If you just look at the fact that IBM Stock (NYSE: IBM) is up less than 10% over the past year, you might not see much to like about this stock. But if you look deeper, IBM may be the best hybrid cloud and AI stock to buy right now.

IBM is quietly building a thriving hybrid cloud and AI business. It's in the process of acquiring a company that has the potential to drive growth across its business, in addition to providing a big direct boost to its bottom line. Read on to find out why investors are talking about IBM stock right now.

IBM News

IBM Finds Cost of Data Breach Jumped in 2023

An IBM study has found that the average cost of a single data breach incident has increased to $4.45 million in 2023, up from $4.35 million in 2022. In 2020, the cost was estimated to be $3.86 million. The cost of a data breach has been on the rise in recent years, a sign that companies need to invest more in cybersecurity.

IBM's Q2 Earnings Beat Expectations

IBM reported second-quarter earnings per share, a key measure of profitability, that beat analysts' expectations. The EPS of $2.18 compared with the analyst estimate of $2.10. Earnings were boosted by strong sales in IBM's software division. The company reiterated its outlook for the full year 2023, which points to revenue growth.

IBM Acquires a Profitable Business With Over 1,500 Clients

In a deal valued at $4.6 billion, IBM agreed to acquire Apptio, a platform that helps large enterprises track their IT asset usage and spending. IBM is looking to Apptio to bolster its cloud business. But it also says Apptio has the potential to boost its AI and consulting businesses. Apptio is a profitable business with more than 1,500 customers worldwide.

International Business Machines Corp (IBM) Overview

Source: Pixabay

IBM Meaning

IBM (International Business Machines Corporation) is an American multinational technology giant headquartered in Armonk, New York.

Founded in 1911, IBM was originally called the Computing-Tabulating-Recording Company. The founders of IBM were Herman Hollerith, Thomas Watson, and Charles Ranlett Flint.

In the early years, IBM made calculators and typewriters. It then moved into personal computers. The company pioneered the personal computer and is one of the largest cloud providers. IBM has evolved and grown over the years through mergers and acquisitions, international expansion, joint ventures and partnerships.

IBM's current CEO, Arvind Krishna, took over in 2020. Krishna is a longtime IBM insider, having joined the company in 1990. After studying electrical engineering in college, Krishna joined IBM in the research department.

IBM shares went public in 1915. The company has a market capitalization of nearly $130 billion. IBM stock is part of the blue-chip Dow Jones index.

IBM's Top 5 Shareholders

|

IBM Stock Shareholders |

Stake |

|

Vanguard Group |

8.53% |

|

SSgA Funds Management |

5.90% |

|

BlackRock |

5.46% |

|

Geode Capital Management |

1.79% |

|

Morgan Stanley Smith Barney |

0.99% |

Who owns IBM

IBM stock is a favorite of many professional investors who continue to buy the stock on the dip. In recent months, Eurizon Capital, UBS Fund Management and Randolph have purchased tens of thousands of IBM shares.

Key Milestones in IBM's History

For a company that has been at the forefront of technological innovation for more than 100 years, IBM has achieved many milestones since its founding. These are some of the key milestones in the company's history:

|

Year |

Milestone |

|

1911 |

IBM founded as Computing-Tabulating-Recording Company (CTR) |

|

1915 |

CTR (IBM) stock goes public in an IPO that raised $5 million. |

|

1924 |

CTR rebrands to International Business Machines (IBM). |

|

2001 |

IBM becomes the first company to generate over 3,000 patents in one year. |

|

2002 |

IBM acquires PwC Consulting. |

|

2005 |

IBM sells its personal computer division to Lenovo in a restructuring step. |

|

2019 |

IBM acquired Red Hat for $34 billion to bolster its hybrid cloud business. |

IBM's Business Model

IBM runs a diversified business that provides it with multiple revenue streams. Its clients include governments, financial providers, healthcare providers, retailers, and education providers. Among IBM's various businesses, some generate more revenue than others.

How IBM Makes Money

IBM sells hardware and software products. It also offers consulting and financial services. Most of the company's revenue comes from its software business. Consulting is IBM's second largest source of revenue.

