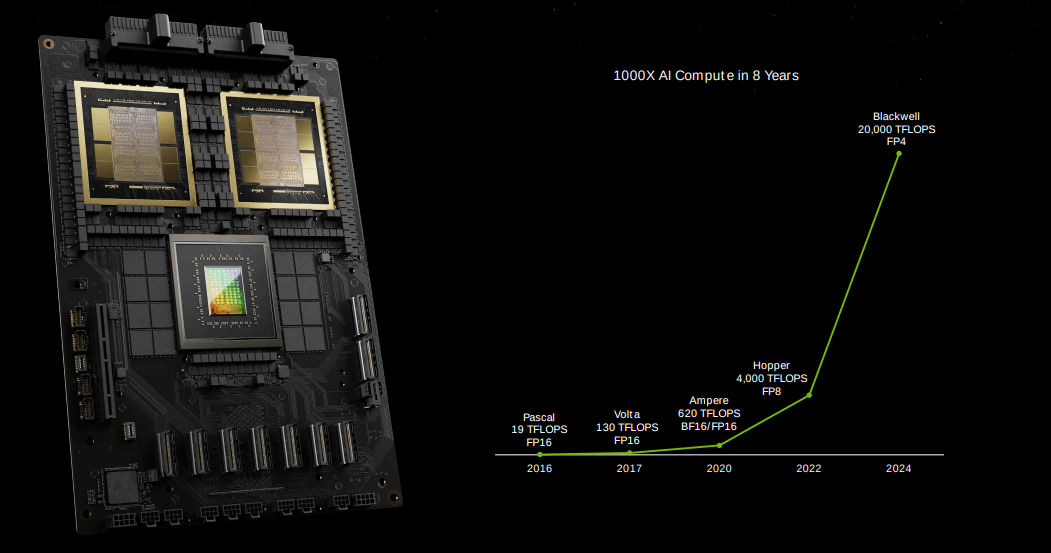

- Nvidia 的 Blackwell 架构标志着 AI 计算的飞跃,与前身 Hopper 相比,性能有了显着提升,FP8 训练和 FP4 推理分别提高了 2.5 倍和 5 倍。

