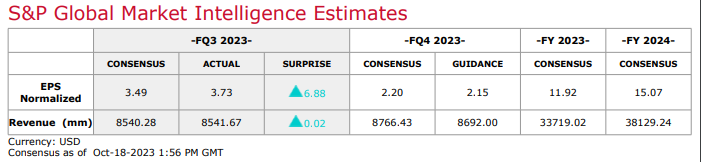

- Netflix experienced an 8% Y-o-Y revenue increase in Q3'23, with a 25% rise in operating income, surpassing forecasts and elevating the operating margin to 22.4%.

- The company's global expansion strategy, diverse content offerings, and successful localization efforts drive higher engagement, evident in top-watched series and expansion into sports programming.

- Successful implementation of paid sharing, occasional price adjustments, and foray into ads contribute to revenue positivity and strong advertiser interest.

- Netflix demonstrates robust cash flow generation, with an upward revision of FY23 free cash flow forecast and a commitment to returning excess cash through share repurchases.

In a dynamic digital landscape, Netflix has continued to revolutionize entertainment consumption. Its recent financial report (Q3 2023) unveils a narrative of unprecedented growth, driven by strategic maneuvers and content innovation. From revenue surges and enhanced engagement tactics to innovative monetization strategies, Netflix's success story offers insights into the streaming giant's relentless pursuit of excellence and financial prowess.

Revenue Growth and Operating Margin Improvement

Q3'23 Performance and Forecast

Netflix showcased robust revenue growth in Q3'23, surpassing expectations by posting an 8% year-over-year increase. This growth was fueled by a remarkable 9% rise in average paid memberships, resulting in 8.8 million paid net additions, substantially higher than the 2.4 million in Q3'22. The growth drivers included the rollout of paid sharing, a consistent stream of high-quality programming, and the continuous expansion of streaming services globally.

Operating income also saw a substantial increase, totaling $1.9 billion, marking a notable 25% surge from the previous year. This led to an impressive operating margin of 22.4%, surpassing the forecast by three percentage points. Such significant improvements in revenue and operating margin underscore Netflix's effective management of both revenue growth and cost control strategies.

Forecast and Operational Goals

Netflix's forecast for Q4'23 indicates a further 11% year-over-year growth in revenue, highlighting the company's confidence in sustaining its growth trajectory. Additionally, the revised operating margin guidance for FY23 stands at 20%, representing an upward adjustment from the prior 18% to 20% forecast. This forecasted margin improvement signals the company's commitment to enhancing operational efficiency and profitability.

Looking ahead to FY24, Netflix anticipates maintaining an operating margin within the range of 22% to 23%, reflecting a consistent upward trend. This ambitious yet realistic projection suggests the company's strategic initiatives are aimed at continuous improvement in profitability.

Source: Netflix Earnings Call

Engagement and Content Strategy

Driving Engagement Through Quality Content

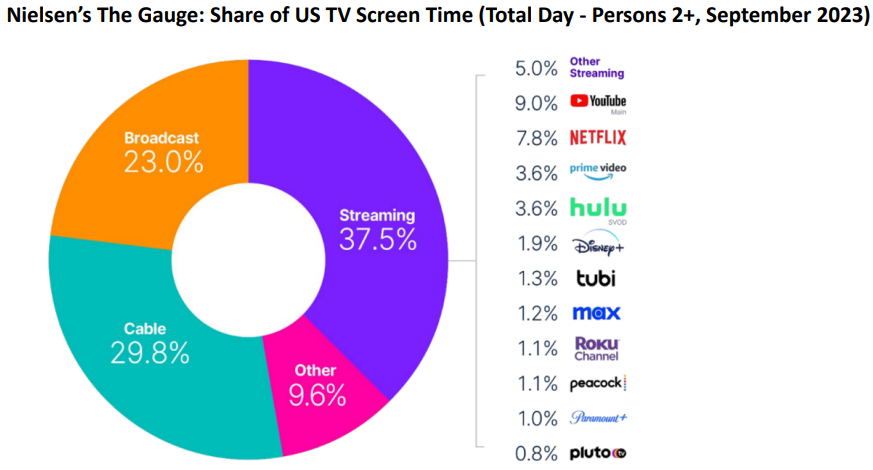

Netflix recognizes that engagement is pivotal for customer retention and acquisition. Their strong engagement levels are a testament to their superior content quality, expansive reach, and efficient recommendation algorithms. The company's ability to secure the top spot for the most-watched original series and movies in the US for a significant portion of the year signifies its prowess in captivating audiences.

