Deere & Company (NYSE:DE), commonly known as John Deere, has established itself as a powerhouse in the agricultural and construction equipment industry. The company's fundamental strengths and data-driven performance reveal its rapid value growth potential. In this detailed analysis, we'll delve into specific factors and financial metrics that underpin Deere's capacity for value growth as of Q3 2023.

Robust Financial Performance

Impressive Operating Margin: Deere's operating margin is a fundamental indicator of its profitability. In the third quarter, Deere achieved an operating margin of 22.6% for equipment operations. This is a remarkable figure, signifying efficient cost management and pricing strategies.

Strong Revenue Growth: Deere's financials indicate significant revenue growth. Net sales and revenues increased by 12% to reach $15.801 billion (Q3 2023). The net sales for equipment operations, a core business segment, surged by 10% to $14.284 billion. Such substantial revenue growth is indicative of strong market demand and effective business strategies.

Profitability: Deere reported a net income of $2.978 billion, which translates to $10.20 per diluted share. This demonstrates the company's capacity to generate substantial profits, which are essential for value growth.

Market Demand and Fundamentals

Sustained Industry Demand: The persistent demand for both farm and construction equipment, underscoring Deere's growth potential. Both the agricultural and construction industries are experiencing robust demand, leading to full order books and strong retail demand. This surge in demand bolsters Deere's growth prospects and indicates a resilient market.

Positive Customer Sentiment: Positive customer sentiment is a critical factor supporting Deere's growth. Satisfied customers are more likely to make repeat purchases and recommend the brand to others, contributing to increased sales and brand loyalty.

Solid Order Visibility: There is a solid order visibility in both the agricultural and construction equipment sectors. This visibility allows Deere to plan its production and inventory effectively, minimizing operational risks.

Segment Performance

Production & Precision Ag: This segment posted a strong performance with an impressive operating margin of 26.2% for the quarter. Such a high margin signifies efficient operations and pricing strategies, making a substantial contribution to Deere's overall profitability.

Small Ag & Turf: Despite a 3% increase in net sales, the segment achieved a remarkable 19.6% operating margin. This performance underscores Deere's ability to manage costs efficiently and maintain high profitability.

Construction & Forestry: This segment recorded a 14% increase in net sales and an operating margin of 19.1%. The strong performance in this segment is driven by effective price realization and improved shipment volumes, further strengthening Deere's financial position.

Regional Growth and Diversification

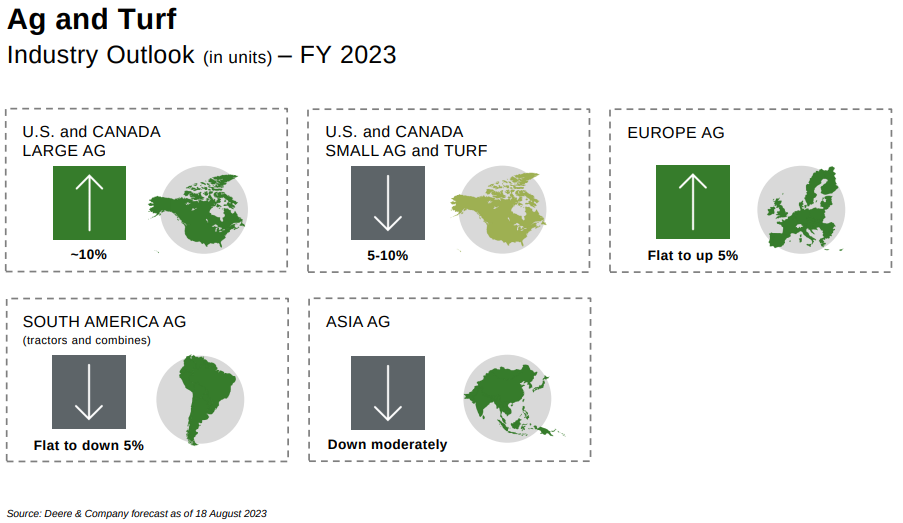

Global Market Presence: Deere operates in multiple regions, including the U.S., Canada, Europe, South America, and Asia. This diversified geographical presence helps the company mitigate risks associated with regional economic fluctuations and political uncertainties.

Predictable Growth: The company's ability to forecast market conditions and order books in various regions allows for predictable and strategic resource planning. This minimizes operational disruptions and enhances its capacity for sustained growth.

Outlook and Projections

Positive Industry Outlook: Deere's projections for the agricultural and turf markets globally are highly optimistic. For example, they anticipate a 10% increase in large ag equipment sales in the U.S. and Canada, reflecting strong demand and healthy market fundamentals.

Continuous Improvement: Deere forecasts further growth in its segments, with the Production & Precision Ag segment expected to maintain strong performance with a 20% increase in net sales for the fiscal year.

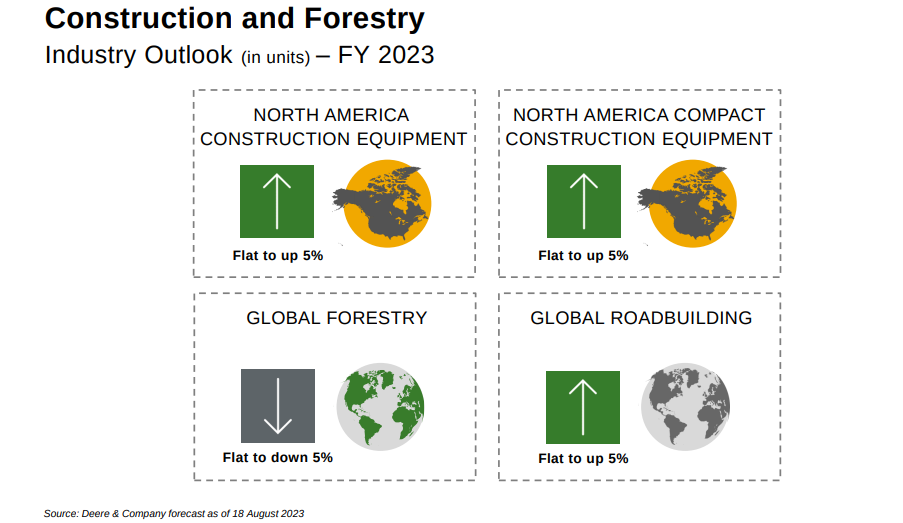

Construction & Forestry Outlook: Despite market fluctuations, the Construction & Forestry segment is expected to grow between 15% and 20% in 2023. This indicates that Deere's growth is not an isolated occurrence but part of a broader, sustained trend.

Source: Q3 2023 Earnings Call

Effective Cost Management

Deere's success in managing costs efficiently is evident. Q3 2023 highlights lower-than-expected production cost inflation, which positively impacts margins. This robust cost management is essential for maintaining profitability and sustainable growth.

Customer Loyalty and Repeat Business

Deere's factories operated smoothly, resulting in a return to normal seasonality. Meeting customer commitments and delivering products on time is essential for building and maintaining customer loyalty. Satisfied customers are more likely to choose Deere for future purchases and recommend the brand to others.

In summary, Deere's rapid value growth potential is grounded in its robust financial performance, high operating margins, solid market demand, efficient cost management, diversified global presence, positive industry outlook, and strong customer loyalty. These specific fundamental strengths and data-driven indicators position Deere as a company with the potential for sustained growth and value creation in the agricultural and construction equipment industry.

The technical perspective on the weekly price moves of DE stock can be comprehended as follows:

Source: tradingview.com