I. Introduction

A Brief overview of oil trading and contracts for difference (CFDs)

Oil trading plays a vital role in global financial markets, facilitating the exchange of this precious commodity on various platforms. Contracts for Difference (CFDs) have emerged as a popular financial instrument for oil trading, allowing investors to speculate on oil price movements without owning the physical asset. In this critical explanation, we will delve into both oil trading and CFDs, highlighting their significance in the global financial landscape.

Oil trading involves the buying and selling of crude oil and its refined products, such as gasoline and diesel, on various commodity exchanges worldwide. It is a complex market influenced by geopolitical factors, supply and demand dynamics, economic indicators, and speculative activity. Traders can participate in oil trading through different instruments, including futures contracts, options, and CFDs.

CFDs, in particular, have gained popularity due to their flexibility and accessibility. A CFD is a derivative contract between a buyer and a seller where the buyer speculates on the price movement of an underlying asset (in this case, oil) without owning the physical asset. Instead, they profit or incur losses based on the difference between the opening and closing prices of the CFD. This allows traders to take advantage of both rising and falling oil prices, making it a valuable tool for hedging or seeking speculative opportunities.

The Importance of oil trading in global financial markets

The importance of oil trading in global financial markets cannot be overstated. Oil is a critical commodity, serving as a primary source of energy and a fundamental input for numerous industries. Fluctuations in oil prices can have far-reaching effects on economies, currencies, and financial markets worldwide. As such, oil trading plays a significant role in shaping global economic trends and investor sentiment.

Furthermore, oil trading has broader implications for financial markets and investors globally. Oil price movements can affect inflation rates, interest rates, and overall market sentiment. For example, a significant increase in oil prices may lead to higher production costs for businesses, resulting in inflationary pressures. Central banks may respond by adjusting interest rates, which can have cascading effects on currency values, stock markets, and bond yields.

Source: geoenergetics.com

The interconnectedness of oil prices and financial markets is exemplified during periods of geopolitical tensions or supply disruptions. Political conflicts or natural disasters in major oil-producing regions, such as the Middle East or hurricanes affecting the Gulf of Mexico, can lead to supply disruptions. These events often result in sudden price spikes, impacting not only the oil market but also reverberating through financial markets globally. Investors closely monitor such developments, adjusting their portfolios and trading strategies accordingly.

In recent years, the rise of CFDs has further amplified the importance of oil trading in financial markets. CFDs provide retail traders and institutional investors with easy access to oil markets, allowing them to take advantage of price movements without the need for significant capital or the complex logistics associated with physical ownership. This increased participation has brought greater liquidity and contributed to price discovery in the oil market.

II. Type of oil CFDs

When it comes to oil CFDs, two types stand out as the most common and widely traded: West Texas Intermediate (WTI) and Brent crude oil. Understanding the production, quality, and market factors of these two oil benchmarks is crucial to comprehending their importance in global oil markets.

Explanation of the two most common oil CFDs: WTI and Brent

WTI is a type of crude oil that is extracted from the Permian Basin in West Texas and surrounding regions in the United States. It is classified as a light sweet crude, which means it has a relatively low density and sulfur content. The extraction and production processes for WTI are technologically advanced, allowing for cost-efficient operations. As a result, WTI is often seen as a benchmark for pricing crude oil in North America.

