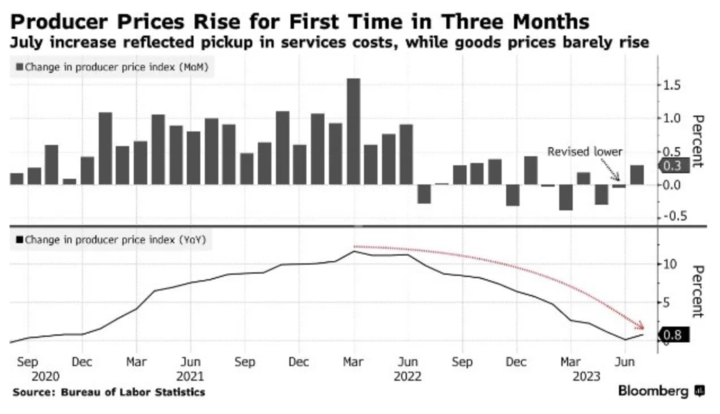

According to data released by the U.S. Department of Labor on August 11th, the year-on-year growth rate of the U.S. Producer Price Index (PPI) accelerated to 0.8% in July from 0.1% in the previous month, beating market expectations of 0.7%. The previous reading was revised from 0.1% to 0.2%. On a year-over-year basis, the PPI rose 0.3%, beating forecasts for a 0.2% increase, which was the largest gain since January 2023. And the previous reading was revised to 0 from 0.1%.

While the latest core consumer inflation data was released last Thursday, showing the smallest monthly increase in more than two years, which could lead to the Federal Reserve opting to maintain interest rates at its upcoming September meeting. However, the Producer Price Index (PPI) data released on Friday presented a different picture and appeared to show that U.S. inflation is resisting stronger than many had expected. Meanwhile, supply-side pressures have diminished in favor of lower inflation as global supply chains have recovered well over the past year. However the start of higher energy prices in late July should push up headline inflation from next month's release and pose upside inflation risks to the core index as energy factors feed through to energy-intensive sectors such as manufacturing and transportation services.

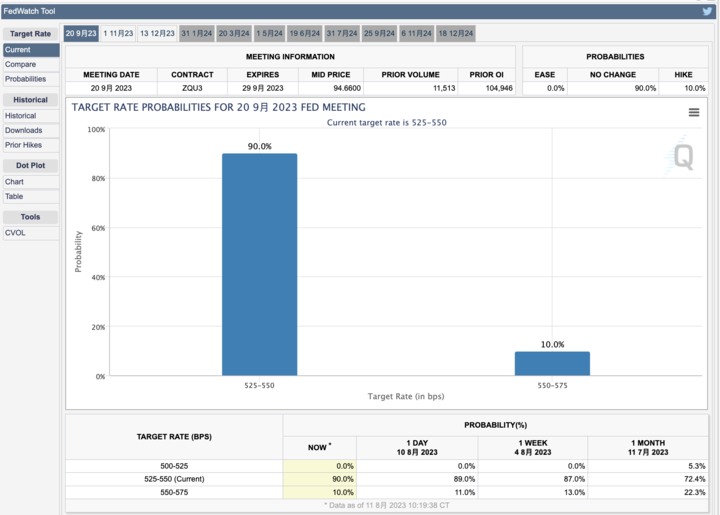

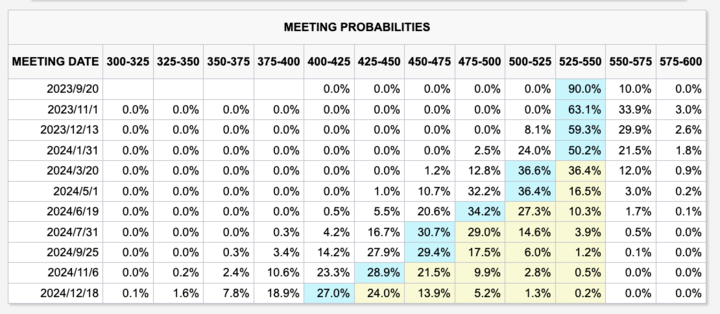

According to the CME FedWatch tool, the market is now pricing in a 90% chance that the Fed will leave rates unchanged in September, up slightly from previous data.

Chart: The Fed rate hike probability chart

Source: FED watch

And the probability of a 25 basis point rate hike by November is 33.9%, up from the previous figure.

