Many people focus on Big names like Bitcoin and Ethereum to make a profit. However, there are other opportunities for investors to make maximum profit. One such project is OMG, which is doing well and gaining increasing awareness.

This guide will explore the OMG network and strategies for trading using CFDs for maximum profit.

Welcome to the OMG Network

The OMG Network is a decentralized network built on the Ethereum blockchain. Previously known as OmiseGO, it offers low-cost, fast, secure, and interoperability between various digital assets. The network, founded by Jun Hasegawa and Donnie Harinsut, uses a Layer-2 Plasma system to provide high throughput that guarantees scalability.

The OMG network aims to solve some of the limitations of the Ethereum platform. One of the main issues with Ethereum is scalability- the ability to support high transactional throughput. However, OMG Network employs the More Viable Plasma system to optimize transaction throughput.

Lower gas fees are another area that sets the OMG Network apart from Ethereum. The gas fee is the cost of processing transactions. Transactions are processed in bundles in the OMG Network, so it is relatively cheaper.

OMG- an ERC-20 token standard, is the utility token of the network. This token has a limited supply of 140,245,398. About 9.9% was reserved for the team, 65% was a public ICO, 20% was a reserve for the development of the network, and 5% was distributed to users.

The token facilitates faster and more affordable transactions on the OMG network. You can use the token to pay for services within the network. In addition, you can stake the token to earn passive income and contribute to the growth of the network.

Trading OMGUSD

OMGUSD is a trading pair that is subject to high volatility. Volatility provides an opportunity for traders to make a profit from price swings. Although volatility poses some risks, using appropriate trading strategies can help traders maximize profit.

An example of OMG volatility was the 350% rise in 2017 which eventually dropped by 90%. This scenario indicates that volatility is a double-edged sword that must be carefully understood. The 90% drop highlights significant losses for many traders. Therefore, it is critical to use risk management tools like stop-loss orders to minimize loss.

On the other hand, investors who entered the market before the 350% increase had an opportunity for significant gains. Therefore, a trader's ability to anticipate and capitalize on price movements is critical to profit from volatility.

Another attractive feature of OMG is its trading volume and liquidity. High liquidity allows for easy entry and exit of a market position, which minimizes slippage and promotes the execution of orders. Therefore, the liquid nature of OMG provides opportunities for traders to benefit from volatility.

Day traders can capitalize on short-term price fluctuations by opening and closing positions within a day. Another opportunity to make a profit from OMG’s volatility is trading CFDs. Contracts for Difference are financial instruments that allow traders to profit by speculating on the price of OMG without actually owning it.

Market, fundamental, and technical analyses are critical to capitalizing on volatility. In the next sections, we shall analyze the strategies for efficient trading of OMGUSD.

Use CFDs to Boost Leverage & Liquidity

In this section, we shall examine the advantages and critical aspects of trading OMG CFDs

a. OMGUSD CFDs allow traders to gain exposure with leverage

Trading OMGUSD using CFDs is an excellent way to boost leverage and liquidity. CFD trading usually involves leverage, which allows traders to control bigger positions with small capital. As a result, traders can make higher returns compared to their capital. However, if the market goes against you, the loss will also be significant. For example, you choose to trade with 10x leverage. You can deposit $10,000, and the broker will borrow you the remaining funds to control a position worth $100,000. In this case, your profit will be calculated based on the entire position, not your initial deposit.

Another advantage of trading OMGUSD with CFDs is that it offers the flexibility to go short or long. Traders can go long when they predict a potential increase in the market value of OMG. Consequently, they can sell the CFD at a higher price and profit from the price difference. On the other hand, traders can sell CFDs when they anticipate a price crash to avoid loss. The flexibility of going short or long allows traders to potentially make gains from both falling and rising market conditions.

Furthermore, you can trade OMG CDFs with brokers offering competitive pricing and higher liquidity access. As a result, traders can efficiently execute trades at desirable prices. Brokers may also offer trading tools and resources to assist traders in making informed decisions.

Therefore, it is critical to select reputable CFD brokers like VSTAR. Before choosing the best broker, compare the reputation, regulations, interface, trading fees, and customer support.

