rủi ro/lợi nhuận

Các chuyên gia thường khuyên các nhà giao dịch mới bắt đầu chỉ nên mạo hiểm một tỷ lệ nhỏ vốn của họ, tức là khoảng 2% số dư tài khoản khả dụng cho mỗi giao dịch. Tuy nhiên, các nhà giao dịch có mức độ chấp nhận rủi ro cao lên tới 5% cho mỗi giao dịch.

C. Bạn sẽ giao dịch CFD tiền điện tử nào?

Có hàng ngàn loại tiền điện tử trên thị trường và việc giao dịch tất cả chúng là điều không thể. Việc có danh sách theo dõi với hàng trăm công cụ có thể khiến bạn mất tập trung. Do đó, bạn cần xác định các công cụ tiền điện tử phù hợp với phong cách giao dịch của mình và thường mang đến cho bạn các cơ hội giao dịch mà bạn đang tìm kiếm. Chi phí giao dịch và sự biến động cũng là những yếu tố cần xem xét.

D. Quy tắc vào và thoát lệnh của bạn là gì?

Một trong những điều quan trọng khi phát triển chiến lược giao dịch của bạn là xác định điểm vào lệnh và lập kế hoạch điểm thoát lệnh. Khi bạn xác định được quy tắc vào lệnh, nó sẽ giúp bạn tham gia thị trường mà không phải do dự ngay khi bạn xác định được cơ hội giao dịch tốt.

Nó cũng áp dụng cho việc thoát giao dịch của bạn khi bạn đang lãi hoặc lỗ.

E. Bạn cần những chỉ báo kỹ thuật nào?

Chỉ báo là công cụ quan trọng trong phân tích kỹ thuật của bạn, do đó khiến chúng trở thành một yếu tố quan trọng trong chiến lược giao dịch. Chúng cung cấp cho bạn những hiểu biết sâu sắc về những gì đang xảy ra trên thị trường. Trên hết, các chỉ báo kỹ thuật cũng hữu ích trong việc xác định và căn thời điểm vào và thoát lệnh tốt trên thị trường.

Một số chỉ báo được sử dụng rộng rãi trong không gian giao dịch tiền điện tử bao gồm:

Đường trung bình động (MA) có ý nghĩa quan trọng trong việc xác định xu hướng, sự đảo chiều xu hướng cũng như các mức hỗ trợ và kháng cự tiềm năng. Các MA phổ biến nhất là đường trung bình động giản đơn (SMA) và đường trung bình động lũy thừa (EMA)

Chỉ báo dựa trên khối lượng giúp bạn phân tích mối quan hệ giữa biến động giá và khối lượng giao dịch để xác định cường độ của xu hướng. Ví dụ về các chỉ báo như vậy bao gồm chỉ báo OBM, chỉ số khối lượng tích cực (PVI), Chỉ số dòng tiền,

Dải Bollinger - nó giúp bạn xác định các giai đoạn biến động cao hay thấp và khả năng đảo chiều giá trên thị trường.

Chỉ số sức mạnh tương đối (RSI) giúp bạn xác định các điều kiện mua quá mức hoặc bán quá mức, cuối cùng cho thấy khả năng thị trường đảo chiều.

Các đường hồi quy Fibonacci giúp xác định các mức hỗ trợ và kháng cự tiềm năng mà giá có thể đảo chiều hoặc tích luỹ.

Chỉ báo dao động ngẫu nhiên (Stochastic oscillator) là một chỉ báo động lượng giúp xác định khả năng đảo chiều xu hướng và các điều kiện mua/bán quá mức trên thị trường.

Unsplash

F. Backtest và cải thiện chiến lược giao dịch của bạn

Khi bạn đã phát triển một chiến lược giao dịch, bạn cần biết nó hoạt động tốt như thế nào trên thị trường và đó là lý do tại sao bạn cần 'backtesting'. Nó đòi hỏi phải phát lại hành động giá thị trường và ghi lại các giao dịch của bạn theo cách thủ công. Với công nghệ tiên tiến, bạn có thể sử dụng nhiều công cụ (tool) để kiểm tra lại các công cụ (instrument) khác nhau trên thị trường.

Khi 'backtest', bạn có thể xác định một số lĩnh vực cần điều chỉnh để giúp chiến lược giao dịch của bạn tạo ra nhiều lợi nhuận hơn.

Học phân tích kỹ thuật và biểu đồ

Phân tích kỹ thuật khá cần thiết trong giao dịch tiền điện tử: nó giúp bạn xác định các mô hình và xác định xác suất biến động trong tương lai trên thị trường. Nói chung, sự hiểu biết sâu sắc về phân tích kỹ thuật có thể giúp bạn xác định các cơ hội giao dịch tiềm năng cao trên biểu đồ bằng bất kỳ khung thời gian nào.

Bạn nên học và hiểu chính xác điều gì về phân tích kỹ thuật? Dưới đây là năm khía cạnh chính cần tập trung vào:

