The advent of Oil CFD platforms has reshaped the landscape of oil trading, equipping traders with a dynamic toolbox for analysis and strategic execution. These platforms, exemplified by MetaTrader 4 and 5, cTrader, and others like VSTAR, transcend mere trading interfaces by fostering a holistic trading ecosystem. With features like technical analysis tools, widespread availability, mobile access, and the opportunity for demo trading, these platforms cater to traders of all experience levels, ensuring that they are well-prepared and empowered to navigate the complexities of the oil market. As the trading landscape continues to evolve, these platforms will undoubtedly remain at the forefront of discussions within the trading community.

I. Introduction to Oil Trading Platforms for CFDs

The realm of financial markets has witnessed a transformative evolution with the emergence of Oil Trading Platforms for Contracts for Difference (CFDs). These platforms have revolutionized the way investors and traders participate in the oil market, offering a gateway to trade oil without the need for a traditional futures account. The analysis delves into the pivotal aspects of these platforms, highlighting their significance, features, and impact on the crude oil trading landscape.

CFD platforms allow trading oil without needing a futures account.

Oil Trading Platforms for CFDs have gained substantial prominence due to their accessibility and convenience. Unlike conventional futures trading, which requires substantial capital and specialized accounts, these platforms have democratized access. This is exemplified by platforms like eToro and Plus500, which allow traders to engage in oil trading with lower capital requirements, thus attracting a wider range of participants, including retail investors.

Source: etoro.com

Offer features like charting, technical analysis, and order execution

One noteworthy aspect of these platforms is their comprehensive set of features. They extend beyond mere trading functionalities by incorporating advanced charting tools and technical analysis capabilities. This empowers traders to make informed decisions by analyzing historical price movements, identifying trends, and employing technical indicators. For instance, platforms like IG offer real-time charting and customizable indicators, enabling traders to devise robust trading strategies.

Moreover, the order execution mechanisms embedded within these platforms enhance trading efficiency. Trades can be executed swiftly with the click of a button, ensuring that traders can capitalize on fleeting market opportunities. The seamless execution not only minimizes slippage but also provides traders with a sense of control over their trades. Notably, AvaTrade's platform offers one-click trading for efficient order placement, catering to the fast-paced nature of the oil market.

Source: avatrade.com

Allow trading spot oil and other oil-related instruments

These platforms transcend the scope of traditional oil trading by offering diverse instruments beyond spot oil. This is exemplified by the inclusion of oil-related derivatives, such as oil indices and ETFs, which broaden the trading horizon. For instance, XTB's platform provides access to oil CFDs based on various benchmarks, allowing traders to diversify their portfolios and mitigate the risks associated with single-asset exposure.

However, the proliferation of Oil Trading Platforms for CFDs has not been without controversy. Critics argue that the accessibility offered by these platforms comes at the cost of increased risk exposure for retail traders. The leverage offered by these platforms can amplify both gains and losses, potentially leading to substantial financial setbacks for inexperienced traders. The European Securities and Markets Authority (ESMA) implemented regulations to mitigate these risks by imposing leverage limits on retail clients, underscoring the need for responsible trading practices.

II. Major Oil CFD Platforms

The landscape of oil trading has been significantly reshaped by the emergence of prominent Oil Contract for Difference (CFD) platforms, each with distinct features and capabilities. This critical analysis evaluates the major platforms, including MetaTrader 4 and 5, cTrader, and proprietary broker platforms like VSTAR's, shedding light on their impact, offerings, and implications for traders.

MetaTrader 4 and 5

MetaTrader 4 and 5 (MT4 and MT5) stand as the cornerstone of retail CFD trading platforms, boasting immense popularity among traders. These platforms have garnered a substantial user base due to their user-friendly interfaces and advanced features.

