I. Introduction

In the world of financial trading, success often hinges on the ability to effectively manage risk. This is particularly true when it comes to trading Gold CFDs (Contracts for Difference), where market volatility and price fluctuations can pose significant challenges. To navigate this landscape with confidence, it is essential to develop a comprehensive risk management strategy.

In this article, we delve into the intricacies of trading Gold CFDs and explore the importance of risk management. From understanding market risks to employing risk mitigation techniques such as stop-loss orders and position sizing, we provide valuable insights to help traders safeguard their capital and optimize their trading performance in the exciting realm of Gold CFDs.

Definition of trading Gold CFDs

Trading Gold CFDs (contracts for difference) are a financial activity where individuals speculate on the price movements of Gold without owning the physical asset. While it offers potential benefits such as flexibility and leverage, it also poses significant risks. CFD trading lacks transparency as it is conducted over-the-counter without a centralized exchange. Traders are exposed to counterparty risk as CFD providers may fail to honor their obligations. The use of leverage amplifies both gains and losses, increasing the potential for substantial financial harm.

Additionally, CFD trading can be highly volatile, subject to market manipulation, and vulnerable to unexpected events, making it a speculative and potentially hazardous investment choice.

The importance of understanding risks in Gold CFD trading

Understanding the risks involved in Gold CFD (contract for difference) trading is of paramount importance. Firstly, CFDs are complex financial instruments with high volatility, making them susceptible to rapid price fluctuations and substantial losses. Leverage, a common feature in CFD trading, amplifies these risks by magnifying gains and losses.

Lack of transparency in the over-the-counter market leaves traders vulnerable to counterparty risk, where the CFD provider may default on their obligations. Market manipulation and unexpected events further compound the risks. Without a comprehensive understanding of these risks, traders may face severe financial consequences, emphasizing the need for thorough education and caution in Gold CFD trading.

II. Market Risks

Explanation of market risks in Gold CFD trading

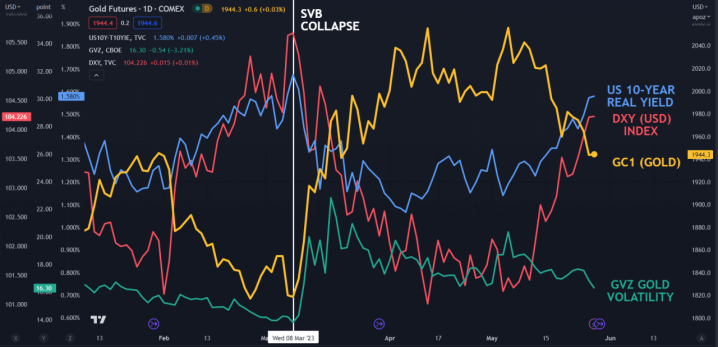

Gold CFD (contract for difference) trading entails significant market risks. Volatility is a key concern, as Gold prices can experience sharp fluctuations driven by economic, geopolitical, and sentiment factors. Such volatility amplifies both profit potential and potential losses, especially when leverage is involved. Liquidity risk arises during low trading volumes, leading to difficulties in executing trades at desired prices. Furthermore, market manipulation is a risk, with fraudulent practices distorting prices and misleading traders. To navigate these risks, traders must closely monitor market conditions, implement risk management strategies, and stay informed through reliable sources to make informed trading decisions.

A. Volatility

Gold markets exhibit inherent volatility due to various factors such as economic indicators, geopolitical events, and investor sentiment. This volatility can lead to significant price swings, presenting both opportunities and risks for traders.

Source: ig.com

For instance, if a trader opens a long position on Gold CFDs anticipating a price increase but a sudden economic downturn occurs, the Gold price may plummet, resulting in substantial losses. On the other hand, if the trader correctly predicts a geopolitical event that boosts Gold demand, they can realize substantial gains. The extreme price movements associated with Gold volatility require traders to closely monitor market conditions, apply risk management strategies, and be prepared for unexpected fluctuations.

B. Liquidity

Liquidity refers to the ease of buying or selling an asset without causing significant price disruptions. In Gold CFD trading, liquidity can fluctuate based on market conditions and trading volumes. During periods of high liquidity, traders can quickly enter or exit positions at the desired prices. However, during low liquidity periods, such as weekends or holidays, executing trades becomes more challenging.

For example, if a trader attempts to close a Gold CFD position during a market with low liquidity, they may experience delays or obtain a less favorable price due to wider bid-ask spreads. Limited liquidity can also lead to slippage, where the executed price differs from the expected price. This can result in losses or reduced profits, highlighting the need for traders to carefully consider liquidity conditions before executing trades.