- 第五代 NVLink 互连速度提高了一倍,可促进多达 576 个 GPU 之间的无缝通信,这对于扩展 AI 工作负载至关重要。

- Nvidia GB200 Grace Blackwell Superchip 体现了高速互连性,这对于高效数据交换和并行处理至关重要。

- Nvidia 的 Blackwell 平台获得了广泛的行业认可、云提供商的采用以及强大的全球合作伙伴网络,增强了人们对其能力和市场潜力的信心。

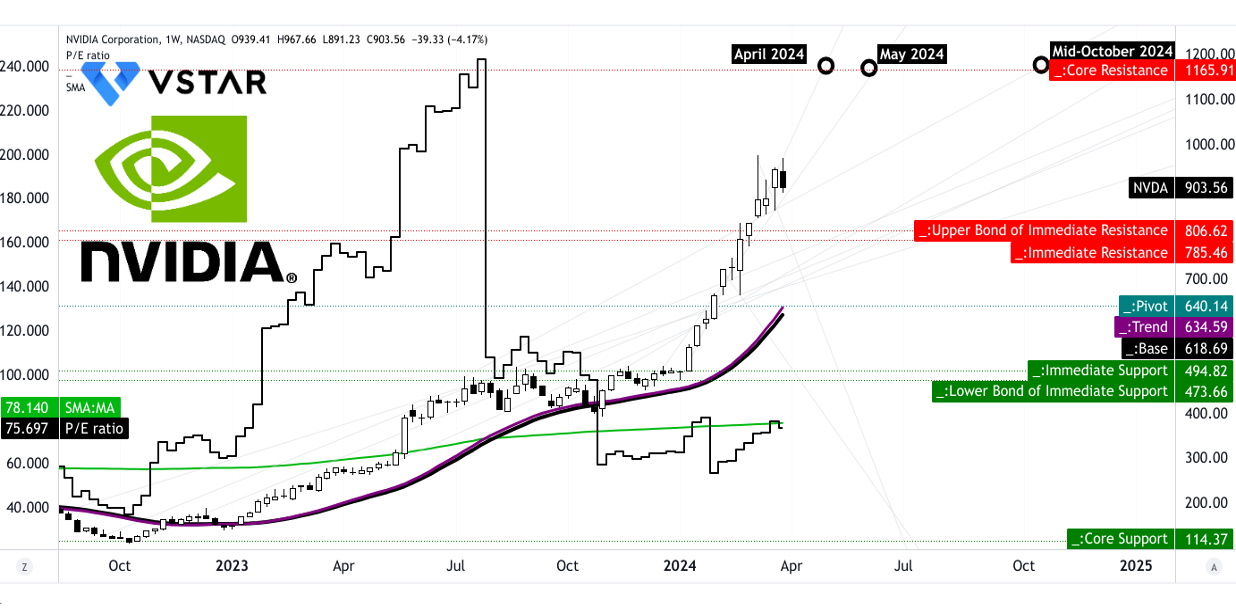

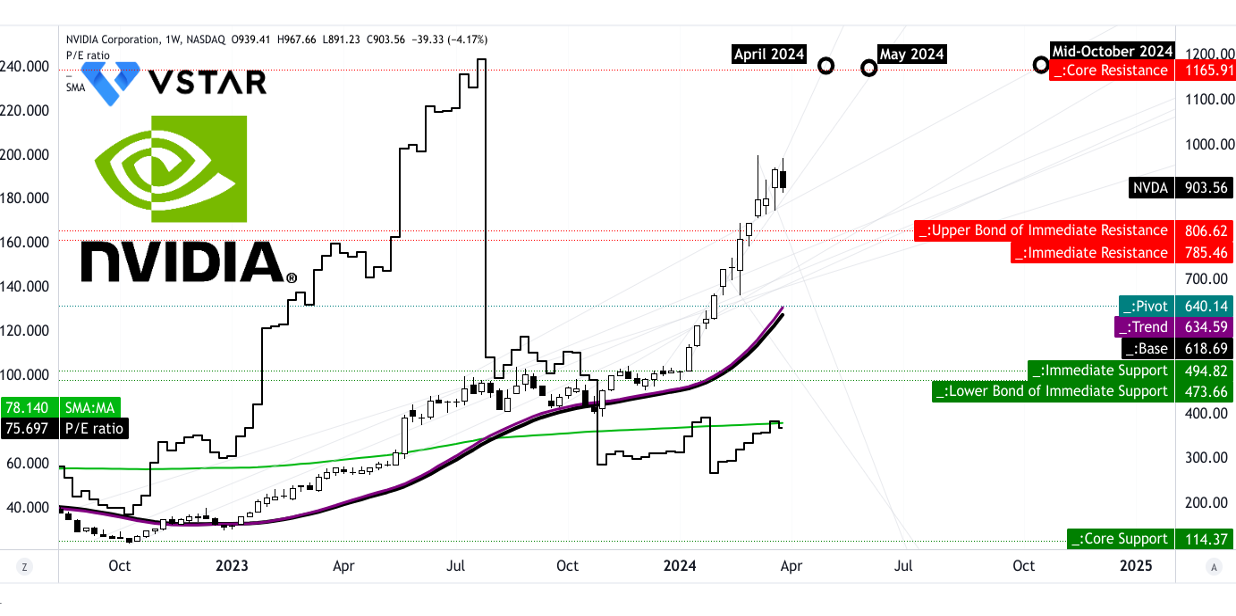

- 从技术上讲,Nvidia 股价可能在 2024 年 4 月至 5 月期间触及 1,165 美元,并可能出现小幅调整。

在人工智能计算领域,英伟达(纳斯达克股票代码:NVDA)作为先锋,季度环比领先。最近,在 2024 年全球技术大会,该公司通过其 Blackwell 架构引入了突破性的进步。从指数级增强的性能指标到重新定义软件开发方法,Nvidia 的创新超越了单纯的技术升级,它们象征着范式转变。阅读更多内容,了解 Nvidia 的 GTC 2024 和 Blackwell 如何为公司股票估值的稳健增长奠定基础。了解有关 NVDA 1,165 美元近期目标价的更多信息。该股的表现已经明显优于市场。

