I. Introduction

Gas CFD trading involves speculating on the price movements of gas contracts without owning the physical asset. While it offers potential opportunities for profit, it also carries inherent risks that traders should be aware of.

Explanation of Gas CFD Trading Risks

Price Volatility: Gas prices can be highly volatile due to factors such as geopolitical events, supply and demand dynamics, weather conditions, and economic indicators. This volatility can result in rapid and significant price fluctuations, leading to potential losses for traders.

For example, suppose a trader enters a long position on a gas CFD, anticipating an increase in prices. However, if unexpected news regarding increased gas production emerges, causing a sudden oversupply, the price may plummet, leading to substantial losses.

Leverage: CFD trading typically involves using leverage, which allows traders to control larger positions with a smaller capital outlay. While leverage amplifies potential profits, it also magnifies losses. If the market moves against a leveraged position, traders can incur substantial losses that exceed their initial investment.

For instance, a trader with 10:1 leverage enters a gas CFD trade with a $1,000 margin. If the gas price drops by 10%, the trader would lose $10,000 (10 times the initial margin), resulting in a total loss of $9,000.

Counterparty Risk: Gas CFDs are traded through brokers, and traders are exposed to counterparty risk, which refers to the risk of the broker defaulting on their obligations. If a broker becomes insolvent or fails to honor trades, traders may face difficulties recovering their funds.

The Importance of risk management in Gas CFD trading

Effective risk management is crucial in Gas CFD trading to protect capital and minimize potential losses. Here are a few reasons why risk management is essential:

Capital Preservation: By implementing proper risk management techniques, traders can preserve their capital and avoid catastrophic losses. This ensures that they have sufficient funds to continue trading and seize future opportunities.

Emotional Control: Risk management strategies help traders maintain emotional control and make rational decisions. When traders have clear risk parameters in place, they are less likely to succumb to impulsive actions driven by fear or greed.

Long-Term Profitability: Consistent risk management practices contribute to long-term profitability. By limiting losses during adverse market conditions, traders can maintain a positive risk-to-reward ratio and sustain their trading activities over time.

Introduction of stop-loss orders as a risk management tool

A stop-loss order is a risk management tool that allows traders to set a predetermined price level at which their position will be automatically closed. It helps limit potential losses by exiting a trade if the market moves against the desired direction.

Source: tradingview.com

For instance, if a trader enters a long gas CFD position at $8.25 per unit, they can set a stop-loss order at $2.80. If the price drops to or below $7.80, the stop-loss order will trigger, automatically closing the position and limiting the loss to $0.45 per unit.

Stop-loss orders enable traders to define their maximum acceptable loss for each trade. By setting stop-loss levels based on their risk tolerance and market analysis, traders can limit potential losses and protect their capital. They eliminate the need for constant monitoring of trades. Once the order is set, it will execute automatically if the specified price is reached, even if the trader is not actively monitoring the market. Also, stop-loss orders enforce discipline in trading by removing emotions from the decision-making process.

II. What is a stop-loss order?

Definition of stop-loss order

A stop-loss order is a risk management tool used in trading to automatically close a position when the price reaches a specified level, thereby limiting potential losses. It is an order placed with a broker to sell (or buy, in the case of short positions) a security once it reaches a predetermined price.

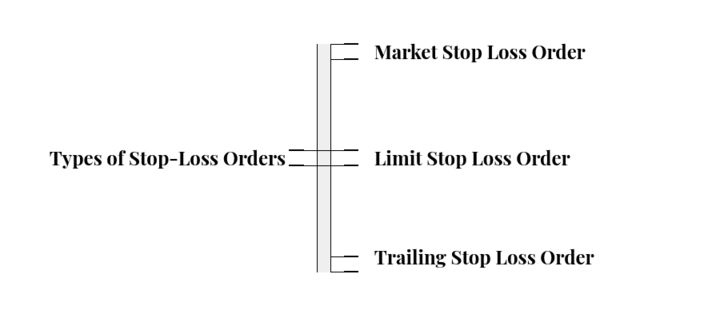

Types of stop-loss orders (market, limit, trailing)

Market Stop Loss Order: This type of stop loss order instructs the broker to sell the position at the prevailing market price once the specified price level is reached. It guarantees execution but does not guarantee the exact price at which the order will be filled. In fast-moving markets, the execution price may deviate from the specified stop price.

Example: A trader enters a gas CFD trade with a long position at $3.00 per unit and sets a market stop-loss order at $2.80. If the gas price drops to $2.80 or below, the stop-loss order will be triggered, and the position will be closed at the best available market price at that time.

Limit Stop Loss Order: A limit stop loss order specifies both the stop price and the minimum price at which the position should be closed. It ensures that the position is closed at a specific price or better. If the market price reaches the stop price, the limit order is triggered, and the position is closed at the specified limit price or higher.

