Introduction

The Federal Reserve attempts to clearly communicate its monetary policy intentions through its FOMC meeting statements and releases in order to influence various expectations in the markets and the economy. These expectations can affect various aspects of business investment, consumer spending, the stock market, the bond market, and the foreign exchange market. The Fed hopes to achieve its monetary policy goals by managing these expectations. Therefore, it is important for investors to learn to analyze the implications associated with FOMC meeting.

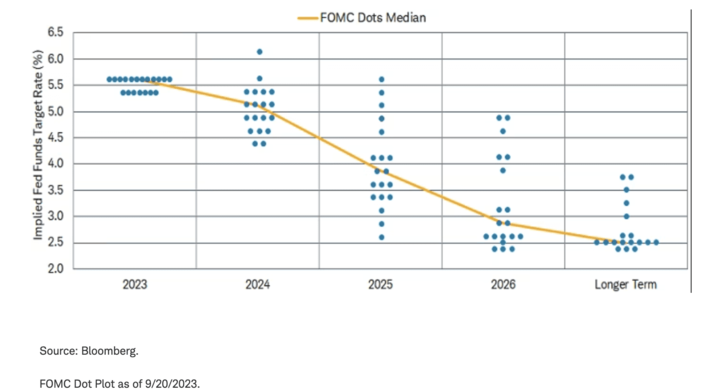

On September 20, 2023 EST, the U.S. Federal Reserve (Fed) decided to keep interest rates at their current levels, but expects to raise them again before the end of the year. Fed Chairman Jerome Powell continued to insist that the 2% core inflation target remains unchanged, but expressed concern about the possibility of a gradual slowdown in the U.S. economy (a so-called "soft landing"). According to the latest dot plot, the Fed plans to implement a tighter monetary policy by 2024 than previously expected, and the likely rate cut in 2024 has been reduced to 50 basis points from 100 basis points previously. U.S. stocks saw sharp swings in late trading following Powell's speech.

Chart: The Federal Open Market Committee's dot plot suggests that interest rates could stay higher for longer.

Background and Significance of the Birth of the Federal Reserve and FOMC Meeting

In the early twentieth century, the United States experienced a series of financial crises and inflation, events that triggered the need for reform of the U.S. financial system. The most famous of these were the stock market crash of 1929 and the ensuing Great Depression, and the hyperinflation of the late 1970s and early 1980s.

In 1933, the United States took a number of steps to stabilize the financial system, including the abandonment of the gold standard and the establishment of a fiat currency system in which the dollar was no longer pegged to gold. This gave the Federal Reserve more flexibility to implement monetary policy.

In 1935, the U.S. Congress passed the Federal Reserve Act, which formally established the Federal Reserve to provide stability and regulation to the U.S. financial system.

Once established, the Fed began using monetary policy tools to control the money supply and interest rates in order to stabilize inflation, promote employment, and maintain financial stability. The rate-setting meetings became one of the key institutions for formulating these policies.

The FOMC typically meets several times a year, including regular meetings and special meetings as needed. The meetings are attended by members of the Federal Reserve Board, including the Chairman of the Federal Reserve, other members of the Federal Reserve Board, and the presidents of the regional reserve banks. Together, they discuss current economic conditions, assess inflation risks and employment conditions, and then decide whether interest rate policy needs to be adjusted to achieve economic objectives. The transparency and openness of this process is critical to the U.S. economy and financial markets because it provides market participants and investors with important information about the future direction of monetary policy.

For the market, the rate-setting statement, the economic outlook report, and the chairman's speech at the press conference are all windshields to explore the Fed's stance. In the Federal Reserve FOMC official website can check the previous FOMC meeting statement, meeting calendar and other information:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

Chart: Federal Reserve FOMC Official Website

Expectations Management by the Federal Reserve

The Fed manages market and economic expectations through its rate-setting meetings, primarily in the following ways

Adjustment of interest rate policy: At the FOMC meeting, the Fed decides whether to adjust short-term interest rates, specifically the federal funds rate. This rate guides the entire financial market because it affects other short-term and long-term interest rates. When the Fed decides to raise interest rates, market participants typically expect higher financing costs in the future, which may reduce borrowing and investment activity. Conversely, if the Fed decides to lower interest rates, the market may expect cheaper financing, which may encourage borrowing and investment.

