Kinross Gold Corporation has enjoyed stable growth and the backing of investors since it was founded back in 1993 because assets like gold are seen as the best investments to reduce risks facing your portfolio. It also helps that Kinross is a dividend-paying company and has returned millions for investors over the years.

Like any other market, the rising interest rates and fear of recession have impacted gold prices which in turn negatively affected companies like Kinross that rely majorly on gold production. However, with its strong Q1 2023 report, investors' confidence is up again and Kinross expects to keep the moment going throughout 2023. Now the big question is: should I buy Kinross gold stock and will it see any meaningful growth in 2023? Let's find out if this is the gold stock to buy.

Background

Kinross Gold Corporation is a Canadian-based gold and silver mining company. It was founded in 1993 by Robert Buchan and headquartered in Toronto, Ontario, Canada.

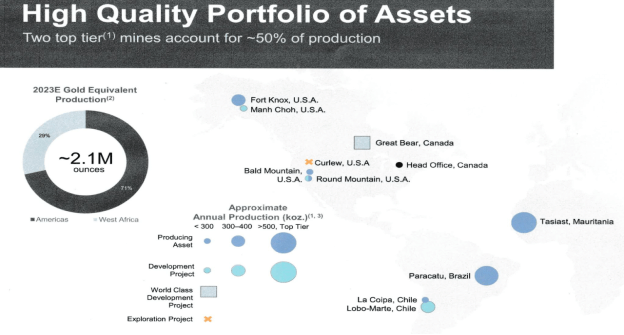

It currently operates six active gold mines in North and South America as well as West Africa. It also owns about 58% of gold production in the Americas and is rated as one of the top gold-mining companies in the world with J. Paul Rollinson as its CEO.

Source: NXTmine

Business Model and Services

Kinross Gold has a diverse portfolio of mining properties and mostly engages in the extraction and processing of gold and silver ore. Its exploration activities are majorly carried out in Canada, the United States, Brazil, Mauritania, and Chile. The gold and silver found in its mines are then shipped to refineries for final processing.

Products and Services

The company majorly supplies gold ore to refineries with a little bit of silver. It produced around 2 million gold equivalent ounces in 2022 and is aiming to produce 2.1 million in 2023.

Source: Seeking Alpha

Financials and Growth

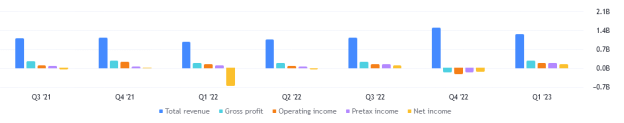

Kinross Gold saw a 32.59% increase in its year-over-year revenue after bringing in 929.3 million in its first quarter and still plans on exceeding expectations as the year goes by. Its annual revenue from 2022 was also a 32.91% increase from the previous year bringing in $3.5 billion for the year. Kinross's P/E ratio of 33.31 is also a 26.78% increase from the previous year mainly due to higher gold prices. After taking a beating in 2021, the company is gradually showing that it can still be profitable.

All in all, Kinross had a strong balance sheet compared to its peers with cash and near-term receivables at 479.5 million. Its total liquidity is around $1.8 billion and $2.59 billion of debt an increase from $1.63 in 2021.

Source: Tradingview

Key Metrics

Investing in gold stocks remains a go-to method for investors because of the relative stability in prices that gold has enjoyed over the years. But with the heightened volatility in gold prices, it is important to pick the company with the most potential and stability.

Kinross is a senior gold producer with a market cap of $7.2 billion but its rivals Barrick Gold and Franco-Nevada Corp are much larger with a market cap of $42.4 billion and $37.50 billion respectively. However, in terms of revenue growth and net income, Kinross is doing much better than its counterparts as both areas have grown by 32.59% and 117.22% respectively. Franco, on the other hand, is struggling to maintain profitability as its YoY revenue and net income growth are down by 18.45% and 14.01% respectively. The same applies to Barrick Gold with its YoY revenue and net income growth down by 7.36% and 72.6%.

