I. Recent Micron Stock Performance

Micron Offers A Steady Earnings Growth

In the wake of strong Nasdaq:MU financials, Micron stock continued to rise, supported by a steady stream of favorable evaluations from analysts. Achieving share price benchmarks exceeding the dot-com bubble period signifies a momentous achievement.

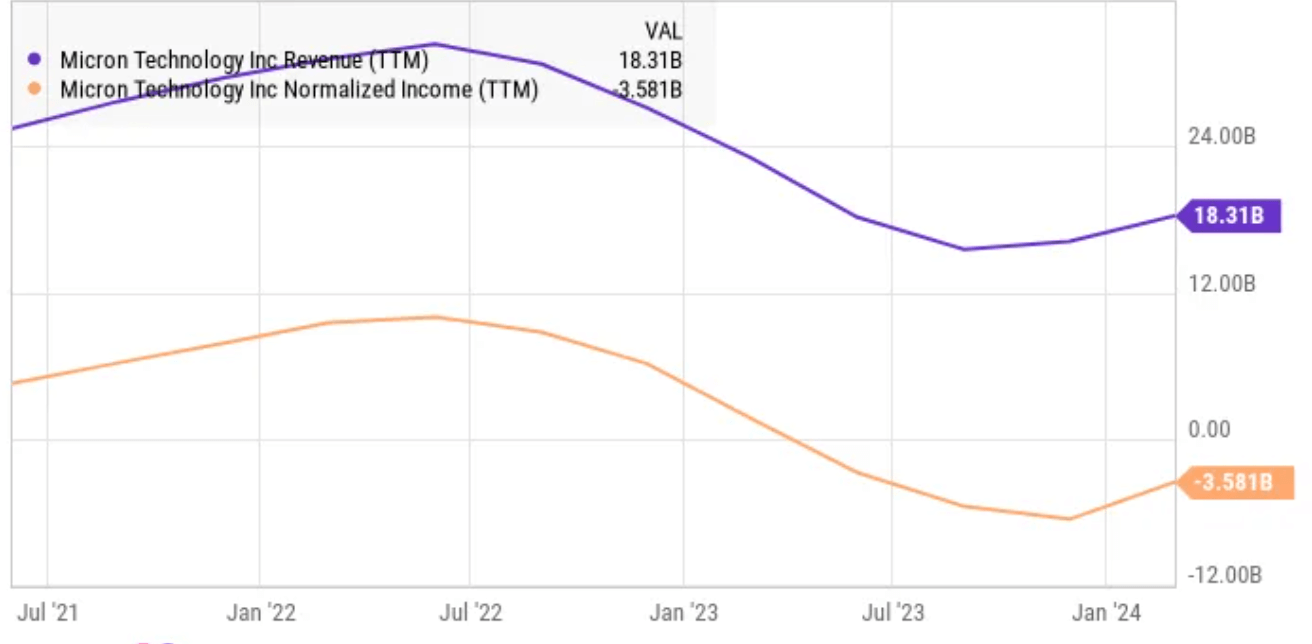

Notwithstanding this surge, Micron's operational performance is multifaceted. Although current sales and earnings are increasing, they will experience a protracted decline in 2022 and 2023.

In this paradoxical situation, Micron stock soared to all-time highs despite recent sales declines and negative MU earnings for the past 12 months. Optimistic investors are placing significant faith in the prospective expansion of sales associated with artificial intelligence.

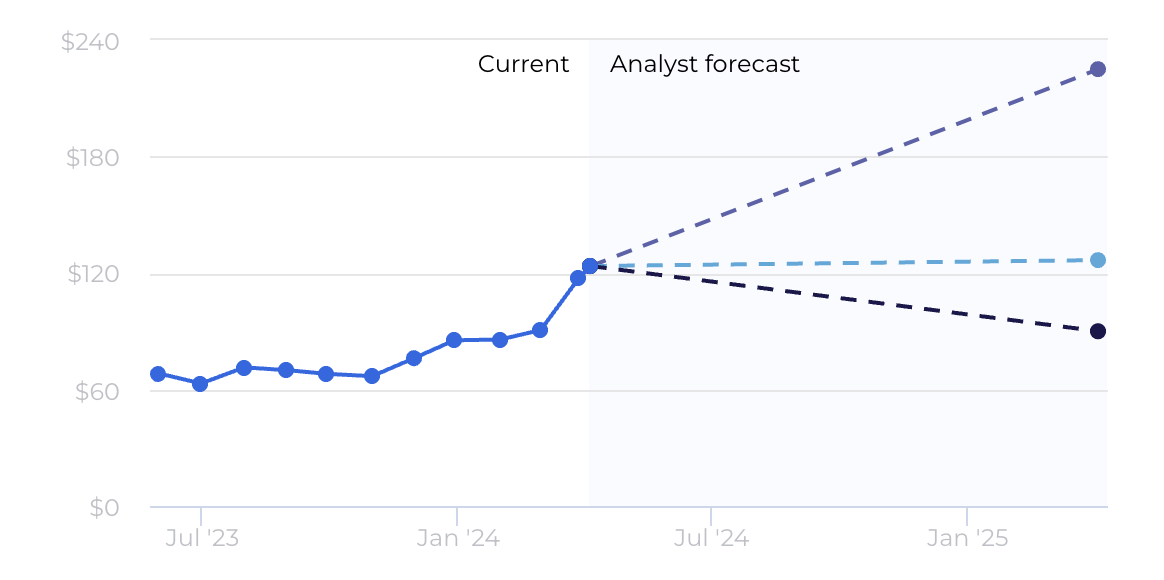

Analysts Are Optimistic About MU

Micron Technology (MU) 's stock value significantly increased to an all-time high in March 2024, following Bank of America analysts increasing their Micron stock price target. Analysts emphasized Micron's favorable standing after the surge in artificial intelligence (AI).

Bank of America classified Micron, Marvell Technology (MRVL), and Advanced Micro Devices (AMD) as "junior samurAI," which are entities that exhibit promise in the field of artificial intelligence, in line with industry frontrunners Nvidia (NVDA) and Broadcom (AVGO).

The analysts observed that each "junior samurAI" trades at a valuation premium compared to its respective leader, indicating the possibility of heightened stock volatility. They emphasized that as the AI market expands, these junior actors will be able to carve out lucrative niches.

According to the analysts, Micron is in a favorable position to increase its market share in the high-bandwidth memory (HBM) sector, potentially surpassing Korean competitors, due to the increased demand for HBM in AI technology.

Bank of America increased its Micron price target from $120 to $144, maintaining a "buy" rating, considering these prospects.

Micron Stock (MU) Outperformed Nasdaq 100

Micron Stock (MU) is a Nasdaq 100 component that recently caught the attention of investors due to its remarkable growth in 2023.

The stock has grown 107% in the last year, while the Nasdaq 100 provided a 39% gain, much lower than the MU. The ongoing surge in artificial intelligence and Micron's shift in this direction were key to the price growth. Moreover, the stock has more room for upside, which means a buying opportunity from the near-term area could be from a cheaper price.

Expert Insights on MU Stock Forecast for 2024, 2025, 2030 and Beyond: Micron Stock buy or sell?

