Introduction

Despite the steep uptrend since the Fed's rate hike, the US Dollar Index has pulled back slightly with the pause in rate hikes. However, strong economic data that slowed the decline in sticky inflation also increased tightening expectations, prompting a rebound in long-term U.S. interest rates, and the resulting pullback in the Dollar Index has recently resumed an upward trend.

The U.S. Dollar Index is one of the indicators closely watched by economic and financial market analysts to reflect the dynamics of global currency markets. Regarding the history and impact of the US Dollar Index, Wikipedia and other online sources are less and not systematic. For this reason, Vivi has made a more detailed compilation of the birth of the US Dollar Index, its influencing factors and its impact, and hopes that this will be helpful to you.

US Dollar Index

The U.S. dollar accounts for a significant share of the global foreign exchange market and is often considered to be one of the world's most important foreign exchange currencies. According to the Bank for International Settlements (BIS), the U.S. dollar's share of the global foreign exchange market's average daily trading volume will be approximately 88% by 2021. This means that nearly 90% of foreign exchange transactions will involve the U.S. dollar on an almost daily basis.

The US Dollar Index (USDX) is essentially a measure of the relative strength of the US Dollar against a basket of other major international currencies, reflecting the trend of global capital flows out of and into the United States (US Dollar). Its method of calculation is based on the dollar's exchange rate against six major international currencies (the euro accounted for 57.6%, the yen 13.6%, the pound 11.9%, the Canadian dollar 9.1%, the Swedish krona 4.2%, the Swiss franc 3.6%), the weighted geometric mean calculation.

If the dollar index is greater than 100, it means that the dollar has appreciated in the international currency market, i.e. it is worth more relative to the basket of currencies at the base period.

It is common for people to confuse the US Dollar Index with the US Dollar Forex.

Different roles

The US Dollar Index is typically used for long-term trend analysis and international monetary policy. Unlike dollar forex, which is traded by multinational corporations, investors, traders, and even international travelers, where participants buy and sell dollars for international trade or speculative transactions involving the buying and selling of dollars for exchange rate differentials or currency conversions, the U.S. dollar index is primarily used to help analysts, investors, and policymakers understand the overall performance of the U.S. dollar in international trade and financial markets, to assess the relative strength or weakness of the dollar, and to determine the liquidity of the dollar.

Various forms

The U.S. dollar can be traded in a variety of forms, including currency pairs (such as EUR/USD, which indicates that the euro trades against the U.S. dollar), options, futures contracts, etc. in the forex market. While the Dollar Index is a numerical indicator, usually expressed as a percentage, that shows the relative change in the dollar against the base period, the Dollar Index is traded on the Intercontinental Exchange (ICE) in the U.S. The Intercontinental Exchange Dollar Index is traded 21 hours a day and can be traded on online forex platforms, CFDs and carry trade brokers. There are also a number of ETFs on the market that are long and short the US Dollar Index.

The birth of Bretton Woods and the fixed exchange rate system

The US Dollar Index was born in 1973 and its historical origins can be traced back to the collapse of the Bretton Woods system.

The Bretton Woods system was a monetary system established after World War II in which the U.S. dollar was pegged to gold and other international currencies were pegged to the U.S. dollar.

The reason for pegging the dollar to gold was that at the end of World War II, the United States was the only country in the world with a strong, stable economy. The rapid recovery and rise of the United States after the war, its largest industrial capacity and GDP relative to other countries, and the fact that the United States had the largest trade surplus in the world at the time, made the dollar a powerful attraction in the international economy.

The dollar remained relatively stable during the war compared to other countries involved in the war, and this stability allowed the dollar to be considered a reliable reserve currency after the war.

Thus, at the Bretton Woods Conference in 1944, delegates agreed to a new international monetary system in which the dollar would serve as the primary international reserve currency. This decision was based in part on the influence and power of the United States at the conference and its commitment to exchange the dollar for gold at $35 per ounce, a system that made the dollar's position in the international economy more secure because other countries could exchange the dollar for gold.

Under this system, the exchange rate for most of the world's currencies is fixed against the dollar, and the dollar can be converted into gold.

The Triffin Dilemma

However, the "Triffin Dilemma", first formulated by Belgian economist Robert Triffin in the 1960s, raised concerns about the Bretton Woods system and the status of the US dollar as an international reserve currency, and is credited with exposing the fatal flaws inherent in the Bretton Woods system.

The essence of the Triffin Dilemma is that when a country's currency is widely used as an international reserve currency, it must continue to provide that currency to other countries in order to meet the growth of world trade and reserve requirements. Under the Bretton Woods system, the U.S. dollar served as this international reserve currency.