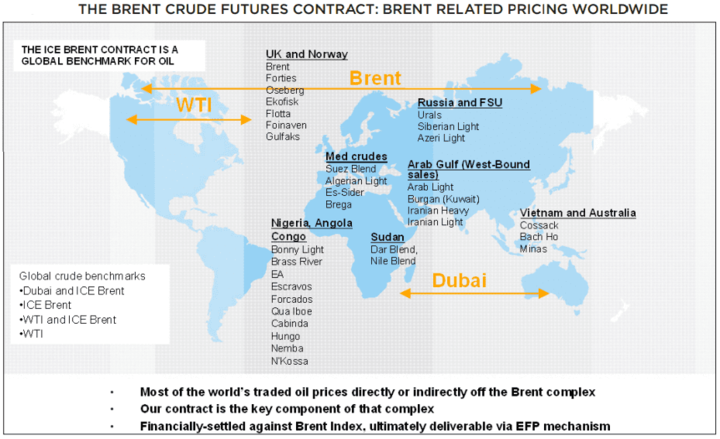

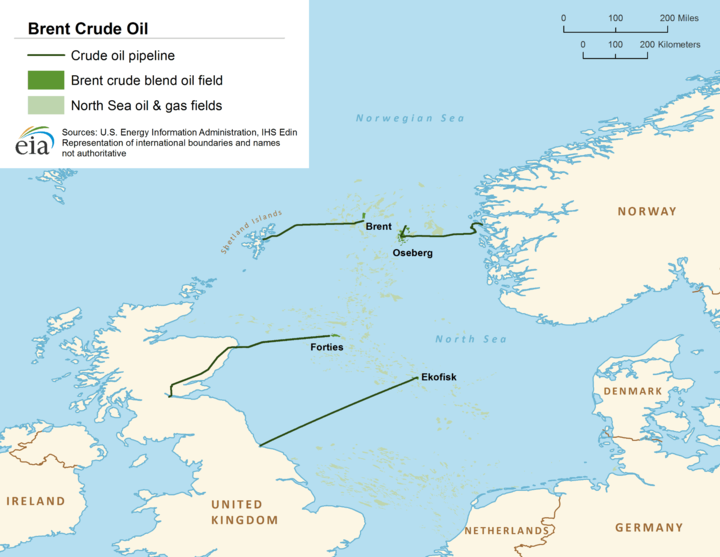

On the other hand, Brent crude oil comes from fields in the North Sea, primarily between the United Kingdom and Norway. It is also a light, sweet crude, but its composition and quality differ slightly from WTI. Brent has a slightly higher sulfur content and is denser than WTI. Historically, Brent crude has served as a pricing benchmark for oil produced in Europe, Africa, and the Middle East.

Source: theice.com

Comparison of the production, quality, and market factors of WTI and Brent

The production dynamics of WTI and Brent contribute to their significance in global oil markets. The United States is one of the largest oil producers globally, and WTI represents a substantial portion of its domestic production. The shale revolution and advancements in hydraulic fracturing techniques have boosted U.S. oil output, leading to increased reliance on WTI as a pricing reference. The growth of the U.S. as a major oil producer has challenged the dominance of traditional oil-exporting nations.

Brent, on the other hand, reflects the production and supply trends in the European, African, and Middle Eastern regions. Several significant oil-producing nations, such as the United Kingdom, Norway, Nigeria, and Saudi Arabia, contribute to the Brent crude market. This makes Brent a crucial benchmark for pricing oil from these regions and acts as a reference for international oil trades.

Market factors also play a role in the importance of WTI and Brent. The liquidity and trading volumes associated with these benchmarks are substantial, making them attractive for market participants. Both WTI and Brent crude oil futures contracts are actively traded on major commodity exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

Importance of WTI and Brent in global oil markets

The significance of WTI and Brent extends beyond their regional influence. They serve as global benchmarks, influencing the pricing of other crude oil varieties. Other oil grades are often priced differently from WTI or Brent, reflecting the quality and transportation costs associated with each grade. The pricing differentials, known as price spreads, provide opportunities for traders to profit from the relative value discrepancies between WTI, Brent, and other crude oil grades.

For example, if the price of WTI crude oil experiences a significant increase due to supply disruptions or geopolitical events, it can impact the price of other crude oil grades globally. Similarly, changes in Brent crude oil prices can have ripple effects on pricing decisions for crude oil shipments and refined petroleum products in various parts of the world.

III. West Texas Intermediate (WTI)

Definition and explanation of WTI CFDs

WTI CFDs, or West Texas Intermediate Contracts for Difference, are derivative financial instruments that allow traders to speculate on the price movements of West Texas Intermediate (WTI) crude oil without owning the physical asset. WTI CFDs are based on the price of WTI crude oil, which is a type of light, sweet crude oil extracted from the Permian Basin in West Texas and surrounding regions in the United States. These CFDs enable traders to profit from both rising and falling WTI prices by taking long or short positions, respectively.