MU stock surged due to its shift to the artificial intelligence sector, which might take the price above the current all-time high level. Before proceeding to the MU stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about MU stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$198 |

$245 |

$400 |

|

Coincodex |

$ 211.30 |

$154.39 |

$478.56 |

|

Stockscan |

$120.03 |

$137.91 |

$210.83 |

II. MU Stock Forecast 2024

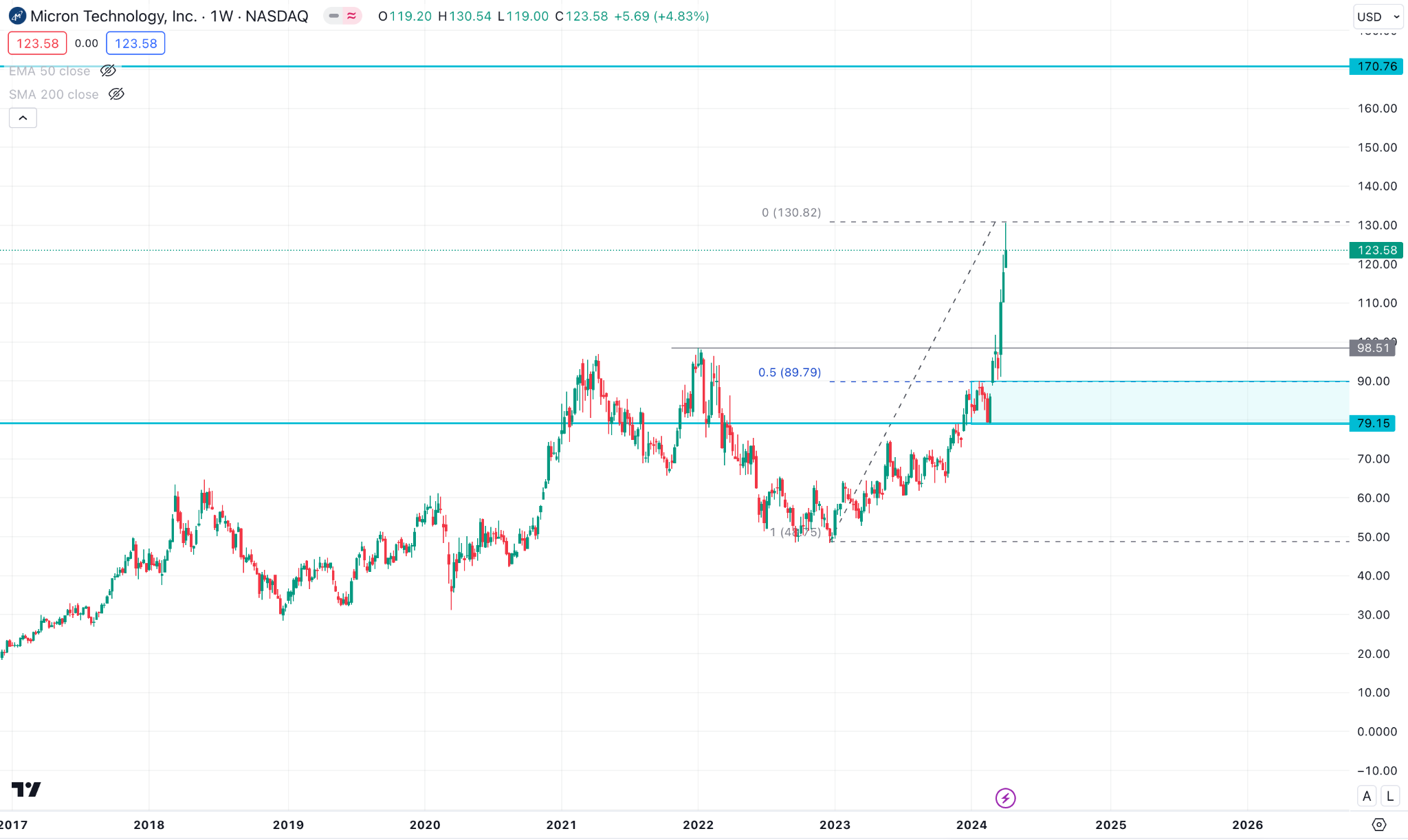

As per the ongoing bullish impulse in the weekly price, MU peaked at the crucial Fibonacci Extension level, where a decent downside recovery might happen in 2024. Considering the bearish rejection at the ceiling, the price could likely move down at the close of the year at the 100.00 area.

In the weekly MU chart, a prolonged bullish momentum is visible, whereas a bullish overextension is visible at the multi-year high. Considering the Fibonacci indicator from 98.75 high to 48.54 low, the 161.8% Fibonacci Extension level is at the 129.79 level, which suggests a top of the current context.

As the recent price reached the crucial Fibonacci Extension level, with a strong gap with the 50-week EMA, we may expect a bearish recovery in the coming weeks. Moreover, the 200-week SMA is also below the current price of the 50-EMA line, which suggests a confluence bullish signal. In that case, a downside recovery is potent but, it might not be enough to consider it a trend reversal.

Based on the MU Stock Forecast 2024, investors should monitor how the price trades at the current Fibonacci Extension level. A bearish weekly signal from this area could lower the price towards the 100.00 psychological level. However, a bullish recovery is possible from the 120.00 to 98.00 zone, which needs a solid recovery with a stable market above the 50 EMA line. In that case, the buying pressure might extend above 150.00 by the end of 2024.

Let's see what other indicators say about MU Stock Forecast 2024:

- MACD: In the weekly chart, the MACD Histogram maintained a bullish momentum while the signal line remained overbought. It is a sign of ongoing buying pressure, which could resume after having a decent bearish correction.

- Ichimoku Cloud: The ongoing buying pressure is potent above the Ichimoku Kumo Cloud, where the current Kijun Sen support is at 97.28 line. As the current price overextended above the Chikao Span Line, a downside recovery is possible to the 98.00 area. However, an extensive downside pressure below the 78.94 level could be a bearish signal, targeting the 50.00 line.

- Relative Strength Index (RSI): In the current reading, the Relative Strength Index (RSI) peaked by maintaining a strong bullish position above the 70.00 overbought line.