Triffin points out that if the U.S. continues to meet global demand for dollars, it will have to continue to issue more dollars internationally, which could lead to inflation and a loss of dollar stability. On the other hand, if the U.S. takes steps to curb inflation and maintain dollar stability, then the world may face a shortage of dollar supply, leading to instability in the international financial system.

Simply put, with the expansion of world trade, all fixed exchange rate systems need to increase available reserves, in other words, increase the number of currencies that are accepted globally in order to meet the growing demand for trade, investment and financing. According to the established price system of the Bretton Woods system ($35 per ounce of gold), gold production in the future will not be sufficient to meet the demand, therefore, within the Bretton Woods system, the source of international liquidity to meet the needs of growth in the future can only be the U.S. dollar. And the only way to transfer dollars into the hands of other countries is through the U.S. balance of payments deficit.

The creators of the Bretton Woods system never imagined that the fixed exchange rate system, based on the U.S. trade surplus, would have to be supported by the U.S. trade deficit, which in turn would undermine confidence in the system.

This has become an intractable problem.

The G7 and the Bretton Woods System

In the early 1970s, when the world economy was facing serious challenges. The Bretton Woods system was already under pressure and unstable. The U.S. continued to issue more dollars, and the oil crisis and the Vietnam War dragged the U.S. into an unprecedented "Great Inflation" (over the course of a decade, the Federal Reserve was able to contain the crisis by tightening monetary policy, such as increasing reserves and discount rates), and at the same time led to the international reserve currency system being in trouble, with global inflationary and recessionary pressures also increasing.

To address this predicament, government leaders held an emergency meeting in Washington, D.C., in 1971, known as the "Washington Agreement," to restructure the Bretton Woods system. This did not solve the problem, however, and countries continued to search for a solution in the years that followed. In this context, the G7 was formally established in 1975, initially consisting of seven countries: the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. The goal of this small organization was to increase coordination among these countries in order to solve global economic and monetary problems. While the G7 did not replace the Bretton Woods system, it has played an important role in global economic governance and continues to influence the formulation of international monetary and trade policies.

The G7 members are a group that has played a leading role in international financial and trade policy, particularly in coordinating exchange rate policies, promoting international trade negotiations, and responding to the global financial crisis. Since then, the G7's agenda has gradually expanded to include other international issues, such as international security, energy, and climate change. The G7 has since evolved into the G8 (including Russia) and the G20 (a larger group of major developing and emerging economies, including China), which play a broader role in international economic and political affairs, but the G7 as a core grouping still retains its relevance in global governance.

The Collapse of the Bretton Woods System and the Floating Exchange Rate System

Historically, the United States also took some measures to solve this problem, such as strengthening the management of the international gold and foreign exchange markets. However, due to the distrust of the U.S. dollar, some countries began to demand that their dollar reserves be exchanged for gold, especially France, which was dissatisfied with the dominance of the United States in the international financial system and called for a reform of the system. This resulted in a large loss of gold, and the gold reserves of the United States continued to decline. The U.S. government gradually realized that maintaining the sustainability of the gold exchange became impossible because the gold reserves were not sufficient to support its massive foreign exchange reserves. On the other hand, the persistent trade deficits and domestic inflationary pressures in the United States caused by the Vietnam War made it impossible for the United States to maintain sufficient gold reserves to cope with the rising global demand for economic expansion in the later stages of the establishment of the Bretton Woods system.

Therefore, in 1971, U.S. President Richard Nixon announced the suspension of the dollar-gold peg, an event known as the "Nixon Peg". This led to the collapse of the Bretton Woods system and the dollar was no longer convertible into gold at a fixed rate.

After the collapse of the Bretton Woods system, the international monetary system was in disarray. In response to this situation, the International Monetary Fund (IMF, as part of the Bretton Woods system, was established in 1944 and officially began operations in 1947. Its main tasks include coordinating international monetary policies, providing financial support to member countries, promoting international trade and maintaining monetary stability). At the end of 1971, a series of measures were taken, including allowing currencies to float their exchange rates and attempting to re-coordinate the international monetary system.

Since then, the world has entered the era of floating exchange rates, in which the exchange rate of most countries' currencies is determined by market supply and demand, rather than being fixed at a certain rate. This system is more flexible, but can also lead to greater exchange rate volatility.

The Birth of the US Dollar Index

To better monitor the value of the U.S. dollar in this new international monetary system, a representative basket of major currencies agreed in 1973 to create the US Dollar Index. The purpose of this index was to track the performance of the U.S. dollar relative to other major currencies and to become a reference indicator for use in international finance and trade.