Issue a policy statement: After each interest-rate meeting, the Fed releases a policy statement that reflects the views of the members at the meeting and the results of their decisions. This statement typically includes an assessment of current economic conditions and hints about future monetary policy. Market participants pay close attention to these statements for clues about the Fed's future policy direction.

Post-meeting press conference: The Fed Chairman typically holds a press conference after a policy meeting to explain to the public the rationale and background for the policy decision. This conference provides more detailed information that helps the market and the public better understand the Fed's policy intentions.

Economic Outlook Report: Each year, the Fed publishes the Economic Outlook Report, which provides a long-term outlook for the economy and monetary policy. This report helps market participants understand Fed officials' views on the future direction of the economy and inflation expectations.

Analysis of the September 2023 meeting as an example

Website for the minutes of the September 2023 FOMC meeting:

https://www.federalreserve.gov/monetarypolicy/fomcpresconf20230920.htm

Chart: FOMC Meeting Statement (September 2023)

Comparing FOMC meeting statements

Analysts often compare the most recent statement with the previous one to examine the Fed's approach to its goals for inflation, employment, the economy, and financial markets.

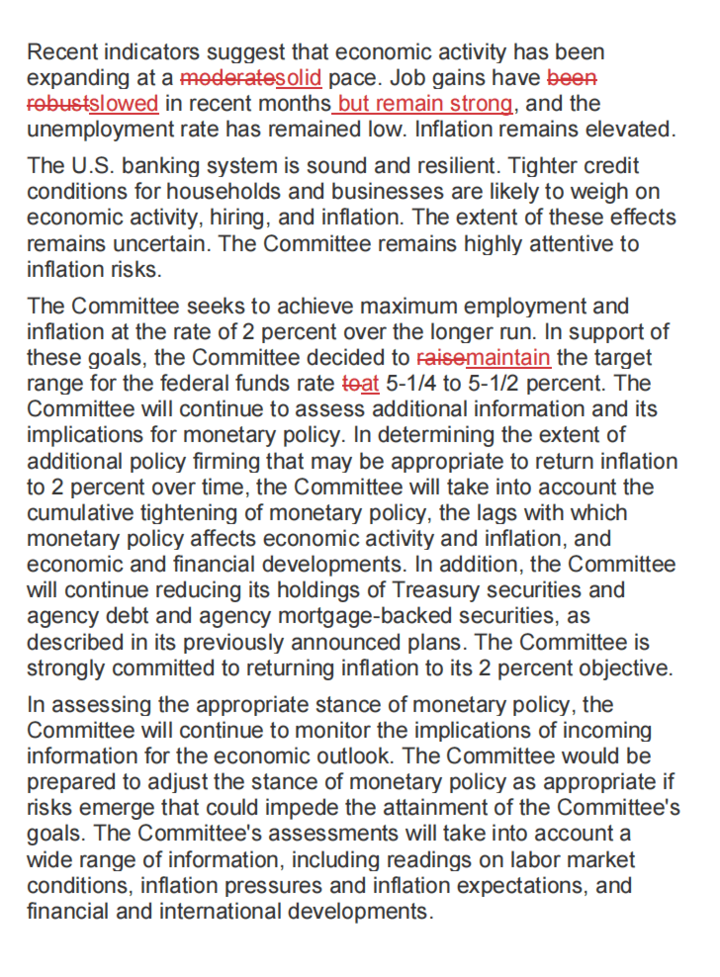

Chart: Highlights of the revised part of the statement

For example, the Federal Open Market Committee (FOMC) statement in September noted that economic growth is expanding at a "solid" pace, compared with the previous statement, which described it as "moderate." This shows that the Fed believes that economic growth is still strong, the impact of interest rate hikes on the economy is still controllable, but also for its view that the economy and can provide the basis for a soft landing.