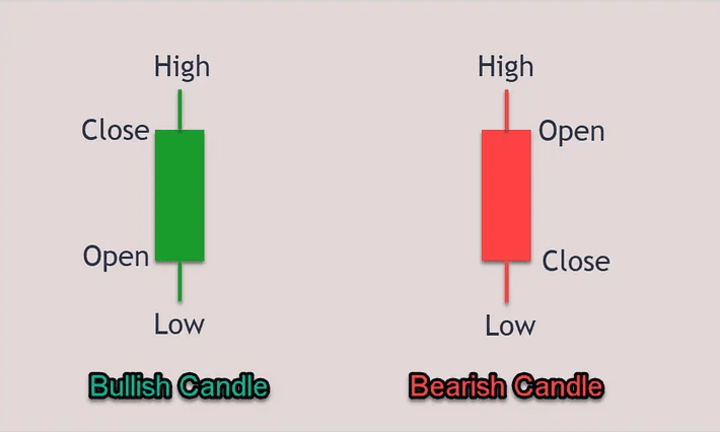

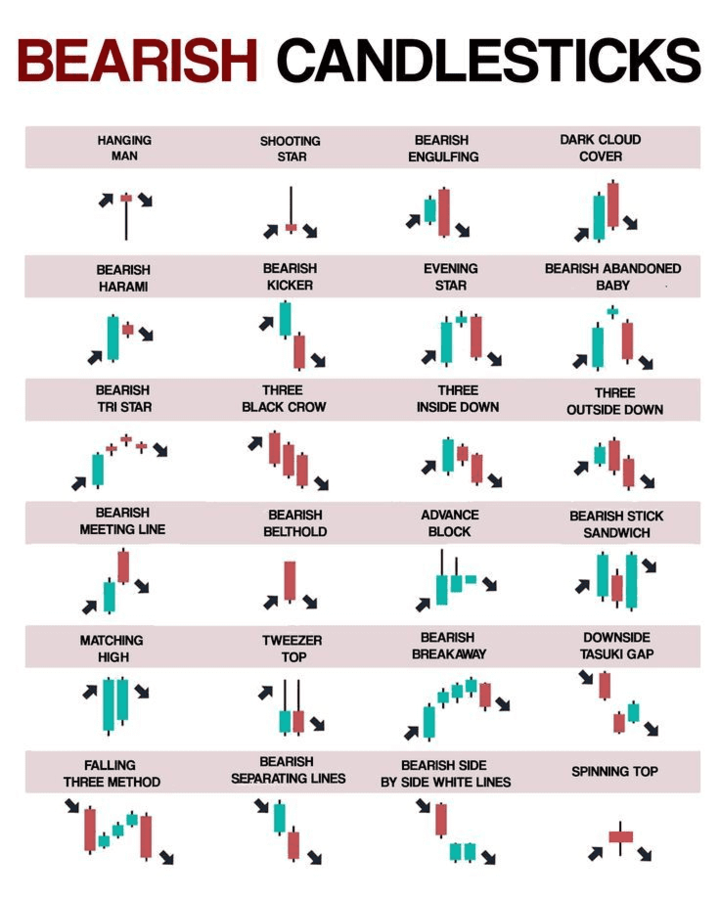

A. Nhận biết các mẫu biểu đồ nến khác nhau

Các mẫu biểu đồ nến khá quan trọng trong phân tích kỹ thuật. Bạn đang thắc mắc nó là gì? Hãy bắt đầu bằng việc mô tả một nến để hiểu tốt và rõ ràng hơn. Đó là một thanh hiển thị thông tin về biến động giá của tài sản. Theo thời gian, nến hình thành các mô hình trong một khung thời gian nhất định. Thông thường, theo mặc định, nến sáng (xanh hoặc trắng) đại diện cho người mua (xu hướng tăng) và nến tối (đỏ hoặc đen) đại diện cho người bán (xu hướng giảm) trên thị trường. Bạn phải hiểu rằng mỗi ngọn nến mang đến một câu chuyện. Vì lý do này, việc biết cách đọc biểu đồ nến là vô cùng quan trọng.

Nguồn: InsiderFinance Wire

Giờ đây, bạn có thể xác định mô hình nến là một công cụ phân tích kỹ thuật hiển thị các biểu đồ thể hiện biến động giá trên thị trường như được trình bày trên biểu đồ nến. Có ba loại mô hình nến:

● Mô hình nến giảm giá

Mô hình này hình thành sau một xu hướng tăng trong đó giá đóng cửa thấp hơn giá mở cửa. Chúng cho thấy một điểm kháng cự và có khả năng giảm giá cao, do đó báo hiệu điểm vào lệnh cho người bán trên thị trường.

Ví dụ về các mô hình nến giảm giá phổ biến bao gồm:

Người treo cổ (Hanging man) - nó có hình dạng tương tự như chiếc búa theo sau và hình thành ở cuối xu hướng tăng. Nó cho thấy phe bò (người mua) đang mất quyền kiểm soát và người bán đang tham gia thị trường.

Ngôi sao băng (Shooting star) – bạn có thể nhận biết nó bằng hình dạng của một chiếc búa ngược được thể hiện bằng bấc trên dài và thân dưới nhỏ. Nó cho thấy tiềm năng đảo chiều xu hướng tăng.

Đám mây đen che phủ (Dark cloud cover) – nó được biểu thị bằng hai chân nến, tức là một nến đỏ mở phía trên nến xanh trước đó và đóng dưới điểm giữa của nó. Nó chỉ ra một mô hình đảo chiều giảm giá ở cuối xu hướng tăng.

Ba con quạ đen (Three black crows) – Mô hình này bao gồm nhiều (thường là ba) cây nến đỏ dài liên tiếp có bấc ngắn. Nó báo hiệu sự bắt đầu của một xu hướng giảm.

Ngôi sao buổi tối (Evening star) – đó là mô hình ba cây nến được biểu thị bằng một cây nến ngắn nằm giữa các thân nến dài màu xanh lá cây và đỏ. Nó cho thấy khả năng đảo chiều từ xu hướng tăng sang xu hướng giảm.