Source: IBM

IBM's Main Business Divisions

The company has organized its operations into several business divisions. Each of the divisions has a primary focus, though there are some overlapping operations across the divisions. These are IBM's main business segments:

- IBM Software: This division houses IBM's cloud computing, AI technology, and cybersecurity businesses. It accounts for more than 40% of the company's annual revenue.

- IBM Consulting: This segment helps clients with business strategy, technology implementations, and digital transformation. It accounts for about 30% of IBM's revenue.

- IBM Infrastructure: This division houses the company's hardware business, which includes sales of mainframe computers, servers, and storage systems. It also includes some cloud offerings. The division accounts for about 25% of IBM's revenue.

IBM's Financial Performance and Balance Sheet Condition

Financial performance is the signal factor that moves stocks the most. If you're wondering whether now is a good time to buy IBM stock, you should take a look at the company's financials or IBM earnings. Let's examine IBM's financial results and balance sheet strength to get an idea of where the stock might go in the future.

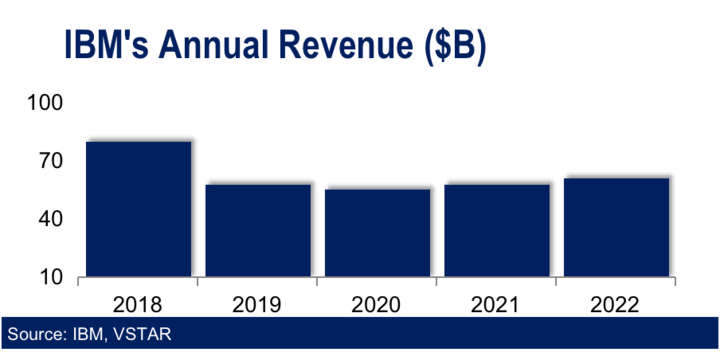

IBM Revenue

The chart above shows IBM's annual revenue trend. The company's revenue increased 5.5% to $60.5 billion in 2022, supported by strong growth in its consulting and infrastructure businesses. The company expects its revenue to grow 3% to 5% in 2023, suggesting revenue of as much as $64 billion.

In recent years, IBM has divested some of its businesses as part of its transformation efforts. The divestments can partly explain the annual revenue fluctuation.

IBM's Net Income

The company has been consistently profitable for many years, though divestitures have led to profit fluctuations in some years. In 2022, the company made a profit of $1.6 billion, adding to a profit of $5.7 billion in 2021.

In what represents a strong start to the year, IBM's profit rose 13% year over year to $1.6 billion in the second quarter of 2023.

Over the past 5 years, IBM achieved its highest annual profit in 2019, when it reported a bottom line of $9.4 billion.

IBM stock has a trailing 12-month return on equity of 10.43%.

IBM's Profit Margins

The company's gross profit margin improved to 55.9% in the second quarter of 2023 from 54.5% in the year-ago period, beating analysts' estimate of 54.7%. IBM has maintained its gross margin above 45% for the past 5 years.

IBM's Cash Position and Balance Sheet Strength

The company produced more than $10.4 billion in cash flow from operations and $9.7 billion in free cash flow in 2022.

As of June 2023, the company had $16.3 billion in cash, compared to $8.7 billion at the start of the year. It is aiming to produce $10.5 billion in free cash flow in 2023.

IBM's balance sheet shows $132 billion in assets against $57.5 billion in debt.

IBM Stock (NYSE: IBM) Analysis

IBM Stock Valuation

IBM stock currently trades at a forward P/E ratio of 14.24, a forward P/S ratio of 1.98, and a P/B ratio of 5.71. The stock has an EV/EBITDA ratio of 22.12.

|

IBM stock (IBM) |

Amazon (AMZN) |

Microsoft (MSFT) |

Accenture (ACN) |

Oracle (ORCL) | |

|

Forward P/E |

14.24 |

71.70 |

31.92 |

25.86 |

20.89 |

|

Forward P/S |

1.98 |

2.25 |

11.04 |

2.93 |

5.81 |

|

P/B ratio |

5.71 |

8.55 |

13.18 |

7.80 |

298.67 |

|

EV/EBITDA |

22.12 |

27.84 |

24.97 |

16.68 |

21.39 |

As you can see in the table above, IBM stock offers more favorable valuations than most of its peers across a variety of metrics.