Example: A trader has a short gas CFD position at $4.00 per unit and sets a limit stop-loss order at $4.20. If the gas price rises to $4.20 or above, the stop-loss order will be activated, and the position will be closed at $4.20 or any higher price.

Trailing Stop Loss Order: A trailing stop loss order is dynamic and adjusts the stop price as the market price moves in the trader's favor. It maintains a specified distance (called the "trailing stop") from the highest achieved price in the case of long positions or the lowest achieved price in the case of short positions.

Example: A trader enters a gas CFD trade with a long position at $2.00 per unit and sets a trailing stop-loss order at $0.20. If the gas price increases to $2.50, the stop-loss order will adjust to $2.30 ($2.50 minus $0.20). If the price then drops to $2.30 or below, the position will be closed.

How stop-loss orders work in Gas CFD trading

In Gas CFD trading, stop-loss orders play a crucial role in managing risk. Traders can use stop-loss orders to protect their capital and limit potential losses in the following ways:

Protection against Unexpected Market Movements: Gas prices can experience sudden and significant fluctuations due to various factors. By placing a stop-loss order at a predetermined level, traders can minimize losses if the market moves against their position.

Risk Mitigation during Volatile Periods: Gas markets can be highly volatile, especially during events such as geopolitical tensions, natural disasters, or economic crises. Stop-loss orders act as a safety net, automatically closing positions to limit losses if the market becomes highly unpredictable.

Flexibility and Automation: Stop-loss orders provide traders with flexibility and automation. Once a stop-loss order is set, traders can focus on other activities, knowing that their position will be closed automatically if the specified price is reached. This reduces the need for constant monitoring of trades and allows traders to implement their trading strategies effectively.

III. Benefits of using stop-loss orders in Gas CFD trading

Protection against unexpected market events

Gas markets can be influenced by various unexpected events, such as geopolitical tensions, natural disasters, or regulatory changes. These events can trigger significant price fluctuations, potentially resulting in substantial losses for traders. By using stop-loss orders, traders can protect themselves against such events by automatically closing their positions when the market moves against them.

For instance, suppose a trader enters a long gas CFD position at $8.80 per unit. However, due to a few vital events in June 2022, gas prices plummeted to $5.35 in a few days. By setting a stop-loss order at $8.25, the trader's position would be automatically closed, limiting the loss to $0.55 per unit. Without the stop-loss order, the trader might have faced a more significant loss if they had held onto the position.

Minimization of losses

One of the primary purposes of a stop-loss order is to limit potential losses. By defining a predetermined price level at which a position should be closed, traders can ensure that their losses are contained within an acceptable range. This is particularly important in volatile markets, where price movements can be swift and unpredictable.

For example, consider a trader who opens a short gas CFD position at $4.00 per unit, anticipating a price decline. To manage the risk, the trader sets a stop-loss order at $4.20. If the gas price unexpectedly rises to $4.50, triggering the stop-loss order, the trader's position would be closed, limiting the loss to $0.50 per unit. Without the stop-loss order, the trader might have continued to hold the position, resulting in larger losses as the price continued to rise.

Increased discipline in trading

Implementing stop-loss orders promotes discipline and helps traders stick to their predetermined risk management strategies. It removes the emotional element from decision-making and ensures that trades are executed based on predefined rules rather than impulsive reactions to market fluctuations.

For instance, imagine a trader who sets a risk tolerance of 2% per trade and uses stop-loss orders accordingly. If the trader's account balance is $10,000, they would limit their potential loss to $200 per trade. By consistently applying this risk management approach and using stop-loss orders to exit losing trades, the trader maintains discipline and avoids excessive losses that could jeopardize their overall trading strategy.

IV. Setting up stop-loss orders in Gas CFD trading

Setting up stop-loss orders in Gas CFD trading is a critical aspect of effective risk management. Traders need to determine the appropriate stop loss level, set up the order in their trading platform, and be prepared to adjust the stop loss order as the trade progresses.

Determining the appropriate stop loss level

Determining the appropriate stop-loss level requires careful consideration of various factors, including market conditions, volatility, risk tolerance, and the trader's trading strategy. Traders should aim to set a stop-loss level that allows for a reasonable amount of price fluctuation while still protecting against excessive losses.

For example, if a trader enters a long gas CFD position at $3.00 per unit, they may decide to set a stop-loss level at $2.80. This allows for a 20-cent price fluctuation before the position is automatically closed. By considering the market's recent volatility and the trader's risk tolerance, they can determine a stop-loss level that aligns with their risk management objectives.

Setting up the order in the trading platform

Once the appropriate stop loss level is determined, traders can set up the stop loss order in their trading platform. The specific steps may vary depending on the platform used, but generally, traders need to select the relevant gas CFD contract, specify the order type as a stop-loss order, and enter the stop-loss price.