Biểu đồ mô hình nến giảm giá (Nguồn: Trading SeeNa)

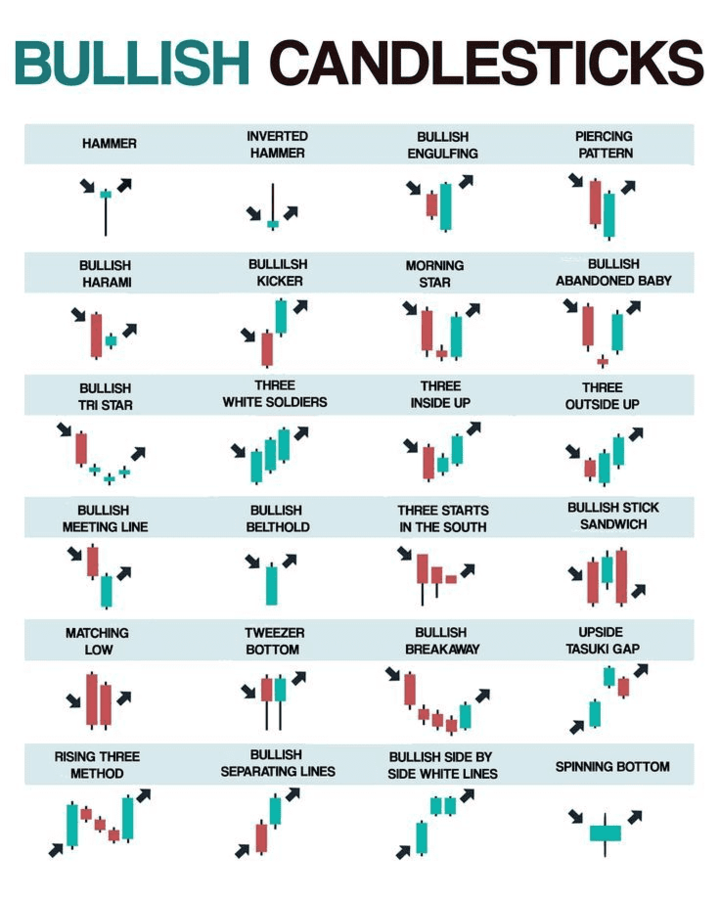

● Mô hình nến tăng giá

. Loại mô hình nến này hình thành sau một xu hướng giảm, theo đó giá đóng cửa cao hơn giá mở cửa. Chúng báo hiệu sự đảo chiều giá lên phía trên; do đó, người mua nên xem xét mở các vị thế mua.

Ví dụ về các mô hình nến tăng phổ biến bao gồm:

Búa (Hammer) - nó được biểu thị bằng một cây nến có thân ngắn với bấc dài phía dưới, thường ở dưới cùng của một xu hướng giảm. Nó báo hiệu một xu hướng tăng mạnh sắp bắt đầu.

Búa ngược (Inverse hammer) – nó được thể hiện bằng một chiếc búa ngược (bấc trên dài và thân ngắn). Nó cho thấy người mua sắp nắm quyền kiểm soát thị trường.

Nhấn chìm tăng (Bullish engulfing) – đó là mô hình hai cây nến được biểu thị bằng một thân ngắn màu đỏ bị nhấn chìm hoàn toàn bởi một cây nến lớn màu xanh lá cây.

Ba người lính trắng (Three white soldiers) - nó đối lập hoàn toàn với ba con quạ đen được nêu ở trên.

Biểu đồ mô hình nến tăng giá (Nguồn: Trading SeeNa)

● Mô hình nến tiếp diễn

Loại mô hình nến này cho thấy không có sự thay đổi về hướng/xu hướng thị trường. Mô hình này thường hình thành khi giá thị trường trung lập hoặc thiếu quyết đoán. Loại mô hình nến đặc biệt này giúp bạn lọc nhiễu trên biểu đồ và tập trung vào hướng thị trường phổ biến.

Ví dụ về các mô hình nến tiếp diễn phổ biến bao gồm:

Doji – nó được biểu thị bằng một thanh nến giống như dấu cộng hoặc dấu chéo. Nó cho thấy một cuộc đấu tranh giữa người mua và người bán; do đó, giá kết thúc tại cùng một điểm mà nó đã mở.

Giảm giá ba bước (Falling three methods) / tăng giá ba bước (rising three methods) – mô hình này bao gồm một cây nến có thân lớn theo sau là ba cây nến có thân nhỏ hơn theo hướng ngược lại và một cây nến lớn khác.

Đường phân tách (Separating lines) – mô hình này được hình thành bởi hai nến đối diện, theo đó nến đầu tiên là nến dài ngược với xu hướng thịnh hành và nến thứ hai khớp với xu hướng và mở với một khoảng trống hoặc ở cùng mức với giá đóng cửa trước đó.

Freepik

B. Hiểu các chỉ báo kỹ thuật

Các chỉ báo kỹ thuật là một bộ công cụ khác trong phân tích kỹ thuật và nhà giao dịch cần hiểu cách chúng hoạt động. Chúng là các phép tính toán học dựa trên hoạt động về khối lượng hoặc giá cả trong quá khứ và hiện tại của các công cụ giao dịch. Có bốn loại chỉ báo, là chỉ báo xu hướng, động lượng, hỗ trợ/kháng cự và biến động.

Mục đích của việc sử dụng các chỉ báo kỹ thuật trong giao dịch tiền điện tử là gì?

Như đã nêu trước đó, các chỉ báo kỹ thuật giúp nhà giao dịch nhìn thấy các xu hướng trong quá khứ và dự đoán những biến động trong tương lai trên thị trường. Nhưng có nhiều lợi ích hơn khi sử dụng các chỉ báo kỹ thuật. Chúng bao gồm:

● Giúp xác định các điểm vào và thoát giao dịch có xác suất cao.