C. Market manipulation

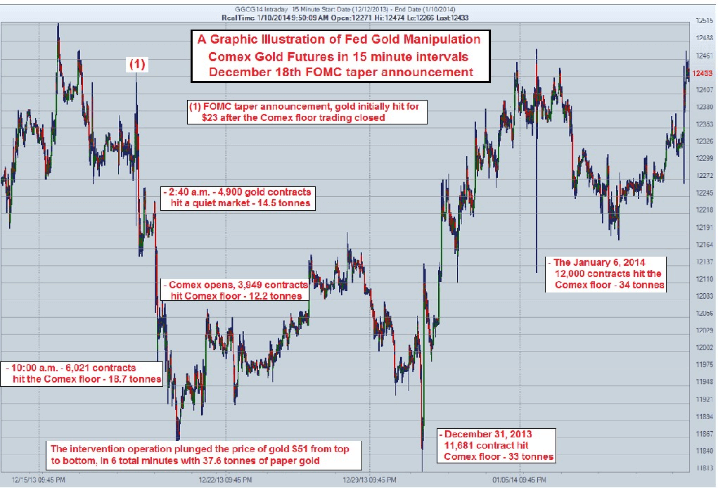

Market manipulation poses a significant risk in Gold CFD trading, as it can distort prices and mislead traders. Manipulation can involve spreading false information, engaging in fraudulent trading practices, or artificially inflating or deflating prices.

Source: nasdaq.com

For instance, a manipulator might spread rumors of a major economic crisis to drive up demand for Gold, creating false market sentiment. Traders who fall victim to such manipulation may enter positions based on inaccurate information, resulting in losses when the market corrects itself. To combat market manipulation, traders need to stay informed through reliable sources, analyze market trends and developments critically, and be cautious of sudden price movements that may be driven by manipulation rather than genuine market forces.

Impact of market risks on Gold CFD trading

Market risks have a profound impact on Gold CFD (contract for difference) trading. The inherent volatility of Gold markets can result in substantial gains or losses, making risk management imperative. Traders face challenges due to liquidity risks, such as wider bid-ask spreads and execution difficulties during low liquidity periods. Market manipulation poses a serious threat, distorting prices and undermining the integrity of trading. These risks can erode profitability, lead to unexpected losses, and harm the trader's overall portfolio. To mitigate the impact of market risks, traders must employ robust risk management strategies, stay vigilant for manipulation attempts, and adapt their trading approaches to changing market conditions.

III. Counterparty Risks

Explanation of counterparty risks

Counterparty risks are crucial factors to consider in financial transactions, including Gold CFD (Contract for Difference) trading. These risks involve the possibility of the counterparty, typically the broker or CFD provider, defaulting on their obligations. Broker insolvency can result in the loss of funds or the inability to execute trades, as seen in the MF Global bankruptcy case. Credit risk arises when the counterparty fails to fulfill contractual obligations, leading to financial losses. To mitigate counterparty risks, traders should choose reputable and regulated brokers, diversify funds, assess financial stability, and employ risk management strategies such as stop-loss orders.

A. Broker insolvency

Broker insolvency refers to the situation where the broker or CFD provider becomes bankrupt or fails to meet its financial obligations. In such cases, traders may face challenges in recovering their funds or executing trades.

For instance, if a trader has a significant amount of funds deposited with a CFD broker that becomes insolvent, they may face difficulties withdrawing their funds or recovering their investments. This can lead to financial losses and the inability to exit positions. The infamous case of the bankruptcy of MF Global in 2011 serves as an example, where clients were unable to access their funds for an extended period, resulting in substantial losses. To mitigate this risk, traders should carefully select regulated and reputable brokers, consider the financial stability of the broker, and diversify their funds across multiple brokers if possible.

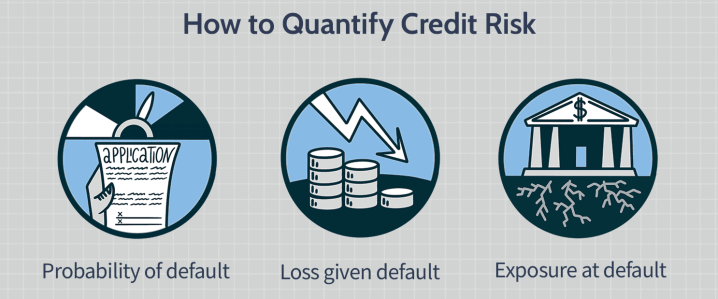

B. Credit risk

Credit risk arises from the possibility that the counterparty, typically the broker or CFD provider, may default on their contractual obligations. This includes the failure to honor trades, fulfill margin requirements, or settle transactions.