The original base period value of the US Dollar Index was 100.0, and the constituent currencies included the six major international currencies: the euro, the yen, the pound sterling, the Canadian dollar, the Swedish krona, and the Swiss franc (the major countries involved in the construction of the international economic and financial order from the end of World War II through the 1960s).

Since then, the US dollar index has been an important indicator in international financial markets, helping investors, policymakers, and economic analysts assess the relative strength or weakness of the U.S. dollar in global currency markets. The index's constituent currencies and weights have also changed over time to reflect the evolution of the international monetary system.

Factors Affecting the US Dollar Index

Fluctuations in the U.S. Dollar Index can be influenced by a variety of factors, including U.S. economic data, monetary policy decisions, international trade relations, geopolitical events, and more. Investors and forex traders often use the U.S. Dollar Index to develop trading strategies because it provides important information about the overall trend of the U.S. Dollar in global markets.

Despite the complexity of the factors that affect the Dollar Index, there are a number of more obvious fluctuations and events that can be followed.

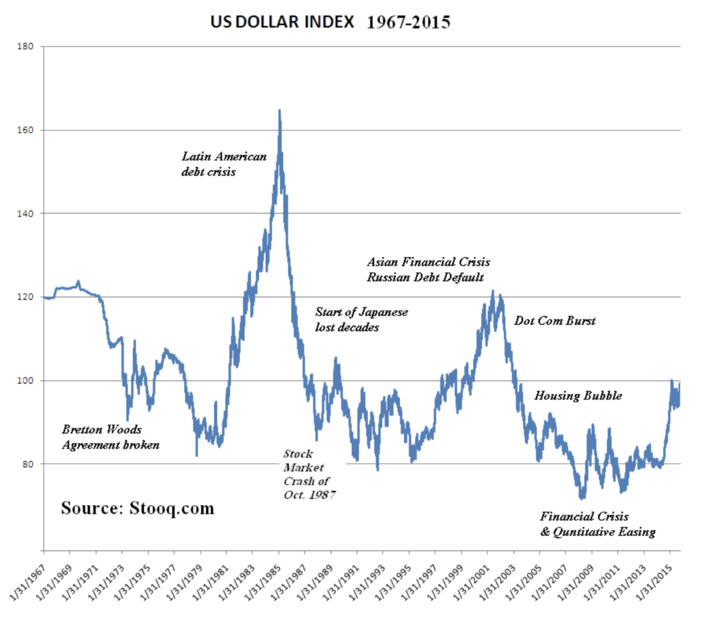

Chart: US Dollar Index Trends and Events

Stability in international finance: In 1971, after the "Nixon Peg," the U.S. dollar was unpegged from gold, a decision that led to a significant devaluation of the dollar and triggered a series of international currency fluctuations. During this period, the dollar index showed a clear downward trend. The same financial crisis events include the Latin American debt crisis, the 1987 stock market shock, the 1998 Asian financial turmoil, and the 2008 global financial crisis. The instability of international finance will affect the dollar index, but whether the dollar strengthens or weakens is related to the causes of the financial crisis and even more related to the economic situation of the United States.

Tightening of U.S. monetary policy: If the Federal Reserve adopts a tighter monetary policy and raises interest rates, this can increase the attractiveness of the U.S. dollar because it can offer higher yields.In the 1970s, the U.S. experienced unprecedented hyperinflation and the Federal Reserve Chairman, Paul Volcker, in order to fight the hyperinflation, he adopted a very tight monetary policy and raised the Federal Funds Rate to over 20%, which is one of the highest levels in history. That is one of the highest levels in history. Accordingly, the US Dollar Index showed a steep upward trend.

U.S. economic performance: When the U.S. economy performs well relative to other countries, investors and currency traders may buy U.S. dollars in anticipation that U.S. economic growth will lead to higher interest rates and better investment opportunities.In the information revolution era of the 1990s, U.S. Internet companies led the world in the development of information technology, and U.S. technology companies attracted large amounts of investment, creating economic prosperity and a large number of jobs, resulting in a rise in the dollar index.In contrast, Japan lost three decades, the Japanese economy shifted from rapid development to stagnation, and the U.S. dollar became relatively stronger. In contrast, Japan lost three decades, the Japanese economy shifted from rapid development to stagnation, and the US dollar became relatively stronger.