● Giúp nhà giao dịch đưa ra quyết định sáng suốt hơn (ở một mức độ nào đó, nó thậm chí còn giúp lọc ra cảm xúc trong các quyết định giao dịch của bạn).

● Cho phép bạn cải thiện chiến lược giao dịch tổng thể của mình.

Cách sử dụng các chỉ báo kỹ thuật sao cho đúng

Có hàng trăm chỉ báo kỹ thuật, nhưng bạn không cần tất cả chúng: bạn cần sử dụng các chỉ báo một cách có mục đích. Thông thường, quá tải chỉ báo có thể gây hại nhiều hơn lợi bằng cách tạo ra sự nhầm lẫn trên biểu đồ của bạn.

Chọn chỉ báo lý tưởng liên quan đến việc hiểu các chỉ báo cụ thể hoạt động như thế nào trong các điều kiện thị trường khác nhau.

Tóm lại, bạn nên trả lời các câu hỏi sau khi chọn một chỉ báo:

A. Bạn muốn sử dụng chỉ báo để làm gì?

B. Bạn có hiểu cách hoạt động của chỉ báo cụ thể đó không?

C. Bạn nên sử dụng thiết lập nào?

D. Khi nào chỉ báo bị lỗi?

Ví dụ về các chỉ báo phổ biến

Dưới đây là ví dụ về các chỉ báo phổ biến dựa trên 4 loại chỉ báo khác nhau:

1. Chỉ báo xu hướng

Các chỉ báo này hoạt động tốt nhất trong thị trường có xu hướng. Chúng được sử dụng để xác định hướng của một xu hướng và cho biết liệu xu hướng đó có còn tồn tại hay không. Chúng bao gồm Đường trung bình động (MA), chỉ báo hướng trung bình (ADX) và Ichimoku Kinko Hyo.

2. Chỉ báo động lượng

Chúng rất cần thiết trong việc xác định sức mạnh của xu hướng và xác định sự đảo chiều xu hướng. Chúng bao gồm chỉ báo Stochastic Oscillator, MACD và RSI.

3. Chỉ báo biến động

Chỉ báo khối lượng cho biết mức độ thay đổi của một tài sản trong một khoảng thời gian nhất định. Chúng bao gồm Dải Bollinger, độ lệch chuẩn và chỉ báo ATR.

4. Các chỉ báo hỗ trợ và kháng cự

Chúng giúp xác định rào cản giá của một tài sản ở các mức nhất định theo một hướng nhất định. Chúng bao gồm Fibonacci, Wolfe Waves, Camarilla Pivots và Murrey Math Lines.

C. Xác định xu hướng và đảo chiều xu hướng.

Xu hướng là một khía cạnh cốt lõi của phân tích kỹ thuật. Xu hướng là hướng chung (lên, đi ngang hoặc đi xuống) của thị trường trong một khoảng thời gian nhất định. Bạn có thể đã từng nghe các nhà giao dịch chuyên nghiệp và có lợi nhuận tuyên bố: “Di chuyển theo xu hướng và không đi ngược lại xu hướng”. Không phải nhầm lẫn đâu: họ hiểu rằng đi theo xu hướng cho đến khi dữ liệu cho thấy xu hướng đảo chiều là một cách để kiếm lợi nhuận.

Làm thế nào để bạn xác định một xu hướng?

Có nhiều cách khác nhau để xác định một xu hướng. Chúng bao gồm:

Kết nối một loạt các mức cao hoặc thấp - Ví dụ: các đỉnh cao và đáy cao liên tiếp gợi ý một xu hướng tăng, trong khi các đỉnh thấp và đáy thấp gợi ý một xu hướng giảm

Vẽ đường xu hướng - đảm bảo bạn có ít nhất hai điểm kết nối và điểm tiếp xúc thứ ba là đường xu hướng hợp lệ.

Sử dụng các chỉ báo kỹ thuật (như đã nêu ở trên)

Lợi ích của việc xác định xu hướng là gì?

● Nó giúp ước tính quỹ đạo giá trong tương lai của tiền điện tử

● Nó cho bạn ý tưởng về nơi có thể xảy ra sự đảo chiều xu hướng

● Nó cho phép bạn giao dịch theo hướng của xu hướng, giúp tối đa hóa cơ hội chiến thắng trong giao dịch.

● Nó giúp bạn vẽ các mức hỗ trợ và kháng cự với độ chính xác cao hơn.

Đảo chiều xu hướng là gì và làm thế nào để bạn xác định được nó?

Đảo chiều xu hướng là khi giá của một loại tiền điện tử thay đổi hướng. Nói chung, nó đánh dấu sự kết thúc của một xu hướng hiện tại và bắt đầu một xu hướng mới.

Điều quan trọng là phải phân biệt giữa đảo chiều và hồi quy. Đảo chiều là biến động giá trong thời gian dài và có nhiều khả năng xảy ra bất cứ lúc nào. Ngược lại, sự hồi quy là ngắn hạn và có xu hướng xảy ra sau những biến động lớn về giá theo hướng (những thay đổi nhỏ như pullback).

Unsplash

Có nhiều cách khác nhau để xác định sự đảo chiều xu hướng. Chúng bao gồm:

Sử dụng đường xu hướng – thông thường, các điểm tiếp xúc của đường xu hướng đóng vai trò là mức hỗ trợ và kháng cự. Nếu giá phá vỡ đường xu hướng và bắt đầu di chuyển theo hướng ngược lại, điều đó cho thấy xu hướng đảo chiều. Tuy nhiên, việc kết hợp các đường xu hướng với các công cụ kỹ thuật khác là điều quan trọng để xác nhận sự đảo chiều và tránh các đột phá giả.