For example, if a trader enters into a Gold CFD contract and the counterparty fails to deliver the promised profits or meet margin calls, the trader may suffer financial losses. Credit risk becomes particularly relevant when trading on margin or using leverage, as it amplifies both potential gains and losses. To mitigate credit risk, traders should assess the financial health and reputation of the counterparty, consider risk management tools such as stop-loss orders, and closely monitor their positions and margin requirements.

Source: investopedia.com

How counterparty risks can impact Gold CFD trading

Counterparty risks have a significant impact on Gold CFD (contract for difference) trading. In the event of broker insolvency, traders may face challenges in recovering funds or executing trades, resulting in financial losses. Credit risk poses the danger of a counterparty defaulting on contractual obligations, leading to potential losses. Both risks can disrupt trading activities, hinder access to funds, and erode investor confidence. To navigate these risks, traders must carefully choose reliable and regulated brokers, diversify their funds, and employ risk management strategies. Vigilance and thorough due diligence are essential to mitigate the adverse impact of counterparty risks in Gold CFD trading.

IV. Leverage Risks

Explanation of leverage risks

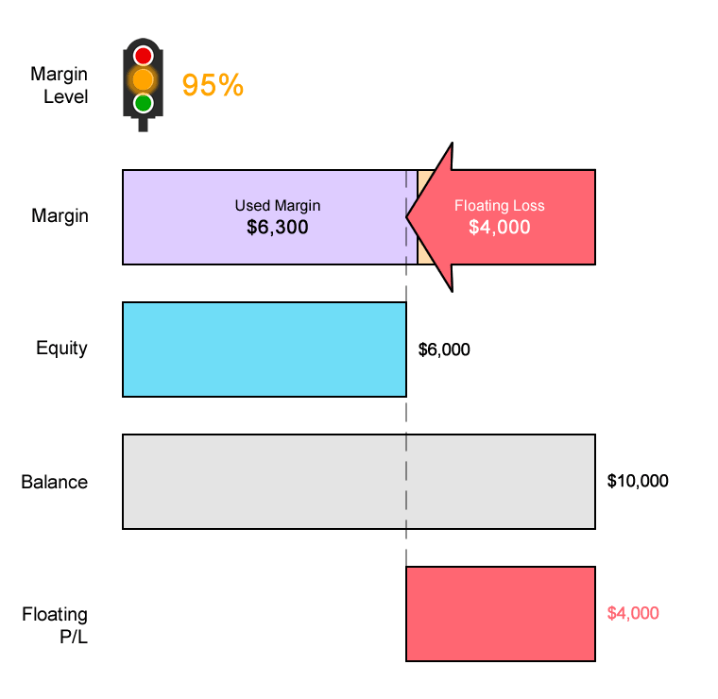

Leverage risks in trading, including Gold CFD (Contract for Difference) trading, are critical to understand. Leverage amplifies both potential gains and losses, making it a powerful yet precarious tool.

Excessive leverage increases the potential for significant losses that can surpass the trader's initial investment. Margin calls, triggered when account equity falls below a specified threshold, can force traders to deposit more funds or face position liquidation.

Overleveraging, where traders take on more leverage than their risk tolerance or available capital allow, exposes them to heightened financial vulnerability. Proper risk management, cautious use of leverage, and monitoring margin requirements are essential to navigate the inherent risks associated with leverage in Gold CFD trading.

A. Margin calls

Margin calls occur when a trader's account equity falls below a certain threshold set by the broker, leading to a demand for additional funds to meet margin requirements. Failure to meet a margin call can result in the broker closing out the trader's positions, potentially at unfavorable prices, to cover the outstanding margin.

For instance, if a trader enters into a leveraged Gold CFD trade and the market moves against their position, causing a substantial decrease in account equity, the broker may issue a margin call. If the trader fails to deposit additional funds to meet the call, the broker can liquidate the position, resulting in realized losses. This can lead to significant financial setbacks, particularly if the market reverses shortly after the forced liquidation.

Traders should carefully monitor their margin requirements, employ risk management techniques, and have sufficient funds to meet potential margin calls.

B. Overleveraging

Overleveraging occurs when a trader uses an excessively high level of leverage, exceeding their risk tolerance and available capital. While leverage can amplify potential gains, it also amplifies losses, making overleveraging a risky practice.

For example, if a trader opens multiple leveraged positions on Gold CFDs without considering the associated risks, a significant adverse market movement can lead to substantial losses that exceed the trader's initial investment. Overleveraging can quickly deplete account balances, leading to a margin call or even a complete loss of capital.