The successful adaptation of popular content, such as the manga series "One Piece" and the licensed series "Suits," demonstrates Netflix's capability to breathe new life into existing franchises, catering to both existing fans and new audiences. This adaptability and content diversification strengthen the platform's engagement levels across global markets.

Global Expansion and Localization of Content

Netflix's expansion beyond the US market, with over 70% of its members located internationally, underscores its commitment to catering to diverse audiences. Their strategy involves offering authentic, local-language stories produced or co-produced in over 50 countries and languages. The company's success in various regions, including the UK, Korea, Brazil, and Spain, reinforces the importance of tailoring content to resonate with local audiences while also attracting a global viewership.

The phenomenon of Netflix's biggest local language titles gaining traction globally, as observed with hits like "Squid Game," "Money Heist," and "Lupin," highlights the platform's ability to help creators find a larger audience for their stories. This approach not only fosters consumer satisfaction but also supports content creators in reaching wider demographics.

Source: Netflix Earnings Call

Sports Programming and Innovation

Diversification into Sports Content

Netflix's venture into sports programming marks a strategic move to diversify its content portfolio. By offering documentaries and series covering various sports genres such as tennis, football/soccer, cycling, and boxing, the company aims to attract sports enthusiasts to its platform. The positive response and conversation generated around content like "Formula 1: Drive to Survive" and the Tour de France docuseries validate the platform's capability to engage audiences beyond traditional entertainment content.

Innovative Customer Engagement Strategies

Netflix's commitment to fostering fan engagement transcends content creation. The company's innovative approach includes offering pop-up experiences like the Netflix Bites restaurant and planned physical flagship destinations under the Netflix House concept. These initiatives aim to provide fans with immersive experiences between seasons, fostering a deeper connection with the platform's content and characters.

Expansion into Animated Content and Upcoming Releases

Strategic Focus on Animated Content

Netflix's emphasis on animated content is evident through strategic partnerships and upcoming releases. The company's multi-year agreement with Skydance Animation and the announcement of major animated movies and series, including "Leo" and "Chicken Run: Dawn of the Nugget," highlight its commitment to diversifying its content offerings. These partnerships and projects align with Netflix's goal of catering to a wide range of audience preferences, further solidifying its position in the animated content segment.

Anticipated Content Releases

The platform's strong fall/winter schedule, featuring highly anticipated releases such as the final season of "The Crown," "Berlin" in the Money Heist franchise, reality competition show "Squid Game: The Challenge," and several star-studded movies, reflects Netflix's focus on delivering a compelling lineup of content to keep audiences engaged and entertained.

Monetization and Growth Strategies

Success of Paid Sharing and Pricing Strategy

Netflix's implementation of paid sharing has yielded positive results, resulting in revenue positivity across all regions where the strategy was employed. The successful conversion of borrowing households into paying or additional members, along with healthy retention rates, signifies the effectiveness of this initiative. As the company continues refining this approach, converting more borrowing households into full-paying or extra members remains a strategic focus for sustained growth.

The company's pricing strategy, characterized by occasional price adjustments and a diverse range of plans, aims to strike a balance between delivering value to members and occasional incremental price increases. Despite price adjustments, Netflix maintains a competitive starting price, offering plans that cater to various consumer needs. The recent price adjustments in the US, UK, and France reflect the company's intent to continue offering value while ensuring sustainable revenue growth.

