- Natural gas prices at Henry Hub surged, with bullish trends in spot and futures prices.

- Regional spot prices showed variations, influenced by local supply and demand dynamics.

- International natural gas futures prices declined, signaling global energy market shifts.

- The supply-demand balance, increased LNG exports, rig counts, and storage levels all influence CFDs on Natural Gas prices.

The following analysis based on EIA data offers insights into the natural gas market, focusing on various aspects such as price dynamics, supply and demand, international trends, liquefied natural gas (LNG) developments, rig counts, and storage figures.

Note: All changes are week-over-week unless specified otherwise.

Henry Hub Spot and Futures Prices

In the week ending November 1, 2023, the Henry Hub natural gas spot price increased from $2.86 to $3.19/MMBtu. The November 2023 NYMEX contract rose by 15 cents to $3.164/MMBtu, while the December 2023 NYMEX contract increased by 12 cents to $3.494/MMBtu. The 12-month strip average for futures contracts reached $3.505/MMBtu.

It indicates a bullish trend in the natural gas market at the Henry Hub. The spot price and futures contracts have all shown upward movement, signifying increased demand or concerns about future supply. The 12-month strip average suggests market participants anticipate a continued price increase over the coming year.

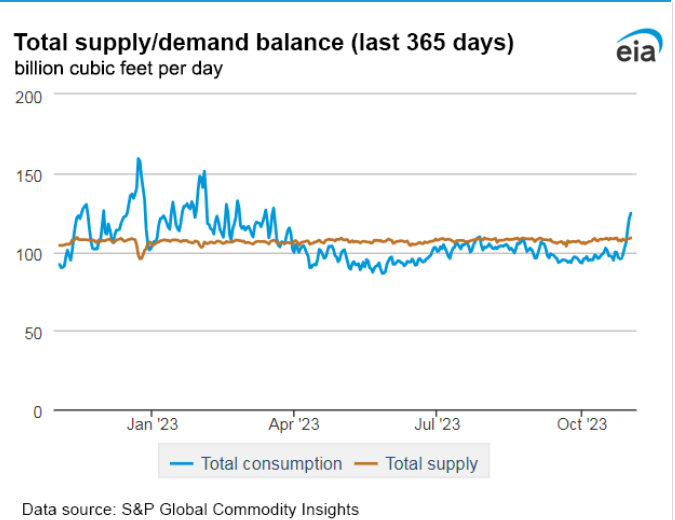

Natural Gas Supply and Demand

Total natural gas supply in the U.S. dipped by 0.2% (0.2 Bcf/d) from the previous week. Dry natural gas production averaged 102.4 Bcf/d, a 0.5% decline. Net imports from Canada rose by 5.3% (0.3 Bcf/d), while domestic consumption surged by 16.1% (11.3 Bcf/d). Residential and commercial sector usage spiked by 61.8% (9.2 Bcf/d) due to colder weather in the Midwest and Northeast. Natural gas consumption for power generation increased by 3.5% (1.1 Bcf/d), and industrial sector usage rose by 4.4% (1.0 Bcf/d). Exports to Mexico decreased by 2.7% (0.2 Bcf/d), and deliveries to U.S. LNG export facilities averaged 13.9 Bcf/d.

Source: eia.gov

It presents a significant imbalance between supply and demand. The substantial increase in demand, especially in the residential and commercial sectors due to weather-related heating demand, suggests strong upward pressure on natural gas prices. Increased consumption for power generation and industrial use further drives demand. The decrease in exports to Mexico may indicate potential domestic supply constraints.

Regional Spot Prices

Natural gas spot prices showed regional variations. The Northeast recorded a notable uptick, with Algonquin Citygate experiencing a significant increase, though prices remained low in North America. In the Midwest, colder weather and higher heating demand led to a rise in the Chicago Citygate price. West Coast prices exhibited mixed trends, remaining relatively high in North America.

Regional variations in prices are attributed to local supply and demand dynamics. The sharp increase in the Northeast is likely influenced by weather conditions and regional consumption patterns. In the Midwest, colder weather led to increased heating demand and subsequently higher prices. The West Coast's mixed price changes may be linked to regional supply dynamics.

International Futures Prices

Global natural gas futures prices dropped, particularly in East Asia and the Netherlands. East Asian LNG cargoes averaged $17.82/MMBtu, a 39-cent decrease from the prior week, while the Netherlands' TTF saw a weekly average of $15.36/MMBtu, down 29 cents. Year-on-year comparisons revealed lower prices in 2023.

The decline in international futures prices reflects changes in global energy dynamics. Lower prices in East Asia and the Netherlands can be influenced by factors such as supply surpluses, reduced demand, or changes in LNG trade. These international trends can indirectly impact the price of CFDs on Natural Gas, depending on the extent of interdependence with global markets.

Liquefied Natural Gas (LNG)

US LNG export terminal deliveries increased by 2.0% (0.2 Bcf/d) to an average of 13.9 Bcf/d. South Louisiana terminals saw a 2.9% rise to 8.7 Bcf/d, while South Texas and non-Gulf Coast terminals remained stable at 4.1 Bcf/d and 1.1 Bcf/d, respectively. During October 26 to November 1, 29 LNG vessels with a total LNG capacity of 108 Bcf departed from U.S. ports. Some LNG facilities obtained approvals for capacity expansion and resumed operations.