Chart: The Fed rate hike probability chart

Source: FED watch

Side effects of interest rate hikes are already being felt

According to the Federal Reserve's data on the "Balance Sheet of Households and Nonprofit Institutions" as of the first quarter of 2023, about 94% of the data comes from households, while the share of nonprofits is lower. In the chart, we can see that the black line represents the net worth of Americans, or assets in green minus liabilities in red. As of the first quarter of this year, the net wealth of Americans was $149 trillion, which is slightly lower than the highs seen at the start of the rate hike (i.e., $153 trillion in the first quarter of 2022), but still significantly higher than the $111 trillion in the first quarter of 2020 at the start of the outbreak.

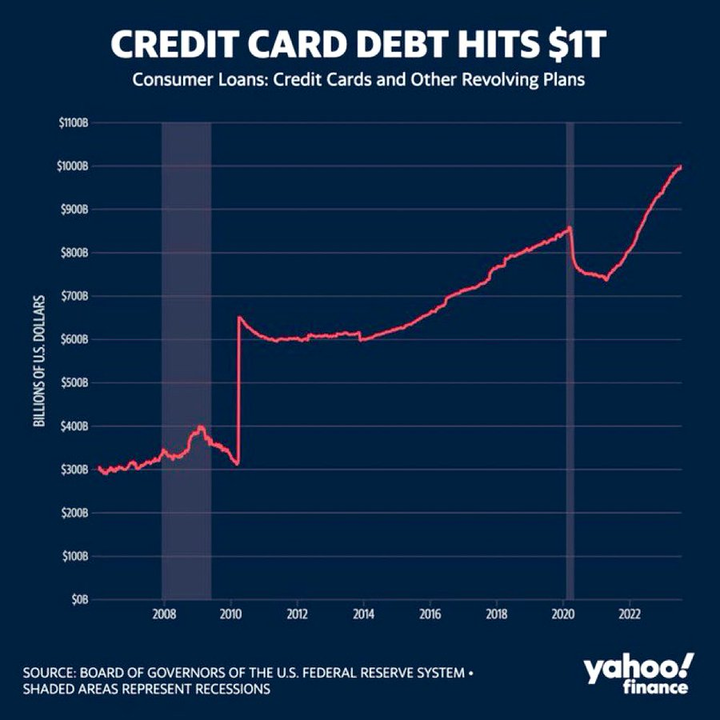

Between the start of the epidemic in 2020 and now, Americans have added $2.9 trillion to their debt, some of which comes from the cost of debt from the Fed's 11 interest rate hikes. Total credit card debt hit an all-time high of one trillion dollars.

Chart: Total U.S. credit card debt exceeds $1 trillion

Source: yahoofinance

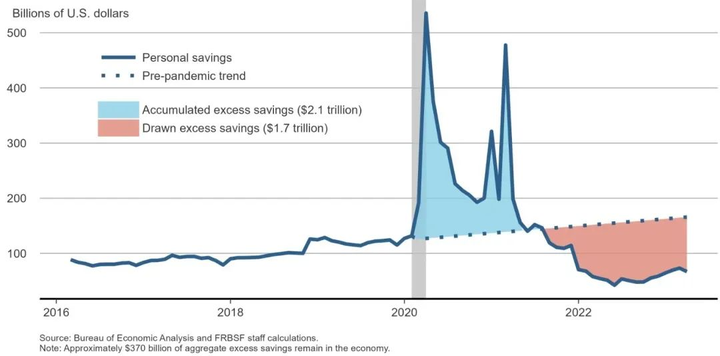

Another measure of household spending power, personal savings, is also shrinking. During the outbreak, government bailout funds were initially saved, and by August 2021, excess savings had accumulated to $2.1 trillion. Households then began to aggressively draw on these savings for consumption. Beginning in 2022, consumption averaged about $100 billion per month, corresponding to a spending boom and rising inflation in the United States. However, as of April of this year, the remaining excess savings had fallen to $370 billion. If U.S. households continue this spending momentum, the excess savings will be exhausted by August, which will likely show up in September's economic data. Since personal consumption contributes 70% of GDP, a slowdown in consumption growth will also slow the economy significantly in the second half of the year.

Figure: U.S. Personal Savings

Source: Bureau of Economic Analysis

Raise interest rates or reduce the money supply?

The Federal Reserve has a long history of regulating inflation through interest rate corridors. By raising the discount rate, raising the reserve requirement ratio, raising the excess reserve ratio, raising the overnight reverse repurchase rate, using open market operations to sell bonds, and then achieving the effect of "catching water." However, the side effects of interest rate hikes are also very obvious, the United States history of recession many times are caused by interest rate hikes.