A. Other Micron Stock Forecast 2024 Insights: Is Micron a good stock to buy?

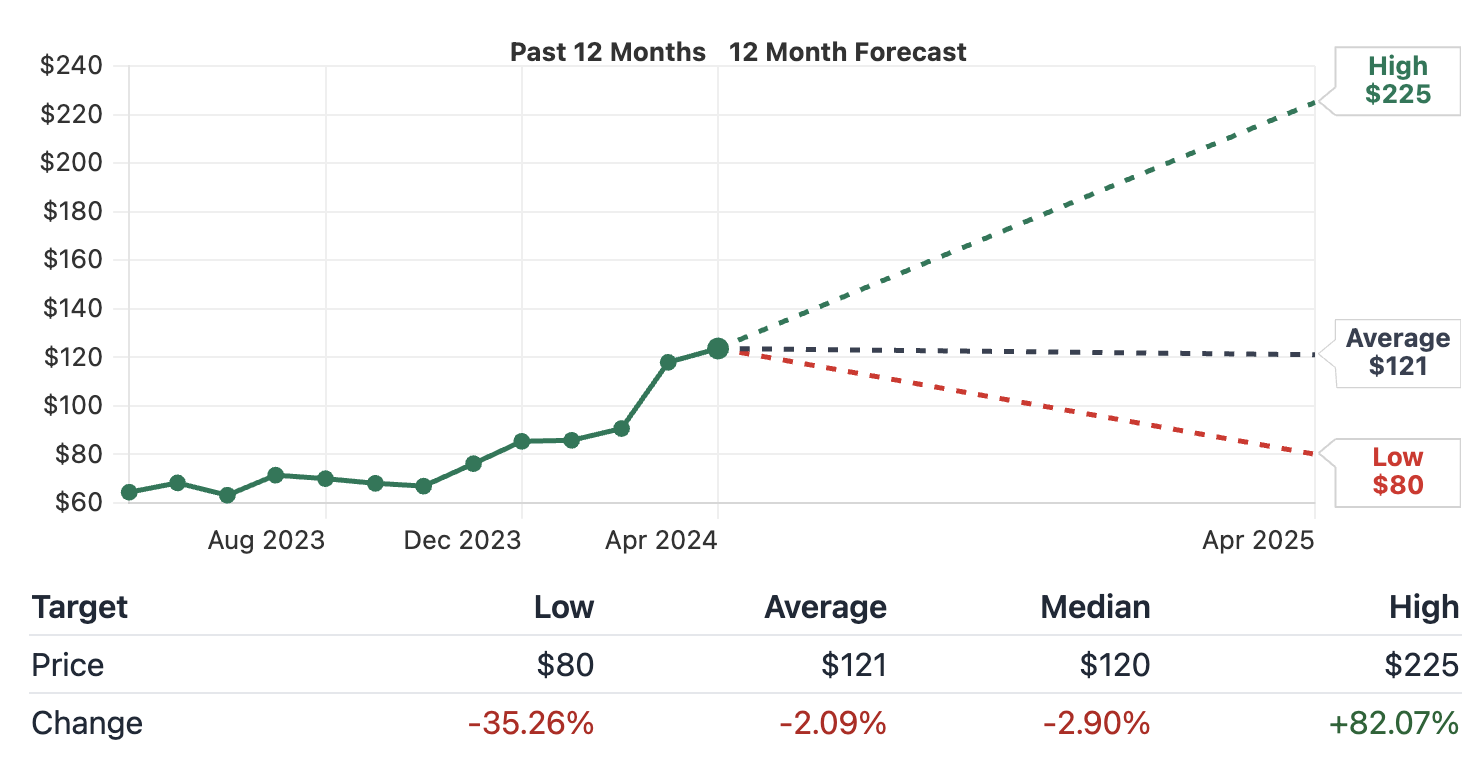

According to a report from Stock Analysis, the 26 analysts who have provided 12-month price forecasts for Micron Technology stock report a mean target price of 121. Their estimates vary substantially, from a minimum of 80 to a maximum of 225. By adhering to this average MU target price, the current stock price of 123.58 would experience a marginal decline of -2.09%.

As per the report from Nasdaq, C.J. Muse, an analyst at Evercore ISI, increased the MU price target from $90 to $100 and assigned it a "strong-buy" rating after the company's Q1 results. Similarly, Aaron Rakers, an analyst at Wells Fargo, reaffirmed his "buy" rating on Micron, citing the company's optimistic financial and operational prospects.

B. Key Factors to Watch for MU Stock Forecast 2024

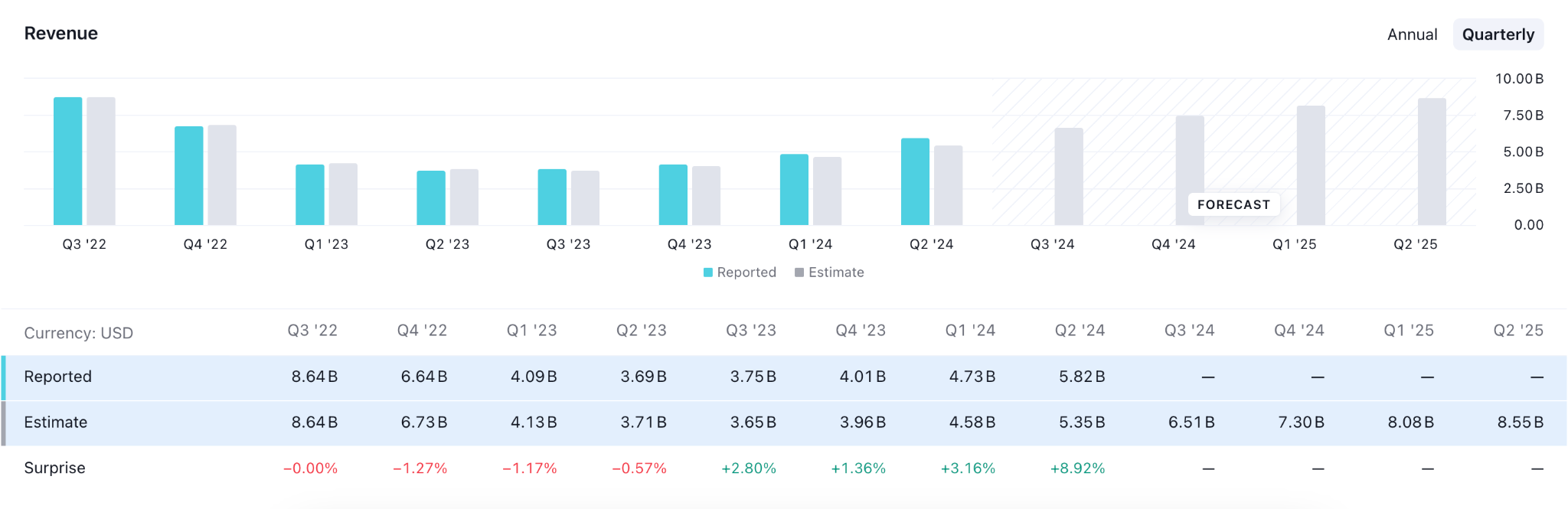

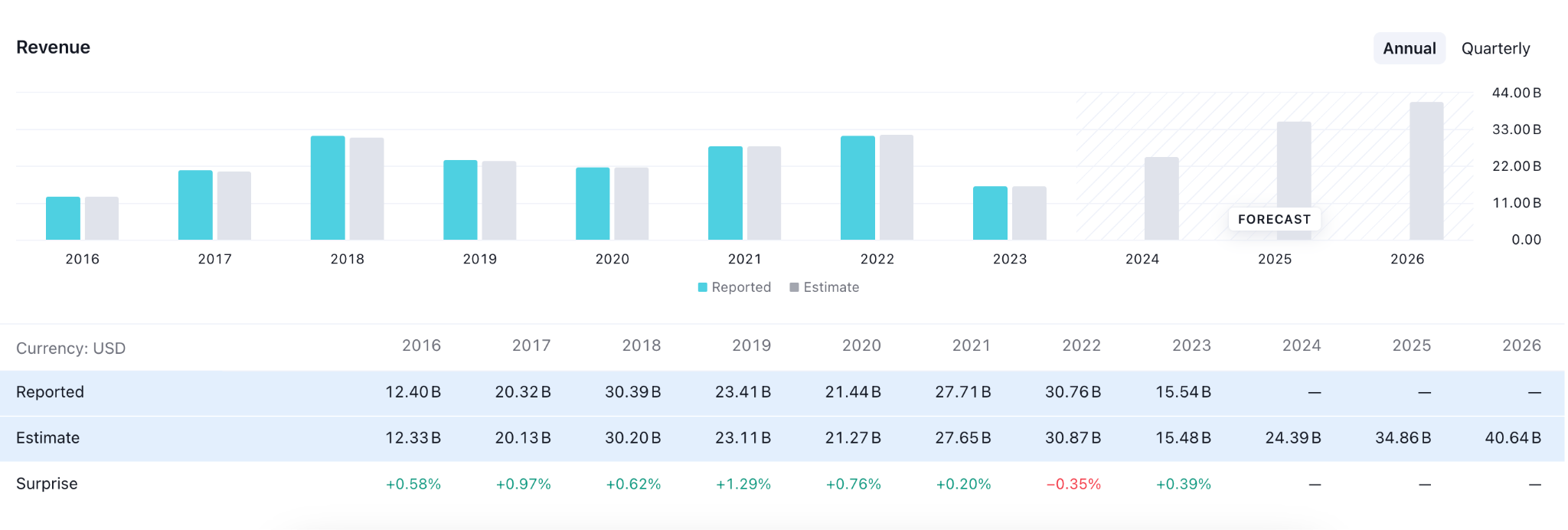

Micron Revenue Growth Looks Impressive

Source: stockanalysis

Micron experienced a notable financial recovery in the first quarter of fiscal year 2024, as evidenced by its outstanding performance. The company achieved a noteworthy 16% year-over-year increase in total revenue to $4.73 billion for the quarter that concluded on November 30. This figure surpassed consensus estimates by $94.7 million and was fueled by improved pricing dynamics. Sequentially, revenue increased by a robust 18%.