After carefully choosing a broker, you need to provide personal information and complete account verification. You can fund the account via bank transfer, debit cards, or credit cards to start trading OMG CFDs.

Vstar is a reliable broker that provides institutional-level trading experience, including the lowest trading cost, which means tight spread and lightning-fast execution.

In addition, Vstar is regulated by CySEC- unregulated brokers often have a high commission, which can erode your profit. More so, Vstar offers a demo account for beginners to practice trading strategies to mitigate loss during actual trading.

b. Analyze the margins/leverage levels across different brokers

Another critical aspect of trading CFDs is analyzing margins/leverage across different brokers and understanding the risks/rewards of using higher leverage. The margin and leverage levels vary depending on the broker. The initial deposit to control a leveraged position is the margin. From the previous example, the margin is $10,000, while the leverage is 10x.

Some brokers offer higher leverage, allowing traders to control greater positions with smaller capital. However, traders must remember that a higher level can result in significant gains or losses. Leverage must be used cautiously, especially when trading OMG CFDs, which is attributed to high volatility. Higher leverage can be a tool to capitalize on volatility to make gains. However, you must consider your trading experience, appetite risk, and market condition before choosing leverage levels.

High volatility indicates instability, which can lead to significant price swings. Therefore, the importance of risk management strategies cannot be overemphasized. When using higher leverage, it is critical to implement stop-loss orders and closely monitor the market to reduce the potential impact of volatility. Subsequently, higher trading leverage has a potential for substantial losses if the market moves against you.

c. OMGUSD CFDs have tight spreads, but be wary of overnight fees

Another benefit of trading OMGUSD CFDs is tight spreads. However, traders must consider the cost of overnight trading incurred by keeping a position open for more than a day.

Spreads are the difference between the buying and selling prices of CFDs. Tight spreads imply the difference between the opening and closing prices is small. Therefore, traders can execute orders at prices that favor potential higher profitability. However, spreads vary with different brokers, which may depend on general market conditions.

Brokers often charge an overnight fee when you keep a CFD position overnight. They may also be called rollover fees, which are charged as the cost of maintaining a leveraged position beyond a trading day. These charges may significantly affect your profit, especially for long-term positions. Therefore, you need to understand overnight costs, which should influence your trading plan.

d. CFDs eliminate the need for a crypto wallet

Since trading CFDs involves speculating the price of OMG, it eliminates the need for a crypto wallet. Unlike traditional crypto transactions, you do not have to own OMG tokens. Therefore, you do not need to open a wallet since you are making a profit without actual ownership of the tokens.

However, crypto positions held as CFDs cannot be transferred in or out of your wallet. CFDs are contracts between traders and brokers to exchange the difference between OMG's ask and bid price. Therefore, the trader does not have ownership, only a contract based on the price movement of OMG.

Long/Short Support & Resistance

Support or resistance levels can help you choose whether to go long or short. Support levels are price levels where the buying pressure has historically been enough to prevent the price from further decline. Analysis of historical price data can help traders identify the support levels for OMGUSD.

Identification of support levels is critical because it presents buying opportunities. The aim is to buy dips at key support levels where volatility has created large price drops and reversals in the past. Traders can use candlestick patterns, oscillator indicators, or increased buying volume to confirm anticipated price reversals.

i. The major long-term support region is between $7 to $10

Price levels between $7 and $10 have been a major long-term support zone for OMGUSD. Over the years, this region has acted as a significant support level as the price often reverses from this region. Therefore, it shows that demand increases when the price of OMGUSD falls within the support zone.

Therefore, analyzing this region and implementing wide stops, given volatility, is a critical consideration for traders. Wide stops provide a larger buffer between the entry price and stop-loss levels. Price movements within the support region are often volatile, so wider stop-loss orders reduce the chances of closing a trade due to minor price fluctuations.

However, suppose the price breaks the support level and continues to decline. In that case, the associated loss of using wider stops will be significant. Critical risk management strategies include position sizing, trail stops, and portfolio diversification.