Source: arcpublishing.com

Historical background and significance of WTI

WTI crude oil has a rich historical background and significant importance in the global oil markets. The WTI pricing benchmark emerged in the early 1980s when the New York Mercantile Exchange (NYMEX) introduced crude oil futures contracts based on oil produced in the United States. WTI became the primary reference for pricing crude oil in North America.

WTI's significance lies in its representation of U.S. oil production, which has experienced substantial growth in recent years. The shale revolution and advancements in hydraulic fracturing techniques have propelled the U.S. to become one of the world's largest oil producers. As a result, WTI has gained prominence as a benchmark for pricing and trading crude oil domestically.

Analysis of WTI market trends and price movements

Short-term market trends in the WTI market are influenced by factors such as supply and demand imbalances, geopolitical events, economic indicators, and technical analysis. Traders often use technical tools and chart patterns to identify short-term price movements and potential trading opportunities.

Volatility plays a significant role in the short-term market as it reflects the degree of price fluctuations. High volatility can present both opportunities and risks for traders. It allows for potentially higher profits if correctly anticipated, but it also increases the likelihood of sudden price swings and potential losses. Traders can utilize volatility indicators such as the average true range (ATR) or Bollinger Bands to assess short-term market volatility and adjust their trading strategies accordingly.

Source: tradingview.com

Long-term market trends in the WTI market are influenced by macroeconomic factors, global energy demand, production levels, technological advancements, and environmental regulations. Understanding these factors is crucial for assessing the long-term outlook for WTI prices.

Long-term price movements in the WTI market are often driven by fundamental factors. For example, shifts in global energy consumption patterns, emerging market growth, changes in oil production from major oil-producing nations, and shifts towards renewable energy sources can have significant impacts on WTI prices over an extended period.

Volatility in the long-term market can vary based on the stability of supply and demand dynamics, geopolitical developments, and regulatory changes. Generally, long-term volatility tends to be lower compared to short-term volatility as it reflects the overall stability and trends in the market over a longer period of time.

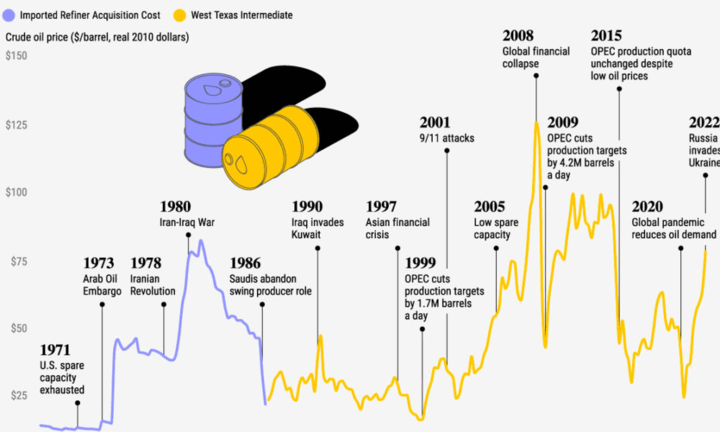

Factors influencing WTI prices, including inventory levels, supply and demand, geopolitical events, and OPEC decisions

The WTI market exhibits various trends and price movements influenced by a range of factors. These trends and movements reflect the dynamics of supply and demand, inventory levels, geopolitical events, OPEC decisions, and other market influences.

Supply and demand dynamics play a crucial role in shaping WTI prices. Increases in global demand, driven by economic growth and industrial activity, tend to push prices higher. Conversely, demand shocks or economic slowdowns can result in lower prices. Supply disruptions caused by geopolitical tensions, conflicts, natural disasters, or production issues in key oil-producing regions can also impact WTI prices significantly.

WTI prices are also influenced by inventory levels. High inventories can indicate an oversupply situation, exerting downward pressure on prices. Conversely, low inventories can signal a tight market, leading to price increases. Inventory data, such as the weekly crude oil inventory reports published by the U.S. Energy Information Administration (EIA), is closely monitored by market participants to assess supply-demand imbalances and anticipate price movements.