So, is Kinross gold undervalued compared to its peers? It seems so. Despite Kinross having a better balance sheet than its two biggest competitors, these companies are still trading better than KGC stock making it relatively undervalued.

KGC Stock Performance

Trading Information

Primary exchange & Ticker: NYSE: KGC

Listed: Kinross was first listed on the Toronto Stock Exchange and NASDAQ in 1993 and was later listed on the New York Stock Exchange in 1994.

Country & Currency: CA (USD)

Trading Hours: Pre-Market hours (4:00 - 9:30 am ET) and the After Hours Market (4:00 - 8:00 pm)

Stock Splits: Kinross Gold stock has only undergone one stock split. The 1:3 split happened in February 2003.

Kinross gold stock dividend: 0.03 USD quarterly dividend amount

Latest Developments Investors/Traders Should note

Great Bear Project

In a little over a year since acquiring the project Kinross Gold has done a substantial amount of work and has drilled over 250 kilometres. They have already detected high-grade gold deposits and are working to convert the area into an open-pit underground mine that will provide long-term benefits for the company.

Q1 2023 Earnings

Kinross Gold's earnings report for the first quarter of 2023 exceeded investors' expectations in so many ways and also improved kinross gold stock outlook for 2023. The company’s net earnings of $90.2 million or $0.07 per share beat Zacks Consensus Estimate of $0.05 per share and also surpassed its Q1 2022 earnings of $0.06 per share.

Source: Tradingview

Additional purchase of Arion shares

Kinross Gold purchased additional stocks from Aurion Resources Ltd to maintain its leadership position of 9.98%.

Overview of KGC Stock Performance

Overall Kinross gold stock price has increased 34.55% in the last 5 years and 10.39% year to date. But it hasn't been able to get back to its recent high of $10 in 2020 and fell even further in 2022 due to the losses the company experienced. But it picked up once again and rose to a near 52-week high of $5.46 after its Q1 earnings for 2023.

Now trading at $4.70, analysts are not too hopeful about the company’s growth in 2023. While they reported that their mines are still on target to meet their production goals, Kinross's annual production growth rate is not impressive and it is expected to remain at 2.1 million and 2 million ounces per year for 2024 and 2025 respectively.

It is also dealing with higher operational costs because of its investment in the Great Bear Project while maintaining its dividends and buying back its shares. Despite its near-term challenges, Kinross gold analysis still puts it as one of the best gold mining stocks to purchase given the company’s reputation as one of the largest gold producers.

Key Drivers of KGC Stock Price

Stock is highly sensitive to gold prices

There may be no immediate risks to Kinross's capital returns but since the majority of their earnings comes from the production of gold, it is highly sensitive to changes in the price of gold. Its cost per ounce remained above its peers at $1,321 but if the price of gold were to drop further, Kinross could reduce its dividends because of the effect the drop would have.

Low Gold production

In general Kinross Gold has a good Q1 2023 but it also marked the lowest gold production the company has had in years with production down by nearly 35% in 5 years.

Source: StockNews

Analysis of Future Prospects of KGC Stock

Kinross Gold has some lucrative opportunities on the way like its 24k project and the Solar Plant that are both set to be operational this year. The company is also improving on its other assets like Round Mountain and Fort Knox. Even though it might take a while to get back to the days of 2.5 million ounces, at least its current projects will keep production relatively stable.

So is Kinross gold stock buy, hold or sell? Kinross gold stock rating from Zacks Investment Research is a B mainly because of its recent price changes and earnings estimate. Wall Street analysts have also deemed KGC a hold and Kinross gold stock forecast for 2023 has its growth at $6.04.

Risks and Opportunities

Risks

Competitors: Kinross Gold competitors include companies like Semafo, Yamana Gold, Barrick Gold Corporation, and Agnico Eagle.

Recent Losses:Kinross Gold is majorly controlled by institutional investors owning up to 74% of the company. If Kinross Gold stock continues to suffer losses this year, these institutional investors may want to sell the stock which could hurt individual investors.