Source: metatrader4.com

Most popular retail CFD trading platforms

MT4 and MT5 are two of the most popular CFD trading platforms for retail traders. Proprietary broker platforms like VSTAR's are also gaining momentum among traders. These platforms allow trading on vstar.com and other brokers once they integrate with the broker. These access various brokers, including vstar.com, thereby enabling traders to access oil CFDs conveniently.

Offer advanced charting, indicators, and algorithms

Offering a plethora of technical indicators (like RSI, ADX, Bollinger Bands, and Volume Profile), charting tools, and even algorithmic trading capabilities, MT4/5 empowers traders to perform comprehensive analyses and execute strategies with ease.

Alternative platform to MT4/5

cTrader

A notable alternative to MT4/5 is cTrader, which distinguishes itself by prioritizing rapid order execution. Designed for traders who value swift responses to market movements, cTrader offers a seamless trading experience. Much like MT4/5, it is accessible through platforms such as vstar.com, ensuring that traders have multiple options to choose from based on their preferences and requirements.

Source: app.ctrader.com

VSTAR

In addition to these well-known platforms, certain brokers choose to develop their own proprietary trading platforms. For instance, vstar.com has introduced the VSTAR Trader platform, tailored to provide a unique trading experience. While these proprietary platforms may offer a customized interface and specialized features, they might lack the flexibility and broad functionality of more established platforms like MT4/5 and cTrader.

Focused on providing fast execution

VSTAR's platform, as an example, showcases an institutional-level trading experience coupled with user-friendly features suitable for beginners and professionals alike. Its emphasis on tight spreads, low trading costs, deep liquidity, and lightning-fast execution underscores its commitment to catering to traders of varying expertise levels. The platform's mobile-enhanced trading experience and simplified interface, which highlights "Popular Markets," exemplify a focus on user convenience and ease of trading.

Source: vstar.com

These Platforms are also available at brokers like VSTAR.com.

The MT4 and MT5 are available at brokers like VSTAR. The data provided by VSTAR further accentuates its strengths. With over 1000 instruments available, a daily trading volume of 360 million, support across 100+ districts, and more than 50 deposit methods, VSTAR positions itself as a robust player in the oil CFD trading domain. Its emphasis on offering a wide range of commodities, including hard and soft commodities, in micro and mini lots aligns with the diverse trading preferences of investors seeking to profit from both rising and falling markets.

Proprietary Broker Platforms

Overall, the oil trading landscape has been significantly impacted by major CFD platforms such as MT4/5, cTrader, and proprietary platforms like VSTAR's. These platforms not only offer advanced features, charting tools, and algorithmic trading capabilities but also cater to traders with varying levels of expertise. While MT4/5 and cTrader are renowned for their widespread adoption, proprietary platforms like VSTAR showcase a tailored approach that combines convenience, speed, and a wide array of tradable instruments. As the oil trading sector continues to evolve, these platforms will play a crucial role in shaping the trading experience and strategies of market participants.

III. Key Features of Oil CFD Platforms

Technical Analysis Tools

Oil CFD platforms have ushered in a new era of trading, marked by a suite of key features that are paramount to success in the ever-evolving energy markets. This critical analysis delves into the essential attributes of these platforms, including technical analysis tools, automated trading capabilities, and mobile trading apps. By exploring these features with the backdrop of VSTAR as an example, we can appreciate how they shape the landscape of oil trading.