IBM Stock Trading Information

IBM shares are listed on the NYSE under the ticker symbol “IBM”.

You can trade IBM stock as early as 4 a.m. ET and as late as 8 p.m. However, the regular trading session for IBM stock opens at 9:30 a.m. and closes at 4 p.m.

About 4.5 million IBM shares exchange hands on an average trading day, making it one of the most active AI stocks.

IBM Stock Split History

IBM has split its stock eight times since the IPO. The first IBM stock split was a 5-for-4 in 1964. In 1966, the company implemented a 3-for-2 reverse split. It implemented a 2-for-1 split in 1968. In 1973, IBM implemented another 5-for-4 split.

The company implemented a 4-for-1 split in 1979. In 1997 and 1999, it implemented 2-for-1 stock splits. The latest IBM stock split was a 1,046-for-1,000 in 2021.

Companies usually split their stock to make it more affordable for individual investors. When a stock becomes more affordable, demand for it can increase and drive up the stock price.

IBM Dividend

Is IBM stock a good long-term investment for dividend investors? IBM is one of the most reliable dividend stocks. Not only does it pay dividends consistently, it also pays increasing dividend amounts and offers an above-average yield.

IBM Stock Dividend History

The company has paid increasing annual dividends for the past 14 consecutive years. IBM stock currently offers a dividend yield of 4.76%, well above the industry average of 1.03%.

IBM Stock Performance

IBM Stock Price History Performance

IBM stock has traded in a range of $115 to $153 over the past year. As you can see in the chart above, $153 is also IBM's all-time high since the last stock split. At the current price of about $140, the stock has climbed more than 20% above its 52-week low, but trades at an 8.5% discount to its 52-week high.

IBM Stock Forecast

More than a dozen analysts cover IBM stock and offer a variety of insights for IBM stock price forecast. The average forecast price target for IBM stock is $146, implying an upside of 5%. The maximum IBM stock price target of $175 implies an upside of 25%. The bottom IBM stock price target of $110 implies a 20% downside.

IBM Stock Short Interest

IBM stock has a short interest of 2.96%, representing 27 million shares. The number of shares sold short is six times the average daily trading volume of IBM stock.

These are investors betting that IBM stock will fall from its current level. If the stock continues to rise, they will be forced to close their short positions. This could trigger a short squeeze that, given the large number of shares involved, could send IBM's stock price soaring for an extended period of time.

IBM Stock Technical Analysis

The chart above shows the price action of IBM stock since January, along with the 20-day SMA line (green) and resistance and support points.

In the downtrend, the chart shows that the 20-day SMA has acted as a resistance level. In the uptrend, the 20 SMA has acted as a firm support level.

After a recent consolidation period, IBM stock jumped above its 20 SMA and broke through the previous resistance level at $139. The stock's next resistance level is at $147 and a firm support level has been established at $134.

IBM's Opportunities and Challenges

IBM's Growth Opportunities

1. Cloud Computing

Many companies are moving their workloads to the cloud to take advantage of the many benefits of cloud computing. As a result, demand for cloud services is growing and the cloud market is expanding.

But the cloud computing space is highly competitive, with Amazon and Microsoft already far ahead. Instead of trying to beat these leaders at everything, IBM has decided to carve out a subset of the cloud market: the hybrid cloud. IBM is now one of the top hybrid cloud vendors. The acquisition of Red Hat greatly strengthened IBM's position in this cloud segment.