Advertising Endeavors and Progress

Netflix's venture into the advertising space is showing promising signs of growth. Despite being relatively new, the advertising arm is witnessing encouraging progress. The platform's ability to attract advertisers is bolstered by its strong engagement metrics and the attractiveness of its ad tier memberships. The introduction of title sponsorships, like Frito Lay's Smartfood® sponsorship of the Emmy-nominated series "Love is Blind," exemplifies the platform's potential to offer brands highly engaging and culturally relevant advertising opportunities.

The company's focus on expanding its advertising membership, with nearly 70% quarter-over-quarter growth, and phasing out the Basic plan in certain regions to promote ad and Standard plan adoption demonstrates Netflix's commitment to building a robust advertising revenue stream. Furthermore, future plans to introduce new ad products, expand feature sets, and explore partnerships with device and ISP partners indicate a forward-looking approach to strengthening the advertising segment.

Cash Flow Management and Share Repurchase

Robust Cash Flow Generation

Netflix has demonstrated robust cash flow generation, evident from the substantial increase in net cash generated by operating activities and free cash flow in Q3 compared to the prior year. This highlights the company's ability to efficiently manage its operations and generate substantial cash reserves.

The upward revision of the FY23 free cash flow forecast to approximately $6.5 billion, compared to the prior forecast of at least $5 billion, underscores the company's positive cash flow trend. Despite the challenges posed by strikes affecting content spend, Netflix aims to maintain substantial positive free cash flow in 2024, reinforcing its commitment to financial stability and growth.

Share Repurchase and Return of Excess Cash

Netflix's commitment to returning excess cash to shareholders is evident through its share repurchase program. The company has repurchased $4.1 billion of its stock under the original $5 billion authorization. With the board's approval for an additional $10 billion for repurchases, Netflix affirms its confidence in its growth prospects and commitment to shareholder value.