资料来源:tradingview.com

Nvidia 新兴的基本护城河

先进的计算能力:

英伟达的 布莱克韦尔平台 代表了计算能力的重大飞跃,特别是针对人工智能应用程序量身定制的。

性能改进:

Blackwell 架构比其前身 Hopper 架构提供了显着的性能改进。具体来说,它提到每个芯片的 FP8 训练性能提高了 2.5 倍,FP4 推理性能提高了 5 倍。这些趋势凸显了 Nvidia Blackwell 架构在计算能力方面取得的快速进步。通过量化性能提升,投资者和行业分析师可以衡量 Nvidia 在多大程度上突破了加速计算的界限。

资料来源:Nvidia Blackwell Architecture GTC 2024

NVLink 互连速度:

第五代 NVLink 互连的速度是之前架构的两倍,可在多达 576 个 GPU 之间实现无缝高速通信。每个 GPU 的吞吐量为每秒 1.8 TB。这强调了英伟达对增强互连技术的关注,这对于跨分布式计算环境扩展人工智能工作负载至关重要。速度翻倍意味着数据传输速率的显着飞跃,从而使 GPU 之间的并行处理和协作更加高效。

超级芯片性能:

Nvidia GB200 Grace Blackwell Superchip 配备两个 Blackwell Nvidia B200 Tensor Core GPU,通过 900GB/s NVLink 芯片间互连连接到 Nvidia Grace CPU,标志着计算密度和效率的显着进步。

这展示了 Nvidia 超级芯片的复杂架构,突出了 GPU 和 CPU 组件之间的高速互连。这种架构有助于高效的数据交换和并行处理,这对于处理复杂的人工智能工作负载至关重要。

机架级系统性能:

Nvidia GB200 NVL72系统,结合了36颗Grace Blackwell超级芯片,实现了卓越的AI训练和推理性能。它指定单个机架中的 AI 训练性能为 720 petaflops,AI 推理性能为 1.4 exaflops。这些指标强调了 Nvidia 机架规模系统的可扩展性和性能能力。在单个机架内实现百亿亿次人工智能性能,证明了 Nvidia 在提供针对人工智能工作负载量身定制的高性能计算解决方案方面的领先地位。

Exaflop 人工智能系统:

由 Nvidia GB200 Grace Blackwell Superchips 提供支持的 DGX SuperPOD 可在 FP4 精度下提供 11.5 exaflops 的 AI 超级计算能力。该指标代表了人工智能应用实现百亿亿次计算的一个重要里程碑。这凸显了英伟达突破人工智能超级计算界限的能力,使组织能够以前所未有的规模应对复杂的人工智能挑战。通过提供百亿亿次计算能力,Nvidia 使研究人员和企业能够加速人工智能创新和发现。

行业认可和采用:

Nvidia 的 Blackwell 平台已获得各行业的广泛认可和采用,表明对其能力充满信心。

资料来源:investor.Nvidia.com

认可:

来自 Alphabet、亚马逊、微软、Meta 等行业领导者的认可。科技行业主要参与者的认可凸显了 Nvidia Blackwell 平台的重大影响和可信度。这些认可的巨大影响力充分说明了业界对 Nvidia 技术的信心。投资者和分析师可以将这些认可解读为该平台推动各行业增长和创新潜力的指标。

云服务提供商采用:

Amazon Web Services、Google Cloud、Microsoft Azure 和 Oracle Cloud Infrastructure 等主要云服务提供商是首批提供 Blackwell 支持的实例的公司之一。领先云提供商的参与标志着 Nvidia 技术在云计算基础设施中的大量采用和集成。

投资者和分析师可以通过考虑云提供商的市场份额和影响力来推断采用云提供商的重要性。主要云平台采用 Blackwell 支持的实例表明了强劲的市场需求,并使 Nvidia 成为云 AI 领域的关键参与者。

全球合作伙伴网络:

Nvidia 已与基于 Blackwell 的产品和服务的庞大公司网络建立了合作伙伴关系,其中包括云服务提供商、服务器制造商、软件开发商等。伙伴关系的广度和多样性表明了广泛的合作和生态系统整合。

投资者和分析师可以通过考虑合作伙伴公司的声誉和市场影响力来评估 Nvidia 合作伙伴网络的实力。强大的合作伙伴生态系统增强了 Nvidia 的市场影响力,并让更多人能够更广泛地使用其技术,从而推动采用和收入增长。

利用生成式人工智能彻底改变软件开发:

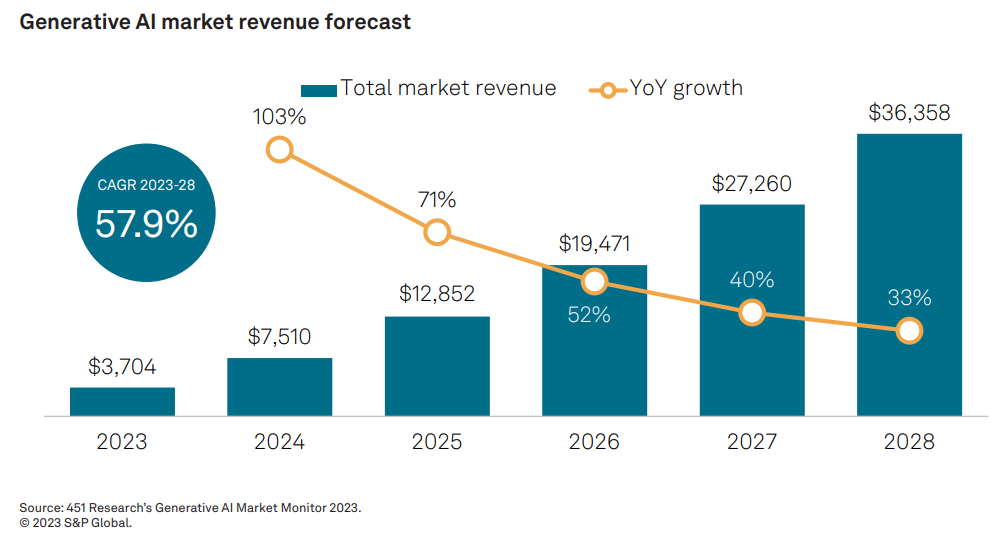

Nvidia 的 Blackwell 平台准备通过利用生成式人工智能技术彻底改变软件开发。这一基本发展可能为英伟达提供坚实的营收增长优势。根据 S&P Market Intelligence 的数据,到 2024 年,整个 Gen AI 市场的收入可能会增长 103%。

资料来源:S&P Market Intelligence

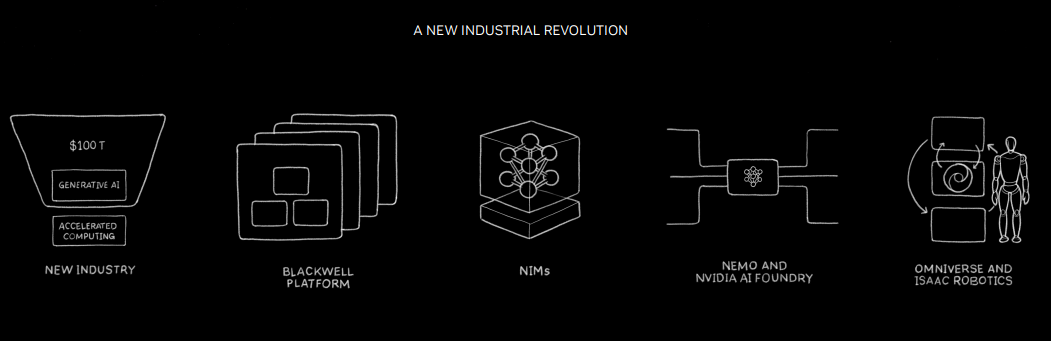

过渡到生成式人工智能:

软件开发向生成式人工智能的根本转变。它强调了英伟达组装人工智能模型来创建软件的愿景,而不是传统的编码方法。

这种转变代表了与传统软件开发实践的重大背离,对效率、可扩展性和创新产生了影响。这种转变的规模及其重塑软件行业的潜力。

Nvidia NIM 微服务:

Nvidia 推出 NIM 微服务,代表了软件交付的新范例。它强调 NIM 微服务的可扩展性和多功能性,将开发人员与数百万个 GPU 连接起来以部署自定义 AI 解决方案。 NIM 微服务的概念提出了一种能够支持不同人工智能工作负载的可扩展架构。这种可扩展性对于满足各行业对人工智能驱动的应用程序不断增长的需求至关重要。

资料来源:investor.Nvidia.com

行业应用:

与 Cohesity、NetApp、SAP、ServiceNow 和 Snowflake 等行业领导者合作,使用 Nvidia 的技术构建副驾驶和虚拟助理。知名公司的参与凸显了 Nvidia 生成式 AI 解决方案的现实适用性和价值。

投资者和分析师可以通过考虑合作伙伴公司的市场影响力和声誉来推断这些合作的重要性。行业领导者对 Nvidia 技术的采用验证了其有效性,并将 Nvidia 定位为跨行业人工智能驱动创新的关键推动者。

Omniverse:将人工智能带入物理世界

Nvidia 的 Omniverse 平台可能会弥合人工智能与物理世界之间的差距,从而实现先进的模拟和自动化。

物理世界中的人工智能学习:

Omniverse 作为人工智能了解物理世界的模拟引擎。这一概念强调了英伟达致力于将人工智能功能扩展到数字环境之外。

这种向物理世界的扩张对机器人、制造和自主系统等行业具有重大影响。虽然定量指标可能没有明确概述,但人工智能驱动的现实应用程序进步的潜力。

Omniverse 云 API:

Nvidia 宣布推出 Omniverse Cloud API,将该平台的应用范围扩展到现有的设计和自动化软件应用程序中。集成 Omniverse 核心技术,可在现有工作流程中无缝采用。

云 API 的可用性表明 Nvidia 对可访问性和互操作性的关注,促进了 Omniverse 在各行业的更广泛采用。 Omniverse 通过云 API 的扩展表明了在不同应用程序生态系统中增加使用和集成的潜力。

行业采用:

与 Ansys、Cadence 和 Dassault Systèmes 等主要工业软件制造商合作,将 Omniverse Cloud API 集成到他们的软件中。领先公司的参与凸显了该平台在不同行业的相关性和适用性。

投资者和分析师可以将这些合作伙伴关系视为 Omniverse 的市场接受度和推动工业工作流程创新潜力的指标。虽然定量指标可能没有广泛概述,但行业合作伙伴关系的广度和深度表明了巨大的市场吸引力和增长潜力。

