GameStop stock surged by as much as 112%, while AMC stock experienced an increase of up to 129% shortly after the market opened. These gains added to the impressive growth both stocks had seen during Monday's trading session, with GameStop rising approximately 75% and AMC seeing a similar increase.

Let's delve into the entire saga of the GameStop phenomenon and conduct an analysis of its stock price. The question looms: will the upward momentum continue, and is it a wise decision to buy in?

GameStop Saga of 2021

Early 2020: Bull Theory

Though GameStop fervor peaked in early 2021, it had been in the works for months. Keith Gill, aka Roaring Kitty, had been posting about his bullish theory for GameStop since the summer of 2020, and mentions of GME on the r/wallstreetbets subreddit began to grow in the second half of 2020.

Over 10 million retail investors are estimated to have opened accounts in 2020. Collectively, retail investors accounted for approximately 19.5% of market activity in 2020. The appetite for trading that had taken hold of retail investors in 2020 helped set the stage for the memestock boom in the following months.

January 2021: The Spark

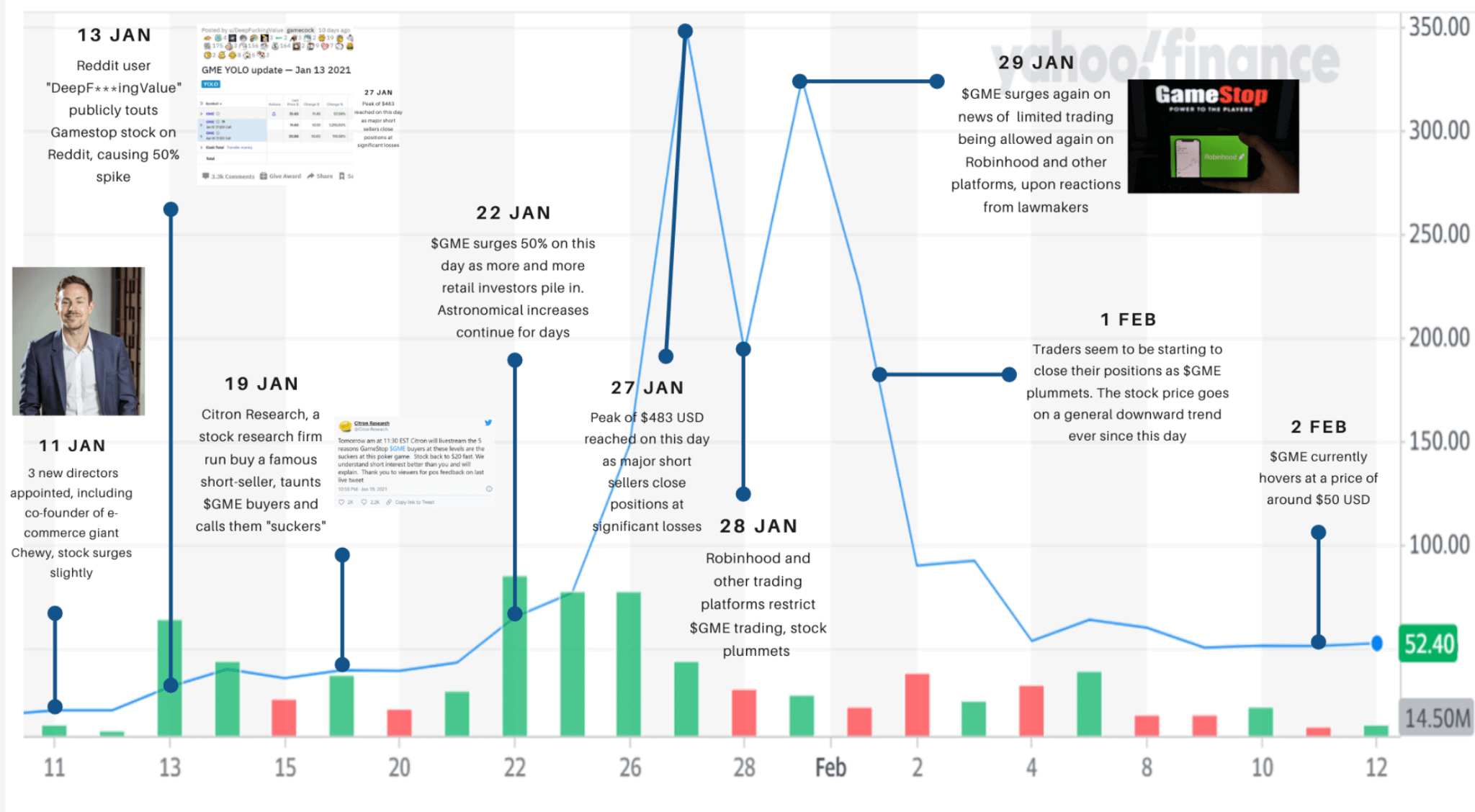

- January 11: GameStop announces significant changes to its board of directors, including the addition of three members from RC Ventures, led by Chewy founder Ryan Cohen. The move bolsters investor confidence even as the company reports a 3.1% decline in holiday sales but a 300% increase in e-commerce sales.

- January 13: Following the board announcement, GameStop's stock surges 57% from $19.95 to $31.40, driven by enthusiasm on Reddit's r/wallstreetbets (WSB) forum.

The Short Squeeze Begins

- January 22-27: GameStop's stock price rises dramatically as retail investors from WSB go on a massive buying spree. The stock closes at $65 on January 22, nearly doubles to $148 on January 26, and reaches $347.51 on January 27.