Micron is a company that functions in four separate business segments. Among these, the Compute and Networking Business Unit has witnessed exceptional development, with a 45% sequential increase in revenue. This increase can be attributed to the escalating shipments of AI-related services to clients and data centers.

The Mobile Business Unit experienced sequential revenue growth of 7%, driven primarily by the smartphone market's resurgence. Embedded Business Unit revenue increased sequentially by 21% due to robust expansion in most of Micron's end markets. In contrast, the Storage Business Unit experienced a 12% decrease in revenue compared to the preceding quarter.

Management's Opinion On Micron Stock (MU)

Micron forecasts that the demand for DRAM bits will increase at a compound annual growth rate (CAGR) in the mid-teens in the future years, whereas the demand for NAND bits will increase at a CAGR in the low-20s.

By analyst projections, management expects fiscal year 2024, the second quarter, to generate $5.3 billion in revenue (plus or minus $200 million). In addition, the quarter's gross margin is anticipated to be approximately 13% (plus or minus 150 basis points), with narrower losses of $0.28 per share (plus or minus $0.07) as opposed to $1.91 per share in the prior year's corresponding quarter.

Analysts forecast a revenue increase of 48% to $22.9 billion for the entire fiscal year 2024. This growth trend is anticipated to continue in fiscal year 2025, when revenue will increase by 38% annually to $31.7 billion. Profitability is anticipated by analysts for the company by fiscal year 2025. Micron is an attractive growth stock at its current price of three times its forward-projected 2025 sales, particularly in light of its AI-related growth prospects.

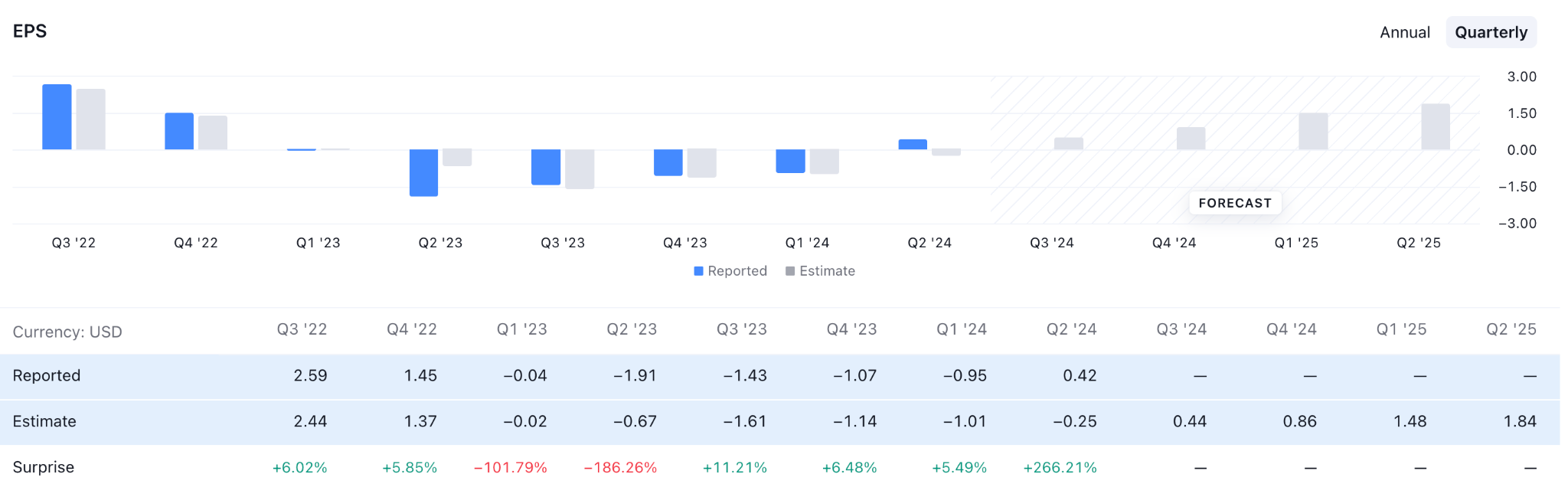

MU EPS Forecast of 2024

According to the current analyst's project, MU's quarterly earnings per share have upward traction, which might extend the momentum in the coming quarters.

The above image represents MU's forecasted EPS for 2024. Q4 2024 could generate $0.86 a share, which is higher than the last three years' average.

Micron Stock Forecast 2024 - Bullish Factors

Micron is poised to benefit from robust demand for memory chips across various sectors, including data centers, smartphones, and automotive electronics. As digital transformation accelerates globally, the need for memory chips rises, providing Micron with a steady revenue stream.

As per the above image, the expected growth rate for the Memory chip market is 6.9% per annum, which suggests a market cap of $99.57 billion in 2024.

Collaborations between Micron and industry titans such as Nvidia strengthen the company's revenue potential and competitive standing. For example, collaborations with AI-centric platforms such as Nvidia's Grace Hopper GH200 and H200 platforms provide Micron with fresh opportunities to broaden its market penetration and stimulate expansion.

MU Stock Forecast 2024 - Bearish Factors

Micron operates in a demanding and ever-changing market, a highly cyclical industry prone to fluctuations. Occasional fluctuations in market conditions or economic recessions may give rise to instances of surplus supply, which could negatively impact the cost of chips and, by extension, on Micron's revenue and profitability.

Technical pressure is another factor to look at for this stock. As per the weekly price, the stock is trading at the bullish overextension zone, where a significant downside recovery is pending as a mean reversion.

III. MU Stock Forecast 2025

Based on the ongoing buying pressure in the technical chart and optimistic investors' opinions regarding the implementation of artificial intelligence, MU stock could gain more upward pressure and reach the 170.00 level by the end of 2025.

The broader market context for the daily price of MU is bullish, with the recent price hovering at the multi-year high. The ongoing buying pressure is solid as it trades with a bullish rally-base rally formation, where a bullish continuation might come from a valid rebound.

In the MU Stock Forecast 2025, investors should closely monitor how the price rebounds after having a sufficient downside correction. As of now, the 79.15 level would be a crucial level to look at as a bullish rebound from the 100.00 to 79.00 area could be a potential long signal, targeting the 170.00 resistance level.

The alternative trading approach is to wait for bearish exhaustion at the top. A counter-impulsive bearish recovery with a stable market below the crucial 79.00 level could be a valid short opportunity targeting the 45.00 area.

MU Stock Forecast 2025: Volume Analysis

In the volume structure, the ongoing buying pressure is also solid, as the high volume level since March 2020 has been at a low of 70.59. As the current price exceeds this line, we may expect the buying pressure to extend in the coming years.

However, the gap between the current price and the high volume level has expanded, which suggests a pending bearish correction as a mean reversion. As per the volume structure of MU Stock Forecast 2025, a sufficient downside correction is pending. Still, any rebound could be a high, probable long opportunity, with a target of 170.00 and even 200.00 levels within 2025.

A. Other Micron Stock Forecast 2025 Insights: MU Stock buy or sell?

Analyst John Vinh from KeyBanc Capital Markets has increased his MU stock price target to $135 per share, up by $20. He believes that the margin-recovery narrative is likely to continue through 2025, supported by a more favorable product mix and enhanced pricing.

Similarly, N. Quinn Bolton of Needham has adjusted his MU price target from $100 to $120, while Aaron Rakers from Wells Fargo has raised his MU stock price target by $10 to $135 per share.

Another Micron stock prediction by 22 analysts shows an optimistic view of MU stock. According to a recent report from Wallstreetzen, MU could reach the peak of $225.00 within 2025, with a median level of $126.64.