Sử dụng các chỉ báo kỹ thuật – các chỉ báo kỹ thuật như MA, MACD, Parabolic, Stochastic và Ichomoka có thể giúp bạn phát hiện xu hướng đảo chiều

Sử dụng các mô hình giá – bạn sử dụng các mô hình nhất định để xác định sự đảo chiều xu hướng. Tuy nhiên, bạn cần kiên nhẫn để hình thành hoàn toàn mô hình. Ví dụ về các mô hình đảo chiều điển hình bao gồm:

1. 2 đỉnh/ 2 đáy

2. 3 đỉnh/3 đáy

3. Vai đầu vai/ vai đầu vai ngược

4. Cái nêm

5. Mô hình đảo chiều chữ V

6. Mô hình nến nhấn chìm

7. Mô hình nến pin bar

D. Sử dụng các mức hỗ trợ và kháng cự

Bạn có thắc mắc tại sao mức hỗ trợ và kháng cự lại quan trọng đến vậy trong phân tích kỹ thuật? Đây là những mức giá mà bạn có nhiều khả năng gặp nhiều áp lực mua và bán trong một khung thời gian nhất định.

Mức hỗ trợ là gì? Nó được định nghĩa là mức giá thấp hơn giá thị trường hiện tại và thể hiện sự quan tâm/áp lực mua. Nó thường là các đáy dao động trước đó.

Mức kháng cự là gì? Đó là mức giá cao hơn giá thị trường hiện tại và gợi ý sự quan tâm/áp lực bán. Nó thường là các đỉnh dao động trước đó.

Tại sao mức hỗ trợ và kháng cự lại quan trọng trong phân tích kỹ thuật?

Bạn có thể sử dụng các mức này để lập kế hoạch cho các điểm vào và thoát lệnh của mình trên thị trường. Chẳng hạn, các nhà giao dịch mua ở mức hỗ trợ và chốt lãi ở mức kháng cự hoặc bán ở mức kháng cự và chốt lãi ở mức hỗ trợ.

Chúng cũng là những điểm quan trọng khi xác định tâm lý thị trường và cung cầu.

Làm thế nào để bạn tìm thấy mức hỗ trợ và kháng cự?

Dưới đây là những cách phổ biến để tìm mức hỗ trợ và kháng cự trên thị trường:

Sử dụng đường xu hướng - bạn có thể vẽ đường xu hướng từ một điểm thấp nối các đáy cao khác để tìm các mức hỗ trợ trong một xu hướng tăng. Đối với xu hướng giảm, bạn có thể vẽ đường xu hướng từ một điểm cao nối các đỉnh thấp hơn khác để tìm mức kháng cự.

Sử dụng các chỉ báo kỹ thuật – Các chỉ báo Fibonacci và Pivot Points có thể giúp bạn xác định các mức hỗ trợ và kháng cự trên thị trường.

Xác định đỉnh và đáy trên biểu đồ của bạn – đỉnh cao hơn và đỉnh thấp hơn đóng vai trò là mức kháng cự, trong khi đáy thấp hơn và đáy cao hơn đóng vai trò là mức hỗ trợ.

Pexels

Thành thạo việc quản lý rủi ro và tiền bạc

Bạn nên thừa nhận rằng giao dịch liên quan đến rủi ro; do đó, các khoản lỗ nên được định giá ngang với lợi nhuận/thu nhập. Nói chung, điều đó có nghĩa là thua lỗ là nội tại trong giao dịch và bạn nên chấp nhận chúng để trở thành một nhà giao dịch thành công.

Tuy nhiên, bạn cần đảm bảo rằng bạn có thể kiểm soát mức độ rủi ro hoặc thua lỗ của mình. Điều đó chỉ có thể thực hiện được thông qua quản lý rủi ro và tiền phù hợp. Nó được coi là nền tảng của sự thành công trong giao dịch. Đáng ngạc nhiên, đây là một trong những kỹ năng quan trọng nhất trong giao dịch nhưng lại bị bỏ qua nhiều nhất.

Tại sao quản lý tiền và rủi ro lại quan trọng trong giao dịch?

Nó giúp bạn bảo vệ vốn của mình khỏi những khoản lỗ đáng kể: bạn khó có thể thổi bay tài khoản của mình. Nó cũng cho phép bạn tối đa hóa lợi nhuận trong khi giảm thiểu tổn thất. Cuối cùng, với việc quản lý rủi ro hợp lý, tâm lý của nhà giao dịch có xu hướng ở trạng thái tốt hơn để giảm thiểu nỗi sợ hãi và lòng tham của họ trên thị trường.

Kỹ thuật quản lý tiền và rủi ro hiệu quả

A. Chỉ mạo hiểm những gì bạn có khả năng để mất

Mạo hiểm những gì bạn có thể để mất đảm bảo rằng bạn không ảnh hưởng đến sự ổn định tài chính của mình. Ngoài ra, bạn có nhiều khả năng tập trung vào các mục tiêu giao dịch dài hạn của mình hơn.

B. Thực hiện theo nguyên tắc vàng của quản lý rủi ro

Thông thường, quy tắc ngón tay cái trong giao dịch là mạo hiểm 1-2% vốn tài khoản của bạn trong một giao dịch. Với quy tắc vàng này, bạn có nhiều khả năng duy trì hoạt động ngay cả sau khi thua các giao dịch liên tiếp. Trên hết, hãy đảm bảo bạn duy trì tỷ lệ rủi ro trên lợi nhuận dương.