Geopolitical events have a profound impact on WTI prices. Political instability, conflicts, or sanctions targeting major oil-producing nations can disrupt supply and contribute to price volatility. For example, tensions in the Middle East or production disruptions in countries like Libya or Venezuela have historically led to sharp price increases. On the other hand, geopolitical developments that alleviate concerns or increase production capabilities can ease price pressures.

OPEC decisions also influence WTI prices. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have the power to influence global oil supplies through production agreements and output adjustments. OPEC's decisions to increase or decrease production quotas can impact WTI prices as they shape global supply levels and market expectations.

Source: visualcapitalist.com

For instance, in 2020, OPEC+ implemented significant production cuts in response to the COVID-19 pandemic's impact on oil demand. These cuts helped stabilize oil prices and support the market's recovery. Conversely, decisions by OPEC+ to increase production can lead to concerns of oversupply and potential price declines.

IV. Brent Crude Oil

Definition and explanation of Brent CFDs

Brent Crude Oil Contracts for Difference (CFDs) are derivative financial instruments that allow traders to speculate on the price movements of Brent crude oil without owning the physical asset. Brent crude oil is a type of light, sweet crude oil extracted from fields in the North Sea, primarily between the United Kingdom and Norway. Brent CFDs enable traders to profit from fluctuations in Brent crude oil prices by taking long or short positions.

Source: eia.gov/wikimedia.org

Historical background and significance of Brent

Brent crude oil has a historical background that dates back several decades. It gained prominence as a pricing benchmark for oil produced in Europe, Africa, and the Middle East. Originally, the term "Brent" referred to a specific oilfield in the North Sea. However, over time, it became synonymous with the pricing and trading of crude oil from the broader region.

The significance of Brent crude oil lies in its representation of production and supply trends in the European, African, and Middle Eastern regions. Major oil-producing nations such as the United Kingdom, Norway, Nigeria, and Saudi Arabia contribute to the Brent crude market. As a widely recognized pricing benchmark, Brent plays a crucial role in shaping global oil market dynamics.

Analysis of Brent market trends and price movements

Similar to WTI, Volatility plays a significant role in the short-term market, representing the magnitude of Brent price fluctuations within a given period. High volatility in the short term allows traders to capitalize on price swings but also increases the potential for sudden and significant losses. Whereas long-term market trends in the Brent market are influenced by fundamental factors such as global supply and demand dynamics, macroeconomic conditions, geopolitical developments, and energy policies. Long-term price movements in the Brent market are often driven by shifts in global energy consumption patterns, changes in production levels in major oil-producing regions, regulatory changes, and market sentiment.

Factors influencing Brent prices, including global supply and demand, geopolitical events, production disruptions, and economic trends

Global supply and demand dynamics play a significant role in determining Brent prices. Increased demand from emerging economies, such as China and India, can contribute to higher prices, while demand shocks or economic downturns can lead to price declines. Additionally, changes in production levels from major oil-producing nations can impact the global supply-demand balance and subsequently influence Brent prices.

Geopolitical events have a considerable impact on Brent crude oil prices. Political tensions, conflicts, or sanctions targeting major oil-producing regions can disrupt supply and create price volatility. For example, political unrest in the Middle East, such as conflicts in Iraq or geopolitical tensions between Iran and the United States, has historically led to price spikes in the Brent market.

Production disruptions in key oil-producing regions also affect Brent prices. Natural disasters, technical issues, or labor strikes can disrupt oil extraction and supply. For instance, hurricanes in the Gulf of Mexico can lead to production shutdowns, reducing supply and potentially causing price increases in the Brent market.

Economic trends and indicators play a significant role in shaping Brent prices. Changes in global economic growth, inflation rates, or currency exchange rates can influence oil demand and pricing. For example, a slowdown in global economic activity can dampen oil demand, exerting downward pressure on Brent prices. Conversely, robust economic growth can drive oil demand and support higher prices.

Additionally, market sentiment and investor behavior contribute to Brent price movements. Speculative activity, investor sentiment, and financial market trends can amplify price volatility in the Brent market. Traders and investors closely monitor economic indicators, geopolitical developments, and market sentiment to anticipate price movements and make informed trading decisions.