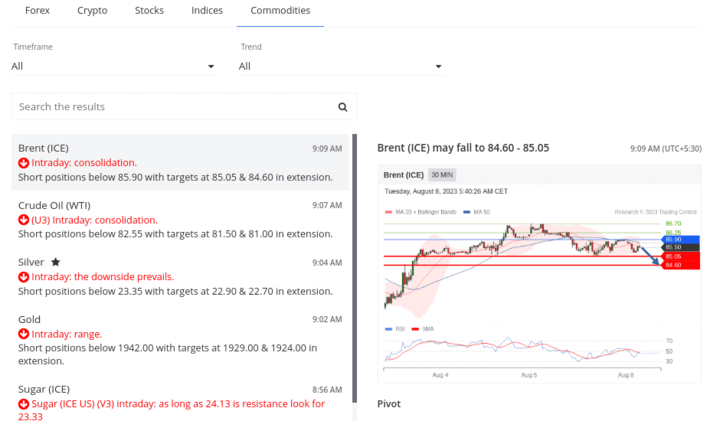

Chart types like candlesticks and indicators like RSI and Fibonacci

Technical analysis tools constitute the bedrock of effective decision-making in oil trading. The inclusion of diverse chart types, such as candlestick charts, equips traders with visual representations of price movements, facilitating the identification of trends and patterns.

Indicators like the Relative Strength Index (RSI) and Fibonacci retracement levels offer quantitative insights into market dynamics.

Source: vstar.com

Helping to analyze price action and identify trading opportunities

Such tools empower traders to comprehend price action, make informed predictions, and seize lucrative trading opportunities. VSTAR, in this context, aligns itself with these features, supporting a wide range of hard and soft commodities and providing access to both rising and falling markets.

Automated Trading

Automated trading has emerged as a game-changer, offering traders the ability to construct and backtest expert advisors or algorithms. This automation permits trades to be executed based on pre-defined strategies, reducing the impact of emotional bias and enhancing consistency. MetaTrader platforms, for instance, embody this capability, allowing traders to create intricate trading algorithms that align with their unique trading styles. However, the implementation of automated trading demands a judicious approach, considering the potential for unforeseen market behavior to influence algorithmic executions.

Automated trading methodologies and platforms allow traders to build and back-test customized algorithms with the support of expert advisors.

Automate trade execution according to a programmed strategy

There are many different trading strategies available, so you need to choose one that is appropriate for your risk tolerance and investment goals. Once traders have chosen a trading strategy, they need to program it into a computer program. This program will be responsible for executing trades according to the strategy's rules. Before traders start automating trades, they should backtest the strategy to see how it performs over time. This will help identify any potential problems with the strategy and make sure that it is profitable.

It is necessary to choose a broker that supports automated trading. Most major brokers offer this service, but traders need to make sure that the broker's platform is compatible with their trading strategy.

Once traders have chosen a broker, they need to connect with a reliable broker like vstar.com to integrate the trading program. This will allow the programs to execute trades on behalf of the traders.

Mobile Trading Apps

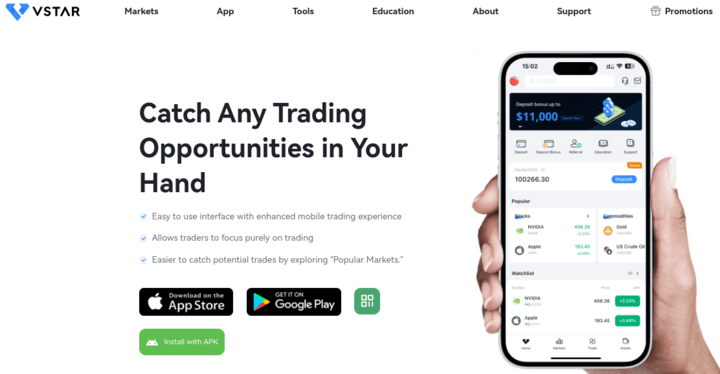

Mobile trading apps are pivotal in enabling traders to remain active and engaged, even while on the move. The convenience of monitoring and executing trades via mobile devices resonates strongly with modern traders. This attribute proves especially beneficial for active oil traders who seek to capitalize on rapid market shifts. The mobile trading app offered by VSTAR exemplifies this trend, affording an easy-to-use interface and enhancing the overall trading experience by focusing on "Popular Markets". This feature allows traders to quickly identify potentially lucrative trades.