To avoid overleveraging, traders should carefully assess their risk appetite, use leverage conservatively, and set strict risk management parameters, such as position size limits or stop-loss orders.

How leverage risks can impact Gold CFD trading

Leverage risks have a profound impact on Gold CFD (contract for difference) trading. Margin calls can force traders to inject additional funds or face position liquidation, resulting in realized losses. Overleveraging, where excessive leverage is used, magnifies losses and can deplete account balances rapidly. Both risks can lead to significant financial setbacks, potentially exceeding the trader's initial investment. To mitigate leverage risks, traders must carefully manage their margin requirements, employ risk management strategies like setting stop-loss orders, and avoid overextending their positions. Prudent risk management is essential to navigate the impact of leverage risks and safeguard capital in Gold CFD trading.

V. Market Gaps and Risks

Explanation of market gaps and risks

Market gap risks refer to the potential for sudden and significant price movements that create gaps in the trading charts. These gaps can occur during periods of non-trading hours, such as weekends, or due to major news events. Market gaps can impact trading by leading to unexpected losses, missed profit opportunities, or unfavorable trading conditions.

Traders must be aware of the risks associated with market gaps and employ risk management strategies to mitigate their impact. Staying informed, monitoring market events, and adapting trading approaches are essential to navigating the challenges posed by market gap risks.

A. Weekend gaps

Weekend gaps occur when the price of an asset, such as Gold, experiences a significant jump or drop when the market reopens after a weekend. During the weekend, global events, economic data, or geopolitical developments can unfold, causing a shift in market sentiment.

For example, if there is a major geopolitical event over the weekend that triggers a surge in demand for safe-haven assets like Gold, the market may open with a substantial price gap. Traders who held open positions before the weekend may face unexpected losses or missed profit opportunities. These gaps can be challenging to manage as they occur outside of regular trading hours when traders are unable to actively monitor or react to market movements.

To mitigate the impact of weekend gaps, traders may consider implementing risk management tools such as stop-loss orders or adjusting their position sizes before the weekend.

B. News gaps

News gaps occur when a significant news announcement or economic data release leads to a sudden and substantial price movement in the market, creating a gap in the price chart.

For example, if there is an unexpected economic report indicating a sharp decline in global economic growth, the Gold market may respond with a substantial price drop, resulting in a news gap. Traders who are not adequately prepared or positioned for such news events may experience unexpected losses or missed profit opportunities. News gaps can be particularly challenging for short-term traders who rely on technical analysis or those who have placed limit orders that get triggered at unfavorable prices.

To manage the risks associated with news gaps, traders should stay informed about upcoming economic releases, monitor news events, and consider adjusting their trading strategies or positions accordingly.

How market gaps and risks can impact Gold CFD trading

Market gap risks have a significant impact on Gold CFD (Contract for Difference) trading. Weekend gaps, which occur when the market reopens after the weekend, can lead to unexpected losses or missed profit opportunities. News gaps, triggered by significant news announcements or economic data releases, can result in sudden price movements and unfavorable trading conditions.

Traders may face challenges in managing these gaps due to limited control over market movements during non-trading hours. To mitigate the impact of market gap risks, traders should stay informed, implement risk management strategies, and adjust their trading approaches to adapt to changing market conditions in Gold CFD trading.

VI. Risk Management

An explanation of risk management and its importance in Gold CFD trading

Risk management is a critical aspect of Gold CFD (Contract for Difference) trading, essential for preserving capital, minimizing losses, and maximizing returns. It involves identifying, assessing, and mitigating risks associated with market volatility, liquidity, counterparties, leverage, and other factors. Effective risk management strategies include setting stop-loss orders, diversifying portfolios, managing leverage levels, and staying informed about market conditions.

By implementing robust risk management practices, traders can protect themselves from catastrophic losses, maintain discipline in their trading approach, and improve the overall longevity and profitability of their Gold CFD trading activities. It is an indispensable tool for navigating the uncertainties and complexities of the financial markets.