The increase in natural gas deliveries to U.S. LNG export terminals and the substantial number of LNG vessels departing from U.S. ports indicate a growing global demand for natural gas. The approvals for LNG facility expansion suggest a positive outlook for future exports, which can have a cascading effect on domestic natural gas prices. These developments emphasize the interconnectedness of the global natural gas market.

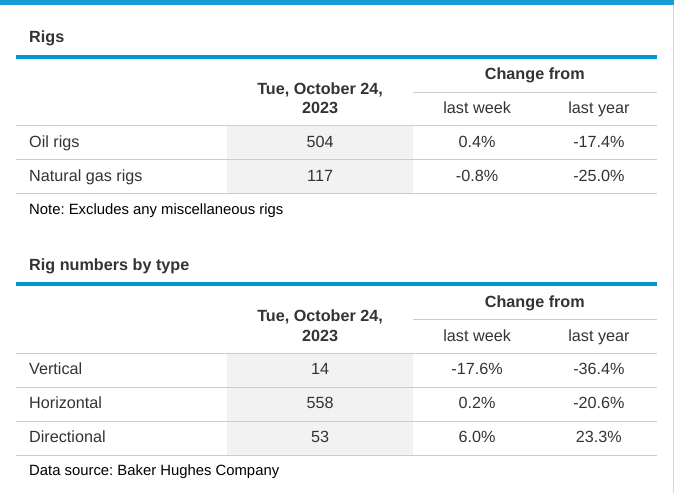

Natural Gas Rig Count

The natural gas rig count dropped by one to 117 rigs, while oil-directed rigs increased by two to 504 rigs. The total rig count, including miscellaneous rigs, was 625, 143 rigs fewer than the same time the previous year. The slight decrease in the natural gas rig count might signify a reduction in exploration and production activities. Lower rig counts can lead to reduced natural gas production, potentially tightening the supply and supporting price increases. This factor is significant for CFDs on Natural Gas as it directly impacts the supply side of the market.

Source: eia.gov

Natural Gas Storage

For the week ending October 27, net injections into storage reached 79 Bcf, exceeding the five-year average of 57 Bcf but falling short of last year's 99 Bcf. Working natural gas stocks stood at 3,779 Bcf, reflecting a 6% surplus over the five-year average and an 8% increase over the same period last year.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 76 Bcf to 85 Bcf, with a median estimate of 81 Bcf. The net injections into storage exceeding both the five-year average and the previous year's injections indicate a robust supply of natural gas. While high storage levels may limit upward pressure on prices, the market's reaction depends on factors like expected future demand. Elevated storage levels can provide a cushion against potential supply shocks.

Based on the analytical interpretation, let's explore the possible implications on the price of CFDs on Natural Gas, with a primary focus on the price direction:

Bullish Price Outlook

The significant increase in the Henry Hub spot price and the upward movement in futures contracts point towards a bullish sentiment in the market. Traders of CFDs on Natural Gas may anticipate further price appreciation in the near term. Strong demand, particularly in the residential and commercial sectors due to weather-related heating demand, could put upward pressure on prices. This could lead to bullish trading strategies. The decrease in natural gas rig counts suggests reduced production, which can contribute to supply constraints and support higher prices.

Regional Factors

Regional variations in prices, especially the sharp increase in the Northeast and the Midwest, may influence the overall price direction of CFDs on Natural Gas. Weather-related factors play a crucial role in regional price dynamics. Traders should closely monitor weather forecasts, especially in key consuming regions, as these can impact price movements.

Global Market Dynamics

International market trends, particularly the decline in LNG prices in East Asia and the Netherlands, can indirectly affect domestic natural gas prices. Traders need to consider the impact of global market dynamics when trading CFDs on Natural Gas. The approval of LNG facility expansions and the high number of LNG vessels departing from U.S. ports highlight the growing importance of global LNG trade. This can potentially lead to increased demand for domestic natural gas, supporting higher prices.

Supply-Demand Balance

The imbalance between supply and demand is a critical factor influencing the price of natural gas. Traders should closely monitor data related to production, consumption, and exports. A sustained increase in demand, especially for heating and industrial use, can contribute to price appreciation. Conversely, any disruptions in supply can further exacerbate price increases.

Storage Levels

High working natural gas stocks can provide a cushion against potential supply shocks. However, the market's reaction to storage levels depends on future demand expectations.Traders should assess the storage figures in the context of seasonal variations and potential events that might impact future demand.

In conclusion, the EIA data based analysis suggests a bullish outlook for CFDs on Natural Gas, with several factors supporting upward price movements. Regional dynamics, global market trends, supply-demand balance, and storage levels are essential considerations for traders. With the potential for supply constraints and increased demand, CFDs on Natural Gas offer opportunities for traders. Staying informed about these key factors and market developments is essential for making informed trading decisions in this evolving energy landscape.

Natural Gas Technical Commentary

Source: tradingview.com

The prices of CFD on Natural Gas have experienced a pivotal shift near $3.46, notably at the recent weekly highs a bearish divergence with the RSI indicator has emerged. This indicates a robust bearish signal, suggesting a potential price decline. To the downside, $3.255 acts as a crucial support level, but in the event of heightened volatility, the price could potentially drop to $3.005.

However, from a fundamental perspective, the outlook for natural gas appears positive, which may prompt a reversal to the upside, breaking through the resistance level at $3.665. Further up, $3.920 stands as a critical resistance, especially if market volatility trends in favor of a bullish momentum.