B. Key Factors to Watch for MU Stock Forecast 2025

MU Revenue Forecast For 2025

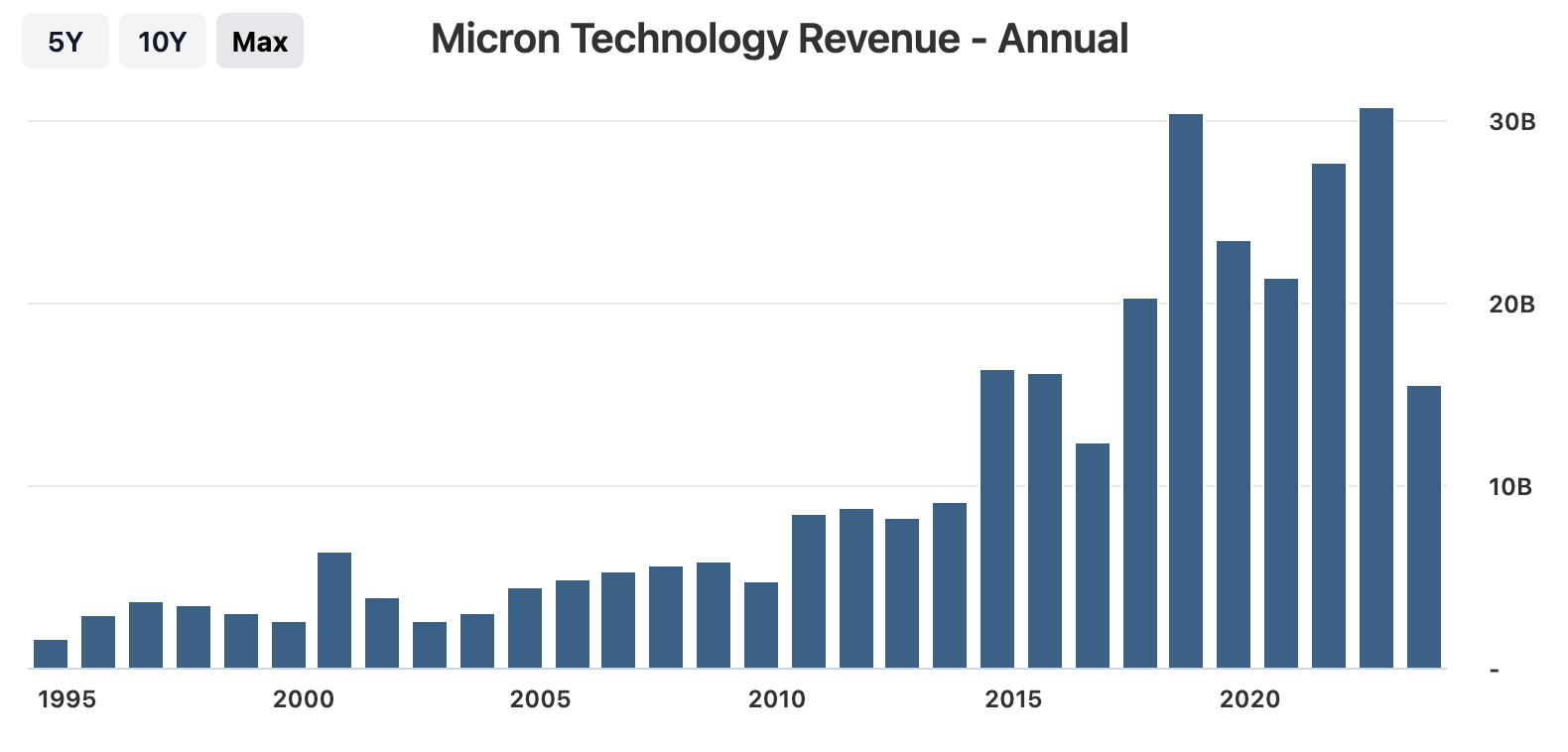

Micron's revenue forecast for 2025 suggests a bullish impact for the stock as analysts' projection suggests a $36.84 billion in revenue or $7.53 a share. This upbeat projection suggests a 200% increase in the yearly revenue reported in 2023.

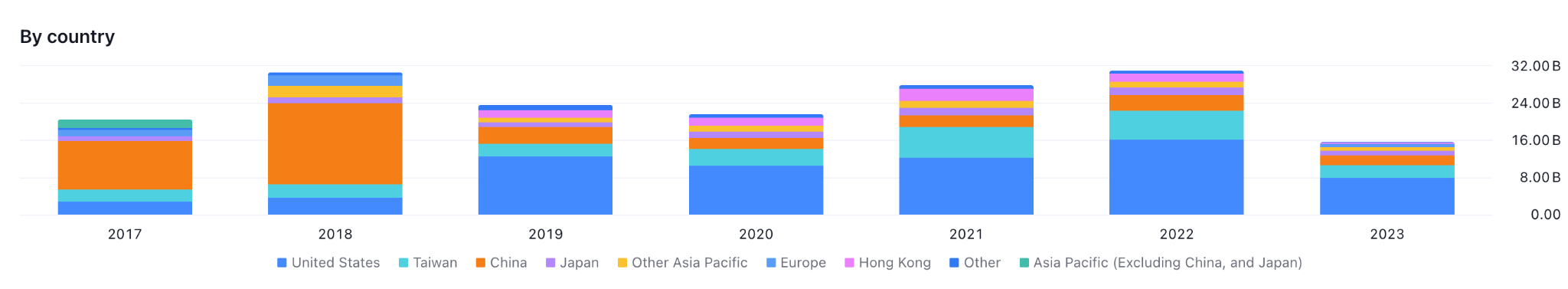

Micron's Revenue Segment

In 2018, China was the key revenue generator for MU as the company generated $17.36 billion of revenue from that country. However, since 2019, MU has shifted its target to the US, and since then, the US has been the company's major revenue generator.

Although 2023 reported a weaker revenue, the US maintained a larger position than other continents. Therefore, investors should closely monitor the US economy, where major indexes are at a record high in 2024. A rate cut by the Fed in 2024, with a potential reverse in major indexes, could work as a bearish factor for this stock.