Giả sử mức độ chấp nhận rủi ro của bạn cao hơn; bạn có thể mạo hiểm nhiều hơn. Tuy nhiên, hãy sẵn sàng chấp nhận kết quả của những tổn thất đáng kể giống như bạn chấp nhận lợi nhuận cao.

C. Đặt mục tiêu cắt lỗ và chốt lãi

Đặt mức cắt lỗ ở mức tối ưu được xác định trước sẽ giúp hạn chế tổn thất trước khi chúng leo thang nếu giao dịch đi ngược lại với bạn. Tương tự, chốt lãi cho phép bạn tự động đóng giao dịch có lãi ở mức giá định trước nếu giao dịch diễn ra theo phân tích của bạn. Nói chung, việc đặt ra các mục tiêu này giúp loại bỏ sự tự tin thái quá khi giao dịch.

D. Hạn chế đòn bẩy và giao dịch ký quỹ

Mặc dù ký quỹ làm tăng sức mua của bạn, cho phép bạn mở một vị thế lớn hơn (cuối cùng là tăng lợi nhuận của bạn) trên thị trường, nhưng nó cũng khuếch đại khoản lỗ của bạn khi phân tích của bạn sai. Để giảm thiểu mức độ thua lỗ của bạn, hãy cân nhắc việc hạn chế đòn bẩy bạn sử dụng.

E. Đa dạng hóa

Bạn nên đa dạng hóa danh mục đầu tư của mình trên nhiều loại tiền điện tử. Do đó, khi một loại tiền điện tử bị lỗ, một loại tiền điện tử khác có thể thu được lợi nhuận, do đó sẽ bù đắp cho khoản lỗ. Cân nhắc chọn tiền điện tử có mối tương quan thấp để có kết quả tốt hơn và giảm rủi ro.

Phát triển kỷ luật với tư cách là một nhà giao dịch tiền điện tử

Kỷ luật cũng là một phần cơ bản của giao dịch. Bạn có thể có kỹ năng phân tích kỹ thuật đáng kinh ngạc, quy tắc quản lý rủi ro phù hợp và số vốn lớn, nhưng nếu thiếu kỷ luật, về lâu dài bạn vẫn không có lãi. Để trở thành một nhà giao dịch thành công, bạn cần nắm vững kỷ luật của mình.

Làm thế nào bạn có thể phát triển kỷ luật như một nhà giao dịch? Dưới đây là một số mẹo giúp bạn thành thạo và duy trì kỷ luật với tư cách là một nhà giao dịch:

A. Xây dựng một kế hoạch giao dịch và bám sát nó

Có một kế hoạch giao dịch sẽ xây dựng nền tảng để bạn trở thành một nhà giao dịch có kỷ luật. Với kế hoạch giao dịch, bạn có các nguyên tắc/quy tắc phác thảo các cơ hội giao dịch cụ thể mà bạn sẽ tìm kiếm, cách bạn thực hiện giao dịch, rủi ro được xác định và cách bạn thoát giao dịch. Do đó, bạn ít có khả năng thực hiện giao dịch bốc đồng.

B. Ghi lại các giao dịch của bạn và học hỏi từ những sai lầm

Bằng cách ghi nhật ký các giao dịch của mình, bạn có thể dễ dàng xác định các mẫu trong hành vi giao dịch của mình. Do đó, bạn có thể dễ dàng suy nghĩ về những sai lầm giao dịch của mình và điều chỉnh.

C. Kiểm soát cảm xúc bằng cách tự động hóa các quy trình

Tự động hóa các chiến lược giao dịch của bạn là một cách để loại bỏ cảm xúc trong giao dịch tiền điện tử. Nó còn được gọi là giao dịch thuật toán. Với công nghệ tiên tiến ngày nay, bạn có thể dễ dàng tìm thấy các chương trình/phần mềm giúp bạn trong quá trình này: không cần kỹ năng viết mã. Chương trình có thể xác định một cơ hội giao dịch đáp ứng các tiêu chí của bạn, nó thực hiện giao dịch mà không do dự.

D. "Đừng kết hôn với giao dịch của bạn."

Nếu phân tích giao dịch của bạn sai và thị trường đang di chuyển theo hướng bất lợi cho bạn và bạn không đặt lệnh cắt lỗ đúng, đừng giữ giao dịch quá lâu với hy vọng nó sẽ đảo chiều có lợi cho bạn. Tương tự, nếu giao dịch của bạn đã có lợi nhuận lớn và tỷ lệ rủi ro trên lợi nhuận của bạn được đáp ứng, đừng giữ cùng một giao dịch lâu và hy vọng nó sẽ tiếp tục có xu hướng theo cùng một hướng.

E. Tránh giao dịch phục thù

Thực tế là không ai miễn nhiễm với thua lỗ trong giao dịch. Do đó, tránh giao dịch phục thù vì nó có thể khiến bạn đưa ra quyết định phi lý với hy vọng thu hồi khoản lỗ của mình. Trong hầu hết các trường hợp, bạn có thể sẽ mất nhiều hơn.

Pexels

Xác định cơ hội giao dịch

Nếu bạn có kế hoạch giao dịch và thành thạo phân tích kỹ thuật, việc xác định các cơ hội giao dịch trên thị trường CFD tiền điện tử sẽ không còn là vấn đề khó khăn. Điều đó có nghĩa là bạn đã biết loại tiền điện tử mà bạn sẽ giao dịch và có thể nằm trong danh sách theo dõi của bạn.