In addition, the statement changed the description of the labor market, emphasizing that job growth has "slowed" rather than the last mentioned "strong". The Federal Reserve according to the Phillips curve to determine the employment and inflation trends, the labor market heat decline is conducive to reducing inflation, therefore, the Federal Reserve judgment labor market cooling, rate hike is expected to reduce.

In describing inflation, the Fed indicated that inflation remains high, which should not be surprising given that most inflation data remain well above the Fed's target. Since the Fed's monetary policy goals are price stability and full employment, lowering inflation has become relatively the most important goal and the goal to focus on when setting policy in the absence of a crisis in the labor market.

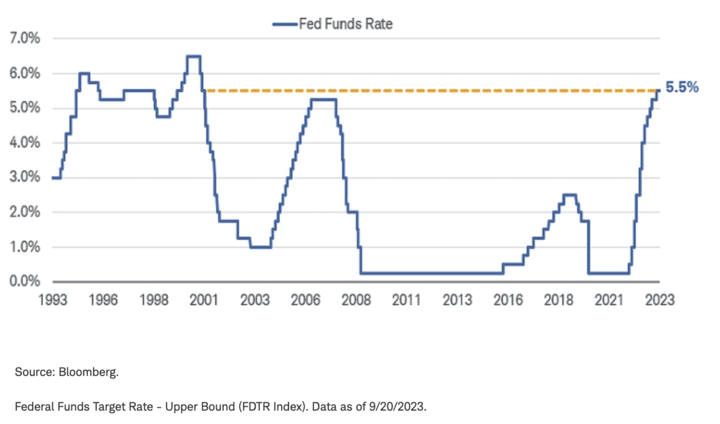

Chart: Federal Funds Rate Capped at 5.5%, Highest Since 2001

Economic Outlook Report Analysis

Original Economic Outlook Report published in September 2023:

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20230920.htm

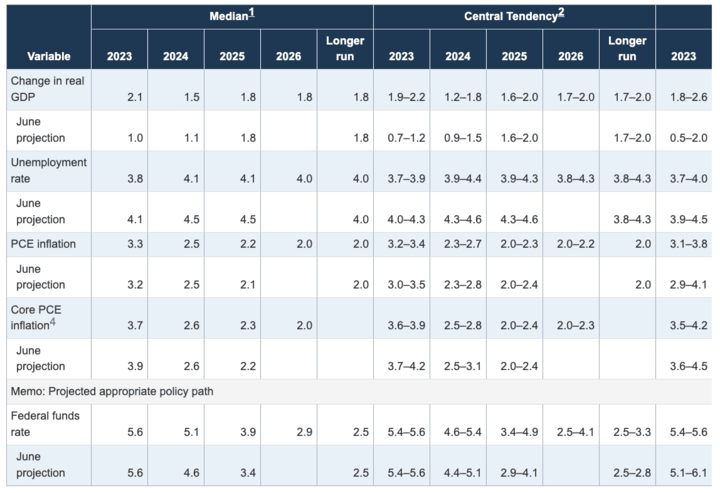

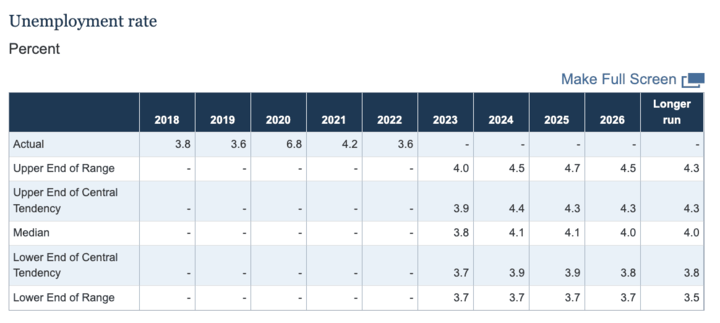

According to the Economic Outlook Report, the FOMC is optimistic about the outlook for the U.S. economy. U.S. GDP growth expectations for 2023 were revised up to 2.1 percent from the 1.0 percent expected in June, and U.S. GDP growth expectations for 2024 were revised up to 1.5 percent from 1.1 percent; the unemployment rate is expected to be 3.8 percent in 2023 and 4.1 percent in 2024, with the long-term rate in the range of 3.8 percent to 4. The PCE is also expected to be much lower, at 3.8 percent in 2023, down from 4.1 percent in the previous period; core PCE is expected to be a bit higher than in the previous period, revised up to 3.3 percent from 3.2 percent, but is projected to reach 2.6 percent in 2024, and both PCE and core PCE are expected to reach the 2 percent target in 2026.