V. Other types of oil

A Brief explanation of other types of oil traded in the market, such as Dubai crude, Oman crude, and Bonny Light

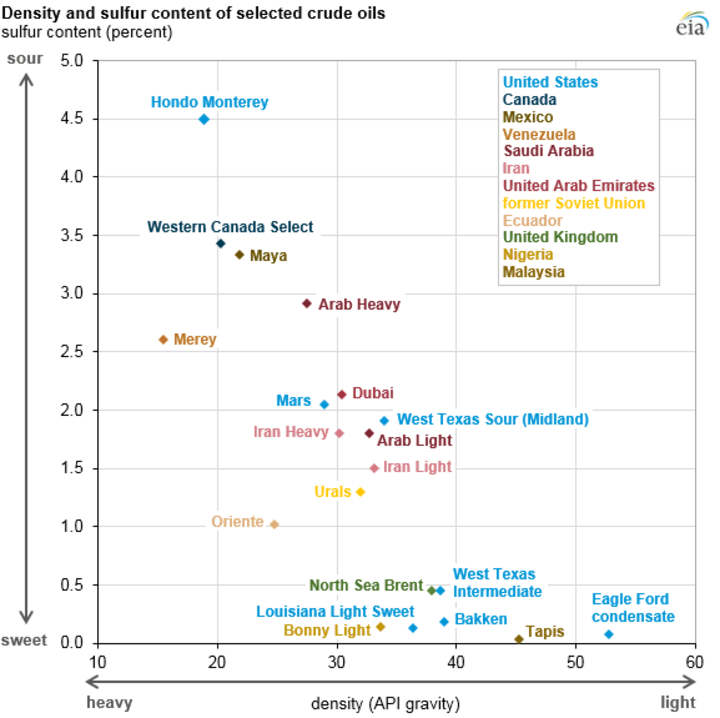

In addition to West Texas Intermediate (WTI) and Brent crude oil, there are several other types of oil that are traded in the market. These include Dubai crude, Oman crude, and Bonny Light. Each of these oil varieties has distinct characteristics in terms of production, quality, and market factors.

Dubai crude is a medium-sour crude oil that is produced in the United Arab Emirates (UAE). It is a benchmark for pricing oil from the Middle East and is often used as a reference for crude oil shipments in the Asia-Pacific region. Dubai crude is characterized by its relatively high sulfur content and medium density. The production and export of Dubai crude are influenced by factors such as OPEC production quotas, geopolitical tensions, and demand from Asian countries.

Oman crude, as the name suggests, is produced in Oman, a country located in the Arabian Peninsula. It is also a medium-sour crude oil, similar to Dubai crude. Oman crude is primarily exported to Asian markets and serves as a pricing benchmark for crude oil shipments in the region. The production and pricing of Oman crude are influenced by factors such as OPEC decisions, production levels in the Middle East, and demand from Asian refineries.

Bonny Light is a type of light, sweet crude oil produced in Nigeria, a major oil-producing country in Africa. It is known for its low sulfur content and high API gravity, which makes it a desirable crude oil variety for refineries around the world. Bonny Light is traded on the international market and is often priced differentially to Brent crude oil. Factors such as geopolitical events in Nigeria, production disruptions, and global demand for light sweet crude influence the pricing and trading of Bonny Light.

Comparison of other types of oil with WTI and Brent in terms of production, quality, and market factors

Source: eia.gov

When comparing these other types of oil with WTI and Brent, there are notable differences in terms of production, quality, and market factors. WTI and Brent are both light sweet crude oils, whereas Dubai crude, Oman crude, and Bonny Light can have varying levels of sulfur content and API gravity.

In terms of production, WTI is primarily produced in the United States, particularly in the Permian Basin and surrounding regions. Brent is produced in the North Sea, primarily between the United Kingdom and Norway. Dubai crude is produced in the UAE, Oman crude in Oman, and Bonny Light in Nigeria. The production dynamics, geopolitical factors, and investment in infrastructure differ across these regions, influencing the availability and pricing of each oil variety.