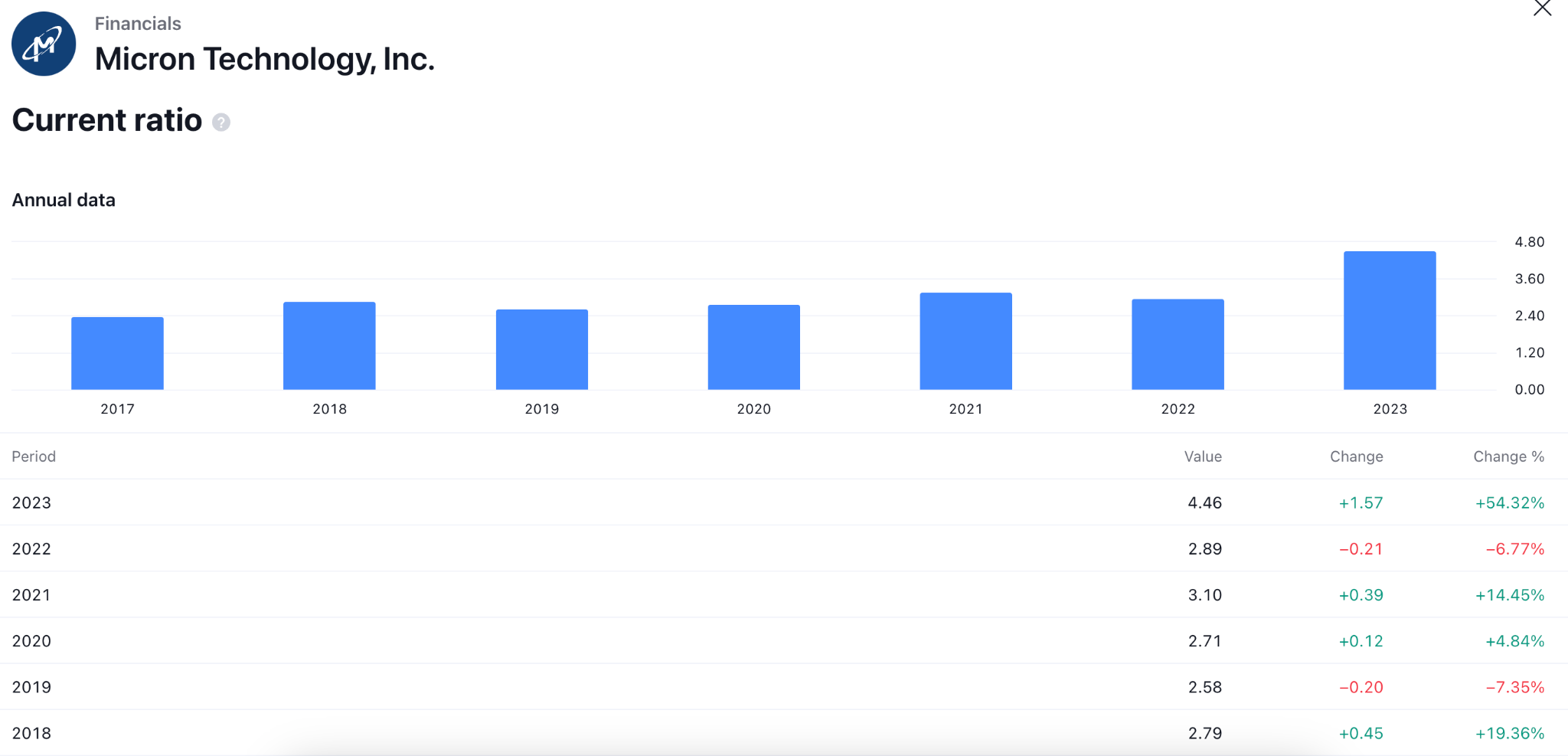

MU Liquidity Position

In the recent Quick ratio, the company maintained a stable liquidity position, which suggests a strong day-to-day business operation. Moreover, 2023 reported a higher current asset for the company, opening the possibility of a business expansion in 2025 and 2026.

Micron Stock Forecast 2025 - Bullish Factors

Micron's Compute and Networking Business Unit, which distributes memory processors for PCs and data centers, witnessed a significant % sequential revenue increase of 45% in 2024. Management ascribed the expansion to heightened shipments associated with artificial intelligence (AI) within the data center industry. The primary objectives behind the increased need for high-bandwidth memory (HBM) in AI servers are to improve performance, decrease power usage, and provide a larger storage capacity.

Micron projects that the increase in production of its most recent HBM generation could generate "several hundred" million dollars in revenue during the current fiscal year, with additional growth anticipated in 2025. In the long term, HBM is anticipated to be a significant growth driver for Micron, as memory manufacturer SK Hynix projects an impressive annual growth rate of 82% through 2027.

MU Stock Forecast 2025 - Bearish Factors

In an extremely competitive market, Micron contends with Samsung and SK Hynix, among others. Price conflicts are a frequent consequence of intense competition, which squeezes the profit margins of all industry participants. Refrain from upholding competitive pricing or effectively differentiating its products may hurt Micron's financial performance.

Trade tensions between major economies, particularly the ongoing U.S.-China trade dispute, can potentially disrupt the supply chain and generate uncertainty for semiconductor companies such as Micron. Protectionist measures such as tariffs and export controls can impede Micron's access to critical markets and procurement of essential components, potentially affecting the company's profitability and revenue.

IV. MU Stock Forecast 2030 and Beyond

As per the ongoing price surge, MU is more likely to maintain price stability until 2030. If the company maintains stable revenue, MU stock price might move above the $200.00 psychological line and reach the $420.00 level within 2030.

In the monthly chart of MU, the stock price showed upward pressure, reaching a multi-year high from which a decent downside recovery is possible. However, the last monthly candle showed a bullish continuation as the larger portion of the candle body was above the 99.17 swing. Meanwhile, the MACD Histogram maintained the bullish pressure, while the Signal line formed a divergence with the main price swing.

Based on the Micron Technology stock forecast 2030 and Beyond, a mixed sentiment is visible. A sufficient downside recovery could be a potential long signal above the 200.00 psychological line. On the bearish side, immediate upside pressure could hint at a possible bearish reversal due to profit-taking.

Let's see what other technical indicators say about the MU Forecast 2030 and Beyond:

- Ichimoku Cloud: The price overextended above the dynamic Ichimoku Cloud zone, suggesting a pending downside correction as a mean reversion. Moreover, the dynamic Kijun Sen support is also below the current price, with a wider gap suggesting a confluence bearish signal.

- Relative Strength Index (RSI): In the current reading, the Relative Strength Index (RSI) is also at the overextended above the 70.00 line, which could result in a bearish correction in the coming months.

A. Other Micron Stock Forecast 2030 and Beyond Insights: MU buy or sell?

According to a report from nasdaq.com, Micron's revenue is expected to experience a substantial 40% surge in fiscal 2025, succeeding by a comparatively moderate 9% increase culminating in $34.5 billion in fiscal 2026, as the growth momentum diminishes.

A conservative estimate based on these projections indicates that Micron may be able to maintain a 5% CAGR in revenue between fiscal 2026 and fiscal 2030, potentially attaining an annual revenue of around $42 billion by the end of the period above.