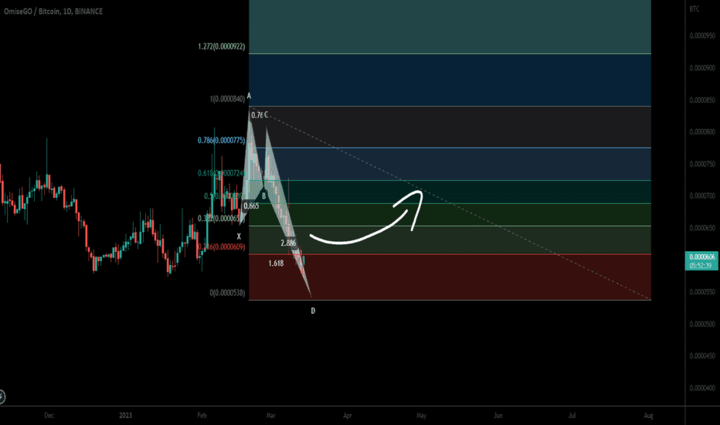

ii. Resistance levels

Resistance zones are price levels when the selling pressure has historically been strong enough to prevent further price uptrend. As a result, monitoring resistance zones can help traders anticipate a potential price downtrend. Technical indicators like trendlines and Fibonacci retracements are critical to identifying resistance zones. Resistance levels are significant because they indicate an increasing willingness to sell, often leading to an uptrend reversal.

Therefore, traders may consider shorting (opening a sell position) at significant historical resistance levels where downward momentum could pick up again. However, traders must be cautious of the risks of picking the top. This is an attempt to predict the specific price level where the reversal may occur.

iii. Use of indicators and support/resistance levels

Combining support/resistance levels with trendlines and momentum indicators like RSI can optimize the reliability of entry and exit positions. Trendlines can show the direction of price movement, so it helps to reveal the market condition. On the other hand, indicators like the relative strength indicator (RSI) reveal the strength and momentum of trends. They also help traders to identify if OMGUSD has been overbought or oversold. Therefore, combining indicators and support/resistance levels can confirm signals.

Another way to mitigate risks is to hedge positions- opening opposite trades to mitigate risks. For example, a trader has a long position but expects a price reversal from a resistance level. The trader can open a short position at the resistance level to mitigate risk. Therefore, if a price reversal occurs, the losses can be offset made from the short position.

Range Trading the Swings

Range trading the swings involves identifying significant short-term swing highs and lows within a volatile range. The aim is to capitalize on volatility within a specific range instead of predicting long-term price movements. Let us dive into more details:

❖ Identify swing highs and lows

A rangebound market is characterized by price movements within a specific range. You can identify this market by observing the level where the price of OMGUSD reaches a resistance level and experiences a decline or when the price reaches the support level and begins to increase.

Swing highs occur when the price of OMGUSD reaches temporary peaks, while swing lows are trough price levels. These swing highs or lows indicate potential zones of resistance or support within the range. Traders can identify swings within a rangebound market by closely monitoring the range zone.

A reversal in upward movement often characterizes swing highs. Subsequently, swing lows often represent a reversal in a downward trend. Trendlines can help traders connect swing points, which provides a visual representation of the range. In addition, it helps traders to identify potential trading opportunities.

❖ Use tighter stops

Range trading requires the need to use tighter stops to avoid being stopped out prematurely. The goal of range trading is to capitalize on short-term volatility. Hence, setting stop orders closer to the entry levels may be beneficial. This helps to protect your capital in case the price breaks out of range.

In addition, making quick profits when using a range trading strategy is critical. Therefore, traders should set take-profit orders relatively closer to the entry points. Consequently, they can secure quick profits and avoid holding positions for longer, which may have negative outcomes due to volatility.

❖ Analyze historical ranges

Another critical aspect of range trading is analyzing historical ranges to identify successful swing trading areas. When you observe the price of OMG over a period, you can identify patterns, support zones, and resistance zones. However, paying attention to daily charts is also important as it provides insight into the current market condition.

During analysis, pay attention to levels where the price of OMG has exhibited rangebound characteristics. Historical ranges help traders to identify trading opportunities and inform decisions about entry and exit positions.

