- Microsoft's Azure cloud platform records a remarkable 23% year-over-year revenue growth, reaching $35.1 billion, fueled by AI accelerators, strategic partnerships like OpenAI, and innovative offerings.

- Dynamics revenue grows by 19%, with Dynamics 365 specifically surging by 23%, reflecting strong momentum in cloud-based business applications.

- Concerns arise over Microsoft's heavy reliance on Azure revenue and moderation in new business growth in segments like Office Consumer and Dynamics.

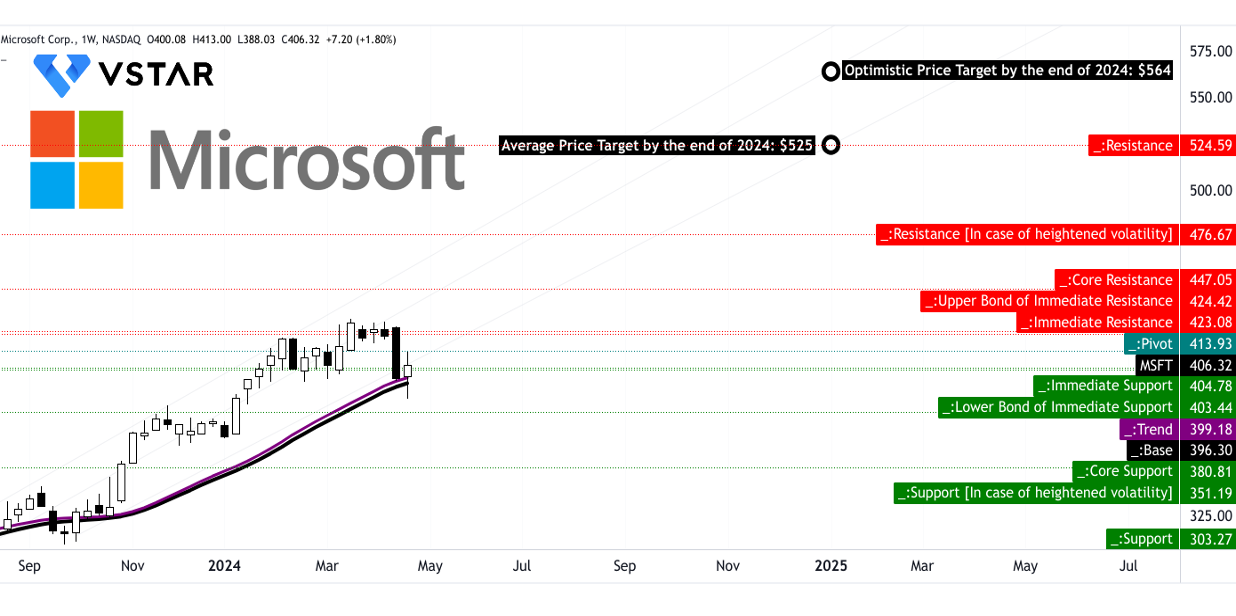

- Technical analysis projects a bullish Microsoft outlook, with an average MSFT price target of $525.

As observed in Q3 fiscal 2024 the soaring lead of Microsoft's Azure cloud platform and Dynamics suite as they derive the company's revenue growth. Delve into the fundamentals, explore market dynamics, and unlock stock projections to navigate the landscape of Microsoft's offerings and investment opportunities.

Microsoft Fundamental Strengths

Azure Cloud Revenue Growth:

Microsoft's Azure revenue grew by 31% year-over-year in the Intelligent Cloud segment, contributing significantly to the segment's 21% overall revenue growth. Microsoft's Azure cloud platform demonstrates remarkable growth, with cloud revenue reaching $35.1 billion, a notable 23% year-over-year increase. This substantial growth underscores Azure's strong market position and increasing adoption by businesses globally.

Source: Q3 2024 Presentation

Moreover, the diversity in AI accelerators, strategic partnerships such as OpenAI, and innovative offerings like Models as a Service contribute significantly to Azure's appeal among customers. For instance, the AI services component of Azure contributed 7 points to the overall growth, highlighting the concentration of revenue within Azure.

Azure's ability to offer a wide array of AI accelerators, including those from NVIDIA, AMD, and its own first-party silicon, aligns with the increasing demand for AI-driven solutions in various industries. The strategic partnership with OpenAI, mentioned to be leveraged by more than 65% of Fortune 500 companies, further enhances Azure's credibility and attractiveness to customers seeking cutting-edge AI capabilities.

The specific trials and partnerships with companies like CallMiner, LTIMindtree, PwC, and TCS demonstrates Azure's real-world applications and the confidence placed in its capabilities by industry leaders. Additionally, the growth in revenue from migrations to Azure and the increasing number of large Azure deals, including billion-dollar commitments from Cloud Software Group and The Coca-Cola Company, reaffirm Azure's value proposition and rapid expansion in the market.

Dynamics Revenue Growth:

In the realm of Dynamics, Microsoft reports significant revenue growth, with Dynamics products and cloud services revenue increasing by a noteworthy 19% (17% in constant currency). This growth, surpassing expectations, reflects the continued success and demand for Microsoft's Dynamics 365 offerings across various industries.