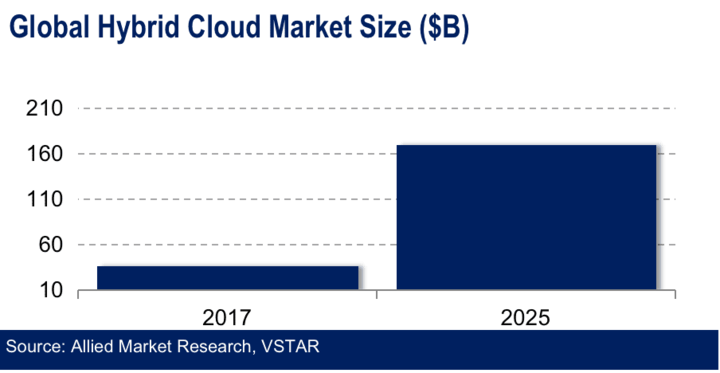

The global hybrid cloud market was valued at just over $36 billion in 2017. With a compound annual growth rate of 21%, the global hybrid cloud market is on track to exceed $170 billion by 2025, according to Allied Market Research. To capitalize on this massive revenue opportunity, IBM is expanding its cloud services offerings.

2. IT Consulting Services

Providing IT consulting services is IBM's second largest business by revenue. The company's consulting revenue will be more than $19.1 billion in 2022, up from $17.8 billion in 2021. There is plenty of room for the company to grow in this market.

Global IT consulting services revenue is expected to grow from $64 billion in 2021 to more than $100 billion by 2028, according to Proficient Market Research. Increasing adoption of digital solutions and automation of functions in healthcare, finance, retail and defense are driving demand for IT consulting services and expanding the market for IBM. The company's expanding consulting services position it well to maximize its revenue opportunities.

3. AI Technology

Those who have only been exposed to the power of artificial intelligence technology through OpenAI's ChatGPT might think that IBM has nothing to offer in the AI space. Nothing could be further from the truth. IBM has been building AI systems for many years through its Watson brand.

While ChatGPT has been a hit with consumers, hence its popularity, IBM has been quietly developing powerful AI tools for enterprise users. IBM continues to expand its AI offerings, including the recent launch of the WatsonX AI platform. MoffettNathanson analyst Lisa Ellis has called WatsonX IBM's most promising product in years.

The firm estimates that AI technology could add $16 trillion to the global economy by 2030. In addition to creating additional revenue opportunities, AI technology could also help IBM increase its operational efficiency to improve profit margins. For example, the company is exploring the use of its internally developed AI chip to reduce the cost of running its cloud service.

4. Cybersecurity Market

IBM is a major player in cybersecurity. As the threat of hacking increases and the cost of dealing with system breaches rises, many companies are investing more to strengthen the security of their systems. As a result, the demand for cybersecurity solutions is increasing, which in turn expands the revenue opportunity for cybersecurity providers like IBM.

The global cybersecurity market is on track to reach $480 billion by 2030, up from about $236 billion in 2022, according to Vantage Market Research. IBM can leverage its strong brand position, IT expertise and connections with large IT clients to capitalize on the security market opportunity.

IBM's Risks and Challenges

- Macroeconomic headwinds: Difficult economic times can mean that IBM's potential clients aren't able to spend as much as they should. That in turn limits the company's revenue opportunities.

- Forex rate fluctuation: IBM operates in more than 170 countries, and in many cases it charges for its products in the local currencies. It converts its international sales into the U.S. dollar for reporting purposes. International sales can be diminished by a stronger dollar.

- High competition: IBM's diversified business means that it faces competition on multiple fronts. These are some of IBM's major competitors and the threats they pose:

|

IBM Competitors |

Threat |

|

Accenture |

Accenture competes with IBM in the IT consulting market. IBM and Accenture compete for both clients and talents. IBM once sued its former executive who left to go work for Accenture. |

|

Dell |

Dell competes with IBM in the enterprise hardware market, especially the business of selling servers. Dell currently controls the largest share of the global server market. |

|

HPE |

Hewlett Packard Enterprise is IBM's other competitor in the server market. HPE and IBM are also rivals in the enterprise software market. |

|

Amazon |

Amazon is IBM's biggest competitor in the cloud computing market. IBM also competes with Microsoft and Google in this space. |

IBM's Competitive Advantages

1. Solid Financial Position

IBM expects to generate $1 billion more free cash flow in 2023 than it did in 2022. The company already has a large cash balance to fund its dividend program and reinvest in growing its business. IBM also has minimal debt compared to other technology companies.