B. Key Factors to Watch for MU Stock Forecast 2030 and Beyond

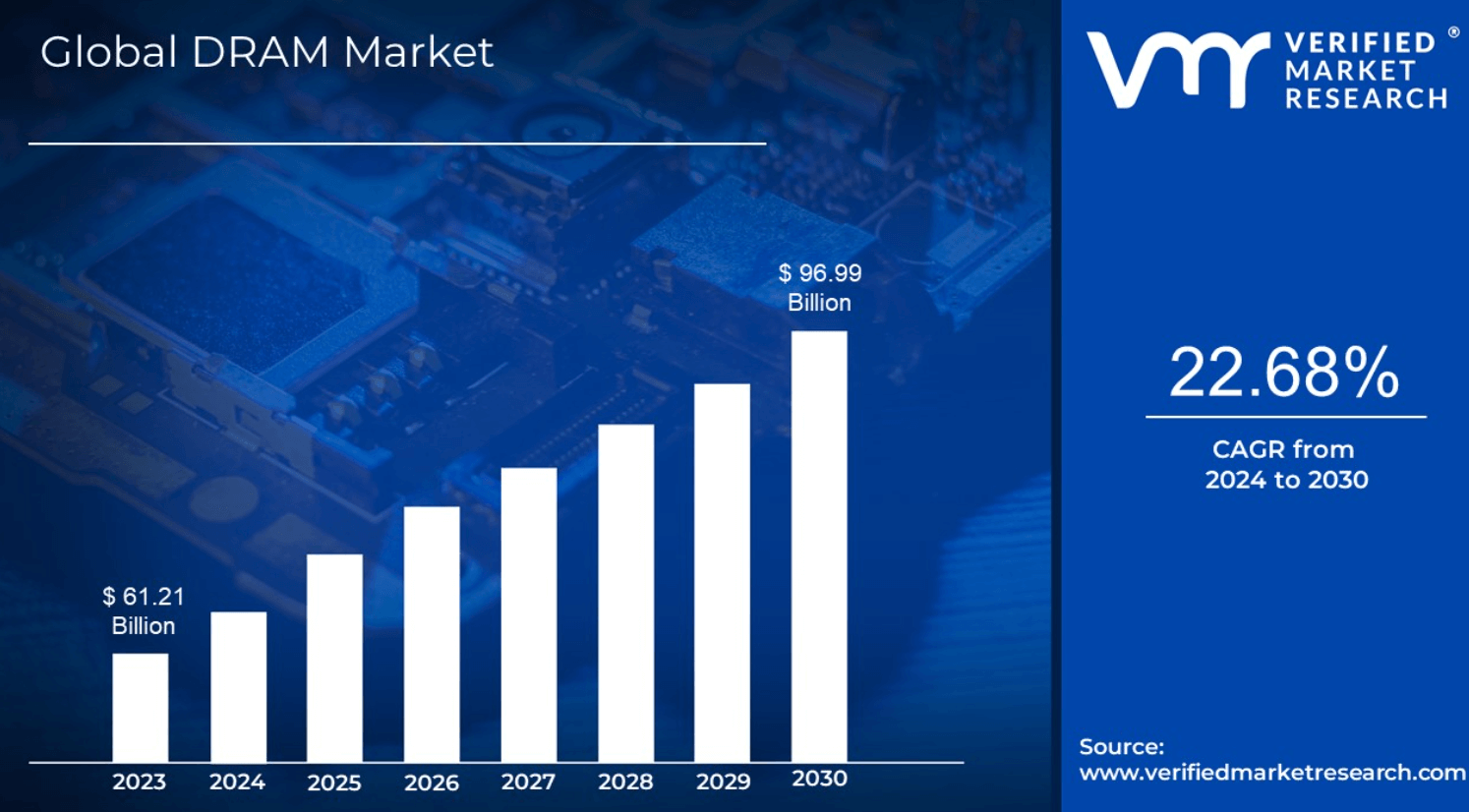

Micron's Position in DRAM Market

Source: verifiedmarketresearch

The memory market, specifically DRAM and NAND, is expected to grow due to increasing demand for data storage in areas like AI, cloud computing, and 5G. Watch for Micron's ability to capture this growing market share.

In 2023, the DRAM market was valued at USD 61.21 billion. By 2030, it is anticipated to have expanded at a CAGR of 22.68%, or USD 96.99 billion.

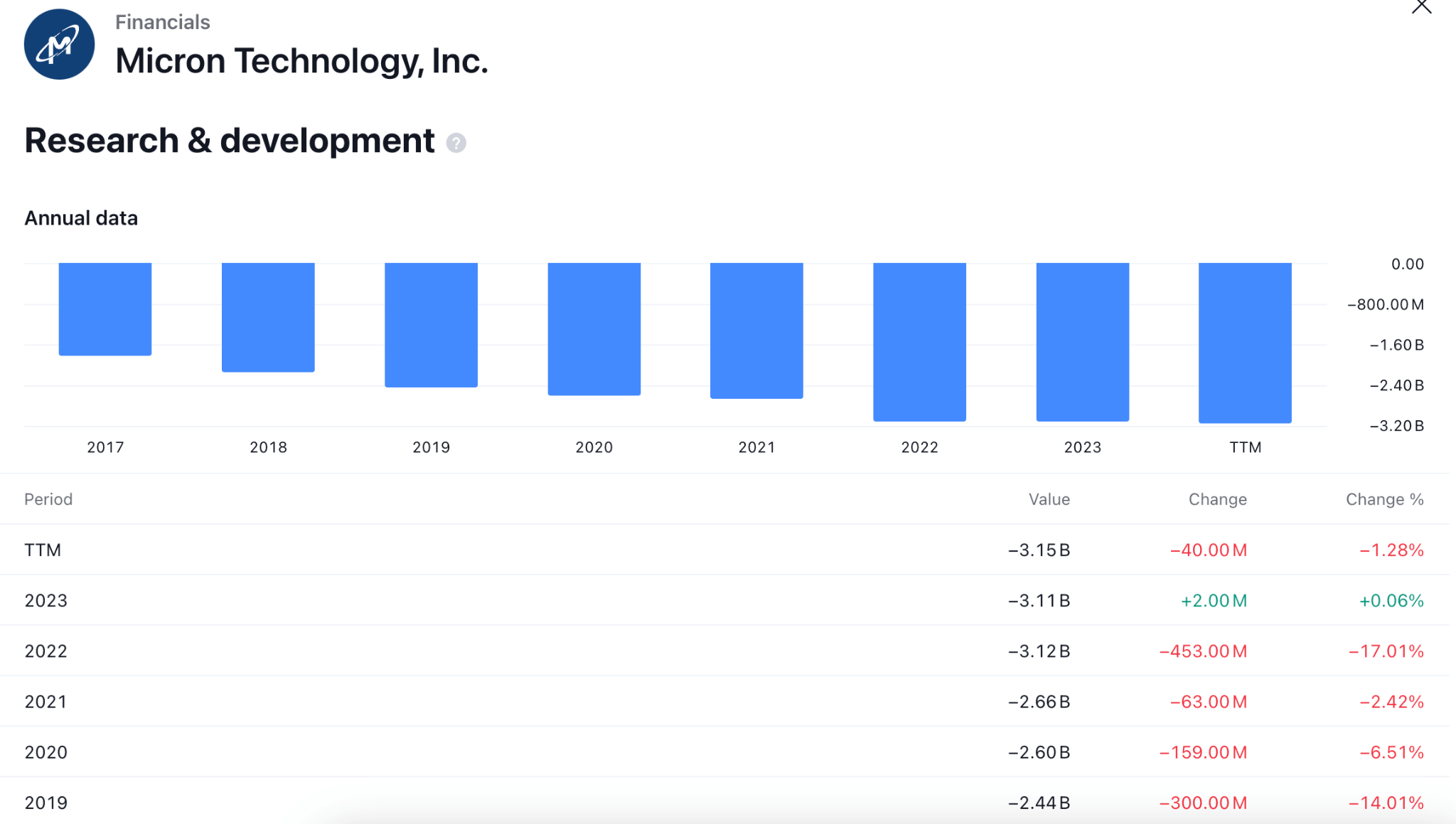

Micron's Research & Development Expense

Companies like Micron might benefit from the recent implementation of artificial intelligence. However, higher competition could be a challenging factor for this company.

Micron maintained a stable expense on Research and Development over the past five years. Investors should keep a close eye on this segment, where a higher cost with a greater success rate could be a potential long signal in this stock.