Strategies for managing risks

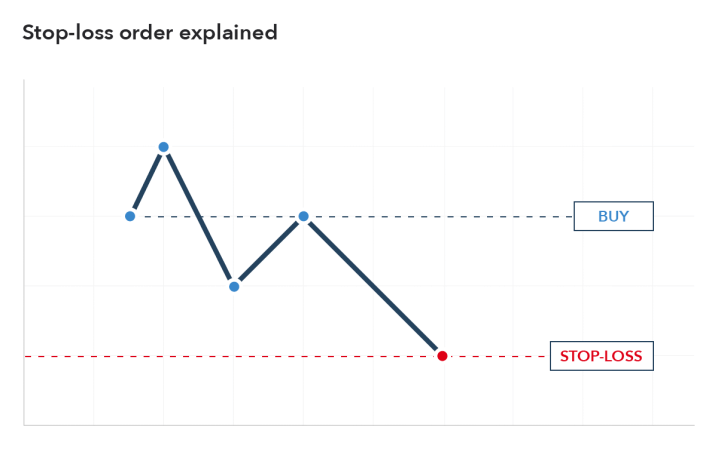

A. Stop-loss orders

Stop-loss orders are risk management tools that allow traders to set predetermined exit points for their positions. By placing a stop-loss order, a trader defines the maximum acceptable loss they are willing to bear on a trade. If the price reaches or exceeds the specified level, the order is triggered, automatically closing the position.

For instance, if a trader buys a Gold CFD at $1,500 per ounce and sets a stop-loss order at $1,480, they are limiting their potential loss to $20 per ounce. This strategy helps protect against significant losses in volatile markets or in cases of unexpected price movements. Stop-loss orders enable traders to manage their risk by ensuring that losses are controlled, even if they are unable to actively monitor the market.

B. Diversification

Diversification is the practice of spreading investments across multiple assets or markets. In Gold CFD trading, diversification involves trading different instruments or including other asset classes in one's portfolio.

For example, instead of solely focusing on Gold CFDs, a trader may also allocate funds to stocks, bonds, or other commodities. Diversification helps reduce the impact of adverse events or volatility in a single asset. If Gold prices experience a significant decline, other investments in the portfolio may perform well, offsetting potential losses. By diversifying, traders aim to minimize risk and create a more balanced and resilient portfolio.

C. Position sizing

Position sizing refers to determining the appropriate amount of capital to allocate to each trade based on risk tolerance and account size. Traders should carefully consider the size of their positions relative to their account equity and risk tolerance. For instance, a trader with a $10,000 account may decide to risk only 1% ($100) of their capital on each trade. This approach allows them to manage their exposure and limit the impact of individual trades on their overall portfolio. By appropriately sizing positions, traders can prevent excessive losses and ensure they have sufficient capital to participate in future opportunities.

Importance of having a risk management plan

These risk management strategies play a vital role in safeguarding capital and preserving long-term profitability in Gold CFD trading. Implementing stop-loss orders helps control losses and minimize the impact of adverse price movements.

Diversification reduces concentration risk and improves overall portfolio resilience. Position sizing enables traders to manage their exposure and avoid excessive risk-taking. Combining these strategies provides a comprehensive risk management framework, enhancing the likelihood of consistent and successful trading outcomes.

Having a risk management plan is of utmost importance in any trading endeavor, including Gold CFD (Contract for Difference) trading. It provides a structured approach to identifying, assessing, and mitigating risks, protecting traders from catastrophic losses, and preserving capital.

A well-defined risk management plan ensures discipline, helps traders make informed decisions, and promotes consistent and sustainable trading practices. It acts as a safety net, guiding traders through market uncertainties and unexpected events. Without a risk management plan, traders are exposed to undue risks and may fall victim to emotional decision-making, jeopardizing their long-term success in Gold CFD trading.

VII. Conclusion

Summary of learning about the risks in Gold CFD trading

Learning about the risks of Gold CFD trading is essential for traders to navigate the market effectively. Risks such as market volatility, liquidity, counterparty risks, leverage, and market gaps can significantly impact trading outcomes. It is crucial to understand these risks and their potential consequences and implement appropriate risk management strategies like stop-loss orders, diversification, and position sizing.

By being aware of the risks, traders can make informed decisions, protect their capital, and increase the likelihood of long-term success in Gold CFD trading. Proper risk management is a key factor in achieving profitability while minimizing potential losses.

The importance of taking proactive measures to manage risks in trading Gold CFDs

Taking proactive measures to manage risks in trading Gold CFDs is crucial for safeguarding capital and maximizing potential returns. By actively identifying, assessing, and mitigating risks, traders can reduce the impact of adverse market conditions and unexpected events. Implementing risk management strategies like setting stop-loss orders, diversifying portfolios, and managing leverage levels allows traders to control their exposure and limit potential losses.

Proactivity in risk management fosters discipline, enhances decision-making, and protects against emotional and impulsive trading. It is a fundamental aspect of responsible trading that empowers traders to navigate the uncertainties of the market and improve their chances of long-term success in Gold CFD trading.