❖ Use Oscillators to improve entry/exit accuracy

Oscillators like the Stochastic Oscillator or Relative Strength Index (RSI) are critical tools for determining intra-range tops, bottoms, and reversals. These indicators measure the momentum and strength of a trend. In addition, they expose the overbought or oversold conditions of OMGUSD to help traders identify profitable exit/entry points within the range.

For example, when the price reaches the upper end of the oscillator (70 and above), it signifies overbought conditions. Therefore, it indicates a selling opportunity as there may be a trend reversal. On the other hand, when the price reaches the lower end (30 and below) of an oscillator, it signifies oversold conditions. This suggests a potential price rebound, which presents a buying opportunity for traders.

Therefore, using oscillators with other analyses can improve the accuracy of entry or exit positions. This is because they provide confirmation for price swings within the range.

Breakout Trading for Potential Trend

A breakout occurs when the price of OMG goes above or below a significant level. This momentum strategy involves entering the market when the price moves outside a relatively confined range (support/resistance level). Breakout trading helps traders to catch new trends early. In addition, it is a highly profitable strategy because breakouts often lead to aggressive price movements. Let us explore other aspects of breakout trading:

Buying breakouts at the top of short-term ranges or historic highs

Breakout trading involves buying breakouts at the top of short-term ranges (if long-term) or historic highs (if all-time highs) for larger trends. When the price exceeds a significant resistance level, it suggests a possible development of a bigger trend. Therefore, traders can enter the market early to capture the upward trend and ride the momentum to make a profit.

Volatility can lead to a higher chance of losing positions

High volatility associated with OMG translates to uncertainty, predisposing higher chances of losing positions. Breakouts are also associated with uncertainty, so there is no assurance that the trend will be sustained or quickly reversed. Temporary breakouts are often described as false breakouts. The price of OMG quickly reverses and can lead to significant losses. However, breakout trading has the potential for huge rewards, ranging from 2 to 10 times the initial deposit if traders successfully catch a trend. Therefore, it is critical to confirm breakouts before opening a position. Moving average convergence divergence (MACD) indicators and volume profiles are crucial in confirming the authenticity of breakouts.

Use Wider-trailing stops

Breakout trading requires the use of wider trailing stops as opposed to a short-term range strategy. These wider stops provide allowance to accommodate piece fluctuations during the early stage of breakout. The aim is to keep the position open to generate significant profit and avoid closing positions prematurely. Traders can adjust their trailing stops as the trend progresses to protect profit. Therefore, continuous monitoring of the market is critical to maximize the full potential of the trend.

Risks of false breakouts

One of the risks of breakout trading is false breakouts. False breakouts- when the price briefly moves beyond a support/resistance zone and retracts- are quite common in the crypto market. Therefore, traders must understand this risk and its management to protect their trading positions. Suppose the initial breakout position is closed due to a false breakout. However, if the trend continues, traders can consider re-entry strategies.

False breakouts can be managed by confirming trends before opening a position. Another risk associated with breakout trading is the rapid pace, which may be too much pressure for some traders.

Conclusion

This guide has examined three strategies for trading the volatility of OMGUSD using CFDs (Contracts of Difference). Range trading involves identifying significant short-term swing lows and high within a rangebound market. Breakout trading focuses on buying breakouts at the top of short-term ranges or historic highs to catch larger trends. Alternatively, traders can use leverage to capitalize on the volatile nature of OMG to make a profit.

Traders must consider the potential ratio of risk to reward before opening a position. We recommend starting with range trading and using tight risk management until you are familiar with the price action of OMG.

Trading OMG CFDs with leverage can be lucrative but comes with high risk. Therefore, we recommend never risking more than you can afford to lose. Usually, about 2-5% of your trading capital should be invested in an asset. Use brokers like VSTAR that offer several instruments to diversify your trading portfolio.

Finally, irrespective of trading strategy, there is a potential to make huge profits from the price fluctuations of OMGUSD. However, apply these strategies cautiously, employ appropriate risk management strategies, monitor market trends, and use relevant indicators.

Visit VSTAR today; we are excited to assist you on your journey to maximizing profit by trading OMG CFDs!