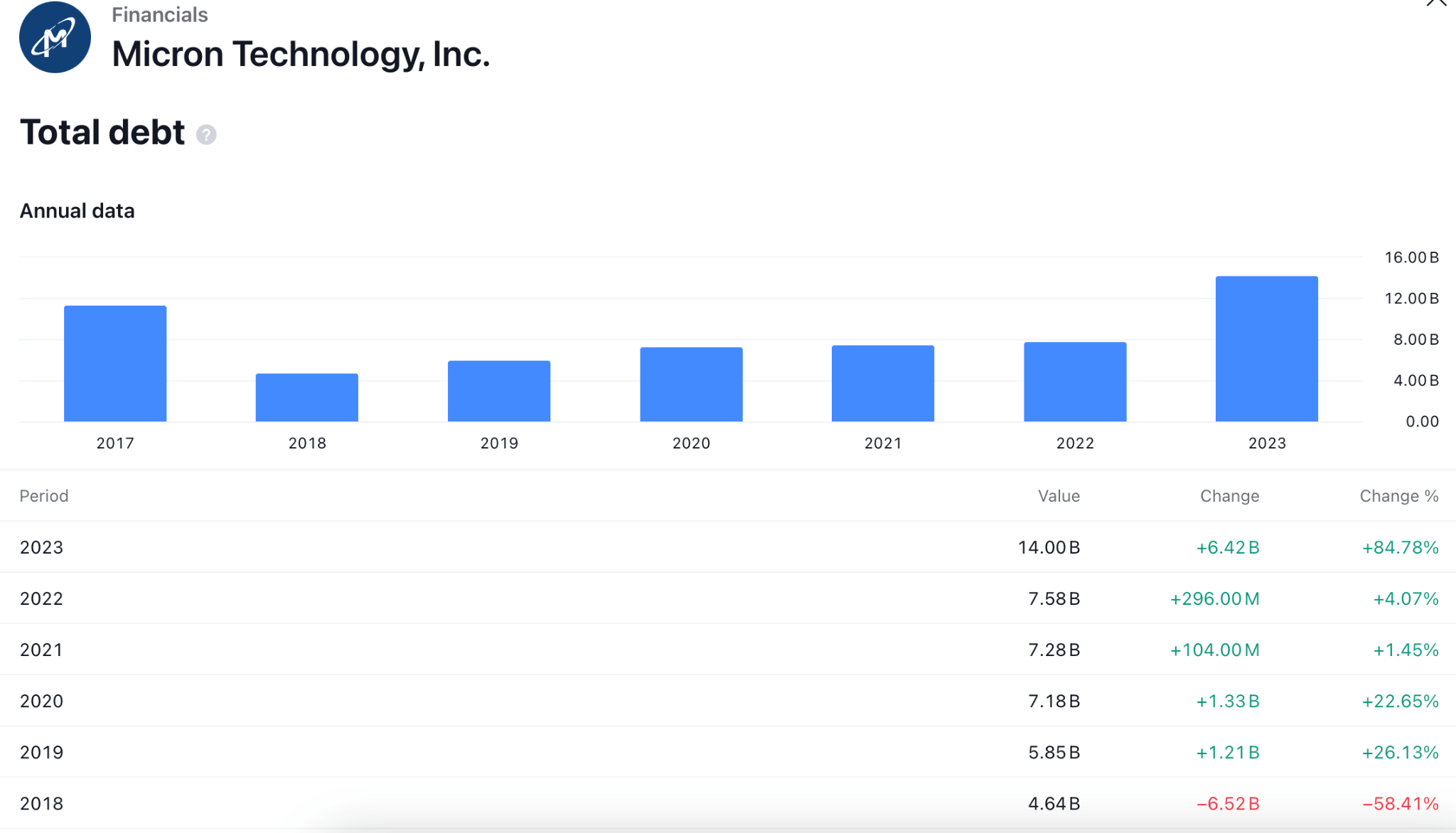

Micron's Debt Management

Upon reviewing the latest balance sheet data, it is evident that Micron Technology has accumulated long-term liabilities comprising US$14.00 billion, while its short-term liabilities amount to US$4.77 billion. To offset these obligations, the company possesses cash equivalent to $9.59 billion and receivables due within 12 months totaling $2.44 billion. As a result, the aggregate value of its liabilities exceeds that of its cash and short-term receivables by $8.10 billion.

Considering the considerable Micron market cap of US $ 89.9 billion, these liabilities can be effectively controlled. However, the substantial obligations necessitate continuous examination by the shareholders.

Constant attention must be paid to the balance sheet, specifically regarding debt analysis. The company's capacity to sustain a sound balance sheet will ultimately be determined predominantly by forthcoming earnings.

MU Stock Forecast 2030 and Beyond - Bullish Factors

- Global data production is soaring due to technologies such as artificial intelligence, cloud computing, and the Internet of Things. This requires a continuous increase in memory capacity for processing and storing data.

- Implementing 5G networks requires substantial memory enhancements in network equipment, devices, and base stations.

- By decreasing the size of its chips, Micron can accommodate a greater amount of memory onto a single unit, thereby reducing expenses and enhancing performance.

- Micron is investigating memory technologies of the next generation, such as 3D NAND for increased storage capacity and GDDR7 for high-bandwidth applications.

Micron Stock Forecast 2030 and Beyond - Bearish Factors

- The semiconductor industry undergoes cyclical phases of expansion and contraction. A recession may result in diminished demand, decreased consumer expenditure, and decreased business investment.

- Price battles waged by chipmakers could negatively impact Micron's profit margins and its ability to maintain market share during economic downturns.

- In the future, novel memory solutions such as resistive RAM (RRAM) and magnetoresistive RAM (MRAM) may pose a threat to the dominance of DRAM and NAND.

- Trade disputes among nations possess the potential to impede supply chains, escalate expenses, and restrict Micron's entry into critical markets.

- Long-term, if Micron falls behind its competitors in research and development, its products may no longer be competitive.

V. MU Stock Price History Performance

A. Micron Stock Price Key Milestones

2020: Strong work-from-home trends due to COVID-19 increased demand for memory chips for laptops, PCs, and data center servers. As a result, tech stocks found a boost taking the MU price from $56.50 to $75.45 level.

2021: Global chip shortage drives memory prices higher. Supply chain disruptions limited chip production, and high demand for electronics and data storage led to surging memory chip prices. As a result, the stock price maintained growth by moving from the 70.59 level to the 93.81 area.

2022: Supply chain issues and inflation concerns lead to market correction. Chip shortage eased, but overall market correction due to inflation and rising interest rates impacted tech stocks. The stock started the year at 94.67 but closed at 57.19 level, with a 39.59% loss.

2023: Memory market stabilizes, Micron invests in a new fab, signaling confidence in future demand growth. The stock rebounded from the opening price and reached the 86.72 level, with a 72.31% growth.

B. MU Stock Price Return and Total Return

Investing in a stock needs a macro overview to find an optimistic investment opportunity. Investors can gauge the upcoming price direction by looking at the stock performance in different timeframes:

|

Timeframe |

Return MU |

Return S&P 500 |

|

1 week |

+3.67% |

-1.11% |

|

1 month |

+27.98% |

+2.85% |

|

6 months |

+76.41% |

+25.50% |

|

Year to date |

+48.11% |

+9.72% |

|

1 year |

+102.84% |

+26.59% |

VI. Conclusion

Several key insights emerge when assessing Micron Technology Inc. (MU) stock performance against the backdrop of the broader market represented by the S&P 500. Over various timeframes, ranging from a week to a year, MU consistently demonstrates notable outperformance relative to the S&P 500. Notably, MU has shown resilience in the short term, posting gains even amid market fluctuations.

Moreover, its robust performance over longer periods underscores its potential as an attractive investment opportunity. With impressive returns across multiple timeframes, Micron Technology Inc. is a compelling choice for investors seeking growth and value within the technology sector.

Furthermore, a stock's growth potential hinges on how investors mitigate risk through a trustworthy trading platform such as VSTAR.

VSTAR offers a user-friendly platform to trade Micron stock CFDs with the following key elements:

- Copy Trading: Learn from experienced traders by replicating their positions.

- Market Monitor: Stay informed with real-time market data and analysis tools.

- Educational Resources: Enhance your trading knowledge with educational materials.

- Portfolio Diversification: Invest in stocks, cryptocurrencies, forex, indices, and precious metals from a single place.

VSTAR empowers you to make informed decisions about Micron and other investment opportunities. Explore VSTAR's features and conduct your own research to determine if Micron aligns with your investment goals. Remember, all trading involves risk, so invest wisely.

FAQs

1. Is MU a good stock to buy?

Micron Technology (MU) is currently rated as a Zacks Rank 2 (Buy), which suggests an above-average return relative to the market over the next few months. However, valuation metrics suggest that it may be overvalued with a Value Score of F.

2. What are the price targets for MU?

The average price target for MU stock is $128.68, with a high estimate of $225.00 and a low estimate of $90.00.

3. What will MU stock be worth in five years?

The MU stock price forecast for 2029 is $140.578 USD, indicating a potential increase of about +14.69% over the next five years.

4. What does the future hold for MU stock?

Micron is expected to benefit from long-term trends such as demand for its memory products in markets like data centers, 5G, and the Internet of Things.