For instance, a trader using a trading platform enters a long gas CFD position at $3.50 per unit. They decide to set a stop-loss order at $3.30. On the platform, they select the gas CFD contract they are trading, choose the stop loss order type, and enter the stop loss price of $3.30. Once the order is submitted, it is now active in the market and will trigger if the gas price reaches or falls below the specified stop-loss level.

Adjusting the stop-loss order as the trade progresses

Traders should actively monitor their trades and be prepared to adjust the stop-loss order as the trade progresses. This involves evaluating the market conditions, reassessing the risk/reward dynamics, and potentially moving the stop loss level to protect profits or limit losses.

Source: tradingview.com

For example, suppose a trader enters a short gas CFD position at $8.40 per unit with a stop-loss order initially set at $9.65. As the trade progresses, the gas price drops to $7.00, and the trader believes further downside potential exists. In this case, the trader may choose to adjust the stop-loss order to $8.20 to secure a breakeven trade or potentially lock in a small profit. By actively adjusting the stop-loss order based on evolving market conditions, traders can optimize risk management and potential profitability.

Adjusting the stop-loss order should be done thoughtfully and based on sound analysis rather than impulsive reactions to short-term market fluctuations.

V. Tips for using stop-loss orders effectively in Gas CFD trading

Avoid setting stop-loss levels too close to the entry price

Setting stop-loss levels too close to the entry price can lead to premature stop-outs. While it's essential to protect against excessive losses, placing the stop-loss order too tight may result in being stopped out by normal market fluctuations. Traders should give the position enough room to breathe and consider the natural ebb and flow of price movements.

For example, if a trader enters a long gas CFD position at $3.00 per unit, setting a stop-loss order at $3.01 might be too tight. In this case, even minor price fluctuations or noise in the market could trigger the stop-loss, prematurely closing the position. Traders should consider a wider stop-loss level, taking into account the average volatility of the gas market.

Considering market volatility when setting stop-loss levels

Market volatility plays a significant role in determining appropriate stop-loss levels. More volatile markets require wider stop-loss levels to accommodate price fluctuations, while less volatile markets may allow for tighter stop-loss levels.

For instance, during periods of high market volatility, such as news announcements or economic events impacting gas prices, traders may need to set wider stop-loss levels to avoid being prematurely stopped out. Conversely, in relatively calm market conditions, tighter stop-loss levels may be more appropriate.

Regularly reviewing and adjusting stop-loss orders

Markets are dynamic and subject to changing conditions. Traders should regularly review their positions and adjust stop-loss orders accordingly. This includes monitoring price movements, technical indicators, and fundamental factors that may impact gas prices.

By regularly reviewing stop-loss orders, traders can make informed decisions to protect profits or limit potential losses as the trade progresses. Adjusting stop-loss orders should be done based on careful analysis and consideration of relevant market information.

For example, if a trader is in a long gas CFD position with a stop loss order set at $2.90 and the price increases to $3.20, the trader may consider adjusting the stop loss order to a higher level, such as $3.00, to lock in profits or protect against a potential reversal. Regularly reviewing and adjusting stop-loss orders helps traders adapt to changing market conditions and optimize risk management.

Stop-loss orders are a powerful risk management tool, but they should not be used in isolation. Traders can enhance their risk management approach by combining stop-loss orders with other techniques such as position sizing, diversification, and risk-reward analysis. By incorporating multiple risk management techniques, traders can build a comprehensive risk management strategy that accounts for different market scenarios and helps protect their overall portfolio.

VI. Conclusion

A Recap of the importance of risk management in Gas CFD trading

In conclusion, risk management is of utmost importance in Gas CFD trading to protect capital and navigate the volatile nature of the market. By implementing effective risk management techniques, traders can enhance their chances of success and long-term profitability. Stop-loss orders, in particular, play a vital role in managing risk and should be incorporated into a trader's strategy.

Summary of the benefits and tips for using stop-loss orders effectively

Stop-loss orders offer several benefits in Gas CFD trading. They provide protection against unexpected market events, minimize potential losses, and promote discipline in trading. By setting a predetermined stop-loss level, traders can limit their downside risk and preserve capital, even in the face of adverse market conditions.

To use stop-loss orders effectively, traders should avoid setting stop-loss levels too close to the entry price, consider market volatility when determining appropriate levels, and regularly review and adjust their stop-loss orders. These tips help ensure that stop-loss orders are set at optimal levels, considering market conditions and individual trading strategies.

Encouragement to incorporate stop-loss orders into Gas CFD trading strategies

Incorporating stop-loss orders into a Gas CFD trading strategy is strongly encouraged. By using this risk management tool, traders can protect their capital, manage their risk exposure, and maintain discipline in their trading activities. Stop-loss orders should be seen as a fundamental aspect of trading, providing a safety net that safeguards against potential losses while allowing traders to focus on their overall trading objectives.