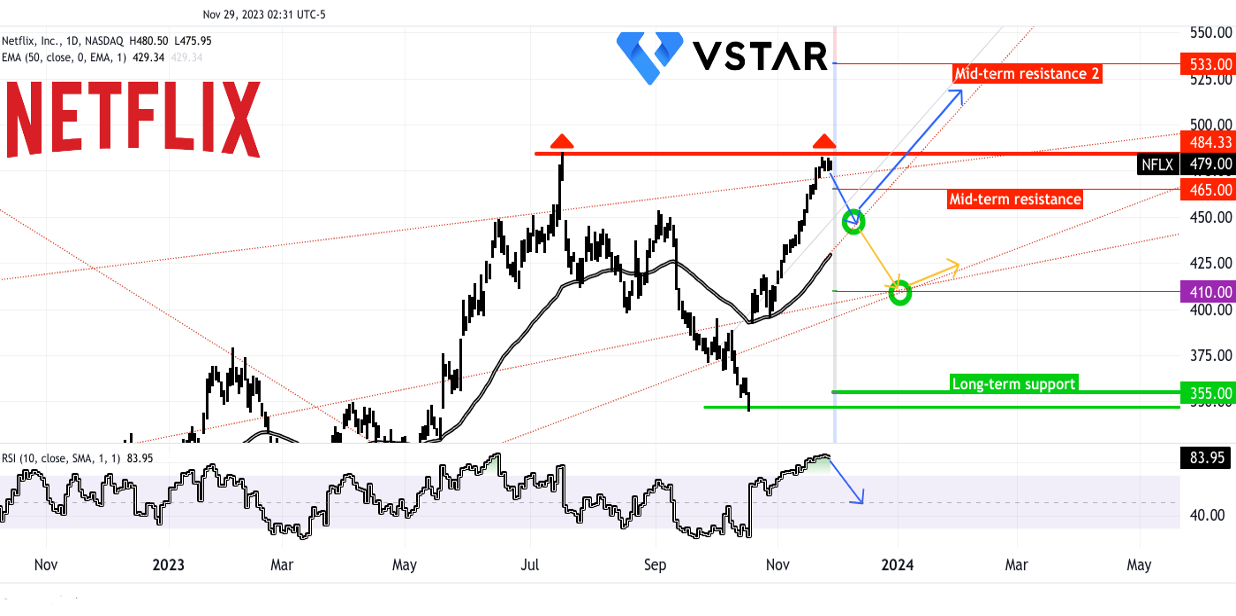

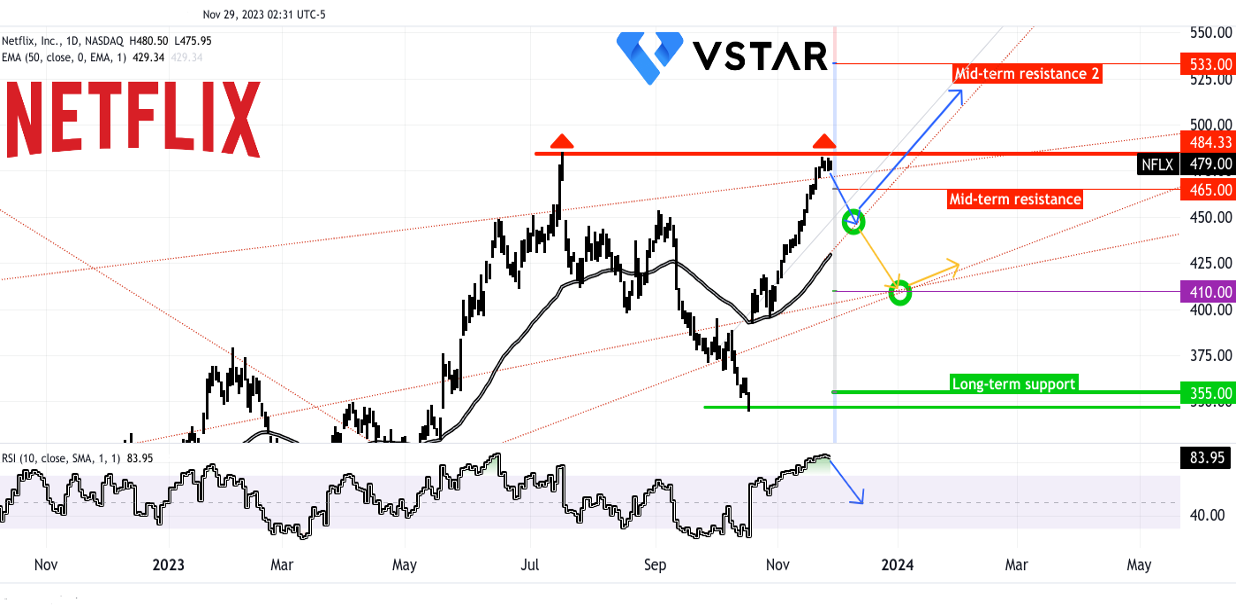

Netflix Stock (NFLX) Technical Take

Source: tradingview.com

Netflix stock price could potentially reach $533 (a resistance based on Fibonacci extension) in the short to mid-term, riding the current trend's momentum. However, the path ahead isn't a smooth, straight line. Presently, the stock is testing resistance at $484, signaling a possible downside correction due to the double top pattern and an RSI level of 84 (overbought). Despite this, the 50-day EMA suggests limited downside potential (indicated by the blue arrows).

However, considering the dynamic nature of support level provided by EMA, there is a possibility that price may breach the EMA and could lead to testing the pivot around $410 (highlighted in yellow). It's crucial to note that such a downtrend might manifest in the event of significant adverse developments affecting the market as a whole (like inflation numbers) or negative shifts in critical performance metrics (like subscriber growth). These potential downward movements offer an opportunity to lower the average dollar amount on long positions.

In summary, Netflix's fundamental strengths are evident across multiple facets of its operations. These strengths include consistent revenue growth, efficient cost management leading to improved margins, a diverse and engaging content strategy resonating globally, innovative approaches to customer engagement, expansion into new content genres like sports and animation, strategic monetization strategies, robust cash flow management, and a shareholder-friendly approach through share repurchases. These collective strengths position Netflix as a leader in the highly competitive streaming industry and lay the foundation for sustained growth.