Source: vstar.com

Monitor and execute trades on mobile

It is useful for active oil traders who are on the go. The data provided by VSTAR highlights its institutional-level trading platform, which features super-low trading costs, deep liquidity, and lightning-fast execution. With over 1000 instruments, a daily volume of 360 million, support in 100+ districts, and a multitude of deposit methods, VSTAR underscores its commitment to serving a diverse range of traders.

IV. Getting Started with the Oil CFD Platform VSTAR

Open a brokerage account like vstar.com that supports the platform

The initial step involves opening a brokerage account with a platform that supports VSTAR, such as vStar.com. This selection is pivotal, as it lays the foundation for accessing the platform's features and engaging in oil trading. The choice of brokerage should align with individual trading goals, considering factors such as fees, trading instruments, and customer support. The establishment of a robust brokerage account sets the stage for a seamless transition into the VSTAR trading ecosystem.

Download the VSTAR App

Once the brokerage account is established, traders can proceed to download the VSTAR app. This application serves as the portal to the platform's offerings, enabling traders to access a wealth of tools and information while on the go. The app's user-friendly interface ensures that both novice and experienced traders can navigate it with ease, further enhancing the trading experience.

Add oil CFD symbols to your watchlist and analyze charts

Upon accessing the platform, traders are empowered to curate a watchlist featuring oil CFD symbols. This allows for real-time monitoring of oil prices, enabling traders to seize timely opportunities and make informed trading decisions. The inclusion of advanced charting tools within the VSTAR app facilitates technical analysis, empowering traders to scrutinize price trends and patterns. This comprehensive analysis aids in pinpointing optimal entry and exit points, thereby enhancing the potential for profitable trades.

Open a demo account to test strategies before live trading

A pivotal step in the process involves opening a demo account. This feature enables traders to test their strategies in a risk-free environment before venturing into live trading. By utilizing virtual funds, traders can evaluate the effectiveness of their chosen strategies and fine-tune them without exposing their capital to potential losses. This element aligns seamlessly with VSTAR's commitment to fostering a well-informed and prepared trading community.

V. Conclusion

Oil CFD platforms empower traders with tools for analysis

In conclusion, the world of oil trading has been profoundly impacted by the emergence of Oil CFD platforms, which have revolutionized the way traders engage with the energy markets. These platforms empower traders through a rich arsenal of analytical tools, accessibility options, and risk mitigation strategies. This final analysis encapsulates the key takeaways from exploring these platforms.

Oil CFD platforms have elevated the trading experience by providing traders with a plethora of tools for analysis. Technical analysis features, including diverse chart types like candlestick charts and indicators such as RSI and Fibonacci retracements, facilitate a comprehensive understanding of price movements. These tools enable traders to decipher patterns, trends, and potential reversals, thus aiding in making informed trading decisions. The availability of such features on platforms like MetaTrader 4 and 5, and cTrader, ensures that traders have a wide array of options across different brokers to suit their preferences and strategies.

Options like MT4/5, cTrader available across brokers

Moreover, these platforms democratize access to the oil market through their availability across various brokers. Established platforms like MT4/5 and cTrader are widely offered, providing traders with consistent features and interfaces across different trading environments. This fosters a sense of familiarity and ease for traders as they navigate the complexities of oil trading.

Mobile access allows traders to manage trades from anywhere

Mobile access has emerged as a pivotal aspect, enabling traders to manage their trades from virtually anywhere. The proliferation of mobile trading apps ensures that traders can monitor market movements, execute trades, and manage their portfolios even while on the move. This feature resonates particularly with active traders who seek to capitalize on swift market shifts and seize opportunities in real-time.

Demo trading helps prepare for real trading

Furthermore, the concept of demo trading within these platforms offers an essential bridge between theory and practice. By providing traders with the ability to simulate trades using virtual funds, these platforms offer a risk-free environment for honing strategies and refining techniques. This preparatory phase proves invaluable in instilling confidence and competence in traders before they venture into live trading.