2. Strong Brand Recognition

IBM has been in business for more than 100 years. Over these years, it has built strong brand recognition and established firm trust and credibility with its customers. Because of its strong brand position, IBM has an easy time introducing itself and its products to potential customers.

3. Strong Innovation Track Record

IBM is one of the most innovative companies in the world. The company has accumulated more than 150,000 patents covering a broad range of technology areas. The massive patent portfolio is the result of IBM's heavy investment in research and development efforts.

4. Diversified Business

IBM runs several business divisions and covers a diverse range of industries. Moreover, IBM's business is geographically diversified across America, Europe, Asia, and Africa. Diversification is a smart way to mitigate risk. For example, the company can still deliver revenue growth even if some of its businesses or markets aren't doing well.

5. Strong Partnerships

IBM has built a robust ecosystem of partners. These partners bring various strengths that complement IBM's efforts in various areas, such as helping to improve products and attracting and retaining customers. In fact, IBM has been good at turning competitors into partners. For example, IBM has found a way to work with Amazon and Accenture despite their competing interests.

Why Traders Should Consider IBM Stock

IBM is a large technology company with a long history of profitability and a generous dividend distribution. It has substantial cash to invest in driving future growth.

The company is a leader in the hybrid cloud computing market and has the potential to dominate the enterprise AI market.

IBM stock currently trades at a substantial discount to its all-time high and IBM stock predictions show that it has impressive upside potential.

If you're looking for the best cloud stock or the best AI stock, IBM is worth considering. These are the common ways you can make money with IBM stock:

1. Long-Term Investment Strategy

This strategy involves purchasing and holding IBM shares for one year or longer. With this type of investment, you are eligible to receive dividends. However, you will need a large initial investment and will have to wait a long time for returns.

2. Short-Term Investment Strategy

This investment method provides light exposure to IBM stock. It allows you to earn profits over short periods of time and requires little initial capital. CFD trading is a type of short-term investment method that is quickly becoming popular because it is flexible and allows you to profit in both bull and bear market conditions.

Trade IBM Stock CFD with VSTAR

If you're ready to start trading IBM stock CFD, consider using VSTAR. Designed for traders of all levels, VSTAR offers a low-cost trading platform with tight spreads and no commission accounts.

The platform also has low minimum capital requirements. You can start trading IBM stock CFD on VSTAR with as little as $50. VSTAR offers generous leverage, allowing traders to increase their positions.

For its effective risk management features and prompt customer support, VSTAR has received excellent ratings on the Trustpilot review site.

Getting started with VSTAR is fast and easy. Open your free VSTAR account today and start trading IBM stock CFD. The platform offers new traders up to $100,000 in a demo account to practice trading.

Final Thoughts

Many investors seeking the best cloud stock or the best AI stock to buy now may overlook IBM (NYSE: IBM). But IBM could be a highly rewarding stock for both long-term investors and short-term traders. The company has solid financials, a stable management, plenty of growth opportunities, and the stock forecast reveals substantial upside.

You can have the best of both worlds with IBM stock. You can trade IBM stock CFD for short-term profits and hold IBM shares for long-term returns.

FAQs

1. Is IBM a Buy, Sell or Hold?

The consensus analyst rating on IBM stock is Hold. While IBM has stabilized revenue and earnings after years of decline, growth is expected to be modest.

2. What is IBM target price?

The average analyst price target for IBM stock is $153. Price targets range from $115 on the low end to $195 on the high end.

3. What is the dividend on IBM stock?

IBM's forward dividend yield is about 4.8%. On an annualized basis, the dividend payment is $6.60 per share.

4. When has IBM stock split?

IBM has split its stock eight times since the IPO. The first IBM stock split was a 5-for-4 in 1964. The most recent IBM stock split was a 1,046-for-1,000 in 2021.