Dividend payment doesn't appear sustainable:Kinross Gold is one of the dividend-paying companies but it paid out 97% of its free cash flow as dividends which is not great. If this happens again this year, the company may not be able to sustain its dividend payment.

Opportunities

Large gold producer: The company is one of the largest gold producers with a diversified portfolio of development projects and mines.

Growth in the Canadian Market: Kinross Gold aims to produce 466,022 ounces of gold this year and with their recent expansion projects, the company can meet that goal.

Optimizing existing operations: Two of the company’s mines Tasiast and Paracatu have gradually increased their production capacity since the start of the year and continue their exploration program at Great Bear in Ontario.

Future Outlook and Expansion

Kinross Gold has big plans for 2023 and beyond and has started putting some of its plans into action. Its Tasiast 24k project is still on track to produce 24,000 tonnes per day in mid-2023. The company is also developing the Manh Choh project in Alaska where it has a 70% stake. Kinross gold stock price prediction for 2024 sees it remaining relatively stable at $5.93.

Source: Mining.com

How to Profit from KGC Stock as a Trader

Types of Profit Strategies

Short-term v Long-term strategies

Short-term trading strategies like scalping, swing trading, and CFDs, mainly deal with price action because the goal is to make profits from quick changes in Kinross gold stock market price. If you want to be a short-term trader, it is important to understand that it is a very time-intensive process that sometimes requires you to execute several trades in seconds or minutes, which can be hectic. So, remember to use tools like take profit targets and stop-loss orders to protect your capital.

Long-term trading strategies, on the other hand, require the use of key fundamentals about the company. Long-term trading strategies work best for stocks like KGC because the stock market has historically risen more than inflation and other economic conditions.

When trading long-term, it is important to use techniques like dollar averaging or position sizing to reduce the level of risk you face.

Technical Analysis Strategies

Technical analysis involves analyzing charts and price trends to discover the most profitable trading opportunities. Performing Kinross gold stock analysis involves the use of indicators like the pennant, flag, heads and shoulders, and triangles. When examining the price chart, it is also important to learn to spot candlestick patterns like doji and hammer because they can provide strong Kinross gold stock buy or sell signals and show you where the market is heading.

Source: EXCO Trader

Fundamental Analysis Strategies

While technical analysis focuses on trends identifiable on a chart, fundamental analysis involves research on the financial status of the company.

Fundamental analysis majorly requires that you do a lot of research on the company and general industry situations. For instance, you would have to look out for kinross gold news and see what sot of events could heavily impact the company.

Implementing Profit Strategies for KGC Stock

Making a profit trading KGC Stock or any other stock for that matter requires patience, consistency, and discipline. To become a master trader you should:

Set realistic goals: Understand that it will take you a while to get to the level you want especially as a beginner. Also, remember that no matter how good you are at trading, losses are bound to happen.

Develop a trading plan: This helps with discipline but it is a good way to evaluate your trading habits and see what needs fixing or improving.

Execute trades with discipline: Follow the strategy strictly and have a steady pattern when it comes to trading.

Common Mistakes to Avoid

Emotion-based trading: There shouldn't be room for panic or fear when trading. It is hard to completely block out your emotions but try to remain as objective as possible when trading.

Over-trading: Overtrading can affect your overall performance and eventually lead to massive losses. The best way to beat overtrading is to exercise self-awareness and always stick to your risk management tools when trading.

Lack of flexibility: It is good to have a steady strategy to rely on but it should still give you enough room to pivot in different market situations.

Trade KGC Stock CFD at VSTAR

Traders have chosen VSTAR as their go-to platform for trading KGC stock due to its competitive pricing and reliability. You immediately gain access to over 1000 markets and high leverage to avoid missing out on lucrative opportunities in the stock market or any other financial market of your choosing.

Want to make a profit in seconds? Sign up to VSTAR and start trading now!

Conclusion

The growth of Kinross Gold is highly dependent on the stability of gold prices and this is something to keep in mind if you plan on investing. The company’s projects are going great but it may take some time before its production capacity is back to its glory days.

However, the company’s long-term fundamentals are good and it remains a viable investment if are not concerned about immediate profits.