Public common sense usually assumes that inflation is a monetary problem, which is a classic monetarist argument. It emphasizes the key role of money supply in influencing economic activity, inflation and economic stability. The central idea of this theory is that changes in the money supply directly affect the price level and overall economic activity. But why doesn't the Fed operate with the goal of regulating the money supply?

Monetarism holds that changes in the amount of money in the economy are the main cause of inflation and deflation. If the money supply grows too fast, it can lead to inflation, while insufficient growth in the money supply can lead to deflation. Monetarism tends to believe in the existence of a stable quantitative relationship between the money supply and the price level, known as the Quantity Theory of Money (QTM). According to this theory, if the money supply doubles, the price level will roughly double as well.

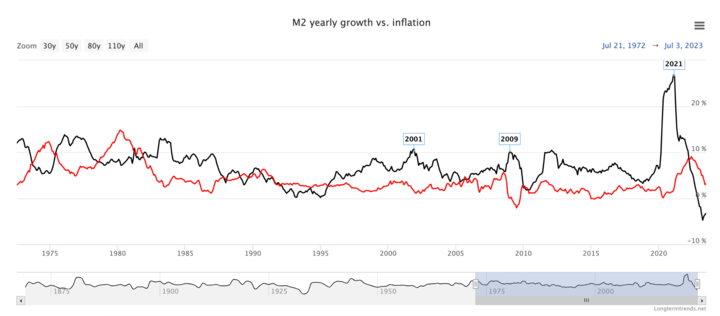

Monetarism received a great deal of attention in the mid-20th century, most notably from economist Milton Friedman. In practice, however, monetarism is highly controversial. The chart below shows the relationship between the annual rate of M2 growth and inflation in the U.S. It can be observed that moments of strong M2 growth do not necessarily lead to a rise in inflation, and more often than not the opposite trend (the current inflation, which started in 2020, is more due to supply-side inflation caused by the Russian-Ukrainian war and epidemics, and the synchronization of cash handouts by the government to the population, resulting in the synchronization of M2 and inflation).

Chart: US M2 annual growth rate (black line) vs. inflation (red line)

Source: longtermtrends

Paul Volcker is a well-known figure in the history of the Federal Reserve's success in fighting the Great Inflation, during his tenure in 1979-1982, the United States broke out in the history of the worst hyperinflation, the price index rose at an annual rate of 13%, Volcker by raising the discount rate (up to 12%), requiring banks to increase deposit reserves, to stop lending to speculative activities and other initiatives to fight inflation, the result is that the U. S. Three-month Treasury rate of more than 17%, commercial banks preferential lending rates up to 21.5%, the most responsive to the market mortgage rates of more than 18%, becoming the highest interest rates in the financial history of the United States at the moment. The Federal Reserve at that time did not set the inflation target as a clear value, but once set the money supply as the policy target, Volcker is also known as "practical monetarist". Federal Reserve in March 1980, with President Carter implemented the "credit control", stopped the car and home shopping loans to inhibit the growth of money supply, and led to a sharp decline in money supply, but the result is that inflation did not fall as expected, on the contrary, orders for manufactured goods in the decline, meaning that the recession is coming. Accordingly, a large number of Americans paid off their credit cards, which led directly to a sharp decline in bank deposits, and President Jimmy Carter received countless clipped credit cards from the public at the White House every day. As a last resort, credit controls were eased three months after they were imposed, and both the economy and the money supply began to recover strongly. This brief moment of recession was also recorded in the history books.

The Fed no longer focuses on the money supply

The Federal Reserve no longer regulates the money supply as its primary objective and means of influencing economic activity.

First, the monetary transmission mechanism is complex: the relationship between the money supply and inflation is not always simple and straightforward. The monetary transmission mechanism in an economy involves a variety of factors, including the velocity of money, credit market conditions, and asset price fluctuations. Thus, a simple adjustment of the money supply may not precisely control inflation.

Second, the multifactor effects of inflation. Inflation is usually influenced by a variety of factors, including supply and demand, cost-push and demand-pull, and does not depend solely on the money supply. Therefore, inflation may not be fully addressed by simply adjusting the money supply.

Again, long-term versus short-term effects: The effects of monetary policy usually take some time to feed through to real economic activity and the price level. Adjustments to the money supply may cause instability in the short run, and the effects may not be felt for some time.

At the same time, the goal of monetary policy is not only to control inflation, but also include real output, employment, and other aspects. As a result, the Federal Reserve typically prefers to use other tools, such as interest rate policy and quantitative easing, to achieve its economic stabilization and inflation objectives. These tools can more directly affect market interest rates, credit conditions, and financial markets.