Other factors: Some geopolitical events or international tensions may lead to increased demand for safe-haven assets, and the US dollar is usually regarded as a safe-haven asset, so it may appreciate. Another special factor is the United States ruling party change, to advocate the industrial state, the development of the economy and central banking Hamiltonianism rise of the United States Republican Party in charge of the period, generally opposed to government intervention in economic and social life, advocating tax cuts, cuts in social welfare, increase defense spending. In contrast, the Democratic Party generally opposed tax cuts and favored increased government and social spending. In general, unrestrained finances will lead to a decline in the dollar index.

Impacts of the US Dollar Index

Simply put, when the US Dollar Index rises, it means that the US Dollar is stronger in the international market and vice versa.

When the US Dollar Index rises, it usually has the following effects on other countries' currencies:

Weakening of other currencies: A rise in the U.S. Dollar Index indicates that the U.S. Dollar is stronger relative to a basket of other major international currencies, and therefore other countries' currencies are weaker relative to the U.S. Dollar. This typically leads to a depreciation of other countries' currencies.

Reduced export competitiveness: The depreciation of other countries' currencies can make the products and services exported by those countries more expensive in international markets. This can put pressure on those countries' exports as foreign buyers have to pay more in their own currencies for their products.

Rising import prices: The depreciation of other countries' currencies can lead to an increase in the price of imported goods and raw materials, as more must be paid in local currency to purchase these imports. This can lead to inflation unless the government takes steps to curb it.

Increased international debt pressure: If a country has a large amount of debt denominated in a foreign currency, the depreciation of other countries' currencies can lead to an increased debt burden, as more of the national currency must be paid to service the debt. The most famous case is the Latin American debt crisis.

Capital flows: Depreciation of other countries' currencies can trigger capital outflows as investors seek more attractive investment opportunities to avoid the negative impact of currency depreciation on their assets.

In Japan, for example, the dollar index has risen since the Federal Reserve raised interest rates in March 2022, and the yen has recently depreciated to a 2023 low. The yen depreciated 8.65% against the dollar in the first seven months of the year, making the yen the worst performer in the advanced economy currency camp.

The market for the United States prices remain high sense of alarm increased, at the same time due to the Bank of Japan continued to implement negative interest rate policy, investors to sell the yen confidence increased.

Yen depreciation did not help exports, and Japan's trade deficit continues to expand. This year, the yen has weakened significantly, but Japan's export growth did not synchronize to improve, instead, there is no small decline.

Data show that in addition to a small increase in June last year, since October 2021, Japan's real exports experienced a sustained decline, and weak exports dragged down the Japanese economy. As of May this year, Japan has run a trade deficit for 22 consecutive months. Although June turned to a small surplus, the first half of the total deficit is still as high as 6.96 trillion yen, a new record. The depreciation of the yen was expected to stimulate exports and improve Japan's trade situation, but the data does not seem to show a significant effect. Japan needs to take more measures to stimulate the economy in order to cope with the increasingly severe challenges of the trade environment.

The depreciation of the yen has been accompanied by a rise in commodity prices, and the combination of the two has hit some Japanese companies and consumers much harder than before. In response, the Japanese government has had to resort to fiscal stimulus.

The rise in the US Dollar Index can also affect individual investors in a number of ways, depending on their investment objectives, asset allocation, and time horizon. The following are some areas of concern:

Decrease in the value of foreign assets: When the U.S. dollar strengthens, it typically causes foreign currencies to depreciate, which can negatively impact investors with significant holdings of foreign assets. If an investor holds foreign assets, such as foreign stocks, bonds, or real estate, the value of those assets may decline because they are worth less in U.S. dollars.

Domestic exporters benefit: A stronger U.S. dollar can benefit U.S. exporters by making their products more competitive in international markets. Investments in stocks of export-related industries may benefit from a stronger dollar.

Lower prices for domestic imports: A stronger U.S. dollar typically leads to lower prices for imported goods because fewer U.S. dollars must be paid for imported goods. This can have a positive impact on individual consumers by lowering the cost of living.

Increased financial market volatility: A stronger dollar can lead to increased volatility in global financial markets as exchange rates and the financial position of multinational corporations are affected. This can cause short-term fluctuations in the prices of stocks, bonds, and other assets.

Increased emphasis on investment diversification: Diversified portfolios become more important in times of a strengthening dollar, as the performance of different asset classes may vary. Diversification can help reduce certain market risks.

Foreign Exchange Risk: If you trade or hold foreign currencies in the foreign exchange market, a strengthening U.S. dollar may result in a loss on your foreign exchange position.

In general, a rise in the U.S. dollar index for the currencies of other countries usually means that they may face devaluation and a range of economic challenges, including export pressures, inflation risks, and international debt problems. Governments have had to implement monetary and economic policies to address these challenges. It is also important for individual investors and households to monitor changes in the dollar index and allocate their assets wisely.