Vì các nhà giao dịch tìm kiếm những thứ khác nhau trên biểu đồ để tham gia giao dịch nên không có cách cụ thể nào để xác định các cơ hội giao dịch. Những gì hiệu quả với người khác có thể không hiệu quả với bạn. Tuy nhiên, có nhiều cách khác nhau mà hầu hết các nhà giao dịch sử dụng để phát hiện các cơ hội giao dịch trên thị trường dựa trên các chiến lược và phong cách giao dịch khác nhau. Chúng bao gồm:

A. Tìm kiếm một đột phá của các mức quan trọng

Bạn có thể tìm thấy những cơ hội giao dịch tuyệt vời khi xảy ra đột phá trên thị trường. Để phát hiện cơ hội giao dịch, bạn có thể sử dụng những cách sau:

Đường xu hướng - vẽ đường xu hướng trên biểu đồ có thể giúp bạn nhìn thấy những đột phá có thể xảy ra. Giá có thể đột phá khỏi đường xu hướng và tiếp tục xu hướng đó. Ngoài ra, giá có thể đột phá khỏi đường xu hướng và sau đó đảo chiều.

Các kênh - vẽ kênh có thể giúp bạn phát hiện các cơ hội đột phá theo một trong hai hướng của xu hướng.

Tam giác - giá thị trường có xu hướng hình thành mô hình tam giác khi nó củng cố trước khi xảy ra đột phá. Nó có thể là tam giác tăng, tam giác giảm hoặc tam giác cân.

Các mẫu biểu đồ - các mẫu biểu đồ như 2 đỉnh/ 2 đáy và vai đầu vai biểu thị các đột phá đảo chiều.

B. Phát hiện các mẫu biểu đồ cho biết xu hướng

Ngoài các mẫu biểu đồ được nêu ở trên, nhà giao dịch còn sử dụng các mẫu khác để phát hiện các cơ hội giao dịch trên thị trường. Những ví dụ bao gồm

● Mô hình nhấn chìm

● Mô hình chữ nhật

● Mô hình Doji star

● Mô hình búa và búa ngược

● Mô hình cái nêm tăng và giảm

C. Theo dõi tin tức và tâm trạng xã hội

Cập nhật tin tức mới nhất về ngành tiền điện tử và các bài đăng trên mạng xã hội liên quan đến không gian tiền điện tử có thể giúp bạn xác định các cơ hội giao dịch. Mặc dù có một cách cụ thể để đánh giá cảm xúc, nhưng bạn có thể sử dụng một số thứ nhất định trên mạng xã hội để đo lường tâm trạng thị trường. Chúng bao gồm phân tích cộng đồng, funding rate và chỉ số cảm tính. Với tâm lý thị trường tiền điện tử, bạn có thể dự đoán động lực trong tương lai của tiền điện tử.

Các tin tức chính liên quan đến tiền điện tử từ các nền tảng đáng tin cậy có xu hướng tác động tiêu cực hoặc tích cực đến giá tiền điện tử. Nhờ đó, bạn có thể dễ dàng xác định các cơ hội giao dịch ngắn hạn.

Thực hiện giao dịch hiệu quả

Khả năng thực hiện giao dịch theo kế hoạch giao dịch của bạn là khá cần thiết trên thị trường. Việc thực hiện của bạn quyết định loại kết quả mà bạn nhận được. Dựa trên phân tích, bạn có thể tham gia và thoát giao dịch tốt như thế nào ở mức giá thời điểm tối ưu? Bạn có thể thực hiện giao dịch nhanh và chính xác đến mức nào? Bạn có thể thực hiện các giao dịch mà không sợ hãi hay tham lam không? Thực hiện giao dịch đúng cách xoay quanh những câu hỏi này.

Tại sao việc thực hiện giao dịch phù hợp lại quan trọng trong giao dịch của bạn?

Việc thực hiện đúng trong giao dịch có thể tạo ra sự khác biệt giữa việc có lãi hay thua lỗ một cách nhất quán. Ngoài ra, nó giúp bạn tham gia thị trường với mức giá tốt nhất có thể, nơi bạn có thể tối đa hóa lợi nhuận của mình. Trên hết, nó cho phép bạn thực hiện các giao dịch với sự kiểm soát và bình tĩnh mà không bị ảnh hưởng bởi cảm xúc và ý kiến.

Dưới đây là các mẹo có thể giúp bạn thực hiện giao dịch hiệu quả hơn trong giao dịch tiền điện tử:

A. Chuẩn bị và thực hành

Trước khi tham gia thị trường, bạn cần thực hành các kỹ năng khớp lệnh của mình trước khi mở các giao dịch trực tiếp. Nó có thể được thực hiện trên một tài khoản demo miễn phí. Ngoài ra, bạn có thể sử dụng các công cụ backtesting hoặc phát lại tương tự. Thực hành giúp bạn xây dựng sự tự tin và tính nhất quán trong thực hiện giao dịch.

Một khía cạnh quan trọng khác là chuẩn bị cho môi trường giao dịch của bạn và bản thân bạn. Tâm trí, vị trí, công cụ giao dịch và tốc độ internet của bạn phải được thiết lập tốt trước khi tham gia thị trường. Hãy nhớ rằng, sự chuẩn bị là một nửa trận chiến!

B. Chọn nền tảng và công cụ giao dịch phù hợp

Hãy xem xét các nền tảng và công cụ giao dịch phù hợp với phong cách, mục tiêu và chiến lược giao dịch của bạn. Đây là nơi các yếu tố như phí đăng ký, tính năng, chức năng, tính dễ sử dụng, bảo mật và độ tin cậy đóng vai trò quan trọng.

C. Sử dụng lệnh thị trường và lệnh giới hạn

Lệnh thị trường là một trong những công cụ quan trọng bạn cần để thực hiện giao dịch của mình một cách hiệu quả. Sử dụng lệnh thị trường khi bạn muốn thực hiện giao dịch nhanh ở mức giá hiện tại. Lệnh giới hạn là cách tốt nhất để thực hiện giao dịch ở một mức giá cụ thể: chỉ cần đặt lệnh và lệnh sẽ được kích hoạt sau khi đạt đến mức đó.

