Alibaba is at a critical juncture, transitioning from an "e-commerce platform company" to a "full-stack AI and cloud infrastructure provider." Although slowing growth in Chinese consumption and e-commerce poses short-term constraints on the fundamentals, a new growth engine centered on the Cloud Intelligence Group (CIG) is significantly accelerating. Its quality of growth and strategic position are reshaping the market's perception of Alibaba's long-term value.

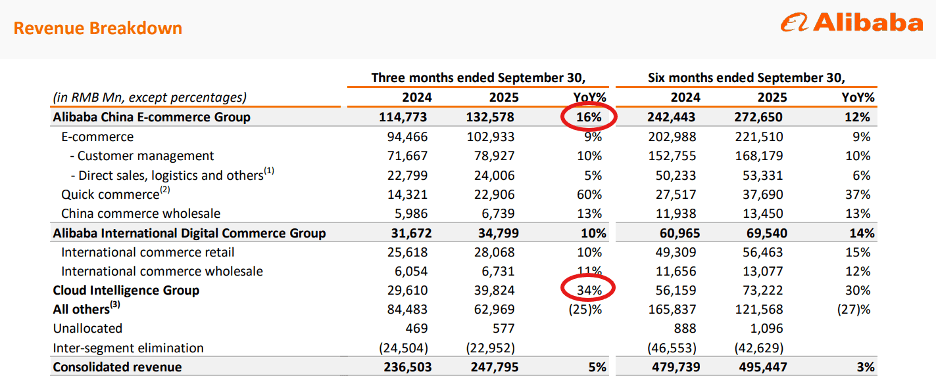

From a business structure perspective, Alibaba remains highly dependent on e-commerce, with domestic and international e-commerce collectively contributing about 68% of revenue, but the growth rate has visibly slowed. In contrast, the Cloud Intelligence Group is becoming the most resilient source of growth. In the quarter ending September 2025 (FY2026 Q2), CIG achieved revenue of RMB 39.8 billion, a year-over-year increase of 34%, significantly higher than the e-commerce business's 16% growth rate, and has achieved 30% revenue growth and 31% EBITA profit growth over the past six months. Although the cloud business currently only accounts for about 16% of the group's revenue, it has clearly become the central growth driver for Alibaba's future.

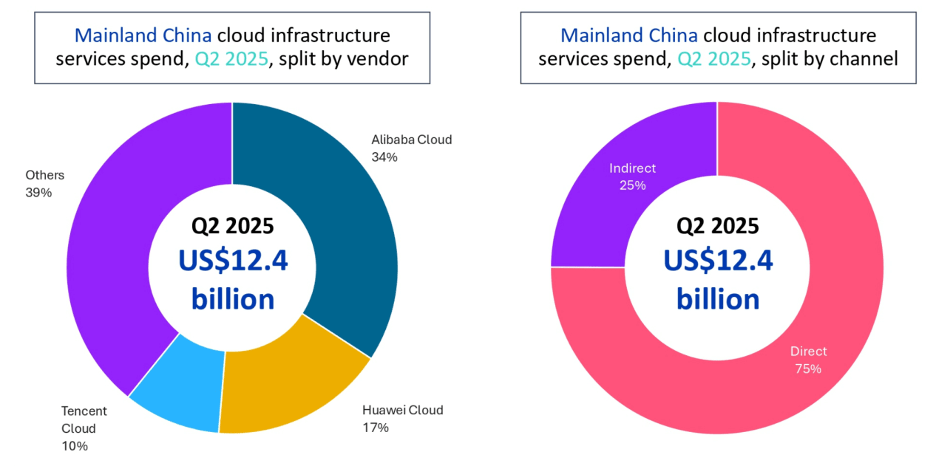

The core competitiveness of Alibaba Cloud lies not only in its scale but also in its full-stack AI capability layout. The company forms a closed loop between cloud computing, AI foundation models, and computing infrastructure through its self-developed T-Head (PingTouGe) AI chips. This strategy highly aligns with China's direction of "technological self-reliance" and "domestic substitution." According to Omdia data (2025Q2), Alibaba Cloud's market share in the mainland China cloud infrastructure market is about 34%, significantly leading Huawei (17%) and Tencent Cloud (10%), granting it a structural position in the domestic market similar to AWS in the United States.

From the perspective of industry and demand, management explicitly points out that AI computing demand remains in a state of "supply exceeding demand." CEO Eddie Wu stated in the earnings call that there are global supply bottlenecks generally affecting AI servers, GPUs, and storage, which will be difficult to completely alleviate in the short term (next 2–3 years). This implies that the high growth of Alibaba Cloud is not a one-time jump but is more likely a medium-cycle trend driven by the continuous increase in AI penetration.