Quality-wise, WTI and Brent are known for their relatively low sulfur content and light density, making them suitable for refining into a wide range of petroleum products. Dubai crude, Oman crude, and Bonny Light can have higher sulfur content and different density characteristics, which may require additional processing in refineries.

Market factors also play a role in differentiating these oil varieties. WTI and Brent are widely recognized global benchmarks and serve as references for pricing other crude oil grades. They have established futures contracts and high trading volumes on major commodity exchanges. Dubai crude, Oman crude, and Bonny Light, while also actively traded, have different market dynamics and pricing differentials compared to WTI and Brent. Factors such as regional supply and demand, geopolitical events specific to their respective production regions, and export flows to different markets impact the pricing and trading of these oil varieties.

Trade OIL CFDs with VSTAR

VSTAR offers the opportunity to trade oil Contracts for Difference (CFDs) and participate in global commodity trading. With their institutional trading experience and platform, traders can potentially profit from the fluctuations in global commodity prices.

One of the advantages of trading oil CFDs with VSTAR is the flexible leverage they offer. Traders can access commodity CFDs with leverage of up to 1:200, allowing for greater exposure to price movements and potential profits.

The ability to take both long and short positions is another benefit provided by VSTAR. Traders can capitalize on both rising and falling markets, ensuring they never miss an opportunity to profit from oil price fluctuations.

VSTAR also offers micro and mini lots, making commodities trading easily accessible even with lower initial funds. This allows traders to participate in the market with smaller investments and manage their risk accordingly.

Trading commodities can act as a defense against inflation. As commodity prices tend to rise during inflationary periods, traders can take advantage of market movements by speculating on price changes in various commodities.

Geopolitical tensions often impact commodity markets. VSTAR provides the opportunity to profit from trading during volatile geopolitical conditions by taking advantage of both up-trending and down-trending markets. This flexibility allows traders to adapt their strategies to changing global events and potentially maximize their returns.

VI. Conclusion

A Summary of the key points discussed in the essay

In this essay, we have explored various aspects of oil trading and Contracts for Difference (CFDs). We discussed the importance of oil trading in global financial markets, highlighting how it serves as a crucial commodity that influences economies and impacts various industries worldwide.

We then delved into the two most common types of oil CFDs, WTI and Brent. We provided an overview of these benchmarks, analyzing their production, quality, and market factors. Understanding the distinctions between WTI and Brent is vital for traders, as it allows them to navigate the oil market and make informed trading decisions based on specific factors influencing each benchmark.

Furthermore, we examined the historical background and significance of WTI, analyzing its market trends and price movements. We explored the factors that influence WTI prices, including inventory levels, supply and demand dynamics, geopolitical events, and decisions made by OPEC. These insights provide traders with a comprehensive understanding of the factors that impact WTI prices, enabling them to anticipate market trends and formulate effective trading strategies.

Moving on to Brent crude oil, we discussed its definition, historical background, and market significance. We analyzed the market trends and price movements of Brent, emphasizing the importance of factors such as global supply and demand, geopolitical events, production disruptions, and economic trends. Traders who grasp these factors gain a competitive edge in navigating the Brent market and capitalizing on price fluctuations.

In addition, we briefly touched upon other types of oil traded in the market, such as Dubai crude, Oman crude, and Bonny Light. These varieties have their own production, quality, and market factors that differentiate them from WTI and Brent. Understanding the characteristics of these oil types enhances traders' knowledge and expands their opportunities in the global oil market.

Oil market size (Source: visualcapitalist.com)

Importance of understanding the different types of oil CFDs and their market factors for successful trading

In conclusion, comprehending the different types of oil CFDs and their associated market factors is crucial for successful trading. Traders need to stay informed about production levels, quality characteristics, supply and demand dynamics, geopolitical events, and other factors specific to each oil type. This knowledge empowers traders to make well-informed decisions, effectively manage risks, and capitalize on market opportunities.

Oil CFD trading is a complex and dynamic endeavor that requires continuous monitoring, analysis, and adaptation. By staying abreast of market trends and understanding the factors that influence oil prices, traders can position themselves for success in the highly competitive and lucrative world of oil trading.