Nvidia 股票预测技术分析

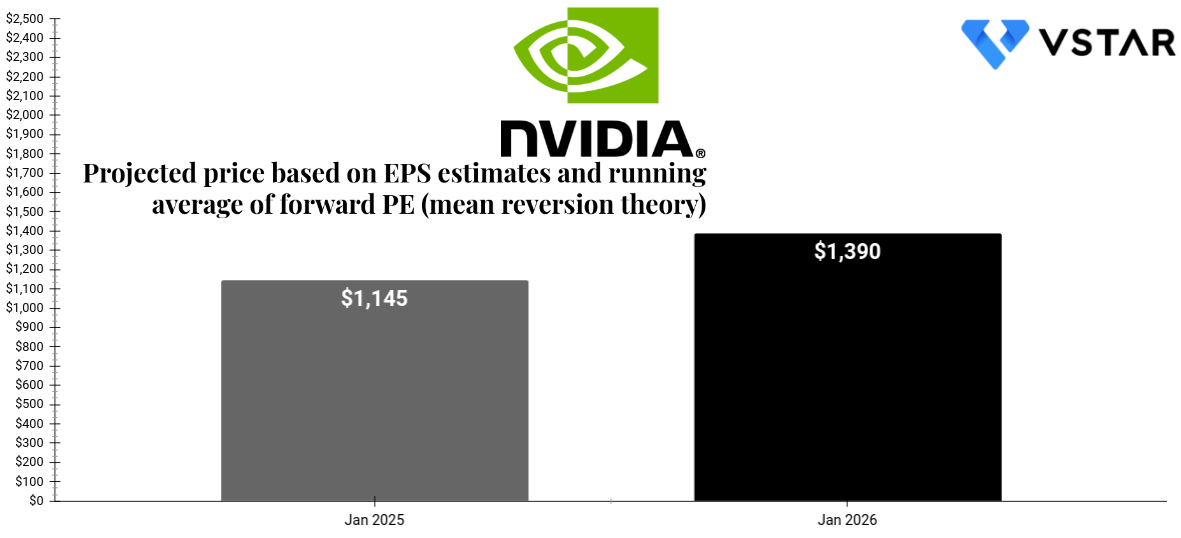

从根本上说,根据 46.17 的非 GAAP(远期)市盈率长期平均预测价格以及 2025 年 1 月每股收益共识预测 24.81 美元,得出的目标为 1,145 美元。同样,2026 年 1 月的理论目标价格为 1,390 美元。有趣的是,这些保守的预测表明该股存在巨大的上涨空间。英伟达的股价从根本上受到每股收益同比增长或利润扩张的影响。根据华尔街的估计,2025 财年每股收益同比增长 91.45%。

简而言之, 上述最新进展 可能为未来几个季度的盈利提升提供坚实的支持。

资料来源:Analyst's compilation

从技术上讲,乐观情况下,Nvidia 股价可能会在 2024 年 4 月底达到 1,165 美元。平均而言,到 2024 年 5 月底,即到 2025 财年第二季度末,价格可能会达到相同水平。在悲观情景下,到 2024 年 10 月中旬,价格可能会达到 1,165 美元。乐观情景是基于当前NVDA股价呈现走高势头。同样,平均情况是基于更高低点的动量。最后,悲观情景是基于中期价格势头。

这些预测基于近期价格波动预测的斐波那契回撤/扩展水平。

查看市盈率 (GAAP) 与股价之间的相关性。 NVDA 股票按当前价格水平估值合理。当前市盈率为 76(黑色阶梯线),接近市盈率的长期平均值(5 年),即 78(绿色 SMA)。股价的任何调整都可能提供建立股票多头头寸的机会,投资期限不超过 12 个月。精确支撑区域在 807 美元至 785 美元之间。该区域是当前水平价格通道的上键。

资料来源:tradingview.com

缺点

对专用硬件的依赖:

Blackwell GPU 架构采用六项革命性技术,拥有 2080 亿个晶体管,并采用定制的 4NP TSMC 工艺。专用硬件虽然提供卓越的性能,但由于需要大量投资,因此存在潜在的可扩展性挑战。制造这些 GPU 和相关硬件组件的确切成本尚未明确公布。

然而,生产规模和单位成本是影响可扩展性的关键因素。如果成本仍然很高且生产可扩展性有限,则可能会阻碍 Blackwell 平台的广泛采用。

复杂性和集成问题:

Blackwell 平台引入了复杂的架构,包括第五代 NVLink 互连、RAS 引擎、安全 AI 功能和解压引擎等。虽然这些功能增强了性能和安全性,但它们也增加了系统复杂性,可能导致集成挑战。然而,多种先进技术的存在表明与以前的架构相比具有更高程度的复杂性。总体而言,复杂性可能会转化为更高的部署和维护成本,从而阻碍组织扩大采用基于 Blackwell 的解决方案。

总之,技术分析表明英伟达股价呈看涨趋势,短期潜在目标为 1165 美元。尽管出现短期波动,但在强劲基本面和行业认可的支持下,长期轨迹仍保持上升趋势。对于建立多头头寸,特别是在价格调整期间,可以考虑 807 美元至 785 美元的支撑区域。然而,由于 Nvidia 对专用硬件和集成复杂性的依赖,建议谨慎监控,这可能会影响基于 Blackwell 的解决方案的可扩展性。