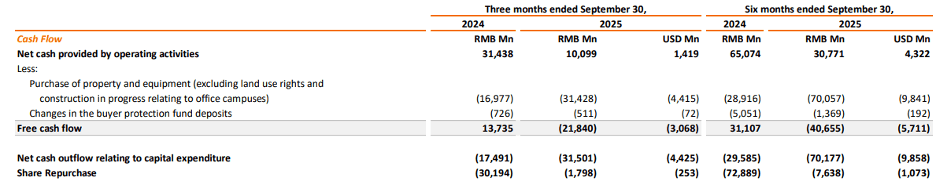

On the financial front, Alibaba is undertaking significant upfront investment pressure for cloud and AI. AI-related capital expenditure in the past four quarters was approximately RMB 120 billion, with a single-quarter CAPEX reaching RMB 31 billion, a year-over-year increase of 100%; coupled with a RMB 50 billion subsidy plan, this led to the FY2026 Q2 EBIT margin dropping to 2% (a low point since 2021), a 53% year-over-year decline in net profit, and negative free cash flow of RMB -21 billion. While short-term profitability is under pressure, this is essentially a strategic choice of "proactive growth for exchange," which is highly consistent with the capital cycles of global hyperscale cloud vendors.

In terms of capital allocation, Alibaba has clearly shifted its focus from shareholder returns to AI investment. Although the buyback quota was raised by $25 billion in 2024, only $200 million was repurchased in the quarter ending September 2025, a decrease of about 75% from the previous quarter. Management has explicitly placed AI and cloud growth as the top priority, and the pace of buybacks is expected to remain constrained in 2026.

In terms of valuation, Alibaba shows a significant "US-China tech stock discount." The current Forward P/E is about 16.6x, significantly lower than Amazon's and Alphabet's 28–29x; the P/S is 2.1x, compared to Amazon's 3.0x and Alphabet's 9.9x. Even considering the China asset risk premium, Alibaba's valuation remains significantly low given its cloud business's 30%+ growth rate and domestic cloud market share leadership. If the market were to grant it a valuation closer to global tech leaders at 24x P/E in the future, the corresponding price midpoint has re-rating potential of over $200.

Of course, core risks cannot be ignored. First, slowing growth in Chinese consumption and e-commerce will continue to drag down the group's overall revenue performance; second, the cloud business is highly dependent on the AI investment cycle and may continue to suppress profit and cash flow in the short term; third, advanced AI chips still partially rely on overseas supply, with geopolitical factors and export controls posing potential uncertainty; fourth, for the cloud business to truly grow into the largest revenue source, it still requires a 5–6 year period of sustained high growth.

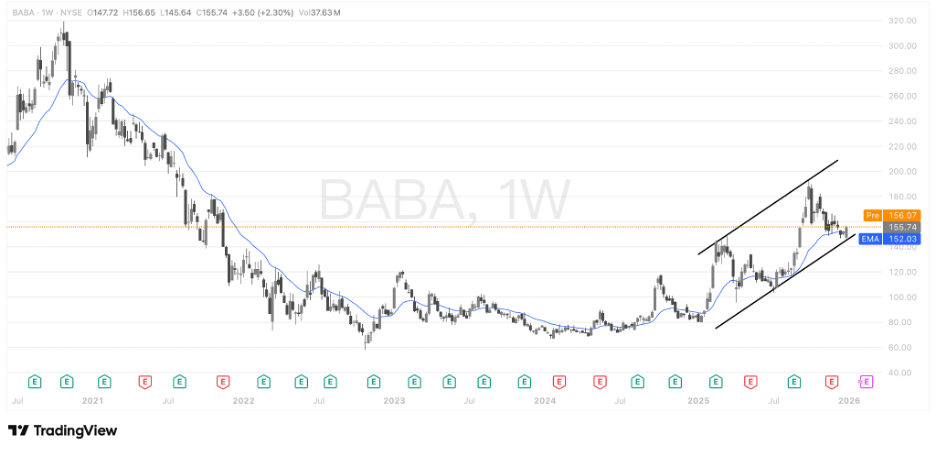

From a technical perspective, observed on the weekly chart, BABA stock price has shown signs of stabilizing and rebounding after touching the support line of the long-term downward channel. The current price receiving support at this critical technical level indicates that bullish forces are attempting to organize a counterattack. If the stock can subsequently be accompanied by a modest increase in trading volume and hold steady above this support area, a weekly-level technical rebound is likely to unfold.

Overall Judgment: Alibaba is currently at a crucial inflection point where "old businesses are under pressure, and a new engine is forming." E-commerce is no longer the valuation anchor; the Cloud Intelligence Group is the core variable determining the long-term scope. Under the combined effects of domestic substitution of AI infrastructure, long-term scarcity of cloud computing power, and a significant valuation discount, Alibaba offers an AI infrastructure investment opportunity with controllable risk but significant upside flexibility.

Investment Rating: Buy (Mid-to-Long Term Allocation).