Figure: Comparison of Forecasts for Key Economic Data and Changes in the Economic Outlook Report for the September 2023 FOMC Rate Meeting

Median expectations for core PCE inflation from 2023 to the end of 2025 are also 3.7 percent, 2.6 percent, and 2.3 percent, respectively, while median expectations for the unemployment rate from 2023 to the end of 2025 are 3.8 percent, 4.1 percent, and 4.1 percent, respectively.

Chart: FOMC Unemployment Rate Forecast

Economic Outlook Report of these economic data expected subtle changes, reflecting the Fed's observation of the market and the economy, the Fed will be based on these changes to do policy adjustments, market investors should also pay attention to these data forward-looking data to deal with the Fed may make policy adjustments.

Chart: FOMC Core PCE Forecast

Powell Speech Analysis

Fed Chairmen at different times have had very different styles when it comes to delivering speeches and views on managing market expectations.

For example, Alan Greenspan was known for his unique speaking style during his tenure as Fed Chairman. He tended to express his views in cautious terms to avoid triggering market instability or misleading investors. This caution was part of his policymaking philosophy. Greenspan often used ambiguous language in his speeches to preserve policy flexibility and avoided being too explicit about the future direction of monetary policy, preferring instead to provide general guidance. This made it less easy for markets and observers to discern his policy intentions, thus preserving greater policy leverage for him.

There are similarities between Powell and Greenspan. They both approach monetary policy and the economy in a prudent and cautious manner, preferring to avoid policies that create market instability or are overly aggressive. Both Chairmen emphasize data-driven decision making. They carefully analyze economic data and trends to better understand current economic conditions and future risks. Both Chairmen value transparency and seek to communicate clear policy intentions to the markets and the public.

The difference is that Greenspan is a distinguished economist with extensive experience in economic research, while Powell has a background in finance and has worked in the private sector. These two different backgrounds will influence their views and decisions on the economy and financial markets.

In the conference following the release of this statement, Powell's main points were that: the decision to be made at the last two meetings of the year would depend on the totality of the data taken together; there was never any intention to signal the timing of any rate cuts, and that there would be a time to do so when it was appropriate.

On the level of interest rates: to keep interest rates unchanged in the range of 5.25%-5.5%, but to retain the wording of "additional policy tightening", and to continue the tapering program. Therefore, in addition to the impact of interest rate hikes, investors should also pay attention to changes in the Fed's balance sheet, and the impact of tapering on liquidity should not be underestimated.

On the interest rate outlook: the FOMC dot plot shows that interest rates will also be raised during the year, indicating a high probability of a rate hike at the November rate meeting. The potential rate cut for the next year has fallen from 100 bps to 50 bps, i.e. the likelihood of a rate cut in 2024 has halved. Expectations for rates in 2026 are 2.9%, which is higher than long-term expectations, meaning high rates are likely to remain higher for longer. Powell said he would raise rates further if appropriate,; has no intention of signaling on the timing of any rate cuts; the neutral rate may have risen and may be higher than the long-term rate - for which the market is starting to trade lower in anticipation of a rate hike.

On the outlook for inflation: Powell said he remains committed to returning inflation to 2%. The dot plot raised PCE inflation expectations slightly for 2023, but lowered core PCE expectations; the inflation target of 2% is expected to be reached in 2026. Continued high energy prices will affect inflation expectations, but Powell tends to ignore the short-term supply and demand of energy food caused by price fluctuations, that is, more attention to the core PCE trend, so investors should also pay more attention to this indicator.