D. Tự động hóa một phần chiến lược của bạn

Có rất nhiều chương trình máy tính (hệ thống giao dịch) có thể tùy chỉnh mà bạn có thể sử dụng để nâng cao quá trình thực hiện giao dịch của mình, bao gồm thực hiện giao dịch ở mức giá tốt nhất có thể. Quan trọng hơn, có rất ít sai sót, đặc biệt là những sai sót có thể do các yếu tố tâm lý và cảm xúc của con người. Bạn chỉ cần thiết lập các tham số định trước dựa trên chiến lược giao dịch của mình và chương trình sẽ xử lý phần còn lại.

Học hỏi và cải thiện liên tục

Cam kết học hỏi liên tục và sẵn sàng cải thiện là một đặc điểm bắt buộc nếu bạn mong muốn trở thành một nhà giao dịch thành công theo thời gian. Khi tham gia vào ngành này, bạn phải chấp nhận thực tế rằng giao dịch tiền điện tử không phải là sự kiện diễn ra một lần. Thị trường tiền điện tử không ngừng phát triển, các xu hướng mới đang nổi lên và chiến lược của bạn có thể ngừng mang lại cho bạn kết quả tương tự khi điều kiện thị trường thay đổi. Vì lý do này, bạn phải không ngừng học hỏi và thích nghi một cách thích hợp: trở thành người học hỏi trên thị trường.

Lời khuyên cho việc học tập và cải thiện liên tục

A. Đọc sách và blog về giao dịch tiền điện tử

Bạn có thể dễ dàng nâng cao kiến thức giao dịch của mình và duy trì động lực bằng cách đọc sách và blog về tiền điện tử. Kết quả là, nó nâng cao khả năng ra quyết định của bạn trên thị trường. Ngoài ra, bạn có thể tìm hiểu các kỹ thuật giúp cải thiện các phần trong chiến lược giao dịch của mình. Đọc blog về các chủ đề khác nhau về tiền điện tử như tin tức về tiền điện tử, phân tích kỹ thuật, chiến lược giao dịch và tâm lý giao dịch trên blog của VSTAR.

B. Xem xét các nghiên cứu điển hình của các nhà giao dịch có kinh nghiệm

Việc xem xét các nghiên cứu điển hình của các nhà giao dịch thành công và giàu kinh nghiệm khác có thể giúp bạn có được những quan điểm và bài học khác nhau có ý nghĩa quan trọng trong giao dịch và cuộc sống của bạn nói chung.

C. Chiến lược backtest sử dụng dữ liệu lịch sử

Backtesting là cách tốt nhất để đánh giá hiệu quả của một chiến lược và xác định các lĩnh vực cần cải thiện. Nó cũng giúp tạo ra những ý tưởng mới để bạn có thể tối ưu hóa các chiến lược giao dịch của mình.

D. Cập nhật những tin tức mới nhất về tiền điện tử và những tiến bộ công nghệ

Là một nhà giao dịch, bạn phải theo kịp những diễn biến và xu hướng tốt nhất của thị trường. Cách tốt nhất để làm điều đó là theo dõi các cập nhật về tin tức và tiến bộ công nghệ về tiền điện tử.

E. Tham gia vào các cộng đồng giao dịch trực tuyến

Kết nối với các nhà giao dịch khác trên phòng trò chuyện, nhóm truyền thông xã hội, diễn đàn và hội thảo có thể mang lại lợi ích cho bạn. Bạn có thể chia sẻ kinh nghiệm, hiểu biết và học hỏi từ những người khác. Bạn cũng có thể đặt câu hỏi và thảo luận về các ý tưởng hoặc chiến lược giao dịch.

Unsplash

Tổng kết

Giao dịch tiền điện tử đã được chứng minh là mang lại lợi nhuận cho hầu hết các cá nhân, nhưng nó cũng có cái giá phải trả. Nó đòi hỏi bạn phải đầu tư thời gian để thành thạo nghệ thuật này. Có phải hầu hết người mới bắt đầu đều có thể đạt đến trình độ tương tự không? Điều đó là có thể.

Để bắt đầu, bạn cần tạo một kế hoạch và chiến lược giao dịch được phác thảo rõ ràng phù hợp với mình. Hai điều này sẽ điều hướng cách bạn tiếp cận thị trường. Bạn cũng cần nắm vững các kỹ năng như phân tích kỹ thuật và xác định cơ hội giao dịch trên thị trường. Đây là những yếu tố quan trọng trong giao dịch tiền điện tử.

Bạn cũng phải là một nhà giao dịch có kỷ luật. Nếu không có kỷ luật, bạn khó có thể thành công trong giao dịch tiền điện tử vì bạn sẽ không tuân theo kế hoạch giao dịch của mình và có thể sẽ phá vỡ các quy tắc giao dịch của mình. Vì thị trường tiền điện tử đôi khi không ổn định nên bạn phải có một chiến lược quản lý tiền và rủi ro tốt. Nó giúp bạn giảm thiểu tổn thất.

Cuối cùng, bạn nên liên tục học hỏi từ nhiều nguồn khác nhau, chẳng hạn như sách giao dịch, blog và các nhà giao dịch dày dạn kinh nghiệm, để bổ sung kiến thức giao dịch của mình. Quan trọng hơn, hãy tiếp tục cải thiện kỹ năng và chiến lược giao dịch của bạn để duy trì lợi nhuận.