The Dynamics 365 revenue specifically grew by 23% (22% in constant currency), indicating strong momentum in Microsoft's cloud-based business applications suite. This growth is attributed to continued expansion across all workloads and better-than-expected new business, despite a moderation in bookings growth. The mention of Dynamics 365's contribution to overall revenue growth underscores its significance as a key driver of Microsoft's success in the booming business applications market.

Microsoft Fundamental Weakness

Decline in Devices Revenue:

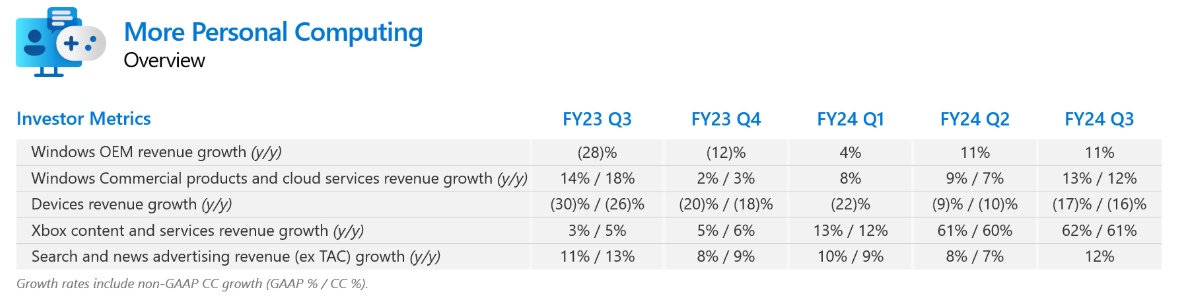

Microsoft's Devices segment witnessed a decline of 17% in revenue, despite efforts to focus on higher-margin premium products. This decline signals challenges in the devices market, potentially due to increased competition or shifting consumer preferences. While Windows OEM revenue increased by 11%, indicating stable demand, the overall decline in devices revenue underscores the need for Microsoft to adapt its device strategy to address changing market dynamics. Exploring innovative product offerings, diversifying into emerging device categories, or strengthening partnerships could help Microsoft mitigate the impact of declining devices revenue and maintain its overall growth trajectory.

Source: Q3 2024 Presentation

Moderation in New Business Growth:

Despite overall revenue growth, certain segments, such as Office Consumer and Dynamics, experienced moderation in new business growth. Office Consumer revenue grew by only 4%, indicating a slowdown in acquiring new customers or expanding product offerings. Similarly, Dynamics revenue growth, although strong at 19%, showed signs of moderation in bookings growth, particularly in Talent Solutions. Addressing this moderation in new business growth is crucial for sustaining long-term revenue growth. Microsoft may need to re-evaluate its customer acquisition strategies, enhance product offerings, or explore new markets to reignite growth in these segments.

Microsoft Stock Forecast 2024

The current Microsoft stock price stands at $406.32, slightly above the modified exponential moving average (EMA) trendline of $399.18 and the baseline of $396.30. The modified EMA indicates an upward trend in the stock price. Over the analyzed period, MSFT stock has been moving in an upward direction. The average Microsoft price target by the end of 2024 is projected at $525.00, based on momentum change-in-polarity over the mid- to short-term, and projected over Fibonacci retracement/extension levels. An optimistic price target of $564.00 is set, considering the price momentum of the current swing over the mid- to short-term, projected over Fibonacci retracement/extension levels. These targets suggest a bullish outlook for Microsoft's stock.

MSFT Price Target - Support and Resistance Levels

The primary support level is identified at $403.44, with the pivot of the current horizontal price channel at $413.93. In case of heightened volatility, resistance levels are projected at $476.67 and $524.59. Core support and resistance are observed at $380.81 and $424.42, respectively. Additionally, support during heightened volatility is seen at $351.19, emphasizing the potential impact of market turbulence on the MSFT stock price movements.

Source: tradingview.com

MSFT Stock Forecast - Relative Strength Index (RSI)

The RSI value stands at 52.62, indicating a neutral position. However, it's noteworthy that the RSI line trend is currently downward, suggesting a potential bearish sentiment in the market. The absence of bullish divergence and the presence of bearish divergence signal a cautious approach, as the stock may experience downward pressure in the near term.

Microsoft Stock Forecast - Moving Average Convergence/Divergence (MACD)

The MACD line is below the signal line at 15.23, with a negative MACD histogram of -2.590, indicating a bearish trend. Moreover, the strength of this bearish trend is increasing, as depicted by the MACD histogram. Investors should be cautious as this indicates a potential downward momentum in the stock price in the near future.

Source: tradingview.com

Conclusion

Microsoft's Azure cloud platform propels the company's Q3 2024, with revenue soaring, reflecting its robust market dominance and strategic partnerships. Despite concerns over moderation in segments like Office Consumer and Dynamics, technical analysis projects a bullish outlook, with an average price target of $525, signaling upward momentum for 2024.