January 28: The Peak

- January 28: GameStop stock hits an intraday high of $483 before closing at $193.6. This rapid rise is partly fueled by short-sellers like Melvin Capital, who are forced to buy back shares at high prices to cover their positions, amplifying the GME stock's rise.

Market Reaction and Robinhood's Decision

- January 28: Robinhood restricts trading of GameStop and other meme stocks due to "market volatility," causing outrage among retail investors who feel betrayed. The move leads to allegations of market manipulation and several lawsuits.

Volatility and Aftermath

- February 2021: GameStop stock plummets to around $40, down 90% from its peak. Volatility continues, however, as the stock rebounds above $200 in March, spurred by continued investor interest and optimism about the company's transformation efforts under Ryan Cohen.

- June 2021: GameStop stock surpasses $300 again amid continued retail investor enthusiasm and speculative trading.

Impact and Legacy

- The GameStop saga is seen as a "David vs. Goliath" battle in which retail investors challenge Wall Street norms. It leads to significant financial losses for hedge funds like Melvin Capital and prompts regulatory scrutiny of short-selling and trading practices.

- The incident also highlights the power of social media to influence stock markets and sparks discussions about market democratization and the role of retail investors.

This period marks a transformative moment in the stock market, driven by a combination of retail investor activism, social media influence, and the dynamics of short selling.

GameStop's Resurgence in 2024

Renewed Interest and Initial Rally

- January-April 2024: GameStop stock remains relatively low, trading below $15. The company continues to struggle with its transformation efforts and maintaining investor interest.

- May 12: Keith Gill ("Roaring Kitty") reappears on social media, hinting at renewed interest in GameStop. This triggers a surge in retail buying activity reminiscent of the 2021 craze.

May 2024: A New Peak

- May 13-14: GameStop stock price jumps 141%, closing at $60.38 on May 14. The rapid increase is driven by a renewed collective effort from retail investors and continued social media hype.

- May 15: Analysts, including Jim Cramer, express skepticism about the sustainability of the rally, warning of potential risks and the likelihood of another speculative bubble.

Market Reactions and Future Prospects

- Late May 2024: GameStop stock remains highly volatile. The company's ability to maintain investor confidence hinges on significant operational improvements and successful execution of its digital transformation strategy. Analysts highlight the need for sustainable business practices to support the elevated stock prices.

Comparative Analysis and Implications: Will Gamestop be the same as it was back then? Can I still buy it?

Roaring Kitty's Bull Theory and the 2021 Short Squeeze:

- Part of Roaring Kitty's bull theory for GameStop was its potential as a short squeeze play. At the time, short interest was over 100%, meaning there were more shares had been shorted than were available. This situation arose because shares were lent out, shorted, and then lent out again. When intense buying pressure came in 2021, short sellers were forced to buy back shares at much higher prices to cover their positions, resulting in billions of dollars in losses for these short sellers. This phenomenon contributed significantly to GameStop's meteoric rise during this period.

Current Short Interest (May 2024):

- As of May 9, 2024, GameStop's short interest stands at 24.1%. While this is higher than the short interest for most other companies, it is substantially lower than the levels seen in 2020 and 2021. This reduction in short interest means that the same level of pressure from short sellers is not present in the current market.

Retail Participation lower than 2021 in 2024:

- The recent increase in GameStop stock price in 2024 has not seen the same level of retail participation as in 2021. According to Vanda Research, the average retail share of GME turnover over the past five trading days was approximately 7%. This is significantly lower than the level of retail participation seen in 2021. Additionally, Vanda Research notes that quant and hedge funds are now better positioned to take advantage of retail surges, marking a key difference between the market dynamics of 2021 and 2024.

Retail investors representing around 25%:

- According to GameStop's March 26 10-K filing, around 75.3 million shares have been directly registered, representing about 25% of the company's outstanding shares. The DRS movement involves investors registering their shares directly in their own names rather than through a brokerage, signifying a strong sense of ownership and commitment among GameStop's retail investors.

A different backdrop to the current market dynamics at GameStop:

- Many retail investors remain on the sidelines, ready to trade GameStop stock. The company already has significant brand recognition among retail traders, and many investors are willing to re-engage with the stock or may never have left the action. This willingness and continued interest from retail investors is a fundamental difference from the 2021 scenario and provides a different backdrop for GameStop's current market dynamics.

Brand Recognition and Continued Interest in 2024:

- GameStop retains strong brand recognition among retail traders. Many investors are willing to re-engage with the stock or maintain their positions, indicating sustained interest. This ongoing appeal highlights the enduring influence and sentiment of retail investors toward GameStop.

Conclusion

GameStop's evolution from the dramatic events of 2021 to its resurgence in 2024 highlights the changing dynamics of retail investor influence and market conditions. Initially driven by Roaring Kitty's bull theory and a massive short squeeze, GameStop's rise in 2021 exemplified the power of collective retail action. However, the current landscape paints a different picture:

- Short Interest: Significantly reduced short interest in 2024 reduces pressure from short sellers, changing the potential for a similar short squeeze.

- Retail Participation: The lower average retail stock turnover in recent trading sessions compared to 2021 indicates a shift in retail participation, with quant and hedge funds better positioned to capitalize on market moves.

- Direct Registration System (DRS) Movement: The significant number of directly registered shares demonstrates a strong sense of ownership among retail investors, underscoring their commitment to GameStop.

- Investor Willingness: Many retail investors remain willing to trade GameStop stock, reflecting the continued interest and brand recognition within this community.

Overall, while the conditions and mechanisms that drive GameStop stock price fluctuations have evolved, the core elements of retail investor enthusiasm and strategic participation continue to play a pivotal role. This continued involvement signals a new era of market dynamics in which informed and engaged retail investors remain a formidable force.