On the economic outlook: will be this year's U.S. GDP growth is expected to be raised from 1% to 2.1%, the whole line of 2023-2025 unemployment rate is expected to be lowered; in recent months, job growth has slowed, but still strong. Powell said will not be a soft landing as a basic expectation, but regarded as the main goal.

As expected, the Fed left its key policy rate - the federal funds rate - unchanged at a range of 5.25% to 5.5% in September, but said there was consensus for another rate hike later this year. The most important message from the Fed is that it will keep interest rates high until inflation falls. This "longer-term high" message reflects the Fed's high degree of uncertainty about how to keep inflation low.

Possibility of a soft landing

The Fed uses "expectations management" as a means of regulating economic activity, which determines the tone of every statement and speech. Fed performance hawkish (more concerned about inflation rather than the economy) or dovish (more concerned about the economy rather than inflation), mainly out of expectations to guide the target, rather than an inevitable fulfillment of the "plan" or "promise.

The current Powell hawkish attitude, on the one hand, is in the process of curbing inflation rate rises and downsizing at the same time, it is impossible not to affect the economy and employment. But in the Federal Reserve to maintain price stability and full employment "dual objective" background, monetary policy can not give up on the economy and employment concerns and appropriate protection. If inflation can make substantial progress, is expected to reach the target, the Federal Reserve is likely to consider a pause in interest rate increases, or even start the pace of interest rate cuts. Therefore, the next step is to continue to pay attention to changes in the labor market and core PCE and other inflation indicators.

On the other hand, aggressive rate hikes could trigger financial market risks and then a recession. Every time the market has priced in a soft landing, the result has usually been a recession.

The U.S. real economy is often highly correlated with financial market conditions, the Federal Reserve through the tightening and easing of monetary policy, affecting the willingness of financial institutions to lend, corporate financing and other credit activities, and ultimately transmitted to real economic activity.

We can focus on the Chicago Fed's weekly index of financial conditions to determine the degree of tightness in the current financial environment. It is composed of 105 financial market indicators in the U.S., and each indicator is disaggregated into three contributing factors: risk, credit and leverage, to measure the U.S. money market, bond and stock markets, as well as the status of the traditional banking system and shadow banking system, with the higher value representing the higher risk of financial conditions, which can be used as a leading indicator of U.S. real economic activity (leading by about 1 ~ 2 quarters).

The Chicago Fed's adjusted National Financial Conditions Index suggests that U.S. financial market conditions will reach their tightest level in nearly a decade by the end of 2022 (excluding the "dollar drought" at the beginning of the 2020 epidemic). The current level is still tight, but has been rising, so the Fed may judge that financial market risks are still at safe levels, supporting expectations of a soft landing.

In addition, Wall Street has recently become more concerned about the risk of US corporate debt. As the Federal Reserve is expected to continue raising interest rates, U.S. corporate bond yields will rise and risk appetite will continue to decline.

Corporate bond yield refers to the yield of investment grade corporate bonds, commonly used Moody's credit rating Aaa grade, Baa grade bond yields as a representative of investment grade bonds. Prime rate refers to the lowest interest rate offered by U.S. banks to customers with the highest credit rating, while the rest, such as mortgages and loan rates are usually lent at this prime rate plus a certain percentage, and banks can earn more on the spread between them.

Corporate bonds for the higher profits of high-risk assets, and Treasury bonds for safe-haven assets, in the boom expansion stage, funds will be more preferential corporate bonds, capital inflows into corporate bonds, resulting in corporate bond prices, corporate bond yields fell, the spread leading the long and short-term Treasury bond spreads narrowed, and to the end of the boom stage, the interest rate hike led to a rise in the federal funds rate, the corporate bond spreads will be the first to turn the negative low-grade for the U.S. bond spreads for the long and short of the leading indicator.

If the Fed continues to raise interest rates while maintaining a tight monetary policy, the U.S. corporate bond market may continue to sell risky assets and chase safe assets, the resulting financial risks cannot be ignored. We believe that the Fed and the market should remain flexible, the uncertainty of the economic and inflation situation to remain modest, to avoid excessive fear of inflation, economic data to remain optimistic at the same time also overlook the other extreme - market risk.